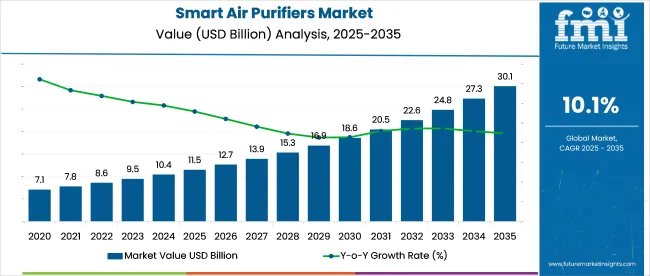

The smart air purifiers market is projected to grow from USD 11.5 billion in 2025 to USD 30.6 billion by 2035, advancing at a CAGR of 10.1%. Growth is being driven less by one-time purchases and more by the shift toward filter-replacement ecosystems and multi-room integration.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 11.5 billion |

| Forecast Value (2035) | USD 30.6 billion |

| CAGR (2025 to 2035) | 10.1% |

Volume is expected to concentrate in China, India, and ASEAN cities where demand is tied to particulate exposure and limited HVAC infrastructure. Manufacturers are reallocating R&D toward adaptive sensor calibration and cross-platform integration. Margins are being defended through filter subscription bundling, while procurement teams are favoring contract manufacturers in Vietnam to hedge labor volatility in southern China.

In May 2025, Blueair’s Classic Pro CP7i and CP9i air purifiers earned the Asthma & Allergy Friendly® Certification from Allergy Standards Ltd (ASL), confirming their compliance with strict global standards for allergen reduction and indoor air quality. This certification signifies that the units underwent extensive laboratory testing to verify performance against airborne irritants, making them suitable for individuals with asthma and allergies.

Recognized across key industries including the UK, China, Germany, and Japan, the certification supports Blueair’s commitment to health-focused air purification. It reinforces consumer trust in the Classic Pro series as scientifically validated solutions for respiratory-sensitive environments.

The smart air purifiers market accounts for approximately 9% of the total air purifiers market. Within the indoor air quality solutions segment, it holds a larger share of around 25%, due to its focus on air filtration and automation.

In the broader home automation and smart home devices industry, its share remains near 4%, as the category competes with lighting, security, and climate control systems. Compared to the global consumer electronics market, its contribution is under 0.5%. Within the HVAC and ventilation equipment market, smart air purifiers represent about 1%, showing their specialized application within integrated air quality systems.

Leading manufacturers are integrating technologies like IoT, AI, and real-time sensing to offer features such as remote monitoring, automatic air quality adjustments, and mobile app control. These smart capabilities enhance user convenience, energy efficiency, and health outcomes. As demand for clean air grows globally, companies are investing in intelligent air purification systems that combine performance with smart connectivity for modern living environments.

The global trade of smart air purifiers is expanding rapidly, driven by rising urban air pollution, increased awareness of respiratory health, and growing demand for connected home appliances. As consumers prioritize indoor air quality, international markets are seeing strong growth in both exports and imports of smart air purification systems equipped with IoT features and AI-powered sensors.

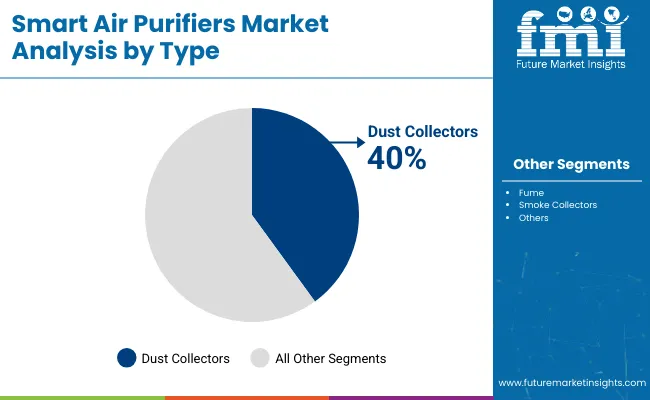

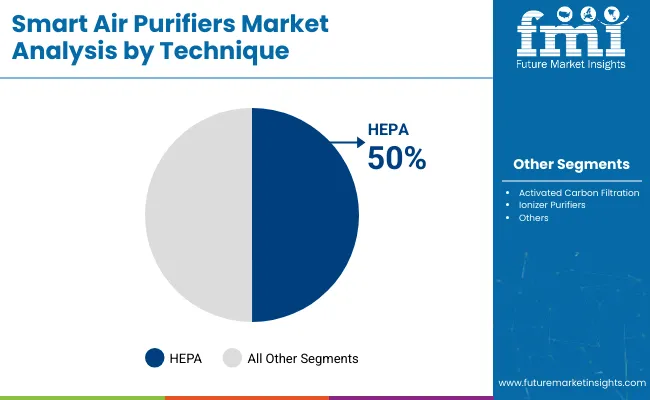

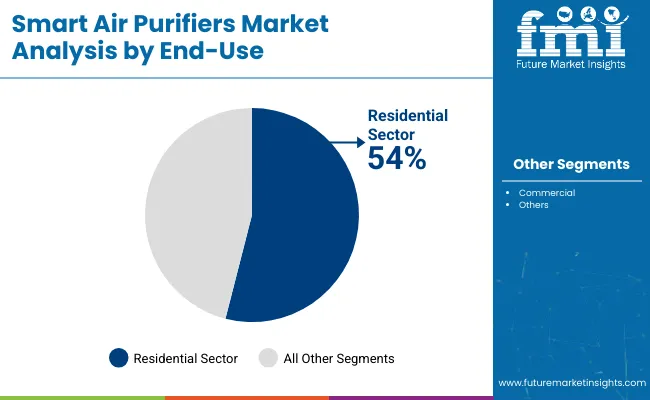

The industry is experiencing significant growth, driven by concerns over air quality and the increasing adoption of advanced filtration technologies. Regions like North America, Europe, and the Asia Pacific are witnessing robust demand. Technological innovations such as HEPA filtration and dust collectors are contributing to industry expansion. Residential and commercial sectors are both increasing their adoption of these solutions, with preferences shifting toward more efficient air purification options.

The dust collectors segment is expected to hold a 40% share by 2025. These devices are increasingly adopted in industrial sectors like manufacturing, construction, and mining, where air quality control is critical for both worker safety and compliance with environmental regulations.

Companies such as 3M and Honeywell are leading with advanced dust collection systems, ensuring efficiency and safety in these sectors. The demand for these solutions is expected to grow as industrialization expands in emerging economies, especially in Asia and Africa. Dust collectors are crucial for meeting safety standards, preventing health hazards, and maintaining productivity.

HEPA filtration is expected to hold 50% of the industry share by 2025, due to its unparalleled efficiency in removing airborne particles such as dust, allergens, and harmful microorganisms. Dyson and IQAir are leading the way with products that utilize HEPA filters, which are especially beneficial in homes with pets, smokers, or individuals with respiratory issues.

The growing awareness of the importance of indoor air quality is fueling demand for HEPA-based air purifiers in both residential and commercial settings. This segment is expected to continue growing as consumers seek healthier indoor environments, especially in regions with high pollution.

The residential sector is expected to account for 54% of the market share by 2025, driven by growing awareness of the harmful effects of poor indoor air quality. Consumers are increasingly investing in air purifiers to ensure a cleaner and healthier living environment.

Brands like Philips and Xiaomi offer energy-efficient, compact models designed for homes, with smart features such as app integration and real-time air quality monitoring. The demand is particularly strong in urban areas, where pollution levels are higher. As more consumers recognize the importance of indoor air quality, the adoption of smart air purifiers in homes is projected to grow steadily.

The industry is influenced by a combination of drivers and challenges. The increasing need for clean indoor air, paired with technological advancements, has spurred demand for smart air purifiers. However, high costs and complex features pose challenges to broader adoption. Despite these obstacles, innovations in connectivity and real-time monitoring are expected to drive continued industry growth.

Increasing concerns about air quality, particularly in densely populated regions, have propelled the demand for air purifiers. Technological developments, including real-time monitoring and app integration, have made it easier for consumers to track and improve air quality in their homes. As more people become aware of the health risks posed by poor indoor air, the adoption of this purifiers has expanded. These devices are increasingly seen as a necessary tool for improving well-being and creating healthier living environments.

Despite strong demand, several challenges hinder the growth of the industry. High initial costs make these devices inaccessible to price-sensitive consumers, limiting their adoption. Moreover, the complexity of advanced features, such as real-time air quality monitoring and app integration, can be overwhelming for less tech-savvy users. The industry is highly fragmented, with numerous competing brands, making it difficult for new entrants to differentiate and secure industry share amidst pricing pressures and intense competition.

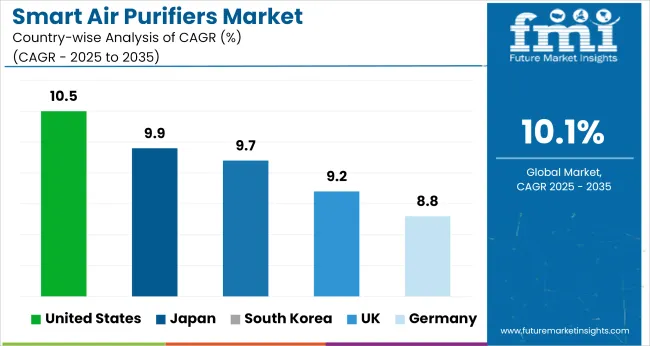

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 10.5% |

| UK | 9.2% |

| South Korea | 9.7% |

| Japan | 9.9% |

| Germany | 8.8% |

Global demand for smart air purifiers is projected to rise at a 10.1% CAGR between 2025 and 2035. The United States leads among OECD markets with 10.5%, surpassing the global benchmark due to increased penetration in high-income households and HVAC-integrated filtration in new residential construction. Japan follows closely at 9.9%, supported by high-density living conditions, aging population segments, and integration of air quality sensors in compact units for homes and clinics.

South Korea records 9.7%, driven by public-private initiatives around school air quality and rapid product refresh cycles from domestic brands. The United Kingdom, at 9.2%, reflects rising demand in hybrid workspaces and allergen-sensitive households, yet regulatory lag in indoor air quality standards has capped faster growth. Germany, at 8.8%, trails its OECD peers by 1.3 percentage points.

The smart air purifiers market in the United States is expected to expand at a CAGR of 10.5% from 2025 to 2035. This growth is driven by increasing concerns about indoor air quality and the rising demand for filtration solutions due to high levels of air pollution in densely populated areas.

The USA Environmental Protection Agency (EPA) has implemented the Clean Air Act to regulate air quality standards. The government has also provided grants for air quality improvement programs and supported initiatives like the Air Quality Index (AQI), which informs the public about pollution levels. The government has pushed for air quality improvement measures through stricter regulations on greater public awareness campaigns.

The UK market for smart air purifiers is anticipated to grow at a CAGR of 9.2% from 2025 to 2035. The demand is primarily driven by increasing awareness of air pollution and its impact on health, especially in major cities. Consumers are increasingly seeking high-performance air purifiers equipped with advanced filters and smart technology.

The UK government has adopted policies under the Clean Growth Strategy to reduce emissions and improve air quality. The Air Quality (England) Regulations 2000 sets strict standards for pollutants such as nitrogen dioxide (NO2) and particulate matter (PM10). The Environment Bill aims to address air quality, reduce emissions and strengthen air quality monitoring.

In South Korea, the demand for smart air purifiers is growing at a CAGR of 9.7% from 2025 to 2035. The demand is largely driven by concerns about fine dust pollution, particularly from neighboring regions. With rising health concerns related to respiratory issues, South Korean consumers are increasingly investing in air purifiers with advanced filtration technologies.

South Korea's government has implemented various initiatives, such as the Fine Dust Management Act, aimed at reducing fine dust pollution. The Clean Air Conservation Act focuses on air quality improvement through stricter emission standards for industries and vehicles. The government has also introduced subsidies and incentives for consumers and businesses to adopt air purifiers and reduce indoor air pollution.

Sales for smart air purifiersare projected to expand at a CAGR of 9.9% from 2025 to 2035. The growth in Japan is supported by heightened awareness of indoor air quality and the demand for air purifiers that offer advanced filtration. Japan's market is driven less by external pollution and more by domestic factors such as health and wellness trends.

Consumers are increasingly seeking air purifiers with smart features, including real-time monitoring and remote control. The government has implemented the Air Pollution Control Law, which sets emissions standards for industries and vehicles. The Clean Air Act focuses on improving air quality in urban and industrial regions.

Demand for smart air purifiers is expanding at a CAGR of 8.8% from 2025 to 2035. Growth is driven by increasing awareness of the health risks posed by poor air quality, alongside stricter environmental regulations. The industry is characterized by a strong preference for high-efficiency filtration systems, especially HEPA-based purifiers. Germany’s government follows the German Clean Air Act, which enforces strict limits on air pollution levels in cities and industrial areas.

The Federal Environment Agency monitors air quality and enforces regulations to reduce particulate matter and nitrogen oxide levels. the Energy Efficiency Act promotes the use of energy-efficient technologies, which has led to increased adoption of energy-efficient air purifiers in homes and businesses.

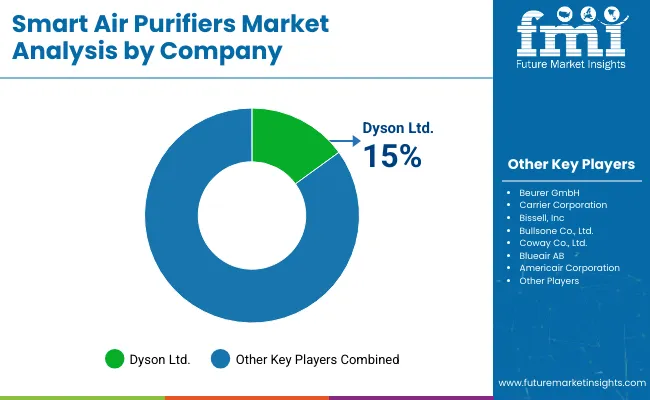

The global smart air purifier market features a layered competitive structure comprising dominant, key, and emerging players. Dominant companies such as Dyson Ltd., Honeywell International Inc., and Coway Co., Ltd. lead with broad product portfolios, advanced R&D capabilities, and extensive distribution networks across residential, commercial, and industrial sectors.

Key players like Blueair AB (Unilever), Xiaomi Corporation, and LG Electronics Inc. focus on application-specific solutions and regionally adapted models, with strong traction in Asia and Europe. Emerging players including Levoit (Vesync Co., Ltd.), Americair Corporation, and Sharp Corporation, are gaining ground through affordable, technology-driven models featuring AI-enabled air quality monitoring and modular filter systems, primarily targeting value-conscious consumers.

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 11.5 billion |

| Projected Industry Size (2035) | USD 30.6 billion |

| CAGR (2025 to 2035) | 10.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Types Analyzed (Segment 1) | Dust Collectors, Fume & Smoke Collectors, Others |

| Techniques Analyzed (Segment 2) | High-Efficiency Particulate Air (HEPA), Activated Carbon Filtration, Ionizer Purifiers, Others |

| End Uses Analyzed (Segment 3) | Residential, Commercial, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Beurer GmbH, Carrier Corporation, Bissell, Inc, Bullsone Co., Ltd., Coway Co., Ltd., Blueair AB, Americair Corporation, Breville Pty., Ltd., Arovast Corporation (Levoit), Awair Inc, Beijing Hike IoT Technology Co., Ltd. |

| Additional Attributes | Dollar sales, share by technique and end use, HEPA and IoT -based purifier integration trends, regional demand in urban households, real-time air quality data adoption across commercial spaces |

The segmentation is intodust collectors, fume & smoke collectors, and others.

Key segmentation is into high-efficiency particulate air (HEPA), activated carbon filtration, ionizer purifiers, and others.

The segmentation is into residential, commercial, and others.

The segmentation is into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The industry is projected to reach USD 11.5 billion in 2025.

The industry is expected to grow at a CAGR of 10.1% from 2025 to 2035.

HEPA filtration is expected to capture a 50% of the industry share in 2025.

The Asia Pacific region, especially China and India, is projected to show the highest growth from 2025 to 2035.

The industry is projected to reach USD 30.6 billion by 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA