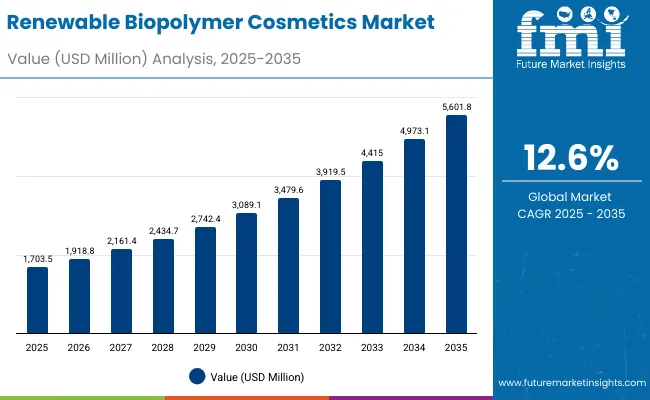

The global Renewable Biopolymer Cosmetics Market is expected to record a valuation of USD 1,703.5 million in 2025 and USD 5,601.8 million in 2035, with an increase of USD 3,898.3 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.6% and a 2X increase in market size.

Global Renewable Biopolymer Cosmetics Market Key Takeaways

| Metric | Value |

|---|---|

| Global Renewable Biopolymer Cosmetics Market Estimated Value in (2025E) | USD 1,703.5 million |

| Global Renewable Biopolymer Cosmetics Market Forecast Value in (2035F) | USD 5,601.8 million |

| Forecast CAGR (2025 to 2035) | 12.6% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,703.5 million to USD 3,089.1 million, adding USD 1,385.6 million, which accounts for 35.5% of the total decade growth. This phase records steady adoption in creams/lotions, haircare gels, and sun care formulations, driven by the need for sustainable alternatives that reduce reliance on petrochemical-derived polymers. Biodegradable claims dominate this period as they cater to over half of global demand, supported by consumer preference for transparency in eco-labeling and corporate sustainability goals. Film-formers represent the highest functional demand as they are critical in maintaining product stability, texture, and longevity in formulations.

The second half from 2030 to 2035 contributes USD 2,512.7 million, equal to 64.5% of total growth, as the market jumps from USD 3,089.1 million to USD 5,601.8 million. This acceleration is powered by widespread adoption of vegan-certified, palm-free, and eco-certified formulations, alongside deployment of biopolymer-based biodegradable packaging systems across cosmetics supply chains.

Growth is further fueled by increasing uptake in color cosmetics and sun care, where lightweight film-formers and texture enhancers enable improved sensory appeal while maintaining eco-compliance. Specialty clean-beauty retail and e-commerce platforms emerge as dominant distribution channels, supported by younger demographics demanding circularity and traceability.

From 2020 to 2024, the global Renewable Biopolymer Cosmetics Market grew from niche volumes to a structured market worth over USD 1.5 billion by 2024, driven by biodegradable and eco-certified positioning. During this period, the competitive landscape was dominated by ingredient manufacturers controlling nearly 70-75% of revenue, with leaders such as BASF, Croda, and Nature Works focusing on polylactic acid (PLA) and starch-based innovations that could replace synthetic polymers in cosmetic emulsions and textures.

Competitive differentiation relied heavily on supply security, cost competitiveness, and meeting clean-label regulations in Europe and North America. Packaging systems incorporating starch and chitosan biopolymers were developed but adoption remained limited outside niche beauty brands.

Demand for renewable biopolymers in cosmetics will expand to USD 1,703.5 million in 2025, and the revenue mix will gradually shift as biodegradable packaging systems and vegan-certified formulations grow to over 35% share by 2035. Traditional ingredient leaders face rising competition from clean-beauty-driven startups and Asian biopolymer innovators offering cost-effective PHA and chitosan derivatives.

Major suppliers are pivoting to hybrid sustainability models, integrating renewable feedstock sourcing, palm-free supply chains, and broader portfolio certifications (COSMOS, Ecocert, USDA Bio Preferred) to retain relevance. Emerging entrants specializing in eco-certified functional polymers for skin feel enhancement and AR/VR-driven consumer storytelling are gaining share. The competitive advantage is moving away from cost efficiency alone to brand alignment, certification credibility, and lifecycle sustainability metrics.

Advances in biopolymer synthesis and processing have improved film-forming, emulsification, and texture-enhancing properties, allowing for seamless replacement of conventional petrochemical polymers in cosmetics. PLA and starch-based polymers have gained popularity due to their versatility in skincare and packaging. The rise of eco-certifications, vegan claims, and palm-free positioning has further contributed to growth by appealing to consumers demanding ethical sourcing and transparent sustainability metrics. Industries such as skincare, haircare, and sun care are driving demand for renewable biopolymers that can integrate seamlessly into formulations while reducing environmental impact.

Expansion of biodegradable packaging and clean-label formulations has fueled market growth. Innovations in PHA and chitosan derivatives are expected to open new application areas, particularly in haircare gels and color cosmetics where polymer flexibility is key. Segment growth is expected to be led by biodegradable claims, film-formers in function categories, and creams/lotions in applications due to their ubiquity and high product turnover.

The market is segmented by polymer type, function, application, channel, and claim. Polymer types include PLA, PHA, chitosan derivatives, and starch-based biopolymers, representing the core material innovations. Functions cover film-formers, emulsifiers, texture enhancers, and biodegradable packaging systems, which reflect both formulation and packaging roles. Applications span creams/lotions, haircare gels, color cosmetics, and sun care the largest consumption categories in personal care. Channels include e-commerce, mass retail, specialty clean-beauty retail, and pharmacies. Claims emphasize biodegradable, eco-certified, vegan, and palm-free products, aligning with sustainability trends.

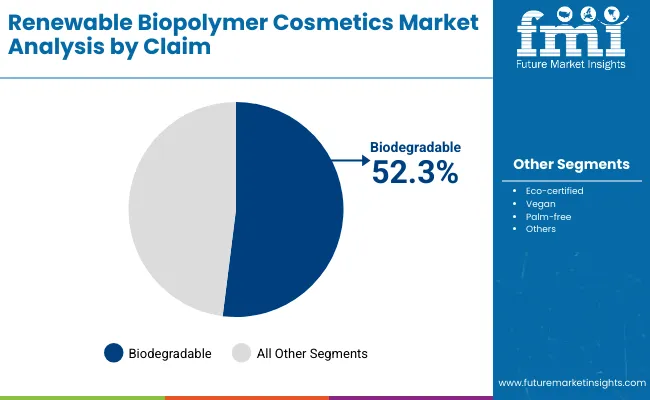

| Claim | Value Share% 2025 |

|---|---|

| Biodegradable | 52.3% |

| Others | 47.7% |

The biodegradable claim segment is projected to contribute 52.3% of the global Renewable Biopolymer Cosmetics Market revenue in 2025, maintaining its lead as the dominant claim category. This is driven by ongoing demand for transparent sustainability credentials, eco-friendly certifications, and consumer awareness of plastic pollution. Leading cosmetic brands have prioritized biodegradable positioning in both formulations and packaging, creating strong pull for PLA and starch-based polymers. As consumer education increases and governments impose stricter regulations, biodegradable products will continue to dominate the market mix.

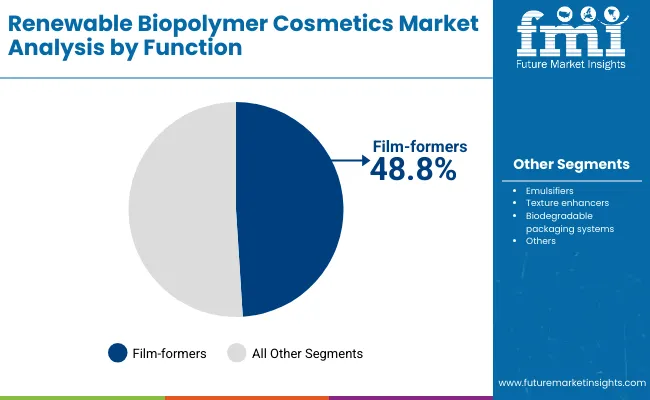

| Function | Value Share% 2025 |

|---|---|

| Film-formers | 48.8% |

| Others | 51.2% |

The film-formers segment is forecasted to hold 48.8% of the market share in 2025, led by its critical role in ensuring formulation stability, uniform spreadability, and sensory attributes. Film-formers are favored for their ability to improve water resistance in sunscreens, enhance gloss in color cosmetics, and provide skin barrier protection in creams and lotions. Their adaptability across multiple product categories has facilitated widespread adoption. Growth is bolstered by advancements in biodegradable and vegan-certified film-formers that enhance sustainability without compromising performance.

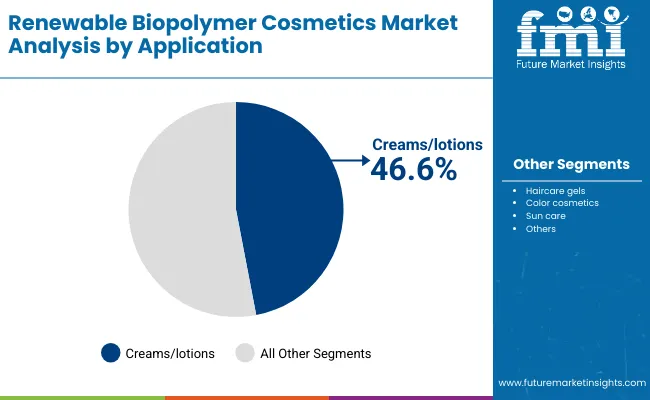

| Application | Value Share% 2025 |

|---|---|

| Creams/lotions | 46.6% |

| Others | 53.4% |

The creams/lotions segment is projected to account for 46.6% of the market revenue in 2025, making it the leading application area. These products are produced in high volumes globally and have shorter consumption cycles, creating consistent demand for renewable biopolymers that enhance texture, stability, and skin feel. Growing consumer interest in natural moisturizers and eco-friendly everyday skincare supports expansion. As leading brands integrate biopolymers into mainstream formulations, creams/lotions will continue to anchor demand across all regions.

Rising Adoption of Renewable Biopolymers in Everyday Skincare and Sun Care

One of the strongest demand-side drivers is the rapid adoption of renewable biopolymers in creams/lotions and sun care products, which together represent nearly half of the market in 2025 (46.6% for creams/lotions alone). These are high-turnover categories consumed daily across global populations, which creates consistent opportunities for renewable materials to displace petrochemical-derived polymers. Multinational beauty companies are actively integrating PLA and starch-based film-formers into moisturizers and sunscreens because they not only deliver performance but also allow brands to market biodegradability, eco-certifications, and palm-free claims. The momentum is amplified by rising consumer awareness of microplastics in traditional sun care polymers, which have been criticized for ocean toxicity and coral reef damage. As sustainability regulations tighten, the use of renewable biopolymers in everyday skincare becomes a compliance necessity rather than just a consumer preference, firmly positioning it as a market driver.

Accelerating Innovation in Biodegradable Packaging Systems

Beyond formulations, the packaging dimension is emerging as a powerful driver for growth. Biodegradable packaging systems based on PHA, starch blends, and chitosan derivatives are gaining traction because they directly address the cosmetics industry’s packaging waste problem, which accounts for a large share of plastic pollution. By 2030, several countries in Europe and Asia-Pacific are expected to restrict or tax non-compostable packaging, forcing brands to adopt renewable alternatives. Companies like Novamont and NatureWorks are scaling packaging-grade PLA and starch biopolymer solutions specifically for cosmetics jars, tubes, and sachets. Clean-beauty retailers and specialty stores are further pushing adoption by mandating sustainable packaging as a condition for shelf placement. This packaging-driven pull is unique because it expands the role of renewable biopolymers from functional formulation agents to end-to-end sustainability enablers across the cosmetics lifecycle.

High Cost Competitiveness Compared to Petrochemical Polymers

Despite strong growth, the cost structure of renewable biopolymers remains a restraint. Production of PLA, PHA, and chitosan derivatives typically involves more expensive feedstock and processing methods compared to conventional synthetic polymers. For instance, PLA prices can be 20-40% higher than equivalent petrochemical polymers, creating adoption barriers in mass retail cosmetics where pricing sensitivity is high. While premium and specialty clean-beauty brands can pass on these costs to consumers, mass-market brands face a squeeze between sustainability commitments and affordability expectations. This gap is especially significant in developing regions like Latin America and parts of Asia, where affordability dictates market penetration. Without large-scale capacity expansion and cost optimization, renewable biopolymers risk remaining concentrated in mid-to-premium price tiers.

Limited Global Supply and Regional Imbalances

The supply side of renewable biopolymers is constrained by regional production concentration. PLA and PHA production is still dominated by a handful of global players such as NatureWorks, BASF, and Novamont, leading to regional imbalances. Asia-Pacific, despite being the fastest-growing demand region (China CAGR 20.2%, India 24.1%), remains heavily dependent on imports for certain biopolymer grades, creating risks of supply bottlenecks and price volatility. This dependency is further complicated by logistics disruptions and trade regulations surrounding bio-based feedstock. For cosmetic manufacturers seeking stable supply chains, such volatility acts as a restraint, particularly for high-volume product lines where reliability of sourcing is crucial.

Emergence of Vegan and Palm-Free Positioning as Core Differentiators

While biodegradable claims lead the market today (52.3% share in 2025), vegan and palm-free positioning are emerging as the next wave of differentiation. This trend goes beyond environmental benefits, tapping into ethical and social dimensions of consumer choice. Palm-free polymers are gaining traction due to the association of palm oil with deforestation and biodiversity loss. Meanwhile, vegan claims resonate with younger demographics in North America, Europe, and increasingly Asia-Pacific, where cruelty-free and animal-free products are shaping purchase behavior. Biopolymer innovations such as vegan-certified chitosan derivatives (developed from fungal fermentation instead of animal shells) are responding to this demand. By 2030, palm-free and vegan positioning are expected to represent double-digit shares of new product launches, signaling a structural shift in how renewable biopolymers are marketed in cosmetics.

Integration of Biopolymers into Specialty Retail and E-Commerce Growth Channels

Distribution trends are transforming the adoption curve. Specialty clean-beauty retailers and online platforms are increasingly prioritizing brands that can demonstrate renewable biopolymer usage across formulations and packaging. For instance, leading clean-beauty chains in Europe and the USA now use renewable content and biodegradable certifications as listing criteria, pushing suppliers to innovate faster. Simultaneously, e-commerce platforms are amplifying consumer education on sustainability, enabling renewable biopolymer products to gain visibility beyond niche audiences. The ability of e-commerce to communicate detailed product stories including lifecycle benefits and eco-certification details makes it a critical enabler of demand growth. By 2035, e-commerce and specialty clean-beauty retail combined are expected to account for over 40% of global renewable biopolymer cosmetics sales, solidifying distribution as a structural trend rather than a channel shift.

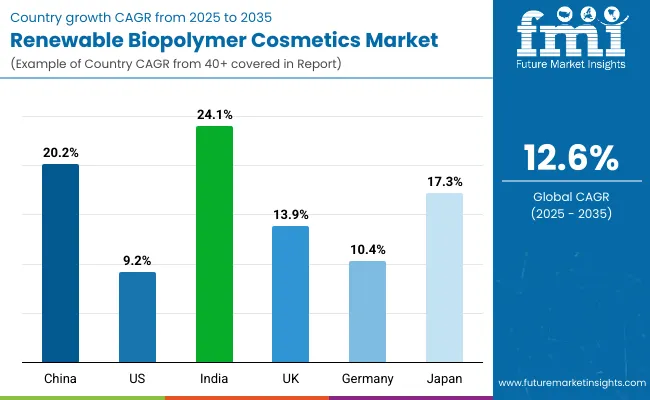

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.2% |

| USA | 9.2% |

| India | 24.1% |

| UK | 13.9% |

| Germany | 10.4% |

| Japan | 17.3% |

The global Renewable Biopolymer Cosmetics Market shows sharp differences in growth rates across countries, reflecting regional maturity, regulatory dynamics, and consumer behavior. India (24.1% CAGR) and China (20.2% CAGR) are the fastest-growing markets, driven by rising middle-class consumption, rapid adoption of clean-beauty formulations, and expanding e-commerce penetration. Both countries are seeing aggressive entry of local and multinational brands that highlight biodegradable and eco-certified claims to attract younger demographics. India’s growth is also fueled by increasing government support for biodegradable materials, while China benefits from large-scale manufacturing capacity that accelerates cost-effective adoption. Japan (17.3% CAGR) also emerges as a strong growth hub, supported by its innovation-led cosmetics sector and consumer demand for advanced functional ingredients like biopolymer-based film-formers and texture enhancers.

In contrast, mature markets such as the USA (9.2% CAGR), Germany (10.4% CAGR), and the UK (13.9% CAGR) are expanding more steadily. Growth in these countries is anchored in regulatory enforcement, brand sustainability commitments, and the gradual replacement of synthetic polymers in mainstream product lines. The USA continues to represent the largest market in absolute terms, but growth is moderated by its already significant adoption base and price sensitivity in mass retail. Europe, particularly Germany and the UK, benefits from strong clean-beauty retail channels and early consumer acceptance of palm-free and vegan claims, though saturation in premium segments keeps CAGR lower than Asia. Overall, the mix of high-growth emerging markets and steady developed markets highlights a two-speed expansion, where Asia-Pacific leads volume-driven acceleration while North America and Europe anchor long-term regulatory and premium positioning.

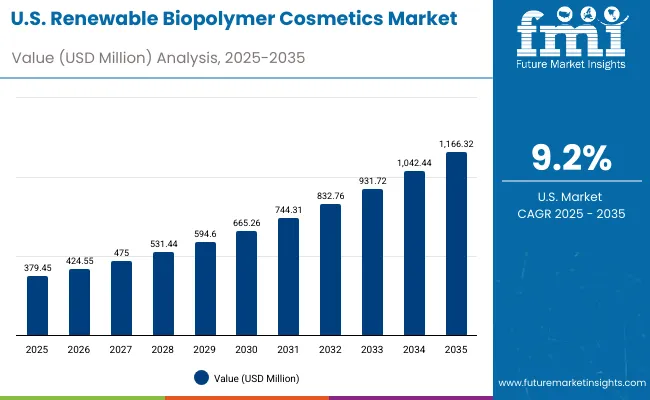

| Year | USA Renewable Biopolymer Cosmetics Market (USD Million) |

|---|---|

| 2025 | 379.45 |

| 2026 | 424.55 |

| 2027 | 475.00 |

| 2028 | 531.44 |

| 2029 | 594.60 |

| 2030 | 665.26 |

| 2031 | 744.31 |

| 2032 | 832.76 |

| 2033 | 931.72 |

| 2034 | 1,042.44 |

| 2035 | 1,166.32 |

The Renewable Biopolymer Cosmetics Market in the United States is projected to grow at a CAGR of 9.2%, led by increased investment across skincare, haircare, and sun care categories. Biodegradable claims accounted for 55.2% of the USA market in 2025 (USD 209.3 million), reflecting consumer preference for eco-friendly everyday products. Retail adoption is expanding as mass retail and pharmacy chains accelerate shelf space for eco-certified and palm-free product lines. Meanwhile, indie clean-beauty brands are using biopolymer-based packaging to differentiate themselves in crowded e-commerce channels. Growth is also fueled by USA regulatory momentum, with state level restrictions on microplastics pushing large brands to reformulate.

The Renewable Biopolymer Cosmetics Market in the United Kingdom is expected to grow at a CAGR of 13.9%, supported by demand in creams/lotions and haircare gels. Leading British skincare and haircare companies are rapidly moving toward palm-free and vegan-certified biopolymers to align with both consumer sentiment and UK environmental policies. Heritage brands are collaborating with packaging innovators to replace plastic jars and tubes with PLA- and starch-based biodegradable alternatives, often co-branded with eco-certifications. Specialty clean-beauty retailers dominate distribution, while e-commerce platforms provide transparency on sourcing and certifications, enhancing consumer trust.

India is witnessing rapid growth in the Renewable Biopolymer Cosmetics Market, which is forecast to expand at a CAGR of 24.1% through 2035. Expansion is fueled by tier-2 city adoption, as affordable clean-beauty products and biodegradable packaging reach beyond metro markets. Domestic brands are integrating starch-based and chitosan-derived polymers into affordable lotions and gels, offering sustainable products at competitive price points. Educational campaigns on eco-labels and government-backed initiatives on biodegradable plastics further reinforce demand. Local startups are positioning renewable biopolymer cosmetics as vegan, palm-free, and eco-certified, capturing younger urban consumers.

The Renewable Biopolymer Cosmetics Market in China is expected to grow at a CAGR of 20.2%, the highest among leading economies. Growth is driven by smart retail platforms, e-commerce penetration, and domestic innovation in film-formers and emulsifiers. Local manufacturers are scaling cost-effective PLA and PHA production, which reduces dependency on imports and accelerates adoption in mainstream cosmetics. Municipal initiatives on plastic reduction are encouraging brands to adopt biodegradable packaging, particularly for mass-market skincare. Competitive pricing by domestic suppliers enables biopolymer integration into color cosmetics and haircare gels, making sustainability accessible at scale.

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.3% |

| China | 11.9% |

| Japan | 7.0% |

| Germany | 15.4% |

| UK | 8.5% |

| India | 5.3% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.8% |

| China | 12.9% |

| Japan | 9.9% |

| Germany | 13.4% |

| UK | 7.7% |

| India | 5.9% |

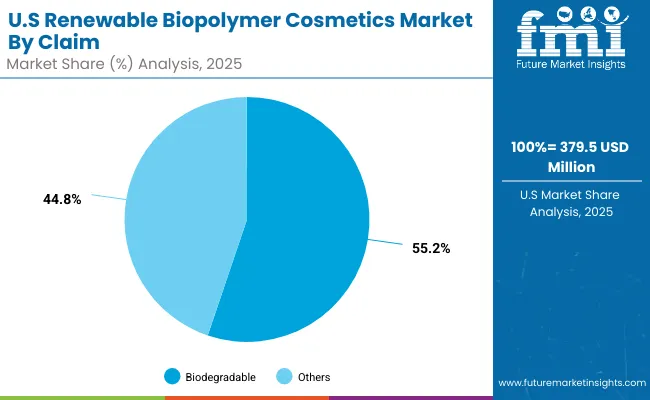

| USA by Claim | Value Share% 2025 |

|---|---|

| Biodegradable | 55.2% |

| Others | 44.8% |

The Renewable Biopolymer Cosmetics Market in the United States is projected at USD 379.5 million in 2025, growing at a CAGR of 9.2% through 2035. Biodegradable claims dominate with 55.2% share (USD 209.3 million), reflecting the strong influence of consumer awareness around microplastic pollution and environmental safety. This leadership is underpinned by widespread integration of PLA- and starch-based film-formers into mainstream skincare and sun care formulations. Mass retail chains and pharmacy outlets are accelerating adoption by allocating shelf space to eco-certified and palm-free brands, while specialty clean-beauty retailers drive premium positioning.

The USA market reflects a balanced mix between mainstream and indie innovation. Larger cosmetic brands emphasize scalable biodegradable packaging, while indie players leverage vegan and palm-free claims to capture younger demographics. The regulatory backdrop is also favorable, with several USA states pushing bans on non-biodegradable microplastics in cosmetics, driving rapid reformulation across mass and premium segments. By 2030, a significant portion of USA skincare and color cosmetics is expected to feature renewable biopolymers as a baseline expectation, not just a premium differentiator.

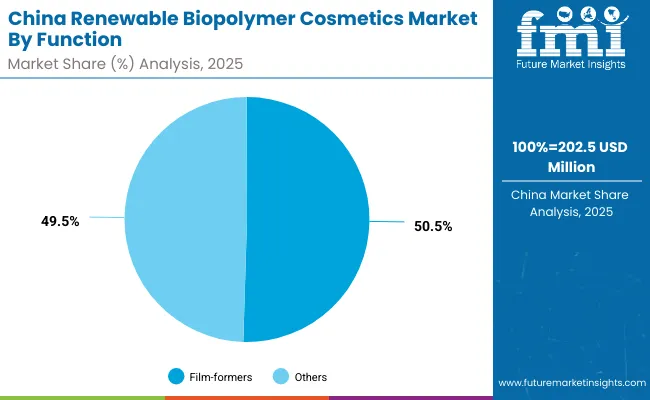

| China by Function | Value Share% 2025 |

|---|---|

| Film-formers | 50.5% |

| Others | 49.5% |

The Renewable Biopolymer Cosmetics Market in China is projected at USD 202.5 million in 2025, growing at a CAGR of 20.2%, the highest among major economies. Film-formers contribute 50.5% (USD 102.2 million), showing the strong pull from skincare and sun care formulations that rely heavily on water resistance and uniform skin coverage. The dominance of film-formers stems from the country’s large demand base in daily skincare and sun protection products, which are essential in urban markets with rising pollution and UV exposure concerns.

China’s opportunity lies in both demand and supply. Local manufacturers are scaling PLA and PHA capacity, offering cost-competitive inputs that reduce dependence on imports. E-commerce giants such as Tmall and JD.com amplify the market by promoting eco-certified and vegan-labeled beauty products, giving biopolymer-based cosmetics high visibility. Municipal policies on plastic waste reduction further accelerate adoption of biodegradable packaging systems. This combination of strong local supply, government policy, and consumer pull positions China as a core global hub for renewable biopolymer cosmetics.

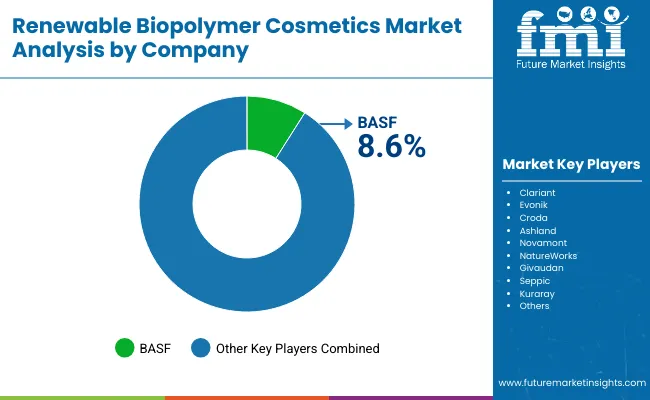

| Company | Global Value Share 2025 |

|---|---|

| BASF | 8.6% |

| Others | 91.4% |

The global Renewable Biopolymer Cosmetics Market is moderately fragmented, with a mix of global chemical leaders, biopolymer specialists, and cosmetic ingredient innovators competing for share. Global leaders such as BASF, Clariant, Evonik, and Croda hold significant market presence, driven by their established portfolios in PLA- and starch-based biopolymers and their ability to integrate into mass-market cosmetic supply chains. Their strategies increasingly emphasize biodegradable packaging systems, vegan-certified functional ingredients, and palm-free supply chain traceability, positioning them as the backbone of global adoption.

Mid-sized innovators such as Novamont, NatureWorks, Givaudan, and Seppic are carving out niches with advanced PHA and chitosan derivatives tailored for texture enhancement and clean-label emulsification. These companies benefit from strong R&D pipelines and close partnerships with clean-beauty brands that demand agility and rapid certification alignment. Kuraray and Ashland focus on high-performance polymers and emulsifiers, catering to color cosmetics and haircare segments where stability and sensory quality are critical.

Competitive differentiation is shifting from simple material supply to ecosystem-building around certifications, regulatory compliance, and brand alignment. Vendors offering renewable biopolymers with multi-certification portfolios (EcoCert, COSMOS, palm-free verification) gain preference from multinational brands aiming to harmonize global launches. Furthermore, partnerships between raw material suppliers and cosmetic giants are strengthening ensuring scalability, cost efficiency, and co-branding opportunities. The competitive edge is no longer just about material innovation but about lifecycle sustainability, regulatory readiness, and market storytelling.

Key Developments in Global Renewable Biopolymer Cosmetics Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,703.5 Million |

| Polymer Type | PLA (polylactic acid), PHA (polyhydroxyalkanoates), Chitosan derivatives, Starch-based biopolymers |

| Function | Film-formers, Emulsifiers, Texture enhancers, Biodegradable packaging systems |

| Application | Creams/lotions, Haircare gels, Color cosmetics, Sun care |

| Channel | E-commerce, Mass retail, Specialty clean-beauty retail, Pharmacies |

| Claim | Biodegradable, Eco-certified, Vegan, Palm-free |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Clariant, Evonik, Croda, Ashland, Novamont, NatureWorks, Givaudan, Seppic, Kuraray |

| Additional Attributes | Dollar sales by claim, function, and application, adoption trends in biodegradable and eco-certified cosmetics, rising demand for vegan and palm-free formulations, sector-specific growth in skincare, haircare, and sun care, e-commerce and specialty clean-beauty retail channel expansion, certification-led positioning (EcoCert, COSMOS, USDA BioPreferred), integration of biodegradable packaging systems, regional trends shaped by consumer awareness and regulatory mandates, and innovations in PLA, PHA, starch, and chitosan derivatives. |

The global Renewable Biopolymer Cosmetics Market is estimated to be valued at USD 1,703.5 million in 2025.

The market size for the global Renewable Biopolymer Cosmetics Market is projected to reach USD 5,601.8 million by 2035.

The global Renewable Biopolymer Cosmetics Market is expected to grow at a 12.6% CAGR between 2025 and 2035.

The key polymer types in the global Renewable Biopolymer Cosmetics Market are PLA, PHA, chitosan derivatives, and starch-based biopolymers.

In terms of claims, the biodegradable segment is expected to command 52.3% share in the global Renewable Biopolymer Cosmetics Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Renewable Heating Fuels Market Size and Share Forecast Outlook 2025 to 2035

Renewable Isocyanate Market Forecast and Outlook 2025 to 2035

Renewables Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Renewable Naphtha Market Size and Share Forecast Outlook 2025 to 2035

Renewable Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Renewable Energy Certificate Market Size and Share Forecast Outlook 2025 to 2035

Renewable Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Renewable Energy Contactor Market Size and Share Forecast Outlook 2025 to 2035

Renewable Methanol Market Growth - Trends & Forecast 2025 to 2035

Renewable Solvents Market

Biopolymer Injection Molders Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Biopolymer Closure Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biopolymer Films Market Size and Share Forecast Outlook 2025 to 2035

Biopolymer Tubes Market

Bioplastic and Biopolymer Market Forecast Outlook 2025 to 2035

Castor Oil-Based Biopolymer Market Size and Share Forecast Outlook 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Pet Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Nutricosmetics Market Analysis - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA