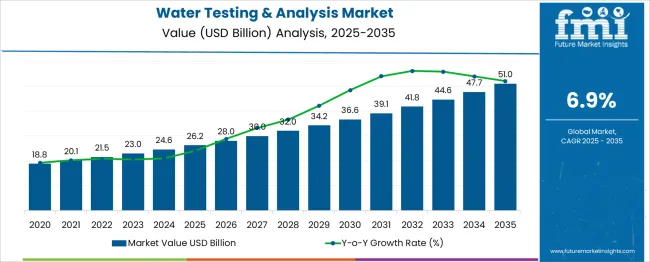

The water testing & analysis market is estimated to be valued at USD 26.2 billion in 2025. It is projected to reach USD 51.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

The water testing and analysis market is projected to create an incremental gain of USD 24.8 billion over the decade at a CAGR of 6.9%, resulting in a market multiplier of 1.95x. The 10-year trajectory demonstrates consistent expansion with widening annual increments, signaling a back-weighted growth structure.

The first half of the period (2025–2030) moves from USD 26.2 billion to 36.6 billion, adding USD 10.4 billion, which accounts for 41.9% of total gains, driven by regulatory enforcement in wastewater treatment and municipal supply chains. The second half (2030–2035) delivers USD 14.4 billion, or 58.1% of cumulative growth, as adoption of automated testing systems, IoT-enabled sensors, and predictive analytics gains momentum across industrial and residential applications.

Yearly additions increase from USD 1.8 billion in early years to over USD 3.3 billion by 2035, indicating accelerated demand for real-time water quality monitoring and portable testing solutions. This multiplier-driven analysis confirms significant opportunities for companies investing in integrated digital platforms, advanced chemical and microbiological testing technologies, and cost-efficient compliance solutions as global water safety standards and resource management protocols become increasingly stringent.

| Metric | Value |

|---|---|

| Water Testing & Analysis Market Estimated Value in (2025 E) | USD 26.2 billion |

| Water Testing & Analysis Market Forecast Value in (2035 F) | USD 51.0 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The water testing and analysis market represents a vital segment across multiple broader industries, though its share varies significantly. In the environmental testing services market, it accounts for 25–28%, as water quality assessments are central to environmental compliance and monitoring programs. Within the laboratory analytical instruments market, the share is about 6–8%, since this category includes diverse instruments for chemical, biological, and material analysis beyond water applications.

In the industrial process monitoring market, water testing contributes 10–12%, driven by its importance in sectors such as pharmaceuticals, food and beverage, and power generation where process water quality is critical. For the public and government water safety and regulatory market, its share stands at 15–18%, reflecting stringent mandates for potable water and municipal supply safety. In the wastewater and municipal treatment services market, the share is 8–10%, as testing ensures compliance with discharge standards and effective treatment performance.

Although the overall share varies across these parent markets, demand for water testing continues to grow due to regulatory tightening, industrial quality requirements, and environmental sustainability targets. Innovations such as real-time monitoring, sensor-based systems, and portable analysis devices are shaping the future of this segment, making it integral to global water resource management.

Heightened regulatory mandates for potable water standards and industrial discharge limits are driving increased investments in analytical instruments and digital testing technologies. Government-backed infrastructure programs, water recycling initiatives, and pollution monitoring efforts are contributing to the broad-based deployment of advanced testing solutions.

In particular, climate-related challenges such as droughts, floods, and rising pollution levels are prompting both public and private sectors to adopt proactive water quality management strategies. The evolution of portable, real-time, and cloud-connected testing devices has enabled faster detection of microbial, chemical, and physical contaminants, facilitating timely interventions and resource optimization.

As digitization of water utilities expands and ESG reporting becomes more stringent, the integration of high-precision analyzers with remote data capabilities is expected to become increasingly central to sustainable water governance. This shift is positioning water testing as a foundational component of modern environmental management systems.

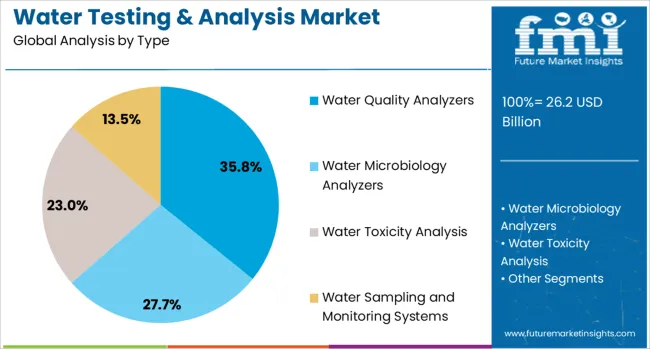

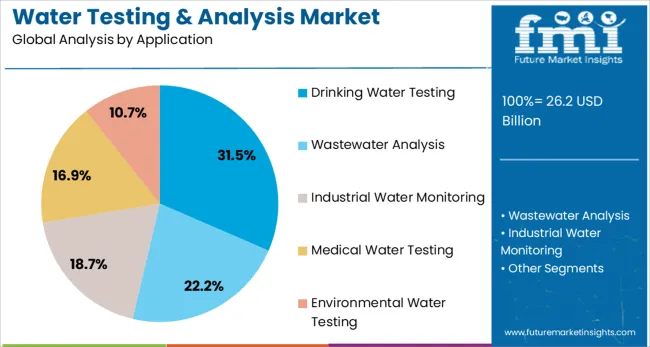

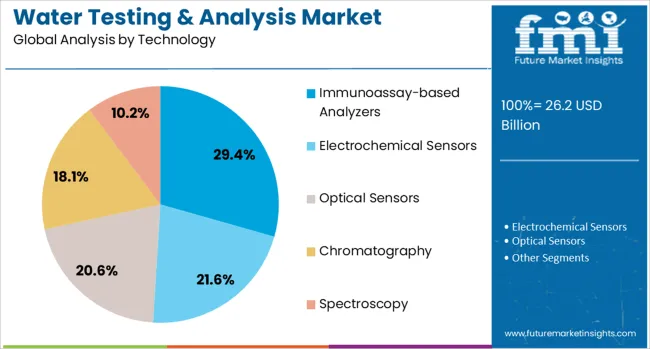

The water testing & analysis market is segmented by type, application, technology, end-user, and geographic regions. By type of the water testing & analysis market is divided into Water Quality Analyzers, Water Microbiology Analyzers, Water Toxicity Analysis, and Water Sampling and Monitoring Systems. In terms of application of the water testing & analysis market is classified into Drinking Water Testing, Wastewater Analysis, Industrial Water Monitoring, Medical Water Testing, and Environmental Water Testing. Based on technology of the water testing & analysis market is segmented into Immunoassay-based Analyzers, Electrochemical Sensors, Optical Sensors, Chromatography, and Spectroscopy. By end-user of the water testing & analysis market is segmented into Municipalities, Industries, Healthcare Facilities, Environmental Protection Agencies, and Research Institutions. Regionally, the water testing & analysis industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Water quality analyzers are expected to account for 35.8% of the total revenue share in the water testing and analysis market in 2025, making it the leading segment by type. The segment’s dominance is being propelled by the growing need to assess multiple water parameters such as pH, turbidity, conductivity, and dissolved oxygen with high accuracy and speed.

The ability of these analyzers to provide real-time results, coupled with their integration into smart monitoring systems, has made them a preferred choice in municipal, industrial, and agricultural applications. Water quality analyzers have also benefited from enhanced digital interfaces and wireless communication features that support remote diagnostics and data logging.

As water quality standards tighten and detection thresholds become more precise, demand for analyzers that offer multi-parameter functionality, low maintenance, and compliance with international safety norms is rising. The combination of technological maturity and operational flexibility is further strengthening their position as essential tools in ensuring safe and reliable water quality across diverse environments.

The drinking water testing segment is projected to hold 31.5% of the total revenue share in the water testing and analysis market in 2025, highlighting its significance among applications. The segment’s growth is being fueled by increased public health surveillance, heightened awareness of waterborne diseases, and strict enforcement of potable water standards by global regulatory agencies.

Testing solutions for drinking water have seen expanded use in both urban and rural settings due to rising concerns over microbial and chemical contaminants originating from aging infrastructure, industrial discharges, and agricultural runoff. Technological advances in testing kits and continuous monitoring systems have allowed for quicker contamination detection and more efficient response mechanisms.

Moreover, the adoption of decentralized water supply systems in underserved regions has created demand for compact, user-friendly testing tools to ensure water safety at the point of use. The strategic prioritization of clean drinking water in sustainable development agendas is expected to continue supporting the long-term growth of this segment.

Immunoassay-based analyzers are anticipated to represent 29.4% of the total revenue share in the water testing and analysis market by 2025, marking them as a key technology segment. This growth is being driven by their high specificity, sensitivity, and ability to detect trace levels of biological and chemical contaminants including pesticides, hormones, and pathogens.

These analyzers have gained widespread acceptance in environmental laboratories and municipal water authorities for their effectiveness in targeted screening and confirmatory testing. Unlike conventional techniques, immunoassays offer shorter turnaround times and simplified sample preparation, making them suitable for high-throughput operations and field-based testing.

Advances in multiplexed immunoassay formats and integration with automated systems have further improved detection accuracy and operational efficiency. The increased focus on endocrine disruptors, pharmaceutical residues, and other emerging contaminants in water supplies is accelerating the adoption of immunoassay-based technologies, solidifying their relevance in safeguarding water quality through reliable and repeatable analytical workflows.

Water testing and analysis are being utilized extensively in residential, commercial, municipal, and industrial contexts to verify quality, detect contaminants, and ensure regulatory compliance. Demand has risen for rapid onsite testing kits, digital monitoring solutions, and laboratory-grade analysis services. Real-time sensors, remote sampling devices, and integrated reporting platforms are being deployed to support water safety management. Providers offering comprehensive analytical dashboards, calibration-validated instrumentation, and custom testing services are well placed to serve sectors including utilities, food and beverage, and environmental monitoring.

Water testing has been implemented to support timely detection of pathogens, chemicals, and trace elements in drinking water, wastewater, and process streams. Portable test kits with colorimetric strips and digital photometric readers have enabled field-based analysis by technicians. Online sensors capable of real-time measurement of pH, turbidity, chlorine levels, and conductivity have been integrated into smart water networks and industrial treatment systems. Data platforms with cloud-based dashboards and automated alert functionality have improved responsiveness to water quality deviations. Demand from regulators and commercial users has been observed for scalable testing workflows that combine sample tracking, automated reports, and compliance documentation. As awareness of water safety and traceability has increased, adoption of data-driven testing systems has been elevated across multiple use cases.

Water testing adoption has been constrained by inconsistent sampling procedures and variability in test results across different sites and methodologies. Field-collected samples may require preservation protocols or temperature-controlled transport to ensure validity. Diverse regulatory frameworks across regions have demanded separate validation and certification for testing kits and analysis methods, increasing approval complexity. Laboratory turnaround times for complex assays such as heavy metals or microbial culture have delayed results. Integration of sensor-based data with legacy reporting software has posed technical challenges. Cost of continuous monitoring equipment and analytical services has deterred small-scale operators and municipal bodies with limited budgets. Quality control and calibration protocols remain critical but under-resourced in many testing workflows.

Opportunities are emerging through increased demand for on-site and field-deployable testing solutions in industrial facilities, agricultural operations, and remote regions. Advanced portable devices are enabling decentralized water quality checks, reducing reliance on centralized laboratories. Service providers are introducing bundled offerings that combine testing, compliance reporting, and consultation to support regulatory adherence. Rapid growth in mining, pharmaceuticals, and power generation sectors is creating a need for continuous monitoring systems. Partnerships with municipal authorities for long-term water quality programs have become a key revenue source. Integration of mobile labs, automation, and AI-based data analytics is expected to enhance efficiency, accuracy, and predictive decision-making across diverse applications.

Strong emphasis is being placed on real-time monitoring solutions, where sensor-based systems provide continuous updates on critical water quality parameters. Integration of IoT platforms has enabled remote data access and automated alerts, ensuring faster response to contamination events. Digital dashboards and cloud-based storage solutions are facilitating large-scale water quality management programs. Advanced analytical technologies, including biosensors and microfluidic systems, are being introduced for rapid and precise detection of contaminants. Mobile-based applications linked to portable test kits are improving accessibility in rural and field settings. Use of predictive analytics for early detection of system anomalies and blockchain-based reporting is gaining traction in regulatory compliance workflows.

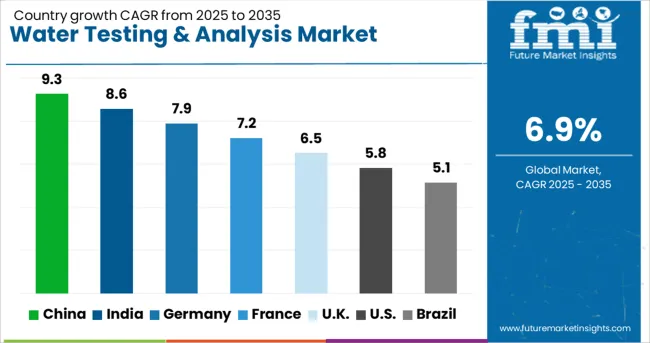

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

The global water testing & analysis market is forecast to grow at 6.9% CAGR from 2025 to 2035, driven by stricter quality regulations, industrial compliance needs, and increased awareness of waterborne contaminants. China leads at 9.3%, supported by large-scale investments in municipal water infrastructure and strict pollution control standards. India follows with 8.6%, propelled by government programs targeting rural water safety and industrial wastewater treatment. Germany posts 7.9%, emphasizing advanced lab-based testing technologies for food and beverage sectors. France records 7.2%, influenced by innovations in rapid microbiological testing for city water networks. The UK grows at 6.5%, focusing on digital water monitoring and real-time data solutions. The report includes analysis of over 40 countries, with five profiled below.

China is projected to expand at 9.3% CAGR, driven by mandatory water quality monitoring standards under national pollution control frameworks. Municipal corporations and industrial plants are investing heavily in advanced spectrometry based analyzers and online sensors for real time contamination detection. Rapid urban population growth and increased agricultural runoff elevate demand for chemical and microbiological testing across water sources. Domestic manufacturers are scaling production of compact automated testing kits for remote applications. Strong investments in connected laboratory infrastructure are improving data accuracy and compliance reporting for regulators. Water testing services for pharmaceutical and semiconductor sectors are also witnessing notable growth as China strengthens its industrial safety protocols.

India is expected to register an 8.6% CAGR, fueled by extensive government programs targeting potable water quality under initiatives like Jal Jeevan Mission. Industrial expansion in pharmaceuticals, food processing, and textiles is increasing demand for advanced water analysis solutions, including TOC (Total Organic Carbon) analyzers and heavy metal detection systems. Regional laboratories are adopting portable testing devices for on-site compliance checks in rural water supply networks. Private labs and third-party testing agencies are expanding coverage to address rising cases of waterborne diseases. Integration of cloud-based platforms for real-time monitoring and reporting strengthens transparency in industrial and municipal sectors.

Germany is forecast to grow at a 7.9% CAGR, driven by strict EU water quality regulations and rising adoption of precision lab equipment in industrial sectors. Advanced testing solutions, including chromatography systems and molecular-based microbial detection, are gaining prominence in the food, beverage, and pharmaceutical industries. Water utilities prioritize real-time data acquisition through smart sensors to maintain compliance with the EU Drinking Water Directives. German equipment manufacturers are focusing on developing multi-parameter analyzers that reduce operational costs while improving detection accuracy. Strategic collaborations between water tech firms and industrial users support innovation in automated sampling systems for both municipal and private applications.

France is expected to grow at a 7.2% CAGR, supported by demand for rapid microbial detection technologies in the municipal and bottled water industries. Water utilities are investing in advanced digital solutions for real-time quality assessment across urban distribution networks. Manufacturers emphasize compact and portable analyzers that cater to small-scale operators and rural water systems. Growth in the pharmaceutical and cosmetics industries drives the adoption of high-precision water testing instruments with strict compliance requirements. Partnerships between testing labs and research institutions are facilitating innovation in bio-based detection kits for contaminant monitoring.

The United Kingdom is projected to grow at a 6.5% CAGR, with growth centered on real-time water quality monitoring and predictive maintenance solutions. Water companies are increasingly using cloud-enabled platforms to manage compliance reporting and optimize operational efficiency. Demand for advanced turbidity and conductivity sensors is rising in municipal and industrial wastewater treatment facilities. Equipment suppliers are introducing connected analyzers that provide continuous data on pH, residual chlorine, and heavy metals. Regulatory emphasis on reducing pollutants in freshwater ecosystems enhances the adoption of automated water testing systems for large-scale utilities and commercial operations.

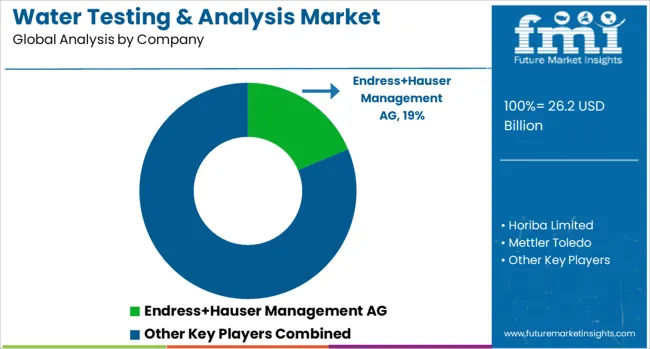

The water testing and analysis market is highly competitive, driven by global leaders such as Endress+Hauser Management AG, Horiba Limited, Mettler Toledo, Danaher Corporation, Agilent Technologies, Emerson Electric Company, Thermo Fisher Scientific, Suez SA, Shimadzu Corporation, and ABB Limited, each leveraging advanced technologies and extensive service networks to meet stringent water quality and safety standards across industrial, municipal, and environmental applications.

The market operates under high regulatory influence, with compliance to WHO, EPA, and regional norms shaping demand for precision instrumentation and real-time monitoring solutions. Endress+Hauser and Emerson focus on integrated process automation and digital water management systems, while Thermo Fisher Scientific and Agilent dominate laboratory testing with advanced chromatography, spectrometry, and molecular analysis platforms. Horiba and Shimadzu provide robust solutions for chemical and biological contaminant detection, catering to pharmaceuticals, food processing, and wastewater treatment industries.

ABB and Danaher lead in deploying IoT-enabled sensors, smart analyzers, and predictive analytics, supporting automation and operational efficiency. Competitive differentiation centers on accuracy, reliability, portability, and connectivity of instruments, alongside aftersales calibration and maintenance services. Strategic initiatives include investments in AI-driven water quality modeling, development of cloud-based platforms for remote data monitoring, and partnerships with utilities for smart water network deployment. Industry rivalry is heightened by rising concerns over water scarcity, pollution, and industrial discharge regulations, pushing innovation in multi-parameter testing kits and on-site rapid detection systems.

Future competitiveness will depend on advancements in real-time pathogen detection, integration of digital twins, and scalable solutions for decentralized water monitoring in urban and rural infrastructure projects.

In June 2024, Endress+Hauser launches the Proline TeqWave MW 300/500, an inline measuring device designed for real-time monitoring of total solids in wastewater sludge. It enhances operational efficiency in municipal and industrial water treatment applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.2 Billion |

| Type | Water Quality Analyzers, Water Microbiology Analyzers, Water Toxicity Analysis, and Water Sampling and Monitoring Systems |

| Application | Drinking Water Testing, Wastewater Analysis, Industrial Water Monitoring, Medical Water Testing, and Environmental Water Testing |

| Technology | Immunoassay-based Analyzers, Electrochemical Sensors, Optical Sensors, Chromatography, and Spectroscopy |

| End-User | Municipalities, Industries, Healthcare Facilities, Environmental Protection Agencies, and Research Institutions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Endress+Hauser Management AG, Horiba Limited, Mettler Toledo, Danaher Corporation, Agilent Technologies, Emerson Electric Company, Thermo Fisher Scientific, Suez SA (Sofina), Shimadzu Corporation, and ABB Limited |

| Additional Attributes | Dollar sales by solution type (instruments, test kits, consumables) and deployment mode (on‑site testing, laboratory, online monitoring), driven by rising standards for industrial water, environmental compliance, and contaminants tracking. North America leads adoption, while Asia‑Pacific rapidly expands via utility and industrial testing programs. Innovation focuses on real-time analyzers, drone‑based water sampling, biosensors, and SaaS platforms for water quality analytics and reporting. |

The global water testing & analysis market is estimated to be valued at USD 26.2 billion in 2025.

The market size for the water testing & analysis market is projected to reach USD 51.0 billion by 2035.

The water testing & analysis market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in water testing & analysis market are water quality analyzers, water microbiology analyzers, water toxicity analysis and water sampling and monitoring systems.

In terms of application, drinking water testing segment to command 31.5% share in the water testing & analysis market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Testing Kit Market Analysis by Product, Test Type, Water Type, End User, and Region - Analysis for 2025 to 2035

Water Quality Testing Equipment Market Growth – Trends & Forecast 2018-2027

Demand for Water Testing Kit in Japan Size and Share Forecast Outlook 2025 to 2035

Microbiological Water Testing Services Market – Growth, Demand & Safety Trends

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA