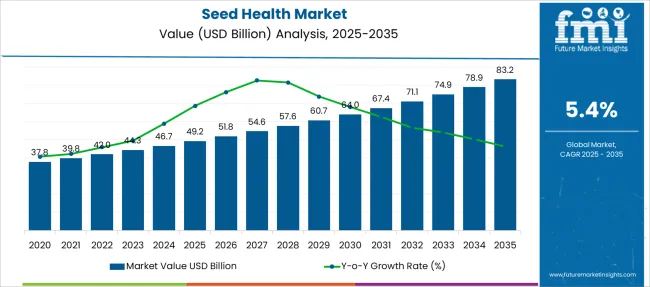

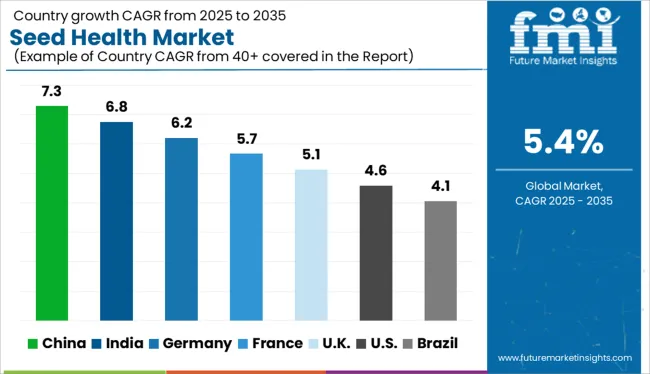

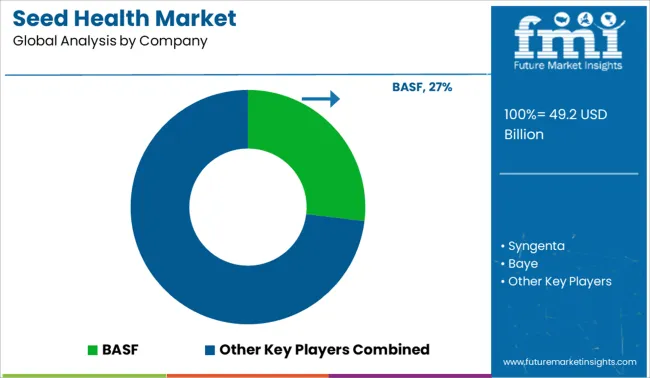

The Seed Health Market is estimated to be valued at USD 49.2 billion in 2025 and is projected to reach USD 83.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Seed Health Market Estimated Value in (2025 E) | USD 49.2 billion |

| Seed Health Market Forecast Value in (2035 F) | USD 83.2 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The seed health market is experiencing substantial momentum owing to the rising demand for disease free crop yields, increased focus on sustainable agriculture, and the advancement of seed treatment technologies. With global pressure mounting on agricultural productivity and food security, seed health solutions have emerged as critical inputs for ensuring robust germination, resistance to pathogens, and consistent crop performance.

Innovation in biological seed treatments, combined with improved delivery mechanisms and compatibility with multiple seed types, is transforming traditional farming practices. Regulatory encouragement for environmentally friendly agricultural inputs and increasing farmer awareness are also fueling the transition from chemical to biological options.

As global agricultural systems evolve to balance yield optimization with environmental preservation, the seed health market is projected to witness robust adoption across both developed and developing agrarian economies.

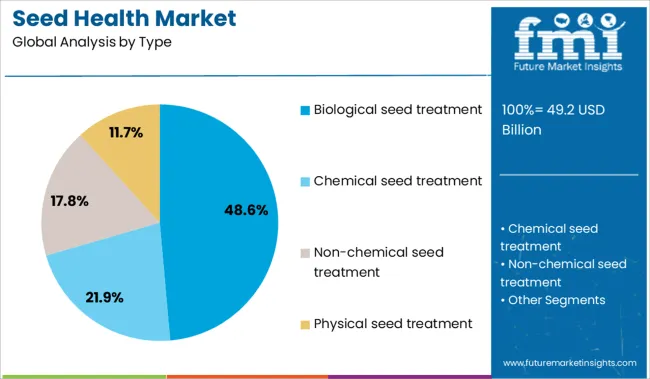

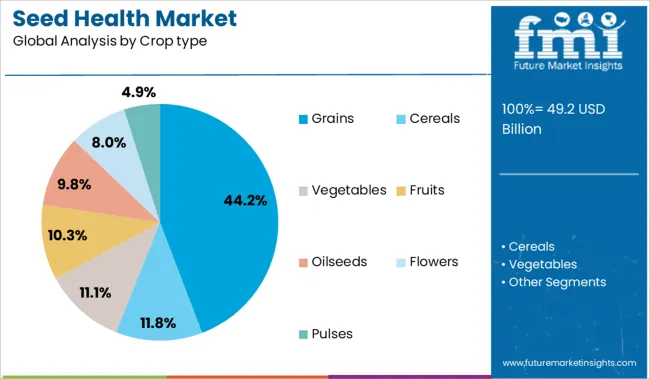

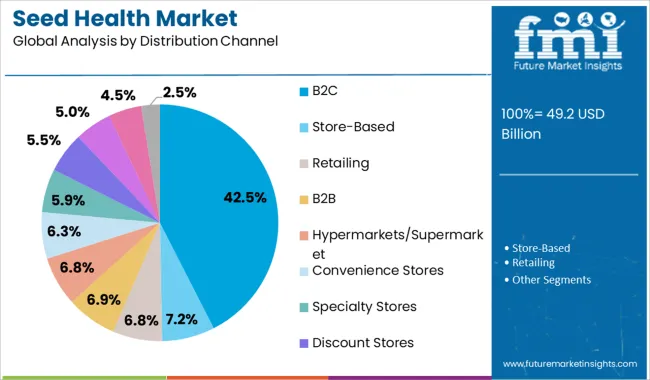

The market is segmented by Type, Crop type, and Distribution Channel and region. By Type, the market is divided into Biological seed treatment, Chemical seed treatment, Non-chemical seed treatment, and Physical seed treatment. In terms of Crop type, the market is classified into Grains, Cereals, Vegetables, Fruits, Oilseeds, Flowers, and Pulses. Based on Distribution Channel, the market is segmented into B2C, Store-Based, Retailing, B2B, Hypermarkets/Supermarket, Convenience Stores, Specialty Stores, Discount Stores, Grocery Stores, Liquor Stores, and Online Retailing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The biological seed treatment segment is projected to account for 48.60% of total market revenue by 2025, making it the most dominant type in the seed health category. This growth is being propelled by increasing restrictions on synthetic chemicals, rising consumer demand for organic food, and greater emphasis on microbial and naturally derived seed enhancements.

Biological treatments support plant immunity, enhance nutrient uptake, and improve resistance to soil borne diseases without leaving chemical residues. As sustainability becomes a core focus across global agricultural policies and supply chains, biological seed treatments are being increasingly adopted as safer and eco friendly alternatives.

Their compatibility with integrated pest management practices and positive impact on soil health are further strengthening their position as the preferred seed treatment option.

The grains segment is expected to contribute 44.20% of total market revenue by 2025 under the crop type category, reflecting its leading position. This dominance is attributed to the large scale production of staple cereals such as wheat, rice, and maize, which form the backbone of global food supply.

The high vulnerability of grains to seed borne and early stage fungal infections has necessitated the use of effective seed health solutions. Additionally, the economic significance of grain exports and their susceptibility to climate induced stress have intensified efforts to protect yield quality from the seed stage.

As grain producers increasingly adopt advanced agronomic practices, the demand for seed health solutions tailored to cereal crops continues to drive this segment’s growth.

The B2C segment is anticipated to hold 42.50% of the total market revenue by 2025 within the distribution channel category, marking it as the leading channel. This growth is influenced by the increasing involvement of individual farmers, smallholder growers, and local distributors in purchasing seed health products directly from manufacturers or online platforms.

Enhanced digital connectivity, mobile agriculture apps, and farmer focused e commerce channels have facilitated easier access to seed treatment solutions. Moreover, the growing trend of farm level decision making and awareness about tailored crop protection products has made the B2C route a preferred model for reaching end users efficiently.

As transparency, convenience, and brand trust become key factors in purchase behavior, the B2C channel continues to expand its influence in the seed health value chain.

According to Future Market Insights, the global market for Seed Health was growing at a CAGR of 3.4% to reach USD 46.7 Billion in 2024 from USD 37.8 Billion in 2020.

The seed health market is anticipated to be driven by research and development projects to develop seed quality assurance capabilities. Additionally, seed health kits are essential for protecting crops from illnesses including soil-borne and soil infection.

Chemical treatment is losing ground to the rising demand for sustainable agricultural products. In addition, the market for seed health kits is anticipated to be directly impacted by emerging trends in organic farming. The market is anticipated to rise due to crops being grown without the use of chemicals.

According to a survey by Future.4Market Insights, the global Seed Health market is projected to expand at a CAGR of 5.4% during the predicted time frame.

The seed health business has long been dominated by North America. The area is home to some of the world's most cutting-edge seed testing infrastructure and procedures. In order to develop new and improved methods of detecting and controlling plant diseases, North American seed corporations have made significant investments in research and development.

Many of the top seed health companies in the world are now based in North America. These businesses are always coming up with new and improved ways to safeguard crops against illness. They are also putting a lot of effort into creating new goods that will aid farmers everywhere in increasing yields and producing better food.

North American seed companies are committed to helping farmers around the world grow healthy food. They are constantly searching for new ways to improve seed health and make their products more accessible to farmers in developing countries.

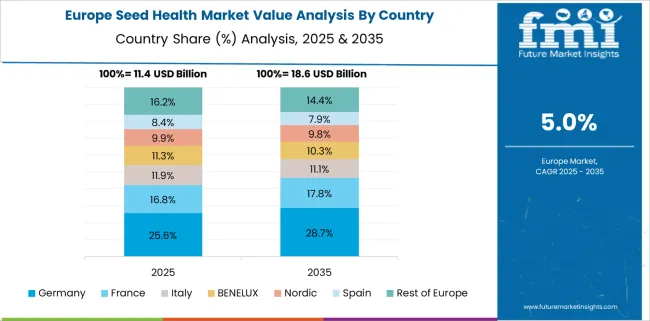

When it comes to setting up a business, Europe is one of the most popular destinations in the world. And it not hard to see why. The continent has a lot to offer entrepreneurs, from a highly educated workforce to a favorable tax regime.

The European market for seed health products is growing rapidly. This is due to factors such as the increasing demand for organic food and the need for more effective pest and disease control in agriculture. As a result, there is a growing demand for new and innovative seed health products.

The seed health market is booming in the Asia Pacific region. Several factors are driving this growth, including increasing concerns about food safety, increasingly stringent environmental laws, and growing demand for organic crops.

One of the main reasons for the growing popularity of seed health products is that they offer a convenient way to protect both conventional and organic crops against various pests and diseases. By using specific seed health products, growers can ensure that their plants are resistant to common threats such as powdery mildew, fungal diseases, and root rot.

Another key factor contributing to the growth of this market is the increasing demand for sustainable agricultural practices. Many consumers are looking for ways to reduce their environmental footprint while still producing high-quality food. Seed health products are one way to achieve these goals since they can help farmers manage pests and diseases without resorting to harmful chemicals or irrigation systems.

To protect chemical crops, one of the most common germination strategies currently available is seed care. It provides superior planting benefits, such as high germination and disease management against soil- and seed-borne diseases, at a relatively cheap cost compared to spraying, ensuring the viability of the harvest.

Plant pathogens like fungus, bacteria, viruses, and nematodes as well as climate factors that encourage insect growth are what fuel the pesticides business. As more consumers become conscious of environmental issues and the safety of food after being treated with nonchemical and other chemicals, the need for seed health kits will increase in the coming years.

Heavy pesticide use has a harmful impact on both the ecosystem and human health. The adoption of non-chemical agricultural approaches, such as the market for seed health kits, is anticipated to be significantly impacted by strict regulations against the use of such harmful pesticides.

Increased seed substitution, the availability of hybrid seeds, the development of novel breeding techniques, and the use of GM crops are a few of the major drivers fueling the market's expansion for seed health kits.

The segment is expected to be driven by the growing popularity of e-commerce and the increasing number of Internet users. In addition, the segment is expected to benefit from the increased purchasing power of consumers and the expanding product range offered by online retailers.

The segment of online retailing is expected to perform quite well in the health and fitness industry.

This is because people are increasingly becoming more health conscious and are looking for ways to lead healthier lives. There are many products available online that can help people live healthier lives, and the online retailing segment is expected to grow significantly in the next few years.

One of the reasons why the online retailing segment is expected to perform so well is because there is a growing trend of people shopping for health and fitness products online.

This is due to the fact that it is convenient and often times cheaper than buying these items in brick-and-mortar stores. In addition, there is a wide range of products available online, which makes it easy for consumers to find what they are looking for.

In order to meet consumers' growing demand and keep their position as industry leaders in the Seed health sector, the majority of businesses are concentrating on innovation and new product launches.

Businesses in the Seed Health market sector are always offering new sorts of components to fulfill changing consumer demands and capture the biggest market conceivable. In an effort to reach new markets, businesses are expanding their distribution networks.

| Attribute | Details |

|---|---|

| Forecast period | 2025 to 2035 |

| Historical data available for | 2020 to 2025 |

| Market analysis | USD million in value |

| Key regions covered | North America; Eastern Europe; Western Europe; Japan; South America; Asian Pacific; Middle east and Africa |

| Key countries covered | USA, Germany, France, Italy, Canada, United Kingdom, Spain, China, India, Australia |

| Key segments covered | Type, Crop Type, Distribution channel, Region |

| Key companies profiled | BASF; Syngenta; Baye; Monsanto; Chemtura; DuPont; CropScience; Sumitomo Chemical Company Limited; Valent U.S.A. Corporation; Novozymes A/S; Morflora; Plant Health Care; Incotec Group BV; Wolf Trax Incorporation; Precision Laboratories Incorporation; Nufarm; Becker Underwood |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics, Challenges, Strategic Growth Initiatives |

| Customization and Pricing | Available upon request |

The global seed health market is estimated to be valued at USD 49.2 billion in 2025.

The market size for the seed health market is projected to reach USD 83.2 billion by 2035.

The seed health market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in seed health market are biological seed treatment, chemical seed treatment, non-chemical seed treatment and physical seed treatment.

In terms of crop type, grains segment to command 44.2% share in the seed health market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seed Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Seed Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Seed Packaging Market Analysis – Growth & Forecast 2025 to 2035

Seed Binders Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Seed Cracker Manufacturers

Seed Polymer Market

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Teaseed Cake Market – Trends & Forecast 2025 to 2035

The Linseed Oil Market is Analysis by Nature, Product Type, Application, and Region from 2025 to 2035

Rapeseed Protein Market Size and Share Forecast Outlook 2025 to 2035

Flaxseed Gum Market Size and Share Forecast Outlook 2025 to 2035

Rapeseed Oil Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Hempseed Milk Business

Rapeseed Meal Market Analysis by Type, Application, Nature, and Region Through 2035

Assessing Rapeseed Protein Market Share & Industry Trends

Flaxseeds Market – Growth, Demand & Nutritional Benefits

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA