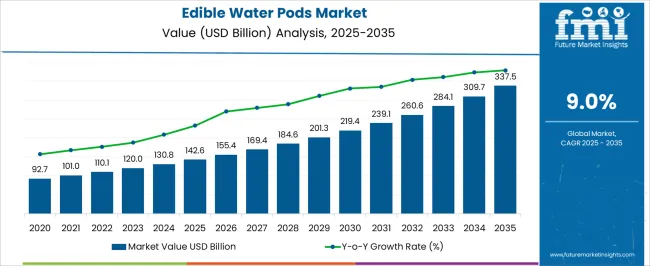

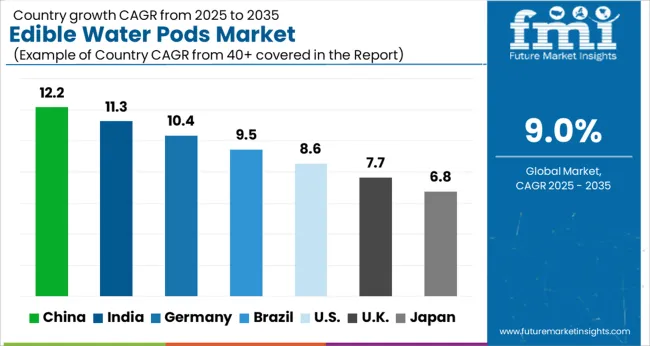

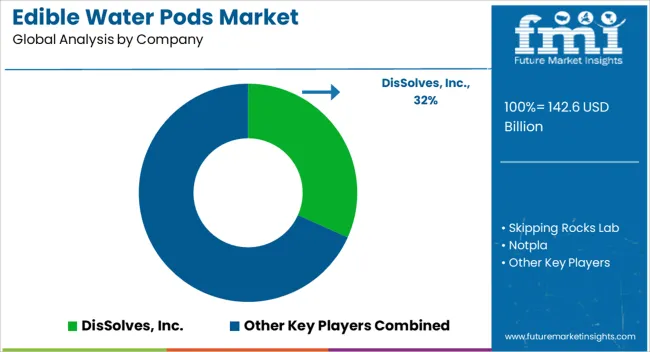

The Edible Water Pods Market is estimated to be valued at USD 142.6 billion in 2025 and is projected to reach USD 337.5 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

| Metric | Value |

|---|---|

| Edible Water Pods Market Estimated Value in (2025 E) | USD 142.6 billion |

| Edible Water Pods Market Forecast Value in (2035 F) | USD 337.5 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The edible water pods market is gaining strong momentum as sustainability concerns and demand for eco friendly alternatives to single use plastics continue to rise. Consumers are increasingly adopting biodegradable packaging solutions that reduce plastic waste while offering convenience and portability.

Alginate and other plant derived materials are being utilized to manufacture water pods that are both safe for consumption and environmentally sustainable. Innovation in flavor infusion, texture enhancement, and shelf stability is further expanding the consumer base beyond hydration into functional and lifestyle beverages.

Supportive policies aimed at reducing plastic pollution along with growing investments from food technology startups and established beverage players are reinforcing adoption. The outlook for this market is optimistic, with opportunities for product diversification, scaling of direct to consumer distribution channels, and penetration into events, hospitality, and fitness sectors.

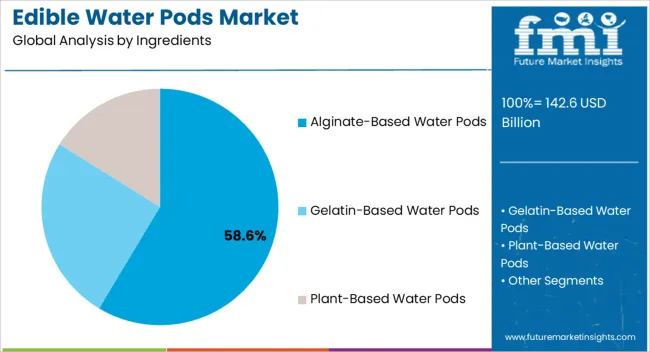

The alginate based water pods segment is expected to account for 58.60% of total revenue by 2025 within the ingredients category, making it the leading segment. This dominance is driven by the natural, biodegradable, and safe characteristics of alginate, which ensure sustainability without compromising product integrity.

Its ability to encapsulate liquids effectively while offering a clean label appeal has supported wide adoption across beverage and hydration markets. Ease of large scale manufacturing and compatibility with flavored and functional water variants have further strengthened its leadership.

The balance of cost effectiveness and consumer acceptance continues to make alginate based pods the most commercially viable solution.

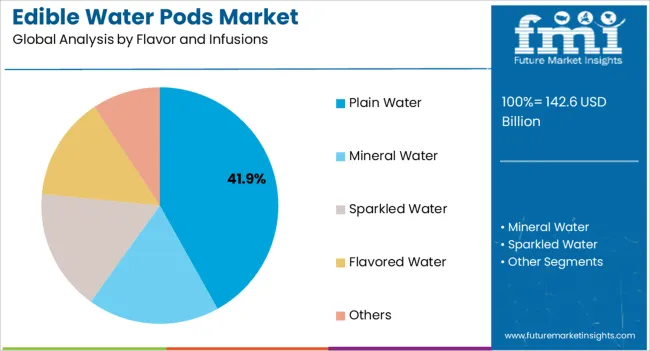

The plain water segment is projected to represent 41.90% of total revenue by 2025 within the flavor and infusions category. This growth is attributed to consumer preference for simple, clean hydration without additives or sweeteners.

The demand for natural, calorie free, and sustainable alternatives is strong, particularly among health conscious demographics and event based consumption. Plain water pods offer a direct replacement for plastic bottled water, aligning with zero waste initiatives and green consumerism trends.

Their convenience for immediate hydration in urban mobility and fitness settings has accelerated adoption, reinforcing their prominence in the market.

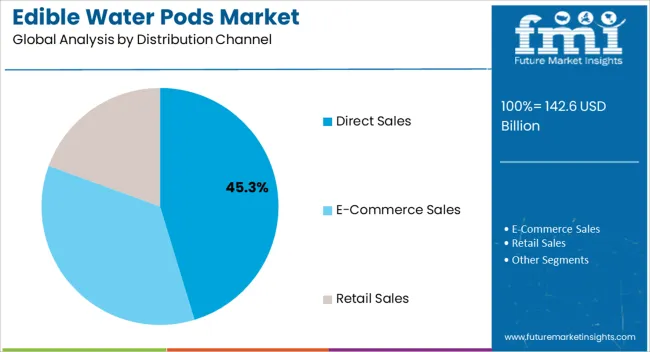

The direct sales segment is expected to contribute 45.30% of total revenue by 2025 within the distribution channel category, making it the dominant channel. This leadership stems from the ability of direct sales to connect eco friendly brands directly with consumers through online platforms, events, and corporate partnerships.

Direct to consumer models enable better control over customer experience, sustainability messaging, and brand positioning. Additionally, the channel facilitates faster adoption of innovative products by reducing reliance on traditional retail infrastructure.

The growth of e commerce, subscription models, and customized packaging solutions has further elevated direct sales as the most effective route to market for edible water pods.

Historically, edible pods have showcased a significant increase in consumer interest and adoption. Edible pods, with their convenient and eco-friendly attributes, have gained popularity among consumers seeking alternative packaging options. The past demand trends indicate a growing consumer preference for edible pods as a sustainable and convenient way to consume various products.

The future sales outlook for the edible pods market is optimistic, driven by several factors.

The versatility of edible pods presents opportunities for expansion into different product categories. While edible water pods have gained significant traction, there is potential for edible pods to be used for other consumable products. Such as condiments, supplements, and personal care items. This diversification of product offerings is likely to contribute to the future sales growth of the edible pods market.

Collaborations and partnerships between edible pod manufacturers and food and beverage companies can open up new distribution channels and drive sales. Edible pods can be integrated into existing product lines or offered as complementary add-ons, increasing their accessibility to a broader consumer base.

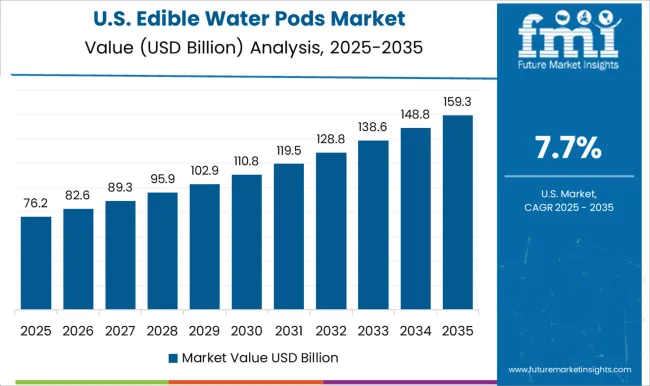

The market share of the United States in the edible water pods market is substantial. Reflecting the growing demand and adoption of these eco-friendly alternatives to traditional plastic bottles. The country's focus on environmental sustainability, coupled with consumer awareness and preference for sustainable products, has contributed to the strong presence and market share of edible water pods in the United States.

As a country known for its focus on sustainability and environmental consciousness, the United Kingdom has embraced innovative solutions like edible water pods to reduce plastic waste. The market share of the United Kingdom in the edible water pods market is notable, indicating the increasing demand and adoption of these eco-friendly alternatives. The British population's growing awareness of environmental issues has contributed to its strong presence. Moreover, their willingness to support sustainable products drives the market share of edible water pods in the United Kingdom.

China has recognized the necessity of sustainable alternatives due to its enormous population and growing concerns about plastic waste. China's market position in the edible water pods market indicates the country's growing desire for environmentally friendly packaging options.

Consumption of edible water pods is being driven by Chinese customers' active pursuit of innovative and sustainable products. Furthermore, the Chinese government's measures to enhance environmental protection and prevent plastic pollution have spurred the rise of the edible water pod industry in China.

The country's strong emphasis on sustainability and eco-friendly practices has contributed to the increasing demand for innovative packaging solutions like edible water pods. South Korean consumers are increasingly conscious of the environmental impact of single-use plastics, leading them to seek alternative options. As a result, the market share of South Korea in the edible water pods market has witnessed significant growth. The government's initiatives to promote sustainable practices and reduce plastic waste have further boosted the adoption of edible water pods in the country.

Alginate-based water pods are a popular choice due to their natural and sustainable properties. It offers a gel-like texture that can hold water and other liquids, making it an ideal ingredient for creating edible water pods. Alginate-based water pods are often biodegradable and can provide a convenient and eco-friendly alternative to traditional plastic water bottles. Additionally, seaweed extract is rich in minerals and nutrients, adding to the appeal of these edible water pods from a health perspective.

Citrus-flavored edible water pods are trending among consumer-base. The refreshing and tangy taste of citrus fruits, such as lemon, lime, and orange, makes them a popular choice for consumers. Citrus flavors are known for their invigorating and thirst-quenching properties, making them an excellent fit for edible water pods.

The bright and zesty flavor profile of citrus fruits adds a delightful twist to the drinking experience, making it more enjoyable and satisfying. Additionally, citrus fruits are often associated with freshness and vitality, which further enhances the appeal of flavored edible water pods.

Retail stores, including supermarkets, convenience stores, and specialty beverage retailers, play a crucial role in making edible water pods easily accessible to consumers.

These distribution channels have established networks, widespread reach, and a strong customer base, allowing them to capture a significant portion of the market share. Retailers provide a convenient and reliable platform for consumers to discover, purchase, and replenish their edible water pods. With attractive product displays, promotional activities, and strategic positioning within the store, retail distribution channels effectively cater to the demands of consumers seeking innovative and sustainable beverage options like edible water pods.

The competitive landscape in the market is characterized by several key players vying for market share. Moreover, striving to differentiate itself in terms of product offerings, innovation, and marketing strategies.

The market is relatively nascent but growing rapidly, attracting both established companies and emerging startups. Some prominent players in the market include:

Ooho: Ooho is a well-known brand that pioneered the concept of edible water pods. They have gained recognition for their innovative biodegradable and edible packaging made from seaweed extract.

Skipping Rocks Lab: Skipping Rocks Lab is another key player in the edible water pods market. They have developed edible packaging solutions, including their notable product, the Ooho edible water bottle.

Notpla: Notpla is a company dedicated to creating sustainable packaging solutions, including edible water pods. They use natural and biodegradable materials, such as seaweed, to produce their edible packaging.

BluCon BioTech: BluCon BioTech is an emerging player in the edible water pods market. They specialize in creating edible and biodegradable packaging solutions for beverages, including water pods.

Water Wand: The company offers edible water pods designed for on-the-go hydration. Their products are made from plant-based materials and are intended to be consumed along with water, eliminating the need for plastic bottles or cups.

The global edible water pods market is estimated to be valued at USD 142.6 billion in 2025.

The market size for the edible water pods market is projected to reach USD 337.5 billion by 2035.

The edible water pods market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in edible water pods market are alginate-based water pods, gelatin-based water pods and plant-based water pods.

In terms of flavor and infusions, plain water segment to command 41.9% share in the edible water pods market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edible Oil Cans Market Size and Share Forecast Outlook 2025 to 2035

Edible Shrink Tunnel Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Edible Animal Fat Market Size and Share Forecast Outlook 2025 to 2035

Edible Cups Market Size and Share Forecast Outlook 2025 to 2035

Edible Beauty Infusions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Nuts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Collagen Casing Market Size and Share Forecast Outlook 2025 to 2035

Edible Seaweed Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Edible Oils and Fats Market Analysis by Product Type, Source, and Distribution Channel Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Edible Oil Packaging Market Growth - Demand & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Competitive Overview of Edible Collagen Casing Market Share

Competitive Landscape of Edible Flakes Providers

Industry Share Analysis for Edible Offal Providers

Edible Packaging Market Report – Key Trends & Forecast 2024-2034

Edible Fungus Market Outlook – Growth, Demand & Forecast 2024 to 2034

Edible and Soluble Films Market

Organic Edible Oil Market Analysis by Type, Distribution Channel, and Region Through 2035

Demand for Edible Nuts in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA