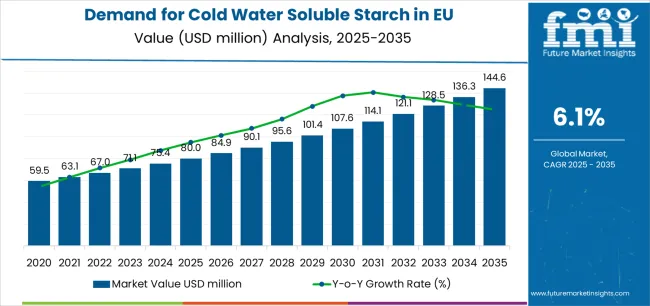

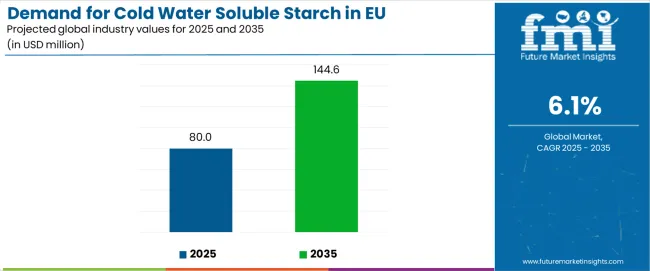

European Union cold water soluble starch sales are projected to grow from USD 80 million in 2025 to approximately USD 144.6 million by 2035, recording an absolute increase of USD 64.9 million over the forecast period. This translates into total growth of 81.1%, with demand forecast to expand at a compound annual growth rate (CAGR) of 6.1% between 2025 and 2035. The overall industry size is expected to grow by nearly 1.8X during the same period, supported by the increasing demand for clean-label ingredients, growing applications across food and industrial sectors, and expanding usage in pharmaceutical formulations throughout European manufacturing and processing channels.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 80 million |

| Market Forecast Value (2035) | USD 144.6 million |

| Forecast CAGR (2025-2035) | 6.1% |

Between 2025 and 2030, EU cold water soluble starch demand is projected to expand from USD 80 million to USD 107.7 million, resulting in a value increase of USD 27.7 million, which represents 42.7% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for functional ingredients in processed foods, increasing adoption of clean-label formulations across bakery and dairy applications, and growing recognition of cold water soluble starch as an efficient thickening and stabilizing agent across food manufacturing and industrial processing. Manufacturers are expanding their product portfolios to address the evolving preferences for natural ingredient solutions, improved processing efficiency, and functionally optimized formulations meeting European quality standards.

From 2030 to 2035, sales are forecast to grow from USD 107.7 million to USD 144.6 million, adding another USD 37.2 million, which constitutes 57.3% of the overall ten-year expansion. This period is expected to be characterized by further expansion of organic varieties, integration into pharmaceutical excipient applications for enhanced formulation performance, and development of specialized grades targeting specific industrial requirements. The growing emphasis on sustainable ingredient sourcing and increasing manufacturer willingness to invest in premium functional ingredients will drive demand for high-quality cold water soluble starch products that deliver consistent performance with clean-label positioning.

Between 2020 and 2025, EU cold water soluble starch sales experienced robust expansion at a CAGR of 6.1%, growing from USD 59.4 million to USD 80 million. This period was driven by increasing demand for natural thickeners among European food manufacturers, rising awareness of functional ingredient benefits in processed foods, and growing recognition of cold water soluble starch versatility across diverse applications. The industry developed as major ingredient suppliers and specialized starch producers recognized the commercial potential of instant-hydrating starch alternatives. Product innovations, improved processing technologies, and functional performance enhancements began establishing manufacturer confidence and mainstream acceptance of cold water soluble starch ingredients.

Industry expansion is being supported by the rapid increase in processed food manufacturing across European countries and the corresponding demand for efficient, cost-effective, and functionally reliable thickening agents with proven performance in instant applications requiring no heating. Modern food manufacturers rely on cold water soluble starch as a critical functional ingredient in instant puddings, ready-to-eat desserts, salad dressings, and dairy products, driving demand for ingredients that deliver consistent viscosity, excellent stability, and convenient processing without thermal treatment requirements. Even minor formulation challenges, such as texture inconsistency, phase separation, or processing inefficiency, can drive comprehensive adoption of cold water soluble starch to maintain optimal product quality and support cost-effective manufacturing.

The growing awareness of clean-label trends and increasing recognition of cold water soluble starch's natural positioning are driving demand for starch ingredients from certified suppliers with appropriate quality credentials and processing transparency. Regulatory authorities are increasingly establishing clear guidelines for modified starch labeling, functional ingredient standards, and quality requirements to maintain food safety and ensure product consistency. Scientific research studies and application testing are providing evidence supporting cold water soluble starch's functional benefits and processing advantages, requiring specialized modification methods and standardized production protocols for optimal hydration characteristics, appropriate viscosity profiles, and consistent performance across diverse pH ranges and processing conditions.

Sales are segmented by product type (form), application, distribution channel, nature, and country. By product type, demand is divided into granular, pregelatinized, and powder formats. Based on application, sales are categorized into food (including dairy, bakery, ready-to-eat/instant, snacks, and fillings), pharmaceutical, textile, and adhesive sectors. In terms of distribution channel, demand is segmented into direct B2B sales, distributor/importer networks, and online B2B platforms. By nature, sales are classified into organic and conventional. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

.webp)

The granular segment is projected to account for 40% of EU cold water soluble starch sales in 2025, expanding to 42% by 2035, establishing itself as the preferred format across European manufacturers. This commanding position is fundamentally supported by granular starch's superior handling characteristics, excellent dispersibility in cold water systems, and optimal particle size distribution enabling rapid hydration. The granular format delivers exceptional manufacturing appeal, providing food processors with an ingredient form that facilitates precise metering, minimizes dust generation, and ensures consistent batch-to-batch performance essential for quality control.

This segment benefits from mature production technology, well-established supply relationships, and extensive application expertise from multiple starch suppliers who maintain rigorous quality standards and continuous process optimization. Additionally, granular cold water soluble starch offers versatility across various applications, including instant desserts, salad dressings, soup mixes, and gravies, supported by proven modification technologies that address traditional challenges in hydration speed and viscosity development.

The granular segment is expected to grow its share from 40% to 42% through 2035, demonstrating strengthening positioning as manufacturers increasingly recognize granular format advantages in automated processing systems and precision dispensing equipment throughout the forecast period.

Key advantages:

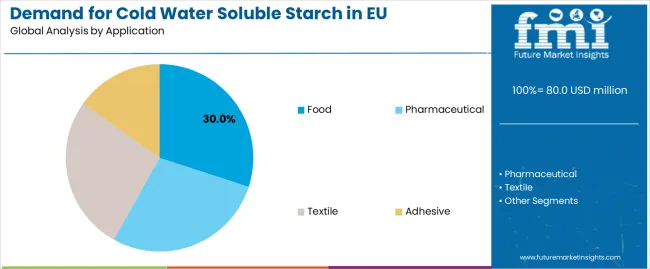

Food applications are positioned to represent 30% of total cold water soluble starch demand across European operations in 2025, declining slightly to 28% by 2035, reflecting the segment's maturity as a core application within the overall category. This substantial share directly demonstrates that food manufacturing represents the primary application, with processors utilizing cold water soluble starch for instant puddings, dairy desserts, salad dressings, bakery fillings, and ready-to-eat meal components requiring convenient preparation without cooking.

Modern food manufacturers increasingly view cold water soluble starch as an essential functional ingredient for product innovation, driving demand for grades optimized for specific pH ranges, appropriate viscosity profiles enabling desired texture, and stability characteristics that support extended shelf-life requirements. The segment benefits from continuous innovation focused on clean-label positioning, natural ingredient claims, and functional performance matching or exceeding conventional modified starches.

The segment's declining share reflects faster expansion in pharmaceutical and industrial applications, with food applications maintaining solid absolute growth while representing a smaller percentage of total demand throughout the forecast period.

Key drivers:

Direct B2B channels are strategically estimated to control 65% of total European cold water soluble starch sales in 2025, declining to 60% by 2035, reflecting the critical importance of direct manufacturer relationships for ensuring technical support and customized grade development. European ingredient buyers consistently demonstrate preference for direct supplier partnerships that deliver dedicated technical service, application development support, and reliable supply continuity across large-volume procurement contracts.

The segment provides essential value through direct technical consultation, customized product development, and quality assurance protocols supporting food safety requirements and regulatory compliance. Major cold water soluble starch suppliers, including Cargill, Roquette, AVEBE, and Ingredion, systematically invest in technical centers, application laboratories, and customer support infrastructure that strengthen direct relationships with food manufacturers, pharmaceutical companies, and industrial processors requiring specialized grades and expert formulation guidance.

The segment's declining share through 2035 reflects growing distributor sophistication and online B2B platform development, with direct sales maintaining dominant positioning while representing a smaller percentage as alternative channels expand throughout the forecast period.

Success factors:

Conventional cold water soluble starch products are strategically positioned to contribute 88% of total European sales in 2025, declining to approximately 82% by 2035, representing products produced through standard modification processes without organic certification requirements. These conventional products successfully deliver cost-effective functionality and consistent performance while ensuring broad commercial availability across all industrial sectors that prioritize volume scalability and price competitiveness over organic certification.

Conventional production serves cost-conscious manufacturers, mainstream food applications, and industrial users that require reliable functional ingredients at competitive price points without organic certification premiums. The segment derives significant competitive advantages from established raw material supply chains, economies of scale in production, and the ability to meet substantial volume requirements from major food processors and industrial users without organic certification constraints limiting sourcing flexibility.

The segment's declining share through 2035 reflects the category's evolution toward premium organic products, which grow from 12% in 2025 to 18% in 2035, as clean-label food manufacturers and premium product developers increasingly prioritize organic certification and natural ingredient sourcing.

Competitive advantages:

EU cold water soluble starch sales are advancing steadily due to increasing demand for convenience foods, growing clean-label ingredient preferences, and rising pharmaceutical excipient requirements. The industry faces challenges, including price competition from alternative thickeners such as gums and hydrocolloids, supply chain volatility affecting raw material costs, and technical performance limitations in certain high-temperature or extreme pH applications. Continued innovation in modification technologies and functional performance optimization remains central to industry development.

The rapidly accelerating development of pharmaceutical tablet formulations is fundamentally transforming cold water soluble starch from primarily food-grade ingredients to specialized excipients enabling improved drug delivery, enhanced tablet disintegration, and superior binding properties for modern pharmaceutical manufacturing. Advanced modification platforms featuring precise pregelatinization control and consistent particle characteristics allow pharmaceutical companies to create tablets with reliable disintegration profiles, excellent compressibility, and predictable drug release kinetics previously achievable only through synthetic excipients. These pharmaceutical innovations prove particularly transformative for generic drug manufacturers, over-the-counter medication producers, and nutraceutical formulators, where excipient functionality proves essential for regulatory approval and product performance.

Major cold water soluble starch suppliers invest heavily in pharmaceutical-grade production facilities, GMP certification, and regulatory documentation supporting drug master file submissions, recognizing that pharmaceutical applications represent high-value growth opportunities for specialized starch grades. Manufacturers collaborate with pharmaceutical companies, contract manufacturing organizations, and formulation scientists to develop validated excipient solutions that meet stringent quality specifications while maintaining cost-effectiveness supporting generic drug economics.

Modern food manufacturers systematically seek cold water soluble starch ingredients with clean-label declarations, including non-GMO verification, organic certification, and simple ingredient statements that align with consumer transparency expectations and retailer ingredient policies. Strategic integration of clean-label positioning enables starch suppliers to command premium pricing, differentiate products in competitive ingredient markets, and align with food industry trends toward natural ingredient formulations. These positioning improvements prove essential for premium food applications, as health-conscious brands demand ingredient solutions supporting front-of-pack claims, simple ingredient lists, and natural positioning resonating with contemporary consumers.

Companies implement extensive supply chain verification programs, organic certification across production facilities, and non-GMO identity preservation protocols targeting premium food manufacturers, including organic processors, natural product brands, and clean-label innovators. Manufacturers leverage clean-label positioning in marketing communications, technical documentation emphasizing natural modification methods, and certification transparency, positioning organic cold water soluble starch as premium alternatives delivering functional performance with consumer-preferred ingredient attributes.

European food manufacturers increasingly prioritize cold water soluble starch grades offering superior processing efficiency through rapid hydration, consistent viscosity development, and reduced processing time eliminating heating requirements and associated energy costs. This efficiency trend enables manufacturers to reduce capital equipment investment through simplified processing systems, lower energy consumption through ambient temperature processing, and improve production flexibility through reduced processing steps. Processing efficiency proves particularly important for instant food applications where manufacturing speed determines production capacity and cost competitiveness.

The development of advanced pregelatinization technologies, including drum drying improvements, spray drying innovations, and extrusion modifications, expands suppliers' abilities to create instant-hydrating starches delivering enhanced functional performance without compromising cost-effectiveness. Suppliers collaborate with food technologists, process engineers, and production managers to develop application-specific grades balancing hydration speed with viscosity stability, supporting efficient manufacturing while maintaining finished product quality across diverse food categories.

| Country | CAGR % (2025-2035) |

|---|---|

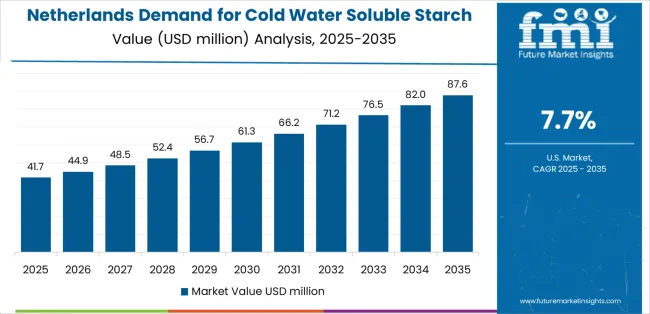

| Netherlands | 7.7% |

| France | 5.8% |

| Germany | 5.7% |

| Italy | 5.6% |

| Spain | 5.3% |

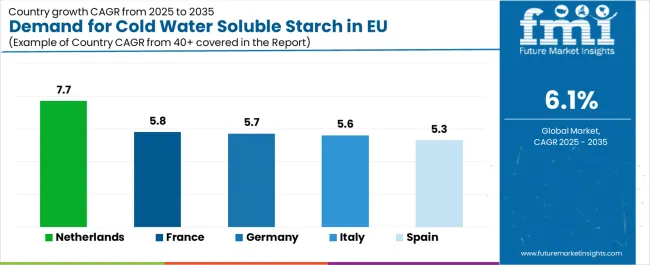

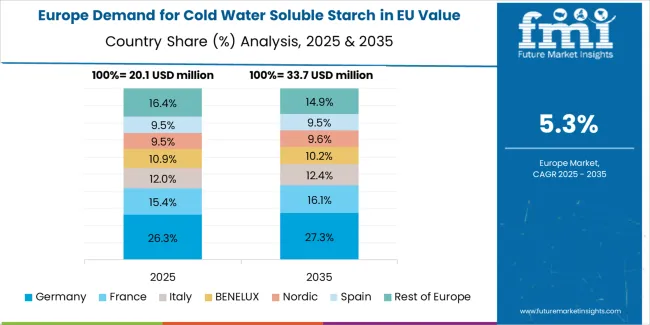

EU cold water soluble starch sales demonstrate solid growth across major European economies, with Netherlands leading expansion at 7.7% CAGR through 2035, driven by strategic ingredient manufacturing positioning and export capacity. France shows robust growth at 5.8% CAGR through diversified manufacturing base. Germany maintains 5.7% CAGR, benefiting from large-scale food and pharmaceutical production. Italy records 5.6% CAGR reflecting steady industrial demand. Spain demonstrates 5.3% CAGR with growing food processing sector. Rest of Europe shows 6% CAGR across diverse smaller operations. Overall, sales show consistent regional development reflecting EU-wide demand for functional ingredients and industrial processing solutions.

Revenue from cold water soluble starch in Germany is projected to exhibit steady growth with a CAGR of 5.7% through 2035, driven by exceptionally well-developed food manufacturing sector, comprehensive pharmaceutical production capacity, and strong industrial processing infrastructure throughout the country. Germany's sophisticated ingredient supply chain and internationally recognized leadership in food safety standards are creating substantial demand for high-quality cold water soluble starch grades across all industrial segments.

Major food manufacturers, including numerous bakery companies, dairy processors, and instant food producers, systematically incorporate cold water soluble starch in formulations, often requiring specialized grades meeting specific functional requirements and rigorous quality specifications. German demand benefits from strong pharmaceutical manufacturing presence, substantial industrial processing capacity supporting textile and adhesive applications, and technical expertise that naturally supports cold water soluble starch adoption across diverse manufacturing sectors beyond core food applications.

Growth drivers:

Revenue from cold water soluble starch in France is expanding at a CAGR of 5.8%, supported by diversified manufacturing economy spanning food processing, pharmaceutical production, and industrial applications. France's strong dairy industry, established bakery sector, and growing convenience food production are driving demand for functional starch ingredients across multiple manufacturing categories.

Major ingredient companies, including Roquette as a domestic supplier, provide comprehensive cold water soluble starch solutions serving French food manufacturers and industrial processors. French sales particularly benefit from sophisticated food processing standards demanding consistent ingredient quality, driving product innovation and technical service within the cold water soluble starch category. Local production capacity and technical expertise significantly enhance penetration rates across diverse manufacturing applications.

Success factors:

Revenue from cold water soluble starch in Italy is growing at a CAGR of 5.6%, fundamentally driven by established food manufacturing tradition, growing ready-to-eat meal production, and gradual industrial sector expansion. Italy's traditional pasta manufacturing, dairy processing, and bakery production are gradually incorporating functional ingredients as product innovation accelerates.

Major food processors strategically invest in ingredient optimization and processing efficiency improvements, creating opportunities for cold water soluble starch suppliers offering technical support and application development services. Italian sales particularly benefit from quality-focused manufacturing culture, creating natural demand for consistent, high-performing functional ingredients supporting premium product positioning and artisanal production scaled to industrial capacity.

Development factors:

Demand for cold water soluble starch in Spain is projected to grow at a CAGR of 5.3%, substantially supported by expanding food processing sector, growing export-oriented production, and increasing pharmaceutical manufacturing presence. Spanish food industry growth in dairy products, bakery goods, and convenience foods positions cold water soluble starch as aligned with manufacturing modernization.

Major food companies systematically invest in processing efficiency and product innovation, with cold water soluble starch supporting cost-effective formulation improvements and functional performance enhancements. Spain's growing position as Mediterranean food production hub supports ingredient demand through volume growth and application expansion.

Growth enablers:

Demand for cold water soluble starch in the Netherlands is expanding at a leading CAGR of 7.7%, fundamentally driven by strategic positioning as European ingredient manufacturing hub, strong starch processing heritage through AVEBE cooperative, and export-oriented production capacity serving broader European markets. Dutch ingredient sector demonstrates particularly high technical sophistication and quality standards supporting premium cold water soluble starch production.

Netherlands sales significantly benefit from established potato starch processing infrastructure, technical innovation in modification technologies, and comprehensive quality systems supporting pharmaceutical-grade production. The country's ingredient manufacturing expertise positions it as innovation testing ground for European functional ingredient categories, with successful Dutch developments often expanding to broader European operations.

Innovation drivers:

EU cold water soluble starch sales are projected to grow from USD 80 million in 2025 to USD 144.6 million by 2035, registering a CAGR of 6.1% over the forecast period. The Netherlands is expected to demonstrate the strongest growth trajectory with a 7.7% CAGR, supported by established starch processing infrastructure, a strong ingredient manufacturing base, and export-oriented production. France follows with a 5.8% CAGR, attributed to the diverse food processing industry and pharmaceutical manufacturing presence.

Germany maintains the largest share at 27.6% in 2025, driven by extensive food manufacturing infrastructure and strong pharmaceutical sector, while growing at 5.7% CAGR. Italy demonstrates 5.6% CAGR, while Spain records 5.3% CAGR. Rest of Europe shows 6% CAGR, reflecting diverse regional manufacturing requirements.

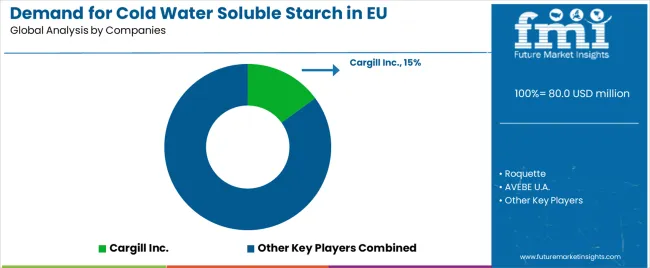

EU cold water soluble starch sales are defined by competition among global ingredient suppliers, regional starch processors, and specialized modification companies. Companies are investing in modification technologies, application development, organic certification, and technical service capabilities to deliver high-quality, functionally optimized, and competitively priced cold water soluble starch solutions. Strategic partnerships with food manufacturers, pharmaceutical companies, and industrial processors, along with technical center investments and sustainability initiatives, are central to strengthening competitive position.

Major participants include Cargill Inc. with an estimated 15% share, leveraging its global ingredient platform, diverse starch portfolio, and comprehensive distribution network across Europe. Cargill benefits from technical service capabilities, application development expertise, and ability to supply multiple industries from food to industrial applications, supporting broad market penetration and customer loyalty.

Roquette holds approximately 12% share, emphasizing French production base, natural ingredient positioning, and innovation leadership in plant-based solutions. Roquette's success in developing specialty starch grades with enhanced functionality creates strong positioning across food and pharmaceutical applications, supported by technical expertise and sustainability commitments resonating with European manufacturers.

AVEBE U.A. accounts for roughly 10% share through its position as Netherlands-based potato starch specialist with cooperative structure, providing consistent quality products with strong regional presence and potato-specific expertise. The company benefits from controlled supply chain, processing technology leadership, and focus on European markets enabling responsive service and customized product development.

Ingredion Inc. represents approximately 9% share, supporting growth through global functional ingredient portfolio, extensive modification capabilities, and technical service infrastructure serving diverse applications. Ingredion leverages ingredient science expertise, application development support, and broad product range enabling customized solutions across food, pharmaceutical, and industrial sectors.

Other companies collectively hold 54% share, reflecting competitive dynamics within European cold water soluble starch sales, where numerous regional processors, specialized modifiers, corn and tapioca starch suppliers, and emerging clean-label ingredient companies serve specific customer requirements, local markets, and niche applications. This competitive environment provides opportunities for differentiation through specialized modification methods, organic certification, pharmaceutical-grade production, and technical service excellence resonating with manufacturers seeking reliable functional ingredient partners.

| Item | Value |

|---|---|

| Quantitative Units | USD 144.6 million |

| Product Type (Form) | Granular, Pregelatinized, Powder |

| Application | Food (Dairy, Bakery, Ready-to-Eat/Instant, Snacks, Fillings), Pharmaceutical, Textile, Adhesive |

| Distribution Channel | Direct B2B, Distributors/Importers, Online B2B |

| Nature | Organic, Conventional |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Cargill, Roquette, AVEBE, Ingredion, Tate & Lyle, Emsland Group, Tereos Group |

| Additional Attributes | Dollar sales by product type (form), application sector, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with global suppliers and regional processors; customer preferences for various starch grades and modification levels; integration with food processing technologies and pharmaceutical manufacturing systems; innovations in modification processes and organic certification; adoption across food manufacturing, pharmaceutical production, and industrial applications; regulatory framework analysis for modified starch labeling and functional ingredient standards; supply chain strategies; and penetration analysis for food manufacturers and industrial processors across European markets. |

The global demand for cold water soluble starch in EU is estimated to be valued at USD 80.0 million in 2025.

The market size for the demand for cold water soluble starch in EU is projected to reach USD 144.6 million by 2035.

The demand for cold water soluble starch in EU is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in demand for cold water soluble starch in EU are granular, pregelatinized and powder.

In terms of application, food segment to command 30.0% share in the demand for cold water soluble starch in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Water Soluble Creamer Market Growth - Base & Function Trends

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Pods and Capsules Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water-Soluble Retinol Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Polymer Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Detergent Pods Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Fertilizers Market Trends 2025 to 2035

Water Soluble Pods Packaging Market Analysis by Material Type, Product Type, End Use, Thickness Type, and Region Forecast Through 2035

Key Companies & Market Share in the Water Soluble Detergent Pods Sector

Competitive Breakdown of Water-Soluble Packaging Companies

Water Soluble Vitamins Market

Water-Soluble Flavors Market

Europe Water Pumps Market – Trends & Forecast 2025 to 2035

Europe Starch Derivatives Market Insights – Growth, Demand & Forecast 2025-2035

Reusable Water Bottle Market Forecast and Outlook 2025 to 2035

Water Pod Soluble Machines Market Size and Share Forecast Outlook 2025 to 2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA