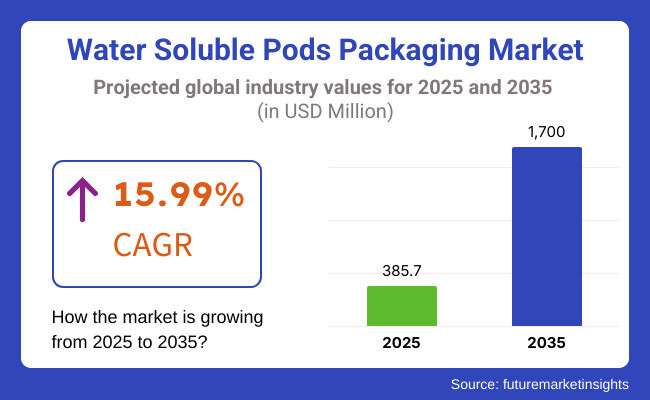

The water soluble pods packaging market is anticipated to reach USD 385.7 million in 2025. It is expected to grow at a CAGR of 15.99% during the forecast period and reach USD 1700 million in 2035.

Industry Outlook

Water soluble pods packaging is becoming increasingly popular as a new eco-friendly solution in many industries, such as household cleaning, personal care, and pharmaceuticals. The pods are made to dissolve in water, minimizing plastic waste and providing convenience for consumers. The growing demand for environmentally friendly substitutes for conventional plastic packaging will drive strong market growth in the coming decade.

The industry growth is also being fueled by growing consumer demand for pre-measured, mess-free solutions in cleaning and personal care categories. Growth in e-commerce and direct sales is driving expansion, with manufacturers focusing on sustainable and convenient packaging. Moreover, progressions in film technology, including better solubility and barrier characteristics, are anticipated to improve the functionality of water-soluble pods across industries.

| 2020 to 2024 Trends | 2025 to 2035 Projections |

|---|---|

| Initial restrictions on single-use plastics. | Stricter global policies mandating biodegradable and water-soluble packaging adoption. |

| Development of basic water-soluble films. | Expansion of high-performance, moisture-resistant, and eco-friendly pod formulations. |

| Widely applied in domestic cleaning and personal hygiene. | Increasing use in pharmaceuticals, agriculture, and industrial applications. |

| Dominance of larger FMCG and cleaning brands. | Initiation of sustainable packaging start-ups in collaboration with biotech companies. |

| Sustainability and convenience-led growth. | Market growth driven by AI-optimized film structures and circular economy efforts. |

| Biodegradable pod materials in their formative transition. | Comprehensive use of entirely carbon-neutral and compostable packaging. |

| Minimal AI applications for material optimization. | Predictive modeling with AI supported by sophisticated automated manufacturing enhancement. |

| More attention is devoted to solubility and durability. | Design of multi-use, high-barrier, and temperature-resistant water-soluble films. |

Between 2020 and 2024, the water-soluble pods packaging industry experienced consistent growth with increasing consumer awareness, corporate sustainability initiatives, and government regulations on single-use plastics. However, high production costs and limitations of material performance have greatly bothered the manufacturers.

The market also witnessed high investments in research to enhance solubility and barrier properties. Growing concerns regarding microplastic pollution propelled regulatory agencies to advocate for biodegradability. In addition, advancements in formulation science helped with increased pod stability and dissolvability.

In the future, the landscape’s growth will be led by innovations in biodegradable film, green coating, and process efficiency. The implementation of AI and automation in package design and production processes will enhance market competitiveness as well.

Furthermore, the growing use of water-soluble products in industrial and agricultural applications will open up new avenues for growth. The development of improved shelf stability and robustness of pods to suit industry requirements is also a focus for companies. The growth of specialized packaging solutions designed for niche markets is expected to pick up pace in the years to come.

The poly vinyl alcohol (PVA) segment should lead the water soluble pods packaging market because it is biodegradable and water-soluble. With industries looking for environmentally friendly packaging, PVA is still the favorite material, particularly in detergents, agrochemicals, and food uses where contactless packaging is important as well as being environmentally friendly.

PVA's hydrophilic nature makes it ideal for coating toxic fertilizers in agriculture and storing condiments in food packaging. In addition, its FDA approval for food applications has encouraged its use in takeaway packaging. As innovation in PVA-based films and coatings rises, this segment is expected to witness rapid expansion.

Multi-chamber water pods will hold the highest proportion in the market for water-soluble pods packaging because of their high level of functionality and convenience. They dissolve in water, thus providing a hassle-free solution for products such as hand wash, detergent, and dish wash.

The category is soaring with rising demand from home-cleaning and personal care brands. Pre-measured and precise dosing reduce waste and are easier to use. With more consumers preferring eco-friendly, pre-packaged goods, multi-chamber pods will see huge market growth.

Detergents will dominate the market for water-soluble pods for packaging purposes because they produce less plastic waste and are more convenient for users. Growth in the environmental concerns aspect will drive more customers toward detergent pods, which dissolve entirely in water without a residue or disposed-of packaging.

Innovation in high-performance, plant-based detergent pods is also driving growth. Several brands are introducing digitally driven campaigns to increase awareness regarding the advantages of water-soluble detergent pods. The segment will grow further as consumers are moving towards sustainable, pre-measured laundry options.

31-60 micro meter thick water-soluble pods are anticipated to dominate the market as they offer the best combination of durability and solubility. This thickness will provide the pod with a solid form when in storage and during handling while dissolving readily in water.

With continuous innovation on dishes and laundry detergent pods, a need exists for customized thickness levels. Companies are making investments in better pod designs for moisture resistance while preserving dissolution effectiveness. Over the years, with the advancement of water-soluble film technology, steady growth is anticipated in this segment.

Challenges

High Production Costs

Production of water soluble films uses specialized materials and sophisticated manufacturing methods, which drive up costs relative to traditional plastic packaging. This increased cost affects pricing and prevents widespread use, especially among price-sensitive industries. Furthermore, increasing consumer need for environmentally friendly substitutes is stimulating investment in low-cost production innovations.

Performance Limitations

Water soluble pods need to have a perfect balance between solubility and durability to be effective. In humid conditions, too much exposure to moisture can weaken their integrity, causing them to dissolve prematurely. Manufacturers are working constantly to develop advanced formulations that provide better moisture resistance while ensuring quick solubility in target applications, enhancing the reliability of these packaging solutions.

Opportunities

Expansion into New Industries

Water soluble pods are finding increasing popularity in pharmaceutical and agro-based industries because of their convenience and environmentally friendly nature. They ensure correct dosing and reduce the waste of packs in drugs, and in agribusiness, they simplify pesticide and fertilizer application. These new applications are opening up new avenues for market growth.

Advancements in Biodegradable Film Technology

Constant research in water soluble material is optimizing the performance of biodegradable films. Improvements target solubility, strength, and environmental friendliness, increasing the versatility of these films in various industries. As sustainability laws continue to tighten, advancements in environmentally friendly film technology are likely to increase product applications and wider use.

Asia-Pacific is expected to dominate the water-soluble pods packaging market, driven by increasing urbanization, rising disposable incomes, and growing environmental consciousness. Regions such as China, India, and Japan are major contributors, with a high demand for sustainable personal care and household cleaning products. Rapid industrialization and growth of the FMCG sector in the region are also contributing to the acceleration of market growth.

The development of the region's market is also sustained by strict government regulations on plastic waste, which are prompting manufacturers to switch to water-soluble alternatives. Moreover, innovation in biodegradable film technology is improving pod performance, which is making them appropriate for a broader set of applications. The growing presence of international packaging manufacturers in Asia-Pacific is also driving local production capacities. In addition, R&D in water-soluble materials are likely to generate new growth prospects in the region.

North America is a leading market for water soluble pods packaging owing to high demand from the home care, personal care, and pharmaceutical sectors. The United States and Canada are spearheading the region with technology development in biodegradable films and eco-friendly packaging solutions. The increasing consumer trend for single-dose packaging is further accelerating the market demand.

The use of eco-friendly and biodegradable packaging materials is in vogue due to government rules and corporate efforts toward sustainability. Rising R&D investments for technology-driven film technologies are further enhancing market growth. Moreover, e-commerce and direct-to-consumer sales growth are also fuelling demand for handy, proportioned pod packaging.

Several companies in North America are also concentrating on optimizing the strength and solubility of packaging films to advance product performance. Developments in barrier coatings for water-soluble pods will also influence the market in the next few years.

Europe occupies a strong percentage of the market for water soluble pods packaging, bolstered by effective regulatory environments that favor biodegradable and plastic-free packaging technologies. Germany, France, and the UK, being the dominant economies, lead the charge on sustainable packaging development. The high investments in circular economy programs and green packaging studies are also contributing to the strengthening of Europe's dominance of the market.

Tight environmental regulations encouraging plastic reduction and compostable packaging materials are driving the transition toward water-soluble pods. Furthermore, growing consumer knowledge and demand for environmentally friendly products are likely to drive long-term market expansion.

The region is also seeing more and more partnerships between packaging producers and FMCG companies to create new water-soluble compositions. In addition, research centers in Europe are investing in future-generation water-soluble films with better solubility and barrier functionality. These improvements are likely to boost the general efficiency and usage of water-soluble pod packaging across different industries.

| Countries | CAGR |

|---|---|

| USA | 5.2% |

| UK | 4.8% |

| Japan | 4.6% |

| South Korea | 5.0% |

The USA dominates the market, driven by the increasing demand for convenient, eco-friendly, and single-use packaging solutions in industries such as household cleaning, personal care, and food & beverage. The shift toward sustainable alternatives to traditional plastic packaging has encouraged manufacturers to develop innovative water-soluble film technologies.

Additionally, government regulations on plastic waste reduction and sustainability initiatives are prompting companies to adopt biodegradable and compostable materials. Moreover, advancements in water-soluble polymer coatings are enhancing product durability and solubility, making them more suitable for diverse applications. Businesses are also exploring multi-compartment pod solutions to improve product efficiency. Furthermore, the increasing demand for non-toxic and chemical-free packaging options is driving innovation in plant-based water-soluble films.

As per FMI research, the UK is expanding as businesses emphasize sustainability and compliance with environmental regulations. The rising demand for biodegradable and waste-reducing packaging solutions has led to the increased adoption of water-soluble pods across various industries. Government initiatives promoting plastic-free alternatives are also pushing companies to integrate water-soluble and compostable films.

In addition, innovations in barrier coatings and film thickness adjustments are making these materials more attractive for global supply chains. Companies are also exploring odor-proof and antimicrobial water-soluble packaging solutions to enhance product shelf life. Furthermore, the rise of refillable and concentrated product formats is improving the adoption of pod-based packaging solutions in the UK market.

Japan is growing steadily due to its high-quality manufacturing sector and the increasing preference for sustainable materials. Companies are focusing on precision-engineered pod packaging for household and industrial cleaning, pharmaceuticals, and food applications. With strict regulations on plastic waste reduction, businesses are adopting plant-based and biodegradable water-soluble films.

Moreover, advancements in rapid-dissolution technologies are driving demand in applications where controlled solubility is essential. Businesses are also investing in automated production technologies to enhance precision and reduce waste. Furthermore, the rise of compact and space-saving packaging solutions in Japan is fueling demand for water-soluble pods in various consumer industries.

South Korea is experiencing significant growth due to increased exports and industrial automation. The need for cost-effective and sustainable packaging solutions has led manufacturers to develop enhanced water-soluble films with better tensile strength and controlled dissolution rates. Government regulations promoting plastic-free and biodegradable materials further support market expansion.

Moreover, businesses are integrating smart packaging solutions such as moisture-resistant water-soluble pods to improve usability and shelf life. The growing demand for convenience-driven and pre-measured pod packaging solutions is further boosting adoption. Additionally, research into temperature-sensitive solubility is helping businesses develop innovative packaging tailored to specific environmental conditions.

The water-soluble pods packaging industry remains moderately concentrated, with leading companies holding a dominant position. Established players leverage advanced manufacturing capabilities and strong distribution networks to maintain their influence. While competition exists, top firms drive industry trends by focusing on sustainability, product performance, and consumer convenience, effectively shaping the sector’s growth and innovation strategies.

Key companies prioritize innovation by investing in biodegradable materials and advanced water-soluble film technology. Their commitment to reducing plastic waste aligns with global environmental initiatives, strengthening their market presence. By continuously enhancing product formulations, they cater to consumer preferences for eco-friendly, pre-measured pods in cleaning, personal care, and industrial applications, reinforcing its competitive advantage.

Mid-sized firms contribute to the industry’s expansion by offering sustainable alternatives and cost-effective solutions. Their ability to balance affordability with performance attracts environmentally conscious consumers and businesses. These companies emphasize transparency in ingredient sourcing and packaging, helping them carve out a niche within the growing demand for ethical, sustainable, and efficient product solutions.

Smaller players and regional brands focus on specialized formulations that meet specific consumer needs. Their agility allows them to introduce innovative solutions, such as compostable pods and plant-based dissolvable films. By differentiating through sustainability and unique product features, they compete with larger firms while addressing niche markets that prioritize minimal waste and environmental responsibility.

Despite concentration among leading firms, the industry fosters continuous competition through technological advancements and regulatory compliance. Companies across all tiers invest in R&D to enhance product performance and eco-friendliness. This commitment to innovation ensures that water-soluble pods packaging remains a dynamic sector, evolving alongside sustainability trends and shifting consumer expectations.

The water soluble pods packaging market is growing due to increasing demand in household, industrial, and healthcare applications. These industries require efficient and sustainable packaging solutions that ensure controlled dissolvability and ease of use. The need for convenient, pre-measured dosing in cleaning and personal care products is driving market expansion and innovation.

Advancements in material formulations are enhancing product performance, with bio-based films, moisture-resistant coatings, and improved solubility technologies addressing sustainability concerns. These innovations ensure that water-soluble pods dissolve efficiently while maintaining protective properties during storage and handling. As companies prioritize eco-friendly alternatives, the shift toward plastic-free and biodegradable packaging continues to gain momentum.

Technological improvements in automated production and supply chain optimization are further shaping industry trends. Automation increases manufacturing efficiency, ensuring consistent quality and cost-effectiveness, while supply chain advancements enhance distribution and inventory management. These developments help businesses streamline operations while meeting the growing demand for sustainable and user-friendly packaging solutions.

Regulatory compliance and certifications are playing a crucial role in market adoption. Companies are investing in research on enzymatic degradation of water-soluble films to improve performance and minimize residue. As environmental regulations become stricter, businesses are focusing on certified eco-friendly packaging solutions to meet industry standards while maintaining product safety and sustainability.

The market is segmented by material type into poly vinyl alcohol.

Based on the product type, the market is segmented into single layer water pods, dual layer water pods, and multi chamber water pods.

Based on end use, the industry is categorized into detergents, hand wash, dish wash, and others.

Based on thickness type, the landscape is segmented into below 30 micro meter, 31-60 micro meter, and 61 micro meter thickness.

Region-wise, the market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The overall market size for the market was USD 385.7 million in 2025.

The market is expected to reach USD 1700 million in 2035.

The market will be driven by increasing demand from home care, personal care, and pharmaceutical industries. Sustainability trends, innovations in biodegradable films, and improvements in solubility performance will further propel market expansion.

The top 5 countries driving the development of the market are the USA, UK, Germany, Japan, and China.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Thickness Type, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Thickness Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Thickness Type, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Thickness Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Thickness Type, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Thickness Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Thickness Type, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Thickness Type, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Thickness Type, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Thickness Type, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Thickness Type, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Thickness Type, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Thickness Type, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Thickness Type, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Thickness Type, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Thickness Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Thickness Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Thickness Type, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Thickness Type, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Thickness Type, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Thickness Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by End Use, 2023 to 2033

Figure 29: Global Market Attractiveness by Thickness Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Thickness Type, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Thickness Type, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Thickness Type, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Thickness Type, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Thickness Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by End Use, 2023 to 2033

Figure 59: North America Market Attractiveness by Thickness Type, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Thickness Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Thickness Type, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Thickness Type, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Thickness Type, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Thickness Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Thickness Type, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Thickness Type, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Thickness Type, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Thickness Type, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Thickness Type, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Thickness Type, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Thickness Type, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Thickness Type, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Thickness Type, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Thickness Type, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Thickness Type, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Thickness Type, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Thickness Type, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Thickness Type, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Thickness Type, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Thickness Type, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Thickness Type, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Thickness Type, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Thickness Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Thickness Type, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Thickness Type, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Thickness Type, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Thickness Type, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Thickness Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Thickness Type, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Thickness Type, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Thickness Type, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Thickness Type, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Thickness Type, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Thickness Type, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Thickness Type, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Soluble Pods and Capsules Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Water-Soluble Packaging Companies

Water Soluble Detergent Pods Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Water Soluble Detergent Pods Sector

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water-Soluble Retinol Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Polymer Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Fertilizers Market Trends 2025 to 2035

Water Soluble Vitamins Market

Water-Soluble Flavors Market

Water Pod Soluble Machines Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Water Resistant Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Soluble Creamer Market Growth - Base & Function Trends

Edible Water Pods Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Digital Watermark Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Water Soluble Fertilizers in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA