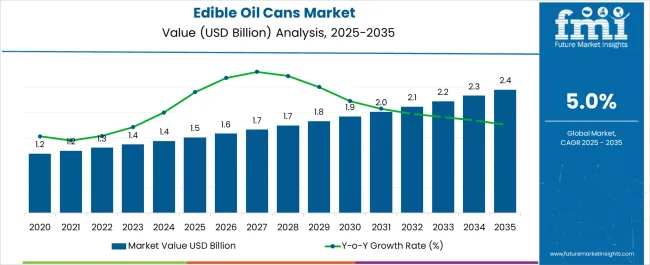

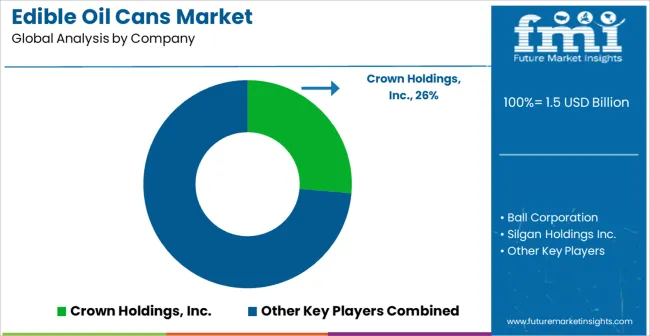

The Edible Oil Cans Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Edible Oil Cans Market Estimated Value in (2025 E) | USD 1.5 billion |

| Edible Oil Cans Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The Edible Oil Cans market is experiencing steady growth driven by increasing consumption of packaged edible oils in both developed and emerging economies. The future outlook of the market is shaped by growing demand for safe, hygienic, and convenient packaging solutions that ensure longer shelf life and maintain product quality. Rising consumer awareness regarding food safety and the adoption of ready-to-use packaging formats have further supported market expansion.

Continuous improvements in packaging technologies, including corrosion-resistant materials and lightweight designs, are enabling manufacturers to deliver enhanced value to end users. Increasing investments in organized retail, e-commerce distribution channels, and modern supply chains are facilitating wider product availability.

Moreover, environmental sustainability initiatives and regulations encouraging recyclable and reusable packaging are influencing product design and material selection As consumers increasingly prioritize convenience, safety, and sustainability, the edible oil cans market is expected to witness continued growth, with opportunities for innovation in material types, product formats, and capacity ranges.

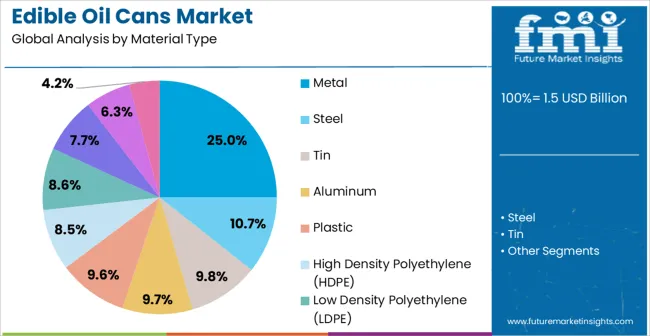

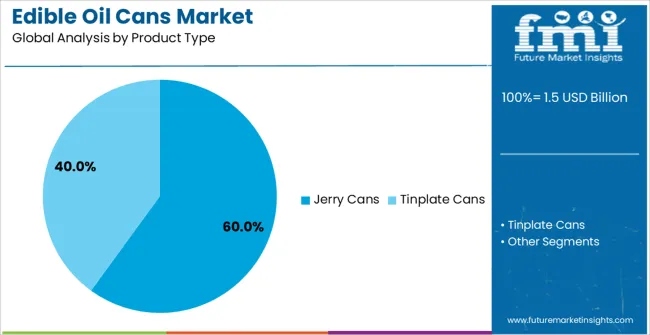

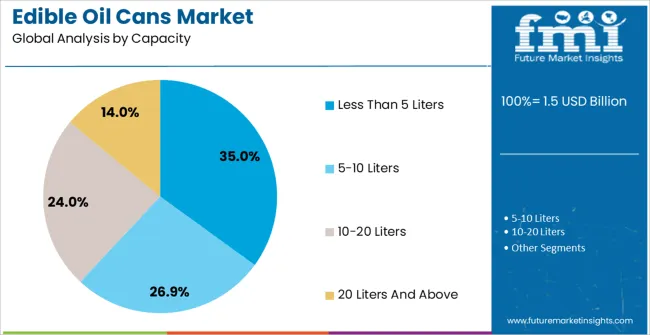

The edible oil cans market is segmented by material type, product type, capacity, and geographic regions. By material type, edible oil cans market is divided into Metal, Steel, Tin, Aluminum, Plastic, High Density Polyethylene (HDPE), Low Density Polyethylene (LDPE), Poly Vinyl Chloride (PVC), Polypropylene (PP), and Polyethylene Terephthalate (PET). In terms of product type, edible oil cans market is classified into Jerry Cans and Tinplate Cans. Based on capacity, edible oil cans market is segmented into Less Than 5 Liters, 5-10 Liters, 10-20 Liters, and 20 Liters And Above. Regionally, the edible oil cans industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The metal segment is projected to hold 25.00% of the Edible Oil Cans market revenue share in 2025, establishing it as a leading material type. This dominance is attributed to the durability, corrosion resistance, and long-term preservation offered by metal cans, which are crucial for maintaining the quality of edible oils. Metal cans allow for airtight sealing, preventing contamination and ensuring consistent product freshness.

Additionally, their robustness facilitates easier handling, storage, and transportation, especially in large-scale distribution networks. The adoption of metal cans has been further driven by the growing emphasis on sustainability, as they are recyclable and can be reused in production.

The segment benefits from technological enhancements in coating and lining processes, which prevent metal-oil interaction and extend shelf life These attributes collectively make metal cans a preferred choice among manufacturers and consumers, reinforcing the growth of this material type in the edible oil cans market.

The jerry cans product type is expected to capture 60.00% of the Edible Oil Cans market revenue share in 2025, positioning it as the leading product format. This growth is driven by the convenience and portability offered by jerry cans, which enable easy handling and distribution across retail and wholesale channels. The sturdy design of jerry cans reduces leakage and spillage, ensuring product safety during transportation.

Additionally, the availability of multiple sizes and ergonomic handles enhances consumer usability, particularly in household and commercial applications. The segment’s expansion is supported by increasing demand for bulk packaging solutions in organized retail, institutional use, and foodservice sectors.

Manufacturers are also investing in innovations such as tamper-evident caps and lightweight designs to further improve consumer satisfaction The combination of practical design, durability, and ease of use has established jerry cans as a dominant product type in the edible oil cans market.

The less than 5 liters capacity segment is anticipated to account for 35.00% of the Edible Oil Cans market revenue in 2025, making it a leading capacity range. This preference is influenced by the rising demand for smaller, consumer-friendly packaging that caters to household consumption and convenience. Smaller capacity cans are easier to store, pour, and use, reducing wastage and enhancing product accessibility.

The segment has also benefited from increasing urbanization, where limited storage space and frequent use patterns favor compact packaging. Additionally, the affordability of smaller capacity cans encourages repeated purchases, driving volume sales for manufacturers.

Retail strategies targeting convenience stores, supermarkets, and e-commerce platforms have further accelerated adoption The emphasis on consumer convenience, combined with operational efficiency for retailers and distributors, continues to propel the growth of the less than 5 liters capacity segment in the edible oil cans market.

Edible oil packaging is considered vital as it plays a critical role in preserving the quality of oil. Edible oil cans are usually used for household applications. Edible oil cans also provide protection against light, moisture, oxygen and various other contaminants.

Materials for edible oil cans is chosen such that it does not react with the oil filled and are less prone to corrosion. Metal cans have to meet packaging requirements and need to have specific characteristics such as strength, inertness and dispensing features to be used as edible oil cans.

Metal edible oil cans are up to 100% recyclable without much loss in strength and hence are known to have less impact on the environment.

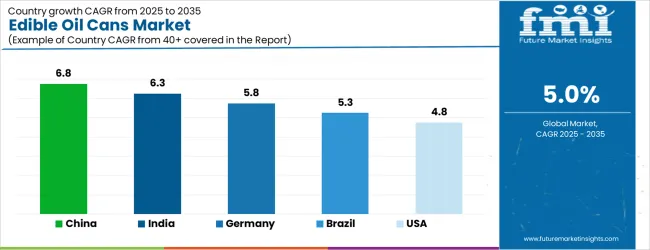

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| Brazil | 5.3% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

The Edible Oil Cans Market is expected to register a CAGR of 5.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.8%, followed by India at 6.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.8%, yet still underscores a broadly positive trajectory for the global Edible Oil Cans Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.8%. The USA Edible Oil Cans Market is estimated to be valued at USD 530.6 million in 2025 and is anticipated to reach a valuation of USD 530.6 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 68.6 million and USD 41.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Material Type | Metal, Steel, Tin, Aluminum, Plastic, High Density Polyethylene (HDPE), Low Density Polyethylene (LDPE), Poly Vinyl Chloride (PVC), Polypropylene (PP), and Polyethylene Terephthalate (PET) |

| Product Type | Jerry Cans and Tinplate Cans |

| Capacity | Less Than 5 Liters, 5-10 Liters, 10-20 Liters, and 20 Liters And Above |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Crown Holdings, Inc., Ball Corporation, Silgan Holdings Inc., Ardagh Group, CCL Industries, Kian Joo Can Factory Berhad, Parekhplast India Limited, and Yee Lee Corporation Bhd |

The global edible oil cans market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the edible oil cans market is projected to reach USD 2.4 billion by 2035.

The edible oil cans market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in edible oil cans market are metal, steel, tin, aluminum, plastic, high density polyethylene (hdpe), low density polyethylene (ldpe), poly vinyl chloride (pvc), polypropylene (pp) and polyethylene terephthalate (pet).

In terms of product type, jerry cans segment to command 60.0% share in the edible oil cans market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edible Oils and Fats Market Analysis by Product Type, Source, and Distribution Channel Through 2035

Edible Oil Packaging Market Growth - Demand & Forecast 2025 to 2035

Oil Catch Cans Market Growth – Trends & Forecast 2025 to 2035

Organic Edible Oil Market Analysis by Type, Distribution Channel, and Region Through 2035

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Edible Shrink Tunnel Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Edible Animal Fat Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA