The kraft box market is witnessing steady expansion, driven by increased demand for sustainable and recyclable packaging solutions across consumer and industrial sectors. Industry updates and packaging company disclosures have emphasized a growing preference for kraft boxes due to their biodegradability, cost-effectiveness, and durability. The rise in e-commerce shipments and retail-ready packaging has heightened the need for structurally sound and lightweight corrugated solutions, further elevating kraft box adoption.

Packaging innovations focused on minimalistic designs, tamper-evident features, and natural aesthetics have aligned well with brand sustainability goals. Manufacturers are optimizing supply chains and investing in recycled paper sourcing to reduce their carbon footprint, which has reinforced market momentum.

Regulatory frameworks promoting eco-friendly packaging and consumer awareness of environmental impact have also accelerated the shift away from plastic-based packaging. Looking forward, demand for kraft boxes is expected to remain strong across diverse end uses, especially in personal care, cosmetics, and lifestyle goods, with unbleached variants and single wall designs continuing to lead due to their performance and sustainability balance.

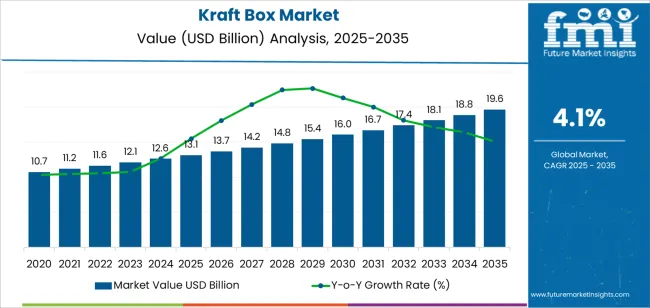

| Metric | Value |

|---|---|

| Kraft Box Market Estimated Value in (2025 E) | USD 13.1 billion |

| Kraft Box Market Forecast Value in (2035 F) | USD 19.6 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

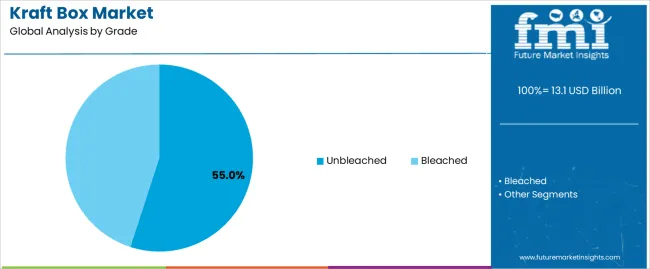

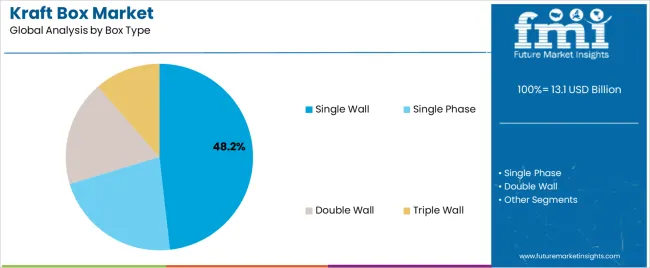

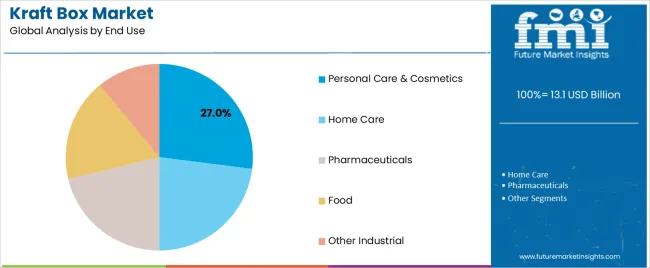

The market is segmented by Grade, Box Type, and End Use and region. By Grade, the market is divided into Unbleached and Bleached. In terms of Box Type, the market is classified into Single Wall, Single Phase, Double Wall, and Triple Wall. Based on End Use, the market is segmented into Personal Care & Cosmetics, Home Care, Pharmaceuticals, Food, and Other Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Unbleached segment is projected to capture 55.00% of the kraft box market revenue in 2025, maintaining its leadership position due to its eco-friendly appeal and raw, natural aesthetic. This segment’s dominance has been shaped by the demand for sustainable packaging that minimizes chemical processing.

Unbleached kraft paper, being less processed, retains higher fiber strength, making it suitable for heavy-duty applications and structurally reliable boxes. Brands have increasingly utilized unbleached kraft boxes to signal authenticity and environmental responsibility, enhancing product perception among eco-conscious consumers.

In manufacturing, unbleached paper has offered cost advantages due to fewer bleaching steps, making it economically attractive for large-volume production. Furthermore, the recyclability and compostability of unbleached kraft boxes have supported regulatory compliance in regions with stringent environmental packaging standards. These factors combined have strengthened the unbleached segment’s position as the preferred grade in both primary and secondary packaging formats.

The Single Wall segment is projected to account for 48.2% of the kraft box market revenue in 2025, establishing itself as the most widely used box type. Growth of this segment has been driven by its versatility across retail, e-commerce, and consumer goods packaging, where moderate protection with minimal material usage is sufficient.

Single wall kraft boxes have been favored for their cost-effectiveness and lightweight profile, which reduces shipping costs and environmental impact. Packaging suppliers have scaled production of single wall configurations to meet the needs of high-frequency shipments, particularly for small-to-medium weight products.

Design adaptability and customization capabilities have further contributed to the segment’s widespread application. Additionally, businesses focused on sustainable practices have opted for single wall kraft boxes as a low-resource alternative without compromising functionality. With continued growth in direct-to-consumer logistics and shelf-ready packaging, the Single Wall segment is expected to remain the dominant structural format.

The Personal Care & Cosmetics segment is projected to contribute 27.0% of the kraft box market revenue in 2025, leading among end-use applications. This segment’s expansion has been fueled by consumer demand for premium yet environmentally responsible packaging in skincare, beauty, and wellness products.

Brands in the personal care industry have increasingly embraced kraft boxes to convey natural and organic brand values, aligning with consumer expectations around clean beauty and sustainable packaging. Industry reports and brand launches have highlighted a preference for minimalist kraft designs with custom prints, embossing, and eco-labeling to enhance shelf presence and reinforce ethical messaging.

Additionally, kraft packaging’s ability to accommodate inserts and secure fragile items has supported its application in high-value cosmetic products. The rise of D2C brands and subscription-based offerings has also increased demand for aesthetically pleasing yet protective packaging formats. As sustainability remains a core pillar in cosmetic product marketing, the Personal Care & Cosmetics segment is expected to retain its leading role in kraft box adoption.

Industry-wide Sustainability Trends to Influence the Kraft Box Market

In the last few years, there has been a growing global awareness of environmental issues such as plastic pollution, climate change, and the depletion of natural resources. Consumers, as well as businesses, have become increasingly conscious of the environmental impact of their purchases, which has created a conducive environment for packaging solutions that include Kraft boxes. Besides this, innovations in the packaging processes have also significantly influenced the kraft box market.

Diversified Applications have Significantly Increased the Sales of Kraft Boxes

The demand for Kraft paper is also touching the skies as they have diversified applications beyond traditional uses. These boxes are extensively utilized in the food and beverage industry for packaging snacks and takeout food, in the cosmetics industry for environmentally friendly packaging solutions, and in the construction industry for protective purposes. This diversification is extending the market reach of Kraft boxes, making it a versatile and in-demand packaging solution across different sectors.

High Upfront Investments to Hinder Industrial Adoption

The significant initial investment required to establish manufacturing facilities for Kraft box production involves substantial capital outlay. This includes expenses associated with machinery, technology, and adherence to environmental regulations. The high initial costs act as a deterrent for new players entering the market and can also impede the growth strategies of established companies.

The kraft box market heavily relies on the performance of various sectors like packaging, e-commerce, food and beverage, and consumer products and goods. Ongoing sustainability trends have also influenced the industry as businesses are actively seeking packaging solutions that are not only cost-effective and durable but also environmentally safe.

In the past few years, the industry has seen a series of ups and downs. When the pandemic hit the world, the industry faced a serious plunge in the demand for Kraft boxes. Supply chain disruptions meant that the e-commerce sector in almost all the countries experienced a negative growth rate. Many companies involved in the manufacturing of Kraft boxes also had to cease their production due to this.

The kraft box industry exhibited a CAGR of 3.5% during the period of 2020 to 2025. However, post-pandemic recovery has sparked a resurgence in the kraft box market. The food and beverage sector, in particular, has witnessed a notable increase in demand for eco-friendly packaging.

This has tremendously increased the sales of the kraft box market. The trend towards minimalistic and recyclable packaging in consumer goods is propelling the growth of Kraft boxes.

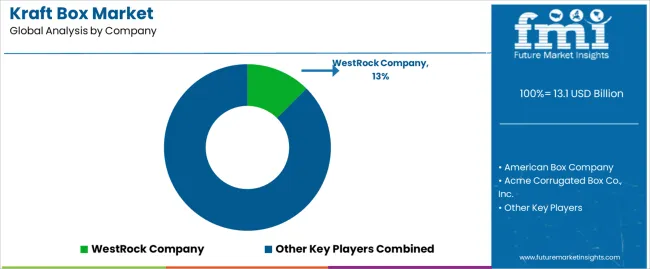

Tier 1 companies such as International Paper Company, Smurfit Kappa Group, and WestRock Company are positioned at the top of the global kraft box market due to their extensive resources, advanced technology, and exceptional product quality.

These companies are known for producing top-tier Kraft boxes that cater to large-scale businesses with demanding packaging needs. With a focus on innovation, sustainable practices, and reliability, they have solidified their position as leaders in the industry, appealing to customers who prioritize premium and environmentally friendly packaging solutions.

Companies in the second tier, like Dunapack Packaging, Mayr-Melnhof Packaging, and Pratt Industries, hold a strong position in the global kraft box market due to their combination of quality and competitive pricing. These companies offer a wide range of Kraft boxes that appeal to businesses of varying sizes.

Known for striking a balance between performance and cost-effectiveness, they have made Kraft packaging more accessible to a broader customer base while maintaining a respectable level of quality, functionality, and customer service.

Tier 3 companies, including independent box manufacturers, boutique packaging companies, and online custom Kraft box printers, are positioned in the global industry as providers of personalized and niche packaging solutions. Their products are designed to be cost-effective, flexible, and tailored to smaller businesses and individuals seeking custom packaging options.

The section below covers the industry analysis for the kraft box market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. India is anticipated to remain at the forefront in the Asian region, with a CAGR of 4.3% through 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Canada | 3.9% |

| The United States | 4% |

| Germany | 3.8% |

| India | 4.3% |

| Thailand | 4.1% |

| South Korea | 3.9% |

| China | 4.2% |

India’s kraft box industry is slated to show a 4.3% CAGR for the forecast period of 2025 to 2035. The kraft box market in India is experiencing robust growth, primarily due to the rapid expansion of the e-commerce sector. As online shopping becomes increasingly popular, there is a rising demand for efficient and sustainable packaging solutions.

Urbanization and the growth of organized retail further have also contributed to this demand. The Indian government's emphasis on environmental sustainability and waste reduction has also led to increased adoption of eco-friendly packaging materials.

Public awareness about the adverse effects of plastic packaging is also growing, prompting businesses to switch to Kraft boxes. Besides this, India's dynamic economic landscape, coupled with supportive regulatory frameworks and consumer preferences for sustainable options, is fueling the growth of the kraft box market.

China also is a promising country in this industry. Over the next ten years, China’s kraft box industry is projected to rise at 4.2% CAGR. In China, the growth of the market is largely driven by the country's extensive manufacturing sector. As the world's largest exporter of goods, China requires substantial packaging solutions for both domestic use and international shipments. The Chinese government's policies aimed at reducing plastic waste and promoting sustainable practices have accelerated the shift towards Kraft boxes.

The rise of environmentally conscious consumers and the growing middle class are pushing businesses to adopt greener packaging alternatives. Innovations in packaging technology and the availability of cost-effective Kraft materials also play a significant role in this market's expansion. These reasons have made Kraft boxes a preferred choice for many Chinese manufacturers and retailers.

The United States is also one of the most profitable countries in the global kraft box industry. The country is anticipated to exhibit a CAGR of 4% through 2035. The United States market is also growing significantly due to heightened environmental awareness and consumer demand for sustainable products.

The trend towards eco-friendly packaging is supported by stringent regulations on single-use plastics and corporate sustainability initiatives. The United States also has a strong and mature e-commerce sector that necessitates reliable and sustainable packaging solutions. Businesses are increasingly prioritizing green packaging to meet consumer expectations and regulatory requirements.

Advancements in recycling technologies and the development of high-quality, durable Kraft materials have made Kraft boxes an attractive option for companies looking to enhance their sustainability credentials. This shift is further supported by active environmental advocacy and consumer education campaigns promoting sustainable living.

The kraft box industry is categorized on the basis of grade, box type, end-use, and region. The section discusses the top two categories in this industry.

The kraft box industry, on the basis of grade, is bifurcated into bleached and unbleached. The unbleached segment holds a maximum share of 55% in the overall industry.

| Grade | Unbleached |

|---|---|

| Value Share (2035) | 55% |

Unbleached Kraft boxes are emerging as a significant trend in the industrial packaging landscape. This is primarily due to the environmental benefits and cost-effectiveness of the boxes over their plastic and polyester counterparts. Their demand is also touching the skies as they are made from natural sources, which suits the ongoing trend of sustainable and eco-friendly packaging solutions. Besides this, unbleached Kraft boxes are also gaining traction due to their cost-effectiveness.

Kraft boxes find their applications in a wide spectrum of industries across sectors such as packaging, personal care and cosmetics, e-commerce, etc. Among these, the personal care and cosmetics segment accounts for 27% of the overall global industry.

| End Use | Personal Care and Cosmetics |

|---|---|

| Value Share (2035) | 27% |

Kraft boxes have become a preferred packaging solution in the personal care and cosmetics sector. Kraft boxes, being biodegradable and recyclable, align perfectly with the ongoing sustainability trend. The clamor for these boxes is also skyrocketing as Kraft boxes offer a rustic and natural appearance that appeals to consumers seeking organic and natural beauty products. Besides this, Kraft boxes also provide robust protection for delicate personal care items, ensuring that products like creams, serums, and cosmetics arrive in perfect condition.

The competitive landscape for the kraft box market is diverse and dynamic, with several key players vying for market share. Some of the major companies operating in this space include WestRock Company, International Paper, Smurfit Kappa Group, Mondi Group, and Georgia-Pacific LLC. These companies offer a wide range of Kraft boxes catering to various industries such as food and beverage, cosmetics, pharmaceuticals, and consumer goods.

WestRock Company, a global packaging company, is a prominent player in the kraft box market, offering sustainable packaging solutions. International Paper is another major competitor known for its innovative and eco-friendly packaging products. Smurfit Kappa Group, with its focus on sustainable and innovative packaging, also competes aggressively in the market.

The competitive landscape is characterized by constant product innovation, focus on sustainable packaging solutions, and strategic partnerships to expand market presence. As the demand for eco-friendly packaging continues to rise, these companies are expected to intensify their competitive strategies to gain a larger market share in the Kraft box segment.

Recent Industry Developments in the Kraft Box Market:

In terms of grade, the industry is divided into unbleached and bleached.

In terms of box type, the industry is segregated into single-phase, single-wall, double-wall, and triple-wall

The industry is classified by end-use industries as personal care and cosmetics, home care, pharmaceuticals, food, and other industrial purposes.

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

The global kraft box market is estimated to be valued at USD 13.1 billion in 2025.

The market size for the kraft box market is projected to reach USD 19.6 billion by 2035.

The kraft box market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in kraft box market are unbleached and bleached.

In terms of box type, single wall segment to command 48.2% share in the kraft box market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kraft Pouch Market Forecast and Outlook 2025 to 2035

Kraft Liner Market Size and Share Forecast Outlook 2025 to 2035

Kraft Labels Market Size and Share Forecast Outlook 2025 to 2035

Kraft Paper Market Size and Share Forecast Outlook 2025 to 2035

Kraft Paper Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Kraft Envelopes Market Size and Share Forecast Outlook 2025 to 2035

Kraft Paper Bags Market Size, Share & Forecast 2025 to 2035

Kraft Paper Pouch Market Growth – Demand & Forecast 2025 to 2035

Kraft Packaging Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among Kraft Liner Manufacturers

Market Positioning & Share in the Kraft Envelopes Industry

Kraft Paper Shopping Bags Market Growth – Size, Trends & Forecast 2024 to 2034

Kraft Block Bottom Pouch Market Growth – Size, Trends & Forecast 2024-2034

Kraft Bubble Mailer Market from 2024 to 2034

Kraft Paper Bakery Bags Market

Kraft Paper Mailer Market

Kraft Paper Tapes Market

Kraft Paper SOS Bag Market

Jumbo Kraft Tubes Market

Saturated Kraft Paper Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA