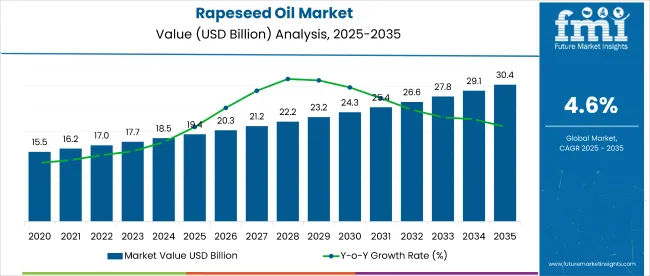

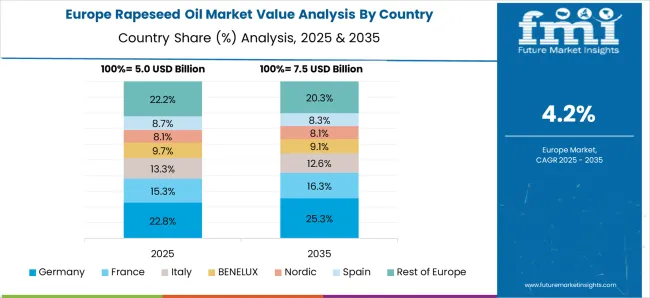

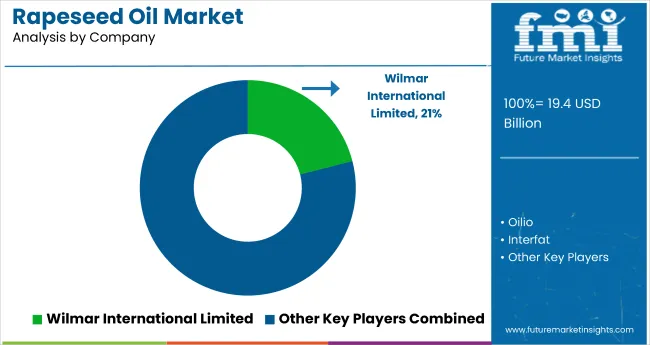

The global rapeseed oil market is projected to grow from USD 19.4 billion in 2025 to USD 30.4 billion by 2035, registering a CAGR of 4.6%. The market expansion is being driven by increasing demand for heart-healthy oils, rising popularity of plant-based diets, and the widespread use of rapeseed oil in food service, personal care, and biodiesel production.

The oil’s high omega-3 content, neutral flavor, and heat stability make it a preferred choice across culinary, nutritional, and industrial applications. The market holds a significant share across multiple parent markets. It accounts for 9% of the global vegetable oil market and around 12% of the edible oil market, driven by its health benefits and culinary versatility. Within the oilseed market, rapeseed contributes nearly 10%, reflecting its strong cultivation base.

In the dietary supplements market, rapeseed oil-based capsules capture about 4%, while in the personal care ingredients market, it holds close to 3% due to its vitamin E and antioxidant content. Additionally, it represents 1% of the biodiesel feedstock market and under 0.2% of the global food and beverage industry.

Government regulations impacting the market focus on food safety, labeling standards, and sustainable agriculture. The European Union’s Regulation (EU) No 1169/2011 ensures proper nutrition labeling of edible oils, while the USA FDA’s food labeling guide mandates transparent ingredient disclosures.

Additionally, frameworks like the EU Common Agricultural Policy (CAP) and India’s National Mission on Edible Oils - Oil Palm promote sustainable and organic oilseed cultivation. These policies drive the adoption of high-purity, organic, and cold-pressed rapeseed oils, enhancing both consumer trust and market penetration.

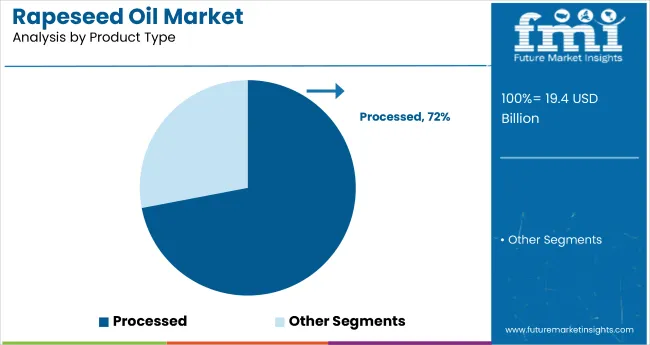

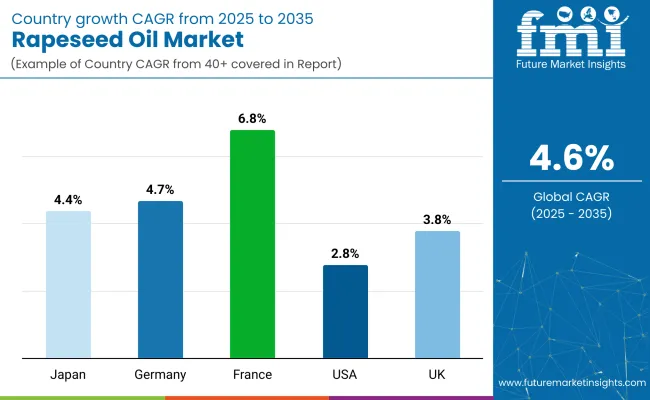

France is projected to be the fastest-growing market, expected to expand at a CAGR of 6.8% from 2025 to 2035. Processed will lead the product type segment with a 72% share, while the food service will dominate end use with a 61% share. The UK and Germany markets are also expected to grow steadily at CAGRs of 3.8% and 4.7%, respectively.

Food technologists evaluate rapeseed oil specifications based on fatty acid composition optimization, oxidative stability parameters, and flavor neutrality characteristics when formulating processed foods, restaurant cooking applications, and specialty dietary products requiring health-conscious lipid sources. Oil selection involves analyzing erucic acid content limitations, tocopherol preservation levels, and processing method impacts while considering storage stability requirements, supply chain logistics, and cost-performance optimization factors necessary for competitive product development. Procurement decisions balance oil costs against nutritional positioning benefits, incorporating consumer health trend alignment, regulatory compliance assurance, and market differentiation potential that justify premium oil adoption through measurable brand value enhancement.

| Metric | Value |

|---|---|

| Market Size 2025 | USD 19.4 billion |

| Market Size 2035 | USD 30.4 billion |

| CAGR 2025 to 2035 | 4.6% |

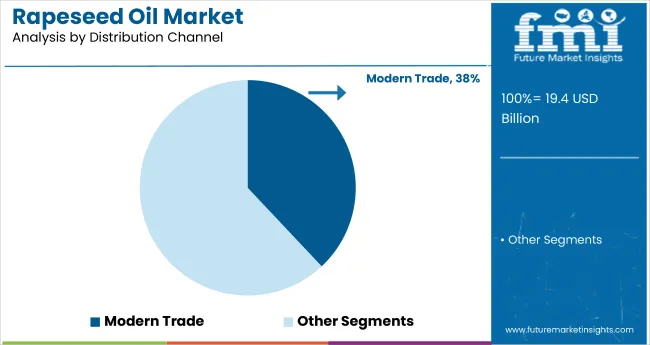

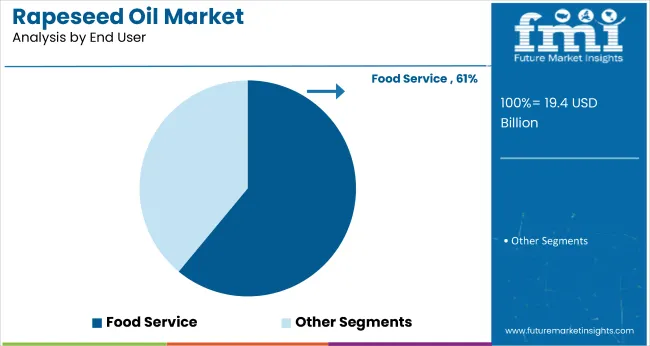

The market is segmented by product type, distribution channel, end user, and region. By product type, the market is divided into processed and virgin. In terms of distribution channel, the market includes franchise outlets, modern trade, online, and specialty stores. By end user, the market is categorized into food processors, food service, and retail. Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Processed is expected to dominate the product type segment by 2025, accounting for 72% of the market share due to its neutral taste, high stability, and suitability for diverse culinary and industrial applications.

Modern trade is projected to hold 38% of the rapeseed oil market share by 2025, driven by wider shelf presence, strong brand visibility, and consumer preference for organized retail formats like supermarkets and hypermarkets.

Food service is expected to dominate the end user segment in 2025, capturing 61% of the market share due to rising demand from restaurants, hotels, and commercial kitchens for healthy and versatile cooking oils.

The global rapeseed oil market is witnessing consistent growth, fueled by rising health awareness, growing demand for plant-based oils, and its wide applicability across food, personal care, and biodiesel sectors. Rapeseed oil is valued for its heart-friendly composition, making it a preferred choice among consumers and industries alike.

Recent Trends in the Rapeseed Oil Market

Challenges in the Rapeseed Oil Market

France momentum is driven by its strong domestic cultivation, biodiesel integration, and alignment with national climate action plans. Germany and Japan maintain consistent demand backed by EU Common Agricultural Policy and innovation in food-grade oil processing. Developed economies such as the United States (2.8% CAGR), United Kingdom (3.8%), and France (6.8%) are expected to expand at 0.61-1.48x of the global growth rate.

France exhibits the strongest growth in the market, driven by dual demand from food-grade oils and biodiesel production, along with national climate action plans. Germany follows closely, supported by organic certification programs and high biodiesel blending mandates. Japan shows stable expansion, fueled by its aging population, demand for fortified foods, and preference for high-purity oils.

The United Kingdom maintains steady growth, with strong usage in bakery and snack production, despite post-Brexit trade limitations. The United States shows comparatively slower growth, with demand centered on dietary supplements and functional foods, while concerns over GMOs and import reliance impact wider adoption.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan rapeseed oil revenue is growing at a CAGR of 4.4% from 2025 to 2035. Growth is driven by consumer preference for heart-healthy oils, demand from aging population segments, and the rise in fortified food categories. As a technology-led OECD economy, Japan emphasizes ultra-refined oils with enhanced purity, minimal additives, and functional health benefits.

The sales of rapeseed oil in Germany are expected to expand at 4.7% CAGR during the forecast period, slightly above the global average and led by policy-backed biofuel production and organic food markets. EU support for local oilseed farming and biodiesel blending targets boosts demand.

The French rapeseed oil market is projected to grow at a 6.8% CAGR from 2025 to 2035, significantly outperforming the global average. Growth is driven by the dual demand from food-grade oils and biodiesel production.

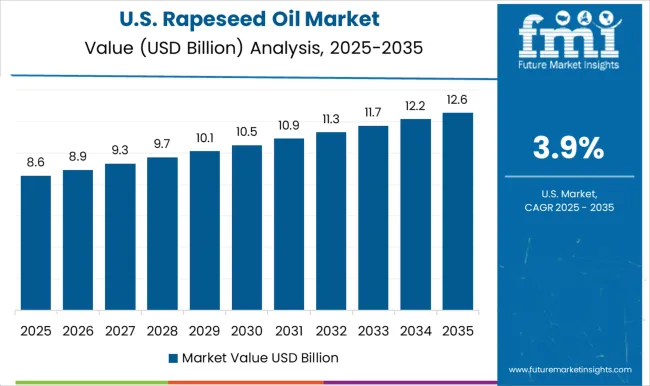

The USA rapeseed oil revenue is projected to grow at 2.8% CAGR from 2025 to 2035, translating to 0.61x the global rate. Growth is concentrated in dietary supplements and the packaged food industry, where rapeseed oil is marketed as a cholesterol-friendly and affordable alternative to olive oil. Import reliance and GMO concerns slightly constrain rapid adoption.

The UK rapeseed oil market is projected to grow at a CAGR of 3.8% from 2025 to 2035, reaching 0.83x the global pace. Bakery and snack manufacturers are the primary users, often replacing butter or palm oil with rapeseed oil. Domestic production meets a large share of local demand.

The Rapeseed Oil Market is experiencing steady growth driven by rising demand for healthier edible oils and the expanding use of rapeseed derivatives in food processing, biofuels, and personal care industries. Leading producers such as Wilmar International Limited, Oilio, and Interfat S.A. are focusing on refining technologies that enhance oil purity and nutritional value while optimizing extraction efficiency.

Vioil Group and Geostroy Engineering Ltd. are expanding their processing capacities in Eastern Europe to meet growing regional consumption and export demand. DLG Group and Scanola A/S are emphasizing cold-pressed rapeseed oil production to cater to consumers seeking premium, minimally processed products.

Global agribusiness leaders like Cargill Incorporated are integrating advanced supply chain traceability and sustainable sourcing models to strengthen market presence in Europe and Asia-Pacific. Biona Organic and Yorkshire Rapeseed Oil are capitalizing on the clean-label and organic food trends, driving demand in retail and gourmet segments. Black & Gold continues to expand in the Asia-Pacific region by promoting rapeseed oil’s culinary versatility and heart-healthy benefits. Overall, the market’s outlook remains positive, supported by increasing consumer awareness of nutritional oils and growing biodiesel blending mandates worldwide.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 19.4 billion |

| Projected Market Size (2035) | USD 30.4 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in kilotons |

| Product Type Analyzed | Processed and Virgin |

| Distribution Channel Analyzed | Franchise Outlets, Modern Trade, Online, and Specialty Stores |

| End User Analyzed | Food Processor, Food Service, and Retail |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Wilmar International Limited, Oilio, Interfat S.A., Vioil Group, Geostroy Engineering Ltd., DLG Group, Scanola A/S, Cargill Incorporated, Biona Organic, Yorkshire Rapeseed Oil, Black & Gold |

| Additional Attributes | Dollar sales by product type, share by channel and region, import-export volume, GMO vs. non-GMO share, sustainability trends, competitive benchmarking |

The global rapeseed oil market is estimated to be valued at USD 19.4 billion in 2025.

The market size for the rapeseed oil market is projected to reach USD 30.4 billion by 2035.

The rapeseed oil market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in rapeseed oil market are processed and virgin.

In terms of distribution channel, franchise outlets segment to command 44.6% share in the rapeseed oil market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Grapeseed Oil Market Size and Share Forecast Outlook 2025 to 2035

Rapeseed Protein Market Size and Share Forecast Outlook 2025 to 2035

Rapeseed Meal Market Analysis by Type, Application, Nature, and Region Through 2035

Assessing Rapeseed Protein Market Share & Industry Trends

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA