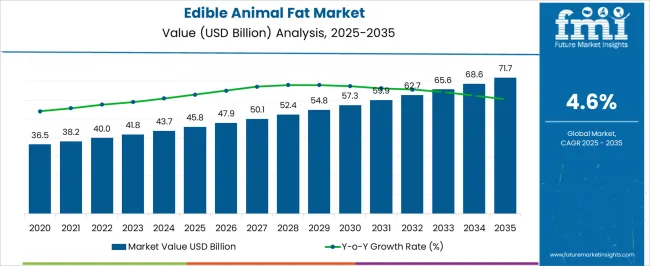

The edible animal fat market, estimated at USD 45.8 billion in 2025 and projected to reach USD 71.7 billion by 2035 at a CAGR of 4.6%, is significantly influenced by regulatory frameworks governing food safety, labeling, and quality standards. Regulatory agencies across key markets, including the U.S. Food and Drug Administration, the European Food Safety Authority, and various Asia-Pacific food safety authorities, enforce stringent compliance requirements regarding permissible fat content, processing methods, and hygiene standards.

These regulations directly affect production, packaging, and distribution processes, ensuring that only approved additives, processing aids, and storage protocols are utilized, which imposes operational costs and influences market pricing structures. Moreover, regional regulations related to animal welfare and traceability of raw materials contribute to market dynamics by shaping sourcing strategies and operational decisions. For instance, mandatory documentation of origin and adherence to humane slaughtering practices can increase production complexity, thereby affecting the cost structure and potentially constraining smaller producers.

Trade regulations and import-export standards also play a pivotal role in determining cross-border supply and market penetration, particularly in Europe and North America, where compliance enforcement is rigorous. Over the forecast period, regulatory interventions are expected to continue guiding technological adoption in processing and refining operations, promoting higher standards of safety and quality. While these regulations support consumer confidence and long-term market credibility, they also create barriers to entry and may slow market expansion in regions with stringent enforcement, ultimately shaping the growth trajectory and competitive landscape of the edible animal fat sector.

| Metric | Value |

|---|---|

| Edible Animal Fat Market Estimated Value in (2025 E) | USD 45.8 billion |

| Edible Animal Fat Market Forecast Value in (2035 F) | USD 71.7 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The edible animal fat market represents a specialized segment within the global food ingredients and processing industry, emphasizing culinary applications, flavor enhancement, and functional performance. Within the broader fats and oils sector, it accounts for about 4.1%, driven by demand in bakery, confectionery, processed foods, and savory products.

In the meat and dairy derivatives industry, its share is approximately 3.8%, reflecting usage in shortening, margarine, cooking fats, and snack products. Across the food processing and ingredient solutions market, it contributes around 3.5%, supporting texture, mouthfeel, and thermal stability. Within the processed and convenience foods category, it represents 3.2%, highlighting adoption by manufacturers for product standardization and extended shelf life. In the overall edible fats and culinary solutions ecosystem, the market contributes about 2.9%, emphasizing versatility, functional performance, and consistent quality in diverse food applications. Recent developments in the edible animal fat market have focused on quality improvement, functional diversification, and regulatory compliance. Groundbreaking trends include interest in fractionated fats, hydrogenation alternatives, and blends with vegetable oils to enhance nutritional profile and thermal performance. Key players are collaborating with food manufacturers to develop application-specific fats for bakery, confectionery, and processed food products. The adoption of refined, deodorized, and fully traceable products is gaining traction as a means to meet hygiene and safety standards. The innovation in packaging, storage stability, and flavor retention is being emphasized.

The edible animal fat market is evolving steadily, driven by rising global demand for high-energy, flavor-enhancing ingredients in processed foods and culinary applications. Traditional cooking practices and regional cuisines continue to favor animal fats for their functional and sensory attributes, particularly in bakery, frying, and confectionery sectors.

The growing popularity of ketogenic and low-carb diets has further renewed interest in animal-based fats as a natural source of energy. At the same time, manufacturers are focusing on refining processes and improving product quality to meet modern health and safety standards.

Although plant-based fats are gaining traction, edible animal fats retain significant demand due to their ability to provide texture, flavor, and shelf-life extension in various products. The market is expected to maintain moderate growth, driven by foodservice expansion and sustained use in traditional food production across emerging economies

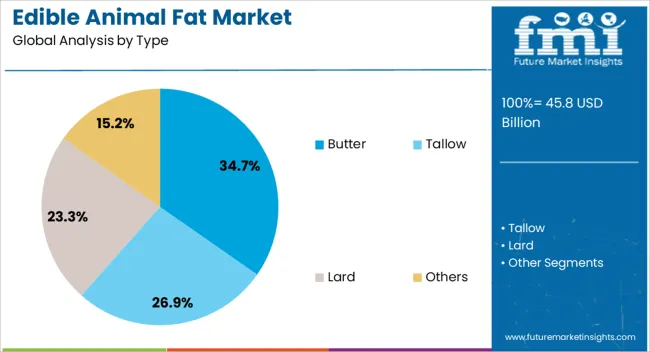

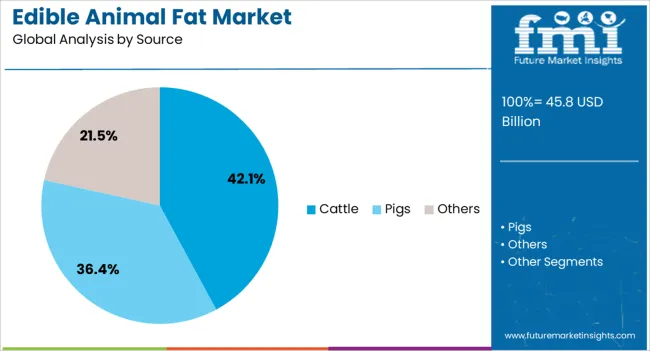

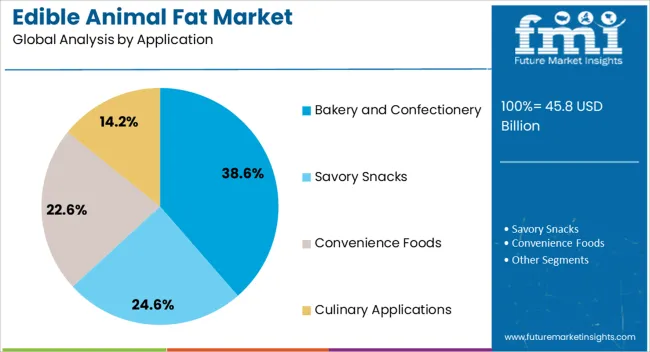

The edible animal fat market is segmented by type, source, application, and geographic regions. By type, edible animal fat market is divided into Butter, Tallow, Lard, and Others. In terms of source, edible animal fat market is classified into Cattle, Pigs, and Others. Based on application, edible animal fat market is segmented into Bakery and Confectionery, Savory Snacks, Convenience Foods, and Culinary Applications. Regionally, the edible animal fat industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Butter leads the type category with a 35% market share, highlighting its continued dominance in both household and industrial food preparation. Its rich flavor profile, natural composition, and superior cooking performance have cemented its position as a preferred fat source in a wide array of recipes.

Butter is especially valued in baking and confectionery for its creaming properties and ability to enhance product texture and mouthfeel. While health trends have introduced scrutiny over saturated fats, consumer preference for clean-label and minimally processed ingredients has contributed to butter’s sustained relevance.

Additionally, rising demand for artisanal and gourmet food products is supporting the segment’s growth. As premium butter varieties, including cultured and grass-fed options, gain popularity, the segment is expected to see continued expansion in both developed and developing markets

The cattle segment accounts for 42% of the edible animal fat market by source, driven by its widespread availability and versatility in food processing. Fats derived from cattle, including tallow and suet, are extensively used across commercial kitchens, industrial food production, and traditional cooking for their high smoke points and distinctive flavor.

This segment benefits from strong integration within meat processing operations, ensuring consistent supply and cost-efficiency. Growing interest in nose-to-tail consumption and sustainable sourcing practices is further reinforcing the use of cattle fat, especially in applications where natural and unprocessed ingredients are favored.

Regulatory clarity and improved rendering technologies are also enhancing product quality and safety. The segment is expected to maintain steady demand, particularly in markets where beef consumption is culturally prevalent and byproducts are efficiently utilized

Bakery and confectionery lead the application category with a 39% share, emphasizing the critical role of animal fats in enhancing flavor, texture, and shelf stability in these products. Animal-derived fats like butter and lard are prized for their ability to create flaky, tender baked goods and smooth, rich confections.

This segment has remained resilient as consumers continue to seek indulgent, premium-quality products where taste and texture are key differentiators. Growth in this segment is supported by rising demand for artisanal and traditional baked items, along with increased global consumption of sweets and snacks.

Manufacturers are leveraging animal fats to improve product quality without relying on synthetic emulsifiers or flavoring agents. As consumer preference shifts toward authenticity and natural ingredients, the bakery and confectionery application is expected to retain its leading position in the edible animal fat market

The market has experienced steady growth as fats sourced from cattle, pigs, poultry, and other livestock are widely used in food processing, bakery, confectionery, and culinary applications. These fats provide flavor, texture, and shelf-life stability in various products, while also serving as key ingredients in margarine, shortening, and frying oils. Demand has been influenced by rising processed food consumption, growth in quick-service restaurants, and regional dietary preferences. Advances in processing technologies, including rendering, fractionation, and deodorization, have enhanced product quality and consistency.

The processed foods and bakery sectors have been major contributors to edible animal fat consumption. Animal fats are used in biscuits, pastries, snacks, and confectionery items to enhance texture, flavor, and shelf life. Quick-service restaurants and food chains employ animal fats for frying and cooking, ensuring consistency in taste and performance. Increased urbanization and convenience-driven lifestyles have amplified demand for ready-to-eat and frozen food products, further boosting fat consumption. Technological improvements in refining and deodorizing processes allow manufacturers to produce neutral-tasting, high-quality fats suitable for diverse applications. The combination of flavor enhancement, functional properties, and adaptability across recipes ensures sustained utilization of edible animal fats in modern food production.

Technological innovations have significantly shaped the edible animal fat market. Improved rendering techniques, vacuum drying, and fractionation processes have enhanced purity, stability, and yield. Hydrogenation and interesterification allow tailoring fat properties to meet specific functional needs such as melting point, hardness, and oxidative stability. Blending with plant oils or specialty additives enables creation of customized products suitable for dietary trends or regional culinary preferences. Automation in processing plants improves efficiency, reduces contamination risks, and ensures consistent product quality. Additionally, research into reducing trans fats and optimizing nutritional profiles has influenced formulation strategies, making edible animal fats more aligned with modern consumer health expectations.

Regional consumption patterns play a significant role in market dynamics. Pork and poultry fats dominate in European and Asian countries where cultural and culinary practices favor their use, while beef tallow and mutton fats are more common in the Middle East and South Asia. Growth of the fast-food industry, increasing processed food exports, and evolving dietary habits in emerging economies have expanded regional demand. Manufacturers are adapting to local regulatory requirements, Halal or Kosher certifications, and labeling standards to ensure acceptance in different markets. The regional focus on traditional flavors, combined with modern food processing needs, has strengthened the adoption of edible animal fats globally.

Regulatory oversight and food safety standards are critical in shaping market operations. Governments and food safety authorities mandate strict adherence to hygiene, traceability, and quality protocols in rendering, storage, and distribution of edible animal fats. Monitoring of microbial contamination, heavy metals, and oxidation levels ensures safe consumption. Compliance with labeling, nutritional information, and certification requirements such as Halal, Kosher, and ISO standards influences procurement and production strategies. Companies are investing in advanced processing technologies, quality control laboratories, and supply chain management systems to meet these regulations. Regulatory pressures, combined with consumer demand for safe, high-quality fats, continue to guide market growth and innovation.

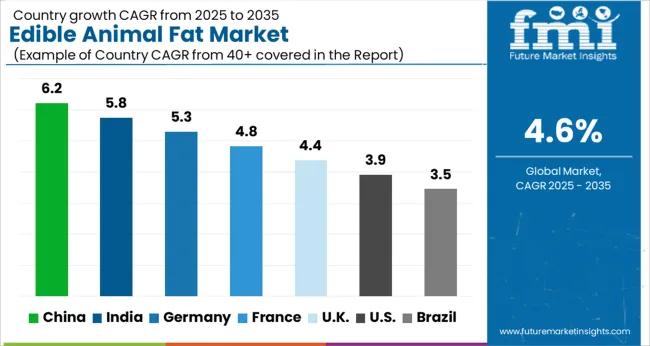

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The market is projected to grow at a CAGR of 4.6% between 2025 and 2035, driven by rising demand in food processing and culinary applications. China leads with 6.2%, supported by large-scale food manufacturing and domestic consumption. India follows at 5.8%, where traditional cooking practices and food industry growth fuel demand. Germany records 5.3%, reflecting regulated production and high-quality standards in the food sector. The UK stands at 4.4%, influenced by processed food consumption and bakery industries. The USA registers 3.9%, with growth linked to niche food products and specialty fats. The increasing demand for processed and convenience foods across regions underpins market expansion. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is registering a CAGR of 6.2%, driven by high demand from the processed food, bakery, and confectionery industries. Animal fats such as lard and tallow are widely used in traditional cooking, industrial baking, and snack production. The rise of packaged and frozen foods has increased bulk consumption of edible fats in commercial food processing. Domestic producers focus on refining technologies, quality control, and food safety certifications to meet regulatory requirements. Export opportunities to neighboring Asian countries further stimulate production, while integration with modern food processing facilities ensures consistent supply and quality standards.

India is expanding at a CAGR of 5.8%, supported by growing food processing, bakery, and snack industries. Tallow and lard are used in industrial cooking, ghee blends, and confectionery production. Increasing adoption of packaged foods and frozen bakery products creates consistent demand. Local manufacturers focus on hygienic processing, refining, and compliance with FSSAI standards to ensure quality and safety. Emerging export markets in South Asia and the Middle East contribute to market growth, while industrial processors continue investing in automated blending and refining facilities to enhance efficiency.

Germany is witnessing a CAGR of 5.3%, led by bakery, confectionery, and processed food industries. German manufacturers emphasize high-quality, refined animal fats with compliance to EU food safety and sustainability regulations. Industrial bakery units and snack producers increasingly adopt tallow and lard blends for premium quality products. Research and innovation focus on reducing saturated fat content while maintaining functionality for baking and frying. The market benefits from strong regulatory oversight and established production processes that ensure consistent quality and food safety.

The United Kingdom is expanding at a CAGR of 4.4%, driven by bakery, confectionery, and food service sectors. Industrial adoption focuses on high-quality lard and tallow for pastries, bakery mixes, and specialty foods. UK manufacturers prioritize compliance with food safety regulations, traceability, and sustainable sourcing practices. Emerging trends in frozen foods and ready-to-eat products are further increasing industrial demand. Niche applications in artisanal baking and specialty confectionery also support market expansion despite overall moderate growth.

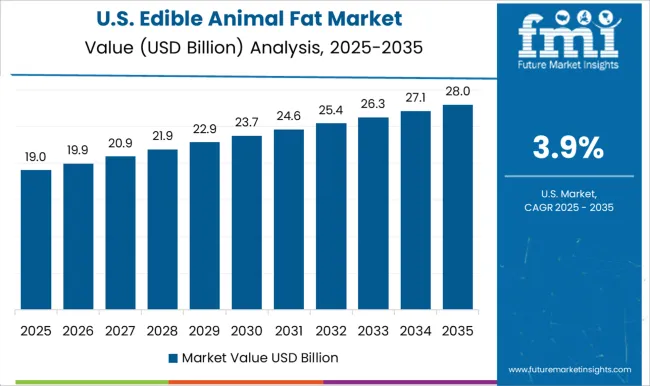

The United States is growing at a CAGR of 3.9%, supported by bakery, confectionery, fast food, and snack industries. Industrial use of tallow, lard, and other edible animal fats is significant for frying, baking, and processed food production. Food safety, quality standards, and regulatory compliance remain critical, while the market also explores reduced-saturated-fat blends to meet health-conscious consumer preferences. Large multinational food processors and industrial bakeries dominate the consumption landscape, with investment in automated refining and blending facilities to ensure consistent supply.

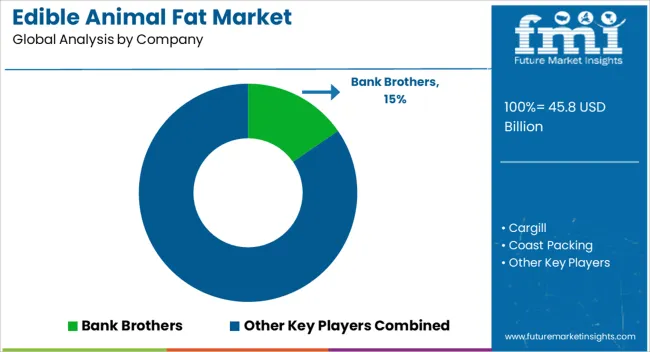

The market is characterized by a mix of global agribusiness giants and regional specialists, catering to food manufacturing, bakery, and industrial applications. Key players such as Cargill, SARIA SE & Co. KG, and Ten Kate Holding B.V leverage their integrated supply chains, large-scale production facilities, and consistent quality standards to maintain leadership across international markets. These companies emphasize product diversification, offering refined, hydrogenated, and specialty fats to meet regulatory, nutritional, and application-specific requirements. Regional players, including Bank Brothers, Coast Packing, Leo Group Ltd, Sanimax, Sonac, and York Foods, focus on niche markets with tailored offerings for bakery, confectionery, and culinary applications. They capitalize on local sourcing, flexible production, and strong customer relationships to compete against global players. Market competitiveness is further influenced by evolving consumer preferences, regulatory compliance regarding labeling and health standards, and sustainability initiatives. Companies that integrate traceability, by-product utilization, and eco-friendly processing gain a competitive edge. Strategic partnerships with food manufacturers, continuous process optimization, and adherence to food safety certifications strengthen market positioning and drive long-term growth in this segment.

| Item | Value |

|---|---|

| Quantitative Units | USD 45.8 Billion |

| Type | Butter, Tallow, Lard, and Others |

| Source | Cattle, Pigs, and Others |

| Application | Bakery and Confectionery, Savory Snacks, Convenience Foods, and Culinary Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bank Brothers, Cargill, Coast Packing, Leo Group Ltd, Sanimax, Sonac, Ten Kate Holding B.V, York Foods, and SARIA SE & Co. KG |

| Additional Attributes | Dollar sales by fat type and application, demand dynamics across food processing, bakery, and confectionery sectors, regional trends in culinary and industrial adoption, innovation in extraction, refining, and stabilization, environmental impact of livestock sourcing and processing, and emerging use cases in functional foods, flavor enhancement, and specialty food products. |

The global edible animal fat market is estimated to be valued at USD 45.8 billion in 2025.

The market size for the edible animal fat market is projected to reach USD 71.7 billion by 2035.

The edible animal fat market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in edible animal fat market are butter, tallow, lard and others.

In terms of source, cattle segment to command 42.1% share in the edible animal fat market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edible Oil Cans Market Size and Share Forecast Outlook 2025 to 2035

Edible Shrink Tunnel Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Edible Water Pods Market Size and Share Forecast Outlook 2025 to 2035

Edible Cups Market Size and Share Forecast Outlook 2025 to 2035

Edible Beauty Infusions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Nuts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Collagen Casing Market Size and Share Forecast Outlook 2025 to 2035

Edible Seaweed Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Edible Oil Packaging Market Growth - Demand & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Competitive Overview of Edible Collagen Casing Market Share

Competitive Landscape of Edible Flakes Providers

Industry Share Analysis for Edible Offal Providers

Edible Packaging Market Report – Key Trends & Forecast 2024-2034

Edible Fungus Market Outlook – Growth, Demand & Forecast 2024 to 2034

Edible and Soluble Films Market

Edible Oils and Fats Market Analysis by Product Type, Source, and Distribution Channel Through 2035

Organic Edible Oil Market Analysis by Type, Distribution Channel, and Region Through 2035

Demand for Edible Nuts in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA