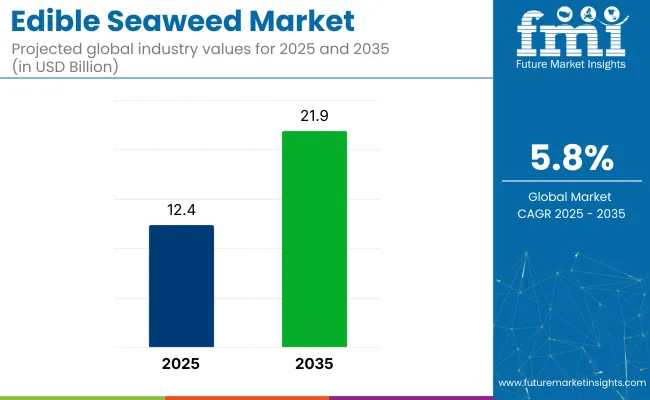

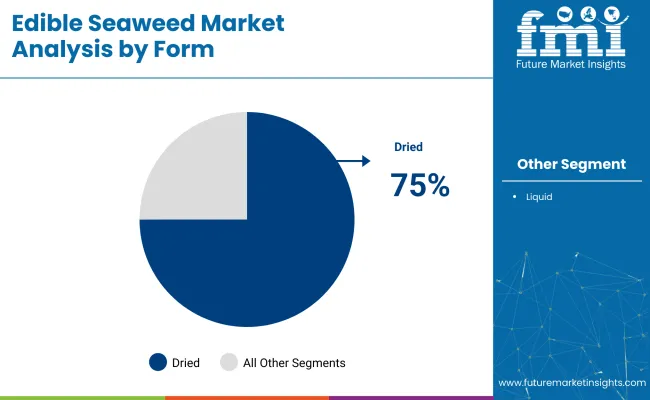

The global edible seaweed market is set to be valued at USD 12.4 billion in 2025 and a projected reach of USD 21.9 billion by 2035. For manufacturers, this reflects a shift from niche food adoption to broader functional applications in plant-based nutrition and health products. In volume terms, dried seaweed retains over 75% share in 2025, led by production clusters in China, South Korea, and Indonesia.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 12.4 billion |

| Industry Value (2035F) | USD 21.9 billion |

| CAGR (2025 to 2035) | 5.8% |

Manufacturers aiming to optimize cost-to-nutrient ratios are shifting focus toward semi-refined carrageenan and alginate fractions, where extraction margins can exceed 18% with minimal raw material waste. In Australia and North America, a wave of biotech-enabled cultivation has emerged, particularly for red seaweeds rich in protein and omega-3 analogues. These strains show potential to outperform traditional nori in both aquaculture feed and snack formulations.

On the demand side, North America, especially the United States, is growing fastest at 6.8% CAGR. Food processors and supplement brands are sourcing organic-certified seaweed inputs for gut health, immunity, and thyroid support applications. Manufacturers supplying to this segment are developing fermentation-free drying techniques to preserve iodine and antioxidant levels.

Compliance remains key. Harmonization of CODEX-aligned quality standards in ASEAN and the EU is reducing trade barriers. Japan’s Food Sanitation Law amendments have catalyzed functional food certifications for brown seaweed extracts. In Europe, high-fiber kelp variants have gained EFSA backing for prebiotic claims, driving formulators to seek suppliers that meet strict traceability metrics. Seaweed’s penetration in protein markets is still low. It is estimated under 3% but lipid and polysaccharide profiles offer novel value propositions outside traditional protein markets.

The industry registers a relatively small share within the broader markets it belongs to, but it is steadily growing due to increasing consumer demand for healthy, sustainable, and plant-based food options. In the legumes and pulses market, edible seaweed would likely represent less than 5%, as this market is dominated by crops like lentils and chickpeas.

In the plant-based protein market, seaweed's share is also modest, likely under 3%, given its niche compared to other protein-rich sources like soy or pea protein. In the functional foods market, seaweed's share is growing but may still be less than 10%. However, in the organic food market, edible seaweed has a more significant presence, especially in coastal regions, accounting for around 5-7% of the market.

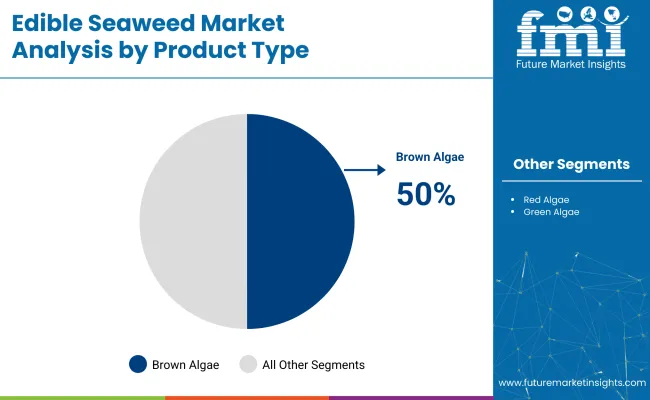

The industry is segmented by product type into brown algae, red algae, and green algae; by end use application into food and beverage processing, pharmaceuticals, dietary supplements and nutraceuticals, personal care and cosmetics, animal feed, aqua feed, pet food, and retail; by extraction method into conventional and current method; and by form into dried and liquid. The regional analysis spans North America, Western Europe, East Asia, and South Asia.

Brown algae is expected to hold the largest share of the market, accounting for 50% of the market in 2025. This is driven by its widespread use in culinary applications (such as kombu and wakame in soups and salads), as well as its growing role in health supplements due to its rich nutrient profile, including iodine, calcium, and magnesium.

The food & beverage processing segment is expected to hold the largest share of the market, accounting for around 45% in 2025. This dominance is driven by the increasing incorporation of seaweed into a wide range of food products, from soups and salads to snacks, beverages, and even plant-based alternatives.

The conventional extraction method is expected to hold the largest share of the market, accounting for 60% share in 2025. This method remains dominant due to its long-established use and familiarity in seaweed harvesting and processing.

The dried form of edible seaweed is expected to hold the largest share of the market, accounting for 75% in 2025. Dried seaweed is highly favored due to its long shelf life, ease of storage, and versatility in both culinary and industrial applications. It is commonly used in snacks, soups, salads, and as an ingredient in processed foods.

Edible seaweed is gaining traction as both a nutrient-dense input and a monetizable crop. Its use in clean-label fortification and alignment with blue-carbon credit frameworks is attracting food brands and coastal producers alike. These twin revenue levers are reshaping supply dynamics across food, supplements, and marine agronomy sectors.

Micronutrient Fortification Contracts Reshaping End-Use Economics

Mandatory sodium-reduction targets in North America and Europe have pushed bakery and cereal makers to secure natural iodine and potassium sources. Food-grade kelp powders now command long-term supply agreements covering 14 kt through 2028, equal to 3.2% of global dried output. Calcium-rich red algae is being blended into oat beverages at 1.1% inclusion, allowing “source of calcium” label claims without mineral salts.

Blue-Carbon Credit Monetization Unlocks Dual Revenue Streams

Macroalgae farms in South Korea and Norway have begun registering sequestration projects under Verra’s VM0043 methodology. Issuance of 0.8 Mt CO₂-eq credits is projected by 2026, enabling growers to hedge biomass-price swings. Forward credit prices averaged USD 19.4 per tonne in Q2 2025, covering up to 17% of cultivation opex for rope-grown kelp. Ingredient processors are layering carbon-neutral claims onto seaweed extract SKUs, securing premium positioning in cosmetics and nutraceutical channels.

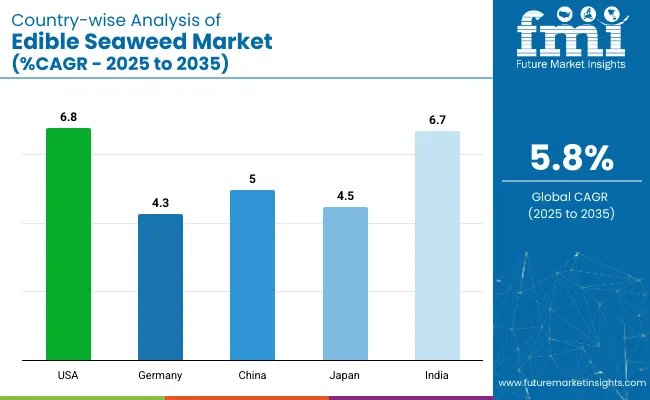

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

| Germany | 4.3% |

| Japan | 4.5% |

| China | 5.0% |

| India | 6.7% |

The edible seaweed market, expected to grow globally at a CAGR of 5.8% from 2025 to 2035, shows varied performance across key countries. The United States, a member of the OECD, is leading with a 6.8% CAGR, driven by strong demand for plant-based, sustainable food options and the rise of vegan and health-conscious diets. India, a member of the BRICS group, is also experiencing growth, with a 6.7% CAGR, fueled by increasing health awareness, plant-based food adoption, and opportunities for local seaweed cultivation.

Moderate growth is being recorded in Japan (OECD), with a 4.5% CAGR, as the traditional consumption of seaweed merges with the rising demand for functional foods and health supplements among the aging population. China, also part of BRICS, is expected to grow at a 5.0% CAGR, driven by its rich culinary history with seaweed and increasing middle-class demand for health-focused products. Slower growth is seen in Germany, an OECD member, with a 4.3% CAGR, reflecting steady but moderate adoption of seaweed as part of the growing organic and sustainable food trend.

The report covers a detailed analysis of 40+ countries, with the top five countries shared as a reference for market trends.

Demand for edible seaweed in the United States is likely to grow at a 6.8% CAGR during the forecast period. The increasing demand for plant-based and sustainable food options has significantly contributed to this growth. As consumers become more health-conscious, seaweed is gaining popularity due to its rich nutrient profile, including high levels of vitamins, minerals, and antioxidants.

The rise of vegan and vegetarian diets, especially among younger generations, has driven the demand for natural, plant-based protein sources like seaweed. eaweed’s minimal environmental impact makes it an attractive alternative to traditional crops, aligning with the growing preference for eco-friendly food choices.

Sales of edible seaweed in Germany is projected to grow at a 4.3% CAGR during the forecast period. Germany has witnessed a rising trend toward health-conscious eating, with consumers increasingly opting for nutrient-dense, functional foods. As one of Europe’s leading markets for organic and plant-based food products, Germany’s demand for seaweed is driven by its high nutritional value and versatility in various food applications.

The German food industry has embraced seaweed as an alternative to traditional ingredients, using it in plant-based products, snacks, and even in non-dairy beverages. The growing awareness of seaweed's potential health benefits, such as supporting immune function and gut health, has further expanded its appeal. .

The edible seaweed market in China is anticipated to grow at a 5% CAGR during the forecast period. China has a long tradition of incorporating seaweed into its cuisine, particularly in dishes like soups, salads, and sushi. The growing middle-class population, along with increasing disposable incomes, has driven demand for both traditional and new seaweed-based food products.

As the country grapples with increasing health concerns, such as obesity and lifestyle diseases, there is a shift toward more nutritious, plant-based diets. The rich antioxidant, vitamin, and mineral content of seaweed makes it an attractive alternative to processed foods. The Chinese government’s focus on sustainable agricultural practices and the growing interest in eco-friendly food sources have contributed to the increased adoption of seaweed farming, further boosting market growth.

The edible seaweed market in Japan is projected to grow at a 4.5% CAGR from 2025 to 2035. Seaweed is an essential part of Japanese cuisine, with products like nori, wakame, and kombu being integral ingredients in traditional dishes such as sushi, soups, and salads. Japan’s long-standing appreciation for the nutritional and health benefits of seaweed continues to drive its consumption.

As the Japanese population increasingly focuses on healthy aging, seaweed’s antioxidant, anti-inflammatory, and immune-boosting properties are gaining traction. Tis rising consumer awareness about sustainable food practices, and seaweed’s minimal environmental impact has made it a favorable choice. The growing popularity of functional foods and health supplements has also contributed to a steady rise in seaweed-based products, which are now being incorporated into snacks, beverages, and wellness products.

The India edible seaweed market is estimated to grow at a 6.7% CAGR between 2025 and 2035. India’s expanding health-conscious population is increasingly seeking alternative, nutrient-rich foods to improve well-being. Seaweed, known for its high fiber content, vitamins, and minerals, is being recognized as a superfood and is gaining popularity in various health supplements and functional foods.

The rising adoption of vegan and plant-based diets in India has fueled demand for plant-based proteins, with seaweed becoming an attractive protein source. India’s coastline offers significant opportunities for seaweed cultivation, aligning with the government's focus on promoting sustainable aquaculture practices.

Key players like Gelymar and Tasmanian seafood seduction dominate the market with their advanced sustainable harvesting techniques. Gelymar specializes in producing high-quality seaweed-based ingredients for the food and beverage industry, while Tasmanian Seafood Seduction offers premium seaweed products with a strong focus on clean, sustainable sourcing.

Other significant players like PhycoHealth and Sea Forest are innovating with seaweed-based health supplements and sustainable aquaculture solutions. Emerging players like the seaweed company and Marinova are focusing on advanced extraction methods for bioactive compounds, contributing to the growing demand for functional foods and supplements.

Recent Edible Seaweed Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 12.4 billion |

| Projected Market Size (2035) | USD 21.9 billion |

| CAGR (2025 to 2035) | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in metric tons |

| Product Type Analyzed (Segment 1) | Brown Algae, Red Algae, And Green Algae. |

| End Use Application Analyzed (Segment 2) | Food & Beverage Processing, Pharmaceuticals, Dietary Supplements And Nutraceuticals, Personal Care And Cosmetics, Animal Feed, Aqua Feed, Pet Food, And Retail. |

| Extraction Method Analyzed (Segment 3) | Conventional And Current Method. |

| Form Analyzed (Segment 4) | Dried And Liquid. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Gelymar, Tasmanian Seafood Seduction, PhycoHealth, Sea Forest, Australian Seaweed Institute, Marinova, Great Southern Ocean, The Seaweed Company, Acadian Seaplants, Qingdao Gather Great Ocean Algae Industry Group |

| Additional Attributes | Dollar sales, market share by product type and region, growth trends, competitive landscape, consumer preferences, regulatory challenges, and forecasts for future demand in key applications. |

The industry is segmented into brown algae, red algae, and green algae.

The industry covers food & beverage processing, pharmaceuticals, dietary supplements and nutraceuticals, personal care and cosmetics, animal feed, aqua feed, pet food, and retail.

By Extraction Method:

The industry is categorized into conventional and current method.

The industry is segmented into dried and liquid.

The market spans North America, Western Europe, East Asia, and South Asia.

The industry is valued at USD 12.4 billion in 2025.

It is forecasted to reach USD 21.9 billion by 2035.

The industry is anticipated to grow at a CAGR of 5.8% during this period.

Dried form is projected to lead the market with a 75% share in 2025.

North America, particularly the United States, is expected to be the key growth region with a projected growth rate of 6.8%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edible Oil Cans Market Size and Share Forecast Outlook 2025 to 2035

Edible Shrink Tunnel Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Edible Animal Fat Market Size and Share Forecast Outlook 2025 to 2035

Edible Water Pods Market Size and Share Forecast Outlook 2025 to 2035

Edible Cups Market Size and Share Forecast Outlook 2025 to 2035

Edible Beauty Infusions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Nuts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Collagen Casing Market Size and Share Forecast Outlook 2025 to 2035

Edible Oils and Fats Market Analysis by Product Type, Source, and Distribution Channel Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Edible Oil Packaging Market Growth - Demand & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Competitive Overview of Edible Collagen Casing Market Share

Industry Share Analysis for Edible Offal Providers

Competitive Landscape of Edible Flakes Providers

Edible Packaging Market Report – Key Trends & Forecast 2024-2034

Edible Fungus Market Outlook – Growth, Demand & Forecast 2024 to 2034

Edible and Soluble Films Market

Organic Edible Oil Market Analysis by Type, Distribution Channel, and Region Through 2035

Demand for Edible Nuts in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA