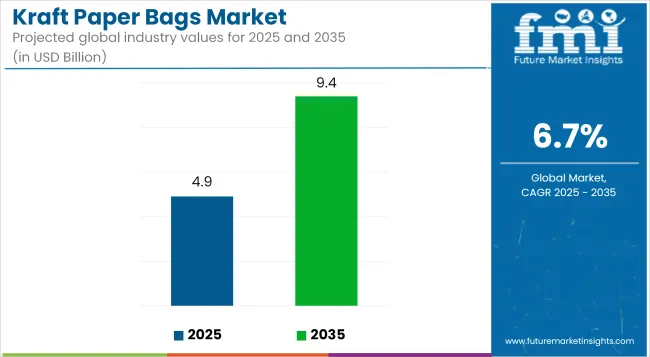

The kraft paper bags market is projected to grow from USD 4.9 billion in 2025 to USD 9.4 billion by 2035, registering a CAGR of 6.7% during the forecast period. Sales in 2024 reached USD 4.5 billion. Growth has been supported by regulatory bans on single-use plastics and consumer preference for biodegradable packaging formats.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 4.9 billion |

| Market Value (2035F) | USD 9.4 billion |

| CAGR (2025 to 2035) | 6.7% |

Premium kraft variants have been adopted for high-end product branding, with emerging economies increasing their consumption due to urban retail expansion. With enhanced customization, texture variations, and handle options, product uptake has gained pace in premium FMCG and lifestyle sectors.

In April 2025, Mondi, a global leader in packaging and paper, has created a recyclable pre-made paper bag for chemical powders, working in partnership with chemical company Evonik. Florian Ullrich, Sales Director Paper Bags Germany, Mondi says:

“Valve bags are designed for high-speed filling and with sensitive contents such as these specialty chemical powders, high quality material and secure closing options are also paramount. Being able to deliver and indeed improve on these elements, while reducing the carbon footprint of the packaging, was a challenge we were delighted to answer alongside Evonik.”

Advancements in paper strength and process efficiency have accelerated the replacement of plastic with kraft paper across multiple sectors. Bleach-free options and compostable coatings have allowed manufacturers to meet evolving environmental compliance norms.

R&D has been focused on fiber recovery and bonding agents that reduce the need for plastic linings. Global retailers have adopted water-based inks and recyclable glues for paper bag production. Innovation has also occurred in closure systems and reinforced handles, which were once drawbacks of kraft-based carriers.

The kraft paper bags market is expected to witness further opportunity from policy shifts favoring low-impact packaging. Governments across Europe and Asia are pushing for reductions in landfill waste, encouraging retailers to phase out plastic entirely. Leading brands are positioning kraft bags not just as utility items but as marketing tools via customizable, premium-printed formats.

Logistics companies and specialty food retailers have emerged as high-volume buyers of kraft-based insulated and laminated bags. M&A activity among kraft mills and converting companies is anticipated as global supply chains consolidate to serve large retailers. As technology bridges the performance gap between paper and plastic, the kraft bag segment is forecast to become the new standard in sustainable secondary packaging across categories.

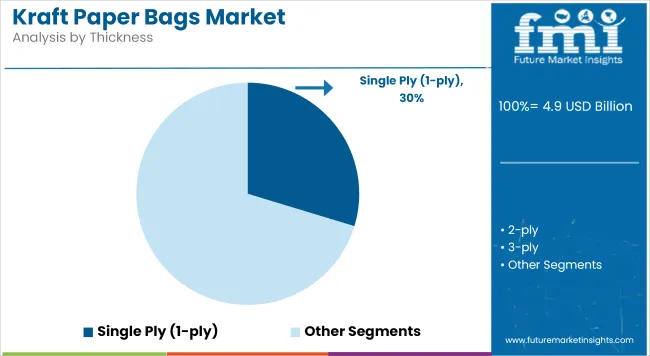

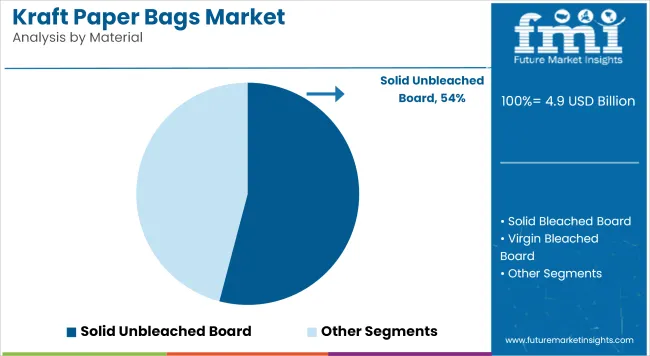

The market is segmented based on material type, thickness, sales channel, end-use industry, and region. By material type, the market includes solid unbleached board, solid bleached board, virgin bleached board, and others. In terms of thickness, the market is categorized into single ply (1-ply), 2-ply, 3-ply, and above 3-ply (multiwall/heavy duty).

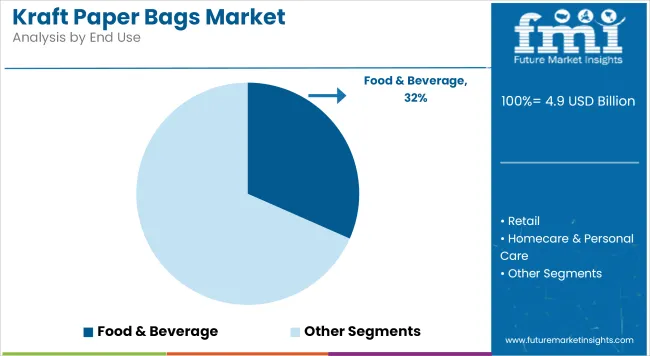

By sales channel, the market comprises manufacturers, distributors, retailers, hypermarkets, specialty stores, convenience stores, warehouse/wholesale clubs, and e-retail. In terms of end-use industry, the market includes food & beverage industry, retail, homecare & personal care, healthcare & pharmaceutical, agriculture, and others. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Solid unbleached board has been projected to dominate the kraft paper bags market with a 2025 share of 54.1%, owing to its robust structure and resistance to tearing. This material has been derived from virgin pulp, ensuring food safety compliance and high tensile strength. Its natural brown appearance has been preferred by brands emphasizing eco-friendly packaging.

Superior printability has enabled high-impact branding on bags without additional coatings. Due to its rigidity, solid unbleached board has been extensively used in stand-up kraft paper bags, pouches, and multiwall sacks. Its durability has suited applications requiring strength in wet, greasy, or high-pressure environments. Adhesive and sealing compatibility have facilitated the use of automated filling and packaging systems. Coating-free designs have minimized processing costs and enhanced recyclability.

With growing regulatory support for plastic replacement, the use of unbleached board has expanded across both premium and bulk formats. Shelf-ready and carry bags have been developed using this material to meet retail and foodservice demand.

Resistance to puncture and heat has increased its suitability for hot-fill or baked goods packaging. Its compostable and biodegradable nature has aligned with circular economy goals. Sustainability certifications such as FSC and PEFC have supported material sourcing transparency.

Unbleached kraft paper bags have also been utilized in e-commerce and takeaway packaging where structural integrity is crucial. The ability to support digital and flexographic printing has allowed for design flexibility. Going forward, this material is expected to retain leadership due to its balance of performance, cost, and environmental compliance.

The food & beverage industry has been estimated to account for 31.6% of kraft paper bags market demand in 2025, due to high packaging turnover, sustainability goals, and hygiene standards. Kraft paper bags have been widely used for bakery items, snacks, dry groceries, and QSR takeaway packaging. Leak-resistant and greaseproof variants have been developed for fried and oily foods.

Both printed and plain kraft bags have been deployed across supermarket, deli, and fast-food applications. Retailers and restaurant chains have shifted toward kraft paper bags as part of their plastic reduction strategies. Compostable and recyclable designs have helped brands comply with global and local sustainability mandates. Windowed and gusseted kraft bags have enabled product visibility while supporting high-volume carryout. Reusable and reinforced handle formats have replaced plastic carryout bags in many jurisdictions.

Kraft bags used in food delivery have incorporated tamper-evident seals and QR tracking to ensure product security. High-barrier paper bags with moisture resistance have extended shelf life for snacks and cereals. Premium kraft finishes have also allowed artisanal and organic food producers to convey authenticity and environmental commitment.

Branded paper bags have been used effectively for consumer recall and loyalty. As foodservice digitization and home delivery accelerate, the role of kraft bags in insulated carriers and POS logistics is growing. Demand for mono-material paper packaging has been prioritized to ensure recyclability in existing waste streams.

Food-grade inks and low migration adhesives have been introduced for compliance with safety norms. The food and beverage sector is expected to drive consistent kraft paper bag consumption through both functional and regulatory tailwinds.

Price Volatility and Supply Chain Disruptions

Kraft paper bags are largely made from raw materials like unbleached wood pulp and recycled fibers. Yet volatile raw material costs, deforestation issues, and supply chain disruptions remain major hurdles. The increasing demand for sustainable packaging has heightened competition for raw materials, resulting in higher production costs and longer lead times.

To address these challenges, producers are increasingly turning to local sourcing, new fiber alternatives, and more efficient recycling infrastructure to keep costs stable and production flowing.

Expansion of Plastic-Free Packaging Initiatives

As governments and corporations increasingly impose bans on single-use plastic, demand for kraft paper bags as an environmentally-friendly substitute fuels growth. These sectors include retail, food & beverage, e-commerce and personal care, all of which are moving to biodegradable, compostable and recyclable packaging in order to achieve their sustainability objectives.

As the packaging landscape continues to evolve, companies that innovate with water-resistant coatings, reinforced paper handles, and customizable printing solutions will benefit from expanding market opportunities and grassroots brand differentiation.

The growth of kraft paper bags in the USA region is majorly driven by environmentally concerned consumers and strict regulatory policies restricting the use of plastic. Green packaging: Consumers are embracing eco-friendly packaging solutions, and businesses are adopting biodegradable packaging solutions to minimize waste and achieve sustainability goals.

Paper-based packaging of industry-leading brands are incorporated into e-commerce and retail shopping further fuelling demand for container board and other grades. Additionally, the market is growing due to the factors regarding the durability and strength of the bags.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

The market for kraft paper bags in the united kingdom is growing, as sustainability becomes a greater focus and the government brings increasingly stricter regulations in place to restrict single-use plastics. This has led to a surge of growth in the market as retailers, grocery stores and other foodservice providers start to transition to paper alternatives.

Petition of consumers to recyclability and compostability also made kraft paper bags more preferred options. The simplicity of online grocery deliveries and sustainable shopping habits play an active role in continuous market growth too.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.0% |

Since the region has well-established sustainability policies, the kraft paper bags market will have huge growth opportunities from the European Union. Germany, France, Italy and other nations lead the way toward paper-based packaging as consumer demand for green alternatives grows.

For instance, the European Commission has set regulations against plastic waste, effectively driving their transition over to kraft paper bags in retail, foodservice, and logistics applications. On the other hand, growing investments in advanced manufacturing technologies of paper bags are also boosting product quality and performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

Japan’s market for kraft paper bags is growing amid rising environmental awareness and the government’s pledge to reduce plastic waste. Details such as the country’s emphasis on sustainable packaging solutions, along generational lines, and the growth of organic food and specialty stores has driven demand.

On the other hand, premium paper bag designs, usually employed in the packaging of luxury retail and high-end consumer goods, are also increasing in popularity. Furthermore, the counterbalancing of paper materials in delivery and e-commerce packaging would bolster the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

In South Korea, a similar surge is happening with kraft paper bags as the government has been encouraging sustainable packing solutions by limiting the use of plastic bags. Another growing trend within the foodservice industry - especially among coffee chains and fast-food restaurants - is the use of kraft paper bags for purely takeaway orders.

Market growth is also being lifted by the thriving eCommerce sector and the rise of eco-conscious brands. Enhancements in durability, moisture-resistant coatings, and similar advancements in paper bag innovations help create growth opportunities in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

The kraft paper bags market is growing on account of shift to environmentally friendly options and regulations around single-use plastic bagsthey’re recyclables and biodegradables, durable for retail, food packing and industrial use.

The demand from grocery chains, quick-service restaurants and apparel brands for reactive modalities has led to manufacturers very quickly ramping their production while also investing in automation.Innovations in printing and bag customization for brand use are also aiding brands keep a focus on sustainability while continuing to drive consumer engagement.

Other Key Players

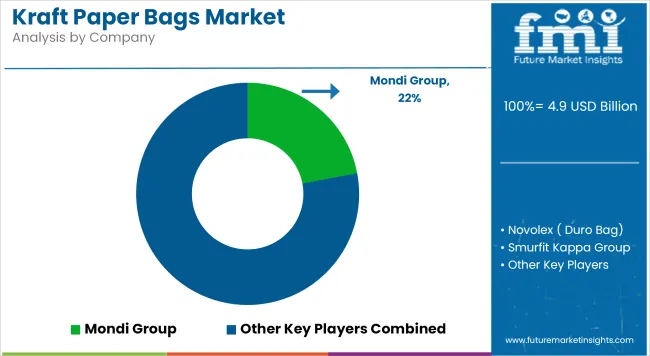

The overall market size for the kraft paper bags market was USD 4.9 billion in 2025.

The kraft paper bags market is expected to reach USD 9.4 billion in 2035.

The demand for kraft paper bags is expected to rise due to increasing environmental concerns, government regulations banning plastic bags, growing consumer preference for sustainable packaging, and expanding applications in retail, food, and e-commerce sectors.

The top five countries driving the development of the kraft paper bags market are the USA, Germany, China, India, and France.

Flat-bottom Kraft paper bags and stand-up kraft paper bags are expected to dominate the market due to their growing usage in retail, grocery, and food service applications.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kraft Paper Bakery Bags Market

Kraft Paper Shopping Bags Market Growth – Size, Trends & Forecast 2024 to 2034

Kraft Box Market Size and Share Forecast Outlook 2025 to 2035

Kraft Pouch Market Forecast and Outlook 2025 to 2035

Kraft Liner Market Size and Share Forecast Outlook 2025 to 2035

Kraft Labels Market Size and Share Forecast Outlook 2025 to 2035

Kraft Envelopes Market Size and Share Forecast Outlook 2025 to 2035

Kraft Packaging Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among Kraft Liner Manufacturers

Market Positioning & Share in the Kraft Envelopes Industry

Kraft Block Bottom Pouch Market Growth – Size, Trends & Forecast 2024-2034

Kraft Bubble Mailer Market from 2024 to 2034

Kraft Paper Market Size and Share Forecast Outlook 2025 to 2035

Kraft Paper Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Kraft Paper Pouch Market Growth – Demand & Forecast 2025 to 2035

Kraft Paper Mailer Market

Kraft Paper Tapes Market

Kraft Paper SOS Bag Market

Jumbo Kraft Tubes Market

Saturated Kraft Paper Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA