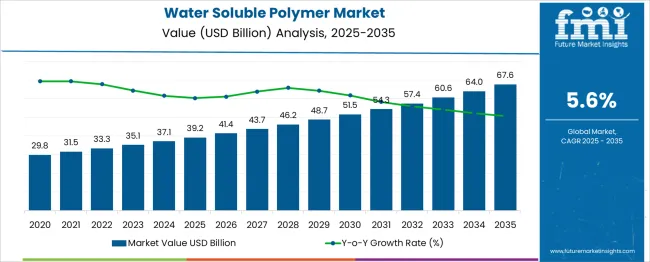

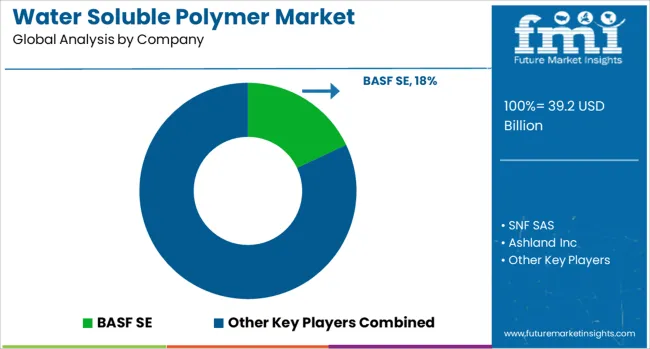

The Water Soluble Polymer Market is estimated to be valued at USD 39.2 billion in 2025 and is projected to reach USD 67.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

Annual gains remain steady throughout the forecast window, with absolute growth ranging from USD 2.2 billion in early years to USD 3.6 billion in the final phase. Between 2025 and 2028, the market expands within a narrow band, reflecting low variability in growth inputs. Such stability stems from consistent industrial demand across water treatment and oilfield applications, where usage patterns remain largely unaffected by economic shifts. The absence of abrupt upswings or contractions reinforces the notion that the market avoids speculative behavior. From 2029 to 2035, higher annual additions are seen, averaging USD 3 billion. Yet, these gains occur without notable deviation from the mean CAGR. When year-over-year values are analyzed for percentage volatility, the standard deviation remains minor, keeping the growth trend predictable. This flat volatility index indicates that supply-side disruptions or downstream demand saturation have not influenced output. As a result, the segment can be viewed as structurally stable, with growth driven by base-load industrial consumption rather than seasonal or discretionary use.

| Metric | Value |

|---|---|

| Water Soluble Polymer Market Estimated Value in (2025 E) | USD 39.2 billion |

| Water Soluble Polymer Market Forecast Value in (2035 F) | USD 67.6 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The water soluble polymer market is gaining momentum, primarily driven by increasing global demand for efficient water treatment solutions, rapid industrialization, and stringent regulatory standards on wastewater discharge. These polymers are widely employed across municipal, industrial, and commercial sectors for their ability to enhance solid-liquid separation, improve flocculation, and reduce sludge volume.

Innovations in polymer formulations have made them more biodegradable, reducing their environmental footprint. The demand is further supported by rising consumption in personal care products, agriculture, and enhanced oil recovery (EOR) processes.

With growing emphasis on sustainable process chemistry, companies are actively investing in high-performance, application-specific polymer grades tailored for regulatory compliance and operational efficiency.

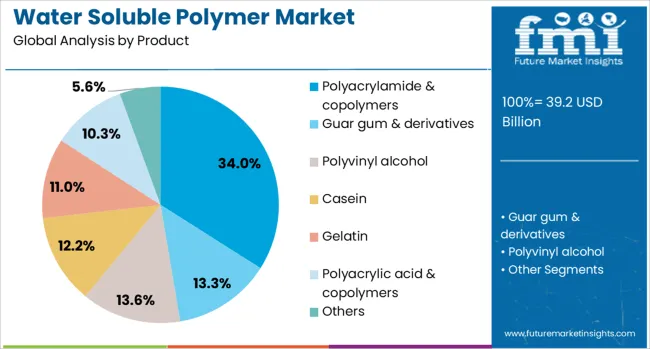

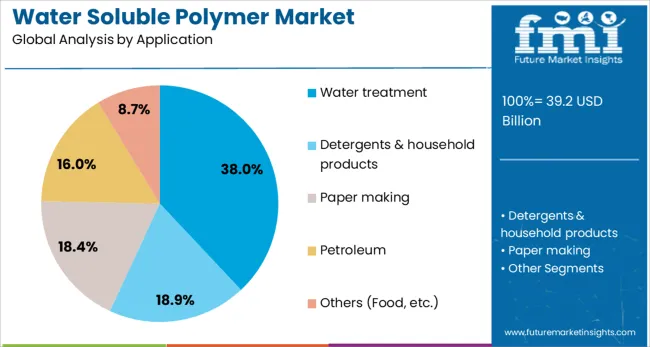

The water soluble polymer market is segmented by product, application, and geographic regions. The product of the water-soluble polymer market is divided into Polyacrylamide & copolymers, Guar gum & derivatives, Polyvinyl alcohol, Casein, Gelatin, Polyacrylic acid & copolymers, and Others. In terms of application, the water-soluble polymer market is classified into Water treatment, Detergents & household products, Paper making, Petroleum, and Others (Food, etc.). Regionally, the water soluble polymer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyacrylamide & copolymers are projected to account for 34.0% of the water soluble polymer market revenue in 2025, making this the leading product category. This dominance is due to their superior flocculating properties and high molecular weight, which make them ideal for water treatment, paper processing, and oil recovery applications.

Their compatibility with both cationic and anionic formulations has expanded their usage across various pH ranges and operational conditions.

Additionally, the development of low-residual monomer variants has improved safety profiles, further driving adoption in municipal and industrial wastewater settings.

Water treatment is anticipated to be the largest application area, commanding a 38.0% share of the total market in 2025. This segment’s leadership stems from escalating water scarcity issues, stricter environmental laws, and the widespread deployment of advanced treatment infrastructure worldwide.

Water soluble polymers are essential in coagulation, flocculation, and sludge dewatering processes, making them indispensable in municipal water purification and industrial effluent treatment.

Continued urbanization, along with government investments in water reuse and desalination projects, is expected to solidify water treatment as the core growth engine of the market.

The water soluble polymer market is expanding due to rising demand from water treatment, textile, and personal care industries. Global polymer production reached approximately 14 million tons in 2024, with water soluble variants accounting for over 20% of the total. Increasing industrial wastewater and growing consumption of personal care products are driving adoption. Polymers are used to improve viscosity, stabilize formulations, and enhance product performance. Agricultural applications, including soil conditioners and controlled-release fertilizers, also contribute to growth. Technological innovations, such as biodegradable and low-molecular-weight polymers, support environmentally compatible solutions.

Water soluble polymers are widely used in water treatment, textile processing, and cosmetics. In water treatment, polymers enhance flocculation, increasing removal efficiency by 15–25% compared to conventional methods. Textile finishing and printing utilize polymers to improve dye retention and fabric strength, reducing wastage by 10–15%. Personal care products, including shampoos, lotions, and gels, rely on polymers for viscosity control, with global demand exceeding 3 million tons annually. Rising industrialization in Asia and growing hygiene awareness in urban regions are increasing polymer consumption. Companies are investing in high-performance polymers with enhanced solubility and biodegradability to meet regulatory requirements and customer preferences.

Demand for biodegradable and specialty water soluble polymers is rising due to environmental regulations and consumer preference. These polymers degrade faster in soil and water, reducing environmental footprint by 20–30%. Specialty polymers with tailored molecular weight and viscosity are gaining traction in pharmaceuticals, food processing, and agriculture. Controlled-release fertilizers using water soluble polymers enhance nutrient absorption by 10–20%, while polymer coatings protect active ingredients in pharmaceutical tablets. Development of low-viscosity, high-solubility polymers supports new applications in adhesives and coatings. Manufacturers are focusing on expanding production capacity of eco-friendly polymers, particularly in Asia Pacific, where industrial growth and environmental policies are driving adoption.

Asia Pacific accounts for over 50% of water soluble polymer consumption due to growing textile and water treatment industries. Latin America is witnessing 5–7% annual growth driven by agriculture and personal care sectors. Governments are implementing wastewater treatment projects, increasing demand for high-efficiency flocculants. Rising textile exports in India, Bangladesh, and Vietnam are boosting polymer use in fabric processing. Adoption of water soluble polymers in biodegradable packaging and agricultural applications is expanding. Companies are introducing advanced polymers with high solubility and low molecular weight to meet performance standards. Investment in R&D and manufacturing capacity ensures continuous supply to meet increasing regional demand.

High production costs of specialty and biodegradable polymers, ranging from USD 2,500 to USD 5,000 per ton, restrict adoption in price-sensitive regions. Stringent regulations on chemical composition, biodegradability, and environmental safety require testing and certification, increasing compliance expenses by 10–15%. Variability in raw material availability, such as acrylamide and polyvinyl alcohol, can impact production schedules and cost stability. Small and medium manufacturers face challenges in scaling up production while meeting global quality standards. Proper investment planning, supply chain optimization, and adherence to environmental regulations are necessary to balance operational efficiency and profitability.

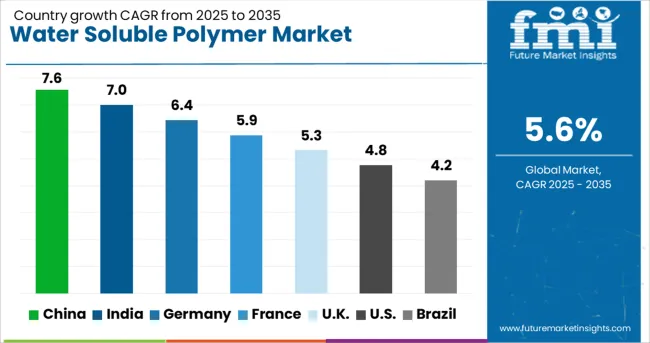

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

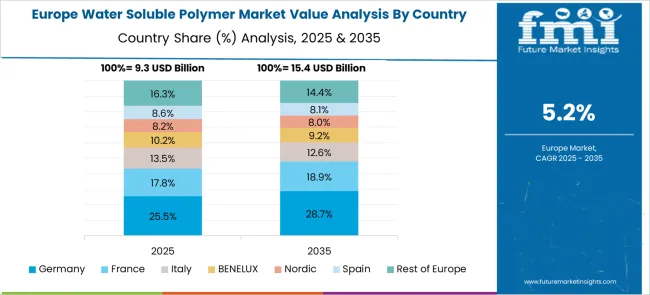

The global water soluble polymer market is projected to grow at a CAGR of 5.6% from 2025 to 2035. China leads with 7.6%, exceeding the global benchmark by 36%, driven by rising demand from wastewater treatment and enhanced synthetic polymer output. India follows with 7.0%, 25% above average, supported by strong agriculture and personal care segments. Germany’s CAGR of 6.4% is 14% higher than the global pace, sustained by investments in bio-based and specialty applications. The UK is tracking just below the global mean at 5.3%, while the US lags at 4.8% due to cost pressures and slower industrial adoption. ASEAN countries show convergence with Indian dynamics, while OECD markets including Germany are progressing through functional diversification and capacity modernization.

China is anticipated to register a CAGR of 7.6% between 2025 and 2035, which is 36% higher than the global average. Wastewater treatment regulations are accelerating polymer usage across municipal and industrial segments. Polyacrylamide and polyvinyl alcohol are seeing stronger demand due to rising chemical and textile output. The food industry’s shift toward film-forming agents has further expanded application diversity. Domestic production capacity has been increasing, driven by capital flow into downstream formulation facilities. Export shipments of commodity polymers are rising as regional producers consolidate procurement channels. Research into renewable derivatives has also intensified, aligning supply resilience with environmental compliance mandates.

India is projected to grow at a CAGR of 7.0% through 2035, outperforming the global average by 25%. Fertilizer additives and seed coating agents are key drivers as polymer-treated agricultural inputs gain traction. Rapid urbanization has led to increased consumption in construction admixtures and paint thickeners. Cost-effective sourcing of guar-based polymers and their blends supports local supply competitiveness. Government tenders on water sanitation continue to boost industrial consumption. Domestic producers are expanding R&D capabilities to move beyond commodity grades into high-value blends tailored for textile and oilfield applications. Logistic constraints in rural areas are being addressed through localized storage solutions.

Germany is expected to grow at a CAGR of 6.4% from 2025 to 2035, outpacing the global rate by 14%. Market activity is being driven by pharmaceutical, cosmetics, and detergent industries, which are increasingly adopting customized polymer formulations. Collaborative programs with EU partners are focusing on biodegradable and renewable polymer variants. Domestic consumption of polyacrylic acid and cellulose derivatives has increased, supported by technical specification upgrades across end-use sectors. Supply chains are adapting to incorporate circularity targets while also reducing reliance on imported fossil-based intermediates. Germany’s position within OECD chemical strategy frameworks has supported policy-driven investments in safer polymer systems.

The United Kingdom is projected to grow at a CAGR of 5.3% through 2035, marginally under the global average. Domestic manufacturers are concentrating on premium and niche applications in pharmaceuticals, personal care, and 3D printing materials. Regulatory shifts post-Brexit are impacting ingredient sourcing strategies and labelling compliance timelines. Import reliance for certain polyvinyl and acrylic compounds continues to constrain operating margins. There is growing interest in localized production models and university-led biopolymer projects. Cost volatility has hindered broader adoption in water and agriculture sectors. The packaging segment has begun to explore coating-grade formulations for dissolvable films and tablets.

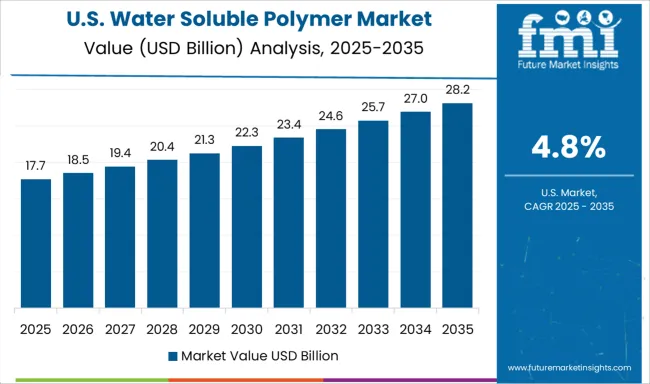

The United States is forecast to grow at a CAGR of 4.8% from 2025 to 2035, underperforming the global rate by 14%. Market dynamics are impacted by limited expansion of polymer use in mature sectors such as detergents and agriculture. Pharmaceutical polymers remain a stable contributor but lack new scale-up investments. Strict FDA compliance requirements have delayed commercialization of bio-based formulations. Regional manufacturing continues to focus on commodity grades due to margin pressures. Imports of high-purity polyvinyl and cellulose polymers are on the rise as local facilities remain underutilized. Cost challenges and energy input fluctuations remain persistent operational constraints.

BASF SE maintains a broad portfolio of water soluble polymers targeting wastewater treatment, paper processing, and enhanced oil recovery. Its strategy includes ongoing R&D into high molecular weight polyacrylamides and investment in Asia-based manufacturing hubs to support local demand. SNF SAS leads global production capacity for acrylamide-based polymers and continues to expand operational sites in the USA and India.

Ashland Inc prioritizes cellulose ethers and polyvinylpyrrolidone derivatives across pharmaceutical, personal care, and food-grade applications, with recent focus on optimizing viscosity control and formulation stability. Arkema S.A. supplies water-based acrylic polymers for coatings and adhesives, leveraging vertical integration in monomer sourcing. Kemira OYJ serves municipal and industrial water treatment markets by offering customized polymer blends backed by long-term contracts and process optimization services.

Kuraray Group emphasizes polyvinyl alcohols used in packaging films and adhesives, with capacity expansion centered in Southeast Asia. E. I. du Pont de Nemours and Company incorporates water soluble polymers into crop protection and cleaning formulations, while The Dow Chemical Company advances modified starch-based polymers for detergent applications. Nitta Gelatin Inc. specializes in pharmaceutical-grade gelatins for capsules and biomedical uses. LG Chem Ltd supplies high-viscosity polyacrylamides for energy sector applications, maintaining export-focused production in South Korea.

BASF introduced eco friendly synthetic polymers, while Dow expanded regional production capacity to meet surging pharmaceutical demand. Ashland formed a strategic partnership with a biotech firm to develop precision drug-delivery polymers. SNF Group opened a new manufacturing facility in Asia-Pacific to support expanding water treatment applications. Across the industry, emphasis on renewable feedstocks, sustainability-focused innovation, and geographic expansion drove market momentum.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.2 Billion |

| Product | Polyacrylamide & copolymers, Guar gum & derivatives, Polyvinyl alcohol, Casein, Gelatin, Polyacrylic acid & copolymers, and Others |

| Application | Water treatment, Detergents & household products, Paper making, Petroleum, and Others (Food, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, SNF SAS, Ashland Inc, Arkema S.A., Kemira OYJ, Kuraray Group, E. I. du Pont de Nemours and Company, The Dow Chemical Company, Nitta Gelatin Inc., and LG Chem Ltd |

| Additional Attributes | Dollar sales by polymer type (polyacrylamide, PVA, guar gum), end-use (water treatment, detergents, oil & gas), demand dynamics in wastewater treatment and pharmaceuticals, regional dominance in Asia Pacific, innovation in bio based polymers, environmental impact of biodegradability, and emerging use cases in agriculture and controlled-release drug delivery markets. |

The global water soluble polymer market is estimated to be valued at USD 39.2 billion in 2025.

The market size for the water soluble polymer market is projected to reach USD 67.6 billion by 2035.

The water soluble polymer market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in water soluble polymer market are polyacrylamide & copolymers, guar gum & derivatives, polyvinyl alcohol, casein, gelatin, polyacrylic acid & copolymers and others.

In terms of application, water treatment segment to command 38.0% share in the water soluble polymer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Pods and Capsules Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water-Soluble Retinol Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Detergent Pods Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Fertilizers Market Trends 2025 to 2035

Water Soluble Pods Packaging Market Analysis by Material Type, Product Type, End Use, Thickness Type, and Region Forecast Through 2035

Key Companies & Market Share in the Water Soluble Detergent Pods Sector

Competitive Breakdown of Water-Soluble Packaging Companies

Water Soluble Vitamins Market

Water-Soluble Flavors Market

Water Pod Soluble Machines Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Cold Water Soluble Creamer Market Growth - Base & Function Trends

Water Dispersible Polymers Market

Demand for Water Soluble Fertilizers in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Cold Water Soluble Starch in EU Size and Share Forecast Outlook 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Polymer Mixing Unit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA