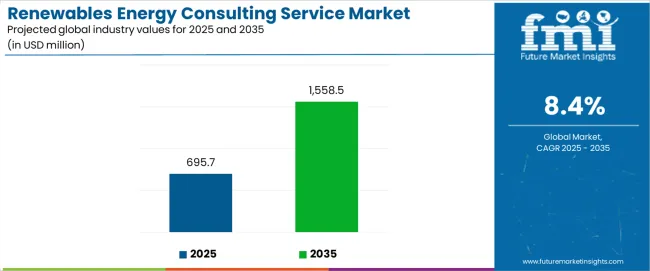

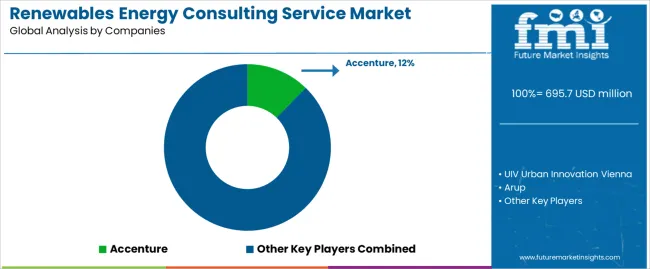

The global renewables energy consulting service market, valued at USD 695.7 million in 2025 and projected to reach USD 1,558.5 million by 2035 at a CAGR of 8.4%, operates within a regulatory landscape that directly influences consulting demand, service scope, and regional growth opportunities. Regulations governing renewable energy adoption, emissions reduction, and energy transition frameworks are increasingly shaping the advisory role of consulting firms. International agreements such as the Paris Agreement and commitments toward net-zero targets by 2050 are compelling governments to design supportive frameworks, creating recurring opportunities for consultants in policy interpretation, compliance strategy, and incentive utilization.

In North America, regulatory drivers include federal and state-level renewable portfolio standards (RPS), tax credits such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC), and compliance obligations under emission reduction mandates. Consulting firms are expected to guide project developers, utilities, and corporations in navigating eligibility criteria, financing structures, and integration into decarbonization pathways. Similarly, in Europe, stringent directives such as the EU Renewable Energy Directive and Green Deal requirements mandate significant renewable energy adoption, pushing stakeholders to rely on consultants for grid modernization strategies, subsidy application, and corporate power purchase agreement (PPA) structuring.

Asia Pacific reflects a more diverse regulatory environment, with China’s five-year energy plans, India’s renewable energy targets, and Japan’s energy transition programs shaping service demand. Consultants here play a critical role in aligning project execution with shifting policies, permitting frameworks, and cross-border energy trade regulations. Regions like the Middle East and Africa are gradually building regulatory baselines, often linked to Vision 2030-type initiatives and diversification agendas, where consulting services are vital to structure foreign partnerships, feasibility studies, and project compliance.

Regulatory uncertainties remain a significant challenge, with shifting subsidy schemes, tariff adjustments, and evolving carbon pricing frameworks altering project viability. Consultants are increasingly required to deliver risk assessments that integrate regulatory volatility, especially for long-term infrastructure projects. Furthermore, grid interconnection standards, renewable energy certificate (REC) frameworks, and permitting protocols are becoming more complex, heightening the reliance on specialized advisory services.

Between 2025 and 2030, the renewables energy consulting service market is projected to expand from USD 695.7 million to USD 1,041.3 million, resulting in a value increase of USD 345.6 million, which represents 40% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of renewable energy technologies, rising demand for grid integration consulting services, and growing emphasis on energy transition planning with enhanced technical expertise characteristics. Energy consulting firms are expanding their service capabilities to address the growing demand for project feasibility studies, regulatory compliance support, and specialized renewable energy system optimization requirements.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 695.7 million |

| Forecast Value in (2035F) | USD 1,558.5 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

From 2030 to 2035, the renewables energy consulting service market is forecast to grow from USD 1,041.3 million to USD 1,558.5 million, adding another USD 517.2 million, which constitutes 60% of the overall ten-year expansion. This period is expected to be characterized by the expansion of digital consulting platforms, the integration of ai-powered energy optimization systems, and the development of comprehensive energy transition strategies with enhanced analytical capabilities. The growing adoption of smart grid technologies will drive demand for renewables energy consulting services with superior data analytics systems and compatibility with energy management software across commercial and industrial operations.

Between 2020 and 2025, the renewables energy consulting service market experienced robust growth, driven by increasing demand for clean energy solutions and growing recognition of specialized consulting as essential services for efficient renewable energy project development across utility-scale installations, commercial energy systems, and distributed generation applications. The renewables energy consulting service market developed as energy developers recognized the potential for consulting services to reduce project risks while maintaining technical performance effectiveness and enabling cost-effective implementation protocols. Technological advancement in energy modeling software and project management systems began emphasizing the critical importance of maintaining technical accuracy and regulatory compliance consistency in diverse renewable energy environments.

Market expansion is being supported by the increasing global demand for renewable energy solutions and the corresponding need for specialized consulting services that can provide superior technical expertise and project optimization capabilities while enabling reduced development risks and enhanced performance outcomes across various clean energy and grid integration applications.

Modern energy developers and utility companies are increasingly focused on implementing consulting services that can deliver comprehensive project support, prevent technical challenges, and provide consistent advisory performance throughout complex regulatory environments and diverse energy market conditions. Renewables energy consulting services' proven ability to deliver exceptional technical guidance against project uncertainties, enable time-efficient development processes, and support cost-effective implementation protocols make them essential services for contemporary energy development and utility operations.

The growing emphasis on energy transition and carbon reduction is driving demand for renewables energy consulting services that can support large-scale project requirements, improve energy system outcomes, and enable integrated advisory solutions.

Energy developers' preference for services that combine technical expertise with regulatory knowledge and market intelligence is creating opportunities for innovative consulting implementations. The rising influence of digital energy platforms and advanced analytics is also contributing to increased demand for renewables energy consulting services that can provide data-driven recommendations, real-time project monitoring capabilities, and reliable performance across extended development periods.

The renewables energy consulting service market is poised for rapid growth and transformation. As industries across energy, utilities, manufacturing, and government agencies seek solutions that deliver exceptional technical expertise, project optimization, and regulatory compliance, renewables energy consulting services are gaining prominence not just as specialized advisory services but as strategic enablers of energy transition and clean technology deployment.

Rising renewable energy adoption in Asia-Pacific and expanding clean energy initiatives globally amplify demand, while consulting firms are leveraging innovations in digital platforms, advanced analytics, and integrated project management technologies.

Pathways like comprehensive energy transition consulting, ai-powered optimization services, and specialized grid integration solutions promise strong margin uplift, especially in utility-scale and commercial segments. Geographic expansion and technology integration will capture volume, particularly where local energy policies and renewable adoption are critical. Regulatory support around clean energy targets, carbon reduction requirements, and energy efficiency standards give structural support.

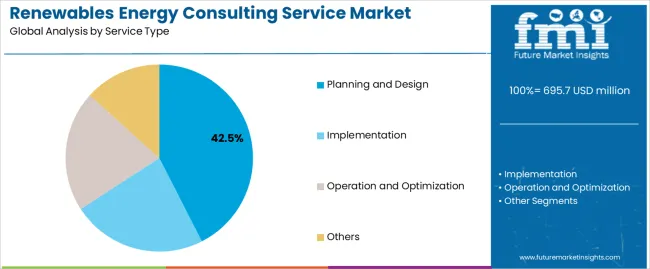

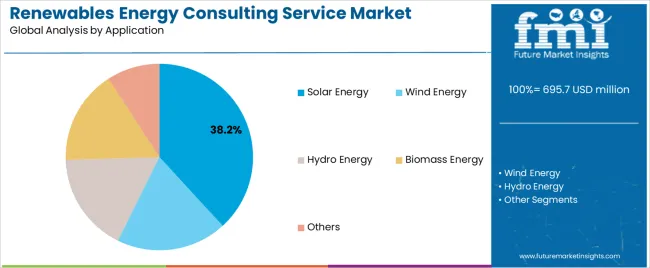

The renewables energy consulting service market is segmented by service type, application, technology focus, client type, and region. By service type, the renewables energy consulting service market is divided into planning and design, implementation, operation and optimization, and others. By application, it covers solar energy, wind energy, hydro energy, biomass energy, and others. By technology focus, the renewables energy consulting service market includes grid integration, energy storage, smart grid solutions, and distributed generation. By client type, it is categorized into utility companies, commercial and industrial, government agencies, and independent power producers. Regionally, the renewables energy consulting service market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

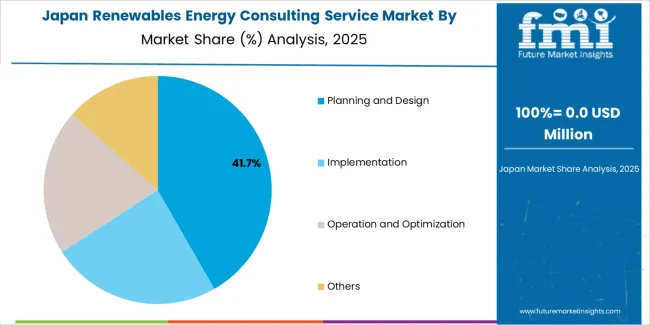

The planning and design segment is projected to account for 42.5% of the renewables energy consulting service market in 2025, reaffirming its position as the leading service category. Energy developers and utility companies increasingly utilize planning and design consulting services for their comprehensive project development capabilities when operating across diverse renewable energy technologies, excellent technical expertise characteristics, and cost-effectiveness in applications ranging from feasibility studies to detailed engineering design. Planning and design consulting services' advanced analytical capabilities and project optimization expertise directly address the industry requirements for comprehensive technical support in renewable energy development environments.

This service segment forms the foundation of modern renewable energy project development, as it represents the consulting type with the greatest strategic impact and established market demand across multiple technology categories and client sectors. Consulting firms' investments in advanced modeling software and digital planning tools continue to strengthen adoption among energy developers and utility companies. With clients prioritizing project success and risk mitigation, planning and design consulting services align with both technical requirements and economic optimization objectives, making them the central component of comprehensive renewable energy development strategies.

Solar energy applications are projected to represent 38.2% of renewables energy consulting service demand in 2025, underscoring their critical role as the primary renewable technology driving specialized consulting requirements for project development, system optimization, and grid integration applications. Solar energy developers prefer consulting services for their exceptional technical expertise capabilities, proven track record characteristics, and ability to reduce project risks while ensuring optimal system performance throughout diverse solar installation programs. Positioned as essential services for modern solar energy development, renewables energy consulting services offer both efficiency advantages and technical excellence benefits.

The segment is supported by continuous innovation in solar technologies and the growing availability of specialized consulting services that enable advanced system design with enhanced performance optimization and comprehensive project management capabilities. Additionally, solar developers are investing in integrated consulting partnerships to support large-scale project development and operational excellence. As solar energy demand becomes more prevalent and technology requirements increase, solar applications will continue to dominate the consulting market while supporting advanced renewable energy utilization and grid integration strategies.

The renewables energy consulting service market is advancing rapidly due to increasing demand for clean energy technologies and growing adoption of renewable energy solutions that provide superior technical expertise and project optimization capabilities while enabling reduced development risks across diverse energy development and utility management applications. However, the renewables energy consulting service market faces challenges, including competition from internal utility teams, pricing pressure from standardized services, and the need for specialized technical expertise and regulatory knowledge. Innovation in digital consulting platforms and ai-powered optimization systems continues to influence service development and market expansion patterns.

The growing adoption of cloud-based consulting platforms, ai-powered project optimization tools, and machine learning-based energy forecasting is enabling consulting firms to produce advanced renewable energy services with superior analytical capabilities, enhanced project efficiency, and automated advisory functionalities. Advanced digital systems provide improved technical accuracy while allowing more efficient client engagement and consistent performance across various renewable technologies and project types. Consulting firms are increasingly recognizing the competitive advantages of digital platform capabilities for service differentiation and premium market positioning.

Modern renewables energy consulting providers are incorporating comprehensive energy transition strategies, carbon footprint analysis, and integrated climate planning systems to enhance client value, enable predictive advisory capabilities, and deliver comprehensive solutions to energy customers. These services improve client outcomes while enabling new advisory capabilities, including long-term energy planning, emission reduction strategies, and reduced operational complexity. Advanced integration also allows consulting firms to support comprehensive corporate energy strategies and energy transition beyond traditional technical advisory approaches.

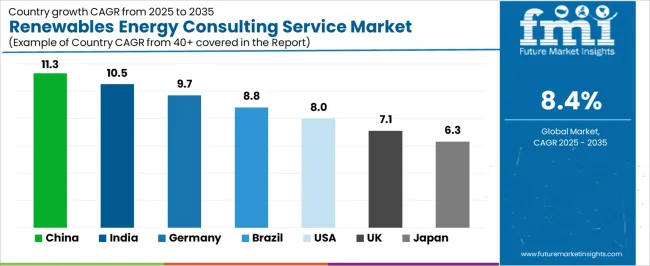

| Country | CAGR (2025-2035) |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| Brazil | 8.8% |

| USA | 8% |

| UK | 7.1% |

| Japan | 6.3% |

The renewables energy consulting service market is experiencing strong growth globally, with China leading at an 11.3% CAGR through 2035, driven by the expanding clean energy development programs, growing renewable energy capacity additions, and significant investment in energy transition consulting services. India follows at 10.5%, supported by government initiatives promoting renewable energy development, increasing utility modernization demand, and growing energy infrastructure requirements. Germany shows growth at 9.7%, emphasizing energy transition leadership and advanced clean technology development. Brazil records 8.8%, focusing on renewable energy expansion and commercial energy consulting modernization. The USA demonstrates 8% growth, prioritizing clean energy standards and grid modernization excellence. The UK exhibits 7.1% growth, emphasizing energy transition planning and renewable energy development. Japan shows 6.3% growth, supported by energy security initiatives and advanced grid integration concentration.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from renewables energy consulting services in China is projected to exhibit exceptional growth with a CAGR of 11.3% through 2035, driven by expanding clean energy development programs and rapidly growing renewable energy capacity additions supported by government initiatives promoting energy transition consulting development. The country's strong position in renewable energy manufacturing and increasing investment in grid modernization infrastructure are creating substantial demand for advanced renewables energy consulting solutions. Major utility companies and energy developers are establishing comprehensive consulting service capabilities to serve both domestic renewable energy demand and international clean energy markets.

Revenue from renewables energy consulting services in India is expanding at a CAGR of 10.5%, supported by the country's ambitious renewable energy targets, expanding government support for clean energy development, and increasing adoption of advanced energy consulting solutions. The country's initiatives promoting renewable energy capacity and growing utility modernization are driving requirements for advanced project development capabilities. International consulting firms and domestic service providers are establishing extensive advisory and technical capabilities to address the growing demand for renewables energy consulting services.

Revenue from renewables energy consulting services in Germany is expanding at a CAGR of 9.7%, supported by the country's advanced energy transition capabilities, strong emphasis on renewable energy innovation, and robust demand for high-performance clean energy consulting in grid integration and energy system applications. The nation's mature renewable energy sector and efficiency-focused operations are driving sophisticated consulting service systems throughout the energy industry. Leading consulting firms and technology providers are investing extensively in digital platforms and advanced analytics to serve both domestic and international markets.

Revenue from renewables energy consulting services in Brazil is growing at a CAGR of 8.8%, driven by the country's expanding renewable energy sector, growing commercial clean energy development, and increasing investment in energy consulting technology development. Brazil's significant renewable energy potential and commitment to clean energy modernization are supporting demand for efficient consulting service solutions across multiple energy development segments. Consulting firms are establishing comprehensive advisory capabilities to serve the growing domestic market and renewable energy export opportunities.

Revenue from renewables energy consulting services in the USA is expanding at a CAGR of 8%, supported by the country's advanced clean energy technology sector, strategic focus on grid modernization, and established renewable energy consulting capabilities. The USA's energy innovation leadership and technology integration are driving demand for consulting services in utility modernization, commercial renewable energy, and energy transition applications. Consulting firms are investing in comprehensive technology development to serve both domestic energy markets and international advisory opportunities.

Revenue from renewables energy consulting services in the UK is growing at a CAGR of 7.1%, driven by the country's focus on energy transition advancement, emphasis on renewable energy efficiency, and strong position in clean energy consulting development. The UK's established energy innovation capabilities and commitment to net-zero targets are supporting investment in advanced consulting technologies throughout major energy regions. Industry leaders are establishing comprehensive advisory integration systems to serve domestic energy operations and specialized international applications.

Revenue from renewables energy consulting services in Japan is expanding at a CAGR of 6.3%, supported by the country's advanced energy technology initiatives, growing clean energy sector, and strategic emphasis on grid integration development. Japan's leading technology capabilities and integrated energy systems are driving demand for advanced consulting services in renewable energy development, grid modernization, and high-performance energy applications. Leading consulting firms are investing in specialized capabilities to serve the stringent requirements of advanced energy technology and precision energy system industries.

The renewables energy consulting service market in Europe is projected to grow from USD 139.1 million in 2025 to USD 311.7 million by 2035, registering a CAGR of 8.4% over the forecast period. Germany is expected to maintain its leadership position with a 32.8% market share in 2025, declining slightly to 32.2% by 2035, supported by its strong energy transition sector, advanced renewable energy capabilities, and comprehensive clean energy consulting industry serving diverse advisory applications across Europe.

France follows with a 19.3% share in 2025, projected to reach 19.8% by 2035, driven by robust demand for consulting services in nuclear energy transition, renewable energy development programs, and clean energy applications, combined with established energy consulting infrastructure and grid integration expertise. The United Kingdom holds a 17.5% share in 2025, expected to reach 17.9% by 2035, supported by strong energy transition sector and growing renewable energy activities. Italy commands a 12.2% share in 2025, projected to reach 12.6% by 2035, while Spain accounts for 9.8% in 2025, expected to reach 10.1% by 2035. The Netherlands maintains a 5.1% share in 2025, growing to 5.3% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Poland, and other nations, is anticipated to maintain momentum, with its collective share moving from 3.3% to 2.1% by 2035, attributed to increasing energy transition activities in Eastern Europe and growing renewable energy penetration in Nordic countries implementing advanced clean energy consulting programs.

The renewables energy consulting service market is characterized by competition among established consulting firms, specialized energy advisory providers, and integrated clean energy solutions consultants. Companies are investing in digital platform research, technical expertise optimization, advanced analytics development, and comprehensive service portfolios to deliver consistent, high-performance, and client-specific renewables energy consulting solutions. Innovation in ai-powered systems, data analytics integration, and operational efficiency enhancement is central to strengthening market position and competitive advantage.

Accenture leads the renewables energy consulting service market with a strong market share, offering comprehensive renewables energy consulting solutions, including advanced digital platforms, with a focus on energy transition and utility modernization applications. UIV Urban Innovation Vienna provides specialized clean energy advisory capabilities with an emphasis on urban energy systems and integrated city planning. Arup delivers innovative energy consulting services with a focus on comprehensive project management and engineering excellence. Vector Renewables specializes in technical advisory and renewable energy project optimization for utility-scale applications. Partner Engineering and Science focuses on environmental consulting and integrated energy solutions. PSC Consulting offers specialized renewable energy advisory with emphasis on regulatory compliance and project development.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 695.7 million |

| Service Type | Planning and Design, Implementation, Operation and Optimization, Others |

| Application | Solar Energy, Wind Energy, Hydro Energy, Biomass Energy, Others |

| Technology Focus | Grid Integration, Energy Storage, Smart Grid Solutions, Distributed Generation |

| Client Type | Utility Companies, Commercial and Industrial, Government Agencies, Independent Power Producers |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Accenture, UIV Urban Innovation Vienna, Arup, Vector Renewables, Partner Engineering and Science, and PSC Consulting |

| Additional Attributes | Dollar sales by service type and application category, regional demand trends, competitive landscape, technological advancements in digital consulting platforms, advanced analytics development, AI integration innovation, and energy transition planning integration |

The global renewables energy consulting service market is estimated to be valued at USD 695.7 million in 2025.

The market size for the renewables energy consulting service market is projected to reach USD 1,558.5 million by 2035.

The renewables energy consulting service market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in renewables energy consulting service market are planning and design, implementation, operation and optimization and others.

In terms of application, solar energy segment to command 38.2% share in the renewables energy consulting service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Energy Efficient Motor Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Size and Share Forecast Outlook 2025 to 2035

Energy Dispersive X-ray Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Energy Harvesting Market Growth - Trends & Forecast 2025 to 2035

Energy Supplement Market Analysis by Product Type, End-user and Distribution Channel through 2025 to 2035

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Energy Efficiency Gamification Market Analysis by Type, Deployment, End User, and Region through 2035

Leading Providers & Market Share in Energy Gel Industry

Energy Intelligence Solution Market - Growth & Forecast 2025 to 2035

Energy & Power Quality Meters Market Growth - Trends & Forecast through 2034

Energy Drink Market Outlook – Growth, Demand & Forecast 2024 to 2034

Energy Recovery Ventilator Core Market Growth – Trends & Forecast 2024-2034

Energy Portfolio Management Market Report – Trends & Forecast 2023-2033

Energy Management System Market Analysis – Growth & Forecast 2017-2025

UK Energy Gel Market Report – Demand, Trends & Industry Forecast 2025–2035

New Energy Vehicle Electric Drive Systems Market Size and Share Forecast Outlook 2025 to 2035

USA Energy Gel Market Outlook – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA