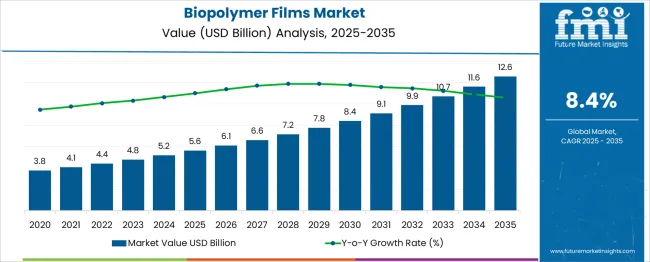

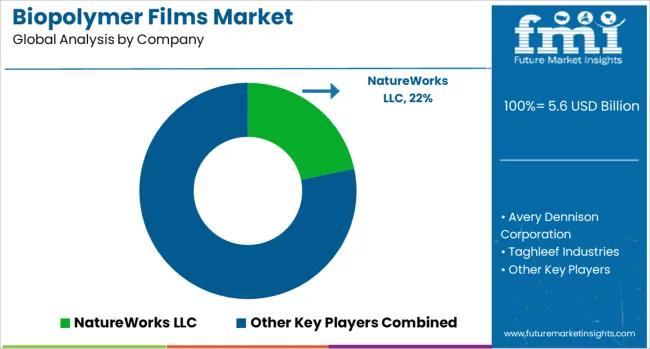

The Biopolymer Films Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 12.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Biopolymer Films Market Estimated Value in (2025 E) | USD 5.6 billion |

| Biopolymer Films Market Forecast Value in (2035 F) | USD 12.6 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

Increasing environmental regulations and consumer awareness about plastic pollution have driven manufacturers to adopt bio-based raw materials. The shift toward reducing carbon footprints has accelerated the use of renewable sources for film production.

Technological advancements have enhanced film performance, enabling biopolymer films to meet industry requirements for durability, flexibility, and barrier properties. Multilayer technology has allowed for combining different biopolymers to optimize functionality while maintaining biodegradability.

Rising demand in sectors such as food packaging and agriculture has further supported market growth. As innovation continues to improve material properties and cost-effectiveness, the market outlook remains positive. Segment growth is expected to be led by bio-based raw materials, multilayer technologies, and polylactic acid (PLA) films due to their versatility and environmental benefits.

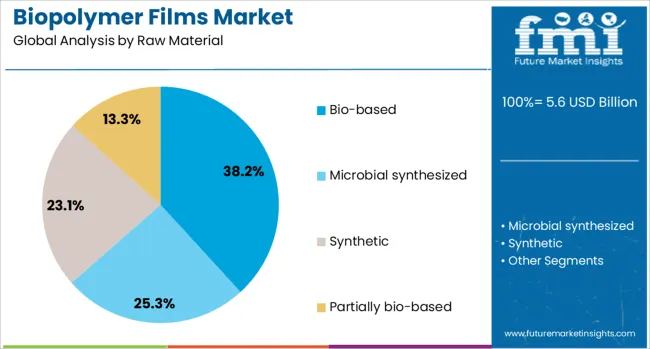

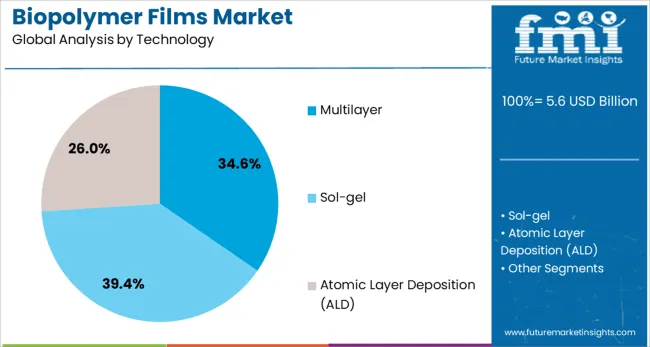

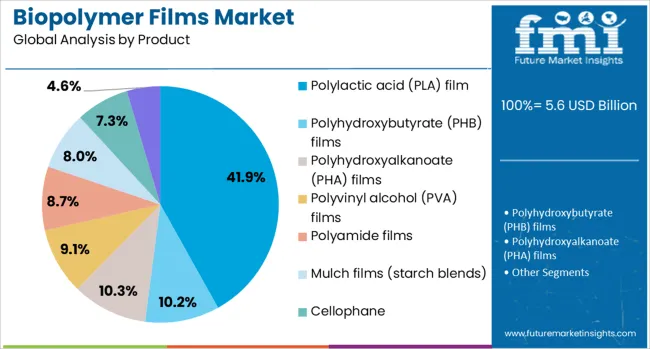

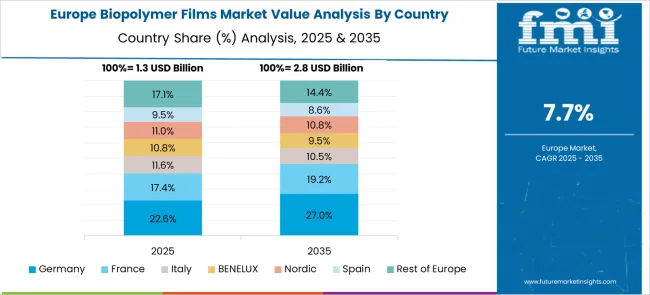

The biopolymer films market is segmented by raw material, technology, product, and end-user and geographic regions. The raw materials of the biopolymer films market are divided into Bio-based, microbial-synthesized, Synthetic, and partially bio-based. The biopolymer films market is classified by technology into Multilayer, Sol-gel, and Atomic Layer Deposition (ALD). The biopolymer films market is segmented into Polylactic acid (PLA) film, Polyhydroxybutyrate (PHB) films, Polyhydroxyalkanoate (PHA) films, Polyvinyl alcohol (PVA) films, Polyamide films, Mulch films (starch blends), Cellophane, and Others. The end-user of the biopolymer films market is segmented into Food & beverage, Home & personal care, Medical & pharmaceutical, Agriculture, and Others. Regionally, the biopolymer films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bio-based raw material segment is projected to hold 38.2% of the biopolymer films market revenue in 2025, maintaining its leadership position. The increasing availability of renewable feedstocks such as corn starch, sugarcane, and cellulose has driven growth. These materials are preferred due to their lower environmental impact compared to fossil fuel-based polymers.

Manufacturers have been encouraged to adopt bio-based sources to comply with regulatory frameworks aimed at reducing plastic waste and promoting circular economies. The consumer preference for sustainable products has also bolstered demand.

The segment’s ability to provide biodegradable and compostable options aligns with global sustainability goals, supporting its sustained market dominance.

The multilayer technology segment is expected to contribute 34.6% of the market revenue in 2025, leading technology types. This growth is attributed to the capability of multilayer films to combine multiple biopolymers, enhancing mechanical strength and barrier performance.

The technology allows for customization of film properties to suit diverse packaging needs while preserving biodegradability. Multilayer films are widely adopted in food packaging, where protection against moisture, oxygen, and contaminants is critical.

Advancements in co-extrusion and lamination processes have further improved the quality and scalability of multilayer biopolymer films. The increasing demand for high-performance sustainable packaging solutions has solidified the position of multilayer technology in the market.

Polylactic acid (PLA) film is projected to account for 41.9% of the biopolymer films market revenue in 2025, establishing it as the leading product segment. PLA films have gained popularity due to their excellent clarity, printability, and compostability. Derived from renewable resources like corn starch, PLA offers a sustainable alternative to conventional plastic films.

Its use in food packaging has increased significantly because it provides good barrier properties and meets consumer demands for eco-friendly packaging. Continuous improvements in PLA processing and blending with other biopolymers have enhanced its physical properties and broadened its applications.

The segment benefits from strong regulatory support encouraging the use of biodegradable materials, ensuring sustained growth in the market.

Regulatory compliance and bans on single-use plastics are driving the adoption of biopolymer films across multiple sectors. Rising demand in food, pharmaceuticals, and personal care is fueling innovation in multilayer, compostable film structures.

Regulatory guidelines focused on eco-friendly packaging materials have influenced the biopolymer films market by shaping adoption trends across food, pharmaceuticals, and personal care sectors. Compliance with compostability and biodegradability standards has accelerated procurement by packaging converters and brand owners. Restrictions on single-use plastics have resulted in a strong preference for films derived from renewable feedstocks, including starch-based and PLA variants. Certification programs for industrial and home compostability have enhanced transparency, influencing buyer trust and material selection. These dynamics have pushed manufacturers to invest in compliant formulations, while regional mandates in Europe and North America have positioned biopolymer films as a strategic substitute in both rigid and flexible packaging systems.

Changing consumer behavior toward packaged foods and ready-to-eat formats has amplified demand for biopolymer films with superior barrier properties. The pharmaceutical industry has adopted these films in blister packaging to maintain product stability under moisture-sensitive conditions. The surge in premium personal care products has encouraged brand differentiation through compostable film-based sachets and labels. This demand shift has led suppliers to develop multilayer structures offering strength without compromising biodegradability. Growth in retail and e-commerce channels has further supported adoption, with businesses exploring films for secondary and tertiary packaging. These sector-specific preferences have redefined product innovation strategies, creating a strong link between material performance and market expansion.

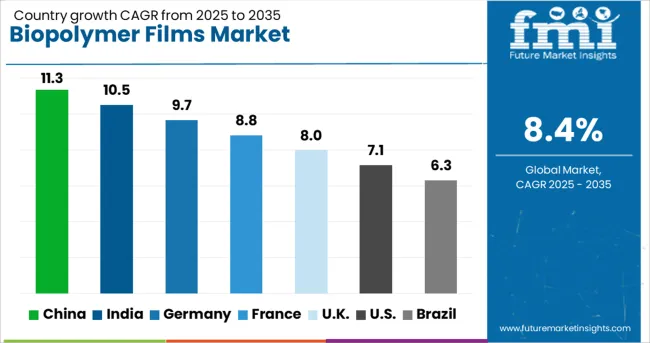

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

The biopolymer films market, projected to grow at a global CAGR of 8.4% from 2025 to 2035, shows robust momentum across leading economies. China leads with a CAGR of 11.3%, driven by government initiatives supporting biodegradable packaging, strong e-commerce growth, and increasing investments in sustainable material innovations. India follows at 10.5%, supported by rising food packaging demand, regulatory moves favoring plastic alternatives, and growing bioplastics manufacturing capacity.

Germany posts 9.7%, benefiting from EU circular economy policies, high adoption in foodservice and industrial packaging, and advanced R&D in compostable materials. The UK records an 8.0% CAGR, influenced by single-use plastic restrictions and partnerships with FMCG brands for green packaging adoption.

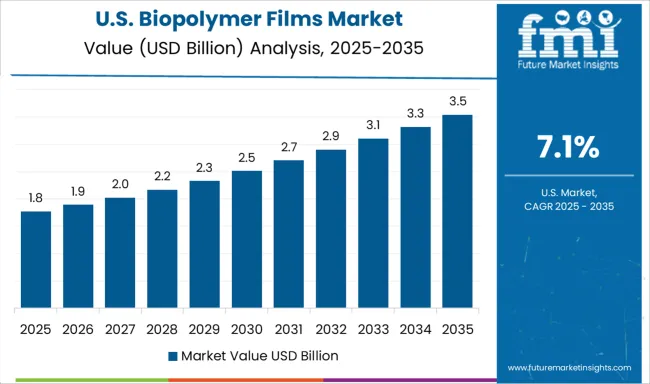

The USA grows at 7.1%, driven by large-scale retail adoption and biopolymer integration in flexible packaging, though growth is tempered by cost and scalability challenges. BRICS countries are leading through cost efficiency and domestic manufacturing expansion, while OECD economies emphasize regulatory compliance, innovation, and advanced application development. The report includes comprehensive coverage of 40+ countries, with the five top-performing markets highlighted for reference.

The CAGR in the United Kingdom advanced from nearly 6.7% during 2020-2024 to about 8.0% for 2025-2035, compared to the global rate of 8.4%. This rise is associated with stringent compliance programs targeting single-use plastic bans and increased incentives for compostable packaging in food retail. Local packaging converters accelerated the adoption of PLA and starch-based films due to evolving Extended Producer Responsibility (EPR) schemes. Partnerships between e-commerce retailers and biopolymer film manufacturers expanded film usage in secondary packaging, addressing sustainability-linked procurement goals. Government-backed recycling mandates also pushed retail brands to substitute conventional films with compostable options, reshaping market growth.

The CAGR in China climbed from approximately 9.4% during 2020-2024 to 11.3% in 2025-2035, outpacing the global benchmark of 8.4%. This surge is tied to aggressive regulatory reforms under the national plastic restriction policy, driving mass adoption of biodegradable films in grocery retail and takeaway packaging. Provincial governments implemented subsidy schemes for compostable material suppliers, creating localized production hubs. Rapid digital grocery expansion has amplified demand for lightweight yet durable packaging films. Domestic players invested in advanced extrusion processes to meet evolving standards for barrier strength and compostability. Partnerships with international resin suppliers further boosted technology penetration, creating strong supply-side resilience.

The CAGR in India moved from nearly 8.2% during 2020-2024 to 10.5% across 2025-2035, supported by the implementation of national policies targeting plastic waste management and strong compliance from FMCG majors. Increased penetration in flexible pouches and snack packaging reinforced demand momentum. Investment in industrial-scale composting infrastructure and rising procurement by retail giants created a robust ecosystem for biopolymer adoption. Domestic manufacturers scaled operations in clusters such as Gujarat and Tamil Nadu, leveraging incentives under Production-Linked Incentive (PLI) schemes. E-commerce and food delivery platforms transitioned to certified compostable bags, reshaping operational packaging strategies across last-mile networks.

Germany experienced a CAGR shift from about 8.5% during 2020-2024 to 9.7% in the 2025-2035 period, slightly above the EU average. The upward trend of rigorous enforcement of packaging compliance under VerpackG regulations and high emphasis on home-compostable solutions. Adoption gained traction in premium food brands, where transparency-driven labeling and lifecycle certifications became key differentiators. Domestic chemical giants scaled R&D to enhance bio-based film durability for dairy and meat applications. Additionally, collaborations between resin producers and film converters accelerated integration into pharmaceutical blister packs, supported by EU eco-design directives. Export-oriented manufacturers leveraged Germany’s technological infrastructure to enhance operational efficiency and regional supply chain flexibility.

The CAGR in the United States moved up from approximately 6.2% during 2020-2024 to 7.1% for 2025-2035, remaining slightly below the global rate. The growth is driven by corporate sustainability commitments and state-level bans on single-use plastics, particularly in California and New York. Quick-service restaurants adopted bio-based films for secondary wrapping in compliance with local food packaging legislation. Brand owners pursued partnerships with certified compostable film producers, emphasizing labeling clarity to build consumer trust. Demand for recyclable multilayer films in e-commerce delivery surged, supported by robust distribution in grocery chains. Domestic resin manufacturers expanded capacity to reduce import reliance, focusing on enhancing compostability without compromising film strength.

In the biopolymer films industry, major companies are strengthening portfolios with compostable and bio-based alternatives targeting packaging converters, food processors, and retail brands. Firms like NatureWorks LLC, BASF SE, and Braskem SA are investing in high-performance PLA and bio-PE solutions designed for both flexible and rigid applications.

Avery Dennison Corporation and Taghleef Industries focus on specialty labeling films and multilayer bio-based wraps, addressing the rising demand for certified compostable formats. Mondi Group and Amcor Ltd. leverage global distribution and printing capabilities to enable recyclable barrier coatings integrated with renewable substrates.

Emerging innovators such as Yield10 Bioscience, BioBag International AS, and Plastic Union NV emphasize starch-based films, organic waste liners, and home-compostable pouches to capture niche segments. Klöckner Pentaplast, Toray Industries, and Innovia Films lead in developing high-barrier solutions for pharmaceuticals and food preservation. These companies' strategies with regulatory frameworks while expanding production capacity in Europe, North America, and Asia.

In April 2024, NatureWorks and IMA Coffee launched a full turnkey compostable coffee pod solution made entirely from Ingeo™ PLA, compatible with Keurig® production speeds across North America.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.6 Billion |

| Raw Material | Bio-based, Microbial synthesized, Synthetic, and Partially bio-based |

| Technology | Multilayer, Sol-gel, and Atomic Layer Deposition (ALD) |

| Product | Polylactic acid (PLA) film, Polyhydroxybutyrate (PHB) films, Polyhydroxyalkanoate (PHA) films, Polyvinyl alcohol (PVA) films, Polyamide films, Mulch films (starch blends), Cellophane, and Others |

| End-User | Food & beverage, Home & personal care, Medical & pharmaceutical, Agriculture, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NatureWorks LLC, Avery Dennison Corporation, Taghleef Industries, Mondi Group, Plastic Union NV, Innovia Films, BASF SE, Evonik Industries AG, Industria Termoplastica Pavese SpA (ITP), Braskem SA, Yield10 Bioscience, Inc., Toray Industries Inc., Amcor Ltd., BioBag International AS, and Klöckner Pentaplast |

| Additional Attributes | Dollar sales by region, share by product type, pricing benchmarks, raw material cost trends, regulatory impact, competitive landscape, growth drivers, end-use demand shifts, and capacity expansion forecasts. |

The global biopolymer films market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the biopolymer films market is projected to reach USD 12.6 billion by 2035.

The biopolymer films market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in biopolymer films market are bio-based, microbial synthesized, synthetic and partially bio-based.

In terms of technology, multilayer segment to command 34.6% share in the biopolymer films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biopolymer Injection Molders Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Biopolymer Closure Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biopolymer Tubes Market

Renewable Biopolymer Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Bioplastic and Biopolymer Market Forecast Outlook 2025 to 2035

Castor Oil-Based Biopolymer Market Size and Share Forecast Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

LDPE Films Market

Card Films Market

Mulch Films Market Size and Share Forecast Outlook 2025 to 2035

Nylon Films for Liquid Packaging Market from 2024 to 2034

Vinyl Films Market

MDO-PE Films Market Analysis by Cast Films and Blown Films Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Retort Films Market

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA