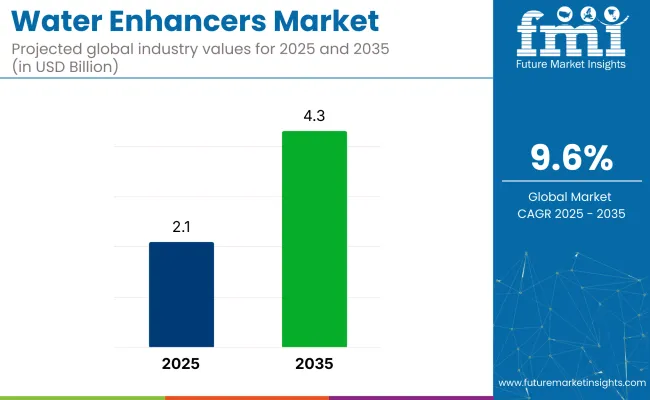

The global water enhancers market is valued at USD 2.1 billion in 2025 and is expected to reach USD 4.3 billion by 2035, reflecting a robust CAGR of 9.6%.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 2.1 billion |

| Projected Value (2035F) | USD 4.3 billion |

| CAGR (2025 to 2035) | 9.6% |

Growth is anticipated to be driven by increasing consumer demand for healthier hydration options, coupled with the convenience offered by these products for on-the-go consumption. Rising innovations in functional formulations with added vitamins and minerals are also expected to support market expansion over the forecast period.

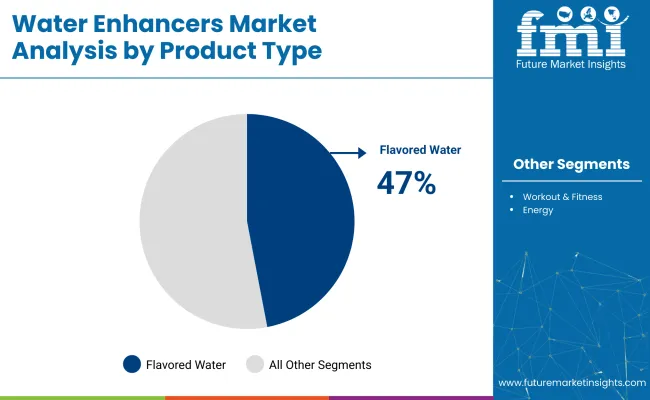

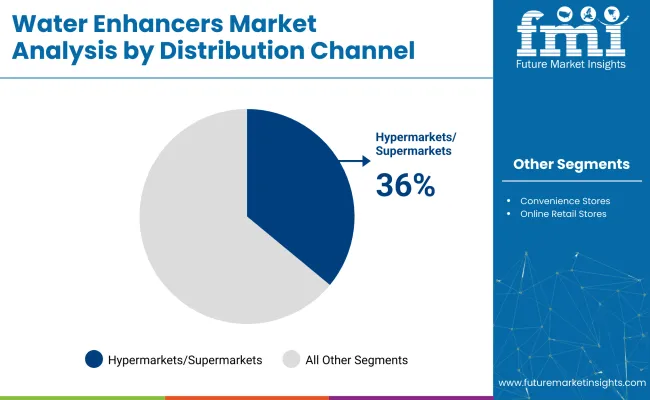

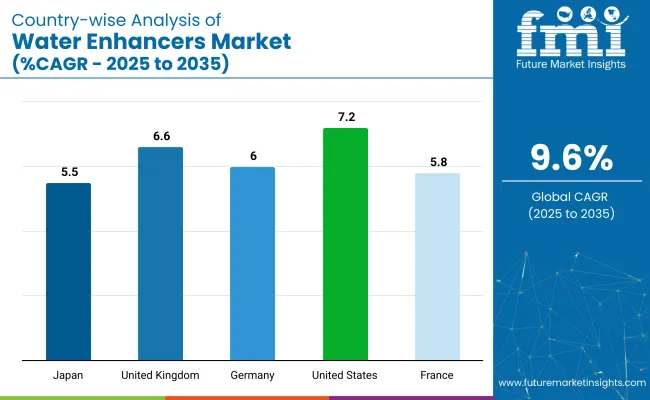

In 2025, the United States is projected to dominate the market with the largest share, expanding at a CAGR of 7.2%, driven by strong demand for nutrient-dense hydration products and availability of multiple flavors. Meanwhile, the UK and Germany closely follow this significant growth with CAGRs of 6.6% and 6.0% respectively.Flavored water is anticipated to remain the leading product type segment with a 47% share in 2025, while hypermarkets and supermarkets are expected to continue as the top distribution channel with a 36% market share.

Themarket is estimated to hold a notable yet niche share within its parent categories. It accounts for approximately 6-8% of the global functional beverages market, driven by its rising popularity as a convenient hydration enhancer.

Within the health and wellness drinks market, it comprises around 4-5%, as consumers still largely prefer ready-to-drink fortified beverages. In the broader non-carbonated drinks market, water enhancers represent about 2-3%, indicating growth potential as awareness increases.

The market is segmented byproduct type, distribution channel, and region.By product type, it includes workout & fitness, energy, and flavored. By distribution channel, it includes pharmacies/drug stores, convenience stores, hypermarkets/supermarkets, and online retail stores.By region,it covers North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa.

During 2025-2035, the flavored water enhancers segment is expected to remain dominant, driven by its enhanced taste and broad consumer acceptance as a healthier alternative to carbonated drinks. With a market share of 47% in 2025, flavored variants are preferred for daily hydration, while workout & fitness enhancers are gaining traction among athletes for electrolyte balance.

Hypermarkets and supermarkets are projected to remain the largest distribution channel for water enhancers, accounting for 36% market share in 2025, due to their extensive retail networks and ability to offer multiple brands and flavors under one roof. Convenience stores also drive sales for on-the-go purchases, while online retail stores are growing steadily, driven by digital adoption and wider product availability across urban and semi-urban consumers globally.

Recent Trends in the Water Enhancers Market

Challenges in the Water Enhancers Market

Between 2025 and 2035, theUSA is projected to witness the highest growth rate at 7.2%, driven by daily consumption and strong brand portfolios. TheUK follows with a CAGR of 6.6%, supported by health-conscious shifts towards low-sugar beverages.

The market in Germany is forecasted to grow at 6.0%, led by fitness-focused consumers and clean-label demand.France is expected to expand at a CAGR of 5.8%, driven by millennial health preferences, whileJapan will see the slowest growth at 5.5%, despite strong convenience store penetration and innovative functional offerings catering to busy lifestyles and aging demographics.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The water enhancers'revenue in the USA is expected to grow at a CAGR of 7.2% from 2025 to 2035. Demand is projected to be driven by rising consumer preference for nutrient-dense hydration solutions and wide product availability across retail formats. Strong brand portfolios, innovative flavors, and functional blends with vitamins and electrolytes are supporting market expansion among health-conscious and fitness-focused consumers.

The water enhancer marketin the UK is projected to register a CAGR of 6.6% from 2025 to 2035. Demand is anticipated to rise due to growing concerns over obesity and diabetes, leading to shifts toward healthier beverage alternatives. The adoption of water enhancers fortified with vitamins and minerals is likely to increase as consumers seek convenient options to improve hydration and general well-being.

The sales of water enhancers in Germany are estimated to expand at a CAGR of 6.0% from 2025 to 2035. Growth is driven by increasing adoption of functional beverages among fitness enthusiasts and working professionals. Rising awareness of hydration nutrition benefits and an established retail ecosystem are supporting market growth, while natural and bio-based formulations gain consumer traction.

The revenue from water enhancers in France is estimated to rise at a CAGR of 5.8% from 2025 to 2035. Increased consumer inclination towards personalized nutrition and hydration solutions is supporting market expansion. Companies are innovating with organic and fortified water enhancer options to cater to health-conscious millennials and working professionals.

The water enhancers marketin Japan is slated to register a CAGR of 5.5% from 2025 to 2035. Growth is driven by rising health awareness, busy lifestyles, and interest in convenient hydration solutions. Demand for water enhancers with added vitamins, minerals, and relaxation-focused blends is increasing, supported by strong convenience store distribution networks.

The water enhancers market is moderately consolidated, with a few global leaders accounting for a substantial share, along with mid-sized regional players. Top companies such as PepsiCo Inc., The Coca-Cola Company, Nestle S.A., and The Kraft Heinz Company compete aggressively based on brand strength, innovative formulations, and diversified flavor portfolios.

Company strategies primarily focus on expanding product lines with functional ingredients, convenient packaging formats, and natural formulations to attract health-conscious consumers. Competitive pricing is adopted to retain mass-market appeal, while partnerships with retail chains and e-commerce platforms ensure wider distribution. Recent launches are emphasizing clean-label, zero-calorie, and vitamin-fortified products to differentiate offerings, as seen with PepsiCo and Kraft Heinz expanding their hydration enhancer lines in major markets.

Recent Water Enhancer Market News

In March 2025, PepsiCo announced to acquire Poppi, which is a leading soda brand. This will boost the company’s customer base and product portfolio.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.1 billion |

| Projected Market Size (2035) | USD 4.3 billion |

| CAGR (2025 to 2035) | 9.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in kilotons |

| By Product Type | Workout & Fitness, Energy, Flavored |

| By Distribution Channel | Pharmacies/Drug Stores, Convenience Stores, Hypermarkets/Supermarkets, Online Retail Stores |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | PepsiCo Inc, The Coca-Cola Company, Nestle S.A., The Kraft Heinz Company, Britvic Plc, Jelsert, Dyla LLC, Pharmavite LLC, Wisdom Natural Brands, Protekt, DreamPak |

| Additional Attributes | Dollar sales by value, market share analysis by segment, region, and country-wise insights |

By product type, methods industry has been categorized into Workout & Fitness, Energy and Flavored

By distribution channel industry has been categorized into Pharmacies/Drug Stores, Convenience Store, Hypermarket/Supermarket and Online Retail Stores

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is valued at USD 2.1 billion in 2025.

The market is forecasted to reach USD 4.3 billion by 2035, reflecting a CAGR of 9.6%.

Flavored water enhancers are expected to lead with a 47% market share in 2025.

Hypermarkets and supermarkets are projected to dominate with a 36% share in 2025.

The USA is anticipated to be the fastest-growing major market with a CAGR of 7.2% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA