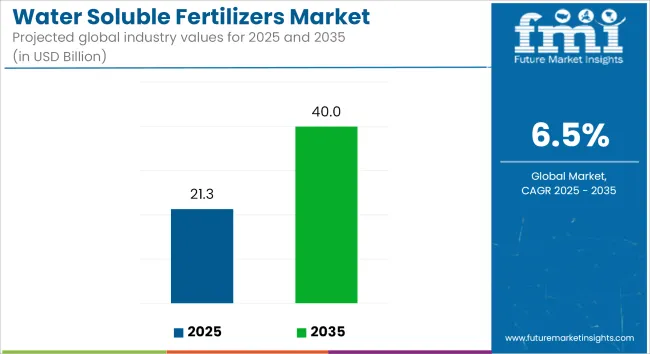

The global water-soluble fertilizers market is projected to expand from USD 21.29 billion in 2025 to USD 39.96 billion by 2035, advancing at a CAGR of 6.5% during the forecast period. Growth in the sector is being supported by rising adoption of controlled-environment farming, micro-irrigation systems, and real-time nutrient management practices. The integration of fertigation and precision agriculture methods has led to increasing use of fertilizer solutions that can be rapidly absorbed and tailored to crop-specific requirements.

| Attributes | Key Insights |

|---|---|

| Estimated Value (2025) | USD 21.29 billion |

| Projected Size (2035) | USD 39.96 billion |

| Value-based CAGR (2025 to 2035) | 6.5% |

A primary contributor to market expansion is the widespread use of N.P.K. complex fertilizers, which continue to be preferred for their ability to deliver nitrogen, phosphorus, and potassium in optimal ratios. These formulations are being deployed across diverse cropping systems to support root establishment, vegetative growth, and yield stability. In fertigation systems, the solubility of N.P.K. fertilizers enables precise nutrient delivery through drip and sprinkler irrigation methods, improving nutrient use efficiency and reducing leaching losses.

Farming regions undergoing soil nutrient depletion are showing increased reliance on water-soluble formulations to correct macro and micronutrient imbalances. In particular, horticultural crops and export-oriented production zones are showing higher application rates, driven by the demand for uniform produce quality and compliance with residue limits. Formulations that allow real-time modulation of nutrient concentration are being used to respond to crop stage-specific needs, contributing to more efficient resource use and minimized input wastage.

The need for high-value, short-cycle crops with predictable output has prompted a shift away from granular fertilizers toward water-soluble variants. In hydroponic and vertical farming setups, fully soluble N.P.K. fertilizers are being used for their compatibility with nutrient film techniques and automated dosing systems. As open-field agriculture adopts integrated crop management practices, water-soluble fertilizers are being positioned as essential inputs that enable both productivity gains and environmental risk mitigation.

With continued emphasis on improving agricultural outputs under limited land and water availability, the market for water-soluble fertilizers is expected to maintain long-term growth momentum, supported by advancements in formulation science, nutrient delivery systems, and diagnostic tools that allow site-specific fertility corrections.

The annual growth rates of the Water Soluble Fertilizers market from 2025 to 2035 are illustrated below in the table. Starting with the base year 2024 and going up to the present year 2025, the report examined how the industry growth trajectory changes from the first half of the year, i.e. January through June (H1) to the second half consisting of July through December (H2). This gives stakeholders a comprehensive picture of the sector’s performance over time and insights into potential future developments.

The table provided shows the growth of the sector for each half-year between 2024 and 2025. The market was projected to grow at a CAGR of 6.4% in the first half (H1) of 2024. However, in the second half (H2), there is a noticeable increase in the growth rate.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.4% |

| H2 (2024 to 2034) | 6.6% |

| H1 (2025 to 2035) | 6.6% |

| H2 (2025 to 2035) | 6.7% |

Moving into the subsequent period, from H1 2024 to H2 2024, the CAGR is projected as 6.6% in the first half and grow to 6.7% in the second half. In the first half (H1) and second half (H2), the market witnessed an increase of 10 BPS each.

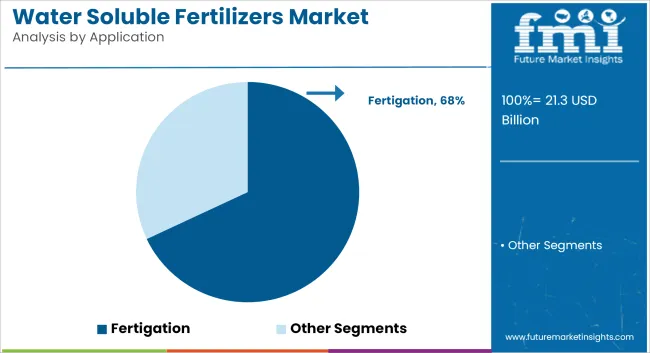

Fertigation is projected to hold approximately 68% of the global water soluble fertilizer market share in 2025 and is expected to grow at a CAGR of 6.6% through 2035. This method integrates fertilizer application directly into drip or sprinkler irrigation systems, enabling uniform distribution of nutrients and minimizing losses due to leaching or volatilization.

Fertigation is increasingly adopted in commercial horticulture, greenhouse farming, and high-value crop production where nutrient-use efficiency is critical. With the expansion of micro-irrigation infrastructure across Asia-Pacific, the Middle East, and Latin America, the demand for fertigation-compatible water soluble fertilizers continues to rise. Government incentives for precision agriculture and water conservation further support the adoption of fertigation systems globally.

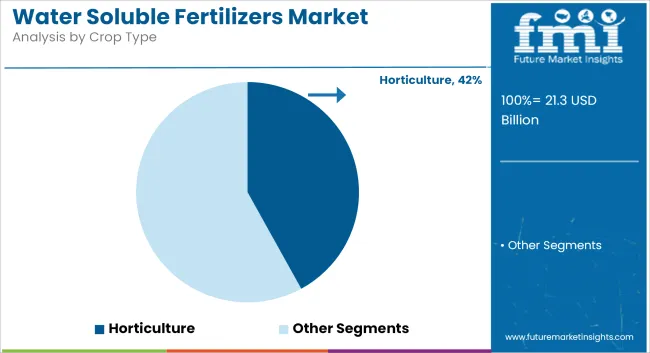

The horticulture segment is estimated to account for approximately 42% of the global water soluble fertilizer market share in 2025 and is projected to grow at a CAGR of 6.7% through 2035. Fruits, vegetables, and floriculture crops require precise nutrient timing and fast nutrient absorption, making them highly responsive to water soluble formulations.

These fertilizers offer flexibility in nutrient combinations and allow for stage-specific application throughout the crop cycle. Countries such as China, India, Mexico, and Spain are seeing increased adoption of water soluble fertilizers in protected cultivation and export-oriented horticultural production. As demand grows for residue-free produce and export-compliant inputs, horticulture will remain the key driver of growth in the water soluble fertilizer market.

Adoption of Precision Agriculture Techniques Boosting Fertilizer Efficiency

Precision agriculture technique is transforming towards modern farming, emphasizing in providing efficient input usage which results in maximize crop yield. Water-soluble fertilizers are centralized for this transformation which supporting practices like fertigation and foliar application. These fertilizers dissolve quickly in water, which are allowing nutrients to be delivered directly to plant roots or leaves and provide nutrients quickly rather than other fertilizers.

Water soluble fertilizers are particularly important in regions where water resources scarcity problem occurs, due to which farmers to use irrigation systems effectively while providing essential nutrients. Compatibility of water-soluble fertilizers with modern farming technologies such as drip irrigation and mechanized sprayers further drives their adoption for water soluble fertilizers.

Nowadays, agriculture is major business across global, so it starts to expand globally, due to which demand for these fertilizers is expected to grow, ensuring sustainable and high-efficiency farming practices.

Sustainability Push Driving Demand for Environmentally Friendly Fertilizers

Looking forward towards push for sustainable agricultural practices which creates a significant driver for water-soluble fertilizers. As compared to traditional fertilizers which lead to soil and water contamination through nutrient runoff, water-soluble fertilizers enable precise application which resulting in minimizing environmental impact. Efficient nutrient delivery system reduces wastage and increase soil health, which focused on sustainability goals and eco-friendly farming initiatives.

These fertilizers are being recommended by the government's regulations and environmental organizations as they are environment-friendly, thereby reducing agriculture's carbon footprint and mitigating climate change. Farmers also adapt sustainable agriculture because of consumers' increasing demand for eco-friendly food products.

Water-soluble fertilizers ability to improve yields without losing the natural resources is one important factor for sustainable farming. These trend is expected to gain further momentum as environmental concerns continue to shape agricultural policies and practices worldwide.

Expanding Market for High-Value Crops Supporting Fertilizer Usage

Cultivation of most used crops such as fruits, vegetables, and ornamental plants is growing rapidly due to rising of consumer demand for high-quality product. These crops are focused towards precise nutrient management for optimal growth, quality, and sustainability. Water-soluble fertilizers are further fulfilling the need of plants by providing a balanced nutrient supply directly to plants, enhancing their growth and productivity yield.

Water soluble fertilizers having properties like quick solubility ensures that nutrients are readily available, which supports critical growth phases. Farmers usually started to cultivate high-value crops which benefits from the efficient use of inputs, reduced wastage, and improved profitability in terms of economy.

Additionally, water-soluble fertilizers are main ingredients in producing high quality crops with better physical properties, such as size, color, and taste, which are crucial for fulfilling the demand of consumers. Nowadays, increasing focus on agriculture and specialty crop production, leading way towards demand for water-soluble fertilizers is expected to witness significant growth in the coming years.

High Cost of Water-Soluble Fertilizers Limiting Adoption Among Small-Scale Farmers

Water-soluble fertilizers are significantly more expensive compared to conventional fertilizers, so it is less accessible to small-scale farmers, particularly in developing regions. High production costs of these fertilizers, with need of additional coupled for specialized equipment like drip irrigation systems for their application, further increase the financial burden.

These fertilizers offer good efficiency and sustainability benefits, but due to lack of initial investment, small farmers are restricted use due to limited financial resources.

Additionally, lack of awareness about the long-term advantages of water-soluble fertilizers creates an issue, as many farmers are not in condition to spend high cost, so having alternatives despite their environmental drawbacks. Addressing this barrier is essential for ensuring broader market penetration and equitable access to advanced agricultural solutions.

Tier 1 companies comprise players with a revenue of above USD 6000 million capturing a significant share of 35-40% in the global market. These players are characterized by high production capacity and a wide product portfolio. These leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple Water Soluble

Fertilizers applications and a broad geographical reach, underpinned by a robust consumer base. Prominent companies within Tier 1 include Yara International ASA, The Mosaic Company, Haifa Group, ICL Group and other players.

Tier 2 companies include mid-size players with revenue of below USD 7000 million having a presence in specific regions and highly influencing the local industry. These are characterized by a strong presence overseas and strong industry knowledge.

These players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Deepak Fertilisers and Petrochemical, EuroChem Group AG, Nutrien Ltd., Coromandel International Limited, and other player.

The section below covers the industry analysis for Water Soluble Fertilizers demand in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided.

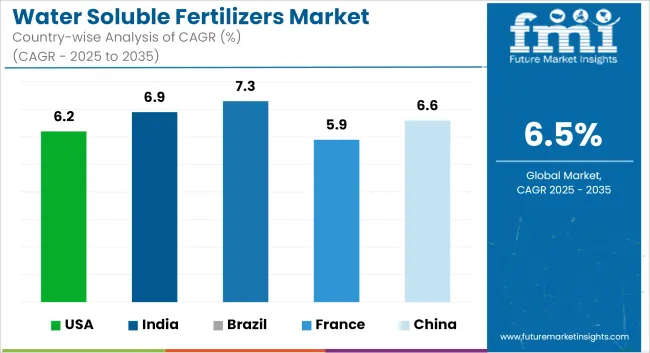

France will hold 38.7% in Western Europe due to Advanced Agricultural Practices and Sustainable Farming. The USA will capture 22.9% in North America owing to increase in demand of high value crop production. China will lead East Asia with 19.2% due to rising demand in agricultural growth several global manufacturers with high production capacity. These companies play a significant role in driving market growth by introducing new, environmentally friendly, and more efficient waterproof coatings.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

| India | 6.9% |

| Brazil | 7.3% |

| France | 5.9% |

| China | 6.6% |

France plays an important role in Europe’s water-soluble fertilizer market, drives by its large area in agricultural sector, for the production of crops like cereals, fruits, and wine grapes. France is focusing towards adapting advanced farming practices, with the help of fertigation techniques, which results in boosts demand for high-efficiency fertilizers.

French farmers are prioritizing towards water-soluble fertilizers, so ability is increased to provide precise and effective nutrient delivery, especially in vineyards and horticultural operations. Strong regulatory focus on sustainability, has grown the market for water soluble fertilizers in France and continues to be a key player in promoting efficient fertilization methods across the European agricultural landscape.

USA is contributor after France in the water-soluble fertilizers market, driven by its focus on production of high quality and high-value crops like fruits, vegetables, and ornamental plants. Due to adoption of advanced irrigation techniques and fertigation systems increases the demand in USA for water-soluble fertilizers, which makes highly effective in these sustainable and controlled environments. USA is considered as contributor in agricultural industry and technological advancements due to farming practices further strengthen its leadership in the market.

China follows the water-soluble fertilizers market due to its vast agricultural base and higher producing capacity with significant quantities of crops requiring advanced fertilization methods. Rising demand for water soluble fertilizers and focus towards maintaining efficiency with eco-friendly sustainable farming.

China’s is contributing in large-scale by agricultural sector drives demand for fertilizers, especially water-soluble fertilizers used in intensive farming systems. Furthermore, China’s robust manufacturing capacity supports both domestic and international demand, making it a key contributor in the global market.

Leading companies are introducing innovative products aimed at fertigation and precision agriculture, focusing on high solubility, crop safety, and improved nutrient efficiency. The trend of utilizing recovered nutrients, such as manure, is gaining traction to promote circular agriculture.

Manufacturers are responding to the increasing demand for water-efficient solutions and creating formulations tailored for specific irrigation methods like drip and foliar feeding. These developments reflect a broader industry shift towards enhancing crop yields, optimizing nutrient absorption, and advancing environmental sustainability, fueling growth in the market.

The Product Type segment is further categorized into Nitrogenous, Phosphate-based, Potassium-based, N.P Complex, N.P.K Complex, Sulfur and Micronutrients.

The Application segment is classified into Fertigation and Foliar.

The End Use segment is classified into Cereals & Pulses, Horticulture, Lawn, Turf & Ornamental and Others.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The global Water Soluble Fertilizers market for Application Fertigation was valued at USD 21.29 billion in 2025.

The demand for Water Soluble Fertilizers industry is set to reach USD 39.96 billion in 2035.

Growing demand for use of precision agriculture techniques, such as fertigation systems, will significantly drive the demand for water-soluble fertilizers. These methods ensure efficient nutrient delivery, improving crop yields while minimizing nutrient waste and environmental impact.

The Water Soluble Fertilizers demand is projected to reach USD 39.96 billion by 2035 growing at CAGR of 6.5% in the forecast period.

Fertigation application is expected to lead during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water Surface Conditioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water-based Inks Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Coatings Market Size and Share Forecast Outlook 2025 to 2035

Waterway Transportation Software Market Size and Share Forecast Outlook 2025 to 2035

Waterless Cosmetics Powders Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Waterproofing Admixtures Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA