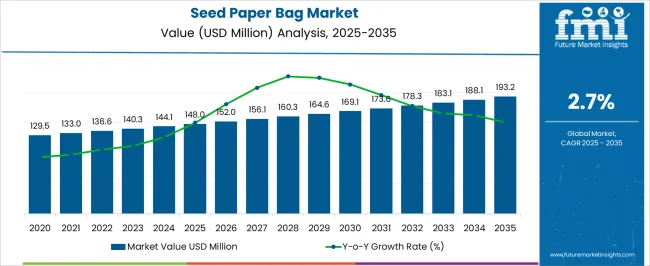

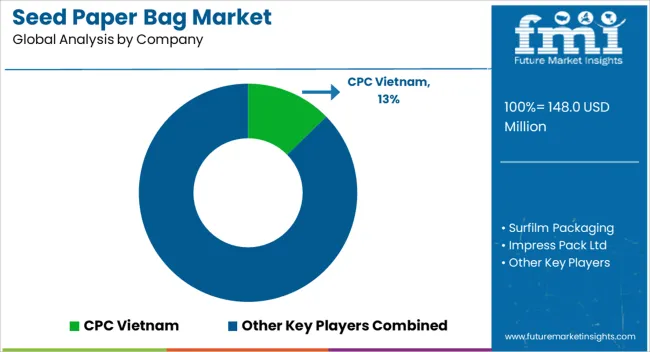

The Seed Paper Bag Market is estimated to be valued at USD 148.0 million in 2025 and is projected to reach USD 193.2 million by 2035, registering a compound annual growth rate (CAGR) of 2.7% over the forecast period.

| Metric | Value |

|---|---|

| Seed Paper Bag Market Estimated Value in (2025 E) | USD 148.0 million |

| Seed Paper Bag Market Forecast Value in (2035 F) | USD 193.2 million |

| Forecast CAGR (2025 to 2035) | 2.7% |

The seed paper bag market is expanding steadily, driven by the rising global emphasis on sustainability, eco-friendly packaging, and circular economy principles. Growing consumer awareness regarding single-use plastics and increasing adoption of biodegradable alternatives have accelerated the demand for seed paper bags. Industry reports and press releases have highlighted the dual benefits of seed paper bags, which combine functionality with environmental regeneration by embedding seeds within packaging.

Governments and regulatory bodies have strengthened their stance on sustainable packaging mandates, further supporting market adoption across retail, foodservice, and agricultural sectors. Corporate sustainability initiatives and brand campaigns have also emphasized green packaging solutions to improve consumer perception and reduce environmental footprints.

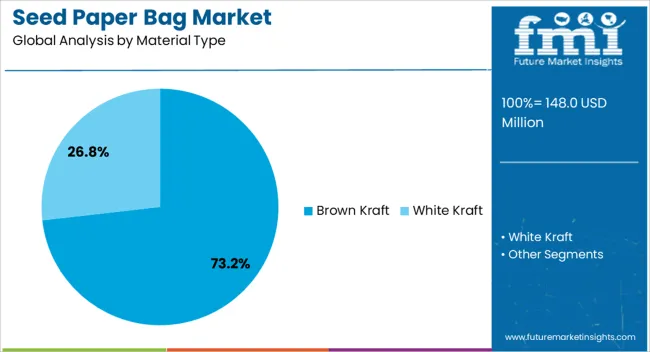

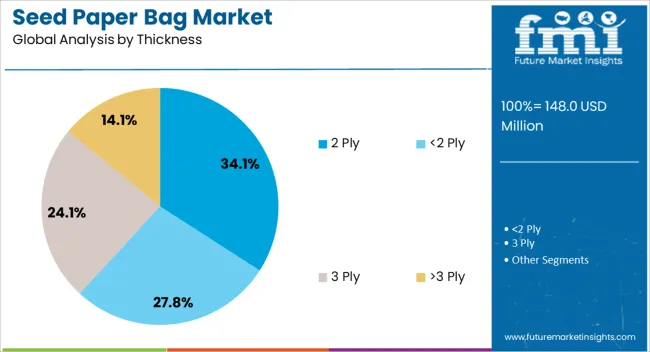

With ongoing advancements in seed embedding technologies and customization of paper bag designs, the market is expected to continue its upward trajectory. Segmental demand has been led by Brown Kraft due to its durability and cost-efficiency, Pinched Bottom Open Mouth bags for their suitability in bulk handling, and 2 Ply thickness for its enhanced strength and protective qualities.

The Brown Kraft segment is projected to account for 73.2% of the seed paper bag market revenue in 2025, sustaining its dominant position. This growth has been driven by the segment’s strength, durability, and wide availability at relatively low cost compared to specialty paper alternatives.

Brown Kraft has been favored by manufacturers for its recyclability and compatibility with printing and seed embedding processes, making it an ideal base material for eco-friendly bags. Market adoption has also been supported by its ability to carry heavier loads, ensuring performance in agricultural, retail, and promotional applications.

Additionally, Brown Kraft’s natural appearance aligns with consumer preferences for sustainable aesthetics, reinforcing brand messaging for eco-conscious businesses. As regulatory frameworks continue to restrict plastic use, the Brown Kraft segment is expected to remain the leading choice for seed paper bag production.

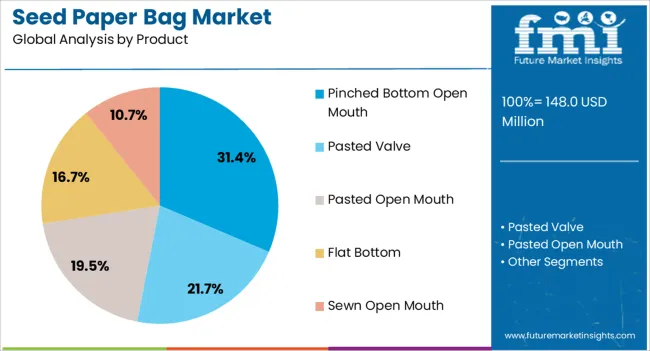

The Pinched Bottom Open Mouth segment is projected to contribute 31.4% of the seed paper bag market revenue in 2025, maintaining its leadership among product types. This segment’s strength has been attributed to its suitability for bulk packaging and efficient handling in agricultural and commercial contexts.

Pinched Bottom Open Mouth bags offer reliable sealing, preventing spillage and improving product safety during transport and storage. Manufacturers have adopted this design for its versatility across seeds, grains, and other loose-fill goods, making it a preferred choice for both producers and retailers.

The segment has also benefited from ease of stacking and space efficiency in warehouses and distribution centers. As demand for functional yet sustainable packaging rises, the Pinched Bottom Open Mouth product segment is expected to retain its market prominence.

The 2 Ply segment is projected to hold 34.1% of the seed paper bag market revenue in 2025, establishing itself as the leading thickness category. Growth of this segment has been influenced by its ability to provide superior strength, puncture resistance, and durability compared to single-ply alternatives.

Manufacturers and end users have favored 2 Ply bags for packaging heavier agricultural products, ensuring reduced risk of tearing during handling and transit. This thickness also offers greater protection for embedded seeds, preserving their viability until planting.

Additionally, 2 Ply bags balance performance with material efficiency, providing a cost-effective option without compromising on strength. With expanding demand from agricultural producers, retailers, and eco-conscious brands, the 2 Ply segment is expected to maintain its strong market position, reinforced by ongoing innovations in paper layering and seed integration technologies.

On the basis of materials, seed paper bags usually come in two variants, which are brown kraft and white kraft. Among these, the brown kraft segment holds a market share of 73.20% as of 2025.

| Attributes | Details |

|---|---|

| Material | Brown Kraft |

| Market Share (2025) | 73.20% |

Brown kraft seed paper bags are in great demand, primarily due to their sustainability and eco-friendliness. These bags are the perfect solution for brands looking to reduce their environmental impact and offer a biodegradable alternative to traditional plastic bags. Besides this, these bags are highly recyclable as they can be planted directly into the soil, where the paper will decompose, and the seeds will germinate, ultimately growing into plants, flowers, or herbs. Features like these have contributed to their increased adoption.

Seed paper bags are of different types, such as sewn open mouth, pinched bottom open mouth, pasted valve, pasted open mouth, flat bottom, etc. On the basis of product type, pinched-bottom open-mouth bags are the most popular, holding a market share of 31.40% in 2025.

| Attributes | Details |

|---|---|

| Product | Pinched-bottom Open-mouth Bags |

| Market Share (2025) | 31.40% |

The clamor for pinched-bottom open-mouth bags in the general populace is increasing day by day as these bags offer a convenient and eco-friendly packaging solution. A multitude of commodities, such as food items, grains, pet food, etc., can be packaged in them. Apart from this, these bags are versatile and can be used for a wide range of products, including dry goods, powders, granules, and more. Their increased sales in the last few years are proof of their cost-effectiveness and versatility as well.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.70% |

| China | 5.10% |

| Thailand | 4.70% |

| United Kingdom | 3.80% |

| Canada | 3.70% |

India is one of the leading markets in the world when it comes to seed paper bags. The market in India is estimated to grow at a CAGR of 5.70% through 2035.

India is a heaven for the food and beverage industry, thanks to its expanding eCommerce sector, rising disposable incomes among the middle class, and enormous population. This industry, from the past few years, has been increasingly adopting sustainable packaging solutions to cater to the demands of eco-conscious consumers and businesses. Thus, companies in this sector in India are investing heftily in adding seed paper bags to their offerings so that they can contribute to environmental conservation while meeting the growing demand for sustainable packaging.

The seed paper bag market in China is also a lucrative one. It is anticipated to expand at a CAGR of 5.10% through 2035.

China is one of the pioneers in taking care of its carbon footprint. The government’s initiative to make industries embrace sustainability has largely been successful. This can be seen in their emphasis on the green economy and the increasing demand for seed paper bags across industries. Besides this, awareness regarding the ill effects of plastic and polymer bags has also pushed consumers to opt for seed paper bags as they are perceived as less harmful to the environment.

The market in Thailand is also predicted to flourish in the coming future. It is very likely to progress at a CAGR of 4.70%.

A substantial part of Thai GDP comes from its hospitality and tourism sector. Every year, millions of tourists flock to the nation to take advantage of its lush mountains and pristine beaches. Hotels and restaurants in the country are largely decorated with indoor plants to give the interior a more sophisticated look. This has largely benefitted the market in Thailand. Besides this, these bags are also purchased as souvenirs by foreign tourists as a reminder of their trip to Thailand.

The United Kingdom is also one of the top countries in the seed paper bag market. It is slated to progress at an outstanding CAGR of 3.80% through 2035.

Industries in the United Kingdom are increasingly adopting sustainable practices and seeking eco-friendly alternatives for packaging. The ongoing trend of tote bags has also increased the sales of seed paper bags in the country. Companies across various industries, including retail, food and beverage, and eCommerce, are transitioning toward eco-friendly packaging solutions like seed paper bags to reduce their environmental impact and meet market demand.

The market in Canada is also a promising one. It is anticipated to progress at a CAGR of 3.70% through 2035.

There has been a rise in environmental consciousness among individuals in this country in the past few decades. This has prompted them to opt for seed paper bags for their daily use. Government bans on single-use plastics, such as plastic bags, straws, and cutlery, have also created opportunities for eco-friendly alternatives like seed paper bags.

The seed paper bag market is still in its nascent stages. There are a very companies in the international marketplace. The market is expected to have a promising future with the ongoing sustainability fad among businesses as well as consumers. These companies are also using these bags as a cost-effective tool to market their products.

Some of the most prominent companies in the market are Botanical PaperWorks, Green Field Paper Company, Seed Paper India, Bloomin, EcoEnclose, Plantable Seed Paper, Seeding Square, and Seedlings Cards & Gifts.

Recent Developments

The global seed paper bag market is estimated to be valued at USD 148.0 million in 2025.

The market size for the seed paper bag market is projected to reach USD 193.2 million by 2035.

The seed paper bag market is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types in seed paper bag market are brown kraft and white kraft.

In terms of product, pinched bottom open mouth segment to command 31.4% share in the seed paper bag market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Paper Bags Providers

Paper Bag Box Market

Hemp Paper Bag Market Trends & Industry Growth Forecast 2024-2034

Kraft Paper Bags Market Size, Share & Forecast 2025 to 2035

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Retail Paper Bag Industry

Europe Retail Paper Bag Market Trends – Growth & Forecast 2023-2033

Paper Based Consumer Bag Market

Dunnage Paper Bags Market

Kraft Paper SOS Bag Market

Kraft Paper Bakery Bags Market

Europe Ecommerce Paper Bags Market Analysis – Trends & Forecast 2024-2034

Insulated Paper Bags Market

Kraft Paper Shopping Bags Market Growth – Size, Trends & Forecast 2024 to 2034

Commercial Paper Bags Market Growth & Trends 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Foodservice Paper Bag Companies

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Bag Feed Seal Pouch Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA