This market of oil-resistant packaging is growing very huge due to its increasing demand from food processing, pharmaceutical, chemical, and industrial sectors. It resists grease, oil, and moisture and maintains the integrity of the product. The top players are competing here with sustainability, innovative barrier technologies, automation, and regulatory compliance.

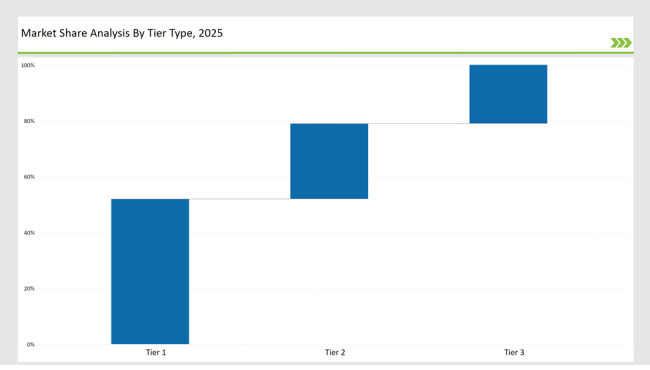

Tier 1: Amcor, Mondi, and Berry Global are the market's top three producers, accounting for 52%. They leverage advanced coating technologies, wide distribution networks, and continuous product innovation.

Tier 2: Companies such as Huhtamaki, Sonoco, and Sealed Air hold 27% of the market, offering specialized, high-performance oil-resistant packaging solutions tailored for food, medical, and industrial applications.

Tier 3: The remaining 21% consists of regional and specialized manufacturers catering to niche markets, including sustainable packaging, laboratory storage, and high-barrier protective solutions. These companies focus on customization and localized distribution strategies.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Mondi, Berry Global) | 21% |

| Rest of Top 5 (Huhtamaki, Sonoco) | 18% |

| Next 5 of Top 10 (Sealed Air, Coveris, Novolex, Uflex, Inteplast) | 13% |

The oil-resistant packaging market serves industries requiring durable, grease-proof, and contamination-resistant packaging.

Manufacturers are focusing on high-performance coatings, sustainability, and enhanced barrier properties.

A significant focus on high-barrier films, automation, and sustainable materials has been observed in the oil-resistant packaging industry. Leading companies are investing in compostable coatings, tamper-proof designs, and lightweight, grease-proof technologies.

Year-on-Year Leaders

Technology suppliers should prioritize innovation, efficiency, and sustainability to meet evolving market demands.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Mondi, Berry Global |

| Tier 2 | Huhtamaki, Sonoco, Sealed Air |

| Tier 3 | Coveris, Novolex, Uflex, Inteplast |

Leading manufacturers are focusing on sustainable coatings, grease-proof technologies, and product safety enhancements.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Introduced high-barrier, recyclable oil-resistant films (March 2024) |

| Mondi | Launched lightweight, grease-proof paper packaging (August 2023) |

| Berry Global | Developed biodegradable oil-resistant pouches (May 2024) |

| Huhtamaki | Expanded production of sustainable greaseproof paper packaging (November 2023) |

| Sonoco | Released industrial-grade oil-resistant packaging solutions (Feb 2024) |

The oil-resistant packaging market is evolving with a focus on innovation, food safety, and sustainability.

Growth is to be expected as smart coatings and developments in the IoT-enabled packaging solution, which include biodegradable materials development. Oil-resistant packaging solution should find great ease among businesses regarding use, since it is eco-friendly, provides excellent performance and meets compliance issues.

Food & beverage, pharmaceuticals, chemical, and industrial sectors.

It provides grease-proof, leak-proof, and contamination-resistant benefits.

Amcor, Mondi, Berry Global, Huhtamaki, and Sonoco.

High-barrier coatings, biodegradable materials, and lightweight packaging.

Companies are developing compostable and recyclable oil-resistant packaging solutions to reduce environmental impact.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Packaging Inserts Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA