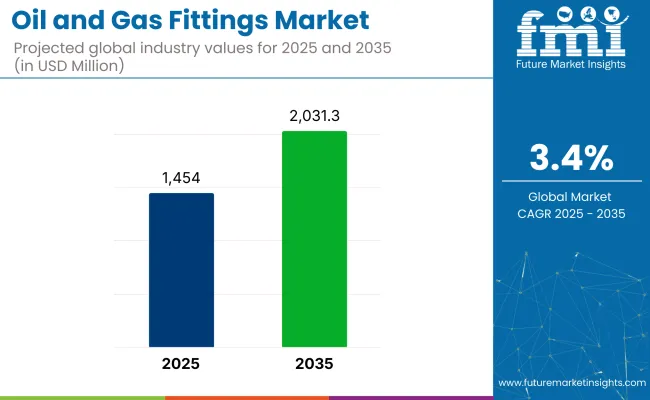

The global sales of oil and gas fittings are estimated to be worth USD 1,454.0 million in 2025 and are anticipated to reach a value of USD 2,031.3 million by 2035. Sales are projected to rise at a CAGR of 3.4% over the forecast period between 2025 and 2035. The revenue generated by oil and gas fittings in 2024 was USD 3 million. The industry is anticipated to exhibit a Y-o-Y growth of 2.9% in 2025.

| Attributes | Key Insights |

|---|---|

| Market Value, 2025 | USD 1,454.0 million |

| Market Value, 2035 | USD 2,031.3 million |

| Value CAGR (2025 to 2035) | 3.4% |

Oil and gas fittings are an essential part of ensuring leak-free operations and pressure integrity in pipelines, drilling rigs, and processing facilities. Due to the flexibility of oil and gas sectors, manufacturers work on redesigning corrosion-resistant, high-performance fittings to overcome the challenges posed by brutal climatic conditions in this sector.

Increased exploration investments and technological advancements related to advanced materials are some of the drivers for the durable and effective fittings market. Replacing the out-dated products with the latest eco-friendly ones is promoting the standard of products on the market.

The global market for Oil and Gas Fittings is fairly simple since upstream, midstream, and downstream systems require quality and efficient fittings for efficient performance.

Various types of products are derived from the products mentioned above, which will generate an incremental opportunity of USD 577.3 million and will grow 1.4X by 2035, mainly because of the industry's growing concern towards safety and environmental compliance is the primary reason that upsurges the demand for advanced solutions.

The growing use of materials like stainless steel, duplex alloys, and composites is, in turn, enabling the fittings to deal with high-pressure and corrosive environments, thus, the market continues to grow.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the oil and gas fittings market.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 2.9%, followed by a slightly higher growth rate of 3.4% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 2.9% (2024 to 2034) |

| H2 | 3.4% (2024 to 2034) |

| H1 | 3.2% (2025 to 2035) |

| H2 | 3.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 3.2% in the first half and remain relatively moderate at 3.6% in the second half. In the first half (H1) the market witnessed an increase of 30 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

Rising E&P Investments Drive Demand for Advanced Oil and Gas Fittings with Enhanced Performance and Durability

The main drivers for the demand for specialized oil and gas fittings are increasing global exploration and production activities, especially in the Middle East and North America. Companies engaged in shale and deepwater drilling need fittings that can withstand extreme pressures and temperatures characteristic of these environments.

Advanced technology such as hydraulic fracturing and horizontal drilling is changing operations for smoother execution and increasing complexities. Robust equipment has, therefore been necessary for such activities, prompting manufacturers to come up with improved fittings which boast better pressure ratings and longer-lasting anti-corrosion qualities.

For example, the Anchor project, costing Chevron USD 5.7 billion off the USA Gulf of Mexico, represents one of the steps that have been taken by the industry.

Chevron used ultra-high pressure technology, 20,000 psi, deployed to unlock access to previously unattainable deepwater resources to open billions of barrels of recoverable oil and gas resources worldwide. In this, advanced fittings will play a critical role in all modern E&P efforts.

Adoption of Advanced Materials for Enhanced Corrosion Resistance in Oil and Gas Fittings

In recent times, advanced materials like stainless steel, duplex alloys, and composites have increasingly been utilized for fittings to reduce corrosion susceptibility and increase life cycle.

They find a niche use in such adverse environments like offshore platforms and subsea operations, which are associated with significant exposure to corrosive elements. With such high-performance materials, it has become mandatory to reduce the chances of down-time and subsequent costs of maintenance in operations.

Recent advances in material science have allowed manufacturers to produce fittings that are not only more resistant to corrosion but also lighter. This weight loss enables energy efficiency as well as enhances the performance of the system while not compromising on structural integrity.

A good example is Sandvik that has incorporated its SAF 2507 super duplex stainless steel into its fittings, offering extraordinary strength and resistance to corrosion in challenging oil and gas applications.

Expansion of Midstream Infrastructure Boosts Demand for Advanced Fittings

The oil and gas fittings market receives demand due to midstream infrastructure, such as pipelines and storage facilities, whose development is being continually pursued.

Investment in the pipeline projects would help optimize transportation of oil and gas in the United States, Canada, and China. Such growth requires sophisticated fittings that provide leak-tight connections to support the reliability and performance of the infrastructure.

Manufacturers are developing fittings designed for major projects to fulfill these demands. Fittings also enhance the durability of the system, especially at various pressures and environmental conditions.

An example of such fittings is Swagelok, which includes advanced materials in its fittings like duplex stainless steel, allowing it to possess superior corrosion resistance for long-lasting performance in harsh midstream applications.

The global oil and gas fittings system market recorded a CAGR of 2.7% during the historical period between 2020 and 2024. The growth of oil and gas fittings market was positive as it reached a value of USD 1,406.2 million in 2024 from USD 1,262.9 million in 2020.

The Oil and Gas Fittings Market experienced a constant growth from 2020 to 2024, as the energy companies were investing in the rehabilitation of the old infrastructure and getting involved in broader exploration activities. The request for fittings with a high performance rose because the sector started to employ more advanced technologies like hydraulic fracturing along with enhanced oil recovery.

As for the outlook from 2025 to 2035, the market will be under good conditions due to the concentration of companies on the reduction of environmental risks and the acquisition of the best operating results.

Breakthroughs in materials and lightweight, sensor embedded fittings will be of great importance in filling the requirements of the industry. In addition, the stage will be set for the growth of the emerging markets in the Asia-Pacific region and Africa, leading to higher demand for fittings and infrastructure investment.

Tier 1 companies comprise market leaders with a market revenue of above USD 30 million capturing a significant market share of 20-25% in the oil and gas fittings market. These market leaders are characterized by extensive expertise in manufacturing across a range of packaging formats and have a wide geographic reach, with a strong foundation of consumers.

They offer an extensive range of series, which includes recycling and manufacturing with the latest technology to meet regulatory requirements and deliver quality. Prominent companies within Tier 1 include Anvil International, AVK UK Ltd, B.O.P Products LLC., Bonney Forge Corporation and FitTech Industries Pvt. Ltd.

Tier 2 and other includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 30 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 2 share segment.

They are small-scale players and have limited geographical reach. Tier 2, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

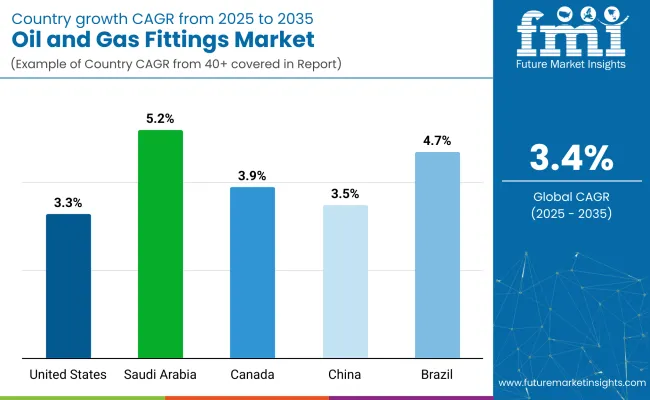

The section below covers the industry analysis for the oil and gas fittings market for different countries. Market demand analysis on key countries is provided. The United States is anticipated to remain at the forefront in North America, with a value share of 73.1% through 2035. In East Asia, China is projected to witness a CAGR of 3.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.30% |

| Saudi Arabia | 5.20% |

| Canada | 3.90% |

| China | 3.50% |

| Brazil | 4.70% |

Deep investment in shale exploration and midstream infrastructure in the oil and gas industry make the USA a continuing strong market driver for the fittings sector. Pipeline infrastructure upgrade along with more storages will provide the demand of long-lasting fittings with high-performance.

Major investments in regions, such as USD 3.1 billion invested into shale-related projects in Ohio in the final half of the year 2023, mean that the requirements for these types of fittings would be more prominent. Real-time monitoring systems have also been deployed to increase the safety aspect of the plant and diminish the cost operations.

As the midstream industry grows, fitting that meets the high corrosion resistance requirement will increase. Recent instances, such as those realized with pipelines using advanced corrosion-resistant materials, will establish the integrity of critical infrastructure. Companies like Mueller Industries will integrate higher-grade alloys into pipeline fittings to meet such high demands while extending system duration.

Saudi Arabia continues to enjoy a strong position in the world oil and gas market by further and more significantly investing in its business ventures. The shift that the Vision 2030 framework beckons is towards natural gas, which drives high investments in its midstream infrastructure.

One major project is the development of the Jafurah field, set to be the largest shale gas development in the Middle East with an estimated USD 100 billion investment. This expansion requires fitting oil and gas with high performances to maintain its integrity, mostly in hostile operating environments.

The diversification of energy production and shale gas production in the country increases the demand for high-performance fittings capable of withstanding extreme conditions, ensuring secure and leak-free connections.

Advanced materials, such as corrosion-resistant alloys in pipelines at Saudi Aramco, demonstrate this trend. These materials are critical to maintaining the longevity and reliability of such critical infrastructure.

Investments in natural gas infrastructure have also contributed significantly to growth in the Oil and Gas Fittings Market in China in recent years. China's production of natural gas increased by 5.6% in 2023 to 232.4 billion cubic meters. With its domestic production, China can produce almost 59% of its domestic requirements.

That would help reduce the use of coal in China and shift it to natural gas, which has fewer carbon emissions and assures higher energy security. As the natural gas pipeline network is increasing day by day, corrosion-resistant fittings will be necessary to ensure the system's integrity and long life.

The domestic market is answering back in appropriate fittings that cater to local and export needs. The International Energy Agency feels that infrastructure investment in China would total USD 14 billion per year from 2024 to 2026 and increase demand for the use of natural gas in durable, quality fittings.

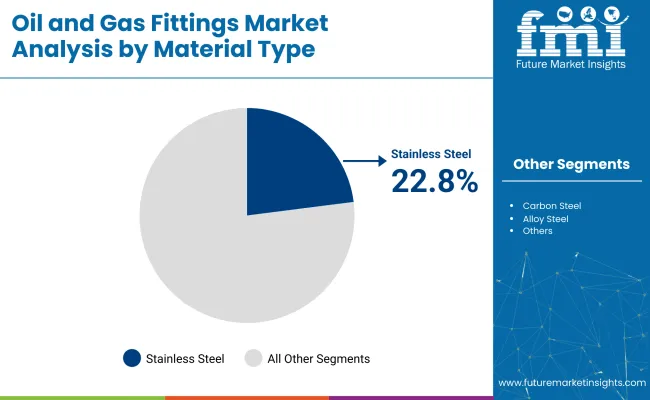

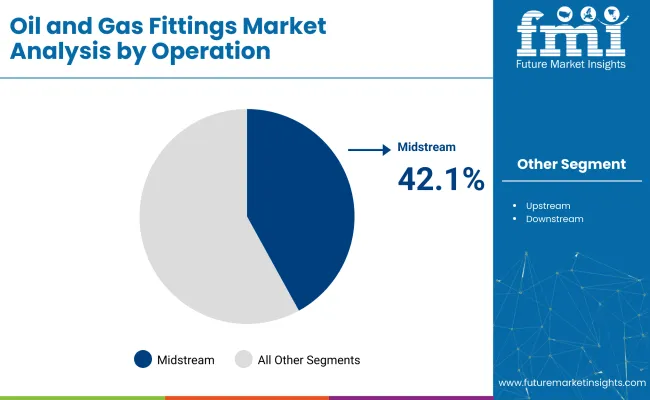

The section contains information about the leading segments in the industry. By material type, stainless steel segment is estimated to grow at a CAGR of 2.5% throughout 2035. Additionally, Midstream operation type is projected to expand at 2.9% by 2035.

| Material Type | Value Share (2035) |

|---|---|

| Stainless Steel | 22.8% |

Among other materials, the oil and gas industry relies largely on stainless steel fittings. Stainless steel is well known for remarkable corrosion resistance alongside high mechanical strength. These strengths make stainless steel particularly suitable in offshore and subsea applications with extreme exposure, which is also one of its biggest challenges.

This has been accompanied by advanced techniques in manufacturing which include precision welding and surface treatment to enhance more performance, assuring durability as well as the reliability of components in critical service.

Stainless steel, in comparison to other materials such as carbon steel, alloy steel, fiberglass, and composites, has better resistance to corrosion and high-pressure conditions. Carbon steel is prone to rust and corrosion, and hence less reliable for use at high pressure.

Alloy steel has strength but might not give the best performance in corrosive environments. It has composite materials made from fibreglass with lighter mass and higher resistances against corrosion, however with less strength for high pressure structures than that of stainless steel.

| Operation | Value Share (2035) |

|---|---|

| Midstream | 42.1% |

The midstream sector is expected to see the largest growth in the Oil and Gas Fittings Market, as an increase in pipeline networks, storage facilities, and high-rise infrastructure, is propelling the market. Fittings are basically used for ensuring safe, leak-free pipe connections within pipelines.

These are critical factors in transporting oil and gas safely without any risk. With less emphasis on downtime and maintenance costs, the demand for high-tech fittings with smart monitoring systems is increasing, thereby improving operational efficiency and safety.

The midstream sector requires more reliable fittings because of extreme pressure and environmental conditions coupled with its operations in exploring and refining processes. In the upstream operations focused on exploration and drilling, the main application of fittings is on high-pressure processes.

In downstream operations involving the processes of refining and distribution, more equipment and valves in the process of refining are the priority. Hence, durability and resistance to corrosion characterize the market demand of the midstream for top-grade fittings.

The growth in the oil and gas fittings market is primarily brought about by development in technology, as well as increasing interest in the extension of pipeline networks. The requirement for robust and leak-proof fittings in pipelines to safely attach connections is intensifying demand, primarily in regions interested in energy security while reducing ecological damage.

Technological innovations that include corrosion-resistant materials and smart monitoring capabilities continue to improve oil and gas fitting efficiency and durability, making these fittings critical in the industry for operational success.

With expansion of pipeline networks across the world, focus shifts to low-cost maintenance and fewer hours of system downtime. Critical infrastructure should, therefore, have advanced fittings for withstanding severe pressure and challenging environmental conditions to ensure reliability for many years.

Deployment of smart fittings with real-time monitoring functions has led to proactive maintenance, playing a very critical role in reducing the risk exposure of pipeline failure and increasing system performance overall.

The corrosion-resistant fitting has gained a lot of demand due to the interest of pipelines to be as long-lasting as possible. Leading companies are using new materials and manufacturing processes to respond to this trend.

Geographic expansion is still an important strategy as companies target emerging markets to support the growth in infrastructure needs in regions such as Asia and the Middle East, where energy demand continues to grow.

Recent Industry Developments

In terms of product type, the industry is divided into tees, flanges, adapters, male pins and studded crosses. Tees is further segmented into studded tees and flow tees. Similarly, segmented into flanges is blind/test, companion and weld neck. Again Adapters is segmented into bottom hole test adaptors and double studded adapters.

In terms of working pressure, the industry is divided into Less than 1000 psi, 1000 - 2000 psi, 2000 - 3000 psi, 3000 - 4000 psi, 4000 - 5000 psi and above 5000 psi.

In terms of operation, the industry is divided into upstream, midstream and downstream.

In terms of material type, the industry is divided into carbon steel, stainless steel, alloy steel, fiberglass, composite and others.

In terms of application, the industry is divided into onshore and offshore.

Key regions of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific and Middle East & Africa have been covered in the report.

The global oil and gas fittings industry is projected to witness a CAGR of 3.4% between 2025 and 2035.

The global oil and gas fittings industry stood at USD 1,454.0 million in 2025.

The global oil and gas fittings industry is anticipated to reach USD 2,031.3 million by 2035 end.

The key players operating in the global oil and gas fittings industry Anvil International, AVK UK Ltd and B.O.P Products LLC.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil Refining Market Size and Share Forecast Outlook 2025 to 2035

Oil Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Oil Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Oil Rotary Pump Market Size and Share Forecast Outlook 2025 to 2035

Oil Resistant Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA