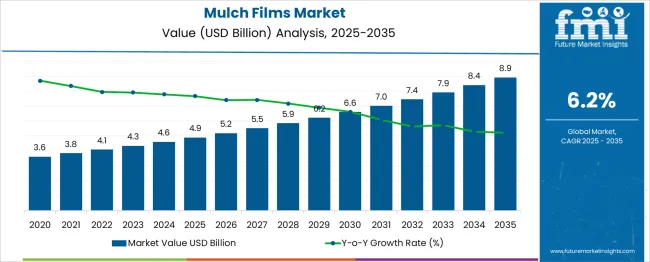

The Mulch Films Market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 8.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. The first breakpoint occurs around 2025, when the market crosses the USD 4.9 billion mark, reflecting increased adoption of sustainable agricultural practices and rising demand for crop yield optimization. Between 2020 and 2025, incremental revenue of USD 1.3 billion is realized as farmers increasingly shift from traditional methods to biodegradable and polyethylene mulch films, driven by government incentives and growing awareness of soil conservation techniques.

The second breakpoint emerges in the period 2030-2035, as the market accelerates toward USD 8.9 billion. This phase reflects an incremental revenue of USD 2.5 billion, fueled by expanding applications in horticulture, vegetable cultivation, and high-value crops. Technological advancements in film durability, UV resistance, and environmentally friendly formulations further drive adoption. These breakpoints highlight periods of significant growth, signaling opportunities for manufacturers, distributors, and investors to capitalize on the expanding market. Overall, the trajectory underscores a shift from moderate adoption to mainstream integration, creating sustained revenue potential across the forecast period.

| Metric | Value |

|---|---|

| Mulch Films Market Estimated Value in (2025 E) | USD 4.9 billion |

| Mulch Films Market Forecast Value in (2035 F) | USD 8.9 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The mulch films market is witnessing robust growth driven by the rising demand for enhanced crop yield and water conservation in agriculture. Sustainable farming practices are increasingly being prioritized globally, leading to wider adoption of mulch films that improve soil moisture retention and reduce weed growth. Innovations in polymer materials, particularly in biodegradable and recyclable films, are influencing product development, making mulch films more eco-friendly and effective.

The expanding global population and increasing food demand are prompting farmers to optimize land use and crop productivity, which supports the integration of mulch films in modern agriculture. Additionally, government initiatives promoting sustainable agriculture and plastic waste management are positively impacting market expansion.

The ongoing research on improving film durability and soil compatibility is expected to further propel market penetration in both developed and emerging regions. Future growth is anticipated as advancements in material science continue to enhance performance attributes, while cost efficiencies encourage wider usage among agricultural communities.

The mulch films market is segmented by type, material, application, and geographic regions. By type, the mulch films market is divided into Black, Clear/Transparent, Colored, and Degradable Others. In terms of material, the mulch films market is classified into Low-density polyethylene (LDPE), Linear low-density polyethylene (LLDPE), High-density polyethylene (HDPE), Ethylene-vinyl acetate (EVA), Polylactic acid (PLA), Polyhydroxyalkanoate (PHA), and Others. Based on the application, the mulch films market is segmented into Agricultural farms and Horticulture. Regionally, the mulch films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

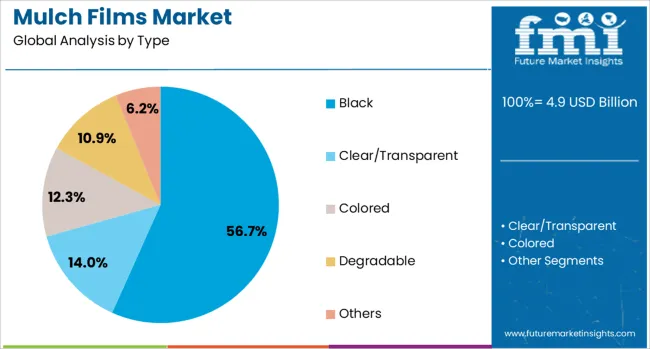

The black type segment is projected to hold 56.7% of the mulch films market revenue share in 2025, reflecting its dominance in the market. This leadership can be attributed to its superior weed control capabilities and effective heat absorption, which are critical for crop growth in various climatic conditions.

Black mulch films are preferred for their ability to suppress light penetration, thereby reducing weed proliferation and improving soil temperature regulation. The segment's growth is further supported by its cost-effectiveness and ease of installation, making it a favored choice among farmers seeking reliable performance without significant investment.

Compatibility with a range of crops and soil types has broadened its applicability across diverse agricultural regions. Additionally, the segment benefits from continuous improvements in polymer formulations, enhancing film strength and degradation rates, which meet sustainability goals while maintaining functional efficiency.

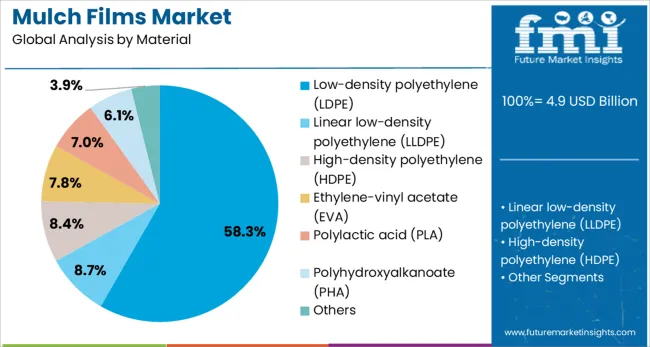

The low-density polyethylene (LDPE) material segment is expected to represent 58.3% of the total revenue share in the mulch films market by 2025. This is primarily due to LDPE’s advantageous balance of flexibility, durability, and cost efficiency that suits a wide range of agricultural applications. LDPE films offer excellent moisture retention and resistance to tearing, which enhances their lifespan during crop cycles.

The material’s adaptability to various thicknesses and formulations enables customization for specific farming needs, such as biodegradability or UV resistance. The availability of LDPE and its well-established manufacturing infrastructure contribute to its widespread use in the market.

Furthermore, LDPE-based mulch films are favored for their recyclability, aligning with increasing environmental regulations and farmer preferences for sustainable farming inputs. These factors collectively contribute to LDPE’s leading position within the material segment.

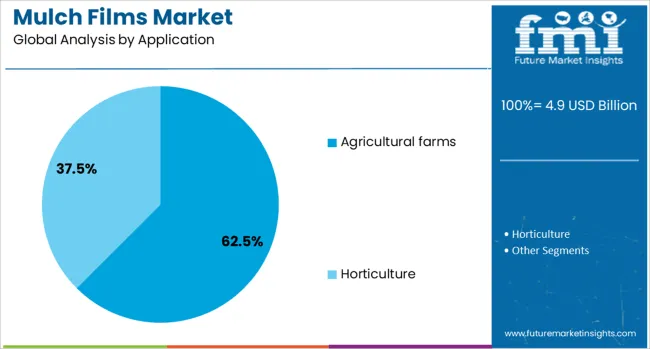

The agricultural farms application segment is forecasted to command 62.5% of the mulch films market revenue share in 2025, establishing it as the largest application category. This prominence is driven by the growing emphasis on maximizing crop yield and minimizing water usage on farms of various scales. Mulch films are widely employed in row crops, vegetable cultivation, and specialty farming to improve soil microclimate and protect against pest infestation.

The segment benefits from enhanced irrigation efficiency and reduced fertilizer runoff, which support sustainable farming practices. Adoption has been accelerated by increased awareness among farmers regarding the benefits of plasticulture and government subsidies promoting advanced agricultural technologies.

Moreover, the ability of mulch films to improve harvest quality and shorten crop cycles further incentivizes their use in commercial farming. As the agricultural sector seeks innovative solutions to meet global food security challenges, this application segment is poised for sustained expansion.

The mulch films market is expanding as farmers adopt solutions to improve crop yield, conserve soil moisture, and manage weeds more effectively. Mulch films, available in polyethylene and biodegradable forms, help regulate soil temperature, enhance water efficiency, and reduce chemical herbicide usage. Rising demand for high-value crops, modern farming practices, and optimized land use drives growth globally. Europe and North America lead due to advanced agriculture, while Asia-Pacific shows increasing adoption. Innovations like UV-resistant and compostable films support sustainable and efficient farming practices.

Mulch films are increasingly adopted to enhance agricultural productivity and soil management. By controlling weed growth, conserving moisture, and regulating soil temperature, these films allow farmers to optimize crop growth conditions. High-value crops such as vegetables, fruits, and specialty grains particularly benefit from consistent soil conditions, leading to higher yields and improved quality. Modern farming practices, including precision agriculture, promote the use of mulch films to reduce labor costs associated with weeding and irrigation management. North America and Europe lead adoption due to advanced farming infrastructure, while Asia-Pacific is witnessing growing interest as arable land optimization becomes a priority. The push for eco-friendly practices also encourages the use of biodegradable and UV-resistant films, which reduce environmental impact and extend film lifespan. Farmers increasingly recognize the value of mulch films as a tool to improve operational efficiency and profitability across diverse crop types.

The mulch films market is evolving with innovations in material composition and design. Traditional polyethylene films are complemented by biodegradable, compostable, and photodegradable alternatives that break down naturally in the soil, minimizing waste management issues. UV-resistant and anti-drip films enhance durability and protect crops from extreme sunlight and moisture conditions. Colored mulch films, such as black, red, or reflective silver, are tailored to specific crop types to influence soil temperature and pest management. Manufacturers are also offering multilayered films and films with controlled porosity to optimize water retention and gas exchange. Product diversification allows farmers to select films suited to regional climate conditions, crop type, and soil characteristics. Collaboration with agricultural research institutions helps validate film performance, supporting adoption and demonstrating long-term benefits. These advancements are critical in meeting growing environmental regulations and farmer expectations for eco-friendly farming solutions.

Mulch films offer operational advantages by reducing manual labor, lowering water consumption, and decreasing reliance on chemical herbicides. By retaining soil moisture and regulating temperature, these films improve irrigation efficiency and reduce crop stress during extreme weather conditions. Higher yields and better-quality produce can translate into increased revenue for farmers. Mulch films also shorten the time between planting and harvesting by creating optimal soil conditions, improving farm productivity. Cost-effectiveness depends on film type, thickness, and durability, making the selection process critical for maximizing benefits. Supply chain reliability for high-quality mulch films is essential, particularly during peak planting seasons. Farmers increasingly prefer ready-to-use or customized films that match specific crop and soil needs. Overall, mulch films represent a practical investment that balances operational efficiency, crop performance, and economic returns.

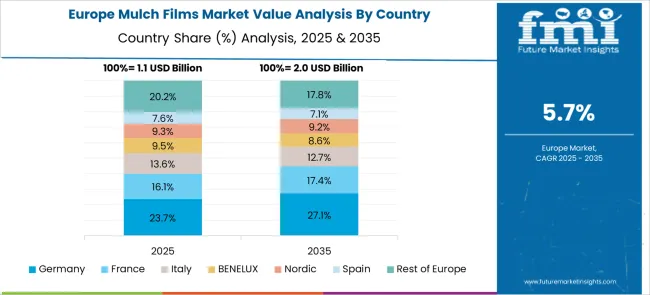

The mulch films market is witnessing growth across multiple regions due to agricultural modernization and increased awareness of crop protection technologies. Europe and North America dominate due to advanced farming practices, well-developed supply chains, and government incentives for efficient agriculture. Asia-Pacific is emerging as a high-growth market, driven by expanding arable land, rising population, and the need for higher crop productivity. Latin America and the Middle East are also showing potential for adoption as farmers seek to reduce water consumption and improve crop yields in water-scarce regions. Market players focus on regional customization, offering films suitable for local climate, soil type, and crop variety. Strategic partnerships with distributors, agrochemical companies, and research institutions help expand market reach. These regional dynamics support overall growth by addressing diverse agricultural challenges and promoting wider adoption of mulch films globally.

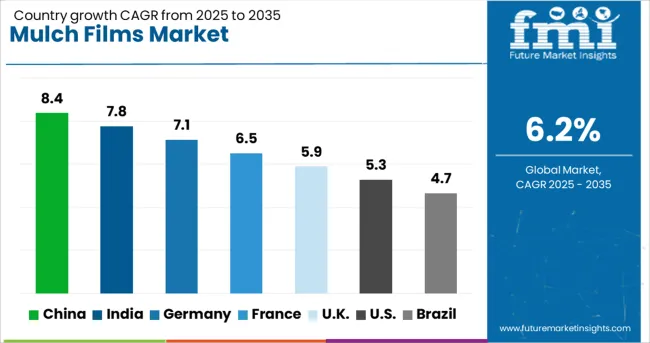

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The mulch films market is expanding at a CAGR of 6.2%, driven by the rising adoption of crop protection solutions and efficient agricultural practices. China leads the market with 8.4% growth, reflecting extensive use of mulch films in large-scale farming and strong domestic manufacturing capabilities. India follows at 7.8%, supported by government initiatives to improve crop yields and modernize farming techniques. Germany records 7.1% growth, driven by technologically advanced farming practices and sustainable crop protection methods. The UK shows 5.9% growth, with increased interest in optimizing horticulture and agriculture outputs. The United States grows at 5.3%, reflecting steady adoption of mulch films in commercial farming operations and innovation in biodegradable film solutions. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the mulch films market with an 8.4% growth rate. The country’s focus on large-scale agriculture and modern farming techniques drives strong demand for protective films that retain moisture and control weeds. Compared to India, China benefits from extensive production infrastructure and access to high-quality raw materials, allowing local manufacturers to produce a wide variety of UV-resistant and biodegradable mulch films. Government initiatives targeting agricultural efficiency and environmental protection encourage adoption of advanced films. The horticulture and vegetable sectors are key end users, using mulch films to improve crop yields and ensure consistent quality. Additionally, rising demand from fruit and specialty crop cultivation further fuels market expansion. Research investments in biodegradable and long-lasting films improve product performance, making China a dominant player in the global mulch films market. Overall, technological and agricultural developments continue to drive robust market growth.

Mulch films market in India grows at 7.8%, propelled by the need to enhance crop yields and reduce water consumption in agriculture. Compared to Germany, India focuses on cost-effective and locally produced films that cater to small and medium-scale farms. Farmers increasingly adopt protective films for vegetables, fruits, and cash crops to maintain soil moisture, control weeds, and prevent crop losses. Government subsidies for agricultural films encourage wider usage and boost market penetration. Partnerships with regional manufacturers improve distribution and availability, especially in rural farming areas. Awareness programs educate farmers about the benefits of UV-resistant and biodegradable films, which also help mitigate environmental impact. The expanding horticulture and vegetable cultivation sectors remain major drivers of demand. As agricultural mechanization and productivity improve, the Indian mulch films market is expected to grow steadily, combining affordability with increased efficiency to meet diverse farming requirements.

Germany maintains steady growth at 7.1% in the mulch films market, primarily driven by high-value crop cultivation and horticultural production. Compared to the United Kingdom, German farms prioritize advanced UV-resistant and biodegradable films that meet stringent environmental and quality regulations. Controlled environment agriculture and greenhouse farming encourage consistent mulch film usage throughout the year. Investments in research and development improve durability, performance, and soil compatibility, ensuring the films remain effective while minimizing environmental impact. Export demand from European markets further supports Germany’s production and market resilience. Farmers focus on efficient water management and weed control using mulch films, which reduces labor costs and improves crop output. The adoption of innovative film materials enhances sustainability, aligning with government policies to reduce plastic waste. Overall, Germany combines advanced technology with environmental standards to sustain continuous growth in the mulch films market.

The United Kingdom mulch films market grows at 5.9%, supported by horticulture, vegetable, and ornamental plant production. Compared to the United States, the UK emphasizes environmentally friendly mulch films and precision application techniques to optimize soil protection. Government programs encourage use of biodegradable and compostable films to reduce environmental impact. Partnerships between manufacturers and agricultural suppliers improve film accessibility for small-scale and greenhouse farmers. Educational campaigns promote adoption by demonstrating increased crop yields, reduced weed growth, and better soil moisture retention. The focus on high-quality standards ensures that products meet sustainability goals while remaining effective for farmers. Growing awareness among organic farms and specialty crop producers further drives market adoption. Continuous R&D investments target improved durability and UV protection, ensuring films maintain performance even under challenging weather conditions. Overall, the UK market is expected to grow steadily, balancing environmental priorities with agricultural efficiency.

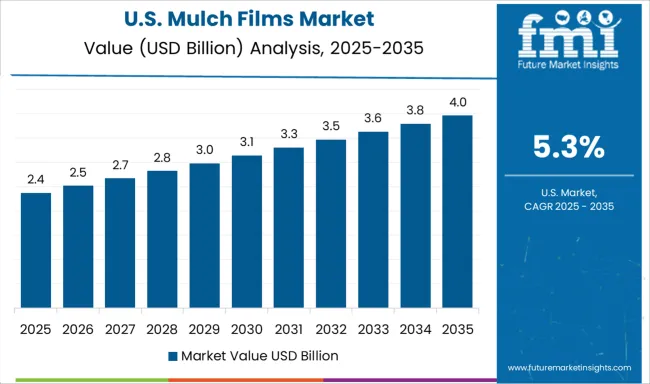

The United States advances in the mulch films market at 5.3%, driven by large-scale crop production, horticulture, and vegetable farming. Compared to China, the US emphasizes biodegradable and weather-resistant films that reduce labor and improve soil health. Farmers adopt mulch films to conserve water, manage weeds, and increase crop productivity. Government programs and environmental initiatives promote the use of sustainable materials, encouraging manufacturers to innovate new compostable films. Specialty crop producers and greenhouse operators remain significant consumers, ensuring steady demand throughout the year. Research investments focus on improving film durability, UV protection, and soil compatibility. Distribution networks and partnerships with regional suppliers enhance availability across diverse farming regions. Overall, ongoing adoption of high-performance mulch films, combined with regulatory support and agricultural modernization, drives steady market growth in the United States.

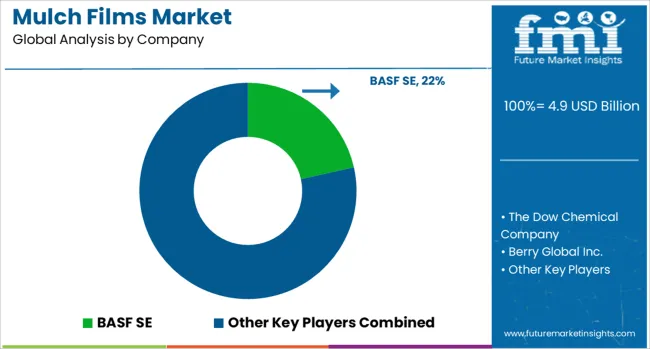

The mulch films market is led by global chemical and polymer companies delivering sustainable and high-performance agricultural films designed to improve soil moisture retention, weed control, and crop yields. BASF SE and The Dow Chemical Company dominate with advanced polymer formulations, emphasizing durability, UV resistance, and compatibility with mechanized farming systems. Berry Global Inc. and Ampacet Corporation focus on value-added solutions, offering customizable colorants and additives that enhance mulch film performance while addressing environmental concerns.

Key strategies distinguishing leading players in the mulch films market revolve around innovation in materials, product diversification, and regional expansion. A major focus has been the development of biodegradable and eco-friendly solutions, with companies like BioBag International introducing products such as BioAgri, made with MATER-BI, that decompose in soil after use, while Nurel SA has achieved TÜV and DIN CERTCO certifications for its biopolymer-based films, highlighting the shift toward compliance with stricter regulations. Another strategy has been investment in advanced material engineering, with multi-layer structures, UV stabilizers, and weatherable materials like EVA being deployed to improve durability and effectiveness in diverse climates. Market penetration through geographic expansion remains equally important, with Asia-Pacific being the center of growth due to agricultural intensification and the need for efficient farming inputs. In addition, players are strengthening their presence through collaborations, mergers, and continuous R&D investment to broaden portfolios of both conventional and biodegradable films, ensuring relevance across global farming practices.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.9 Billion |

| Type | Black, Clear/Transparent, Colored, Degradable, and Others |

| Material | Low-density polyethylene (LDPE), Linear low-density polyethylene (LLDPE), High-density polyethylene (HDPE), Ethylene-vinyl acetate (EVA), Polylactic acid (PLA), Polyhydroxyalkanoate (PHA), and Others |

| Application | Agricultural farms and Horticulture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, The Dow Chemical Company, Berry Global Inc., FKuR Kunststoff GmbH, Novamont S.p.A., RKW Group, Armando Alvarez Group, British Polythene Industries Plc, Plastibends, and Ampacet Corporation |

| Additional Attributes | Dollar sales in the Mulch Films Market vary by material type including polyethylene, biodegradable, and polyvinyl chloride, application across horticulture, agriculture, and landscaping, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing adoption of sustainable farming practices, crop yield enhancement, and demand for weed and moisture control solutions. |

The global mulch films market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the mulch films market is projected to reach USD 8.9 billion by 2035.

The mulch films market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in mulch films market are black, clear/transparent, colored, degradable and others.

In terms of material, low-density polyethylene (ldpe) segment to command 58.3% share in the mulch films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

LDPE Films Market

Card Films Market

Nylon Films for Liquid Packaging Market from 2024 to 2034

Vinyl Films Market

MDO-PE Films Market Analysis by Cast Films and Blown Films Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Retort Films Market

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Films Market Size and Share Forecast Outlook 2025 to 2035

Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Films Market Size and Share Forecast Outlook 2025 to 2035

Stretch Films Market Outlook - Size, Demand & Industry Trends 2025 to 2035

Protein Films Market from 2024 to 2034

PE Foam Films Market

Sealant Films Market

Formable Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA