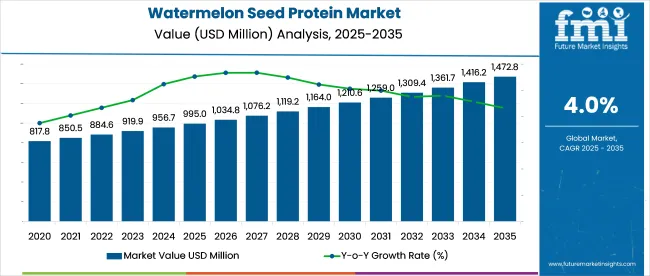

The watermelon seed protein market was valued at USD 995 million in 2025 and is projected to reach USD 1,4768.5 million by 2035, growing at a 4% CAGR.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.9 billion |

| Industry Value (2035F) | USD 5.3 billion |

| CAGR (2025 to 2035) | 4% |

Demand is being driven by rising interest in plant-based protein isolates derived from watermelon seeds, with powdered formulations being favored for protein bars, smoothies, and functional beverages. Raw and roasted seed proteins are being evaluated for their amino-acid profiles, digestibility, and allergen-friendly credentials.

It is argued that manufacturers offering micro-filtered, flavor-neutral protein concentrates will outperform those relying on whole-seed flours. However, inconsistent raw-material supply and processing facility constraints are being cited as barriers unless quality-standard frameworks and secure sourcing partnerships are prioritized.

Guilherme Maia Silva, founder of Força Foods, emphasized the value proposition of watermelon seeds as a superior alternative protein base in an October 2024 interview with Green Queen. His brand’s MILKish product line targets environmentally conscious consumers looking for nutrient-dense, dairy-free options with lower resource inputs.

Highlighting both nutritional and agricultural efficiency, Silva stated, “I discovered that watermelon seeds are not only nutritious, packing more protein than almonds and rich in antioxidants, but also require 99% less water to grow than almonds.” This positioning supports the company's broader strategy to replace water-intensive nut-based proteins with seed-derived ingredients.

The industry holds a niche share within its parent markets. In the plant-based protein market, it accounts for approximately 2-3%, as watermelon seed protein is one of many alternative protein sources. Within the nutraceuticals market, its share is around 1-2%, driven by its inclusion in dietary supplements for health and wellness.

In the health and wellness food market, the share is approximately 2-3%, as watermelon seed protein appeals to health-conscious consumers seeking plant-based proteins. In the functional foods market, its share is about 1-2%, used for its nutritional benefits. In the sports nutrition market, the share is around 2-4%, as it is used in products targeting muscle recovery.

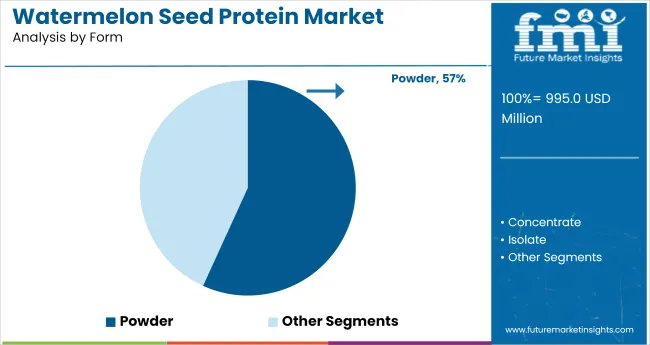

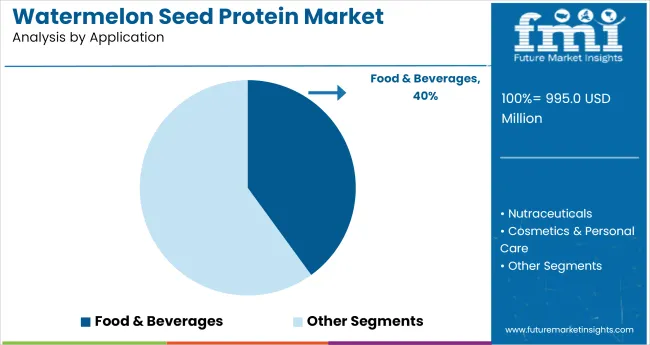

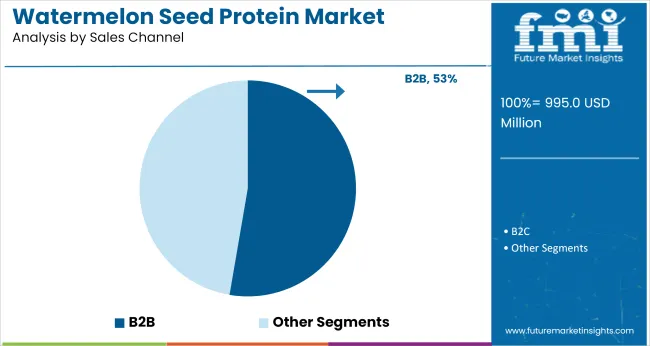

In 2025, the industry will be led by powder form with 57%, food & beverages application at 40%, B2B sales channels capturing 53%, and conventional nature dominating with 69% industry share.

Powdered watermelon seed protein is expected to lead the industry in 2025, accounting for 57% of the industry share. The powder form is widely preferred due to its versatility and ease of use in various food and beverage applications. It can be easily incorporated into smoothies, protein bars, baked goods, and supplements.

The convenient format allows for easier storage, handling, and formulation in both commercial and consumer-grade products. As demand for plant-based protein alternatives rises, watermelon seed protein in powder form will continue to dominate due to its nutritional benefits and suitability for a variety of applications.

Food & beverages are expected to capture 40% of the industry share in 2025. The increasing demand for plant-based, clean-label ingredients in food and beverages is driving the use of watermelon seed protein in various products such as energy drinks, protein shakes, and plant-based snacks.

Watermelon seed protein offers a high-quality source of plant-based protein, which is perfect for products targeting health-conscious consumers looking for functional, allergen-free ingredients. As more consumers seek protein-rich, vegan-friendly food options, watermelon seed protein’s demand in the food and beverage sector is set to rise significantly.

B2B sales channels are expected to hold 53% of the industry share in 2025, making them the dominant distribution method for watermelon seed protein. B2B transactions are critical in supplying large quantities of watermelon seed protein to food and beverage manufacturers, supplement producers, and other industrial users.

This segment benefits from economies of scale, ensuring competitive pricing and steady product availability. The growing use of watermelon seed protein as a key ingredient in plant-based products will continue to drive demand in B2B channels, as companies look for sustainable, high-quality protein sources for their products.

Conventional watermelon seed protein is projected to capture 69% of the industry share in 2025. Conventional products are the most widely used due to their cost-effectiveness and availability in large quantities, making them suitable for both industrial-scale manufacturing and consumer use.

While organic watermelon seed protein options are emerging, conventional products remain the dominant choice in the industry, especially in regions with price-sensitive consumers. Conventional watermelon seed protein is used in various applications, from food products to supplements, and will continue to be the preferred choice due to its affordability and accessibility.

The watermelon seed protein market is expanding due to increasing consumer demand for plant-based, allergen-free protein sources. However, challenges such as limited consumer awareness, inconsistent raw material quality, and high production costs are hindering broader adoption.

Rising Demand for Plant-Based Protein Alternatives

The industry is experiencing growth driven by the increasing consumer preference for plant-based protein sources. Watermelon seed protein offers a complete amino acid profile, making it a valuable alternative to traditional animal-based proteins. Its hypoallergenic nature and suitability for individuals with dietary restrictions further contribute to its appeal. As consumers become more health-conscious and seek sustainable protein options, the demand for watermelon seed protein is expected to rise.

Challenges in Consumer Awareness and Raw Material Quality

Despite its benefits, the industry faces challenges related to limited consumer awareness and inconsistent raw material quality. Many consumers are unfamiliar with watermelon seed protein and its potential health benefits, which can hinder its adoption. The quality of watermelon seeds can vary depending on cultivation practices and processing methods, leading to inconsistencies in the final protein product. These factors can affect consumer trust and limit the industry's growth potential.

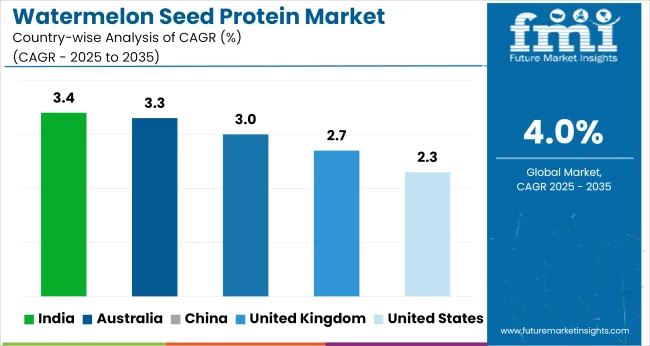

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.3% |

| United Kingdom | 2.7% |

| China | 3% |

| India | 3.4% |

| Australia | 3.3% |

Global industry demand is projected to rise at a 4% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 3.4%, followed by Australia at 3.3%, and China at 3%, while the United Kingdom records 2.7% and the United States posts the slowest growth at 2.3%.

These rates translate to a growth premium of -15% for India, -20% for Australia, and -30% for the United States versus the baseline, while China shows more moderate growth. Divergence reflects local catalysts: increasing awareness of plant-based proteins and sustainability trends in India and China, with the United States and the United Kingdom experiencing slower growth due to industry saturation and limited adoption of watermelon seed protein in conventional food products.

Sales of watermelon seed protein in the United States are projected to rise at a 2.3% CAGR through 2035. Demand remains niche, concentrated among clean-label food manufacturers and plant-based protein innovators. Fitness and wellness brands are adopting watermelon seed protein for its amino acid profile and low allergenicity.

Distribution occurs largely through online wellness portals and boutique nutrition chains. Barriers include limited consumer awareness and competition from almond, pumpkin, and pea proteins.

The United Kingdom’s industry is expected to grow at a 2.7% CAGR from 2025 to 2035. Specialty food manufacturers are incorporating seed protein into gluten-free bakery mixes and non-dairy protein bars. Health-conscious consumers are drawn to watermelon seed protein for its trace mineral content. Growth is supported by ethical food sourcing narratives and interest in minimally processed ingredients.

China’s industry is projected to expand at a CAGR of 3% through 2035. Recovery from snack-grade seeds in processing units is improving, and applications are broadening to include bakery and clinical nutrition. Health trends are shaping demand among middle-class consumers for natural, fortified foods. Local formulators are experimenting with watermelon seed derivatives in beverages, breakfast cereals, and protein-fortified noodles.

India’s industry is expected to grow at a CAGR of 3.4% between 2025 and 2035. Large volumes of watermelon seed waste from the juice and snack sectors are now being redirected for protein extraction. Ayurveda-led brands are developing immunity blends containing seed protein. Rural food processing units have begun integrating it into diabetic-friendly flour mixes.

Australia’s industry is projected to grow at a CAGR of 3.3% through 2035. Emerging interest in native, low-impact protein sources is driving growth. Consumer preference for allergen-free and soy-free proteins has benefited this category. Regional manufacturers are advertising watermelon seed protein in paleo, keto, and clean-eating circles.

In the industry, product depth has been emphasized through grade differentiation, sourcing transparency, and channel reach. Amino Labs occupies a leading position by offering isolate proteins tailored to nutraceutical and sports nutrition brands across North America and Europe, sourcing raw seeds from agro clusters and operating proprietary cold-press extraction.

ZCompany (Europe) and ETChem have targeted food service and bakery channels with concentrate powders produced via co-manufacturing in EU facilities. NP Nutra supports supplement formulators in India and ASEAN through private-label contracts and ecommerce platforms. Aktin Chemicals delivers functional-grade protein for cosmetics and clinical nutrition, navigating EU novelfood and FDA certification pathways.

Recent Industry News

| Attribute Category | Details |

|---|---|

| Industry Size (2025E) | USD 995 million |

| Projected Industry Value (2035F) | USD 1,472.8 million |

| Value-based CAGR (2025-2035) | 4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD million / Volume in metric tons |

| By Form | Powder, Concentrate, Isolate |

| By Application | Food & beverages (Protein Bars, RTD B everages, Bakery Products, Snacks & Cereals, Plant-Based Dairy Alternatives), Nutraceuticals (Dietary Supplements, Functional Powders), Cosmetics & Personal Care (Haircare Products, Skincare Products), Animal Feed (Pet Food, Livestock Feed) |

| By Sales Channel | B2B (Food & Beverage Manufacturers, Supplement Brands), B2C (Retail Stores, Online Retail, Specialty Health Stores) |

| By Nature | Organic, Conventional |

| By Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, Indonesia, Saudi Arabia, United Arab Emirates, South Africa |

| Key Players | Amino Labs Inc., Z-Company (Europe), Aktin Chemicals Inc., NP Nutra (Nature’s Power Nutraceuticals), ETChem, Others |

| Additional Attributes | Dollar by sales, share by form and application, growth in plant-based protein blends, retail shelf performance in sports nutrition and wellness aisles, B2B sourcing shifts toward organic concentrates, and rising demand for upcycled plant protein derivatives in EU and APAC |

Form segmentation includes Powder, Concentrate, and Isolate.

Applications span Food & Beverages (Protein Bars, RTD Beverages, Bakery Products, Snacks & Cereals, Plant-Based Dairy Alternatives), Nutraceuticals (Dietary Supplements, Functional Powders), Cosmetics & Personal Care (Haircare Products, Skincare Products), and Animal Feed (Pet Food, Livestock Feed).

Sales channels include B2B (Food & Beverage Manufacturers, Supplement Brands) and B2C (Retail Stores, Online Retail, Specialty Health Stores).

Nature-based segmentation includes Organic and Conventional.

Regional analysis includes North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The industry is estimated to be USD 995 million in 2025.

The industry is projected to reach USD 1,472.8 million by 2035, with a CAGR of 4% from 2025 to 2035.

The powder form segment leads the industry with a 57% share.

India has the highest projected CAGR at 3.4% from 2025 to 2035.

The leading player in the industry is Amino Labs Inc., holding a 9% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seed Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Seed Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Seed Health Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Seed Packaging Market Analysis – Growth & Forecast 2025 to 2035

Seed Binders Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Seed Cracker Manufacturers

Seed Polymer Market

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Teaseed Cake Market – Trends & Forecast 2025 to 2035

The Linseed Oil Market is Analysis by Nature, Product Type, Application, and Region from 2025 to 2035

Flaxseed Gum Market Size and Share Forecast Outlook 2025 to 2035

Rapeseed Oil Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Hempseed Milk Business

Rapeseed Meal Market Analysis by Type, Application, Nature, and Region Through 2035

Flaxseeds Market – Growth, Demand & Nutritional Benefits

Rapeseed Protein Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA