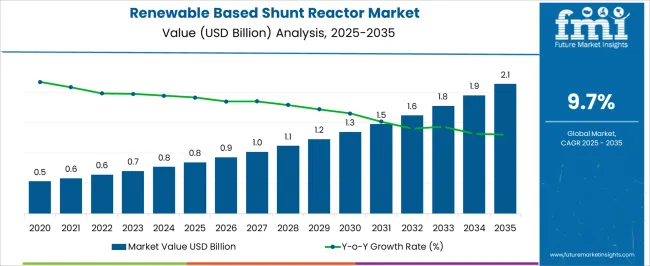

The renewable based shunt reactor market is estimated to be valued at USD 0.8 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

Market penetration is expected to intensify as renewable energy adoption accelerates, particularly in regions investing heavily in solar and wind infrastructure. Early-stage deployment remains concentrated in developed economies where grid modernization and energy storage integration are prioritized, resulting in moderate saturation levels in these regions. Emerging markets are likely to witness significant uptake, driven by government incentives, declining technology costs, and the push for decentralized power generation, suggesting that saturation thresholds will remain distant in these areas through 2035. Technological enhancements, including advanced voltage control, modular designs, and efficient cooling mechanisms, are anticipated to support broader implementation, minimizing operational constraints that could otherwise limit market expansion.

The increase in renewable capacity is expected to stimulate demand for shunt reactors as grid stabilization components, enhancing power quality and reliability. Challenges such as high upfront costs and maintenance requirements are projected to slow adoption in price-sensitive regions but are unlikely to hinder overall market growth. By the end of the forecast period, saturation points are expected to be approached in mature grids, while developing networks are projected to continue scaling installations, offering a balanced growth landscape for market stakeholders.

| Metric | Value |

|---|---|

| Renewable Based Shunt Reactor Market Estimated Value in (2025 E) | USD 0.8 billion |

| Renewable Based Shunt Reactor Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The renewable based shunt reactor market is influenced by several interconnected parent markets, each contributing differently to overall demand and growth. The renewable energy generation market holds the largest share at 50%, driven by the increasing adoption of solar, wind, and other renewable power sources, which require shunt reactors for voltage regulation and grid stability. The transmission and distribution infrastructure market contributes 20%, as upgrades in electrical grids and modernization projects increase the need for reactive power compensation and improved power quality. The industrial and commercial end-use market accounts for 15%, where factories, manufacturing units, and large commercial facilities demand stable voltage levels and energy-efficient solutions. The government and regulatory initiatives market holds a 10% share, fueled by policies and incentives promoting renewable integration, grid reliability, and sustainable energy adoption.

Finally, the energy storage and microgrid solutions market represents 5%, where shunt reactors are used to balance intermittent renewable generation and maintain voltage consistency in decentralized grids. Collectively, renewable generation, grid infrastructure, and industrial consumption account for 85% of overall demand, emphasizing that the deployment of renewable energy projects, grid modernization, and large-scale commercial applications are the primary drivers of market growth, while regulatory support and energy storage initiatives provide supplementary growth opportunities across global markets.

The renewable based shunt reactor market is witnessing robust growth as grid operators and renewable energy developers increasingly prioritize voltage stability and reactive power management in expanding transmission networks. The shift toward cleaner energy generation, supported by global decarbonization targets and government incentives, is driving the deployment of wind and solar power infrastructure, necessitating advanced grid balancing solutions.

Market momentum is being reinforced by investments in high-voltage transmission projects, especially in regions with aggressive renewable integration agendas. Manufacturers are enhancing product efficiency, reliability, and compactness to meet space-constrained installation environments while adhering to stringent environmental regulations.

Price competitiveness and supply chain optimization are becoming key focus areas to mitigate the impact of fluctuating raw material costs Over the forecast horizon, growing electrification demand, coupled with modernization of existing power grids, is anticipated to drive steady adoption, with innovation in insulation technologies and smart grid compatibility expected to further enhance market opportunities and performance reliability.

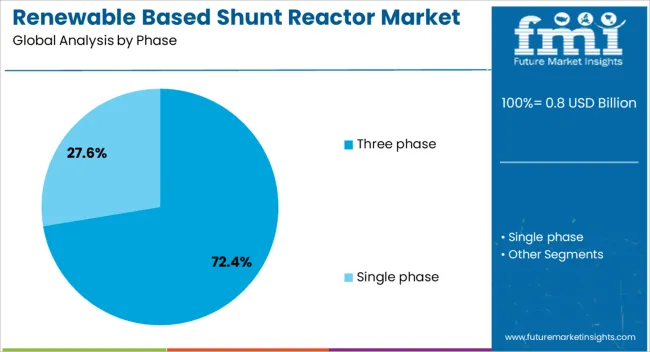

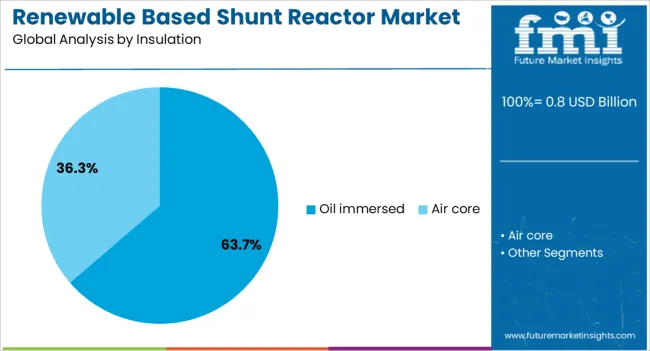

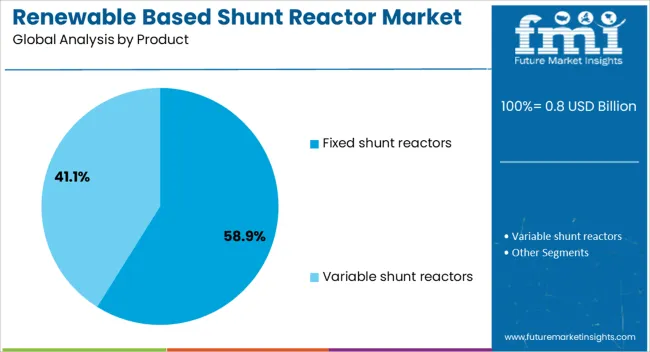

The renewable based shunt reactor market is segmented by phase, insulation, product, and geographic regions. By phase, renewable based shunt reactor market is divided into three phase and single phase. In terms of insulation, renewable based shunt reactor market is classified into oil immersed and air core. Based on product, renewable based shunt reactor market is segmented into fixed shunt reactors and variable shunt reactors. Regionally, the renewable based shunt reactor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The three phase segment, accounting for 72.4% of the phase category, has maintained its leadership due to its suitability for large-scale grid applications and higher operational efficiency in balancing reactive power. Its dominance is supported by its ability to handle high voltage levels efficiently, making it a preferred choice in renewable energy integration projects.

This segment benefits from economies of scale in manufacturing and reduced installation costs per unit of capacity, which enhances its attractiveness for utility-scale deployments. Additionally, technological advancements in core design and winding configurations have improved energy efficiency and reduced losses.

Standardization across major markets has also facilitated faster deployment and compatibility with existing infrastructure With renewable capacity expansions requiring stable and efficient power transmission, the three phase configuration is expected to remain the primary choice, particularly in high-capacity wind and solar farms, sustaining its significant share in the market.

The oil immersed segment, holding 63.7% of the insulation category, is leading the market due to its superior cooling efficiency, longer operational lifespan, and proven reliability in diverse climatic conditions. Its adoption is driven by the capability to manage high voltage stress while maintaining consistent performance in demanding grid environments.

Lower operational maintenance requirements and robust insulation properties have reinforced its preference in utility and industrial installations. Additionally, cost-effectiveness in large-scale manufacturing has made oil immersed reactors competitive against alternative insulation methods.

The segment’s growth is also being supported by design improvements that enhance fire safety, minimize oil leakage risks, and meet evolving environmental standards With a rising number of high-voltage renewable projects, oil immersed insulation is expected to remain the favored option due to its balance of performance, durability, and lifecycle cost advantages.

The fixed shunt reactors segment, representing 58.9% of the product category, continues to dominate due to its established role in providing constant reactive power compensation in transmission networks. Its application in stabilizing voltage levels in grids with fluctuating renewable generation has solidified its position, especially in regions integrating large wind and solar capacities.

Fixed shunt reactors are valued for their simplicity, reliability, and lower initial investment compared to variable designs, making them attractive for long-term infrastructure planning. The segment benefits from standardization in design, enabling faster procurement and installation processes.

Additionally, the durability and minimal operational adjustments required contribute to their cost efficiency over the asset lifecycle With renewable penetration intensifying the need for steady reactive power management, the fixed shunt reactor’s robust performance profile ensures its continued dominance in the market.

The market is primarily driven by renewable energy integration, grid modernization, and industrial demand for stable power. Government incentives and regulatory frameworks further enhance adoption and long-term growth prospects.

The demand for renewable based shunt reactors is being propelled by the rapid expansion of solar and wind energy installations across developed and emerging markets. As renewable power generation capacity increases, grid operators are increasingly deploying shunt reactors to maintain voltage stability and minimize reactive power losses. Countries with ambitious renewable targets are accelerating investments in grid infrastructure, creating higher demand for voltage control equipment. The intermittency of renewable energy sources necessitates reactive power compensation, which positions shunt reactors as essential components in transmission networks. Industry experts highlight that integration with large-scale renewable farms, both onshore and offshore, is expected to drive continuous market expansion, particularly in regions facing frequent voltage fluctuations and reliability concerns.

Expanding and upgrading electrical transmission networks is a critical factor influencing the renewable based shunt reactor market. Aging grid infrastructure in mature economies requires reactive power management solutions to maintain operational efficiency and reduce transmission losses. The deployment of high-voltage networks to accommodate renewable energy sources creates opportunities for shunt reactor integration at key substations. Regional expansion in Asia Pacific, North America, and Europe has intensified demand as governments prioritize grid resilience and efficient energy delivery. Market analysts suggest that proactive investment in grid reinforcement, particularly in high-demand urban and industrial corridors, will sustain demand for shunt reactors. This ongoing focus on grid reliability ensures a consistent market trajectory over the forecast period

Government initiatives and energy regulations are shaping market growth by encouraging reactive power management solutions. Incentives and subsidies for renewable energy infrastructure indirectly stimulate shunt reactor adoption by supporting grid stability measures. Policy frameworks aimed at reducing transmission losses, ensuring consistent electricity supply, and integrating intermittent renewable energy sources have highlighted shunt reactors as vital grid components. Regulatory requirements for power quality compliance in industrial and commercial sectors are further boosting deployment. Countries with active renewable integration strategies are likely to witness accelerated installations. Analysts note that regulatory clarity and supportive policy measures significantly influence investment decisions, thereby enhancing long-term market confidence and creating favorable conditions for sustained growth in shunt reactor applications.

Industrial and commercial electricity consumers are increasingly demanding stable voltage conditions and improved power quality to protect equipment and ensure operational continuity. Large factories, manufacturing plants, and commercial facilities experience voltage fluctuations that can impact production efficiency and equipment lifespan. Renewable based shunt reactors are being integrated into these systems to provide reactive power compensation, mitigate harmonics, and stabilize voltage levels. The growth of data centers, smart factories, and high-capacity industrial complexes is contributing to higher demand. Market observers emphasize that as electricity consumption patterns become more dynamic and energy-intensive, the industrial and commercial end-use segment will remain a crucial driver, supporting both adoption and incremental revenue generation for shunt reactor manufacturers globally.

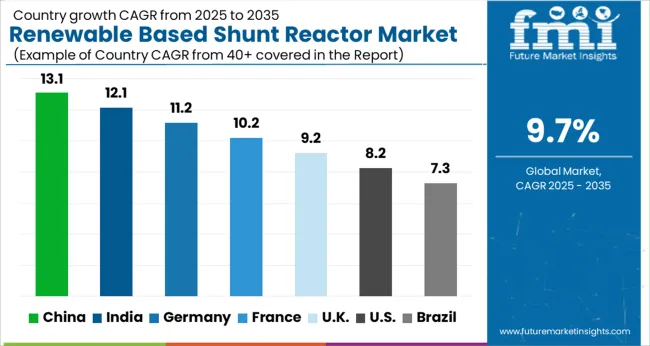

| Country | CAGR |

|---|---|

| China | 13.1% |

| India | 12.1% |

| Germany | 11.2% |

| France | 10.2% |

| UK | 9.2% |

| USA | 8.2% |

| Brazil | 7.3% |

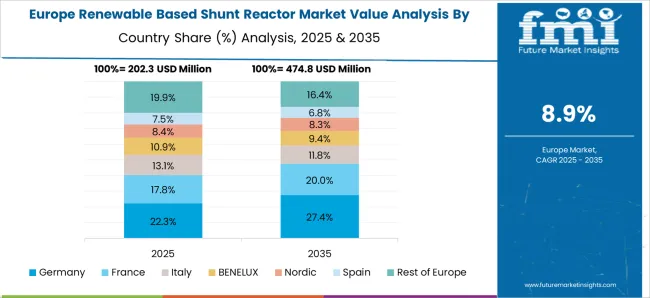

The global renewable based shunt reactor market is projected to grow at a CAGR of 9.7% from 2025 to 2035. China leads adoption at 13.1%, followed by India (12.1%), Germany (11.2%), the UK (9.2%), and the USA (8.2%). Growth is fueled by the rapid expansion of renewable energy installations, investments in grid modernization, and increasing industrial and commercial demand for stable voltage and reactive power compensation. Emerging economies such as China and India are witnessing large-scale integration driven by government incentives and renewable energy targets, while developed markets including Germany, the UK, and the USA focus on upgrading aging transmission networks and enhancing power quality standards. Regional infrastructure projects, cross-border grid connectivity, and high-voltage deployment initiatives further accelerate adoption and reinforce market growth.

The renewable based shunt reactor market in China is projected to grow at a CAGR of 13.1% from 2025 to 2035, driven by the country’s rapid expansion of renewable energy capacity, particularly in solar and wind power. Investments in grid modernization and high-voltage transmission networks are creating significant demand for shunt reactors to maintain voltage stability and reactive power balance. Industrial sectors, including manufacturing hubs and large commercial facilities, are increasingly adopting shunt reactors to protect equipment and ensure uninterrupted operations. Government initiatives and policy incentives aimed at clean energy integration are further accelerating deployment. Regional projects in offshore wind farms and cross-province transmission corridors are creating large-scale implementation opportunities. Manufacturers are focusing on modular designs, efficiency improvements, and localized production to meet growing demand.

The renewable based shunt reactor market in India is expected to expand at a CAGR of 12.1% from 2025 to 2035, fueled by increasing renewable energy capacity and government initiatives promoting grid stability. The integration of solar and wind farms into regional and national grids is driving the need for voltage regulation and reactive power compensation. Industrial and commercial facilities in metropolitan and industrial corridors are adopting shunt reactors to improve power quality and minimize equipment downtime. Investment in transmission infrastructure, high-voltage substations, and microgrid projects is creating new opportunities for market growth. Domestic manufacturers are collaborating with international technology providers to enhance efficiency and reliability. Policies encouraging decentralized energy generation, combined with rising electricity demand, are expected to sustain market expansion throughout the forecast period.

The renewable based shunt reactor market in Germany is projected to grow at a CAGR of 11.2% from 2025 to 2035, supported by the country’s ambitious renewable energy targets and strong transmission network investments. Deployment is concentrated in high-voltage substations and industrial zones, where shunt reactors are used to manage reactive power and maintain grid stability. Aging infrastructure is being upgraded to accommodate intermittent renewable energy sources, increasing market penetration. Industrial sectors, including manufacturing and energy-intensive production, are adopting shunt reactors to minimize voltage fluctuations and improve operational efficiency. Government policies, including incentives for clean energy integration and power quality compliance standards, are creating favorable conditions for adoption. International partnerships and technology transfer are also accelerating deployment in key regions.

The renewable based shunt reactor market in the UK is expected to grow at a CAGR of 9.2% from 2025 to 2035, driven by large-scale offshore wind projects and national grid reinforcement initiatives. The increasing share of renewable generation necessitates voltage stabilization and reactive power management, which supports shunt reactor deployment. Industrial sectors, including commercial buildings and manufacturing facilities, are investing in voltage regulation solutions to reduce downtime and optimize energy consumption. Government programs aimed at supporting green energy integration, coupled with strict power quality compliance requirements, are creating growth opportunities. Regional grid modernization projects and cross-border interconnectivity initiatives are expected to sustain demand over the forecast period, ensuring stable market expansion.

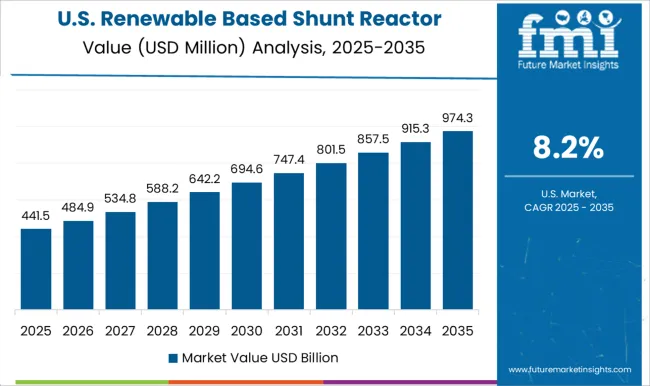

The renewable based shunt reactor market in the USA is projected to expand at a CAGR of 8.2% from 2025 to 2035, driven by the growing integration of solar and wind energy into the national grid. Investment in high-voltage transmission networks, smart grid initiatives, and industrial power management is increasing demand for shunt reactors. Industrial and commercial sectors, including data centers and manufacturing plants, require stable voltage and reactive power control, contributing to market growth. Federal and state policies promoting clean energy adoption, energy efficiency, and grid reliability are creating favorable conditions for reactor deployment. Regional renewable projects, microgrid solutions, and modernized substations are expected to drive sustained market growth throughout the forecast period.

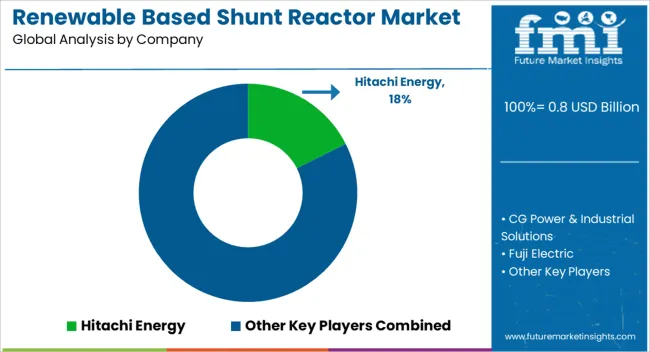

Competition in the renewable based shunt reactor market is shaped by technological expertise, global reach, and project execution capabilities. Hitachi Energy leads with a strong portfolio of high-voltage and medium-voltage reactors, leveraging experience in grid stabilization and renewable integration. CG Power & Industrial Solutions competes through customized shunt reactor solutions for industrial and transmission applications, focusing on reliability and cost efficiency. Fuji Electric differentiates with modular designs and energy-efficient products that support both onshore and offshore renewable projects. GBE and GE maintain competitive positions by offering reactors integrated with smart grid and automation solutions, addressing the growing need for reactive power management and voltage regulation.

GETRA and Hyosung Heavy Industries emphasize large-capacity, high-voltage reactors for transmission networks, catering to industrial and commercial sectors. NISSIN Electric and SGB SMIT focus on specialized designs for utility-scale renewable installations, combining durability and low-loss performance. Shrihans Electricals and TMC Transformers Manufacturing Company are expanding their presence through strategic partnerships and regional project execution. Siemens Energy leverages extensive global experience in grid modernization, reactive power compensation, and renewable integration, offering tailored solutions to emerging and mature markets. Toshiba Energy Systems & Solutions and WEG compete with energy-efficient reactors designed for industrial applications, focusing on regulatory compliance and operational reliability. Key strategies in the market emphasize multi-region project execution, collaboration with renewable project developers, and engineering support for installation and maintenance.

Companies invest in technology adaptation for high-voltage networks, modular designs, and reactive power optimization to differentiate from competitors. Market players also focus on after-sales service, performance warranties, and lifecycle management to secure long-term contracts. The competitive environment is further intensified by mergers, acquisitions, and alliances that expand regional footprints and product portfolios, ensuring comprehensive coverage across industrial, commercial, and utility-scale renewable projects globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.8 billion |

| Phase | Three phase and Single phase |

| Insulation | Oil immersed and Air core |

| Product | Fixed shunt reactors and Variable shunt reactors |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hitachi Energy, CG Power & Industrial Solutions, Fuji Electric, GBE, GE, GETRA, Hyosung Heavy Industries, NISSIN Electric, SGB SMIT, Shrihans Electricals, Siemens Energy, TMC Transformers Manufacturing Company, Toshiba Energy Systems & Solutions, and WEG |

| Additional Attributes | Dollar sales, market share by country and segment, CAGR trends, top end-use industries, competitive landscape, technology adoption rates, regulatory incentives, and grid modernization projects. |

The global renewable based shunt reactor market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the renewable based shunt reactor market is projected to reach USD 2.1 billion by 2035.

The renewable based shunt reactor market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in renewable based shunt reactor market are three phase and single phase.

In terms of insulation, oil immersed segment to command 63.7% share in the renewable based shunt reactor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Renewable Heating Fuels Market Size and Share Forecast Outlook 2025 to 2035

Renewable Isocyanate Market Forecast and Outlook 2025 to 2035

Renewables Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Renewable Naphtha Market Size and Share Forecast Outlook 2025 to 2035

Renewable Biopolymer Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Renewable Energy Certificate Market Size and Share Forecast Outlook 2025 to 2035

Renewable Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Renewable Energy Contactor Market Size and Share Forecast Outlook 2025 to 2035

Renewable Methanol Market Growth - Trends & Forecast 2025 to 2035

Renewable Solvents Market

Si-based Hall Effect Sensors Market Size and Share Forecast Outlook 2025 to 2035

AI-based 3D reconstruction Tools Market Size and Share Forecast Outlook 2025 to 2035

AI based Triage Tools Market Size and Share Forecast Outlook 2025 to 2035

Ph Based Lip Balm Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Driving Systems (L2 to L5) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

AI-based Research Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

AI-based Atrial Fibrillation AFib Detection Market Size and Share Forecast Outlook 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

AI-based Surgical Robots Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA