The kraft pouch market is expanding steadily due to increasing demand for sustainable and flexible packaging solutions. The market is being driven by the growing emphasis on eco-friendly materials, recyclability, and reduced plastic consumption across the packaging industry. Rising adoption of kraft paper-based pouches in food, beverage, and personal care sectors has reinforced consistent demand.

Manufacturers are focusing on enhancing product strength, barrier properties, and shelf appeal through advanced coating and lamination techniques. Regulatory initiatives promoting sustainable packaging and consumer inclination toward biodegradable materials are further accelerating market adoption.

The future outlook remains positive as e-commerce and retail sectors increasingly favor lightweight and durable packaging formats Growth rationale is built on the ability of kraft pouches to combine sustainability with functionality, offering cost-effective, customizable, and environmentally responsible packaging solutions that align with evolving consumer and regulatory expectations across global markets.

| Metric | Value |

|---|---|

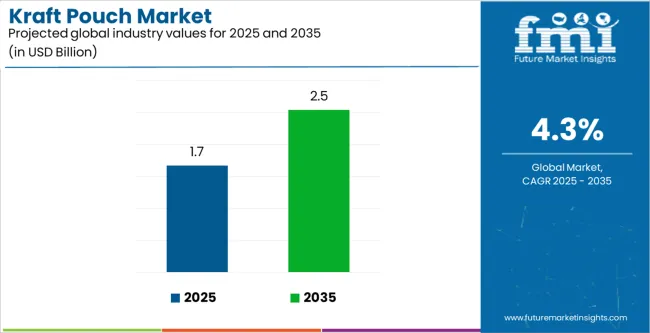

| Kraft Pouch Market Estimated Value in (2025 E) | USD 1.7 billion |

| Kraft Pouch Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

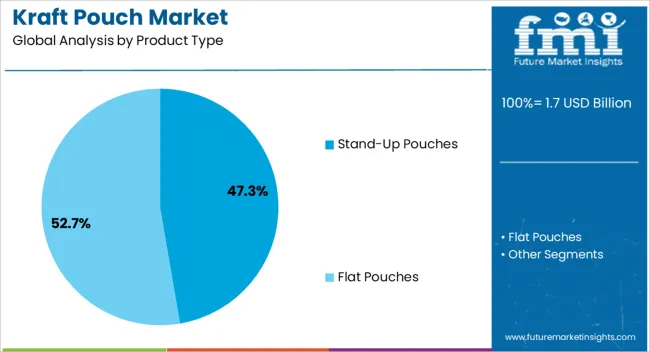

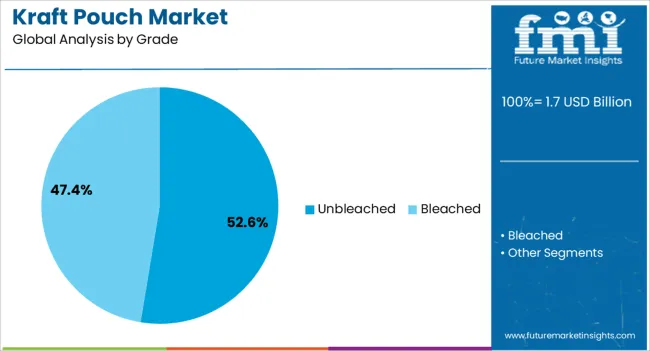

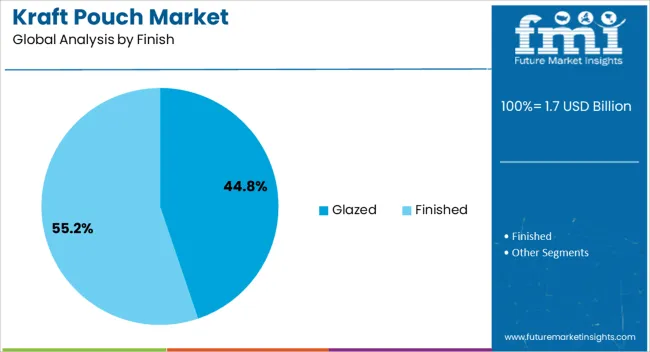

The market is segmented by Product Type, Grade, Finish, and End Use and region. By Product Type, the market is divided into Stand-Up Pouches and Flat Pouches. In terms of Grade, the market is classified into Unbleached and Bleached. Based on Finish, the market is segmented into Glazed and Finished. By End Use, the market is divided into Food And Beverages, Pharmaceuticals, Cosmetics And Personal Care, Electronics And Electricals, and Other Industrial Goods. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stand-up pouches segment, accounting for 47.30% of the product type category, has maintained leadership due to its superior functionality, versatility, and aesthetic appeal. This format is favored across multiple industries for its convenience, efficient shelf utilization, and extended product protection. Demand has been supported by increased use in food packaging, where moisture and oxygen barriers are critical for product preservation.

Manufacturers are optimizing material combinations and printing capabilities to improve branding potential and product differentiation. The segment’s prominence is also linked to growing retail demand for resealable and easy-to-handle packaging.

Continuous innovation in pouch design, supported by automated filling systems, has improved operational efficiency and reduced production costs These factors are expected to sustain the segment’s strong market share over the forecast period.

The unbleached segment, representing 52.60% of the grade category, has emerged as the dominant choice due to its natural appearance, strength, and sustainability credentials. Its preference is driven by growing consumer awareness of environmental impact and preference for chemical-free packaging materials.

The unbleached variant offers high durability and cost efficiency, making it suitable for a wide range of applications, including food, cosmetics, and pet care packaging. Market growth has been reinforced by regulatory support for compostable and recyclable materials.

Manufacturers are increasingly adopting unbleached kraft grades to align with corporate sustainability goals and to reduce carbon footprints This trend is expected to continue as more brands shift toward eco-conscious packaging solutions to meet consumer and regulatory demands.

The glazed segment, holding 44.80% of the finish category, has been leading due to its enhanced visual appeal and superior resistance to moisture and grease. The glossy surface finish improves printability and product presentation, making it highly preferred in retail-oriented packaging.

Demand has been strengthened by its functional benefits, including higher durability and improved handling characteristics. The segment’s growth is also supported by technological advancements in coating applications that enhance both performance and sustainability.

Manufacturers are investing in eco-friendly glazing materials that maintain recyclability while offering protection and aesthetic value This combination of functionality and visual enhancement positions the glazed finish segment as a key contributor to the overall growth of the kraft pouch market.

New Versatility and Customization Trend Nurtures in the Industry

Kraft pouches are a flexible packaging option that may be used to package a wide range of goods and maintain integrity and freshness while reducing waste. The versatility of kraft pouches in terms of sizes, shapes, and closures enables producers to tailor their packaging to certain product specifications and branding preferences.

Brands may improve consumer engagement and stand out in the market by utilizing customization options. Kraft pouches offer an artistic canvas for imaginative branding initiatives because of their vivid prints, striking colors, and distinctive forms. The visual impact and shelf appeal of kraft pouches in retail contexts are enhanced by the production of high-quality, photo-realistic images and complex features made possible by technological improvements in printing.

With practical features like spouts, rip notches, and resealable zippers, Kraft pouches provide a useful and easy-to-use solution. In order to promote global customer involvement and loyalty, they can also incorporate transparent windows, oxygen barriers, and biodegradable materials.

Integration of Sustainable Options to Benefit the Kraft Pouch Industry

The increased need for consumer goods, stand-up pouches in medical components, and sustainable products is the main driver of the kraft pouch industry. Government restrictions on the use of plastic and rising public awareness of the benefits of kraft pouches are anticipated to further fuel industry expansion.

The market is cushioned by environmental concerns, packaging innovations, and the increased demand for reusable and recyclable slider-zipper pouches made of kraft paper. Customers' inclination for flexible packaging options made of paper is anticipated to also present development prospects for the kraft pouch industry.

Regulatory Compliance to Plummet the Adoption of Pouches

To maintain consumer health, environmental protection, and fair trade practices, kraft pouch makers are subject to stringent restrictions. With laws like the Food Contact Materials Regulation (FCMR) and the Food and Drug Administration (FDA) mandating items to be safe for food contact, food safety is a vital area of compliance. Environmental restrictions are a major aspect of the promotion of waste management and recycling.

Information on kraft pouches, including nutritional value, allergy warnings, and handling guidelines, are governed by labeling and packaging standards. Manufacturers may negotiate the complicated regulatory landscape by remaining updated about laws, ensuring quality, engaging with authorities, encouraging customer trust, improving brand reputation, and compelling growth in the kraft pouch industry.

The Kraft Pouch industry heavily relies on the general population's changing consumer preferences and lifestyle trends. Increasing emphasis on sustainability and health-consciousness is also likely to impact the demand for kraft paper pouches. Besides this, technological developments such as ziplocks, waterproof paper, and easy tear notch in the production processes and increasing research and development also have impacted the industry in the past.

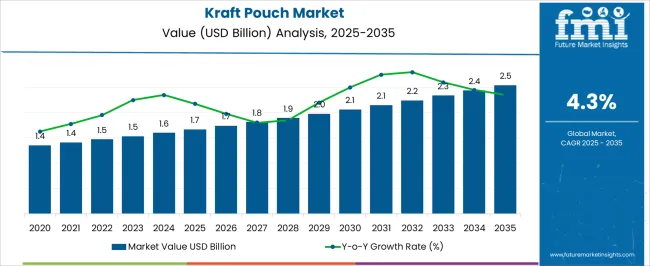

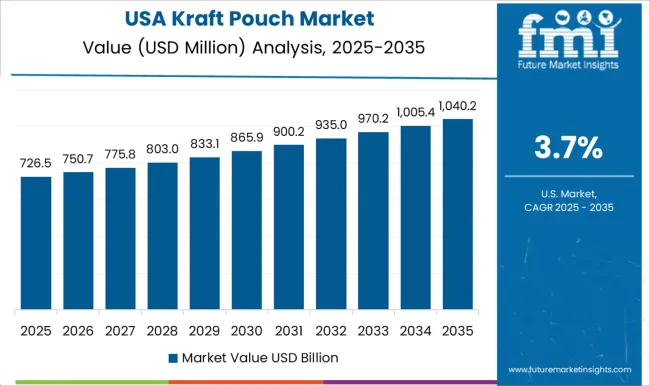

The industry in the period between 2020 to 2025 exhibited a CAGR of 2.9%. When the pandemic hit the world, the production capacities of certain companies involved in the manufacturing of paper pouches also charged. The pandemic, in the early stages, also led to disruptions in supply chains, which adversely affected the industry. The kraft pouch market size expects a considerable valuation bump from USD 1.7 billion in 2020 to USD 1.7 billion in 2025.

In 2025, consumers and major industry players are anticipated to be embracing recyclable packaging options more and more. Kraft paper pouches are a common option because of their easy recycling and eco-friendliness. Kraft pouches are growing more prevalent than alternatives made of plastic, and such a trend is fueling the sales of the kraft pouches.

Throughout the projection period, rising investment, the expanding eCommerce industry, and new markets are going to fuel the market's expansion. Opening the economies also meant that people now possessed extra income to spend on visually appealing kraft pouches.

The Kraft pouch industry is categorized mainly on the basis of product type, grade, finish, basis weight, and end-use. The section discusses in brief the top two categories in this industry, i.e. grade and end-use.

Based on grade, the Kraft pouch industry is bifurcated into bleached and unbleached Kraft pouches. As of 2025, the bleached Kraft pouches hold an industry share of 58.2%.

| Segment | Bleached (Grade) |

|---|---|

| Value Share (2025) | 58.2% |

The demand for bleached Kraft pouches is touching the skies in comparison to the unbleached ones in recent years. This trend is observed primarily due to the aesthetic appeal of these pouches which makes them more attractive for packaging, particularly for premium products. These pouches also provide a better surface for printing. This improved print quality is crucial for brands looking to differentiate their products on crowded shelves.

Kraft pouches are utilized in various industries across sectors, such as food and beverage, pharmaceuticals, cosmetics and personal care, electronics and electrical, and the manufacturing of other consumer goods. The food and beverage segment, as of 2025, holds the maximum share of 39.6% in the overall Kraft pouch industry.

| Segment | Food and Beverage (End Use) |

|---|---|

| Value Share (2025) | 39.6% |

The clamor for Kraft pouches in the food and beverage industry has been skyrocketing all over the world. These pouches are lightweight, and flexible, and offer excellent barrier properties to protect contents from moisture, air, and contaminants. These features are essential for businesses involved in the food and beverage industries to prevent spoilage and extend the shelf life of the products.

The section discusses the region-wise analysis of the Kraft pouch industry. Based on these analytics, it can be inferred that Asian countries such as India, China, and Thailand are some of the most lucrative companies when it comes to the sales of Kraft pouches. Western countries like the United States and the United Kingdom are slated to exhibit sluggish growth rates in the next decade.

| Countries | CAGR 2025 to 2035 |

|---|---|

| India | 6.5% |

| China | 5.8% |

| Thailand | 5.3% |

| United Kingdom | 2.6% |

| United States | 2.7% |

The Indian Kraft pouch industry is showcasing a healthy CAGR of 6.5% for the forecast period of 2025 to 2035.

India, as a country, in the last few decades, has shown tremendous growth in the food and beverage sector. The influx of multinational companies and industry giants in the country has created a conducive environment for Kraft pouch manufacturers as these companies often require high-quality, reliable packaging solutions to maintain product integrity and brand image. Besides this, the proliferation of e-commerce in every nook and corner of the country has also generated a huge demand for Kraft pouches in recent times.

The United States is lucrative for the kraft pouch manufacturers. The industry is slated to showcase a CAGR of 2.7% through 2035. There is a significant shift toward health and wellness practices in the general population of the United States. Consumers in the country are demanding natural and organic products. Kraft pouches, with their natural, earthy appearance and eco-friendly properties are considered perfect by businesses involved in these industries. They are often less harmful than their plastic counterparts. All these factors have increased their adoption in the United States.

The United Kingdom Kraft pouch industry is estimated to report a CAGR of 2.6% for the forecast period of 2025 to 2035. The ongoing trend of premiumization in the world has also influenced the Kraft pouch industry in the United Kingdom. Consumers in the country often associate premium packaging with higher quality and sophistication. Taking advantage of this, manufacturers in the production of artisanal snacks, gourmet foods, or specialty beverages are utilizing Kraft pouches to convey a sense of exclusivity and craftsmanship to premium-seeking consumers.

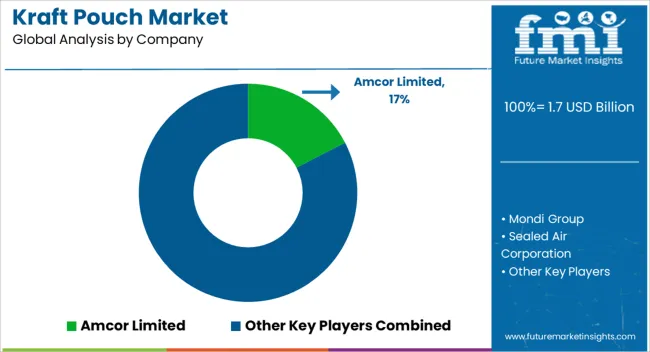

Established kraft pouch manufacturers like Mondi Group and Amcor plc are using their vast experience in the packaging solutions domain to adapt and meet changing market trends. The Mondi Group specializes in sustainable packaging and has expanded its efforts to improve the sustainability and usability of its kraft pouches. At the same time, Amcor plc is working to enhance its production capacity and geographical coverage through acquisitions and collaborations to deliver a range of kraft pouch solutions for various industries and uses.

New entrants like ProAmpac and Glenroy, Inc. are challenging the status quo with their new ideas and flexibility in their operations. To meet the increasing trend of personalized packaging among brands, ProAmpac is using innovative technologies to develop kraft pouch solutions that are customizable and offer high performance. On the other hand, Glenroy, Inc. is positioning itself as the company that offers kraft pouches for businesses of any size with a focus on customer satisfaction and short delivery times.

Industry Updates

In May 2025, Kraft Heinz delighted Capri Sun fans by introducing a family-size bottle featuring a graphic depiction of the iconic pouch. Responding to consumer demand, the move honored the brand's legacy while accommodating changing preferences for larger servings.

Kraft Heinz, headquartered in the United States, launched a revolutionary pouch in 2025 that makes microwaved grilled cheese crispy. This technology, part of the company's broader push to enhance innovation, will initially be featured in Lunchables before expanding to three other brands.

In terms of product type, Kraft pouches are commonly available as flat pouches or stand-up pouches, each offering distinct advantages in packaging design and functionality.

Kraft pouches are classified by grade into bleached and unbleached varieties, with bleached pouches typically favored for their cleaner appearance.

Kraft pouches may come with different finishes, such as glazed or finished, which can affect their tactile and visual qualities.

As per the end-use, the industry is segmented into food and beverages, pharmaceuticals, cosmetics and personal care, electronics and electricals, and other industrial goods.

As per region, the industry is divided into North America, Latin America, Europe, Asia-Pacific, and the Middle East and Africa

The global kraft pouch market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the kraft pouch market is projected to reach USD 2.5 billion by 2035.

The kraft pouch market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in kraft pouch market are stand-up pouches and flat pouches.

In terms of grade, unbleached segment to command 52.6% share in the kraft pouch market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kraft Paper Pouch Market Growth – Demand & Forecast 2025 to 2035

Kraft Block Bottom Pouch Market Growth – Size, Trends & Forecast 2024-2034

Kraft Box Market Forecast Outlook 2025 to 2035

Kraft Liner Market Size and Share Forecast Outlook 2025 to 2035

Kraft Labels Market Size and Share Forecast Outlook 2025 to 2035

Kraft Paper Market Size and Share Forecast Outlook 2025 to 2035

Kraft Paper Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Kraft Envelopes Market Size and Share Forecast Outlook 2025 to 2035

Kraft Paper Bags Market Size, Share & Forecast 2025 to 2035

Kraft Packaging Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among Kraft Liner Manufacturers

Market Positioning & Share in the Kraft Envelopes Industry

Kraft Paper Shopping Bags Market Growth – Size, Trends & Forecast 2024 to 2034

Kraft Bubble Mailer Market from 2024 to 2034

Kraft Paper Bakery Bags Market

Kraft Paper Mailer Market

Kraft Paper Tapes Market

Kraft Paper SOS Bag Market

Jumbo Kraft Tubes Market

Saturated Kraft Paper Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA