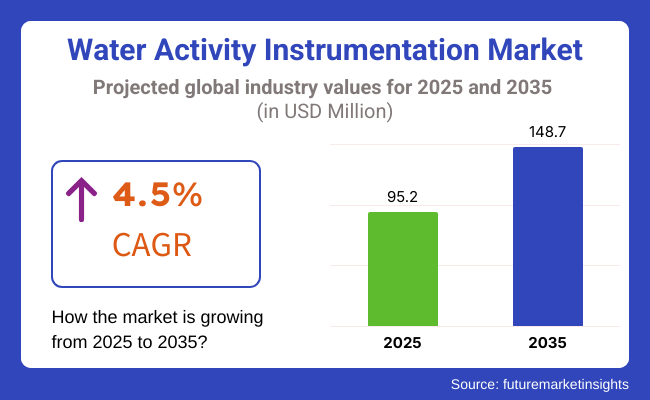

The water activity instrumentation market is valued at USD 95.2 million in 2025 and is expected to reach USD 148.7 million by 2035, advancing at a 4.5% CAGR over the forecast horizon. Regulatory tightening around hazard analysis (HACCP), ICH Q1A(R2) stability testing, and ISO 22000 food-safety management systems keeps demand elevated across laboratories and production floors.

The United States remains the most lucrative national market in 2025 owing to its mature but innovation-hungry food and pharma sectors, whereas South Korea is poised to be the fastest-growing country between 2025 and 2035 as biotech clusters and semiconductor clean-rooms adopt ultra-precise moisture analytics.

Growth is propelled by three converging forces: (1) stricter shelf-life labelling mandates that require sub-AW (water-activity) profiling for low-moisture snacks, (2) the pharmaceutical shift toward biologics and inhalable powders where micro-level moisture alters potency, and (3) Industry 4.0 retrofits that embed IoT-based analyzers directly on filling lines. Restraints include high instrument list prices, periodic calibration downtime, and uneven operator skill levels in emerging economies.

Key trends shaping the water activity instrumentation market are nano-engineered MEMS sensors with <2 min equilibration, AI waveform fitting for prediction of mold onset, and cloud dashboards that consolidate AW, RH, and temperature data into one compliance log-reducing manual paperwork during audits.

Over 2025 to 2035 the water activity instrumentation market will pivot from spot-checking toward predictive moisture management. Vendors are expected to launch non-contact, inline laser spectroscopy modules that feed real-time readings into MES/ERP suites, enabling automatic dryer-speed corrections and energy savings of up to 12%.

Battery-free, NFC-powered micro-tags will let contract packers verify AW at pallet level, while blockchain-anchored audit trails simplify multi-jurisdiction recalls. With personalised nutrition and advanced drug-delivery on the rise, formulators will demand sub-0.001 AW resolution, pushing R&D spend toward quantum tunnelling and graphene-oxide sensor stacks. Consequently, sustained single-digit growth is forecast even under price-compression pressure, cementing water-activity analysis as a non-negotiable quality gate worldwide.

Hand-held water-activity meters generate more than USD 49 million in 2025 revenue-approximately 52 % of the market-because plant inspectors, grain-silo managers, and field agronomists value their sub-2 kg weight, battery autonomy, and Bluetooth syncing.

These devices increasingly incorporate dual-sensor chambers and AI-guided equilibration checks that cut test times from 5 min to under 90 s, a boon for high-throughput snack factories. Yet precision-critical sectors (lyophilised injectables, powdered biologics) are fuelling a renaissance in benchtop analyzers, which maintain airtight temperature control (±0.1 °C) and deliver reproducibility <0.003 AW

As personalised medicine scales, benchtop systems are projected to grow at a 5.3 % CAGR, outpacing their portable peers’ 4.1 %. Suppliers are bundling both formats into subscription packages-hardware, calibration standards, and cloud analytics-lowering cap-ex hurdles for mid-size labs and encouraging product-lifecycle monitoring from R&D through distribution.

| Type (key sub-segment) | CAGR (2025 to 2035) |

|---|---|

| Benchtop Precision Stations | 5.3% |

Food and beverage processors account for nearly 58 % of 2025 sales, compelled by FSMA, EFSA, and GFSI directives that link water activity to pathogen control and shelf-life claims. Bakers calibrate proofing conditions, chocolate makers prevent sugar bloom, and plant-based meat start-ups fine-tune texture by targeting 0.92 AW thresholds. Nonetheless, the pharmaceutical industry will book the highest CAGR of 5.7 % through 2035, driven by moisture-sensitive APIs, dry-powder inhalers, and high-value biologics.

Next-gen continuous-manufacture lines integrate inline AW probes that issue real-time feedback to fluid-bed granulators, ensuring constant tablet hardness and dissolution rates. Cosmetic and personal-care brands, concerned with preservative-free formulations, add a steady revenue undercurrent by adopting low-volume micro-cuvette meters to validate stability protocols defined by ISO 29621.

| End-user segment | CAGR (2025 to 2035) |

|---|---|

| Pharmaceutical & Biotech | 5.7% |

Brick-and-mortar distributors-specialised lab-equipment resellers, metrology-service houses, and OEM direct sales teams-still generated the bulk of 2025 revenue, supplying roughly 68 % of all water-activity instruments.

Their strength lies in hands-on demos, bundled annual calibration contracts, and the ability to customise validation paperwork for FDA or EMA audits-services that remain indispensable for large pharmaceutical and multinational food plants. Even so, the digital shift is unmistakable. Online sales channels are forecast to expand at a brisk 6.1 % CAGR between 2025 and 2035, eclipsing the offline segment’s 3.8 % pace.

Three factors fuel this surge: (1) procurement teams favour e-catalogues that integrate with ERP e-tender portals, shortening quote-to-purchase cycles from weeks to days; (2) manufacturers now offer subscription bundles-including replacement sensors and cloud analytics-through their own e-commerce sites, spreading cap-ex into predictable op-ex; and (3) mid-tier food processors in emerging markets increasingly buy portable meters from global marketplaces to skip local mark-ups and secure genuine accessories.

Live chat tech-support, virtual reality unboxing tutorials, and AI-driven cross-selling of calibration standards further strengthen online stickiness. As Industry 4.0 matures, remote firmware updates and SaaS dashboards will be delivered seamlessly via web shops, reinforcing the digital advantage and gradually trimming the offline share to near-parity by 2035.

| Distribution Channel | CAGR (2025 to 2035) |

|---|---|

| Online Sales | 6.4% |

| Offline Sales | 3.8 % |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Complying with standards set by the FDA, EFSA, and WHO in the fields of food, pharmaceutical, and cosmetics. | Blockchain-protected regulatory data, AI-based compliance automation, and decentralized quality control. |

| Capacitive sensors, TDLS, and IoT-integrated analyzers. | Nano-based sensors, mid-infrared spectroscopy, and AI-powered predictive analytics. |

| For the assessment of food safety, pharmaceutical ingredients, cosmetic ingredients, and agrochemical ingredients. | Used in biotechnology, precision farming, and nanomedicine. |

| Portable water activity meters for cloud-connected manufacturing quality assurance. | Industry 4.0-based smart factories integrated with AI-assisted real-time remote monitoring systems. |

| Energy-efficient instruments with low sample volume requirements. | Self-powering, biodegradable biosensors, and Predictive maintenance AI for enhanced lifespan of instruments. |

| IoT-based data logging, cloud analytics, and automated trend detection. | Forecasting humidity with AI, real-time adjustments to the production line, and traceability with blockchain. |

| Market challenges have included the high costs of instruments and standardization issues. | AI-optimized supply chain monitoring, decentralized manufacturing, and real-time calibration feedback. |

| Growth factors include regulatory pressure, rising food safety concerns, and pharmaceutical stability requirements. | AI-supported automation, Industry 4.0 integration, and precision nanotechnology for further expansion into moisture analysis. |

Technology, accuracy, application, and target industries determine the pricing strategy for the water activity instrumentation market. Water activity meters designed for high precision (e.g., in pharmaceuticals, food safety, and research laboratories) have premium priced equipment because they are equipped with advanced sensors, are more automated, and must meet stringent regulatory standards.

In the mid-range food and industrial applications, you get a cost-performance trade off. Entry-level devices primarily used in agriculture and small-scale production are sold through penetration pricing to attract budget-conscious buyers. Manufacturers usually have a tiered pricing model with basic, advanced and premium versions, targeting different customers. Another model that we are seeing is subscription-based pricing where companies are offering their services as a cloud-based data logging and calibration of hardware.

There are many risks in water activity instrumentation market. Variations in the pricing of raw materials and components - specifically, sensitive sensors and electronic components - may also add to production costs. Supply chain disruptions, such as semiconductor shortages or precision manufacturing delays, may impact product availability.

Regulatory compliance is another big consideration; certain industries such as pharmaceuticals and food production have extensive and complex validation and calibration requirements that can often be costly and complex. Additionally, rivals providing affordable alternatives and state-of-the-art technology demand continual innovation. However, affordability with high accuracy, durability, and compliance need to find a balance for the sustainability of the market in the long term.

Pricing Strategy in the Water Activity Instrumentation Industry

| Metrics | Pricing Level |

|---|---|

| High-precision instruments (pharmaceuticals, research labs) | High |

| Industrial-grade instruments (food safety, manufacturing) | Medium |

| Entry-level instruments (agriculture, small-scale production) | Low |

| Cloud-based data logging and calibration services | Medium |

| Subscription-based pricing models | Medium |

North America dominates the market for water activity instrumentation due to severe food safety standards, advanced pharma production, and strong R&D spending. The USA and Canada are the key contributors, and they report good demand from the food industry and biotech industries. Availability of leading-line manufacturers and technological advances in accuracy instrumentation also fuel the growth of the market. Food safety and drug quality control initiatives from governments are propelling market adoption in the region.

Europe is a stronghold region, with Germany, the UK, and France leading pharmaceuticals and food production. The requirements for drug stability testing and food safety across the EU drive demand for water activity equipment. Market also benefits from advancing automatic test technology and additional funding in research lab facilities. Demand is further driven by rising interest in natural preservatives and clean-label foods, where better analysis of water activity is required for product integrity.

Asia-Pacific is anticipated to register the fastest growth, driven by increasing industrialization, expanding food and pharmaceutical sectors, and growing regulatory enforcement. China, India, Japan, and South Korea are major contributors, with heightened demand from food exporters, generic drug manufacturers, and research institutes.

The increasing adoption of automated lab tests, in association with higher government spending on food and drug quality testing, is driving the growth of the market in the space. Additionally, new emerging players focusing on intelligent water activity solution offerings are altering the competitive space.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| UK | 4.8% |

| European Union | 4.9% |

| Japan | 5% |

| South Korea | 5.3% |

The USA is expanding due to strict food safety practices, enhanced need for pharmaceutical quality control, and technological advancement in sensor technology. The Food and Drug Administration (FDA) exercises strict control on water activity of packaged foods, which propels the adoption of advanced equipment to comply.

In the pharmaceutical, food, and research industries, high-resolution water activity meters are increasingly being employed to establish product stability and prevent microbial proliferation. Greater application of digital sensors and AI-powered monitoring systems enables real-time data collection as well as predictive maintenance.

Greater application of handheld and automated water activity analyzers ensures quality assessment is possible in decentralized sites such as food processing plants and grain stores silos. Industry giants such as Mettler Toledo, AQUALAB, and Rotronic remain committed to introducing high-performance equipment in order to respond to evolving industry needs.

Growth Factors in The USA

| Key Factors | Details |

|---|---|

| Strong Food & Beverage Industry | High demand for water activity measurement in food preservation and safety. |

| Advanced Pharmaceutical Sector | Stringent regulations drive the adoption of precise water activity instruments. |

| Technological Innovations | Growth in smart sensors and IoT-enabled water activity devices. |

| Regulatory Compliance Needs | FDA and USDA guidelines encourage companies to invest in accurate testing equipment. |

The UK is growing due to increasing regulatory attention on food safety, increasing demand for pharmaceutical stability testing, and improvements in measuring technology. The UK Food Standards Agency (FSA) demands stringent monitoring of water activity in processed foods, which encourages manufacturers to invest in precision devices.

The pharmaceutical manufacturers use advanced water activity meters for stabilizing drug formulations and ascertaining Good Manufacturing Practices (GMP). In addition, AI-powered analytics and remote monitoring help enhance the efficiency of food safety and pharmaceutical applications.

Growing demand for portable, easy-to-use water activity equipment in research and quality control labs is fueling market expansion. Major suppliers keep introducing new products, incorporating IoT-based connectivity for real-time data access and compliance tracking.

Growth Factors in The UK

| Key Factors | Details |

|---|---|

| Rising Demand in Food Manufacturing | High focus on food quality and shelf-life enhancement. |

| Growth in Cosmetic Industry | Increasing use of water activity measurement in skincare and cosmetic formulations. |

| Strict Safety Regulations | Compliance with EU and local standards for product quality control. |

| Expansion in Research & Academia | Growing use of water activity instruments in scientific studies and product development. |

The European Union is expanding due to strict regulatory frameworks, increasing demand for food and pharmaceutical quality assurance, and rising investments in automation. The European Food Safety Authority (EFSA) and the European Medicines Agency (EMA) implement stringent laws for consumer products regarding water activity levels.

Germany, France, and Italy are frontrunners in the adoption of high-precision water activity meters for food processing, biotechnology, and pharmaceuticals. The smart sensors married at the altar with the cloud-compliant monitoring platforms for sources of fruitful assessment and compliance along with risk evaluation.

Technology disrupters have also introduced non-destructive water activity testing and lab-on-chip innovations and much more available across the board to increase speed and accuracy of measurement for diverse industries beyond food and beverage applications, into the wider market growth.

Growth Factors in the European Union

| Key Factors | Details |

|---|---|

| Stringent Quality Control Norms | EU food safety laws drive the adoption of precise water activity analyzers. |

| Diverse Industrial Applications | Usage in pharmaceuticals, chemicals, and agriculture. |

| High Investment in R&D | European companies invest in advanced water activity monitoring technologies. |

| Sustainable Packaging Initiatives | Need to optimize moisture levels in biodegradable and eco-friendly packaging. |

Japan is growing because of rising food safety concerns, increasing pharmaceutical research, and government initiatives for quality control. The Japanese Ministry of Health, Labour and Welfare is enforcing stringent standards of water activity in packaged foods and pharmaceuticals, thereby propelling the increased demand for advanced instruments.

Water activity meters with high precision are being increasingly adopted by pharmaceutical companies to improve drug formulation and storage stability. Not only the emergence of increasingly powerful AI diagnostics but also automated quality assurance solutions further energizes market growth. Also, the demand for portable and rapid water activity analysers is on the rise in the food production and research sectors to ensure real-time quality control in decentralized areas.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| Cutting-Edge Technology Development | Japan leads in miniaturized and high-precision water activity instruments. |

| High Standards in Food Processing | Strict regulations for packaged and processed food safety. |

| Expanding Biotechnology Sector | Increased application of water activity measurement in lab research. |

| Focus on Automation & AI | Rising adoption of AI-integrated water activity devices for industrial use. |

Government expenditure on food safety measures and research into pharmaceuticals, along with the digital health transformation, continues to place this nation at the foot of rapid emergence alongside South Korea. The Ministry of Food and Drug Safety (MFDS) has formulated stringent regulations on water activity, which means there will be a rising demand for these precision measurement technologies.

South Korean companies invest heavily in AI-driven water activity monitoring systems, enhancing predictive analytics and automated compliance tracking. The country’s cutting edge pharmaceutical and biotechnology sectors further fuel demand for advanced instrumentation in drug development and storage applications.

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| Booming Semiconductor Industry | Demand for precise humidity and moisture control in electronics manufacturing. |

| Growing Pharmaceutical Sector | High investments in drug formulation and stability testing. |

| Increasing Processed Food Consumption | Rising urbanization fuels demand for moisture-controlled packaging. |

| E-commerce Growth in Lab Equipment | Online sales of precision instruments make water activity devices more accessible. |

METER Group (15-20%)

METER Group has the highest share in the water activity instrumentation market, and it provides state-of-the-art devices for AI-driven data analytics. This company specializes in fast-response sensors and cloud-based data management systems for live monitoring.

Aqualab Decagon Devices (12-16%)

Aqualab primarily offers very precise and user-friendly water activity instruments for food safety, pharmaceutical research, and materials science. These products have very quick analysis speeds and even include some regulatory compliance assistance.

Rotronic AG (10-14%)

Rotronic AG uses extremely accurate water activity analyzers in development with advanced temperature stabilization and humidity control. The company has lab-based instrumentation to serve the food, pharmaceutical, and packaging industries.

Novasina AG (8-12%)

Novasina develops measurement systems for very sensitive water activities in pharmaceuticals, biotechnology, and food applications. Precision and stability in sensor technology have gained high emphasis with the company.

Kett Electric Laboratory (5-9%)

Kett Electric Laboratory adopts production measures that will produce cost-effective portable water activity meters well suitable for usage in food safety, agriculture, and some industrial applications. The company also prioritizes other areas such as usability and accessibility in its devices.

Yet another manufacturer makes its contribution in the development of next-generation water activity measurement solutions, high-precision sensors, and AI-integrated analysis tools.

Based on type, the market is segmented into handheld and benchtop.

According to distribution channel, the market is categorized into offline sales and online sales.

Based on end use, the market is segmented into industrial manufacturing, food industry, pharmaceutical & cosmetics industry, tobacco industry, and seed storage.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The market is projected to witness a CAGR of 4.5% between 2025 and 2035.

The industry stood at USD 95.2 million in 2025.

The industry is anticipated to reach USD 148.7 million by 2035 end.

North America is expected to record the highest CAGR, driven by growing demand in the food, pharmaceutical, and cosmetics industries.

The key players operating in the industry include Freund Corporation, Rotronic AG, Neu-tec Group Inc., Meter Group, Novasina AG, Biobase Group, Labtron Equipment Ltd, Steroglass Srl, and others.

Table 01: Global Market Volume (Units) and Value (US$ Million) Forecast by Type, 2017 to 2032

Table 02: Global Market Volume (Units) and Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 03: Global Market Volume (Units) and Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 04: Global Market Volume (Units) and Value (US$ Million) Forecast by Region, 2017 to 2032

Table 05: North America Market Volume (Units) and Value (US$ Million) Forecast by Country, 2017 to 2032

Table 06: North America Market Volume (Units) and Value (US$ Million) Forecast by Type, 2017 to 2032

Table 07: North America Market Volume (Units) and Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 08: North America Market Volume (Units) and Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 09: Latin America Market Volume (Units) and Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: Latin America Market Volume (Units) and Value (US$ Million) Forecast by Type, 2017 to 2032

Table 11: Latin America Market Volume (Units) and Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 12: Latin America Market Volume (Units) and Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 13: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 14: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 15: Europe Market Volume (Units) and Value (US$ Million) Forecast by Type, 2017 to 2032

Table 16: Europe Market Volume (Units) and Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 17: Europe Market Volume (Units) and Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 18: East Asia Market Volume (Units) and Value (US$ Million) Forecast by Country, 2017 to 2032

Table 19: East Asia Market Volume (Units) and Value (US$ Million) Forecast by Type, 2017 to 2032

Table 20: East Asia Market Volume (Units) and Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 21: East Asia Market Volume (Units) and Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 22: South Asia & Pacific Market Volume (Units) and Value (US$ Million) Forecast by Country, 2017 to 2032

Table 23: South Asia & Pacific Market Volume (Units) and Value (US$ Million) Forecast by Type, 2017 to 2032

Table 24: South Asia & Pacific Market Volume (Units) and Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 25: South Asia & Pacific Market Volume (Units) and Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 26: Middle East & Africa Market Volume (Units) and Value (US$ Million) Forecast by Country, 2017 to 2032

Table 27: Middle East & Africa Market Volume (Units) and Value (US$ Million) Forecast by Type, 2017 to 2032

Table 28: Middle East & Africa Market Volume (Units) and Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 29: Middle East & Africa Market Volume (Units) and Value (US$ Million) Forecast by End Use, 2017 to 2032

Figure 01: Global Market Historical Volume (Units), 2017 to 2021

Figure 02: Global Market Volume (Units) Forecast, 2022 to 2032

Figure 03: Global Market Historical Value (US$ Million), 2017 to 2021

Figure 04: Global Market Value (US$ Million) Forecast, 2022 to 2032

Figure 05: Global Market Absolute $ Opportunity, 2022 to 2032

Figure 06: Global Market Share and BPS Analysis by Type, 2022 & 2032

Figure 07: Global Market Y-o-Y Growth Projection by Type, 2022 to 2032

Figure 08: Global Market Attractiveness Analysis by Type, 2022 to 2032

Figure 09: Global Market Share and BPS Analysis by Distribution Channel, 2022 & 2032

Figure 10: Global Market Y-o-Y Growth Projection by Distribution Channel, 2022 to 2032

Figure 11: Global Market Attractiveness Analysis by Distribution Channel, 2022 to 2032

Figure 12: Global Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 13: Global Market Y-o-Y Growth Projection by End Use, 2022 to 2032

Figure 14: Global Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 15: Global Market Share and BPS Analysis by Region- 2022 to 2032

Figure 16: Global Market Y-o-Y Growth Projections by Region, 2022 to 2032

Figure 17: Global Market Attractiveness by Region, 2022 to 2032

Figure 18: North America Market Share and BPS Analysis by Country - 2022 to 2032

Figure 19: North America Market Y-o-Y Growth Projections by Country, 2022 to 2032

Figure 20: North America Market Attractiveness by Country, 2022 to 2032

Figure 21: North America Market Share and BPS Analysis by Type, 2022 & 2032

Figure 22: North America Market Y-o-Y Growth Projection by Type, 2022 to 2032

Figure 23: North America Market Attractiveness Analysis by Type, 2022 to 2032

Figure 24: North America Market Share and BPS Analysis by Distribution Channel, 2022 & 2032

Figure 25: North America Market Y-o-Y Growth Projection by Distribution Channel, 2022 to 2032

Figure 26: North America Market Attractiveness Analysis by Distribution Channel, 2022 to 2032

Figure 27: North America Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 28: North America Market Y-o-Y Growth Projection by End Use, 2022 to 2032

Figure 29: North America Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 30: Latin America Market Share and BPS Analysis by Country - 2022 to 2032

Figure 31: Latin America Market Y-o-Y Growth Projections by Country, 2022 to 2032

Figure 32: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 33: Latin America Market Share and BPS Analysis by Type, 2022 & 2032

Figure 34: Latin America Market Y-o-Y Growth Projection by Type, 2022 to 2032

Figure 35: Latin America Market Attractiveness Analysis by Type, 2022 to 2032

Figure 36: Latin America Market Share and BPS Analysis by Distribution Channel, 2022 & 2032

Figure 37: Latin America Market Y-o-Y Growth Projection by Distribution Channel, 2022 to 2032

Figure 38: Latin America Market Attractiveness Analysis by Distribution Channel, 2022 to 2032

Figure 39: Latin America Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 40: Latin America Market Y-o-Y Growth Projection by End Use, 2022 to 2032

Figure 41: Latin America Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 42: Europe Market Share and BPS Analysis by Country - 2022 to 2032

Figure 43: Europe Market Y-o-Y Growth Projections by Country, 2022 to 2032

Figure 44: Europe Market Attractiveness by Country, 2022 to 2032

Figure 45: Europe Market Share and BPS Analysis by Type, 2022 & 2032

Figure 46: Europe Market Y-o-Y Growth Projection by Type, 2022 to 2032

Figure 47: Europe Market Attractiveness Analysis by Type, 2022 to 2032

Figure 48: Europe Market Share and BPS Analysis by Distribution Channel, 2022 & 2032

Figure 49: Europe Market Y-o-Y Growth Projection by Distribution Channel, 2022 to 2032

Figure 50: Europe Market Attractiveness Analysis by Distribution Channel, 2022 to 2032

Figure 51: Europe Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 52: Europe Market Y-o-Y Growth Projection by End Use, 2022 to 2032

Figure 53: Europe Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 54: East Asia Market Share and BPS Analysis by Country - 2022 to 2032

Figure 55: East Asia Market Y-o-Y Growth Projections by Country, 2022 to 2032

Figure 56: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 57: East Asia Market Share and BPS Analysis by Type, 2022 & 2032

Figure 58: East Asia Market Y-o-Y Growth Projection by Type, 2022 to 2032

Figure 59: East Asia Market Attractiveness Analysis by Type, 2022 to 2032

Figure 60: East Asia Market Share and BPS Analysis by Distribution Channel, 2022 & 2032

Figure 61: East Asia Market Y-o-Y Growth Projection by Distribution Channel, 2022 to 2032

Figure 62: East Asia Market Attractiveness Analysis by Distribution Channel, 2022 to 2032

Figure 63: East Asia Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 64: East Asia Market Y-o-Y Growth Projection by End Use, 2022 to 2032

Figure 65: East Asia Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 66: South Asia & Pacific Market Share and BPS Analysis by Country - 2022 to 2032

Figure 67: South Asia & Pacific Market Y-o-Y Growth Projections by Country, 2022 to 2032

Figure 68: South Asia & Pacific Market Attractiveness by Country, 2022 to 2032

Figure 69: South Asia & Pacific Market Share and BPS Analysis by Type, 2022 & 2032

Figure 70: South Asia & Pacific Market Y-o-Y Growth Projection by Type, 2022 to 2032

Figure 71: South Asia & Pacific Market Attractiveness Analysis by Type, 2022 to 2032

Figure 72: South Asia & Pacific Market Share and BPS Analysis by Distribution Channel, 2022 & 2032

Figure 73: South Asia & Pacific Market Y-o-Y Growth Projection by Distribution Channel, 2022 to 2032

Figure 74: South Asia & Pacific Market Attractiveness Analysis by Distribution Channel, 2022 to 2032

Figure 75: South Asia & Pacific Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 76: South Asia & Pacific Market Y-o-Y Growth Projection by End Use, 2022 to 2032

Figure 77: South Asia & Pacific Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 78: Middle East & Africa Market Share and BPS Analysis by Country - 2022 to 2032

Figure 79: Middle East & Africa Market Y-o-Y Growth Projections by Country, 2022 to 2032

Figure 80: Middle East & Africa Market Attractiveness by Country, 2022 to 2032

Figure 81: Middle East & Africa Market Share and BPS Analysis by Type, 2022 & 2032

Figure 82: Middle East & Africa Market Y-o-Y Growth Projection by Type, 2022 to 2032

Figure 83: Middle East & Africa Market Attractiveness Analysis by Type, 2022 to 2032

Figure 84: Middle East & Africa Market Share and BPS Analysis by Distribution Channel, 2022 & 2032

Figure 85: Middle East & Africa Market Y-o-Y Growth Projection by Distribution Channel, 2022 to 2032

Figure 86: Middle East & Africa Market Attractiveness Analysis by Distribution Channel, 2022 to 2032

Figure 87: Middle East & Africa Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 88: Middle East & Africa Market Y-o-Y Growth Projection by End Use, 2022 to 2032

Figure 89: Middle East & Africa Market Attractiveness Analysis by End Use, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water Surface Conditioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water-based Inks Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Coatings Market Size and Share Forecast Outlook 2025 to 2035

Waterway Transportation Software Market Size and Share Forecast Outlook 2025 to 2035

Waterless Cosmetics Powders Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Waterproofing Admixtures Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA