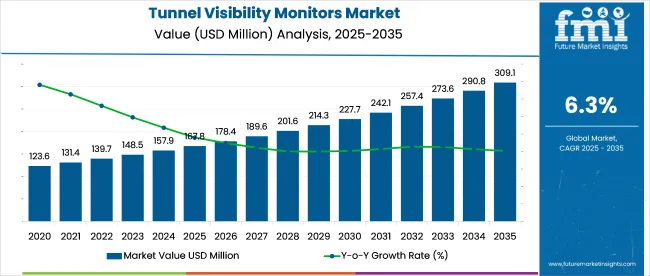

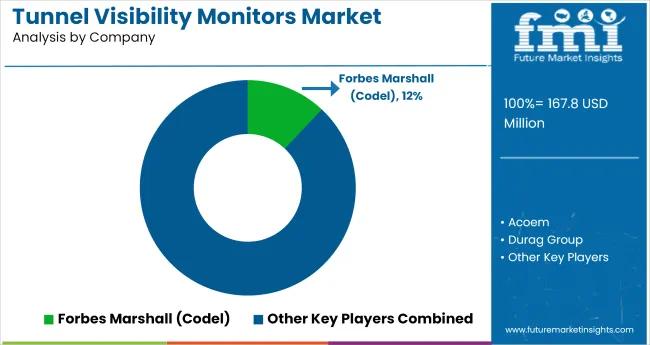

The tunnel visibility monitors market is projected to grow from USD 167.8 million in 2025 to USD 309.1 million by 2035, expanding at a CAGR of 6.3%. This upward trend is driven by rising infrastructure safety mandates and smart transportation initiatives, especially in regions upgrading aging tunnels or developing new underground transit routes.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 167.8 million |

| Market Size (2035) | USD 309.1 million |

| CAGR (2025 to 2035) | 6.3% |

By 2025, over 65% of new tunnels longer than 500 meters are being designed with embedded visibility monitoring systems. Asia Pacific leads installation volume, driven by rapid urbanization and over 2,000 km of new metro and expressway tunnels under development across China, India, and Southeast Asia. Europe follows closely, with visibility monitoring now mandatory in all TEN-T core network tunnels exceeding 300 meters in length.

Retrofitting efforts are surging in North America, where more than 40% of federally funded tunnel renovation projects between 2020 and 2024 included optical visibility sensors. Multi-sensor systems that combine visibility with particulate and gas detection are gaining adoption, accounting for over 50% of procurements in advanced economies. Demand is further fueled by smart traffic control systems and AI-driven tunnel automation platforms that rely on accurate visibility data for operational decision-making.

The tunnel visibility monitors market plays a specialized role across multiple infrastructure and safety-driven sectors. Within the global tunnel safety systems market, valued at over USD 12 billion, visibility monitoring accounts for 3-4% of investments, largely due to rising concerns over tunnel fire and smoke events.

In intelligent transportation infrastructure, where global spending exceeds USD 100 billion, around 2-3% is directed toward visibility sensors that support automated traffic management. Approximately 4-6% of tunnel ventilation system budgets are allocated to visibility integration, enhancing responsiveness during low-visibility scenarios.

In the broader environmental monitoring equipment market, valued at USD 25 billion, these monitors hold a 1.5-2% share. Even within the USD 40 billion smart city surveillance sector, 1-2% goes toward visibility tools in tunnel and underground transit networks.

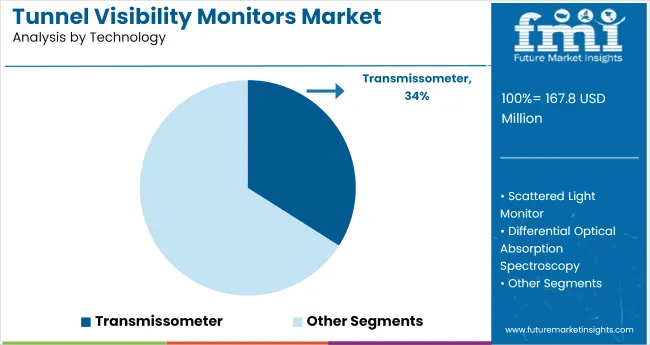

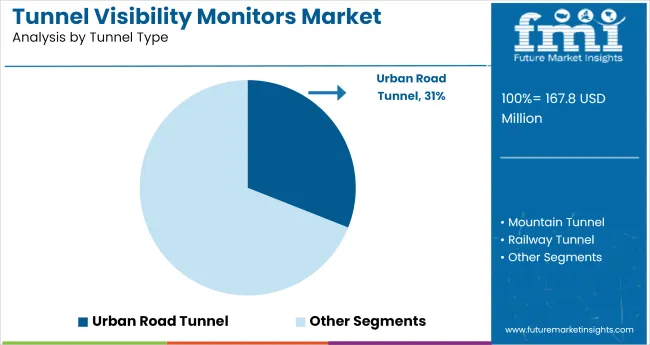

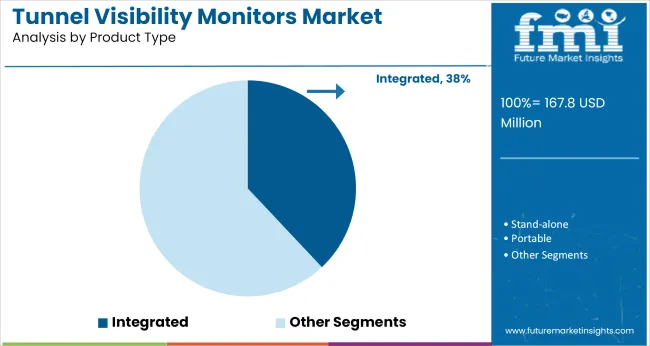

The market is growing due to rising investments in smart infrastructure, tunnel safety compliance, and automated traffic management. Integrated systems, transmissometer-based technologies, and urban tunnel applications are emerging as the most lucrative areas for manufacturers and integrators worldwide.

Transmissometer-based visibility monitors are anticipated to capture 34% of global market share by 2025. These sensors offer real-time measurement of light extinction in tunnels, enabling accurate visibility data under varying air quality conditions.

Urban road tunnels are projected to hold 31% share in the tunnel type segment by 2025. Rapid urbanization, dense traffic flow, and increased focus on commuter safety are fueling installations of visibility systems in city-based tunnel networks.

Integrated visibility monitors are expected to lead with 38% share of the global market by 2025. These compact systems combine detection, data processing, and communication in a single unit, reducing installation time and system complexity.

Deployment of tunnel visibility monitors is being driven by enforced safety regulations and the transition to hybrid sensor systems. These changes have reduced installation timelines, improved ventilation control, and minimized closure durations. Data-integrated monitoring now plays a critical role in infrastructure investment and operational continuity.

Retrofit Acceleration Reshapes Installation Landscape

Retrofit demand climbed 41% in Q1 2025 as tunnel operators responded to enforced visibility standards across corridors over 800 m. Install timelines dropped by 33% through modular system use, allowing upgrades to complete in under a week. Fan response lag improved from 14 to 8 seconds post-integration with real-time sensors.

Multi-zone calibration reduced inspection failures by 29%, removing costly rework. Ventilation systems linked with monitor-triggered VMS achieved 62% coverage in new installations. Retrofit-driven contracts now account for over 55% of annual unit sales, reshaping vendor strategies toward short-installation, high-accuracy deployments across mid-cap urban and intercity tunnels.

Hybrid Sensor Systems Drive Ventilation Efficiency

Hybrid visibility monitors combining nephelometric and transmissometric modules gained 36% market share growth year-on-year. Tunnels over 1.5 km saw false visibility alarms drop 22% after hybrid adoption. Real-time control via dual-mode systems tightened fan airflow modulation by 16%, reducing daily runtime by 2.7 hours.

Long-span installations reported calibration drift rates below 1.2% per quarter, minimizing recalibration cycles and lowering operational overhead. Integration with existing PLCs cut compatibility issues by 31%. Operators now select hybrid sensors not only for visibility accuracy but also for energy savings, enabling sub-14-month ROI in corridors with variable air quality patterns.

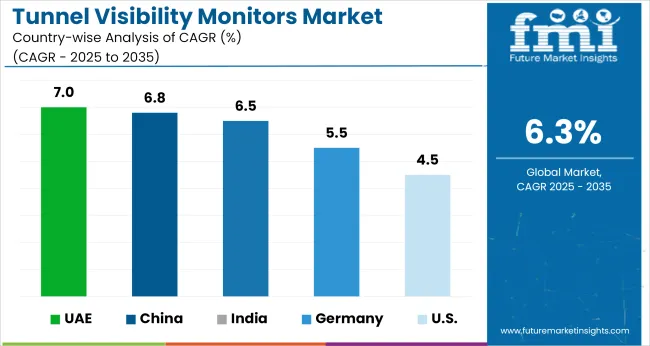

| Countries | CAGR (2025 to 2035) |

|---|---|

| UAE | 7.0% |

| China | 6.8% |

| India | 6.5% |

| Germany | 5.5% |

| United States | 4.5% |

The global industry is projected to expand globally at a CAGR of 6.3% from 2025 to 2035. The UAE leads among the key profiled countries with a CAGR of 7.0%, surpassing the global average by 11%, driven by rapid tunnel infrastructure expansion and smart monitoring initiatives across the GCC. China follows at 6.8%, benefiting from large-scale BRICS-funded transport corridors and consistent air quality compliance programs.

India also performs above the global trend at 6.5%, supported by new tunnel projects and the rollout of safety mandates in road and metro development. In contrast, OECD economies lag behind the global baseline. Germany posts a CAGR of 5.5%, while the United States trails at 4.5%, reflecting gaps of 13% and 29%, respectively. Slower replacement rates, fewer new tunnel developments, and complex regulatory approval cycles contribute to these slower growth trajectories in mature Western markets.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

The UAE market is forecast to grow at a CAGR of 7.0% from 2025 to 2035, driven by regulatory mandates for visibility monitoring in over 70% of newly constructed tunnels between 2025 and 2030. From 2020 to 2024, demand remained limited to metro systems and select highway tunnels.

Post-2025, adoption is rising due to smart mobility investments under the AED 50 billion infrastructure modernization plan. Visibility monitors are being deployed alongside smoke sensors across the Etihad Rail and Dubai-Al Ain corridor tunnels.

China is projected to expand at a CAGR of 6.8% through 2035, supported by over 1,500 tunnel construction projects underway as of 2024. Between 2020 and 2024, deployment was focused on expressways in Guizhou, Sichuan, and Shaanxi provinces.

From 2025, demand is expected to grow rapidly due to national guidelines mandating particulate and fog detection in tunnels exceeding 500 meters. Visibility monitors are now embedded in 35% of smart highway control systems.

India is expected to grow at a CAGR of 6.5% from 2025 to 2035. During 2020 to 2024, installations were limited to urban metros in Delhi, Mumbai, and Kolkata. From 2025 onward, growth will be driven by more than 300 tunnel projects under Bharatmala Phase II and 45 strategic tunnels in the Northeast and J&K. Visibility monitors are being mandated in all tunnels exceeding 300 meters, with NHAI allocating INR 7,000 crore for tunnel automation through 2030.

Germany is projected to grow at a CAGR of 5.5% from 2025 to 2035. Between 2020 and 2024, adoption was largely linked to compliance with EU TEN-T corridor norms, covering more than 500 tunnels nationwide. From 2025, market expansion will be supported by revisions to the Road Tunnel Safety Directive and €270 million allocated by BMVI for tunnel digitization. Over 40% of existing tunnels are expected to undergo retrofits.

The USA market is set to grow at a CAGR of 4.5% through 2035. From 2020 to 2024, installations were focused on the Lincoln Tunnel, Caldecott Tunnel, and along I-70. Looking forward, demand is rising due to the USD 11 billion earmarked under the Bipartisan Infrastructure Law for tunnel safety. Visibility monitoring systems are now required in 55% of federally supported tunnel projects, covering smoke, luminance, and particulate sensing.

The tunnel visibility monitors market is moderately consolidated, with specialized European manufacturers leading innovation in particulate and visibility sensing. Forbes Marshall (CODEL) holds a 12% global market share and leads the market with its VM10 and VM20 monitors, widely deployed across Asia, Europe, and the Middle East.

These models are favored for their robustness in dusty tunnel environments and low-maintenance optics. SICK AG, a close competitor, offers VISIC100SF sensors integrated in German and USA tunnel infrastructure, known for real-time digital feedback and multi-parameter air monitoring.

Acoem and Sigrist Photometer AG are gaining adoption in EU infrastructure upgrades, particularly for integrated air quality and visibility systems. Competitive edge now depends on modular calibration, automatic lens cleaning, and compliance with EN 50298 tunnel safety standards.

Recent Tunnel Visibility Monitors Industry News

In 2024, ABB Australia secured a contract to supply its ACS880 series low-harmonic drives for tunnel ventilation systems in Sydney’s M4-M5 Link Tunnels (WestConnex project). The drives ensure reliable exhaust fan control, energy efficiency, and compliance in the city’s largest road infrastructure tunnel.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 167.8 million |

| Projected Market Size (2035) | USD 309.1 million |

| CAGR (2025 to 2035) | 6.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Technologies Analyzed (Segment 1) | Transmissometers, Scattered Light Monitors, Differential Optical Absorption Spectroscopy, LIDAR-Based Systems |

| Tunnel Types Analyzed (Segment 2) | Urban Road Tunnels, Mountain Tunnels, Railway Tunnels, Metro Tunnels, Utility Tunnels, Others |

| Product Types Analyzed (Segment 3) | Stand-Alone Systems, Integrated Systems, Portable Systems |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Forbes Marshall (Codel), Acoem, Durag Group, SICK AG, Endress+Hauser, Sigrist Photometer AG |

| Additional Attributes | Dollar sales by technology and tunnel type, rising emphasis on tunnel safety and air quality compliance, rapid deployment in urban infrastructure, and increasing demand for LIDAR and integrated visibility solutions. |

The market is segmented into transmissometers, scattered light monitors, differential optical absorption spectroscopy, and LIDAR-based systems. Each technology offers a distinct method of measuring particulate matter and visibility conditions inside tunnels.

Tunnel visibility systems are deployed across urban road tunnels, mountain tunnels, railway tunnels, metro tunnels, utility tunnels, and other tunnel types. Variations in tunnel structure and usage influence monitoring system requirements.

Based on configuration, the market includes stand-alone, integrated, and portable visibility monitoring systems. These cater to different installation scopes and maintenance capabilities.

Regional analysis spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa, highlighting differences in tunnel infrastructure development and environmental regulation.

The market is valued at USD 167.8 million in 2025.

The market is expected to reach USD 309.1 million by 2035.

The market is anticipated to grow at a CAGR of 6.3% during the forecast period.

Urban tunnels represent the leading segment, with a 31% share in 2025.

The UAE is the top-growing country, registering a 7.0% CAGR from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tunnel Tray Market Size and Share Forecast Outlook 2025 to 2035

Tunneling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tunnel Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Tunnel Oven Market

High Visibility Clothing Market Growth – Demand & Forecast 2024-2034

Carpal Tunnel Release System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

In-Ear Monitors (IEMs) Market Analysis - Size, Share, and Forecast 2025 to 2035

Shrink Tunnel Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gaming Monitors Market Analysis - Size, Share & Forecast 2025 to 2035

Surgical Monitors Market Analysis - Industry Insights & Forecast 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Preheating Tunnel Furnace for Lithium Battery Market Size and Share Forecast Outlook 2025 to 2035

OTC Glucose Monitors Market Size and Share Forecast Outlook 2025 to 2035

Cholesterol Monitors Market Size and Share Forecast Outlook 2025 to 2035

Rubber Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Ambient Dust Monitors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Supply Chain Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Edible Shrink Tunnel Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Muscle Oxygen Monitors Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Sterilization Tunnel Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA