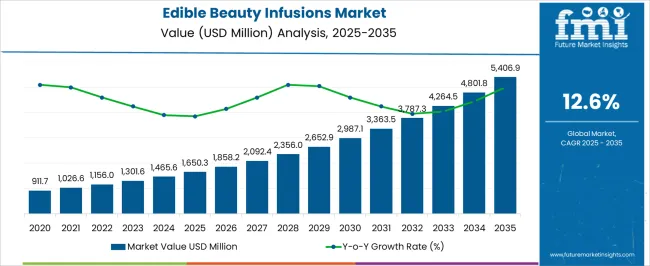

The global edible beauty infusions market is projected to grow from USD 1,650.3 million in 2025 to approximately USD 5,406.9 million by 2035, recording an absolute increase of USD 3,755.5 million over the forecast period. This translates into a total growth of 227.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 12.6% between 2025 and 2035.

The overall market size is expected to grow by nearly 3.3X during the same period, supported by the rising consumer awareness about beauty-from-within concepts and increasing demand for functional beauty supplements.

Between 2025 and 2030, the market is projected to expand from USD 1,650.3 million to USD 2,986.8 million, resulting in a value increase of USD 1,336.5 million, which represents 35.6% of the total forecast growth for the decade.

This phase of growth will be shaped by rising consumer acceptance of ingestible beauty products, increasing awareness about collagen benefits, and growing demand for natural and clean-label beauty supplements. Manufacturers are expanding their product portfolios to address the growing complexity of beauty-from-within requirements.

From 2030 to 2035, the market is forecast to grow from USD 2,986.8 million to USD 5,406.9 million, adding another USD 2,419.0 million, which constitutes 64.4% of the overall ten-year expansion. This period is expected to be characterized by advancement of formulation technologies, integration of personalized nutrition approaches, and development of sophisticated delivery systems across different product formats. The growing adoption of scientifically-backed ingredients and clinical-strength formulations will drive demand for more advanced edible beauty solutions.

Between 2020 and 2025, the market experienced significant expansion, driven by the beauty-from-within trend, increasing consumer awareness about the gut-skin axis, and the rise of wellness-focused lifestyle choices. The market developed as consumers became increasingly interested in holistic beauty approaches and brands recognized the potential of functional beauty supplements to address diverse skin, hair, and nail concerns from within.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1,650.3 million |

| Projected Value (2035F) | USD 5,406.9 million |

| CAGR (2025 to 2035) | 12.6% |

Market expansion is being supported by the growing consumer understanding of the connection between internal nutrition and external beauty, increasing demand for multifunctional products that address beauty and wellness simultaneously, and rising awareness about the limitations of topical-only beauty regimens. Modern consumers seek scientifically-backed solutions that provide visible results while fitting seamlessly into their daily routines, moving away from traditional beauty approaches toward comprehensive inside-out beauty strategies.

The growing sophistication of ingredient technologies, including advanced collagen peptides, bioactive botanicals, and targeted nutrient delivery systems, is enabling more effective formulations and driving demand for premium edible beauty products. Beauty and wellness brands are increasingly investing in research and development to offer differentiated products that can deliver measurable results while maintaining clean-label credentials and addressing specific beauty concerns through targeted nutritional support.

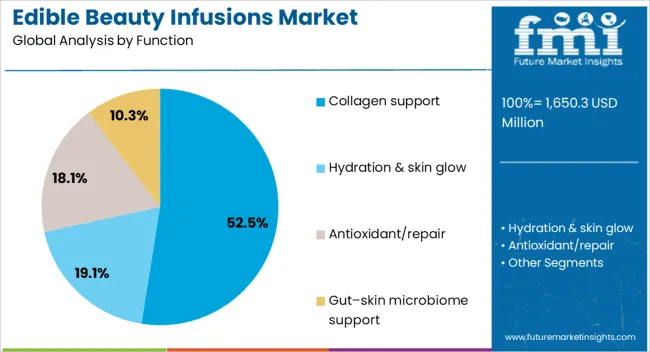

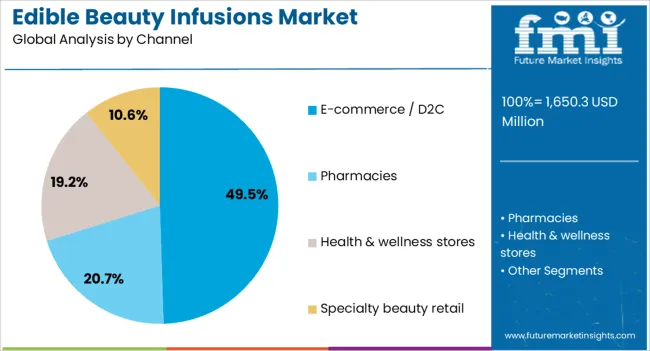

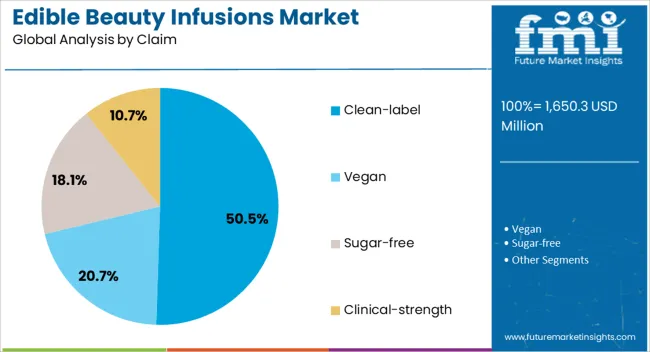

The market is segmented by format, function, ingredient base, channel, and claim. By format, the market is divided into powders, gummies, liquid shots, and capsules. Based on function, the market is categorized into collagen support, hydration & skin glow, antioxidant/repair, and gut-skin microbiome support. In terms of ingredient base, the market is segmented into collagen peptides, botanical extracts, probiotics/prebiotics, and ceramides/HA blends.

By channel, the market is classified into e-commerce/D2C, pharmacies, health & wellness stores, and specialty beauty retail. Based on claim, the market is divided into clean-label, vegan, sugar-free, and clinical-strength. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Powders are projected to maintain their dominant position in the market throughout the forecast period, establishing their role as the preferred format for functional beauty supplements. This market leadership is fundamentally supported by the versatility of powder formulations, superior bioavailability of active ingredients, and consumer preference for customizable dosing and mixing options that enable integration into various beverages and foods.

The preference for powder formats stems from their ability to deliver higher concentrations of active ingredients compared to other formats, cost-effectiveness for both manufacturers and consumers, and longer shelf stability that ensures ingredient potency throughout the product lifecycle. Powder formulations enable the incorporation of diverse ingredient combinations including collagen peptides, botanical extracts, vitamins, and minerals in optimal ratios without the constraints of capsule size limitations or gummy texture requirements.

The market leadership of powders is further reinforced by the growing trend toward personalized nutrition, where consumers prefer to adjust serving sizes based on individual needs and preferences. The segment benefits from innovative packaging solutions, improved taste masking technologies, and the development of instant-dissolving formulations that enhance user experience and convenience.

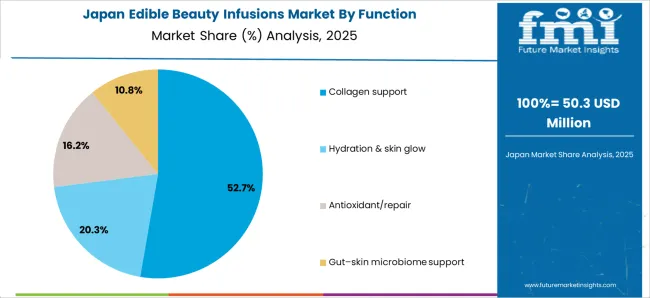

Collagen support is expected to represent 52.5% of edible beauty infusions demand in 2025, establishing its dominance in the global market landscape with a value of USD 866.7 million. This commanding market position reflects the widespread consumer understanding of collagen's role in skin health, aging prevention, and overall beauty maintenance, combined with extensive clinical research supporting collagen supplementation benefits.

The collagen support segment benefits from growing awareness about natural collagen decline with age, increasing consumer education about the benefits of collagen peptides for skin elasticity and hydration, and the development of highly bioavailable collagen formulations that deliver visible results. Modern collagen-focused edible beauty products feature advanced peptide technologies, synergistic ingredient combinations, and targeted delivery systems optimized for maximum absorption and efficacy.

The segment's growth is further supported by the expanding body of clinical evidence demonstrating collagen supplementation benefits, celebrity and influencer endorsements driving mainstream adoption, and the development of diverse collagen sources including marine, bovine, and plant-based alternatives that cater to different dietary preferences and ethical considerations.

E-commerce/D2C channels are projected to contribute 49.5% of the edible beauty infusions market in 2025, representing the preferred distribution model for functional beauty supplements with a value of USD 817.2 million. This delivery method aligns perfectly with the educational nature of edible beauty products, enabling brands to provide comprehensive product information, usage guidance, and ongoing customer support that enhances product efficacy and customer satisfaction.

The competitive advantage of direct-to-consumer distribution lies in its ability to build direct relationships with customers, gather valuable feedback for product development, and provide personalized recommendations based on individual beauty goals and concerns. This model enables brands to control the entire customer experience while building communities around beauty-from-within philosophies and wellness-focused lifestyles.

E-commerce platforms offer consumers convenience, access to detailed product information, subscription options for regular delivery, and the ability to compare products and read authentic reviews from other users. The channel supports customer retention through loyalty programs, educational content, and personalized communication that builds trust and encourages long-term usage of edible beauty products.

Clean-label products are expected to represent 50.5% of edible beauty infusions demand in 2025, establishing their importance in the global market landscape with a value of USD 833.3 million. This significant market share reflects the growing consumer demand for transparency in beauty and wellness products, increasing awareness about ingredient safety, and preference for natural, minimally processed formulations that align with health-conscious lifestyles.

The clean-label segment benefits from rising consumer skepticism about synthetic ingredients, growing interest in whole-food-based nutrition, and increasing regulatory scrutiny of supplement ingredients that drive demand for transparent, recognizable ingredient lists. Modern clean-label edible beauty products feature naturally-derived active ingredients, minimal processing techniques, and clear labeling that enables consumers to make informed purchasing decisions.

The segment's growth is further supported by the premiumization trend in beauty and wellness, where consumers are willing to pay higher prices for products that meet their ethical and health standards, and the increasing availability of clean-label certification programs that provide third-party validation of product claims and manufacturing practices.

The market is advancing rapidly due to increasing consumer awareness about the gut-skin connection, growing acceptance of beauty-from-within concepts, and rising demand for multifunctional products that address beauty and wellness simultaneously. However, the market faces challenges including regulatory complexities across different regions, high development costs for clinically-proven formulations, and consumer education requirements about proper usage and realistic expectations. Product efficacy validation, ingredient sourcing sustainability, and quality control standardization continue to influence market development patterns.

The growing deployment of sophisticated ingredient delivery systems including microencapsulation, nano-emulsification, and targeted release mechanisms is enabling enhanced bioavailability and improved efficacy of active beauty nutrients. These technologies provide superior ingredient stability, controlled release profiles, and synergistic combinations that maximize the beauty benefits of edible formulations.

Modern edible beauty brands are incorporating personalized nutrition approaches, including customized formulations based on individual skin concerns, genetic predispositions, and lifestyle factors. Integration of skin analysis tools, nutritional assessments, and ongoing monitoring creates holistic beauty programs that optimize results through targeted internal nutrition strategies.

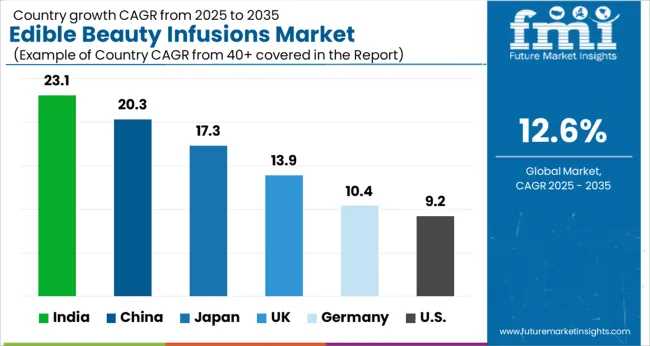

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 23.1% |

| China | 20.3% |

| Japan | 17.3% |

| UK | 13.9% |

| Germany | 10.4% |

| USA | 9.2% |

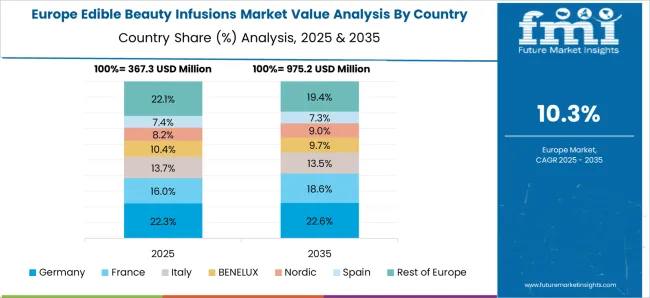

The edible beauty infusions market is growing rapidly across key regions, with India leading at a 23.1% CAGR through 2035, driven by rising beauty consciousness, increasing disposable income, and growing adoption of wellness-focused lifestyle choices. China follows at 20.3%, supported by strong beauty culture and increasing consumer acceptance of functional beauty supplements.

Japan grows at 17.3%, emphasizing quality and innovation in beauty nutrition. The UK records 13.9% growth with focus on natural beauty trends. Germany shows 10.4% growth driven by quality and scientific approach preferences. The USA demonstrates steady 9.2% growth with mature market adoption and established wellness culture.

Revenue from edible beauty infusions in India is projected to exhibit the highest growth rate with a CAGR of 23.1% through 2035, driven by rapid urbanization, increasing beauty consciousness among young consumers, and growing awareness about holistic wellness approaches. The country's expanding middle class, combined with rising disposable income and changing lifestyle patterns, creates an ideal environment for functional beauty products. Major international and domestic beauty brands are establishing comprehensive distribution networks and localized product formulations to serve the growing demand for beauty-from-within solutions.

Revenue from edible beauty infusions in China is expanding at a CAGR of 20.3%, supported by strong beauty culture, increasing consumer education about functional nutrition, and significant investment in beauty and wellness research. The country's sophisticated beauty market and integration of traditional wellness concepts with modern beauty science create a favorable environment for innovative edible beauty solutions. Major beauty conglomerates and emerging brands are developing comprehensive beauty nutrition platforms that combine traditional Chinese medicine principles with contemporary beauty science.

Revenue from edible beauty infusions in Japan is growing at a CAGR of 17.3%, driven by the country's sophisticated beauty culture, emphasis on preventive wellness, and consumer preference for high-quality, scientifically-validated products. Japanese consumers demonstrate strong acceptance of functional beauty supplements and willingness to invest in premium products that deliver measurable results. The market benefits from advanced research capabilities, established beauty industry infrastructure, and consumer culture that values precision and consistency in beauty routines.

Demand for edible beauty infusions in the UK is projected to grow at a CAGR of 13.9%, supported by strong consumer interest in natural beauty alternatives, established wellness market, and growing adoption of clean beauty philosophies. British consumers demonstrate increasing awareness about ingredient safety and preference for products with transparent labeling and ethical sourcing. The market is characterized by focus on natural ingredients, sustainable packaging, and integration with holistic wellness approaches.

Demand for edible beauty infusions in Germany is expanding at a CAGR of 10.4%, driven by consumer preference for scientifically-validated products, established quality standards, and growing acceptance of functional nutrition approaches. German consumers value clinical evidence, product safety, and transparency in beauty and wellness products, creating strong demand for edible beauty solutions that demonstrate clear scientific backing and measurable results. The market benefits from rigorous testing standards, comprehensive regulatory framework, and consumer culture that prioritizes proven effectiveness.

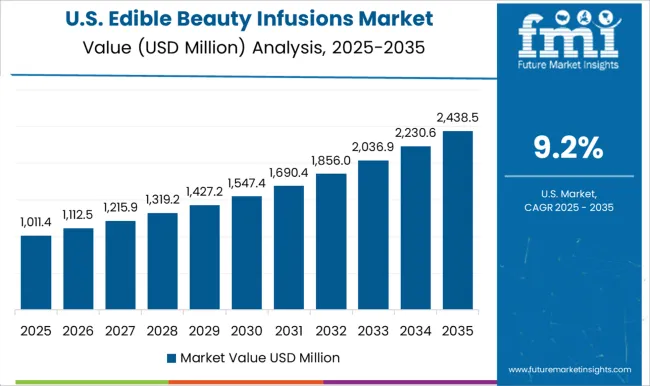

Demand for edible beauty infusions in the USA is growing at a CAGR of 9.2%, characterized by market maturity, diverse consumer segments, and established wellness culture. The American market demonstrates strong foundation in functional supplements and growing interest in beauty-specific nutrition solutions. Market growth is supported by significant investment in beauty and wellness innovation, established distribution networks, and consumer willingness to adopt new beauty technologies and approaches.

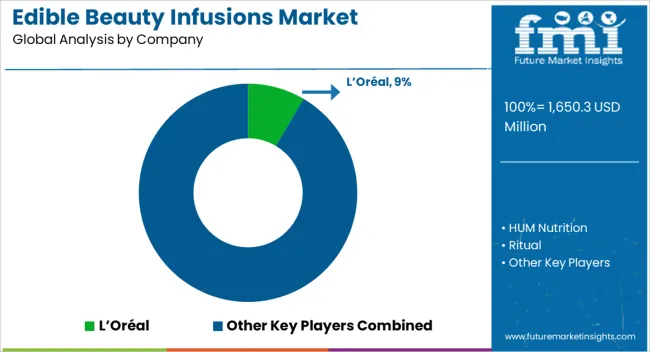

The edible beauty infusions market is characterized by competition among established supplement companies, emerging beauty-focused brands, and specialized functional nutrition providers. Companies are investing in clinical research, innovative ingredient technologies, comprehensive beauty nutrition platforms, and direct-to-consumer strategies to deliver effective, convenient, and scientifically-backed beauty-from-within solutions. Strategic partnerships, product innovation, and consumer education are central to strengthening product portfolios and market presence.

The market is relatively fragmented with numerous players competing across different segments and geographic regions. Leading companies focus on building brand credibility through clinical research, celebrity endorsements, and consumer testimonials while expanding their product portfolios to address diverse beauty concerns and consumer preferences.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,650.3 million |

| Format | Powders, Gummies, Liquid shots, Capsules |

| Function | Collagen support, Hydration & skin glow, Antioxidant/repair, Gut-skin microbiome support |

| Ingredient Base | Collagen peptides, Botanical extracts, Probiotics/prebiotics, Ceramides/HA blends |

| Channel | E-commerce/D2C, Pharmacies, Health & wellness stores, Specialty beauty retail |

| Claim | Clean-label, Vegan, Sugar-free, Clinical-strength |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Vital Proteins, HUM Nutrition, Ritual, The Beauty Chef, Olly, Garden of Life, Neocell, Moon Juice, Perricone MD, and Swisse |

The global edible beauty infusions market is estimated to be valued at USD 1,650.3 million in 2025.

The market size for the edible beauty infusions market is projected to reach USD 5,406.9 million by 2035.

The edible beauty infusions market is expected to grow at a 12.6% CAGR between 2025 and 2035.

The key product types in edible beauty infusions market are collagen support, hydration & skin glow, antioxidant/repair and gut–skin microbiome support.

In terms of channel, e-commerce / d2c segment to command 49.5% share in the edible beauty infusions market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edible Oil Cans Market Size and Share Forecast Outlook 2025 to 2035

Edible Shrink Tunnel Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Edible Animal Fat Market Size and Share Forecast Outlook 2025 to 2035

Edible Water Pods Market Size and Share Forecast Outlook 2025 to 2035

Edible Cups Market Size and Share Forecast Outlook 2025 to 2035

Edible Nuts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Collagen Casing Market Size and Share Forecast Outlook 2025 to 2035

Edible Seaweed Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Edible Oils and Fats Market Analysis by Product Type, Source, and Distribution Channel Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Edible Oil Packaging Market Growth - Demand & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Competitive Overview of Edible Collagen Casing Market Share

Industry Share Analysis for Edible Offal Providers

Competitive Landscape of Edible Flakes Providers

Edible Packaging Market Report – Key Trends & Forecast 2024-2034

Edible Fungus Market Outlook – Growth, Demand & Forecast 2024 to 2034

Edible and Soluble Films Market

Organic Edible Oil Market Analysis by Type, Distribution Channel, and Region Through 2035

Demand for Edible Nuts in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA