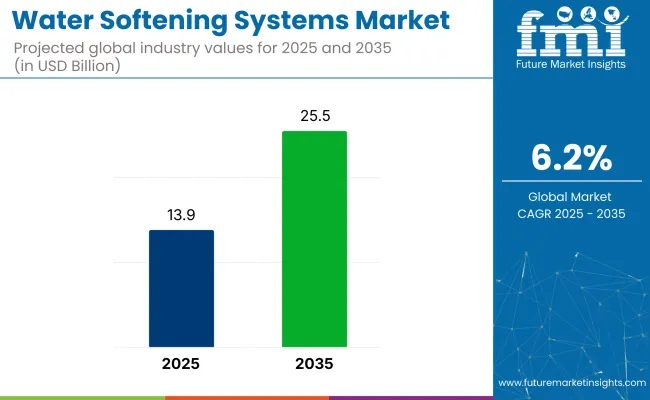

The global water softening systems market is expected to be valued at USD 13.9 billion in 2025 and is projected to reach approximately USD 25.5 billion by 2035 at a CAGR of 6.2%. This growth is being driven by increasing demand across residential, commercial, and industrial sectors, particularly in regions where hard water conditions continue to affect equipment durability, utility efficiency, and public infrastructure. In countries such as the United States, India, Mexico, Saudi Arabia, and parts of Australia, high concentrations of calcium and magnesium in municipal or groundwater sources remain a persistent concern.

In Southern California, municipal advisories have long recommended the use of point-of-entry water softening systems to protect residential plumbing and improve energy efficiency. In Phoenix, Arizona, housing developers are integrating softeners as standard fixtures in new builds to address scale-related maintenance issues in heating systems and dishwashers.

Across Europe, hard water remains a widespread issue. In the United Kingdom, over 60% of homes are in hard water zones, prompting high adoption of household water softeners, especially in cities like London, Birmingham, and Oxford. In Germany, compliance with the Federal Water Act has supported the uptake of salt-free technologies, particularly in ecologically sensitive regions. Meanwhile, in France and Italy, building codes in several municipalities recommend or require softeners in new multi-unit housing developments, especially in hard-water zones like Marseille and Milan.

In Asia, the demand for softening systems is rising in urban and peri-urban areas where rapid construction and infrastructure stress are common. In India, cities such as Coimbatore, Bangalore, and Ahmedabad have reported groundwater hardness exceeding 300 mg/L, triggering widespread installation in industrial laundries, textile units, and residential buildings. In China, especially in Northern provinces like Hebei and Shandong, centralized softening units are being incorporated into municipal water schemes and institutional facilities to comply with water-use efficiency goals outlined in the 14th Five-Year Plan for Environmental Protection 2021-2025.

In the Middle East, where water scarcity and desalination are key issues, softening systems are being installed to protect infrastructure from post-treatment scaling. In the United Arab Emirates, high mineral content in both brackish and desalinated water has prompted the use of compact softeners in luxury residential towers and hospitality infrastructure. In Saudi Arabia, water softening is included in water reuse guidelines promoted by the Saline Water Conversion Corporation (SWCC) and the National Water Company, especially for greywater systems in commercial properties.

Ion exchange systems remain the most widely adopted technology, due to their proven efficiency in reducing hardness at both residential and industrial scales. However, alternative technologies such as magnetic descalers, salt-free conditioners, and electronic water treatment systems are seeing increased traction. These options are especially gaining ground in Western Europe, Japan, and select U.S. states, where environmental discharge regulations restrict the use of sodium-based softening agents.

Global policy frameworks are reinforcing this trend. The EcoDesign Directive (2009/125/EC) in the European Union mandates efficiency standards that softeners help uphold by protecting water-using appliances. Singapore’s Mandatory Water Efficiency Labelling Scheme (MWELS) ensures appliance performance under challenging water conditions, indirectly encouraging upstream treatment. In the United States, the EPA’s WaterSense program promotes compatible fixtures and practices, especially in drought-prone regions like Nevada, Arizona, and Texas. Emerging markets in Africa and Latin America are also creating opportunities.

In Nairobi, Lusaka, and Accra, private developers are installing central softening systems in gated communities to reduce plumbing issues and service costs. In Peru and Colombia, expanding middle-class housing in cities like Lima and Bogotá has brought softening into focus, particularly where public supplies remain untreated. In Indonesia, the National Urban Water Supply Program (NUWSP) is enabling integration of decentralized water treatment, including compact softeners, into peri-urban housing developments.Key Application Area: Water and Wastewater Treatment

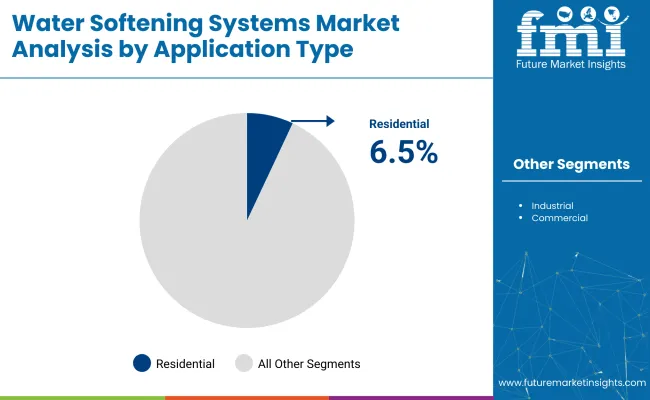

The residential segment is expected to remain the dominant application area in the global water softening systems market through 2035. This segment is projected to expand at a CAGR of 6.5% during the forecast period. Growth is anticipated to be supported by increasing concerns regarding high mineral content in municipal and borewell water supplies, particularly in urban and peri-urban regions.

Residential adoption has been driven by the need to reduce scaling in plumbing, appliance inefficiency, and fabric damage during laundry processes. Water softeners are increasingly being viewed as essential appliances—especially in areas where hard water continues to impact daily household operations. Although point-of-use (POU) water purifiers are still widely used for drinking applications, their inability to treat water at the whole-house level has positioned softening systems as a complementary solution.

Leading manufacturers are offering customized system designs tailored to housing size, layout, and hardness levels. Design variants such as mono pipe, multi-tube, and twin-tube systems are allowing end users to select water softeners based on installation constraints and usage needs. The availability of compact models and wall-mounted configurations has also helped accelerate adoption in apartment complexes and high-density residential areas.

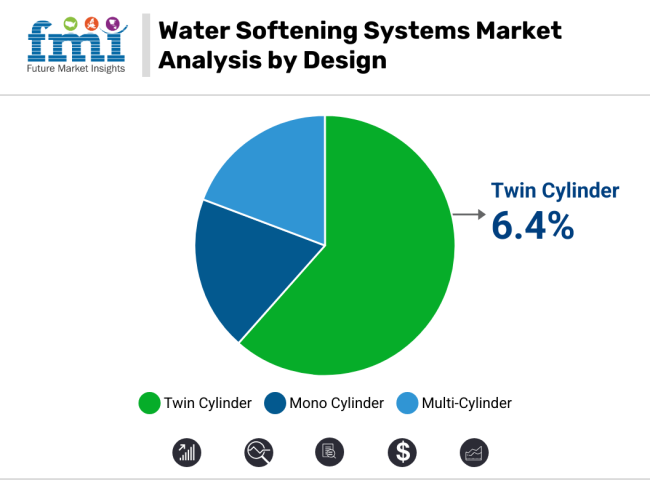

Among system designs, twin-cylinder water softening systems are expected to hold the largest market share during the forecast period. The segment is forecast to grow at a CAGR of 6.4% between 2025 and 2035. Twin-cylinder systems offer continuous softening capabilities, as one resin tank regenerates while the other remains active, ensuring uninterrupted service.

This design is being preferred in regions with very high water hardness levels, such as parts of the United Kingdom, Midwestern United States, and Northern India, where consistent performance and high flow rates are required. Compared to mono-cylinder systems, twin-cylinder variants have demonstrated superior durability, operational reliability, and longer service life. Their uptake is being supported by property developers and commercial plumbing contractors seeking low-maintenance, long-cycle solutions.

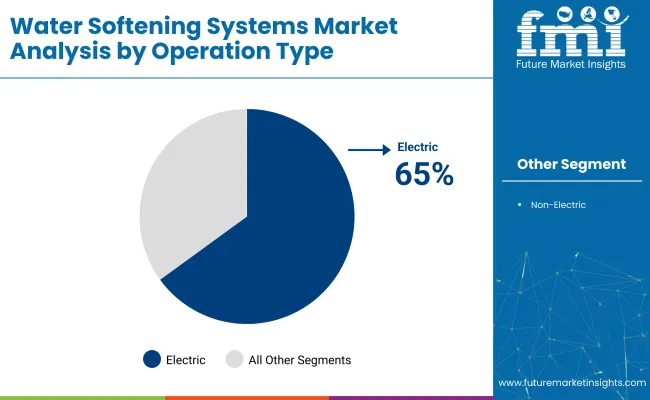

Based on operation type, electric water softening systems are projected to remain the most widely adopted category through 2035 with 65% market share in 2025. Continued innovation in programmable control units, automated regeneration cycles, and digital monitoring features has driven demand across both residential and commercial installations.

Electric systems are being favored for their ability to deliver precision, energy efficiency, and system self-diagnostics, especially in regions where water hardness varies significantly or user convenience is prioritized. Demand is expected to remain particularly strong in North America and Western Europe, including countries like the United States, Canada, and the United Kingdom, where electric systems are often integrated with smart home platforms.

Non-electric softeners are gaining ground in price-sensitive and off-grid markets, where power availability or maintenance expertise may be limited. Their uptake is likely to continue in regions such as sub-Saharan Africa, Southeast Asia, and rural Latin America, where simpler system designs offer ease of use and lower installation complexity.

Significant Installation Expenditures and Complex Maintenance Necessities

The complexities of installation, maintenance, and customization for various water hardness levels can hinder market growth. The process of softening water needs advanced filtration technologies and special ion exchange resins to remove calcium, magnesium, and other minerals. However, the installation cost and recurrent maintenance issues are improving enough to discourage small scale residential and business users.

If systems are not appropriately maintained, scaling, and efficiency issues can lead to a rising operational cost as well. Manufacturers need to come up with affordable, modular water softening solutions that provide automated monitoring and self-cleaning functions to overcome these challenges and develop long-term dependable and efficient solutions.

Growing Need for Sustainable and Intelligent Water Treatment Systems

This is anticipated to provide numerous opportunities for the Water Softening Systems Market as demand continues to rise around the globe for water conservation and lesser build-up of scale in pipelines & appliances. Demand for energy-efficient and sustainable water treatment processes that work towards improving water quality while minimizing the environmental impact is on the rise. Adoption is increasing for smart water softening technologies that can provide the likes of real-time water quality monitoring, automatic regeneration cycles, and salt-efficient softeners.

Moreover, government efforts to encourage sustainable water management, along with the increasing adoption of environmentally-friendly and salt-free softening solutions, is escalating the market growth. Firms leveraging intelligent connectivity, sustainable purification materials, and automated controls will emerge as the clear leaders in this emerging marketplace.

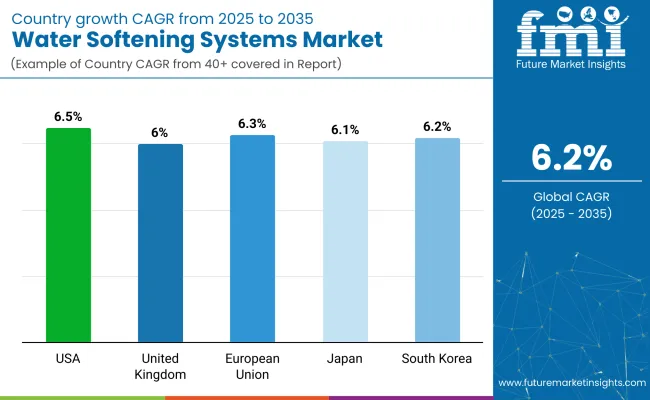

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

United States water softening systems market is expected to grow at a steady rate owing to the presence of high-water hardness degree, rising awareness regarding water treatment systems, and strong demand from residential and commercial sectors. Parts of the Midwest and Southwest, including states like Texas, Arizona and California, contain some of the hardest water found in the country, leading to widespread adoption of water softening systems.

Commercial entities such as hospitality, healthcare, and food service industries are also large-scale consumers of water softeners to prevent scale build up on appliances and improve their efficiencies. Also, the market is growing due to the increased adoption of smart, salt-free and green water softening technologies.

The USA water softening systems market is anticipated to grow at a steady pace attributed to increased consumer inclination towards IoT-enabled and high-efficiency water softeners.

The UK Water Softening Systems Market is driven by high water hardness levels, growing adoption in residential and commercial buildings, and government regulations promoting water-efficient appliances. Some of the hardest water in Europe is found in the UK’s south and east, covering the hotspots of London, Kent and Essex, resulting in high demand for home and business water softeners.

The hospitality industry comprises another important end-use application, where hotels and restaurants leverage water softeners to enhance energy efficiency and minimize maintenance expenses. Furthermore, increasing emphasis on sustainable water treatment solutions is increasing adoption of salt-free and magnetic water softening technologies.

One of the major factors driving the growth of the UK water softening systems market is greater investment in water-efficient infrastructure and consumers becoming more aware of water quality issues.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

In the European Union, the market for water softening systems is steadily growing as demand for potable water increases and stricter water quality regulations are implemented, with the key drivers being increased urbanization and a trend toward sustainable water treatment solutions. Germany, France, and Italy has moderate hardness to hard water ranges, which necessitate the presence of efficient water softening systems across residential, commercial, and industrial applications.

The EU’s demands for sustainable water treatment and reduced sodium discharge will also drive growth in ion-exchange resins, template-assisted crystallization (TAC, and electromagnetic water softeners. Moreover, the increasing uptake rate of smart water management technologies is driving market growth.

In addition, due to increasing awareness about hard water issues and growing demand for high efficient water softening system the EU water softening systems market is anticipated to grow at a stable rate over the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.3% |

The market for Japanese water softening systems will be propelled by the increasing demand for high-quality water among residential, healthcare, and industrial end users. Though Japan is a bit soft on comparison level of water with Western countries, certain regions including Tokyo and Osaka own closely characterized moderate water hardness, which is a significant contributor to localized requirement of water softeners in Japan.

Trending high-efficiency water softening and purification technologies in industrial sector, particularly in electronics, semiconductor manufacturing and pharmaceutical production is consequently contributing to the set to rise ultra-pure water demand. In addition, the municipal areas in Japan treat water, as modern, compact and automated softening systems are in demand.

Owing to ongoing innovations in the field of water treatment technology and increasing demand for high-purity water solutions in Japan, the Japanese water softening systems market is likely to jump up progressively.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The South Korea water softening systems market is mainly driven by growing urbanization and industrialization across households and commercial establishments. South Korea’s dense urban areas filled with apartment and commercial buildings are driving demand for central water softening systems.

Key consumers are in the hospitality and food service industries, with businesses looking to improve appliance longevity and water quality for cooking and beverage preparation. Moreover, the burgeoning smart home sector in South Korea is driving the demand for IoT-enabled water softening systems providing remote monitoring.

The South Korean water softening systems market is projected to thrive, owing to continued investments towards smart water infrastructure and growing awareness of water quality among consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Culligan International Company (15-20%)

Culligan dominates the water conditioning system solutions market with advanced water conditioning & purification systems that boast innovative smart water softener technology, integrated artificial intelligence technology, salt-saving regeneration, and other ultra-performance filtration systems.

A.O. Smith Corporation (12-16%)

A.O. Smith focuses on making compact, energy-efficient, and salt-free systems, which help to maximize performance while minimizing maintenance.

EcoWater Systems LLC (10-14%)

EcoWater creates (Wi-Fi-enabled) water softeners which allow for real-time monitoring with a focus on sustainability and efficiency.

Kinetico Incorporated (8-12%)

Kinetico offers non-electric, high-capacity and dual-tank softeners, where regular washing and maintenance takes place.

Pentair Plc (5-9%)

Their water softeners are designed to customize, and energy-efficient, pentair water softeners are smart home compatible technology and are eco-friendly regeneration systems.

Other Key Players (40-50% Combined)

Several water treatment and home appliance companies contribute to next-generation water softening technology, AI-driven water monitoring, and sustainable softening solutions. These include:

The overall market size for Water Softening Systems Market was USD 13.9 Billion in 2025.

The Water Softening Systems Market expected to reach USD 25.5 Billion in 2035.

The demand for water softening systems will be driven by factors such as increasing water hardness due to urbanization, industrial growth, and rising water consumption. Additionally, growing awareness about the adverse effects of hard water on appliances, skin, and hair will further fuel market growth.

The top 5 countries which drives the development of Water Softening Systems Market are USA, UK, Europe Union, Japan and South Korea.

Electric and Non-Electric Water Softeners Drive Market Growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA