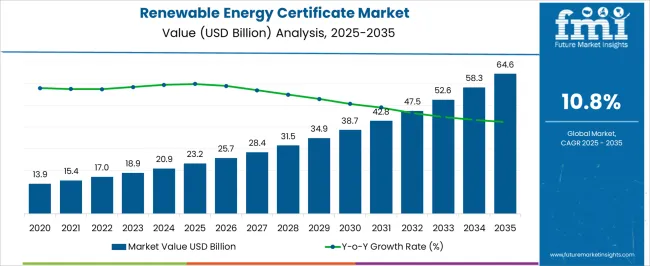

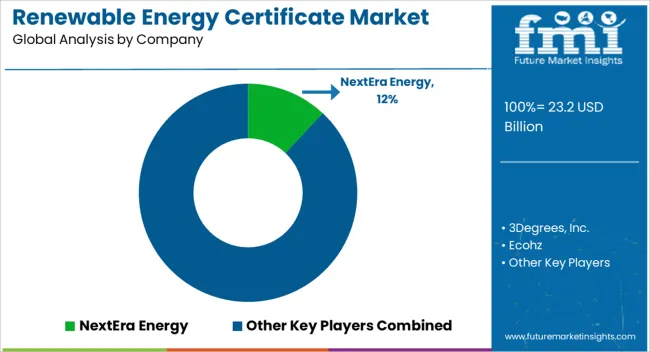

The renewable energy certificate market is estimated to be valued at USD 23.2 billion in 2025 and is projected to reach USD 64.6 billion by 2035, registering a compound annual growth rate (CAGR) of 10.8% over the forecast period.

From 2020 to 2025, the market advanced from USD 13.9 billion to USD 23.2 billion, reflecting the early acceleration phase as corporations and utilities increased purchases of RECs to meet renewable portfolio standards (RPS) and voluntary sustainability commitments. This period was marked by heightened participation from large technology firms and multinational companies aiming to achieve net-zero targets, driving REC trading volumes upward. Between 2026 and 2030, the market rises from USD 25.7 billion to USD 38.7 billion, capturing nearly 37% of the decade’s incremental growth.

This acceleration is fueled by broader policy alignment with the Paris Agreement, stricter corporate disclosure requirements, and the expansion of REC trading platforms across Asia-Pacific and emerging markets, which open access for smaller enterprises and municipal bodies. By 2031–2035, the market advances from USD 42.8 billion to USD 64.6 billion, accounting for the remaining 63% of the absolute dollar opportunity, as standardized global REC frameworks and digital tracking systems enable transparent cross-border trading. Growing integration of blockchain and AI-driven verification mechanisms also strengthens market trust, reducing the risk of double counting.

| Metric | Value |

|---|---|

| Renewable Energy Certificate Market Estimated Value in (2025 E) | USD 23.2 billion |

| Renewable Energy Certificate Market Forecast Value in (2035 F) | USD 64.6 billion |

| Forecast CAGR (2025 to 2035) | 10.8% |

The renewable energy certificate (REC) market holds a significant role within the global energy transition framework, contributing approximately 9–11% share of the overall renewable power trading ecosystem, where direct power purchase agreements and feed-in tariffs remain larger components. Within the broader carbon credits and compliance markets, RECs represent about 12–14%, as they provide a standardized mechanism for organizations to demonstrate renewable electricity usage. In the voluntary green energy procurement segment, RECs account for nearly 15–17%, driven by corporations, institutions, and households seeking to offset carbon footprints and meet environmental commitments. Within regulated compliance programs, such as renewable portfolio standards in North America and Europe, RECs capture close to 10–12%, reflecting their role in ensuring utilities meet mandated clean energy targets.

In the corporate sustainability and ESG reporting space, RECs represent around 6–7%, providing a measurable and tradable tool for demonstrating renewable power adoption. Growth has been driven by increasing corporate climate pledges, expansion of renewable generation capacity, and evolving policies that encourage transparent renewable energy tracking. Market participants are focusing on enhancing digital trading platforms, increasing certificate traceability, and integrating blockchain solutions to ensure authenticity. Although RECs operate alongside other green attributes, their share highlights their role as a key instrument in renewable electricity adoption and corporate decarbonization strategies, consolidating their position in both compliance and voluntary markets worldwide.

The market is advancing steadily, supported by increasing global commitments to reduce carbon emissions and transition toward clean energy sources. The mechanism of RECs allows organizations to offset their carbon footprint while encouraging renewable energy generation, making it a central tool in corporate sustainability strategies.

The market’s growth is being propelled by favorable regulatory frameworks, corporate net zero pledges, and the rising participation in both compliance and voluntary trading systems. Digital trading platforms and blockchain-based verification methods are enhancing transparency and trust in REC transactions, further driving adoption.

As energy consumers and producers alike seek flexible, market-based instruments to meet environmental goals, demand for RECs is anticipated to strengthen across various geographies With ongoing expansion in renewable energy infrastructure and the diversification of sources such as solar, wind, and biomass, the REC market is positioned for sustained long-term growth supported by innovation, policy evolution, and increased market liquidity.

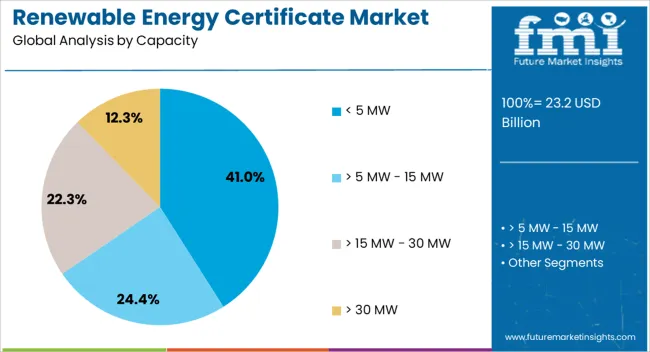

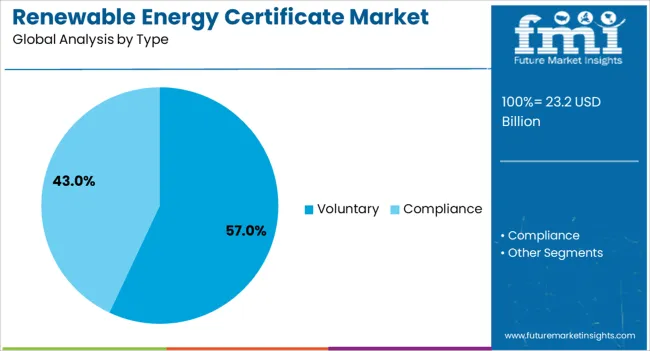

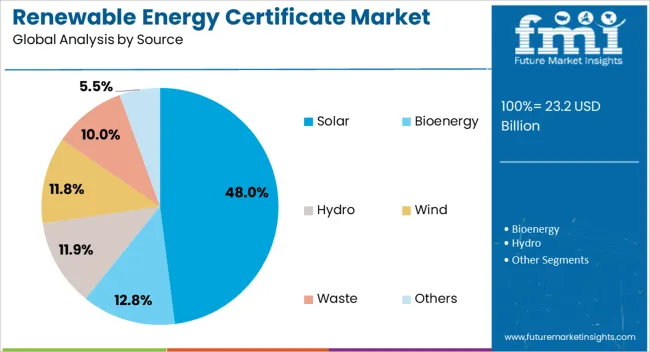

The renewable energy certificate market is segmented by capacity, type, source, and geographic regions. By capacity, renewable energy certificate market is divided into < 5 MW, > 5 MW - 15 MW, > 15 MW - 30 MW, and > 30 MW. In terms of type, renewable energy certificate market is classified into voluntary and compliance. Based on source, renewable energy certificate market is segmented into solar, bioenergy, hydro, wind, waste, and others. Regionally, the renewable energy certificate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The capacity segment below 5 MW is projected to account for 41% of the renewable energy certificate market revenue share in 2025, making it the leading capacity category. This dominance has been driven by the growing number of small-scale renewable projects such as distributed solar installations, community wind farms, and micro-hydro facilities. The scalability and relatively lower capital investment required for projects under 5 MW have encouraged broader participation from private investors, cooperatives, and community groups. In addition, government incentives and streamlined permitting processes for small-scale projects have accelerated their deployment, resulting in a higher volume of RECs generated in this category. These smaller installations are often located closer to end users, reducing transmission losses and enhancing local energy security. The capacity segment has also benefited from advancements in modular renewable technology, which has made it easier for smaller projects to integrate with REC certification systems This combination of accessibility, policy support, and technological flexibility has ensured the continued leadership of the < 5 MW capacity category in the overall market.

The voluntary type segment is expected to hold 57% of the market revenue share in 2025, securing its position as the dominant market type. Growth in this segment has been supported by the increasing number of corporations, institutions, and individuals choosing to purchase RECs beyond regulatory requirements as part of their sustainability commitments. Rising environmental awareness and the need to enhance corporate social responsibility profiles have made voluntary REC purchases a preferred strategy for demonstrating climate action. Flexibility in procurement, absence of compliance restrictions, and the ability to align purchases with specific sustainability goals have further contributed to the segment’s expansion. Additionally, the growth of corporate power purchase agreements and renewable branding initiatives has reinforced the demand for voluntary RECs Digital marketplaces and improved traceability of certificate origins have increased buyer confidence, making voluntary RECs an integral component of organizational sustainability planning.

The solar source segment is anticipated to capture 48% of the market revenue share in 2025, establishing itself as the leading source category. This growth has been attributed to the rapid expansion of solar photovoltaic installations worldwide, driven by declining module costs, high scalability, and favorable government incentives. Solar power projects, ranging from residential rooftops to utility-scale farms, have become major contributors to REC issuance due to their widespread deployment and relatively short development timelines. The segment has also been supported by the high public visibility of solar energy as a clean and abundant resource, which strengthens its appeal for REC buyers seeking to align their sustainability initiatives with recognizable renewable sources. Technological advancements in solar efficiency, combined with increased investment from both public and private sectors, have reinforced its dominance Furthermore, predictable generation patterns in many regions enhance the reliability of RECs sourced from solar projects, further encouraging adoption.

The renewable energy certificate market is gaining momentum through corporate demand, policy frameworks, and voluntary participation. Challenges in pricing and transparency remain, but ongoing improvements strengthen its global adoption.

The renewable energy certificate (REC) market has seen rapid growth as corporations increasingly purchase certificates to meet renewable electricity commitments. Multinational firms in technology, retail, and manufacturing sectors are using RECs to demonstrate progress toward emission reduction targets. This trend is driven by investor pressure, shareholder expectations, and growing emphasis on transparent reporting in annual disclosures. Large-scale buyers are adopting long-term REC purchase agreements to hedge against regulatory changes while ensuring reliable access to renewable energy credits. The ability of RECs to provide a cost-effective, flexible option without the need for direct renewable project investments makes them attractive. Corporate-led demand is now among the largest contributors to REC market expansion worldwide.

Government policies and compliance mandates play a pivotal role in shaping REC adoption. In many countries, utilities are required to meet renewable portfolio standards (RPS), which directly creates demand for certificates. Regions such as North America and Europe have well-structured compliance markets, while emerging economies are designing new frameworks to encourage renewable adoption. Policymakers see RECs as a flexible mechanism to incentivize renewable energy without heavy subsidies. The introduction of digital registries and standardized tracking platforms further enhances accountability. By providing a clear link between renewable generation and consumption claims, policy-backed RECs remain central to how governments guide clean energy transitions and enforce renewable energy commitments.

Voluntary markets for RECs are expanding as individuals, universities, and non-regulated entities adopt certificates to showcase renewable energy usage. Growth in voluntary purchasing has been significant in Asia-Pacific and Latin America, where regulatory frameworks are still evolving but consumer interest is rising. Energy retailers and utility companies are bundling RECs into green tariff programs, offering customers a direct path to renewable claims. These markets provide flexibility, enabling smaller organizations to access renewable energy attributes without engaging in complex power purchase agreements. The voluntary segment also creates diversification, ensuring that REC demand does not rely solely on compliance markets, broadening participation across multiple sectors globally.

REC markets face challenges related to price volatility and transparency. Variations in regional policy frameworks often lead to inconsistent pricing, which complicates investment planning for both buyers and sellers. Concerns about double counting and certificate authenticity have prompted the introduction of blockchain-based tracking systems to improve credibility. Smaller buyers often struggle with limited market access and high transaction costs, which restrict broader participation. Addressing these challenges requires harmonization of standards, efficient trading platforms, and improved awareness of REC benefits. Ensuring confidence in market operations will be crucial to supporting long-term stability and maintaining REC relevance as a credible renewable energy instrument.

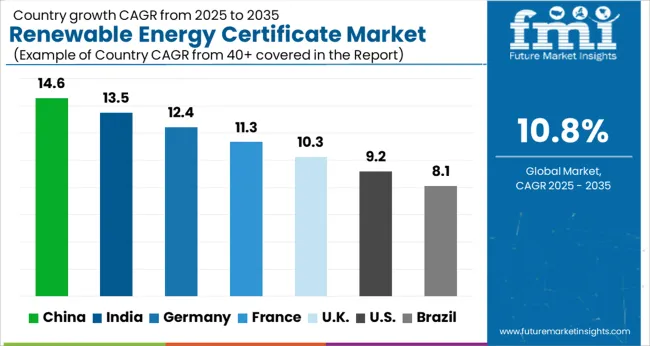

| Country | CAGR |

|---|---|

| China | 14.6% |

| India | 13.5% |

| Germany | 12.4% |

| France | 11.3% |

| UK | 10.3% |

| USA | 9.2% |

| Brazil | 8.1% |

The renewable energy certificate (REC) market is projected to expand globally at a CAGR of 10.8% from 2025 to 2035, driven by corporate climate pledges, compliance mandates, and growing voluntary demand for green energy claims. China leads with a CAGR of 14.6%, supported by large-scale renewable energy generation and government-backed trading platforms that encourage adoption. India follows at 13.5%, with growth propelled by national renewable portfolio obligations, expanding solar and wind capacity, and rising corporate participation. France posts 11.3%, reflecting demand from utilities and corporates aligning with energy transition targets. The United Kingdom achieves 10.3%, supported by green tariffs, REC-backed renewable programs, and rising demand from service industries. The United States grows at 9.2%, where voluntary markets and regional renewable portfolio standards support steady participation, though growth remains moderate compared to Asia and Europe. This trajectory highlights Asia as the dominant growth hub, Europe ensuring structured compliance-driven adoption, and North America maintaining steady yet slower progress in REC integration.

The CAGR for the Chinese renewable energy certificate (REC) market stood at 12.9% during 2020–2024 and increased to 14.6% between 2025 and 2035, reflecting stronger momentum in renewable integration. The early phase saw significant issuance supported by rapid solar and wind deployment, but adoption was partially constrained by fragmented trading platforms. In the following decade, expansion is driven by nationwide renewable energy quotas, digitalized REC exchanges, and increasing corporate participation in voluntary markets. China’s dominance in solar manufacturing and large-scale green power procurement further reinforces its global leadership. With government mandates and corporate climate targets converging, China continues to post the highest CAGR globally for RECs.

India recorded a CAGR of 11.7% between 2020 and 2024, which then rose to 13.5% for the 2025–2035 period, showing accelerated growth. Earlier expansion was driven by renewable energy obligations imposed on utilities, though inconsistent state-level compliance moderated adoption. In the following decade, growth improves due to large-scale solar and wind park deployment, corporate demand for voluntary RECs, and streamlined exchanges under national energy reforms. Private sector interest in meeting ESG targets has also broadened REC utilization. India’s dual role as a compliance-driven and voluntary-driven REC hub strengthens its position as one of the fastest-growing markets globally.

The CAGR for the French REC market was 9.8% during 2020–2024 and grew to 11.3% in 2025–2035, demonstrating steady improvement. In the earlier phase, growth was supported by EU compliance programs and renewable portfolio expansion, but moderate demand from voluntary buyers kept growth restrained. The later decade benefits from rising corporate participation, energy transition legislation, and REC integration into utility-backed green tariff schemes. France’s strong nuclear base reduces reliance on renewable certificates, yet the EU’s clean energy commitments push steady adoption. Improved transparency through EU-wide registries enhances REC credibility, reinforcing France’s growth within Europe.

The CAGR for the UK REC market was 9.1% during 2020–2024 and rose to 10.3% in the 2025–2035 period, reflecting a stronger pace than before. Early growth was moderate as renewable energy programs relied more on direct subsidies and feed-in tariffs, limiting REC issuance. Growth accelerated later with wider adoption of green tariffs, voluntary corporate procurement, and integration of certificates into broader ESG reporting. Energy retailers increasingly bundled RECs with consumer-facing renewable energy products, boosting accessibility. With businesses aligning with net-zero targets and utilities strengthening compliance frameworks, the UK market achieved gradual but firm improvement in REC adoption.

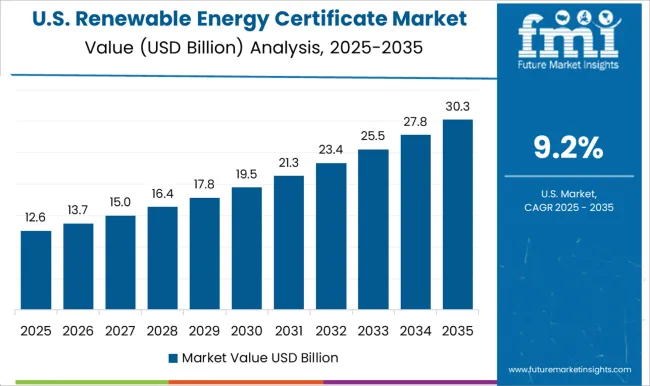

The USA REC market posted a CAGR of 8.5% during 2020–2024 and improved to 9.2% between 2025 and 2035, showing moderate yet consistent momentum. The earlier phase was driven by state-level renewable portfolio standards, though voluntary adoption was uneven across regions. Growth in the later period is shaped by stronger corporate commitments, utility green tariff offerings, and the expansion of digital trading platforms. Regional disparities remain, with compliance demand concentrated in states like California and New York, while other regions show slower uptake. Even with moderate performance compared to Asia and Europe, the USA maintains a stable REC market anchored by voluntary corporate procurement and renewable portfolio compliance.

The renewable energy certificate (REC) market is shaped by a diverse mix of global energy majors, renewable developers, and specialized sustainability service providers. NextEra Energy remains one of the leading players, leveraging its vast renewable generation capacity across wind and solar to supply large volumes of RECs in North America. 3Degrees, Inc. differentiates itself as a sustainability solutions provider, offering REC procurement, advisory services, and corporate partnerships that help companies achieve emission reduction goals. Ecohz plays an important role in Europe, focusing on traceable and verifiable green certificates, often tied to corporate ESG reporting. Statkraft, a key hydropower producer, strengthens its REC presence by offering renewable-backed certificates across multiple European markets. Shell Energy and EDF Trading act as integrated energy traders, combining renewable power generation with REC trading platforms to provide large-scale supply solutions for utilities and corporations.

Enel, Iberdrola, and Ørsted dominate global renewable energy generation, enabling them to issue significant volumes of RECs tied to their extensive wind, solar, and offshore portfolios. Competitive strategies across this landscape emphasize scaling renewable generation, strengthening trading platforms, and offering digital solutions for certificate traceability. Leading players are focusing on long-term corporate contracts, transparency in verification systems, and expanding cross-border REC trading to meet the surging global demand for clean energy attributes.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.2 billion |

| Capacity | < 5 MW, > 5 MW - 15 MW, > 15 MW - 30 MW, and > 30 MW |

| Type | Voluntary and Compliance |

| Source | Solar, Bioenergy, Hydro, Wind, Waste, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NextEra Energy, 3Degrees, Inc., Ecohz, Statkraft, Shell Energy / EDF Trading, and Ørsted |

| Additional Attributes | Dollar sales, share, compliance vs voluntary demand trends, regional trading volumes, corporate procurement drivers, policy impacts, pricing benchmarks, certificate traceability, and future growth outlook. |

The global renewable energy certificate market is estimated to be valued at USD 23.2 billion in 2025.

The market size for the renewable energy certificate market is projected to reach USD 64.6 billion by 2035.

The renewable energy certificate market is expected to grow at a 10.8% CAGR between 2025 and 2035.

The key product types in renewable energy certificate market are < 5 mw, > 5 mw - 15 mw, > 15 mw - 30 mw and > 30 mw.

In terms of type, voluntary segment to command 57.0% share in the renewable energy certificate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Renewable Heating Fuels Market Size and Share Forecast Outlook 2025 to 2035

Renewable Isocyanate Market Forecast and Outlook 2025 to 2035

Renewable Naphtha Market Size and Share Forecast Outlook 2025 to 2035

Renewable Biopolymer Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Renewable Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Renewable Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Renewable Methanol Market Growth - Trends & Forecast 2025 to 2035

Renewable Solvents Market

Renewable Energy Contactor Market Size and Share Forecast Outlook 2025 to 2035

Renewables Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Energy Efficient Motor Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Size and Share Forecast Outlook 2025 to 2035

Energy Dispersive X-ray Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Energy Harvesting Market Growth - Trends & Forecast 2025 to 2035

Energy Supplement Market Analysis by Product Type, End-user and Distribution Channel through 2025 to 2035

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Energy Efficiency Gamification Market Analysis by Type, Deployment, End User, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA