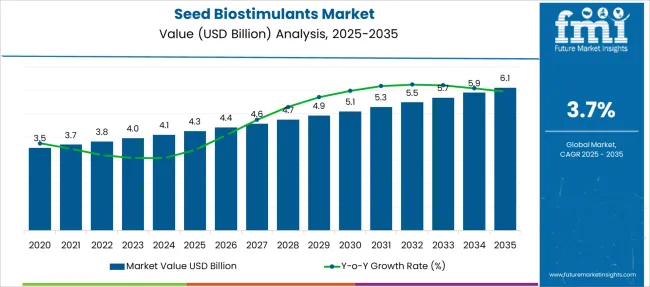

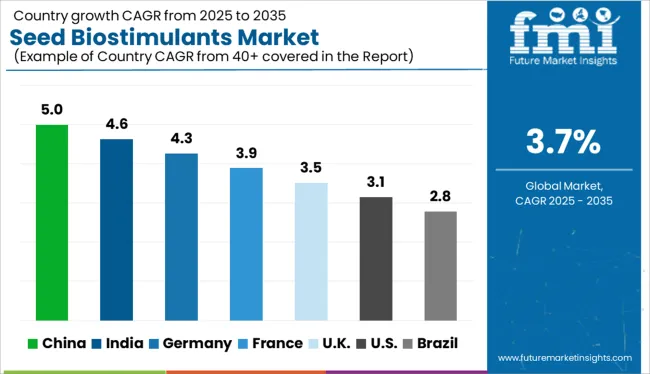

The Seed Biostimulants Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 6.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Seed Biostimulants Market Estimated Value in (2025 E) | USD 4.3 billion |

| Seed Biostimulants Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The seed biostimulants market is gaining momentum as agriculture shifts toward climate-resilient practices, regenerative soil health, and improved seed vigor to meet rising global food demands. Manufacturers and producers are investing in biogenic solutions that promote stress tolerance and nutrient efficiency during early germination stages.

Supportive regulatory frameworks across key agricultural economies have validated the integration of biostimulants into mainstream input strategies. Increasing demand for sustainable yield enhancement, especially in water-stressed regions, has also contributed to adoption.

Technological advancements in carrier solutions and microencapsulation have allowed better formulation stability and targeted seed delivery. As seed treatment becomes a key component in integrated crop management programs, demand for effective, eco-friendly biostimulants is expected to rise sharply across large-scale and precision farming operations.

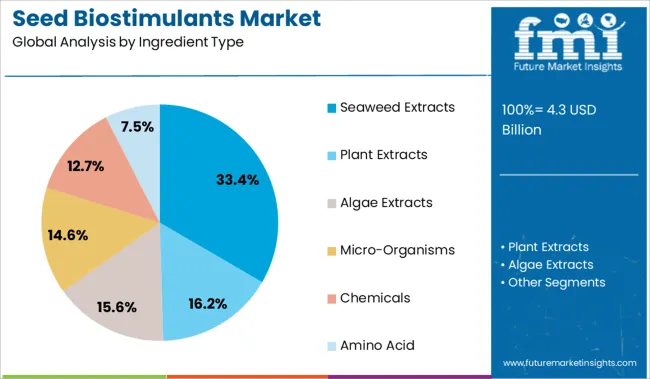

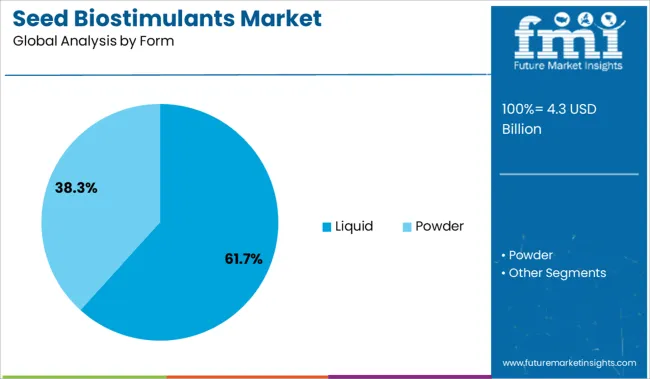

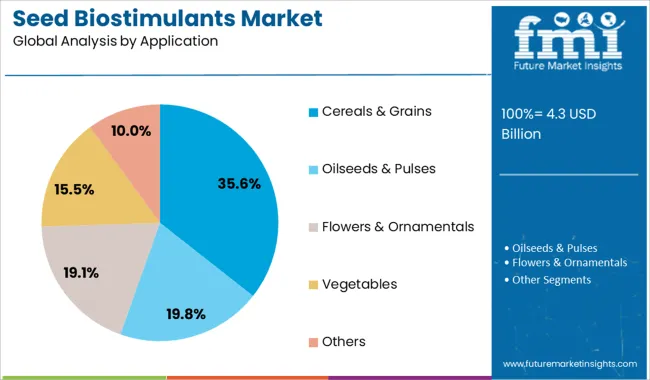

The market is segmented by Ingredient Type, Form, Application, and Sales Channel and region. By Ingredient Type, the market is divided into Seaweed Extracts, Plant Extracts, Algae Extracts, Micro-Organisms, Chemicals, and Amino Acid. In terms of Form, the market is classified into Liquid and Powder. Based on Application, the market is segmented into Cereals & Grains, Oilseeds & Pulses, Flowers & Ornamentals, Vegetables, and Others. By Sales Channel, the market is divided into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Seaweed extracts are projected to contribute 33.4% of the total market revenue in 2025, making them the dominant ingredient type in the seed biostimulants market. Their leadership is supported by the presence of natural growth hormones, trace elements, and polysaccharides that stimulate root development and improve early plant metabolism.

These bioactives have been increasingly adopted due to their compatibility with a wide range of crops and favorable response under abiotic stress. Seaweed-derived compounds are also seen as reliable alternatives to synthetic seed treatments, particularly in organic and residue-sensitive agriculture.

Supply chain advancements and improved extract standardization have made this category more accessible and consistent in performance across geographies.

Liquid formulations are expected to command 61.7% of the total seed biostimulants market by 2025, positioning this form as the most widely used. The growth of this segment has been influenced by ease of handling, compatibility with seed coating equipment, and uniform application.

Liquids enable precise dosing and faster absorption by seeds, offering efficient delivery of active ingredients. Their growing acceptance in commercial farming is also driven by the ability to integrate seamlessly with other seed treatment products and micronutrient formulations.

Storage stability improvements and low viscosity enhancements have further boosted adoption, especially in mechanized farming operations where consistency and scale are critical.

Cereals and grains are anticipated to account for 35.6% of market revenue in 2025, marking them as the top application segment for seed biostimulants. The large acreage under cultivation and the critical need to enhance germination and uniform emergence in crops like wheat, rice, and maize have made this segment a priority target.

Increasing instances of climatic variability and soil degradation in major grain-producing regions have further reinforced the need for pre-sowing interventions. Adoption has also been influenced by the proven yield benefits and enhanced resistance to early-stage drought and salinity stress.

With global grain demand on the rise and pressure to optimize fertilizer use, seed biostimulants are increasingly being positioned as a strategic input to unlock early genetic potential.

In the Historical outlook of the Seed Biostimulants market the value increased from USD 3,137.1 Million 2020 to USD 3,670.0 Million in 2024. The CAGR (2020 to 2024) is observed to be 4.0%.

The major drivers for this market growth are the increasing demand for food and the need for improved crop yield. Seed biostimulants help in improving plant growth and yield by providing essential nutrients and stimulating plant growth hormones.

They are also known to increase the water and nutrient uptake by plants, which leads to better yields. The other benefits of using seed biostimulants include stress tolerance, disease resistance, and enhanced flavor and shelf life of crops.

For the Future projection of the Seed Biostimulants markets the value increased from USD 3,816.8 Million in 2025 to USD 5,332.2 Million in 2035. The CAGR (2025 to 2035) is estimated to be 3.4%.

The market is driven by the increasing demand for organic food and the need for sustainable agriculture practices. The use of biostimulants can help improve plant growth and yield while reducing the use of chemical fertilizers and pesticides.

The North American market is further aided by the presence of large agricultural companies, such as Monsanto and DuPont, which are investing in the research and development of new seed biostimulant products.

The USA contributes 33.7% of the total revenue for the Seed Biostimulants Market.

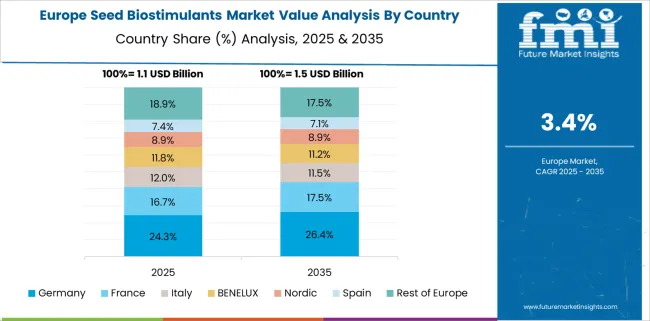

The European Union (EU) is the largest market for seed biostimulants. The region is expected to continue its dominance in the global seed biostimulants market owing to favorable government regulations and policies encouraging the use of biostimulants in agriculture.

Germany contributes 24.5% to the Seed Biostimulants market and United Kingdom CAGR for the forecast period is 4.6%.

The Asia Pacific region is expected to be the fastest-growing market for seed biostimulants. The demand for biostimulants in agriculture is increasing due to the need for higher yields and quality crops. Seed biostimulants help improve plant growth and yield by providing essential nutrients and improving stress tolerance.

The Asia Pacific region has a vast population and an increasing demand for food. This, coupled with the growing awareness of the benefits of seed biostimulants, is expected to drive market growth in this region.

Japan's contribution to the Seed Biostimulants market is 12.3% of the total market share, India and China are market drivers in Asia Pacific and their latest CAGR in the Seed Biostimulants market are 5.8% and 5.9% respectively.

Seed biostimulants are a new and rapidly growing category of products that can be used to improve plant establishment, yield, and quality. The Latin American market for seed biostimulants is expected to grow substantially in the next few years.

There are several factors driving this growth. First, the region has a large and expanding agricultural sector. Second, there is increasing awareness of the benefits of seed biostimulants among farmers and other stakeholders. Third, many countries in the region are investing in the research and development of new seed biostimulant products.

The Latin American market for seed biostimulants offers considerable opportunities for companies operating in this space. There is a need for products that can improve yields and quality while reducing input costs.

The demand for seed biostimulants is driven by the increasing demand for food and the need to improve crop productivity. The Middle East and Africa(MEA) region is expected to be the fastest-growing market for seed biostimulants, due to the increasing population and the rising demand for food.

From the Oceania region, Australia is contributing 2.4% of the total revenue of the Seed Biostimulants market.

There are two main types of seed biostimulants: those that provide nutrients and those that stimulate plant growth.

Nutrient-based seed biostimulants provide essential elements that plants need for proper growth, such as nitrogen, phosphorus, and potassium. These products can be applied before or after planting, and they can be used on a variety of crops.

Growth-stimulating seed biostimulants contain plant hormones or other compounds that promote germination, root development, and shoot growth. These products are usually applied before planting, and they are typically used on field crops such as corn, soybeans, and wheat.

Seed biostimulants are a relatively new type of product on the market that can provide numerous benefits for crops. They are most commonly used as a way to improve seed germination and early plant growth. However, they can also be used to help crops better withstand stress, improve nutrient uptake, and increase yields.

There are a variety of different seed biostimulants available, each with its own unique set of benefits. For example, some products contain micronutrients that can help plants better utilize fertilizers. Others contain beneficial bacteria or fungi that can improve root growth and help plants better absorb water and nutrients from the soil.

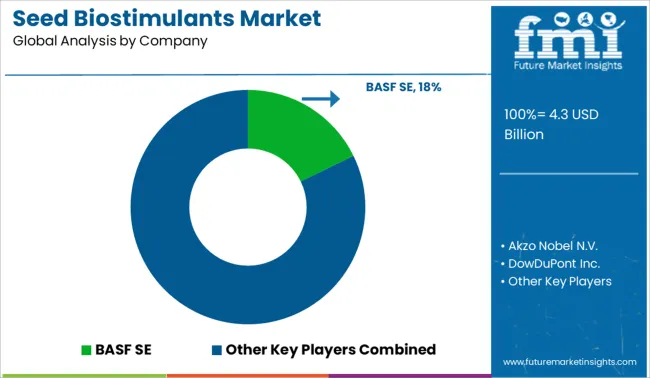

The competitive landscape of the biostimulants market is fragmented with the presence of a large number of players. The key players in the market are BASF SE, Akzo Nobel N.V., DowDuPont, Inc., and others.

BASF SE is one of the leading players in the biostimulants market. The company has a strong product portfolio and is well-positioned in the market with its innovative products and solutions. Akzo Nobel N.V. is another leading player in the biostimulants market. The company has a strong product portfolio and offers a wide range of products for different applications.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa(MEA); RoW |

| Key Countries Covered | USA, Canada, Mexico, Germany, United Kingdom, France, Russia, Brazil, Argentina, Japan, Australia, China, India |

| Key Segments Covered | Ingredient Type, Form, Application, Sales Channel, Region |

| Key Companies Profiled | BASF SE; Akzo Nobel N.V.; DowDuPont Inc.; BAYER CROP SCIENCE; PRP Technologies; Solvay; Koppert Biological Systems; Fyteko; OMEX; Legend Seeds; Biolchim S.p.A.; Isagro S.p.A.; African; Meristem |

| Report Coverage | Drivers, Restraints, Opportunities and Threats Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, Competitive Landscape, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global seed biostimulants market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the seed biostimulants market is projected to reach USD 6.1 billion by 2035.

The seed biostimulants market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in seed biostimulants market are seaweed extracts, plant extracts, algae extracts, micro-organisms, chemicals and amino acid.

In terms of form, liquid segment to command 61.7% share in the seed biostimulants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seed Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Seed Health Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Seed Packaging Market Analysis – Growth & Forecast 2025 to 2035

Seed Binders Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Seed Cracker Manufacturers

Seed Polymer Market

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Teaseed Cake Market – Trends & Forecast 2025 to 2035

The Linseed Oil Market is Analysis by Nature, Product Type, Application, and Region from 2025 to 2035

Rapeseed Protein Market Size and Share Forecast Outlook 2025 to 2035

Flaxseed Gum Market Size and Share Forecast Outlook 2025 to 2035

Rapeseed Oil Market Size and Share Forecast Outlook 2025 to 2035

Rapeseed Meal Market Analysis by Type, Application, Nature, and Region Through 2035

Analysis and Growth Projections for Hempseed Milk Business

Assessing Rapeseed Protein Market Share & Industry Trends

Flaxseeds Market – Growth, Demand & Nutritional Benefits

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA