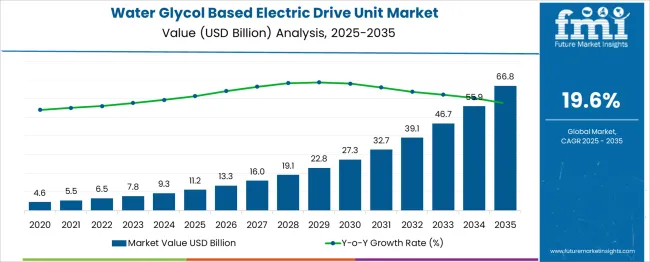

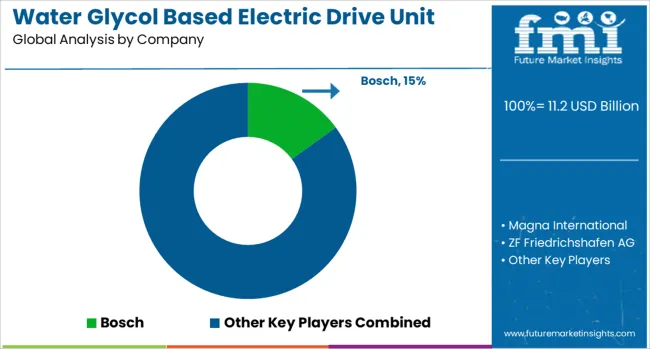

The Water Glycol Based Electric Drive Unit Market is estimated to be valued at USD 11.2 billion in 2025 and is projected to reach USD 66.8 billion by 2035, registering a compound annual growth rate (CAGR) of 19.6% over the forecast period. From 2025 to 2030, the market grows rapidly, increasing to USD 27.3 billion. Annual figures show strong momentum: USD 13.3 billion in 2026, USD 16.0 billion in 2027, USD 19.1 billion in 2028, and USD 22.8 billion in 2029. This surge favors companies offering compact, thermally stable, and energy-efficient drive systems optimized for electric vehicles and industrial equipment.

Vendors that provide solutions with excellent thermal management and low-maintenance operation are well-positioned to gain market share. Players that fail to meet performance expectations, quality standards, or evolving integration requirements may face market share erosion as buyers demand higher reliability and efficiency from suppliers. Speed to market, scalability, and strong OEM relationships will be decisive advantages. From 2025 to 2030, demand will accelerate from e-mobility, robotics, and smart factory applications, making innovation in cooling performance and system integration essential. As global electrification trends grow stronger, market leadership will depend on technological adaptability and production capacity.

| Metric | Value |

|---|---|

| Water Glycol Based Electric Drive Unit Market Estimated Value in (2025 E) | USD 11.2 billion |

| Water Glycol Based Electric Drive Unit Market Forecast Value in (2035 F) | USD 66.8 billion |

| Forecast CAGR (2025 to 2035) | 19.6% |

The water glycol based electric drive unit market is positioned on an accelerated growth trajectory, exhibiting a compound annual growth rate (CAGR) of 19.6 % between 2020 and 2035. This market segment focuses on electric drive units that use water-glycol as a cooling medium an essential solution in electric mobility and industrial automation, where thermal management plays a critical role in system efficiency and lifespan. Analyzing the long-term value trajectory, the market shows an exponential accumulation curve. From a value index of 4.6 in 2020, it climbs steadily to 66.8 by 2035 representing a more than 14-fold increase over the 15-year span.

The early phase (2020–2025) reflects foundational growth, driven by the initial deployment of electric drive units in niche applications, such as EV thermal control systems and compact industrial robots. Between 2025 and 2030, the curve begins to steepen, with increased adoption across commercial electric vehicles, autonomous machinery, and aerospace auxiliary systems. The period 2030 to 2035 illustrates the sharpest incline, as widespread electrification, stricter thermal efficiency standards, and higher energy density requirements push OEMs toward water-glycol solutions. The curve reflects not only high unit sales but also compounded system-level value creation through integration, replacement cycles, and system optimization, making this market a key enabler in next-generation electric drivetrain architecture.

The Water Glycol Based Electric Drive Unit market is undergoing significant expansion as electric mobility continues to gain prominence in the global transportation landscape. The demand for enhanced thermal management systems in electric vehicles has led to a sharp rise in the adoption of water glycol based drive units, which offer superior cooling performance and longer component life.

Governments worldwide are reinforcing zero-emission transportation goals through regulatory mandates and subsidies, prompting original equipment manufacturers to prioritize efficient and sustainable powertrain solutions. Advancements in thermal fluid engineering and the integration of modular drive units in electric platforms are further shaping the future of the market.

As vehicle electrification accelerates across both passenger and commercial segments, the water glycol based drive unit is being recognized for its ability to maintain optimal operating temperatures, improve reliability, and reduce maintenance costs. The market is expected to continue its upward trajectory with innovations in fluid dynamics and materials, supporting the broader shift toward high-performance, energy-efficient electric vehicle systems..

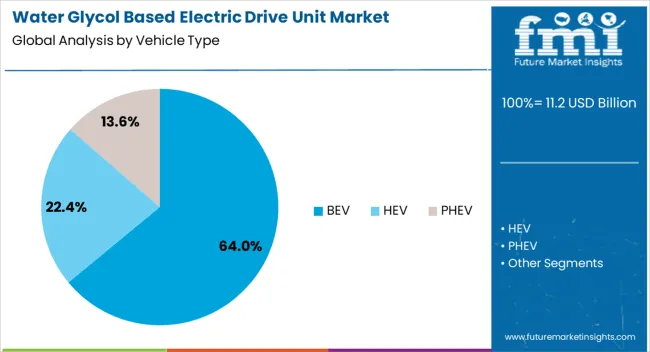

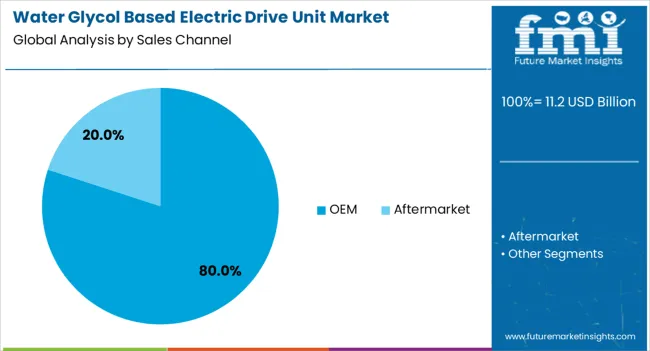

The water glycol based electric drive unit market is segmented by vehicle type and sales channel and geographic regions. By vehicle type of the water glycol based electric drive unit market is divided into BEV. In terms of sales channel of the water glycol based electric drive unit market is classified into OEM. Regionally, the water glycol based electric drive unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The BEV vehicle type segment is projected to hold 64% of the Water Glycol Based Electric Drive Unit market revenue share in 2025, making it the most dominant vehicle category. This leadership has been driven by the widespread adoption of battery electric vehicles as global emissions targets intensify and governments enforce stricter fuel economy regulations. BEVs have been identified as the primary application area for water glycol based drive units due to their need for precise thermal management in both motors and power electronics.

The use of water glycol coolant has proven effective in enhancing system longevity and operational efficiency under high-performance conditions. As manufacturers transition to scalable, platform-based electric architectures, BEVs are being equipped with integrated drive units that leverage water glycol cooling for reliability and reduced complexity.

The thermal stability provided by these systems supports continuous high-load operations, positioning them as the preferred solution for long-range electric mobility. Rising investments in BEV production lines and supportive infrastructure have further amplified the segment's commanding share..

The OEM sales channel segment is expected to account for 80% of the Water Glycol Based Electric Drive Unit market revenue share in 2025, establishing it as the most influential distribution pathway. This dominance has been reinforced by the direct integration of water glycol cooled drive units in electric vehicles during the manufacturing phase, allowing automakers to streamline system compatibility and optimize performance.

OEMs have increasingly preferred in-house or closely partnered sourcing of electric drive units to ensure conformity with evolving design standards, emissions targets, and vehicle architecture requirements. The ability to integrate thermal management as a core element of the drivetrain has improved energy efficiency and vehicle durability, especially for long-range and performance-focused electric models.

The OEM channel also benefits from higher volume commitments, advanced testing capabilities, and aligned development timelines, resulting in seamless incorporation into electric powertrain platforms. As electric vehicle adoption scales rapidly across regions, OEM-led implementation of advanced cooling technologies will continue to shape market dynamics and ensure long-term growth..

The water-glycol based electric drive unit market is growing rapidly as electric vehicles gain traction across commercial and passenger applications. These drive units use a water-glycol coolant mix to manage heat in motors, inverters, and traction electronics, ensuring optimal thermal performance and component lifespan. Adoption is strongest in regions with high EV production and supportive policies, especially in the Asia-Pacific. OEMs are integrating these systems into battery electric and hybrid vehicle platforms to enhance efficiency and safety. Key manufacturers provide scalable units that meet modular vehicle architectures and evolving grid connectivity standards. As automotive electrification expands, demand for efficient, liquid-cooled drive systems continues to rise in global vehicle electrification ecosystems.

Efficient thermal management is a critical driver for water-glycol electric drive unit adoption in EVs. These systems require precise temperature control across power electronics and motors to prevent overheating during rapid acceleration or regenerative braking. Water-glycol coolant offers dependable heat transfer, freeze protection, and stable viscosity across operating conditions. Integration improves system reliability, reduces degradation, and enables faster control electronics cycling. Compared to dielectric coolants, water-glycol blends offer better compatibility and simpler maintenance, though they require caution in electrical isolation design. Suppliers now offer sealed coolant loops with filtration and conductivity monitoring. This coolant strategy supports performance scaling in high-voltage, high-power EV systems. Manufacturers focusing on material compatibility, coolant formulation, and system diagnostics deliver robust thermal solutions aligned with high-efficiency vehicle architectures.

Strong EV adoption targets and infrastructure investment across Asia-Pacific, Europe, and North America are boosting demand for water-glycol cooled drive units. Regions with high EV production volumes prioritize in-house thermal module integration to ensure performance consistency. OEMs incorporate water-glycol cooling into electric drive architectures to meet charging, safety, and service demands. National policies mandating vehicle electrification and tax incentives support technology uptake. As fleets shift to electric buses and commercial vehicles, scalable cooling enabled by water-glycol circuits ensures drive unit durability under prolonged use. Regional manufacturing expansion enhances localised supply chains. Companies aligning capabilities with regional EV programmes are well-positioned to win supply contracts. The synergy between policy, EV growth, and the need for modular drive systems establishes water-glycol units as preferred thermal management platforms in global EV deployment strategies.

Despite performance benefits, adoption of water-glycol electric drive units is constrained by cost and coolant system complexity. Implementation requires precision-engineered coolant loops, sensors for conductivity monitoring, corrosion-resistant materials, and serviceable pumps and filters. Maintenance schedules must address glycol degradation, contamination, and thermal cycle fatigue. OEMs and fleet managers must justify higher upfront cost through long-term thermal reliability and reduced downtime. Training and service infrastructure add operational overhead, especially in emerging markets. Retrofit scenarios may require redesign of vehicle architectures for coolant routing and integration. Smaller vehicle makers or aftermarket operators may delay adoption until system simplicity improves. Without standardized service protocols or coolant management platforms, widespread uptake may remain limited to larger OEMs with robust thermal system support.

Ongoing innovation in coolant formulation and drive unit design is shaping future market dynamics. Suppliers are improving glycol blends to minimise conductivity and material reactivity while maximizing thermal conductivity and reliability. Integration of coolant diagnostics, predictive maintenance, and remote monitoring helps detect coolant degradation or leaks early. Advances in high-density silicon carbide inverters and compact power electronics reduce thermal load, enabling smaller coolant loops and lighter packaging. Manufacturers exploring integrated cold plates, modular pump assemblies, and system-level digital controls support enhanced efficiency and simplified assembly. These trends promise reduced coolant volume requirements and streamlined maintenance. As EV platforms evolve toward higher voltage architectures and increased power density, such cooling optimizations help improve drive unit performance and vehicle design flexibility. Suppliers offering integrated thermal systems aligned with future EV architectures gain competitive edge.

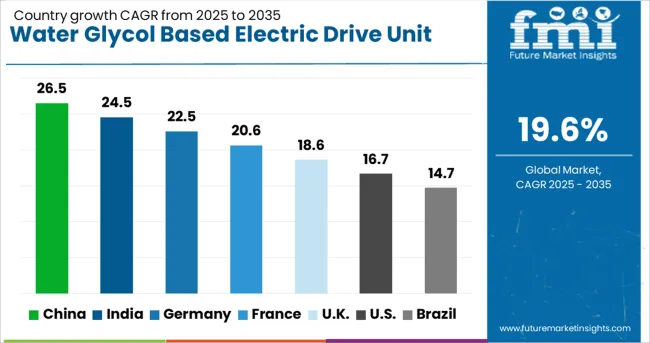

| Country | CAGR |

|---|---|

| China | 26.5% |

| India | 24.5% |

| Germany | 22.5% |

| France | 20.6% |

| UK | 18.6% |

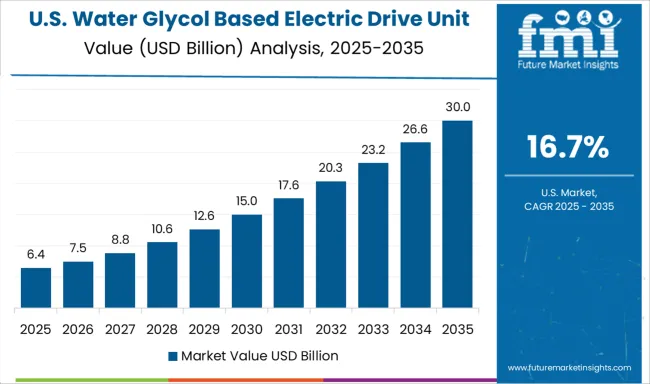

| USA | 16.7% |

| Brazil | 14.7% |

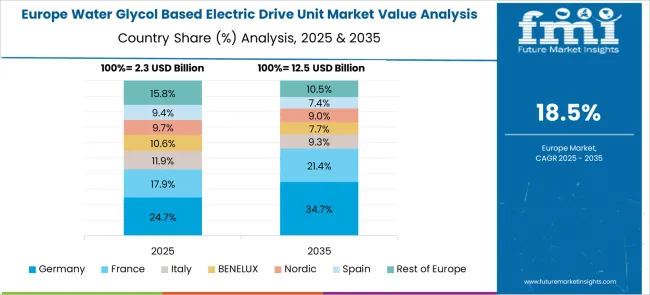

The water-glycol based electric drive unit market is set to expand at a CAGR of 19.6% through 2035, fueled by the global push for efficient, thermally stable, and environmentally safe drive systems in electric vehicles and industrial automation. China leads the market with a projected growth of 26.5%, driven by aggressive EV production and thermal management innovation. India, following at 24.5%, benefits from increasing electrification and localized manufacturing incentives. Germany, growing at 22.5%, is at the forefront of engineering excellence and integration of eco-efficient cooling technologies. The UK, at 18.6%, is advancing in EV infrastructure and fluid efficiency standards. The USA, growing at 16.7%, shows rising adoption in industrial robotics and next-gen electric mobility solutions. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is witnessing a CAGR of 26.5% in the water glycol based electric drive unit market, propelled by rapid electrification across the automotive, industrial, and construction equipment sectors. Domestic manufacturers are scaling up production to meet rising demand for high-efficiency and fire-resistant cooling systems. Water glycol fluids are increasingly preferred in electric drive units for their superior thermal stability, low flammability, and environmental safety, especially in EVs and industrial automation. Leading Chinese companies are integrating these units into battery packs, traction motors, and hybrid powertrains, addressing performance and safety regulations. Policy support for EV adoption and energy efficiency is fueling market expansion. Additionally, export-oriented production and partnerships with international OEMs are strengthening supply chains. Innovations in cooling circuit design and AI-enabled monitoring systems are enhancing reliability and operational life of these systems.

India is registering a CAGR of 24.5% in the water glycol based electric drive unit market, driven by accelerating EV production, industrial modernization, and demand for safe thermal management solutions. With increased focus on electrification of public transport and two-wheeler segments, the need for efficient, non-toxic, and non-flammable cooling mediums is becoming critical. Domestic component manufacturers are collaborating with R&D institutes to develop glycol-based systems optimized for Indian climates and high-traffic usage. These systems are increasingly used in electric buses, railways, and hybrid construction machinery. Government initiatives such as FAME II and PLI schemes are stimulating adoption of electric drive technologies, further boosting demand. Moreover, tier-1 suppliers are integrating smart diagnostics and thermal analytics to improve safety and performance of electric powertrains. Customization, affordability, and local sourcing remain pivotal for scaling adoption across diverse applications.

Germany is experiencing a CAGR of 22.5% in the water glycol based electric drive unit market, backed by its leadership in automotive engineering and commitment to sustainability. German automakers and industrial firms are rapidly replacing traditional oils with water glycol coolants to meet fire safety and efficiency standards in e-mobility applications. These systems are being deployed across EVs, energy storage modules, and precision machinery. The country’s stringent regulatory frameworks for thermal safety, recycling, and emissions are further driving adoption. Advanced systems equipped with real-time monitoring, leak detection, and predictive maintenance capabilities are becoming standard. Collaborations between OEMs, fluid technology developers, and universities are resulting in material innovations and customized formulations. Demand is also rising in automation and robotics, where thermal stability is crucial. Export-oriented production and strict quality control reinforce Germany's role as a global technology hub.

The United Kingdom is observing a CAGR of 18.6 percent in the water glycol based electric drive unit market, influenced by the shift to EVs and hybrid industrial vehicles under its green industrial strategy. Companies are integrating water glycol solutions into EV platforms, marine vessels, and electrified heavy equipment to meet safety and sustainability targets. British R&D centers are developing lightweight, non-corrosive systems tailored to UK environmental conditions and operating standards. Post-Brexit regulatory independence has also enabled local innovations in coolant formulations and design standards. Adoption is growing across OEMs supplying fleet operators and public transport systems. Water glycol fluids help reduce fire hazards and improve long-term energy efficiency, critical for fleet electrification. With growing interest in smart mobility, manufacturers are embedding thermal analytics into electric drive platforms for better system diagnostics.

The United States is recording a CAGR of 16.7% in the water glycol based electric drive unit market, bolstered by growing demand for electrified transportation, industrial safety, and smart infrastructure. As OEMs and suppliers ramp up EV and hybrid production, glycol-based cooling systems are replacing flammable alternatives in batteries, motors, and converters. Federal funding for clean energy and infrastructure modernization is further encouraging adoption in buses, freight vehicles, and military-grade machines. USA manufacturers are prioritizing fire safety, thermal resilience, and environmental compatibility. Smart drive units equipped with IoT sensors and remote diagnostics are gaining ground, particularly in high-risk industrial zones. Customization and modularity are key trends, helping equipment makers adapt solutions across sectors. Moreover, environmental compliance and heat-sensitive applications in data centers and aviation are emerging drivers for market expansion.

The water glycol based electric drive unit market is emerging as a specialized segment within the broader electric drivetrain landscape, driven by the need for efficient thermal management in high-performance EV and hybrid systems. These drive units integrate cooling systems using water-glycol mixtures to maintain optimal operating temperatures for motors, inverters, and transmissions enabling higher power density, prolonged system life, and thermal stability under demanding conditions. Bosch is a key player offering integrated electric drive units that utilize advanced cooling technologies, including water-glycol circuits, to enhance system efficiency in passenger EVs and light commercial vehicles. Magna International provides modular eDrive platforms with liquid cooling systems that support a wide range of vehicle architectures and are designed for scalability, cost-effectiveness, and global production.

ZF Friedrichshafen AG and GKN Automotive lead with compact, high-torque eDrive units using water-glycol-based cooling to optimize performance in premium EV and AWD hybrid applications. Dana Incorporated delivers eDrive systems with proprietary thermal management technologies that leverage water-glycol cooling to maintain consistent performance even in heavy-duty and off-highway electric vehicles. Other important contributors, such as Nidec and Continental, are innovating in compact eAxle solutions with integrated thermal pathways, supporting faster charging, lighter weight, and improved efficiency. As EV adoption grows and drivetrain performance expectations rise, thermal management through water-glycol systems will be a key differentiator, especially in markets prioritizing fast acceleration, towing capacity, and sustained high-speed operation.

As mentioned in the official Hofer Powertrain press release dated January 22, 2024, Hofer Powertrain and VisIC Technologies Ltd. partnered to co-develop 3-level, high-frequency gallium nitride (GaN) inverters for 800 V EV systems. The collaboration focuses on delivering compact, cost-effective, and highly efficient solutions using advanced GaN-based topologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.2 Billion |

| Vehicle Type | BEV |

| Sales Channel | OEM |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Magna International, ZF Friedrichshafen AG, GKN Automotive, Dana Incorporated, and Others (e.g., Nidec, Continental) |

| Additional Attributes | Dollar sales by water‑glycol based electric drive unit type including low, medium, and high‑power variants, by application in BEVs, HEVs, and PHEVs across North America, Europe, and Asia‑Pacific; demand driven by accelerating EV adoption, efficient thermal management, and sustainability incentives; innovation in integrated cooling–inverter systems; costs influenced by glycol feedstock, certification, and power rating. |

The global water glycol based electric drive unit market is estimated to be valued at USD 11.2 billion in 2025.

The market size for the water glycol based electric drive unit market is projected to reach USD 66.8 billion by 2035.

The water glycol based electric drive unit market is expected to grow at a 19.6% CAGR between 2025 and 2035.

The key product types in water glycol based electric drive unit market are bev, _hev and _phev.

In terms of sales channel, oem segment to command 80.0% share in the water glycol based electric drive unit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA