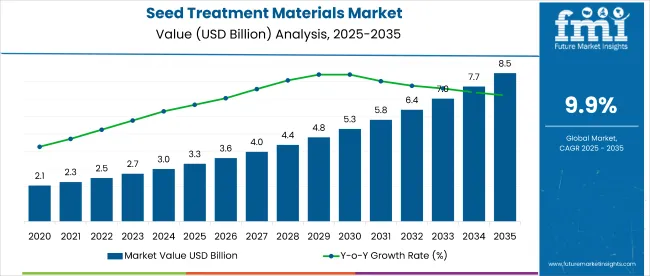

The global seed treatment materials market is valued at USD 3.3 billion in 2025 and is slated to reach USD 8.5 billion by 2035, reflecting a CAGR of 9.9%. Key factors fueling market growth include increasing demand for high-efficiency seed protection solutions, rising awareness among farmers, and the growing popularity of biological and polymer-based treatment materials.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 3.3 billion |

| Market Size (2035) | USD 8.5 billion |

| CAGR (2025 to 2035) | 9.9% |

Additionally, the adoption of sustainable agriculture practices and precision farming technologies is expected to support long-term expansion of the seed treatment materials market globally.

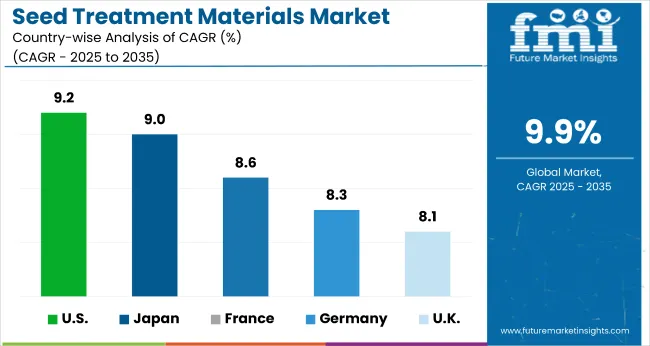

The USA is projected to expand at a CAGR of 9.2% through 2035, supported by high agri-tech penetration, seed innovation, and expanding use of digital advisory platforms for farmers. France is expected to grow at a CAGR of 8.6%, driven by rising demand for disease-resistant crops and increased application of biological seed coatings in cereal and vegetable cultivation.

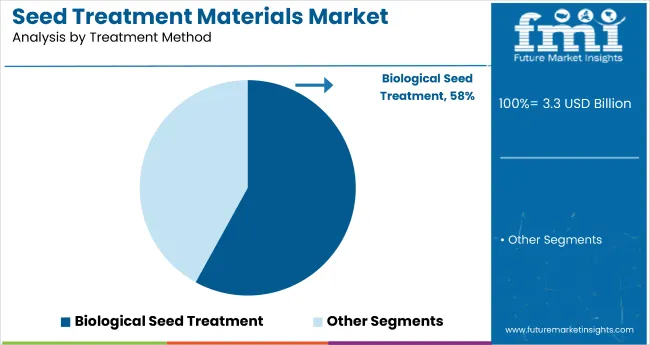

Meanwhile, Germany is anticipated to witness a CAGR of 8.3%, attributed to growing organic farming initiatives and advancements in seed pelleting technologies. In terms of segmentation, liquid form will lead the form segment with a 60% market share, while biological seed treatment to lead the treatment method segment with 58% market share in 2025.

Government regulations are expected to play a pivotal role in shaping the seed treatment materials market between 2025 and 2035. Regulatory bodies such as the USDA and Health Canada enforce stringent standards for the approval, formulation, and commercialization of seed treatment products.

The registration process particularly for biological treatments remains complex and time-intensive, often delaying product launches and increasing development costs. Moreover, differences in regulatory frameworks across regions pose challenges for global companies aiming for simultaneous product approvals, making harmonization difficult.

The market holds a significant position within its parent industries, driven by increasing demand for effective crop protection and sustainable agricultural practices. It accounts for 12% of the crop protection chemicals market, reflecting the growing preference for targeted, seed-applied solutions.

Seed treatments represent about 8%, highlighting their specialized yet important role. In the seed enhancement market, seed treatment materials contribute nearly 35%, given their direct impact on improving seed performance and germination. The overall agricultural inputs sector, the market holds a 6% share, while in the agricultural biotechnology domain, it contributes around 3%, underlining its complementary role in precision agriculture and integrated crop management systems.

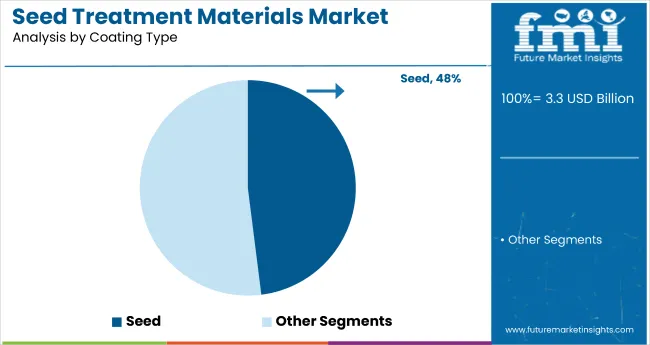

The global market is segmented by coating type, application, form, treatment method, crop type, and region. By coating type, the market is segmented into seed film coating (matte finish, shine, sparkle), seed encrusting, and seed pelleting.

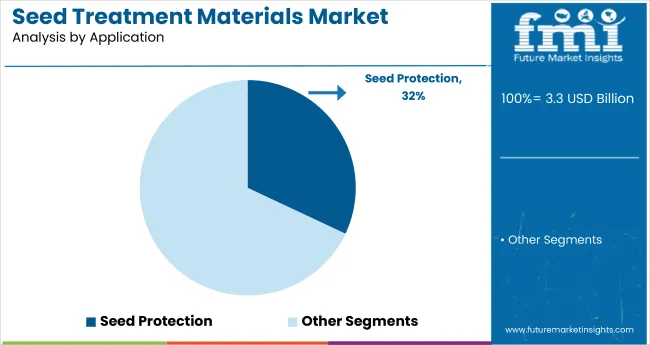

In terms of application, the market is divided into seed polymers (petrochemical-based polymers, biopolymers), binder & fillers, colourant, seed biologicals (biological inoculant, biocontrols, pheromones, biostimulants), seed protection (insecticides such as thiamethoxam, imidacloprid, carbofuran, and other insecticides), and fungicides (thiram, carbendazim, tebuconazole, carboxin, and others).

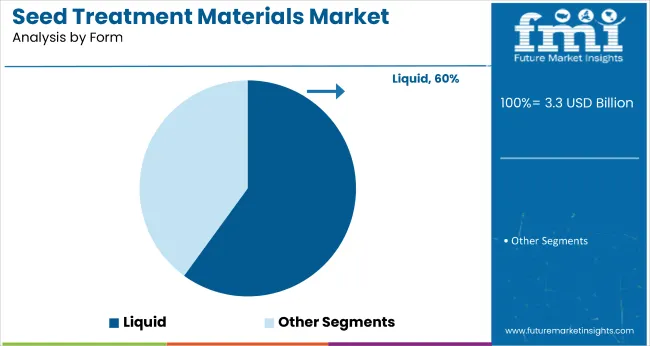

Based on form, the market is bifurcated into powder and liquid. By treatment method, the market is segmented into chemical seed treatment, non-chemical seed treatment (biological seed treatment, physical seed treatment), hot water treatment, and dry heat treatment.

Based on crop type, the market is divided into cereals & grains (corn, wheat, rice, sorghum, barley), oilseeds & pulses (soybean, canola, cotton, sunflower), and others such as turfs, forages, alfalfa, and sugar beets & vegetables. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

Seed film coating is projected to hold a 48% market share in the coating type segment in 2025, making it the most lucrative category. This dominance is attributed to its cost-effectiveness, uniform application, and excellent compatibility with a wide range of seed varieties.

Seed protection is expected to dominate the application segment in 2025, accounting for 32% market share in the market. This leading position is driven by rising incidences of pest attacks and the need for enhanced early-stage crop protection to ensure healthy germination and improved yields.

The liquid form segment is projected to dominate the market by form in 2025, capturing 60% market share. This dominance is primarily attributed to the ease of application, better adhesion to seeds, and compatibility with a wide range of active ingredients, including biologicals and micronutrients.

Biological seed treatment is projected to be the most lucrative segment in the treatment method category, expected to hold a 58% market share in 2025. This dominance is driven by the rising adoption of sustainable and eco-friendly farming practices globally.

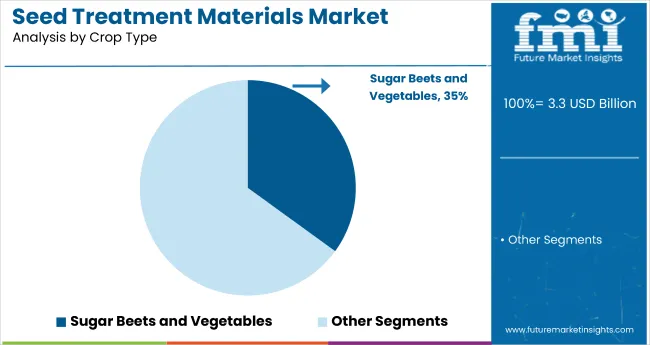

Sugar Beets & Vegetables are projected to be the most lucrative crop type segment, accounting for 35% market share in 2025. This dominance is driven by the high value and sensitivity of these crops, which makes effective seed treatment essential for ensuring strong germination and early-stage protection.

The market is expanding steadily, driven by the rising adoption of sustainable farming practices, increasing demand for high-efficiency seed protection solutions, and growing preference for biological treatments that improve crop resilience and yield.

Recent Trends in the Seed Treatment Materials Market

Challenges in the Seed Treatment Materials Market

Among the top five countries, the USA leads the market with a CAGR of 9.2%, reflecting strong adoption of advanced ag-tech and biological treatments. Japan follows closely with a 9.0% CAGR, driven by smart farming and urban agriculture initiatives. France is projected at 8.6%, supported by biostimulant use in vineyards.

Germany’s market will grow at 8.3%, backed by EU-compliant eco-agriculture. The UK records the lowest growth among the five at 8.1%, though momentum is increasing due to biocontrols and organic practices. These figures highlight varying national priorities and regulatory influences across developed markets.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA seed treatment materials market is projected to expand at a CAGR of 9.2% from 2025 to 2035, driven by high-tech farming practices and strong R&D investments.

Sales of seed treatment materials in the UK are forecast to grow at a CAGR of 8.1% during 2025 to 2035, reflecting a shift from conventional chemical treatments to organic and bio-based materials.

Seed treatment materials revenue in Germany is projected to witness a CAGR of 8.3% between 2025 and 2035, with growth anchored in eco-agriculture initiatives and EU Green Deal compliance. participation over the forecast period.

The French seed treatment materials sales are expected to grow at a CAGR of 8.6% from 2025 to 2035, driven by rising pest concerns and increasing demand for treated seeds in wine grapes, vegetables, and cereals.

Seed treatment materials demand in Japan is projected to expand at a CAGR of 9.0% between 2025 and 2035, supported by precision agriculture technologies and increasing usage of automated seed coating machinery.

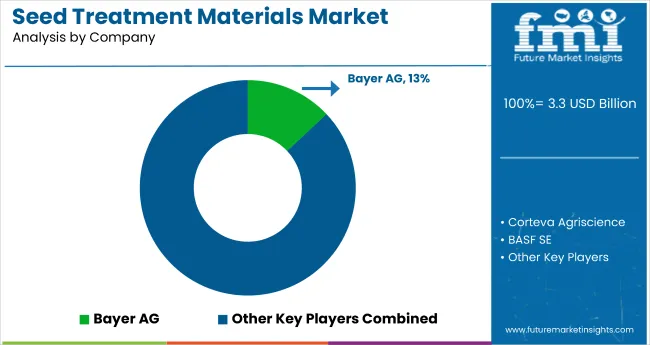

The market is moderately fragmented, with a mix of global agrochemical giants and regionally dominant players competing across product categories such as biologicals, polymers, and seed protection chemicals. Leading firms like Bayer AG, Corteva Agriscience, and BASF SE hold strong positions owing to their extensive R&D capabilities, integrated supply chains, and established seed technologies.

Top-tier companies are actively competing on product innovation, pricing flexibility, and partnerships with seed producers and biotech firms. Many are introducing biological seed treatments and advanced polymer coatings to align with sustainability goals and meet regulatory shifts.

Recent Seed Treatment Materials Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.3 billion |

| Projected Market Size (2035) | USD 8.5 billion |

| CAGR (2025 to 2035) | 9.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in Metric Tons |

| By Coating Type | Seed Film Coating (Matte Finish, Shine, Sparkle), Seed Encrusting, and Seed Pelleting |

| By Application | Seed Polymers (Petrochemical-Based Polymers, Biopolymers), Binder & Fillers, Colourant, Seed Biologicals (Biological Inoculant, Biocontrols, Pheromones, Biostimulants), Seed Protection (Insecticides: Thiamethoxam, Imidacloprid, Carbofuran, Other insecticides like Clothianidin, Fipronil, Chlorpyrifos), and Fungicides (Thiram, Carbendazim, Tebuconazole, Carboxin, Others like Metalaxyl, Fludioxonil, Azoxystrobin). |

| By Form | Powder, Liquid |

| By Treatment Method | Chemical Seed Treatment, Non-Chemical Seed Treatment (Biological Seed Treatment, Physical Seed Treatment), Hot Water Treatment, and Dry Heat Treatment |

| By Crop Type | Cereals & Grains (Corn, Wheat, Rice, Sorghum, Barley), Oilseeds & Pulses (Soybean, Canola, Cotton, Sunflower), and Others (Turfs, Forages, Alfalfa, Sugar Beets & Vegetables). |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, +40 countries |

| Key Players | Corteva Agriscience, Eastman Chemical Company, FMC Corporation, Chromatech Incorporated, Bayer AG, Evonik, BASF SE, Sumitomo Chemical, Clariant Specialty Chemicals, Syngenta AG, Croda International Plc, Germains Seed Technology, Tozer Seeds Ltd, Nufarm Limited, Centor Oceania, ADAMA Agricultural Solutions Ltd., UPL Limited, Jeevan Chemicals Pvt. Ltd., Tagros Chemicals India Ltd., and Novozymes A/S. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The global seed treatment materials market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the seed treatment materials market is projected to reach USD 8.1 billion by 2035.

The seed treatment materials market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in seed treatment materials market are seed film coating, _matte finish, _shine, _sparkle, seed encrusting and seed pelleting.

In terms of application, seed protection segment to command 15.0% share in the seed treatment materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analysis and Growth Projections for Microbial Seed Treatment Business

USA Microbial Seed Treatment Market Analysis – Trends, Growth & Forecast 2025-2035

Europe Microbial Seed Treatment Market Analysis – Demand, Growth & Forecast 2025-2035

Seed Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Seed Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Seed Health Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Seed Packaging Market Analysis – Growth & Forecast 2025 to 2035

Seed Binders Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Seed Cracker Manufacturers

Seed Polymer Market

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Teaseed Cake Market – Trends & Forecast 2025 to 2035

The Linseed Oil Market is Analysis by Nature, Product Type, Application, and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA