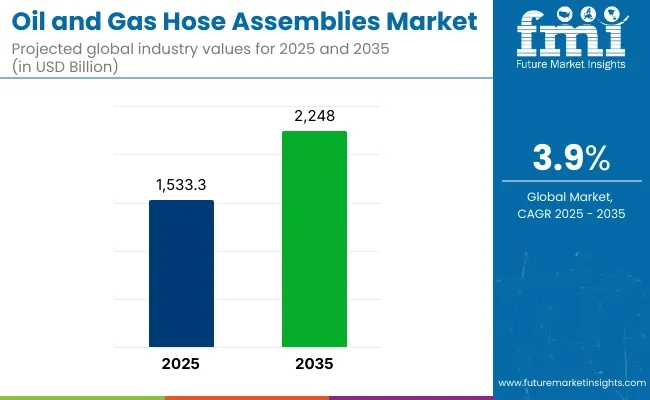

The oil and gas hose assemblies market is estimated to generate a market size of USD 1.53 billion in 2025 and is expected to reach USD 2.25 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.9% during the forecast period.

Hose assemblies are essential in the oil and gas industry for the transportation of oil, gas, and other fluids under high-pressure conditions. These assemblies ensure the safe and efficient transfer of materials between drilling rigs, pipelines, and storage tanks, making them a crucial component of the oil and gas infrastructure.

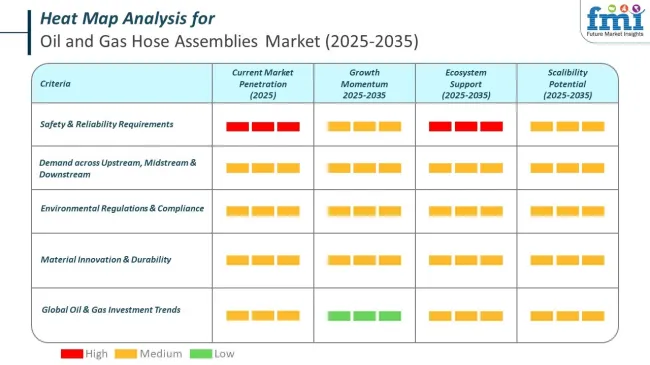

A primary driver of the market’s growth is the increasing global demand for energy, particularly from emerging economies that are expanding their industrial and transportation sectors. As exploration and production activities increase, the need for reliable and durable hose assemblies to handle the transportation of oil, gas, and chemicals is also rising.

The growing focus on offshore drilling and exploration, particularly in deep-water and ultra-deep-water fields, is further driving the need for advanced hose assembly solutions capable of withstanding harsh marine environments and extreme pressures.

Recent developments in the oil and gas hose assemblies market include advancements in materials and technologies used to enhance hose durability and performance. Manufacturers are investing in high-quality materials, such as thermoplastic elastomers and stainless steel, to improve resistance to abrasion, corrosion, and extreme temperatures.

These innovations are making hose assemblies more reliable and long-lasting, which is crucial in ensuring safety and efficiency during oil and gas operations. Additionally, the integration of smart technologies into hose assemblies, such as sensors that monitor pressure and temperature in real-time, is adding an extra layer of performance and safety.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 1.53 billion |

| Market Size in 2035 | USD 2.25 billion |

| CAGR (2025 to 2035) | 3.9% |

On June 25, 2024, ERIKS North America announced the completion of a £35,000 upgrade to its Hose Technology Center in Northampton. The enhancement increases pallet storage capacity by 40%, boosts technical capabilities, and improves safety performance, positioning the center to better meet growing customer demand and support the oil and gas industry. This was officially announced in the company's press release.

As the oil and gas industry continues to expand, particularly in offshore and deep-water exploration, the oil and gas hose assemblies market is expected to experience continued growth. Ongoing advancements in material science and the adoption of smart technologies will further enhance the market’s potential, driving long-term demand for reliable hose assembly solutions.

As oil and gas operations embrace digital transformation, hose assemblies are being enhanced with embedded sensors and integrated into broader operational systems. These smart hoses interface with SCADA, ERP, and EAM platforms (like SAP PM and IBM Maximo), allowing real-time monitoring of pressure, temperature, vibration, and hose lifespan. Advanced manufacturers are also leveraging digital twin software such as ANSYS Twin Builder, AVEVA, and PTC ThingWorx to simulate fatigue behavior in extreme conditions, thereby reducing prototyping time and improving hose durability.

The oil and gas hose assemblies market is governed by overlapping safety, environmental, and equipment conformity regulations across major jurisdictions, creating input requirements for design, testing, installation, and lifecycle management. In the United States, federal agencies and codes define performance and spill prevention expectations, while in Europe and the UK, harmonized directives and national transpositions mandate conformity assessment, explosion safety, and pressure equipment controls. Certification bodies with international reach, such as DNV, layer additional marine/offshore approvals that affect suppliers serving global projects.

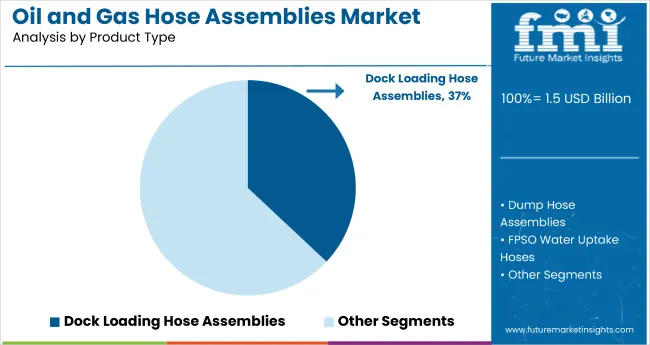

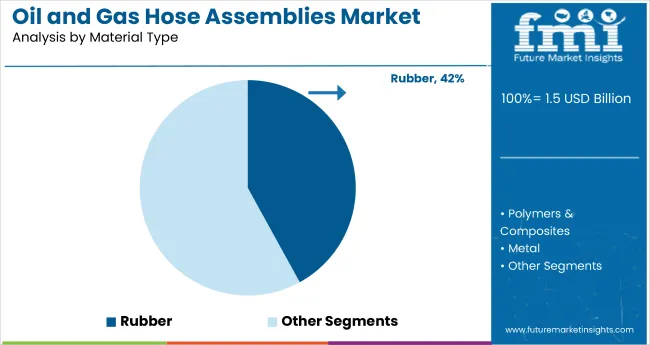

The global oil and gas hose assemblies market is projected to grow steadily from 2025 to 2035. In 2025, dock loading assemblies are expected to capture 37.0% of the product type segment, while rubber is projected to hold 42.0% of the material type segment. Key players include Trelleborg, ContiTech, and Parker Hannifin.

The dock loading assemblies segment is projected to account for 37.0% of the product type market share in 2025. These assemblies are essential for transferring petroleum and chemical products between marine vessels and onshore storage during import and export operations. As global maritime trade in crude oil and LNG expands, the need for reliable, durable, and high-flow capacity hose systems at ports is surging.

Manufacturers such as Trelleborg and Dunlop Oil & Marine are offering advanced dock loading solutions designed to handle aggressive media under fluctuating pressure and temperature conditions. Innovations include reinforced hoses with improved chemical resistance, anti-static liners, and integrated safety systems to prevent spills or blowouts.

With increasing investments in terminal infrastructure across regions like the Middle East and Southeast Asia, dock loading assemblies are also seeing adoption in multiproduct loading scenarios. As international safety norms evolve and marine logistics scale up, dock loading assemblies are expected to remain integral to secure and efficient oil and gas transfer operations.

The rubber segment is expected to capture 42.0% of the material type segment market share in 2025. Rubber remains a preferred material for oil and gas hose assemblies due to its superior flexibility, abrasion resistance, and adaptability across a wide range of operating environments. Its resilience under high-pressure and high-temperature conditions makes it ideal for both upstream and downstream applications.

Parker Hannifin and ContiTech are leading the development of rubber hose assemblies using synthetic compounds like nitrile and EPDM to enhance resistance to oils, chemicals, and environmental wear. These materials are especially valuable in dynamic offshore environments, where hoses must endure constant flexing and exposure to saltwater, UV radiation, and hydrocarbons.

Additionally, the increasing use of floating production systems and subsea installations is driving demand for rubber-based hose systems with reinforced layers and improved fatigue performance. As energy projects shift toward more complex and remote environments, the rubber segment is expected to see ongoing innovation and high market relevance in the years ahead.

One big problem in the oil and gas hose assemblies market t is the high price of strong, high-pressure hoses. This is extra tough for sea and deep-water uses. Strict safety and green rules, which must meet standards like API, ISO, and DNV-GL, make it hard for makers too.

Hoses need to be looked at, fixed, and swapped often to stop leaks and blasts. This adds more trouble for oil and gas firms.

Even with problems, the oil and gas hose assemblies market demonstrates significant potential for expansion. Smart hose tech, which has real-time checks, leak finders, and IoT-run tracking, is making things safer and better.

The rise of LNG transport and fueling systems, which need top-quality cold hoses for liquid natural gas moving, is bringing new market chances. Plus, more use of hydrogen-friendly hoses, backing the worldwide move to cleaner power, should help market growth.

New light, strong hoses for offshore use that last longer and need less care, is also set to speed up market growth.

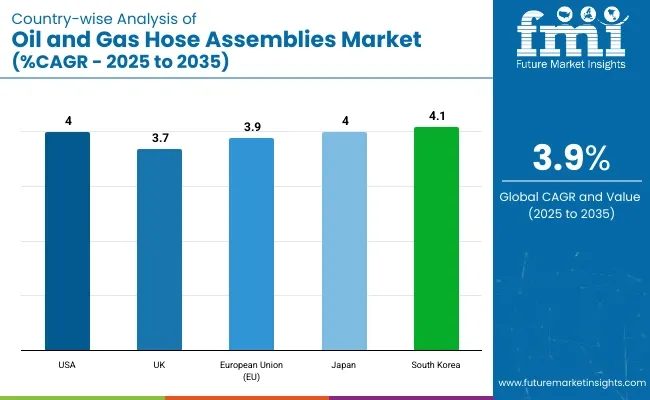

The oil and gas hose assemblies market in the USA is growing well. More offshore searching, bigger spending on shale gas, and high need for tough hoses are pushing this growth. The EPA and API set rules for safety, emissions, and materials.

New LNG setups, more use of bendable hoses for offshore jobs, and more smart systems to check hoses are boosting the market. Also, new light and strong hoses for deep waters are changing the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.0% |

The oil and gas hose assemblies market is growing in the UK. Big investments in North Sea oil and gas push this growth. There is more focus on cutting emissions and strict safety rules for offshore work. The HSE and the OGA handle hose safety and environmental rules.

The rise of top hydraulic hose assemblies helps growth. There’s a need for light and bendy hoses for FPSO uses. Fireproof and static-free hoses are also on the rise. New AI tech helps maintain hoses and shapes industry trends too.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

The European market for oil and gas hose assemblies is growing steadily. It grows because of strict EU green rules, more use of LNG as a bridge fuel, and new money being put into refinery updates. Groups like ECHA and EMSA make sure hoses are safe and the right kind for offshore use.

Germany, France, and Italy are big on using cold hoses for LNG moves. They spend more on tough hoses needed for refining and green hydrogen tasks, which need special hoses. Also, looking into hoses that can be recycled or are bio-based helps lower the environmental impact and supports market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.9% |

The market for oil and gas hose assemblies in Japan is growing. Higher need for LNG brings growth. Investments in hydrogen fuel are also rising. Strong government backing for clean energy moves is key. The Japanese Ministry of Economy, Trade, and Industry and Japan Oil, Gas and Metals National Corporation set hose rules for energy uses.

Japanese companies are putting money into new types of flexible hoses for very cold uses. They are also creating hoses that resist rust for sea platforms. High-quality hoses for moving hydrogen and ammonia fuels are on the rise too. New hose designs that fight wear and can handle ground shake are changing trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

In South Korea, oil and gas hose assemblies market is seeing steady growth. This growth comes from LNG infrastructure, use of high-pressure hoses in ships and offshore projects, and more money in digital tools to watch hose performance. The Ministry of Trade, Industry, and Energy (MOTIE), along with the Korea Gas Safety Corporation (KGS), directs safety rules for these hose assemblies.

Deep-sea drilling hoses and the demand for flexible, lightweight LNG transfer hoses are also driving the market. Projects in renewable energy are requiring new hose solutions too. Plus, money is going into smart hose tech with real-time wear checks for better upkeep.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

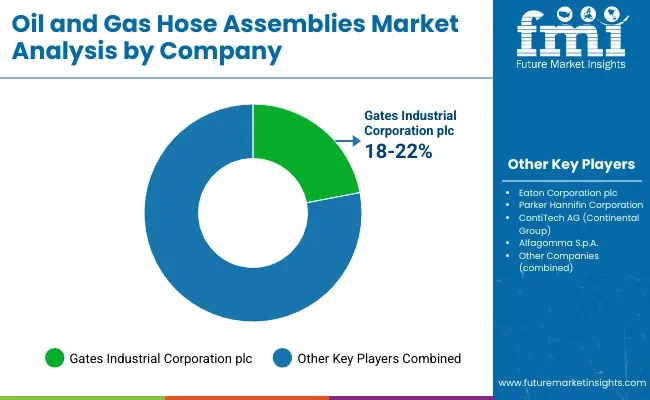

The Market for oil and gas hose assemblies is growing. This rise comes from the need for tough, high-pressure hoses in upstream, midstream, and downstream work. Growth is due to more oil and gas searches, strict safety rules, and better hose materials and tech.

Firms aim for top-notch, rust-proof, heat-resistant hoses to boost safety, work quality, and life in tough spots. The market has top hose makers, oil field tool sellers, and fluid transfer tech teams. Each group helps with new ideas in flexible hoses, cold transfer hoses, and hydraulic hose systems.

Other Key Players

Several hose manufacturers, oilfield service providers, and industrial fluid transfer specialists contribute to advancements in hose reinforcement, flexibility, and safety compliance. These include:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.53 billion |

| Projected Market Size (2035) | USD 2.25 billion |

| CAGR (2025 to 2035) | 3.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Product Types Analyzed (Segment 1) | Dock Loading Hose Assemblies, Dump Hose Assemblies, FPSO Water Uptake Hoses, Jumper Hose Assemblies, Bunkering Hose Assemblies, Drilling Mud Hose Assemblies, Frac Hose Assemblies, Other Custom Hose Assemblies |

| Material Types Analyzed (Segment 2) | Rubber, Polymers & Composites, Metal |

| Application Types Analyzed (Segment 3) | Downstream, Midstream, Upstream |

| Pressure Intake Types Analyzed (Segment 4) | Low Pressure, Medium Pressure, High Pressure |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Oil and Gas Hose Assemblies Market | Gates Corporation, Eaton Corporation Plc, Continental AG, Trelleborg AB, ERIKS, Parker Hannifin, Manuli Hydraulics, ALFA GOMMA, Kuriyama Holdings Corporation, Powertrack International LLC |

| Additional Attributes | dollar sales, CAGR trends, product type segmentation, material type distribution, application-based demand, pressure intake categories, competitor dollar sales & market share, regional trends |

The overall market size for the oil and gas hose assemblies market was USD 1.53 billion in 2025.

The oil and gas hose assemblies market is expected to reach USD 2.25 billion in 2035.

Increasing oil and gas exploration activities, rising demand for flexible and durable hose solutions, and advancements in high-pressure and corrosion-resistant hose materials will drive market growth.

The USA, Saudi Arabia, China, Russia, and Canada are key contributors.

Hydraulic hose assemblies are expected to dominate due to their high-pressure resistance and critical role in offshore and onshore drilling operations.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA