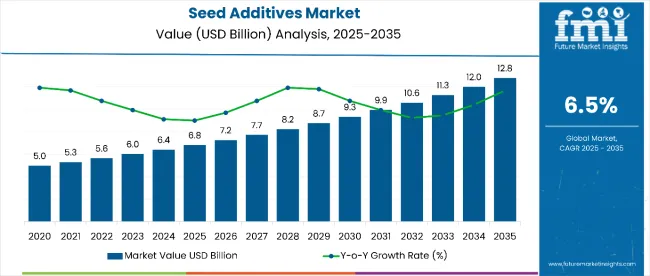

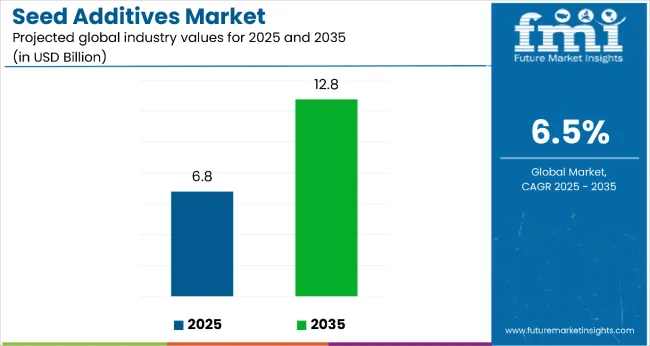

The seed additives market is projected to be valued at USD 6.8 billion in 2025 and is expected to reach USD 12.8 billion by 2035, reflecting a CAGR of 6.5% during the forecast period. This translates into an absolute dollar opportunity of USD 6.0 billion between 2025 and 2035, indicating a 1.88x expansion.

By 2030, the market is anticipated to reach approximately USD 9.3 billion, representing USD 2.5 billion in incremental growth during the first half of the decade. The remaining USD 3.5 billion is expected in the second half, signaling a moderately back-loaded growth trend. This trajectory is driven by global demand for yield-enhancing and stress-resilient seeds, increased adoption of bio-based inputs, and rising focus on sustainable agriculture. Demand remains strong in emerging economies investing in seed treatment infrastructure and regenerative farming practices.

Companies such as BASF SE, Bayer AG, Croda International Plc, and Corteva Agriscience are spear heading innovation with multifunctional seed coatings, nutritional primers, and bioactive protectants. These solutions enhance germination and seedling vigor while offering a competitive advantage in drought-prone and pathogen-heavy environments. Digital platforms and precision farming systems are expanding the use of additive-treated seeds across row crops, vegetables, and specialty seeds.

The market accounts for approximately 18.7% of the total agricultural seed treatment segment, highlighting its critical role in improving crop performance during germination and early growth stages. Within the broader crop input ecosystem, seed additives represent about 6.4% of total value, with an upward trajectory as biological and nutrient-based additives gain traction.

The segment contributes nearly 12% to the bio-agriculture input market, driven by growing adoption of organic and microbial additives, particularly in regulated markets such as the EU and Japan. The share of seed additives in emerging seed enhancement technologies stands at around 20.5%, supported by innovations in encapsulation, nano-coating, and targeted release formulations.

The market is undergoing structural transformation driven by rising demand for high-performance, eco-conscious seed inputs and increasing integration between digital agronomy platforms and treated seed systems. Adoption of biological seed additives is expanding as regulatory scrutiny on chemical residues and soil degradation intensifies. In parallel, large agri-input companies are investing in supply chain digitization and on-farm advisory platforms to promote customized additive formulations. Direct-to-farmer distribution models, subscription-based seed treatment services, and localized microbial inoculants are redefining how value is delivered across the modern seed industry.

Seed additives are increasingly adopted for their ability to enhance germination, promote early seedling vigor, and improve crop resilience, making them a critical input for achieving higher yields and minimizing production risks. These additives ensure uniform plant emergence, improve nutrient uptake, and provide protection against abiotic and biotic stresses, which is crucial under changing climate conditions and soil degradation.

Growing pressure to increase food output without expanding arable land is driving farmers to embrace seed enhancement technologies. Consequently, seed additives are now widely integrated into commercial seed operations for grains, oilseeds, pulses, and vegetables. Rising interest in biological and organic farming also strengthens demand for additives that support residue-free and soil-friendly cultivation practices.

Adoption of hybrid and genetically improved seeds, particularly in Asia Pacific, Latin America, and Sub-Saharan Africa, is reinforcing the need for additives to unlock genetic potential. Government-led programs promoting value-added seeds and precision farming trends are further positioning seed additives as essential components of modern agriculture, with applications extending across row crops, horticulture, and protected cultivation systems.

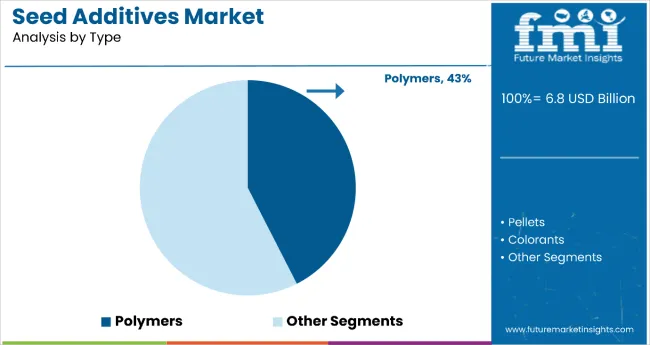

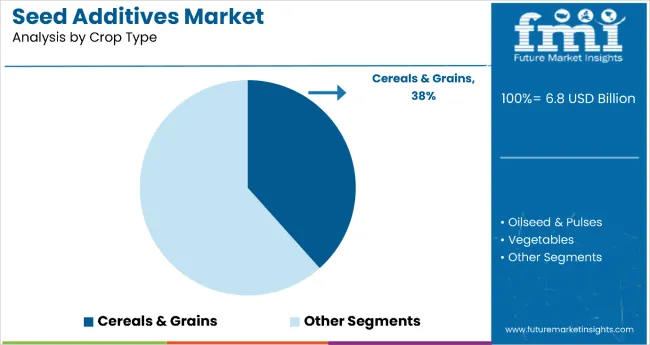

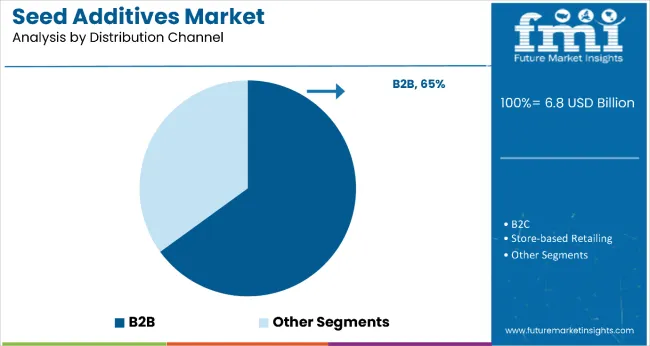

The seed additives market is segmented by type, crop type, distribution channel, and region. By type, the market is divided into polymers, pellets, colorants, minerals/pumice, active ingredients, and other additives. In terms of crop type, the market is classified into oilseeds & pulses, cereals & grains, vegetables, flowers & ornamentals, and others. By distribution channel, the market is bifurcated into B2B, B2C, store-based retailing hypermarkets/supermarkets, convenience stores, discount stores, independent small groceries, and online retailing platforms. By region, the market covers North America, Europe, Asia-Pacific, Latin America, the Middle East & Africa.

The polymer-based seed additives segment commands the largest share of the market at 43%, owing to its critical role in improving seed flowability, mechanical strength, and uniform coating for machine handling. These polymers act as carriers or binders for other functional agents such as nutrients, colorants, or biologicals, forming the structural basis of modern seed enhancement systems.

High compatibility with both synthetic and biological active ingredients makes this segment a preferred choice for commercial seed treatment facilities. The emergence of biodegradable and water-dispersible polymers is further accelerating growth, particularly in regulated markets such as the EU and Japan. Manufacturers are also innovating with polymer encapsulation technologies that provide extended release of protectants or stimulants over time, increasing agronomic value.

With proven functionality, cost-effectiveness, and scalability, polymer additives are expected to maintain leadership in the seed treatment value chain throughout the forecast period.

The cereals and grains segment leads with a 38% share, reflecting the vast acreage and intensive input use in crops such as wheat, maize, rice, and barley. These crops are highly responsive to seed enhancements that boost germination, early root development, and pest or pathogen defense, making them prime targets for additive application.

Farmers and seed companies increasingly rely on nutrient-loaded coatings, antifungal colorants, and bio-based primers for cereals to ensure uniform emergence and stronger initial growth, especially in rain-fedor stress-prone zones. Government programs promoting hybrid cereal varieties and minimum tillage are further increasing reliance on treated seeds in both developed and developing economies.

As global demand for staple grains rises and agricultural practices become more precision-oriented, the cereals and grains segment is projected to remain the largest consumer of seed additives.

The B2B distribution channel holds a commanding 65% share in the seed additives market, primarily dueto its integration with commercial seed processors, agribusiness conglomerates, and cooperatives. These bulk transactions often involve custom formulations aligned with regional agronomy, seed genetics, and soil conditions, ensuring tailored additive applications at scale.

B2B models enable efficient downstream packaging, branding, and distribution by seed companies, making them the backbone of the seed enhancement industry. Major additive manufacturers maintain exclusive partnerships with seed producers to supply proprietary blends optimized for specific crops and geographies.

Despite the rise of online retail and direct-to-farmer marketing, the B2B segment is expected to maintain dominance due to its volume throughput, technological integration, and critical role in industrial seed supply chains.

From 2025 to 2035, seed additive manufacturers are realigning strategies to support climate-resilient and precision farming. By integrating AI-driven agronomy platforms, custom seed treatment packages, and advanced input portfolios, companies aim to strengthen their value propositions. Brands offering proven biological efficacy, regulatory compliance, and tailored solutions are expected to lead in this evolving ecosystem.

Sustainability-Driven Demand Supports Growth

The transition toward sustainable agricultural practices remains a key driver for seed additive adoption. Additives such as polymers, bio stimulants, and micronutrients enhance germination, seedling vigor, and resistance to drought and disease, which are critical factors in climate-sensitive regions. Increased reliance on hybrid and treated seeds across cereals, oilseeds, and vegetables further expands demand. Government initiatives promoting eco-friendly inputs and regenerative farming methods accelerate additive integration among both commercial and smallholder farmers.

Regulatory Complexity and Storage Limitations Restrain Adoption

Despite strong potential, growth is restricted by inconsistent global regulations for biological and nano-additives, resulting in prolonged approval timelines and trade complexities. Storage sensitivity, particularly in microbial-based additives, poses challenges due to limited shelf life and the lack of cold-chain infrastructure in several regions. Price sensitivity and low awareness among farmers in emerging markets also hinder adoption, particularly within direct-to-farmer distribution channels.

Innovation and Regulatory Shifts Create Opportunity

The growing preference for natural and bio-based additives stimulates innovation in microbial formulations, encapsulation technologies, and seed coating solutions. Stricter pesticide regulations in regions such as Europe and Asia accelerate the shift toward biological seed treatments. Companies investing in integrated delivery systems and providing field-level advisory services are gaining early-mover advantages and strengthening their competitive edge in a rapidly evolving market landscape.

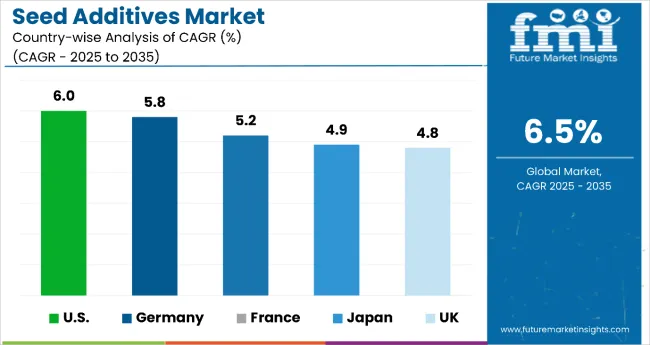

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6% |

| Germany | 5.8% |

| France | 5.2% |

| Japan | 4.9% |

| UK | 4.8% |

Between 2025 and 2035, the USA is projected to lead the seed additives market with a 6.0% CAGR, driven by large-scale commercial farming and rising adoption of biological additives. Germany follows closely at 5.8%, supported by precision agriculture practices and advanced seed technology standards. France is expected to grow at 5.2%, bolstered by eco-friendly innovations and strong seed export activities. Japan, at 4.9%, is witnessing increased demand in urban farming and high-value crop sectors. The UK, with a 4.8% CAGR, is advancing due to post-Brexit sustainability incentives and growing use of microbial coatings in weather-challenged environments.

The report includes an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA seed additives market is projected to grow at a 6.0% CAGR, supported by large-scale commercial farming, strong demand for hybrid seeds, and increasing adoption of biological additives. USA-based agri-business leaders are expanding investments in advanced seed enhancement technologies to comply with USDA-backed regenerative agriculture programs.

The seed additives market in the UK is expected to expand at a 4.8% CAGR, backed by rising interest in eco-friendly inputs and strong adoption of certified seed enhancement protocols. UK farmers are increasingly incorporating mineral-based additives and microbial coatings to manage yield variability under unpredictable weather conditions.

Germany is forecast to grow at a 5.8% CAGR, driven by its commitment to climate-resilient agriculture and stringent seed technology standards. German seed producers are integrating colorants, polymers, and active ingredients into advanced pest and nutrient management systems.

Seed additive sales in France are projected to rise at a 5.2% CAGR, supported by a robust seed export sector and significant investments in R&D for coating technologies. French cooperatives and agri-tech firms are introducing active ingredient blends designed to enhance germination and early root development.

The seed additives market in Japan is expected to grow at a 4.9% CAGR, fueled by rising demand for high-quality seeds in protected agriculture and urban farming systems. Japanese seed producers focus on uniformity, seed hygiene, and compact additive formulations suited for precision-controlled environments.

The global seed additives market is moderately fragmented, led by BASF SE and Bayer AG, which together account for a significant share of global revenues. BASF SE maintains leadership through its comprehensive seed coating systems, micronutrient blends, and consistent investment in field-ready technologies that enhance yield and ensure regulatory compliance across major crop categories.

Dominant player status is shared between BASF SE and Bayer AG. Other major participants include Corteva Agriscience, Clariant AG, and Croda International Plc, each offering specialized additive technologies such as biologicals, surfactants, binders, and seed colorants tailored to diverse agroclimatic zones and crop types. Corteva emphasizes rhizosphere-enhancing microbial additives, while Croda focuses on eco-friendly coating agents with low environmental impact.

Clariant AG holds a strong position in seed colorants and polymers, benefiting from its expertise in pigments and specialty chemicals. Croda's natural surfactant platforms and Clariant's binder systems cater to the growing demand for bio-compatible, residue-free coatings, particularly in Europe and Latin America.

Emerging players such as Pivot Bio, Groundwork Bio Ag, and Verdesian Life Sciences are gaining traction by offering biological alternatives to traditional synthetic additives. These companies leverage microbial innovations and carbon-smart technologies to attract regenerative agriculture proponents and organic-certified seed producers.

Market growth is supported by increasing adoption of seed enhancement technologies, government-backed sustainable farming programs, and stricter agrochemical regulations. Leading firms are advancing through licensing agreements, targeted mergers and acquisitions, and joint ventures with seed companies to co-develop additive-integrated varieties. Competitive differentiation increasingly depends on biological efficacy, regulatory adaptability, and compatibility with precision seed treatment systems.

Key Developments in Seed Additives Market

Bayer is accelerating innovation in seed-applied technologies with biological seed treatment products like JumpStart® and ProStablish®. These products for wheat have demonstrated yield increases of more than 3% through enhanced nutrient uptake and seedling vigor.

Chromatech specializes in seed coating colorants compliant with US EPA regulations (40 CFR Part 180). Their colorants for seed coatings are microplastic-free and APEO-free, designed to be used with fungicides, insecticides, biologicals, and inoculants.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.8 Billion |

| Type | Polymers, Pellets, Colorants, Minerals/Pumice, Active Ingredients, and Other Additives |

| Crop Type | Oilseed & Pulses, Cereals & Grains, Vegetables, Flowers & Ornamentals, and Others |

| Distribution Channel | B2B, B2C, Store-based Retailing (Hypermarkets/Supermarkets, Convenience Stores, Discount Stores, Independent Small Groceries), and Online Retailing |

| Key Country | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Key Companies Profiled | BASF SE, Bayer Crop Science AG, Precision Laboratories LLC, Clariant International, Incotec Group B.V., Chemtura Corporation, and Chroma tech Incorporated |

| Additional Attributes | Dollar sales by additive type and crop segment, adoption trends across B2B and B2C channels, regulatory impact analysis, innovation in biologicals and sustainable coatings, regional performance mapping across USA farming zones |

The global seed additives market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the seed additives market is projected to reach USD 12.8 billion by 2035.

The seed additives market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The B2B segment is expected to dominate the distribution channel with 65% of the market share in 2025.

Polymers are projected to contribute 43% of the market share in seed additives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seed Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Seed Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Seed Health Market Size and Share Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Seed Packaging Market Analysis – Growth & Forecast 2025 to 2035

Seed Binders Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Seed Cracker Manufacturers

Seed Polymer Market

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Additives for Floor Coatings Market

Teaseed Cake Market – Trends & Forecast 2025 to 2035

The Linseed Oil Market is Analysis by Nature, Product Type, Application, and Region from 2025 to 2035

Rapeseed Protein Market Size and Share Forecast Outlook 2025 to 2035

Flaxseed Gum Market Size and Share Forecast Outlook 2025 to 2035

Rapeseed Oil Market Size and Share Forecast Outlook 2025 to 2035

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Analysis and Growth Projections for Hempseed Milk Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA