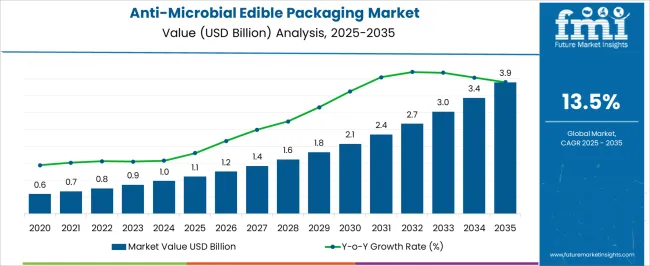

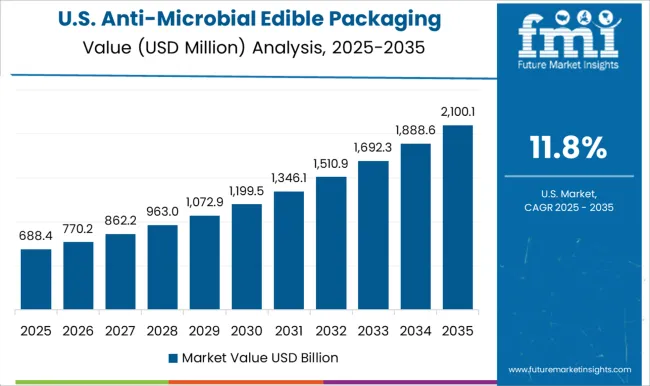

The anti-microbial edible packaging market is valued at USD 1.1 billion in 2025 and is predicted to reach USD 3.8 billion by 2035, resulting in a total increase of USD 2.7 billion over the forecast decade. This represents a 245.5% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 13.5%. Over ten years, the market grows by a 3.5 multiple.

In the first five years (2025-2030), the market progresses from USD 1.1 billion to USD 2.3 billion, contributing USD 1.2 billion, or 44.4% of total decade growth. This phase is shaped by rising demand for sustainable food packaging solutions and increasing consumer awareness of food safety. Regulatory approvals for edible films and coatings in dairy and bakery applications drive early adoption.

In the second half (2030-2035), the market grows from USD 2.3 billion to USD 3.8 billion, adding USD 1.5 billion, or 55.6% of the total growth. This acceleration is supported by advanced antimicrobial technologies, expanded applications in fresh produce packaging, and growing adoption in meat and seafood preservation. Enhanced shelf-life benefits and reduced food waste concerns ensure continued momentum in this innovative packaging segment.

| Metric (USD Billion) | Value |

|---|---|

| Anti-Microbial Edible Packaging Market Estimated Value in (2025E) | USD 1.1 Billion |

| Anti-Microbial Edible Packaging Market Forecast Value in (2035F) | USD 3.8 Billion |

| Forecast CAGR (2025 to 2035) | 13.50% |

From 2020 to 2024, the anti-microbial edible packaging market expanded from USD 0.3 billion to USD 1.0 billion, driven by growing concerns over plastic pollution and food safety. Leading firms such as Notpla Ltd. and Apeel Sciences emphasized natural antimicrobial agents, biodegradability, and regulatory compliance. Differentiation centered on shelf-life extension, food-grade safety, and industrial scalability, while smart packaging integration remained secondary. Research partnerships with universities and food manufacturers accounted for lower share of total revenues during this period.

By 2035, the anti-microbial edible packaging market will reach USD 3.8 billion, growing at a CAGR of 13.50%, with plant extract-based antimicrobial systems and composite multilayer films representing over 45% of market value. Competitive intensity will rise as providers offer enzyme-enhanced coatings, nanoparticle-integrated films, and customized preservation solutions. Established players are adapting with hybrid models combining material innovation with application-specific antimicrobial technologies. Emerging companies such as Kitocoat and BioCote Limited are gaining traction with specialized coatings, targeted antimicrobial release systems, and regulatory-approved formulations, meeting global demand for sustainable and effective food preservation solutions.

The growing need for sustainable food packaging solutions and extended shelf-life capabilities is driving growth in the anti-microbial edible packaging market. These packaging systems reduce plastic waste while providing active protection against bacterial and fungal contamination. Increasing consumer demand for clean-label products and environmentally friendly packaging alternatives supports adoption across food categories.

Edible films and coatings incorporating natural antimicrobial agents such as essential oils, enzymes, and organic acids are gaining traction for their dual functionality. Their ability to preserve food quality while being completely consumable appeals to sustainability-conscious consumers. Integration with fruits, vegetables, dairy products, and baked goods enhances product freshness while reducing packaging waste.

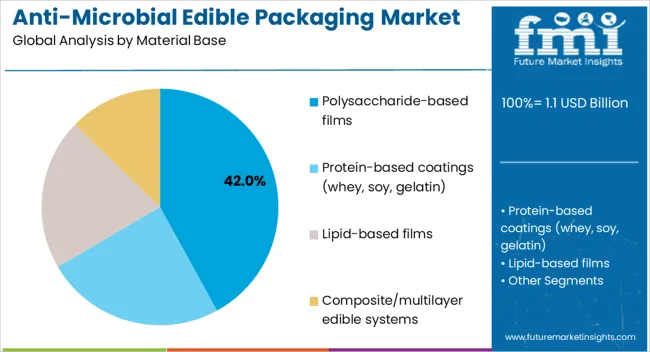

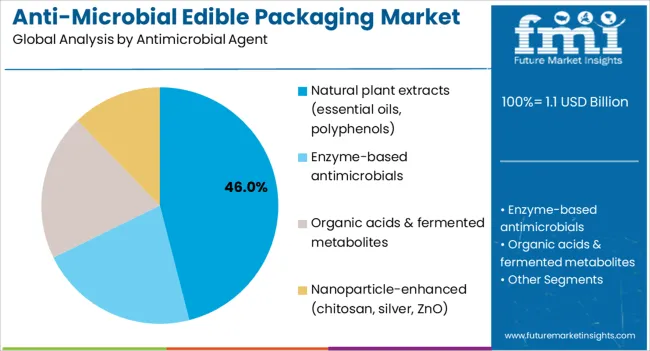

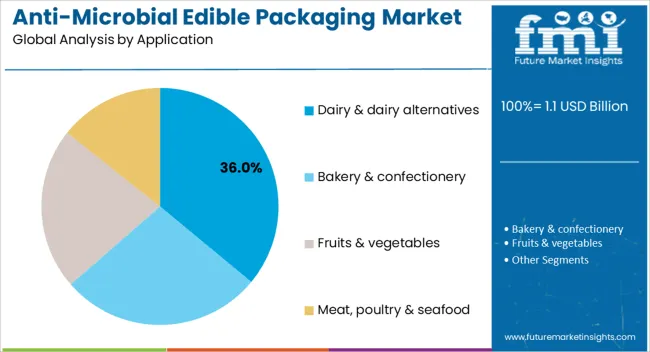

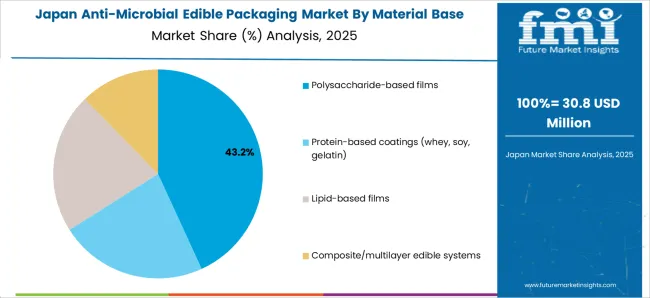

The market is segmented by material base, antimicrobial agent, application, and region. Material base segmentation includes polysaccharide-based films utilizing chitosan, alginate, and cellulose derivatives; protein-based coatings from whey, soy, and gelatin; lipid-based films incorporating waxes and fatty acids; and composite multilayer edible systems combining multiple biopolymers for enhanced barrier properties. Antimicrobial agent classification covers natural plant extracts including essential oils and polyphenols; enzyme-based antimicrobials such as lysozyme and lactoperoxidase; organic acids and fermented metabolites; and nanoparticle-enhanced systems incorporating chitosan, silver, and zinc oxide. Applications include dairy and dairy alternatives, bakery and confectionery products, fruits and vegetables, and meat, poultry, and seafood. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Polysaccharide-based films are projected to account for 42.0% of the market in 2025, driven by their excellent film-forming properties, natural origin, and compatibility with food surfaces. These films, derived from chitosan, alginate, pectin, and cellulose, provide effective moisture barriers while incorporating antimicrobial compounds. Their biodegradable nature aligns with sustainability trends in food packaging.

Growing adoption is supported by regulatory approvals for food contact applications and proven effectiveness in extending shelf life. Advances in cross-linking technologies improve mechanical strength and water resistance. These materials are particularly effective in coating fruits, vegetables, and cheese products, where natural preservation is valued by consumers.

Natural plant extracts are forecast to hold 46.0% of the antimicrobial agent market in 2025, offering broad-spectrum antimicrobial activity while maintaining clean-label appeal. Essential oils from oregano, thyme, and cinnamon, along with polyphenolic compounds from green tea and grape seed, provide effective preservation without synthetic additives.

Their popularity stems from consumer preference for natural preservation methods and regulatory acceptance for food applications. Research continues to optimize extraction methods and encapsulation technologies to enhance stability and controlled release. Integration with edible films ensures uniform distribution and sustained antimicrobial activity throughout storage periods.

Dairy and dairy alternatives packaging is projected to represent 36.0% of the market in 2025, driven by the need to extend shelf life and maintain product quality. Edible coatings on cheese surfaces prevent mold growth while allowing natural aging processes. Applications in yogurt, butter, and plant-based dairy products provide additional preservation benefits.

The segment benefits from established coating technologies and regulatory pathways for dairy applications. Protein-based films from whey and casein offer compatibility with dairy products while providing antimicrobial properties. Growing demand for fresh and minimally processed dairy products supports continued adoption of edible preservation systems.

The anti-microbial edible packaging market is expanding as food manufacturers seek sustainable alternatives to synthetic preservatives and plastic packaging. Rising consumer awareness of food waste, environmental concerns, and clean-label preferences drive adoption. However, cost considerations, regulatory complexities, and technical challenges in large-scale production limit broader implementation. Innovations in nanoencapsulation, enzyme integration, and multilayer film technologies are reshaping market opportunities.

Anti-microbial edible packaging addresses multiple industry challenges by combining preservation functionality with complete biodegradability. Food manufacturers adopt these solutions to extend shelf life without synthetic preservatives, meeting clean-label consumer demands. Environmental regulations restricting single-use plastics create additional incentives for edible packaging adoption. Retail chains support these technologies to reduce food waste and packaging disposal costs. Government initiatives promoting sustainable packaging alternatives further accelerate market growth across developed and emerging economies.

Despite technological advances, production costs remain significantly higher than conventional packaging materials, limiting adoption among cost-sensitive food manufacturers. Scaling laboratory formulations to industrial production presents technical challenges in maintaining consistency and antimicrobial effectiveness. Regulatory approval processes for new edible packaging formulations require extensive safety testing and documentation. Limited shelf stability of some antimicrobial compounds affects product performance during storage and distribution. These factors restrict market growth primarily to premium product categories and specialized applications.

Key trends include development of nanoencapsulation technologies for controlled release of antimicrobial compounds, ensuring sustained effectiveness throughout product shelf life. Enzyme-based systems offer targeted antimicrobial activity while maintaining food quality and sensory properties. Smart packaging integration enables real-time monitoring of product freshness and antimicrobial activity. Multilayer edible films combining different antimicrobial mechanisms provide enhanced preservation capabilities. Research focuses on improving water resistance, mechanical strength, and compatibility with automated packaging equipment to enable broader commercial adoption.

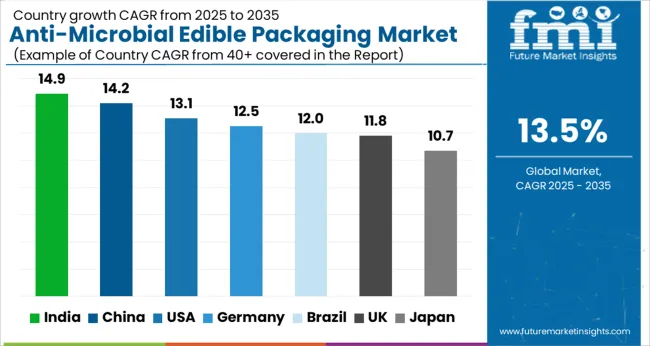

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 14.90% |

| China | 14.20% |

| United States | 13.10% |

| Germany | 12.50% |

| Brazil | 12.00% |

| United Kingdom | 11.80% |

| Japan | 10.70% |

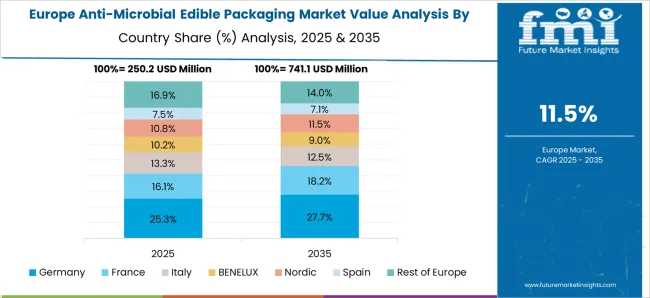

The global anti-microbial edible packaging market is experiencing robust growth, driven by sustainability initiatives, food safety regulations, and technological advances in biopolymer science. Asia-Pacific is emerging as the fastest-growing region, with India and China leading adoption due to large food processing sectors and government support for biodegradable packaging technologies. Developed markets including the United States, Germany, and Japan focus on regulatory compliance, premium applications, and integration with existing food processing infrastructure.

Indian anti-microbial edible packaging market is forecast to record the fastest growth at a CAGR of 14.9% from 2025 to 2035, supported by government initiatives promoting sustainable packaging and significant food waste reduction needs. The country's large agricultural sector creates opportunities for post-harvest preservation applications, while growing processed food industries drive demand for extended shelf-life solutions. Food technology startups receive government backing for developing localized edible packaging formulations using indigenous materials such as rice bran, wheat gluten, and plant-based antimicrobials. Rising consumer awareness of environmental issues and food safety concerns accelerate adoption across dairy, fruits, and bakery segments.

Demand for anti-microbial edible packaging in China is projected to grow at a CAGR of 14.2%, driven by rapid expansion in fresh produce retail and government policies promoting sustainable packaging alternatives. Large-scale food processing companies invest in edible packaging technologies to meet export quality standards and domestic safety regulations. The country's advanced manufacturing capabilities enable cost-effective production scaling of polysaccharide-based films and protein coatings. Research institutions collaborate with industry players to develop region-specific formulations optimized for local food products and climate conditions.

The USA market for anti-microbial edible packaging is expected to grow at a CAGR of 13.1%, supported by FDA regulatory pathways for edible packaging materials and strong consumer demand for clean-label preservation solutions. Food manufacturers in dairy and bakery segments lead adoption, leveraging established protein-based coating technologies. Research universities partner with industry to develop next-generation antimicrobial delivery systems and improve production economics. The market benefits from well-developed food safety regulations that facilitate commercial approval of new edible packaging formulations.

Germany's market for anti-microbial edible packaging is forecast to expand at a CAGR of 12.5%, driven by EU packaging directives promoting biodegradable alternatives and strong consumer acceptance of sustainable food technologies. The country's precision engineering capabilities support development of automated application equipment for edible coatings. Food manufacturers focus on premium organic and natural product segments where edible packaging aligns with brand positioning. Research institutes advance nanoencapsulation technologies for controlled antimicrobial release in various food applications.

Brazil's market for anti-microbial edible packaging is projected to grow at a CAGR of 12.0%, supported by the country's large meat and seafood export industries requiring extended preservation capabilities. Tropical fruit production creates opportunities for post-harvest coating applications to reduce spoilage during transport and storage. Local research institutions develop formulations using abundant natural antimicrobial sources such as propolis, acerola, and cashew nut shell extracts. The market benefits from growing domestic awareness of food waste issues and environmental sustainability.

The UK anti-microbial edible packaging market is expected to grow at a CAGR of 11.8%, driven by major retail chains implementing sustainability targets and consumer demand for reduced plastic packaging. Food manufacturers focus on clean-label preservation solutions that align with organic and natural product positioning. Research collaborations between universities and industry advance enzyme-based antimicrobial systems and improve application technologies. The market benefits from established food safety regulatory frameworks that support innovation in edible packaging materials.

Japan's anti-microbial edible packaging market is projected to grow at a CAGR of 10.7%, supported by advanced food technology research and consumer acceptance of functional food innovations. The country's precision manufacturing capabilities enable development of sophisticated nanotech antimicrobial delivery systems. Food companies focus on high-value applications in seafood, premium fruits, and traditional fermented products where edible preservation enhances product quality. Research institutes collaborate with industry to develop culturally appropriate formulations and application methods.

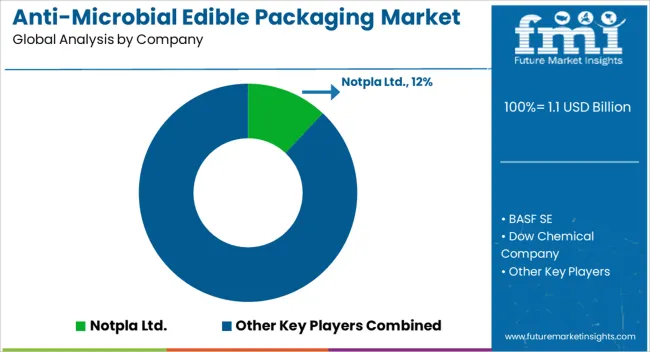

The anti-microbial edible packaging market is moderately fragmented, with biotechnology companies, chemical manufacturers, and food technology firms competing across sustainability-driven packaging applications. Global leaders such as Notpla Ltd. hold notable market share through innovative seaweed-based packaging solutions and natural antimicrobial integration. BASF SE and Dow Chemical Company leverage extensive polymer expertise and manufacturing scale to develop commercial-grade edible film formulations.

Established specialty companies including BioCote Limited, Microban International Ltd., and Sealed Air Corporation focus on antimicrobial technology integration and regulatory compliance across food contact applications. These firms emphasize proven antimicrobial efficacy, food safety certifications, and compatibility with existing food processing equipment.

Emerging technology providers such as Kitocoat and Apeel Sciences concentrate on specialized applications and novel antimicrobial delivery systems. Their strengths include targeted preservation solutions, plant-based antimicrobial compounds, and sustainable production methods that appeal to environmentally conscious food manufacturers and consumers.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| By Material Base | Polysaccharide-based films, Protein-based coatings (whey, soy, gelatin), Lipid-based films, Composite/multilayer edible systems |

| By Antimicrobial Agent | Natural plant extracts (essential oils, polyphenols), Enzyme-based antimicrobials, Organic acids & fermented metabolites, Nanoparticle-enhanced (chitosan, silver, ZnO) |

| By Application | Dairy & dairy alternatives, Bakery & confectionery, Fruits & vegetables, Meat, poultry & seafood |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | Notpla Ltd., BASF SE, Dow Chemical Company, BioCote Limited, Microban International Ltd., Sealed Air Corporation, Kitocoat, Apeel Sciences |

| Additional Attributes | Dollar sales by material base and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging startups, buyer preferences for sustainable versus conventional materials, integration with AI-driven design and digital manufacturing platforms, innovations in multi-material packaging capabilities and closed-loop recycling systems, and adoption of smart packaging solutions with embedded sensors, QR codes, and interactive features for enhanced consumer engagement. |

The global anti-microbial edible packaging market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the anti-microbial edible packaging market is projected to reach USD 3.9 billion by 2035.

The anti-microbial edible packaging market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in anti-microbial edible packaging market are polysaccharide-based films, protein-based coatings (whey, soy, gelatin), lipid-based films and composite/multilayer edible systems.

In terms of antimicrobial agent, natural plant extracts (essential oils, polyphenols) segment to command 46.0% share in the anti-microbial edible packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edible Oil Cans Market Size and Share Forecast Outlook 2025 to 2035

Edible Shrink Tunnel Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Edible Animal Fat Market Size and Share Forecast Outlook 2025 to 2035

Edible Water Pods Market Size and Share Forecast Outlook 2025 to 2035

Edible Cups Market Size and Share Forecast Outlook 2025 to 2035

Edible Beauty Infusions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Nuts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Collagen Casing Market Size and Share Forecast Outlook 2025 to 2035

Edible Seaweed Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Edible Oils and Fats Market Analysis by Product Type, Source, and Distribution Channel Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Competitive Overview of Edible Collagen Casing Market Share

Competitive Landscape of Edible Flakes Providers

Industry Share Analysis for Edible Offal Providers

Edible Fungus Market Outlook – Growth, Demand & Forecast 2024 to 2034

Edible and Soluble Films Market

Edible Packaging Market Report – Key Trends & Forecast 2024-2034

Edible Oil Packaging Market Growth - Demand & Forecast 2025 to 2035

Organic Edible Oil Market Analysis by Type, Distribution Channel, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA