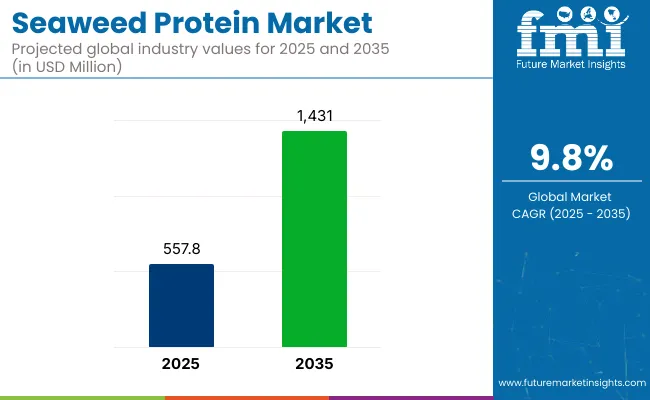

The global seaweed protein market is valued at USD 557.8 million in 2025 and is poised to reach USD 1,431.0 million by 2035, which shows a CAGR of 9.8%. The market is expected to be driven by the increasing demand for plant-based proteins, rising veganism, and technological advancements in seaweed farming and extraction processes.

| Metric | Value |

|---|---|

| Market Size 2025 | USD 557.8 million |

| Market Size 2035 | USD 1,431.0 million |

| CAGR (2025 to 2035) | 9.8% |

Additionally, growth will be supported by expanding applications in food, nutraceuticals, cosmetics, and pharmaceuticals across key Asian and global markets.

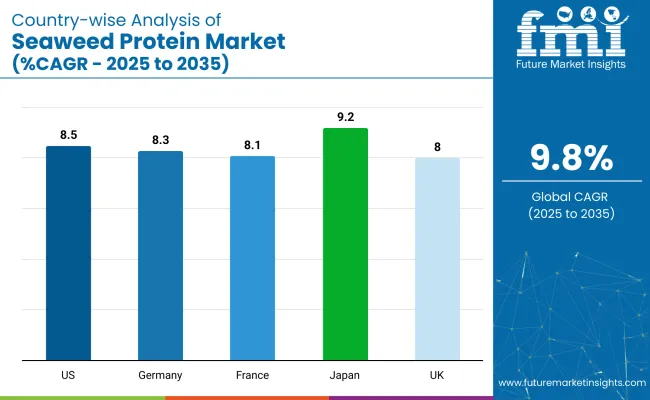

Japan is projected to grow at a CAGR of 9.2% during the forecast period, supported by its strong culinary integration of seaweed and advanced aquaculture infrastructure that ensures a consistent supply. The U.S. follows with a CAGR of 8.5%, driven by increasing clean-label trends, rising demand for plant-based proteins, and growing applications in sports nutrition.

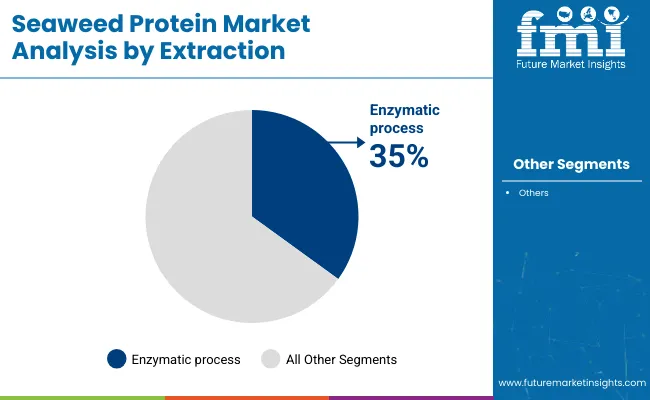

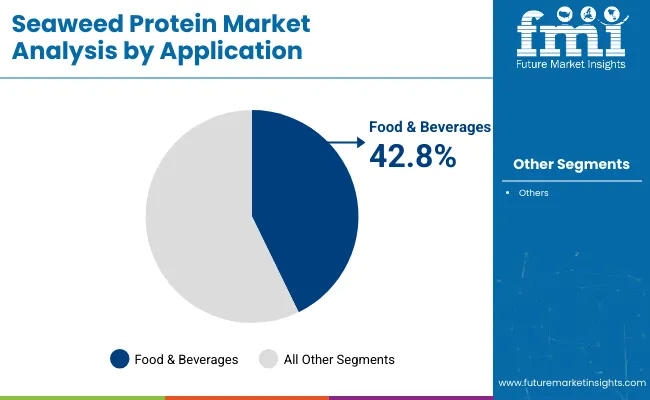

Germany is anticipated to grow at a CAGR of 8.3%, fueled by a strong shift towards vegan dietary preferences. Among applications, food & beverages hold the largest market share at 42.8%, while the enzymatic process dominates the extraction method segment with a 35% share in 2025.

Government regulations play a crucial role in shaping the global seaweed protein market by establishing standards, ensuring food safety, and facilitating trade harmonisation. In Japan, the Ministry of Agriculture, Forestry and Fisheries (MAFF) regulates seaweed farming under the Fisheries Act, providing clear guidelines on licensing, harvesting seasons, quality grading, and environmental conservation.

The market accounts for a small but emerging share within its parent markets. It holds approximately 3-5% of the overall market, as most seaweed is used for hydrocolloids, fertilizers, and traditional foods. Within the plant-based protein market, its share is below 1%, dominated by soy, pea, and wheat proteins.

In the alternative protein market, seaweed protein represents around 1-2%, as microalgae, insect, and cultured meat hold larger shares. Within the functional ingredients and nutraceutical ingredients markets, it holds less than 1%, reflecting its niche but rapidly growing demand for vegan, functional, and bioactive-rich applications globally.

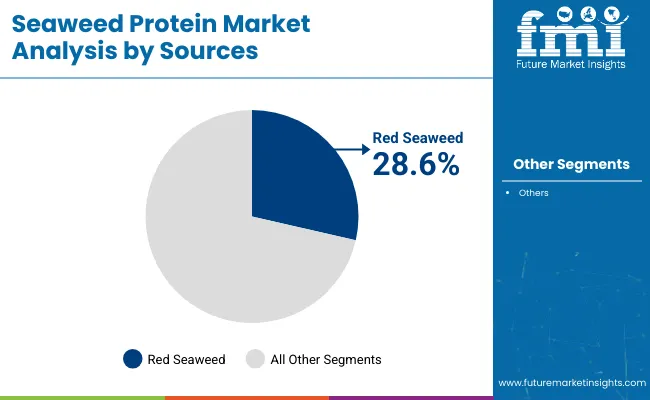

The market is segmented by sources, extraction methods, application, and region. According to sources, the market includes red seaweed, green seaweed, and brown seaweed. Based on extraction methods, it is segmented into conventional methods (physical process, enzymatic process, chemical process) and current methods (ultrasound-assisted extraction, pulsed electric field, microwave-assisted extraction).

By application, the market includes food & beverages, industrial applications, animal feed, aquaculture, cosmetics and personal care, and food processing. Regionally, the market is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Red seaweed is the most lucrative segment in the global market. This is due to its high protein content of 28.6% market share, superior amino acid profile, and wide applicability in food, nutraceutical, and cosmetic formulations.

The most lucrative extraction method segment in the global market is the conventional enzymatic process, holding a market share of 35%.

Food & beverages account for 42.8% market share globally, driven by rising health awareness, consumer preference for sustainable protein sources, and innovations in seaweed-based formulations by leading manufacturers.

The global market is growing steadily, driven by increasing demand for plant-based protein alternatives, rising health and sustainability awareness among consumers, and advancements in seaweed cultivation, extraction technologies, and innovative food and nutraceutical formulations.

Recent Trends in the Seaweed Protein Market

Challenges in the Seaweed Protein Market

Among the top countries, Japan leads with the highest projected CAGR of 9.2%, driven by its established consumption culture and advanced aquaculture techniques. The USA follows with a CAGR of 8.5%, supported by clean-label trends and sports nutrition applications.

Germany shows a CAGR of 8.3%, driven by vegan dietary preferences and processing technologies, while France records a CAGR of 8.1%, boosted by culinary integration and aquaculture initiatives. The UK holds a CAGR of 8.0%, reflecting strong demand for vegan seaweed products and local farming expansions. Overall, Japan remains the fastest-growing market, with Western countries showing steady but slightly lower growth.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA seaweed protein market is projected to grow at a CAGR of 8.5% from 2025 to 2035.

The seaweed protein sales in the UK are poised to grow at a CAGR of 8.0% from 2025 to 2035.

Sales of seaweed protein in Germany are anticipated to grow at a CAGR of 8.3% from 2025 to 2035.

The France seaweed protein revenue is anticipated to grow at a CAGR of 8.1% from 2025 to 2035. Growth is driven by increasing utilisation of seaweed in culinary applications, expanding nutraceutical and cosmetic industries, and government initiatives to promote sustainable aquaculture along coastal regions to boost local production.

The Japan seaweed protein revenue is poised to grow at a CAGR of 9.2% from 2025 to 2035. Growth is driven by established consumption culture, advanced seaweed farming techniques, and continuous innovations in high-quality seaweed protein products for food, nutraceutical, and cosmetic applications, reinforcing Japan’s leadership in this market.

The market is fragmented, with multiple regional and global players competing for market share through product innovation, sustainable sourcing, and strategic collaborations. Top companies focus on advanced extraction technologies, partnerships with food manufacturers, and expanding aquaculture capacities to strengthen their positions.

For example, Cargill Inc. invests in scalable processing facilities and sustainable seaweed sourcing to meet rising plant-based protein demand, while Acadian Seaplants Ltd. focuses on low-temperature dehydration technologies to retain nutrient integrity in its premium seaweed products. The Seaweed Company continues to expand offshore farming operations and partnerships for ready-to-eat seaweed meals targeting European markets.

Recent Seaweed Protein Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 557.8 million |

| Projected Market Size (2035) | USD 1,431.0 million |

| CAGR (2025 to 2035) | 9.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million/Volume (Metric Tons) |

| By Source Type | Red Seaweed, Green Seaweed, Brown Seaweed |

| By Extraction Method | Conventional Method (Physical Process, Enzymatic Process, Chemical Process), Current Method (Ultrasound-Assisted Extraction, Pulsed Electric Field, Microwave Assisted Extraction) |

| By Application | Food & Beverages, Industrial Applications, Animal Feed, Aquaculture, Cosmetics and Personal Care, Food Processing |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Acadian Seaplants Ltd., AquaPharm Laboratories, AtSeaNova, Cargill Inc., Cascadia Seaweed, Cornish Seaweed Co. Ltd., DuluxGroup Australia Pty Ltd., Ebb and Flow Seaweed, gimMe Health Foods Inc., J.M. Huber Corporation, Kelp Products International Pty Ltd., Maine Coast Sea Vegetables Inc., Marcel Trading Corporation, North Atlantic Organics Ltd., Ocean Harvest Technology Ltd., Oceans Balance, Seagarden, Seakura, Seatech Bioproducts Corporation, and The Seaweed Company |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

As per sources, the industry has been categorized into Red Seaweed, Green Seaweed, and Brown Seaweed.

As per extraction method, the industry has been categorized into the Conventional method (Physical process, Enzymatic process, and Chemical process), and the Current method (Ultrasound-Assisted Extraction, Pulsed Electric field, and Microwave Assisted Extraction).

This segment is further categorized into Food & Beverages, Industrial Applications, Animal Feed, Aquaculture and Cosmetics, and Personal Care.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market size is USD 557.8 million in 2025.

The market is projected to grow at a CAGR of 9.8% from 2025 to 2035.

Food & beverages hold the largest share in the market with 42.8%.

The market is projected to reach USD 1,431.0 million by 2035.

Japan is the fastest-growing market with a CAGR of 9.2%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seaweed Extracts Market Size and Share Forecast Outlook 2025 to 2035

Seaweed-Based Anti-Aging Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Seaweed Derived Minerals Market Size and Share Forecast Outlook 2025 to 2035

Seaweed Packaging Market Insights - Demand and Growth Forecast 2025 to 2035

Seaweeds Market Analysis by Form, Application, Packaging, Distribution Channel and Region through 2035

Seaweed Hydrocolloid Market Analysis by Product Type, Application, Sustainability Impact, and Regional Forecast from 2025 to 2035

Seaweed-based Feed Market Analysis by Feed Type, Livestock Application, Sustainability Impact, and Regional Forecast from 2025 to 2035

Market Share Breakdown of Seaweed Flavor Manufacturers

Edible Seaweed Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Commercial Seaweed Market Size, Growth, and Forecast for 2025 to 2035

Brown Commercial Seaweed Market Size and Share Forecast Outlook 2025 to 2035

Processed Eucheuma Seaweed Market

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA