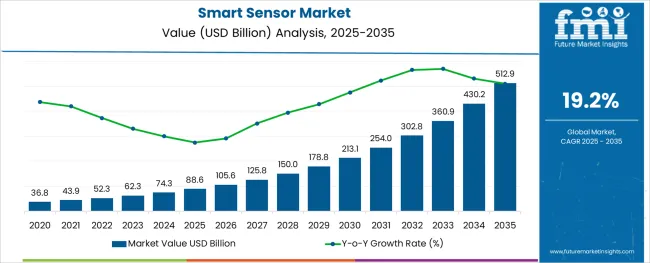

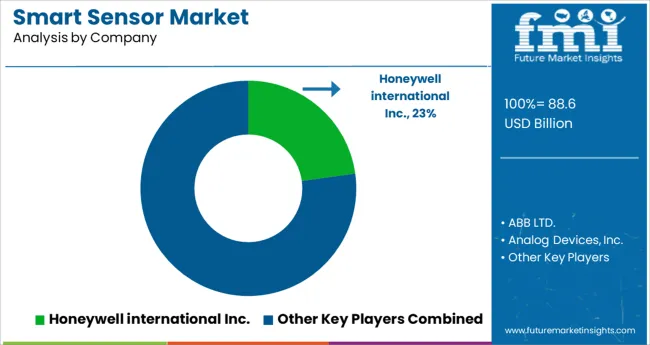

The Smart Sensor Market is estimated to be valued at USD 88.6 billion in 2025 and is projected to reach USD 512.9 billion by 2035, registering a compound annual growth rate (CAGR) of 19.2% over the forecast period.

The smart sensor market is expanding steadily, driven by increasing industrial automation and the growing demand for real-time monitoring and control systems. Advances in sensor technologies have enabled more accurate data collection and enhanced connectivity across industrial equipment. The rise of Industry 4.0 and IoT integration has accelerated the adoption of smart sensors to optimize processes, improve safety, and reduce downtime.

Industrial applications, in particular, require reliable sensors to monitor environmental and operational parameters. Increasing investments in smart manufacturing and predictive maintenance are further fueling market growth. In addition, advancements in sensor miniaturization and processing capabilities have broadened the scope of applications.

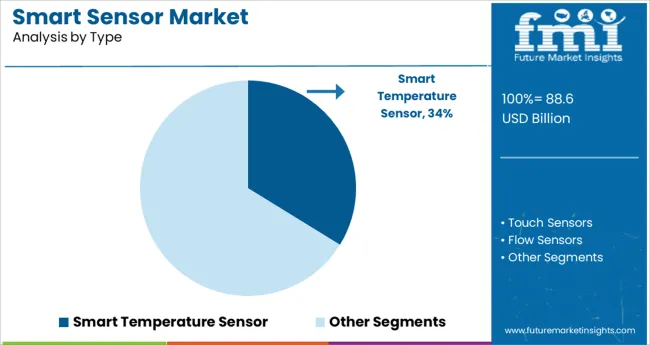

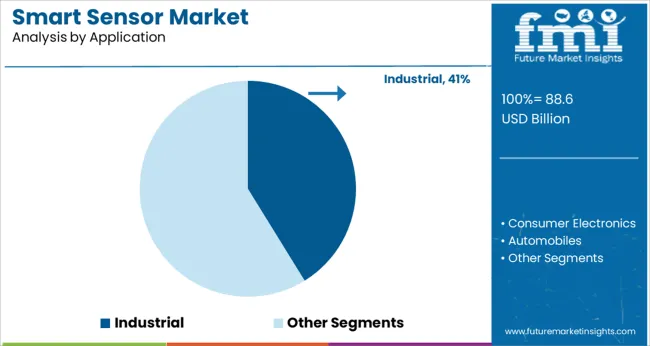

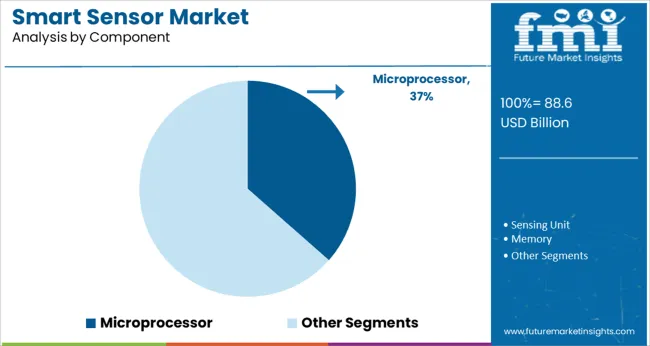

Moving forward, the market is expected to grow as industries adopt smarter solutions for efficiency and sustainability. Segmental growth is expected to be led by Smart Temperature Sensors as the key type, Industrial applications, and Microprocessor components powering sensor functionality.

The market is segmented by Type, Application, Component, and Vertical and region. By Type, the market is divided into Smart Temperature Sensor, Touch Sensors, Flow Sensors, Smart Position Sensor, and Turbidity Sensor. In terms of Application, the market is classified into Industrial, Consumer Electronics, Automobiles, Medical, Avionics, and Food and Beverages. Based on Component, the market is segmented into Microprocessor, Sensing Unit, Memory, Communication Module (RFID, Transceiver), Battery, and Others (Analog to Digital Converter, Amplifiers etc.). By Vertical, the market is divided into Industrial Application, Transportation, Consumer Electronics, Healthcare, Avionics & Defence, Oil & Gas, Energy & Utility, and Environment & Geotechnics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Type, Application, Component, and Vertical and region. By Type, the market is divided into Smart Temperature Sensor, Touch Sensors, Flow Sensors, Smart Position Sensor, and Turbidity Sensor. In terms of Application, the market is classified into Industrial, Consumer Electronics, Automobiles, Medical, Avionics, and Food and Beverages. Based on Component, the market is segmented into Microprocessor, Sensing Unit, Memory, Communication Module (RFID, Transceiver), Battery, and Others (Analog to Digital Converter, Amplifiers etc.). By Vertical, the market is divided into Industrial Application, Transportation, Consumer Electronics, Healthcare, Avionics & Defence, Oil & Gas, Energy & Utility, and Environment & Geotechnics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Smart Temperature Sensor segment is projected to contribute 33.8% of the smart sensor market revenue in 2025, positioning it as the leading type segment. Temperature monitoring is essential across various industrial processes to ensure optimal operation and prevent equipment failure. Smart temperature sensors offer precise readings, durability, and the ability to communicate data wirelessly to control systems.

This has driven their widespread adoption in manufacturing plants, energy production, and chemical processing. The segment benefits from continuous improvements in sensor accuracy, response time, and integration with IoT platforms.

As industries increasingly rely on automated systems, demand for reliable temperature sensing solutions is expected to remain high, supporting the segment’s growth.

The Industrial application segment is anticipated to hold 41.2% of the smart sensor market revenue in 2025, maintaining its dominance among application areas. Industrial environments require sensors that can withstand harsh conditions while delivering accurate data for process control and safety. Smart sensors in industries such as manufacturing, oil and gas, and energy have become critical for monitoring variables like temperature, pressure, and humidity.

The growing trend toward digital factories and predictive maintenance has increased the integration of smart sensors to enhance operational efficiency and reduce unplanned downtime. Investments in upgrading industrial infrastructure and automation have further driven demand.

The Industrial segment is expected to continue leading due to ongoing modernization and the need for advanced sensing solutions.

The Microprocessor component segment is projected to represent 36.5% of the smart sensor market revenue in 2025, establishing itself as the dominant component category. Microprocessors enable smart sensors to process data, execute algorithms, and communicate with external systems, making them integral to sensor functionality.

Improvements in microprocessor performance and power efficiency have allowed smart sensors to become smaller and more capable. This has expanded their applicability across industries requiring real-time analytics and adaptive control.

The ongoing development of low-power microprocessors compatible with wireless communication protocols has supported the growth of connected sensor networks. As sensor intelligence becomes increasingly important in automation and IoT ecosystems, the Microprocessor segment is expected to sustain its leading market position.

Rapid digitalization, rising security and surveillance concerns, surging demand for consumer electronics, exponential growth of end use verticals and growing trend of miniaturization are some of the major factors driving the smart sensor market.

Smart sensors have become the heart of modern technology in the contemporary world. They have gained immense traction across industries such as consumer electronics and automotive. Right from autobraking and blind spot detection in vehicles to navigation systems in smartphones, smart sensors have become talk of the town.

They are being increasingly adopted in automated vehicles, wearables, lighting systems, security systems, medical devices etc. for monitoring and diagnostic purposes. Smart sensors have the ability to detect switch failures, open coils and sensor contamination. Increasing penetration of automation across industries will continue to spur the sales of smart sensors in the future.

Governments across the world are investing large amounts in smart technologies for developing smart cities as well as for addressing environmental challenges. Moreover, growing trend of smart homes is anticipated to provide a strong push to the growth of smart sensors market. These devices are being extensively employed in automatic doors, smoke and fire detectors, and security systems.

Similarly widespread adoption of smart sensors in wearable devices and growing demand for smart temperature sensors in numerous applications will generate lucrative opportunities for the market players during the forecast period.

Despite exceptional growth of smart sensors market, there are various factors that are acting as impediments for the market growth. Some of these factors are lack of privacy, high replacement rates and deployment cost, complex structure, and lack of customization.

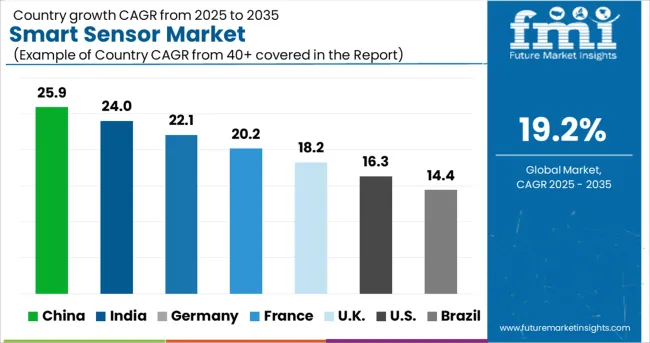

Asia Pacific spearheaded by China and India, is forecast to emerge as the most lucrative market for smart sensors, owing to rapid industrialization, presence of leading consumer electronics manufacturers, strong economic development and growing adoption of smart sensors in defense and automotive industries.

Over the last few years China become a global leader in the production and consumption of electronic products. In fact, the industry (electronics) forms a key pillar of the country’s economy. Electronics manufacturers across the country are increasingly adopting smart sensors in majority of advanced products.

Similarly, rapid growth of end use industries across India is creating opportunities for the manufacturers of smart sensors. The country is witnessing enormous demand for smart electronic products such as smartphones, wearables, motion detectors, security alarms etc.

Moreover, robust expansion of residential sector due to rapid urbanization and increasing populations will continue to support the growth of smart sensors market in Asia Pacific region during the forecast period.

According to Future Market Insights, Western Europe dominated the global smart sensor market in 2025, owing to increasing penetration of automation, rising demand for electronic devices with advanced features and the rapid adoption of smart sensors in a multitude of applications.

USA such as Germany and the United Kingdom are experiencing huge demand for smart sensors due to increasing production and sales of consumer electronics. These sensors are being increasingly integrated into fire detection systems, security alarm systems, autonomous vehicles, wearables, and several other motion monitoring and diagnostic appliances.

Majority of factories across Western Europe use smart temperature sensors to monitor the overheating of machines and equipment. This helps them to protect their assets from any damage. Rising sales of these smart temperature sensors is one of the major forces triggering the growth in the Western Europe market.

Some of the key participants present in the global smart sensor market include ABB LTD., Analog Devices Inc., Customer Sensor & Technologies Inc., Eaton Corporation Plc., NXP Semiconductors, Honeywell International, Inc., Infineon Technologies AG, Emerson Process Management.

These prominent players are investing vigorously in research and development activities for launching new innovative products with efficient features. Moreover, they are using various strategies such as price reduction acquisitions, new facility establishments, partnerships, and collaborations to penetrate attractive markets.

| Report Attributes | Details |

|---|---|

| Growth Rate | CAGR of 19.2% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Type, Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | ABB LTD;Analog Devices Inc.; Customer Sensor & Technologies Inc.; Eaton Corporation Plc.; NXP Semiconductors; Honeywell International, Inc.; Infineon Technologies AG; Emerson Process Management |

| Customization | Available Upon Request |

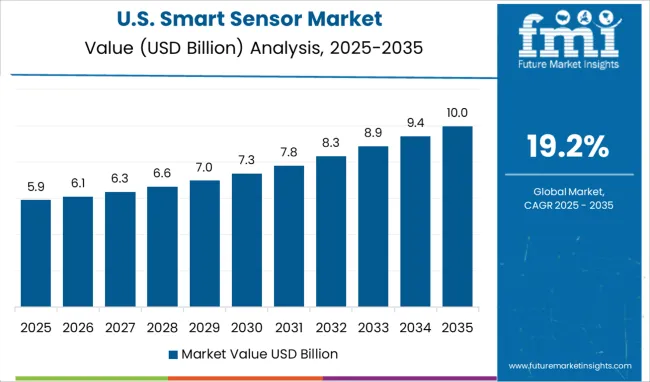

The global smart sensor market is estimated to be valued at USD 88.6 billion in 2025.

It is projected to reach USD 512.9 billion by 2035.

The market is expected to grow at a 19.2% CAGR between 2025 and 2035.

The key product types are smart temperature sensor, touch sensors, flow sensors, smart position sensor and turbidity sensor.

industrial segment is expected to dominate with a 41.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Grid Sensors Market

Smart Vision Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Home Water Sensors & Controllers Market Trends & Forecast 2025 to 2035

Smart Medication Adherence Sensors Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA