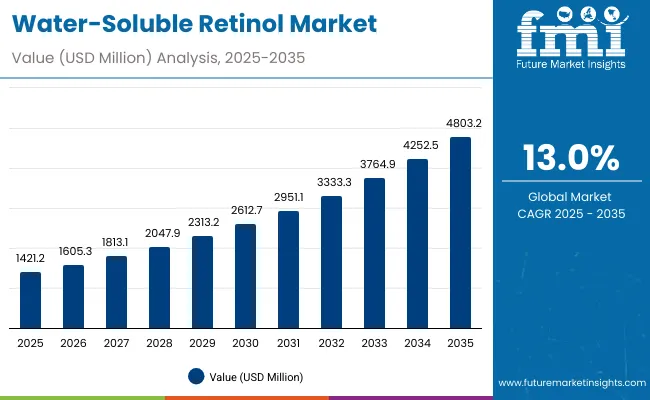

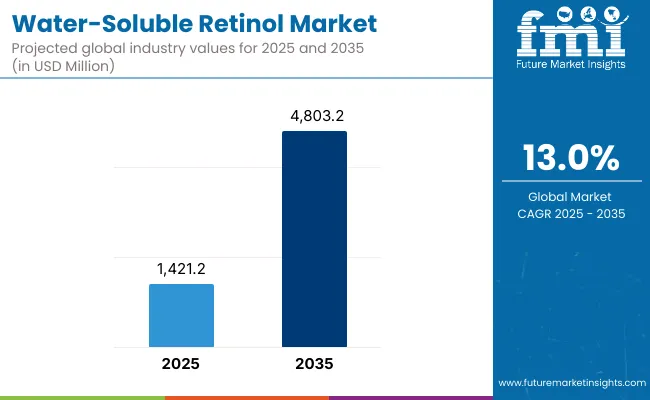

The Water-Soluble Retinol Market is expected to record a valuation of USD 1,421.2 million in 2025 and USD 4,803.2 million in 2035, with an increase of USD 3,382 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 13.0% and more than a 2X increase in market size.

Water-Soluble Retinol Market Key Takeaways

| Metric | Value |

|---|---|

| Water-Soluble Retinol Market Estimated Value in (2025E) | USD 1,421.2 million |

| Water-Soluble Retinol Market Forecast Value in (2035F) | USD 4,803.2 million |

| Forecast CAGR (2025 to 2035) | 13.0% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,421.2 million to USD 2,612.7 million, adding USD 1,191.5 million, which accounts for 35.2% of the total decade growth. This phase reflects steady consumer adoption of retinol-based products for anti-aging and brightening benefits, with serums capturing nearly half of the segment demand. Pharmacies remain a dominant channel, though e-commerce begins to accelerate penetration.

The second half from 2030 to 2035 contributes USD 2,190.5 million, equal to 64.8% of total growth, as the market jumps from USD 2,612.7 million to USD 4,803.2 million. This acceleration is powered by clinical-grade formulations, dermatological endorsements, and rapid e-commerce distribution. Consumer preference for water-soluble retinol serums and creams drives higher repeat purchases, while clean-label and vegan claims attract younger demographics. By 2035, these factors ensure sustained double-digit expansion across both developed and emerging markets.

From 2020 to 2024, the Water-Soluble Retinol Market expanded steadily, supported by increased dermatological recommendations and consumer demand for anti-aging and skin-brightening solutions. Competitive advantage during this period centered on serum-based formulations, with leading brands focusing on product stability and improved delivery systems. Service-based skin clinics played a smaller role, contributing less than 10% of total revenues.

Demand for Water-Soluble Retinol is projected to accelerate in 2025, with the revenue mix shifting toward clinical-grade, dermatologist-tested, and clean-label formulations. Established players face rising competition from digital-first skincare brands leveraging direct-to-consumer e-commerce, AR/VR skin analysis, and subscription-based personalized skincare models. Differentiation is moving beyond product innovation toward ecosystem strength, omni-channel accessibility, and recurring customer engagement.

Water-soluble retinol offers higher stability and reduced irritation compared to traditional retinol, making it suitable for sensitive skin types. This attribute has expanded its use across anti-aging, brightening, and acne-treatment products, widening consumer adoption. Brands are leveraging this advantage to launch multifunctional formulations, particularly in serums and creams, accelerating uptake across both premium and mass-market skincare segments globally.

Clinical validation and dermatologist endorsements are propelling consumer trust in water-soluble retinol. Unlike conventional retinol, its enhanced solubility ensures improved absorption and consistent efficacy, aligning with the demand for clinical-grade, science-backed skincare. As consumers increasingly prioritize proven outcomes, brands emphasizing dermatologist-tested and clinical-grade positioning are capturing significant market share, particularly in pharmacies and professional clinic distribution channels, driving long-term category growth.

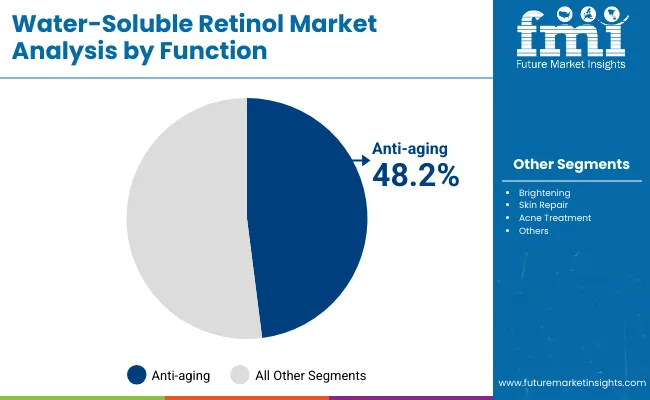

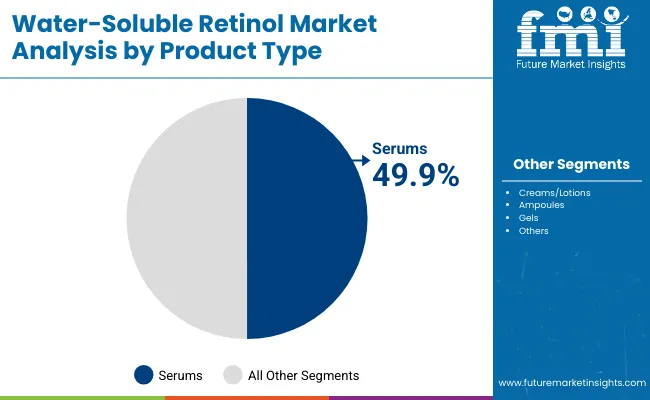

The Water-Soluble Retinol Market is segmented by function, product type, channel, claim, and geography, reflecting its diverse adoption patterns. By function, key categories include anti-aging, brightening, skin repair, and acne treatment, with anti-aging leading in 2025 as the primary application area. Product types span serums, creams/lotions, ampoules, and gels, with serums and creams holding nearly equal shares due to their versatility and consumer preference for concentrated actives.

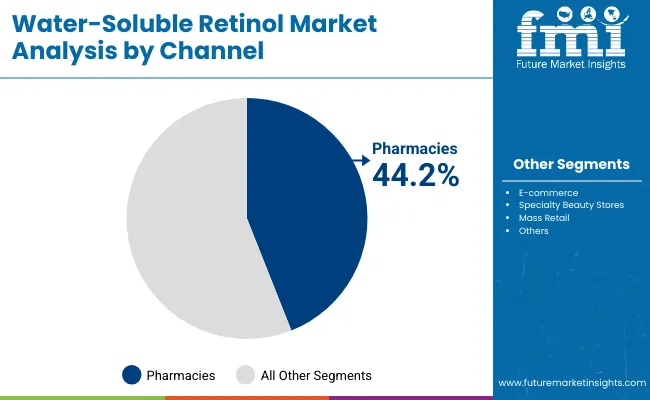

Distribution channels include pharmacies, e-commerce, specialty beauty stores, and mass retail, where pharmacies dominate through clinical-grade positioning, while e-commerce rapidly expands via subscription models and influencer-led promotions. Claims include clinical-grade, dermatologist-tested, vegan, and clean-label, each shaping product positioning and consumer trust.

Regionally, the market covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with China and India emerging as the fastest-growing markets, while the USA , Germany, Japan, and the UK remain strong contributors with stable demand for dermatologist-tested and clean-label formulations.

| Function | Value Share % 2025 |

|---|---|

| Anti-aging | 48.2% |

| Others | 51.8% |

The anti-aging segment is projected to contribute 48.2% of the Water-Soluble Retinol Market revenue in 2025, making it the leading functional category. This dominance is supported by rising consumer demand for wrinkle reduction, skin firming, and preventative skincare solutions that are both effective and less irritating than traditional retinol. The segment’s momentum is further reinforced by dermatologist endorsements and the popularity of clinical-grade formulations in pharmacies and specialty clinics.

Additionally, the growing availability of anti-aging serums and creams with improved stability and enhanced delivery systems is expanding access across both premium and mass-market segments. With middle-aged and younger demographics increasingly seeking preventative skincare, anti-aging applications are expected to remain the backbone of the Water-Soluble Retinol Market over the next decade.

| Product Type | Value Share % 2025 |

|---|---|

| Serums | 49.9% |

| Others | 50.1% |

The serums segment is forecasted to hold 49.9% of the Water-Soluble Retinol Market share in 2025, emerging as the leading product type. Serums are favored for their high concentration of active ingredients, fast absorption, and suitability for layering in skincare routines. These attributes make them particularly effective for delivering water-soluble retinol benefits such as anti-aging, brightening, and skin repair.

The segment’s rise is also driven by innovation in lipid encapsulation and stabilized formulations, which enhance potency while reducing irritation risks. Their lightweight texture and compatibility with other actives have made them a staple in both clinical-grade offerings and mass-market beauty lines. With growing consumer demand for visible results and dermatologist-tested products, serums are expected to remain the most influential product category through the forecast period.

| Channel | Value Share % 2025 |

|---|---|

| Pharmacies | 44.2% |

| Others | 55.8% |

The pharmacy channel is projected to account for 44.2% of the Water-Soluble Retinol Market revenue in 2025, making it a critical distribution avenue. Pharmacies continue to be favored by consumers seeking clinical-grade and dermatologist-tested formulations, reflecting a strong association with safety, efficacy, and trust in science-backed skincare. Their positioning as accessible yet authoritative retail outlets has secured consistent demand from both middle-aged and younger demographics.

The segment’s growth is also supported by professional recommendations, in-store consultations, and increasing partnerships between skincare brands and pharmacy chains. While e-commerce is rapidly scaling, pharmacies remain a cornerstone for credibility and convenience, especially for high-value anti-aging and brightening products. This ensures their continued importance as a trusted channel for water-soluble retinol adoption across developed and emerging markets alike.

Rising Preference for Gentler, High-Efficacy Retinol

Consumers are increasingly drawn to water-soluble retinol because it offers similar anti-aging and brightening benefits as traditional retinol but with reduced irritation. Its improved stability and compatibility with sensitive skin make it suitable for a broader demographic, including first-time retinol users. This quality has encouraged dermatologists to recommend it more often, reinforcing consumer trust. Combined with advancements in lipid encapsulation that enhance absorption, this driver ensures strong adoption across both clinical-grade and mainstream skincare markets worldwide.

Expanding Clinical-Grade and Pharmacy-Based Offerings

Pharmacies have become a pivotal distribution channel for water-soluble retinol, accounting for a significant share due to strong demand for dermatologist-tested products. Clinical validation and evidence-backed claims position these formulations as premium yet accessible, appealing to consumers who prioritize safety and proven efficacy. With pharmaceutical companies collaborating with beauty brands, clinical-grade water-soluble retinol is moving into the mainstream. This driver reinforces the segment’s credibility, fueling adoption in both mature markets like the USA and high-growth regions such as Asia-Pacific.

High Costs and Stability Challenges

Despite its benefits, water-soluble retinol formulations face cost and stability constraints that limit wider adoption. Advanced encapsulation technologies, required to maintain product efficacy and extend shelf life, raise production costs. This often pushes retail prices higher, restricting affordability in mass-market channels. Additionally, ensuring consistent potency during storage and distribution remains technically challenging. These issues create barriers for smaller brands to compete and may slow expansion in price-sensitive regions where traditional retinol products remain the more affordable alternative.

Surge in Clean-Label and Vegan Retinol Formulations

The growing consumer shift toward clean-label and vegan skincare is shaping innovation in water-soluble retinol products. Brands are launching formulations that exclude parabens, silicones, and synthetic additives while focusing on plant-derived lipid carriers. Younger demographics, especially Gen Z, are highly responsive to sustainable and ethical claims, creating momentum for cruelty-free and eco-conscious products. This trend is also being reinforced by e-commerce platforms and social media influencers, who amplify awareness of ingredient transparency, driving demand for vegan, clinical-grade, and multifunctional retinol solutions globally.

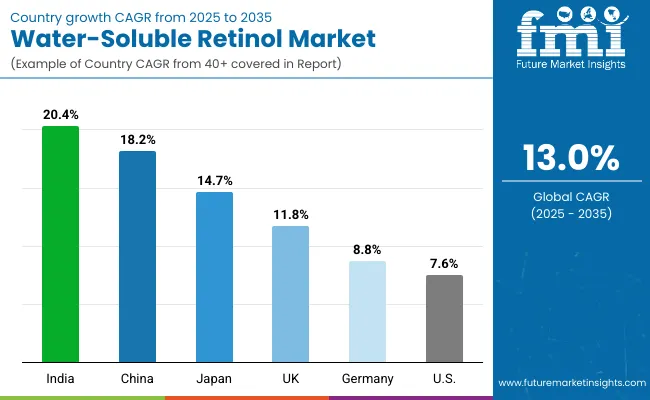

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 18.2% |

| USA | 7.6% |

| India | 20.4% |

| UK | 11.8% |

| Germany | 8.8% |

| Japan | 14.7% |

The global Water-Soluble Retinol Market shows strong regional variations in adoption, shaped by consumer demographics, clinical-grade demand, and distribution channel dynamics. Asia-Pacific emerges as the fastest-growing region, anchored by China with a CAGR of 18.2% and India with 20.4%. China’s momentum is driven by mass adoption of serums and creams through e-commerce platforms, combined with competitive pricing from domestic brands. India’s expansion reflects rising demand in tier-2 and tier-3 cities, supported by pharmacies and dermatology clinics promoting water-soluble, less-irritating retinol alternatives.

Europe maintains steady growth, led by the UK at 11.8% and Germany at 8.8%, supported by regulatory emphasis on dermatologist-tested and clean-label formulations. The UK market benefits from strong uptake in premium beauty, while Germany’s demand is reinforced by clinical-grade launches and high trust in pharmacy channels. Japan, with 14.7% CAGR, showcases strong adoption through multifunctional brightening and anti-aging products tailored to local beauty preferences.

North America shows moderate expansion, with the USA at 7.6% CAGR, reflecting a mature market where retinol penetration is already high. Growth is driven more by clean-label repositioning, vegan offerings, and digital-first D2C strategies than by entirely new adoption. Overall, Asia-Pacific is set to outpace Europe and North America, establishing itself as the dominant growth engine for water-soluble retinol over the next decade.

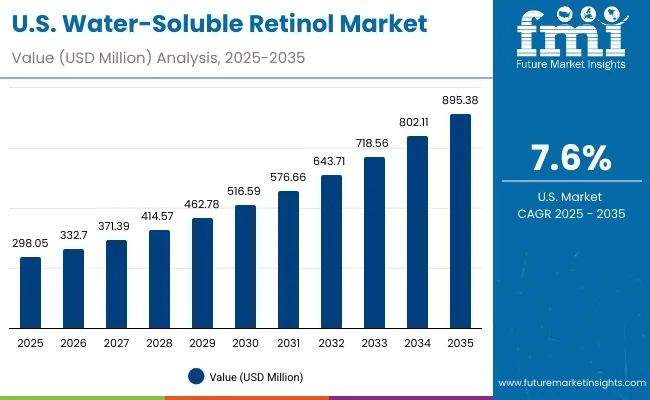

| Year | USA Water-Soluble Retinol Market |

|---|---|

| 2025 | 298.05 |

| 2026 | 332.70 |

| 2027 | 371.39 |

| 2028 | 414.57 |

| 2029 | 462.78 |

| 2030 | 516.59 |

| 2031 | 576.66 |

| 2032 | 643.71 |

| 2033 | 718.56 |

| 2034 | 802.11 |

| 2035 | 895.38 |

The Water-Soluble Retinol Market in the United States is projected to grow from USD 298.05 million in 2025 to USD 895.38 million by 2035, reflecting steady but moderate expansion at a CAGR of 7.6%. Growth is primarily supported by consumer trust in clinical-grade, dermatologist-tested formulations, making pharmacies a central channel. Anti-aging continues to dominate functional demand, with USA consumers particularly focused on wrinkle reduction and skin-firming benefits.

Adoption is also influenced by the rapid expansion of e-commerce platforms and direct-to-consumer beauty brands leveraging digital outreach. Clean-label and vegan claims are gaining traction, especially among younger demographics, while premium brands continue to hold strong in specialty beauty stores. The market is further shaped by the integration of water-soluble retinol into serums and advanced creams, positioned as effective yet gentler alternatives to traditional retinol.

The Water-Soluble Retinol Market in the United Kingdom is projected to expand at a CAGR of 11.8% from 2025 to 2035, supported by rising consumer demand for anti-aging, brightening, and skin repair solutions. The UK market benefits from a strong presence of premium skincare brands and high consumer awareness of dermatologist-tested and clinical-grade formulations. Pharmacies and specialty beauty stores continue to dominate sales, while e-commerce adoption is rising rapidly due to digital-first marketing strategies.

Heritage in the UK’s beauty industry also contributes to early adoption of clean-label and vegan water-soluble retinol products, which resonate strongly with health-conscious and sustainability-driven consumers. Additionally, partnerships between academic institutions, dermatologists, and beauty brands are fueling innovations in stable formulations and delivery systems. With middle-aged consumers seeking proven anti-aging solutions and younger demographics embracing preventative care, the UK market is positioned for consistent growth.

India is witnessing rapid growth in the Water-Soluble Retinol Market, forecast to expand at a CAGR of 20.4% through 2035, making it one of the fastest-growing markets globally. Rising middle-class income, urbanization, and heightened awareness of skincare benefits are fueling adoption across both metros and tier-2 cities. Pharmacies and dermatology clinics are becoming central to distribution, while e-commerce platforms expand reach through cost-effective launches tailored to local affordability.

The preference for anti-aging and brightening products is accelerating, particularly among younger consumers seeking preventative care. Educational initiatives and influencer-driven marketing are further normalizing retinol usage in daily routines. India’s demographic advantage, coupled with strong demand for clinical-grade yet affordable formulations, is positioning it as a growth engine for global players expanding into South Asia.

The Water-Soluble Retinol Market in China is expected to grow at a CAGR of 18.2% through 2035, the highest among leading economies. Growth is driven by e-commerce dominance, city-focused beauty trends, and competitive innovation from local brands. Affordable water-soluble retinol serums are widely accessible, making them popular among younger consumers who seek brightening and acne-treatment benefits alongside anti-aging.

Municipal emphasis on digital health and wellness ecosystems is fostering collaborations between beauty tech platforms and skincare brands. International players are also localizing products to align with Chinese consumer preferences for clinical-grade, clean-label, and multifunctional formulations. With high purchasing power among urban millennials and Gen Z, China is emerging as a global leader in scaling mass adoption of water-soluble retinol.

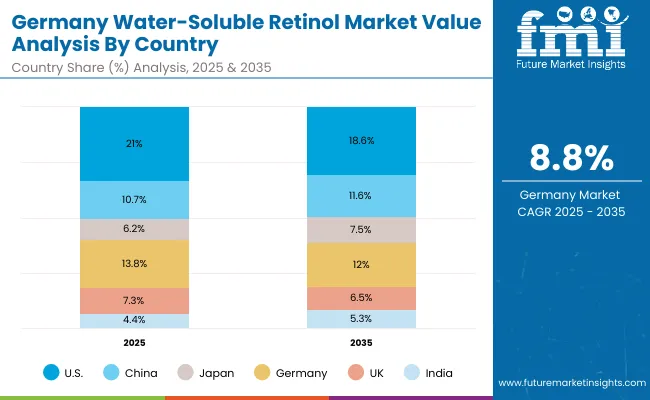

| Country | 2025 Share (%) |

|---|---|

| USA | 21.0% |

| China | 10.7% |

| Japan | 6.2% |

| Germany | 13.8% |

| UK | 7.3% |

| India | 4.4% |

| Country | 2035 Share (%) |

|---|---|

| USA | 18.6% |

| China | 11.6% |

| Japan | 7.5% |

| Germany | 12.0% |

| UK | 6.5% |

| India | 5.3% |

The Water-Soluble Retinol Market in Germany is projected to expand at a CAGR of 8.8% between 2025 and 2035, supported by strong consumer demand for dermatologist-tested and clinical-grade formulations. Germany’s skincare sector is highly regulated, with EU compliance standards reinforcing consumer trust in premium, science-backed solutions. Pharmacies remain the dominant distribution channel, accounting for a significant share, as German consumers associate pharmacies with reliability and safety in active skincare.

Anti-aging remains the primary function driving growth, particularly among older demographics, while brightening and skin-repair products are gaining traction among younger consumers. Clean-label and vegan claims resonate strongly in Germany, reflecting the market’s broader focus on sustainability and ingredient transparency. Domestic and international brands are leveraging this trend by expanding portfolios with eco-friendly formulations and recyclable packaging.

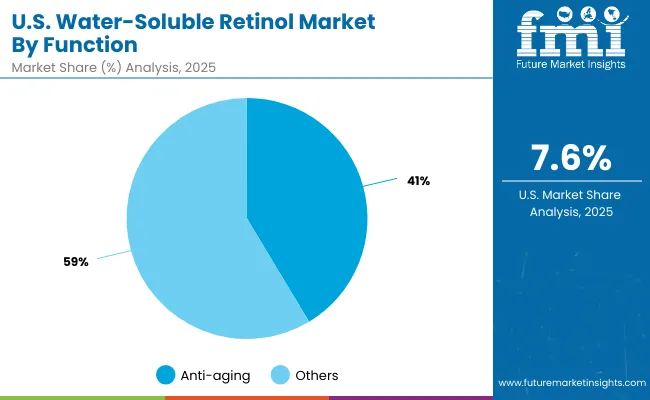

| USA By Function | Value Share % 2025 |

|---|---|

| Anti-aging | 41.4% |

| Others | 58.6% |

The Water-Soluble Retinol Market in the United States is projected to expand steadily, with anti-aging products accounting for 41.4% of the functional demand in 2025. This dominance reflects the mature consumer base’s focus on wrinkle reduction, skin-firming, and preventative care, especially among middle-aged and older demographics. Clinical-grade and dermatologist-tested formulations continue to build trust, while pharmacies remain a leading channel for purchase.

E-commerce platforms are further reshaping the USA market by enabling direct-to-consumer strategies and personalized product recommendations. Clean-label and vegan claims are strengthening adoption among younger consumers, while premium brands retain stronghold in specialty beauty stores. With growing emphasis on preventive skincare and functional efficacy, the anti-aging function will remain the most influential driver of water-soluble retinol adoption in the USA market.

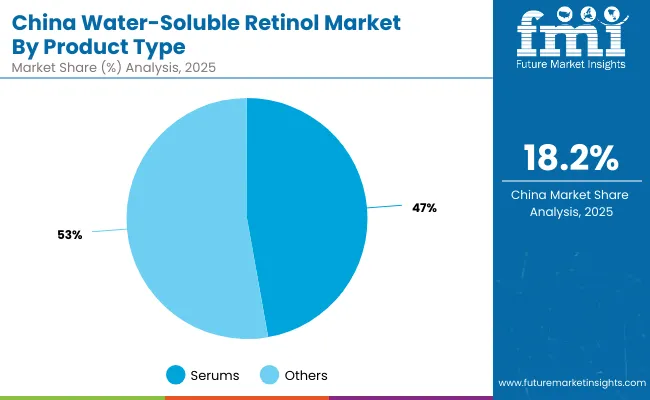

| China By Product Type | Value Share % 2025 |

|---|---|

| Serums | 47.2% |

| Others | 52.8% |

The Water-Soluble Retinol Market in China presents significant opportunities, with serums accounting for 47.2% of sales in 2025. Serums are widely favored by Chinese consumers due to their lightweight textures, faster absorption, and targeted delivery of active ingredients like retinol for anti-aging and brightening. This aligns well with the country’s strong consumer preference for multi-functional, science-backed skincare solutions.

The opportunity is further amplified by China’s rapidly growing e-commerce platforms such as Tmall and JD.com, which dominate beauty sales through digital-first strategies and influencer-led campaigns. Domestic brands are aggressively competing with global players by offering affordable, high-quality serums tailored to local needs. Additionally, the rising demand for clinical-grade, dermatologist-tested formulations opens new avenues for premium international brands to expand. This dynamic mix positions serums as a key growth lever for both global and regional players.

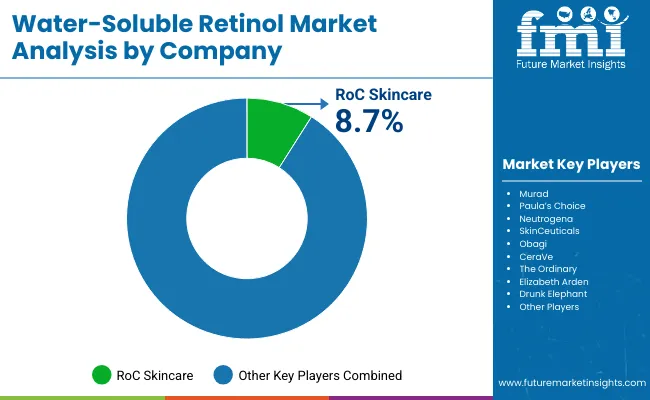

| Comapanies | Global Value Share 2025 |

|---|---|

| RoC Skincare | 8.7% |

| Others | 91.3% |

The Water-Soluble Retinol Market is moderately fragmented, with a mix of global leaders, premium innovators, and niche-focused specialists competing across functional segments such as anti-aging, brightening, and skin repair. RoC Skincare, with 8.7% global market share in 2025, leads by leveraging its strong clinical credibility and focus on dermatologist-tested, water-soluble formulations designed to minimize irritation while maintaining efficacy.

Premium brands such as Murad, Paula’s Choice, and SkinCeuticals are expanding their influence through clinical-grade launches and strong presence in both pharmacies and e-commerce platforms. Mid-sized players like The Ordinary and CeraVe focus on affordable, accessible solutions, which resonate strongly with younger demographics seeking preventative skincare. Niche specialists including Drunk Elephant and Elizabeth Arden emphasize clean-label and vegan claims, aligning with sustainability-driven consumer segments.

Competitive differentiation is moving away from basic retinol offerings toward stability-enhanced, multi-functional, and delivery-optimized formulations. Partnerships with dermatology clinics, digital-first campaigns, and subscription-based D2C models are strengthening customer loyalty. Players that can combine scientific credibility, affordability, and brand storytelling are positioned to lead in this highly competitive landscape.

Key Developments in Water-Soluble Retinol Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,421.2 Million |

| Function | Anti-aging, Brightening, Skin repair, Acne treatment |

| Product Type | Serums, Creams/lotions, Ampoules, Gels |

| Channel | Pharmacies, E-commerce, Specialty beauty stores, Mass retail |

| Claim | Clinical-grade, Dermatologist-tested, Vegan, Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | RoC Skincare, Murad, Paula’s Choice, Neutrogena, SkinCeuticals , Obagi , CeraVe , The Ordinary, Elizabeth Arden, Drunk Elephant |

| Additional Attributes | Dollar sales by function categories such as anti-aging, brightening, skin repair, and acne treatment, consumer adoption trends across serums, creams/lotions, ampoules, and gels, rising demand for dermatologist-tested and clean-label formulations, sector-specific growth in pharmacies, e-commerce, and specialty beauty stores, clinical-grade versus vegan claim revenue segmentation, integration with personalized skincare diagnostics and AI-driven product recommendation tools, regional trends shaped by regulatory approvals and clean beauty movements, and innovations in encapsulation, nano -delivery, and water-soluble stabilization technologies. |

The global Water-Soluble Retinol Market is estimated to be valued at USD 1,421.2 million in 2025.

The market size for the Water-Soluble Retinol Market is projected to reach USD 4,803.2 million by 2035.

The Water-Soluble Retinol Market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in the Water-Soluble Retinol Market are serums, creams/lotions, ampoules, and gels. These categories reflect the primary formulations through which water-soluble retinol is delivered in skincare applications.

In terms of distribution channels, pharmacies are expected to command a significant share in the Water-Soluble Retinol Market in 2025, reflecting consumer trust in clinical-grade and dermatologist-recommended products.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retinol Alternatives (Bakuchiol) Market Size and Share Forecast Outlook 2025 to 2035

Bioactive Retinol Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA