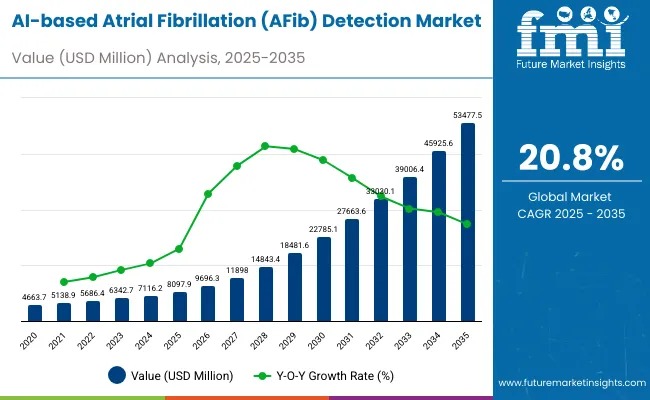

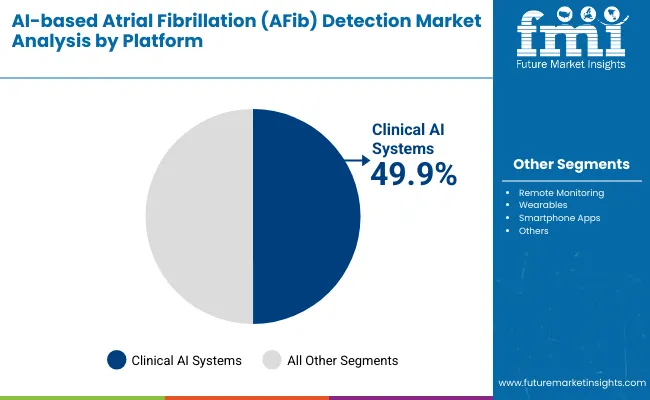

The global AI-based Atrial Fibrillation (AFib) Detection Market is projected to reach a valuation of USD 8,097.9 million by 2025 and USD 53,477.5million by 2035 which indicates a (CAGR) of 20.8%, during the study period. Clinical AI Systems contributes 49.9% share while Continuous Rhythm Monitoring leads the application segment with 30.0% share.

During the first five-year period from 2025 to 2030, the total market value is projected to expand from USD 8,097.9 million to around USD 22,785.1 million, adding nearly USD 14,687.2million, which contributes to 32.4% of the total decade growth.

The Clinical AI Systems segment will remain dominant, holding close to 49.9% share of the category by 2030 due to hospitals’ continued prioritization of advanced diagnostic accuracy and workflow efficiency. The Remote Monitoring segment will account for nearly 24% by 2030, while Wearables 18.2%and Smartphone Apps 7.9%will continue to gain traction as consumer-preferred tools for arrhythmia detection.

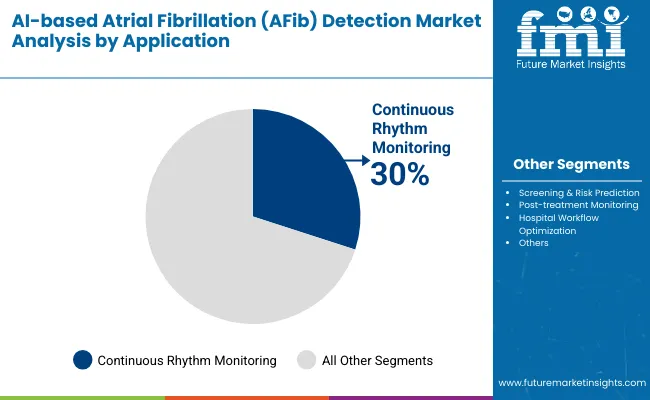

The second half from 2030 to 2035 contributes approximately USD 30,692.3 million, equal to 67.6% of the total growth. This acceleration is powered by the widespread adoption of AI-enabled Continuous Rhythm Monitoring contributing 30% in both specialized cardiology centers and large hospital networks. By the end of the decade, Clinical AI Systems and Remote Monitoring Platforms together are expected to capture over 70% of the market share, while Wearables and Smartphone Apps are projected to maintain strong adoption in cost-sensitive and emerging markets.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 8,097.9 million |

| Industry Value (2035F) | USD 53,477.5million |

| CAGR (2025 to 2035) | 20.8% |

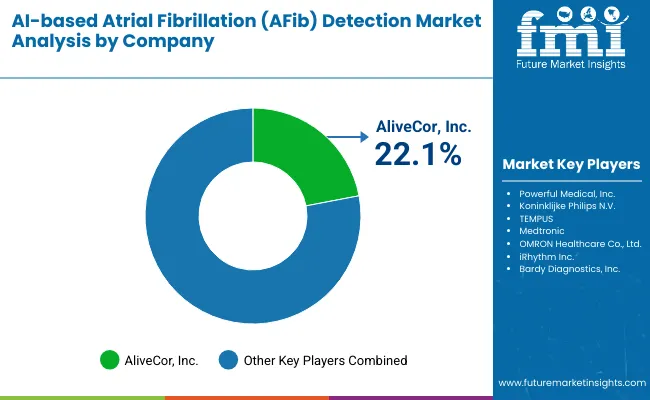

From 2020 to 2024, the overall AI-based Atrial Fibrillation (AFib) Detection Market grew steadilygrew from USD 4,663.7 million to USD 7,116.2 million, supported by the rising adoption of AI-enabled clinical platforms, wearable ECG devices, and smartphone-based rhythm monitoring applications. Leading manufacturers such as AliveCor, Inc., iRhythm Technologies, Koninklijke Philips N.V., Tempus, Medtronic, and OMRON Healthcare collectively account for a significant share of global revenue through AI-driven arrhythmia detection solutions and integration with remote monitoring systems.

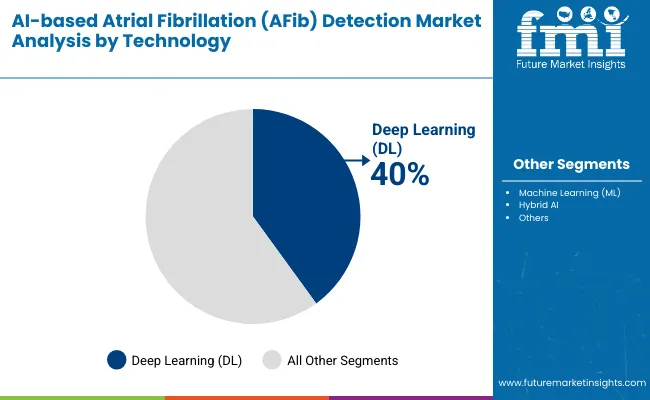

Key strategies deployed by these players include advancements in deep learning (DL) and machine learning (ML) models, development of hybrid AI for rhythm interpretation, and partnerships with hospitals and cardiology centers to standardize early AFib detection and risk prediction workflows.

In 2025, the AI-based Atrial Fibrillation (AFib) Detection Market is expected to reach a value of approximately USD 8,097.9 million, driven by the shift from traditional ECG diagnostics toward AI-powered Clinical AI Systems and remote monitoring platforms. Growth will be propelled by healthcare providers’ investments in precision diagnostics, continuous rhythm monitoring, and improved patient management outcomes.

End users, particularly hospitals and cardiology clinics, are increasingly adopting platforms with AI-based risk prediction models, wearable integration, and smartphone connectivity, supporting both continuous monitoring and post-treatment follow-up. This trend aligns with the rising demand for preventive cardiology solutions and highly accurate arrhythmia detection across both developed and emerging markets.

The AI-based Atrial Fibrillation (AFib) Detection Market is experiencing strong growth as healthcare providers worldwide face increasing demand for early arrhythmia detection, continuous rhythm monitoring, and improved patient outcomes. Major growth drivers include the rising global prevalence of atrial fibrillation, the expanding adoption of wearable and remote monitoring devices, and the integration of AI algorithms with clinical diagnostics.

Advancements such as deep learning (DL) and machine learning (ML) models, smartphone app connectivity, and system-specific AI platforms reduce diagnostic delays, minimize undetected AFib episodes, and enhance treatment decision-making. The shift toward preventive cardiology and growing acceptance of digital health monitoring are further accelerating adoption.

The pandemic heightened the importance of remote patient monitoring and virtual care pathways, driving hospitals, cardiology centers, and digital health providers to standardize AI-based detection workflows. In regions with rapidly expanding healthcare infrastructure particularly in North America, Europe, and Asia Pacific new investments in clinical AI systems and technology upgrades are fueling demand for advanced AFib detection solutions that combine accuracy, safety, and clinical efficiency.

The market is segmented by platform, technology, application, and region. Platform segmentation includes Clinical AI Systems, Remote Monitoring, Wearables, and Smartphone Apps, representing the core solutions driving early arrhythmia detection, patient engagement, and integration with healthcare workflows. Technology segmentation covers Deep Learning (DL), Machine Learning (ML), Hybrid AI, and Other Models, each contributing to improvements in predictive accuracy, rhythm classification, and real-time monitoring capabilities.

Application classification includes Continuous Rhythm Monitoring, Screening & Risk Prediction, Post-treatment Monitoring, and Hospital Workflow Optimization, reflecting the broad spectrum of use cases supported by AI-driven AFib detection tools in clinical practice and patient care pathways. Regional scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa, with market growth influenced by variations in healthcare infrastructure, prevalence of cardiovascular diseases, digital health adoption, and regulatory frameworks for AI-enabled diagnostics.

| Platform | Market Share (%) |

|---|---|

| Clinical AI Systems | 49.90% |

| Remote Monitoring | 24.00% |

| Wearables | 18.20% |

| Smartphone Apps | 7.90% |

Clinical AI Systems are expected to retain a dominant position, contributing 49.9% to the market in 2025, owing to their ability to deliver highly accurate, real-time arrhythmia detection and risk prediction within clinical workflows. Their adoption has been driven by the global shift toward precision cardiology and the increasing integration of AI algorithms with hospital-based monitoring platforms and electronic health records. These systems are increasingly preferred by healthcare providers due to their capacity to reduce undiagnosed AFib cases, enhance treatment predictability, and improve patient management outcomes.

Hospitals and specialized cardiology centers are investing in AI-driven systems to standardize early detection, particularly for high-risk patients requiring continuous monitoring or post-treatment follow-up. Industry adoption has also been supported by advancements in deep learning (DL) and machine learning (ML) models, interoperability with remote monitoring devices, and integration into telecardiology platforms. Collectively, these factors have solidified the position of Clinical AI Systems over consumer-centric wearables or app-only solutions in high-volume, clinically driven healthcare environments worldwide.

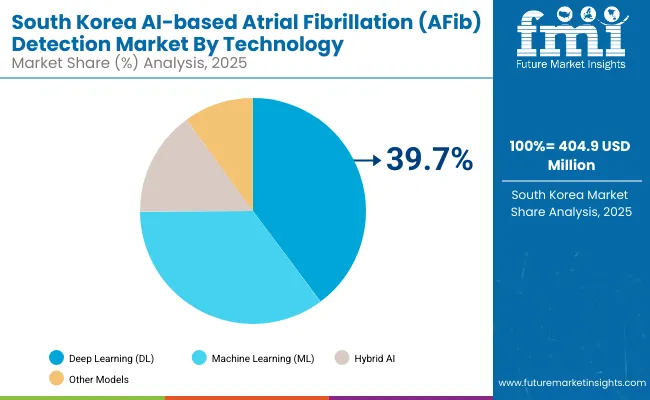

| Technology | Market Share (%) |

|---|---|

| Deep Learning (DL) | 40% |

| Machine Learning (ML) | 35% |

| Hybrid AI | 15% |

| Other Models | 10% |

Deep Learning (DL) is expected to retain a dominant position, contributing 40% to the market in 2025, owing to its unmatched ability to analyze complex ECG and PPG signals for accurate AFib detection. Adoption has been driven by the global shift toward precision cardiology and the increasing deployment of convolutional neural networks (CNNs) and recurrent neural networks (RNNs) in arrhythmia monitoring platforms. DL models are increasingly preferred due to their capacity to improve diagnostic accuracy, reduce false positives, and enable predictive risk stratification in high-risk populations.

Healthcare providers and digital health innovators are investing in DL-based systems to support early detection workflows, particularly for continuous rhythm monitoring and screening programs. Industry adoption has also been supported by advancements in cloud-based computing, GPU acceleration, and integration of DL models into wearable and smartphone-based applications. Collectively, these factors have solidified the position of Deep Learning ahead of traditional machine learning and hybrid approaches, making it the leading technology in AI-driven AFib detection worldwide.

| Application | Market Share (%) |

|---|---|

| Continuous Rhythm Monitoring | 30% |

| Screening & Risk Prediction | 28% |

| Post-treatment Monitoring | 25% |

| Hospital Workflow Optimization | 17% |

Continuous Rhythm Monitoring is expected to remain the largest application segment, contributing around 30% of the market in 2025, driven by its critical role in detecting intermittent and asymptomatic AFib episodes that often go undiagnosed in routine checkups. The majority of long-term monitoring for at-risk patients is performed through AI-enabled clinical systems, wearables, and remote devices, where accuracy, reliability, and real-time data transmission are operational priorities.

The adoption of continuous monitoring is reinforced by the integration of deep learning models, cloud-based analytics, and seamless connectivity with hospital and telecardiology workflows. Investments in healthcare modernization, particularly in high-volume cardiology networks, are enabling the deployment of advanced monitoring solutions to improve patient outcomes and reduce the risk of stroke. Additionally, favorable reimbursement policies for remote patient monitoring and the growing prevalence of elderly populations worldwide are supporting higher adoption levels, cementing Continuous Rhythm Monitoring as the primary growth driver for AI-based AFib detection solutions globally.

Advanced AI Integration into Clinical and Remote Monitoring Systems Driving Precision in Early Atrial Fibrillation Detection

One of the most important growth drivers of the AI-based Atrial Fibrillation (AFib) Detection Market is the rapid integration of advanced deep learning and machine learning models into both hospital-based clinical platforms and remote monitoring devices. These algorithms allow for the real-time identification of arrhythmia episodes, improved accuracy in rhythm classification, and proactive risk prediction. As AFib is often asymptomatic and intermittent, traditional diagnostic methods miss a significant number of cases; AI-driven systems are bridging this gap by continuously analyzing ECG and PPG signals to deliver earlier interventions and reduce stroke-related complications.

Hospitals, cardiology centers, and telehealth providers are compelled to deploy these solutions to streamline workflows, reduce diagnostic errors, and lower the burden of cardiovascular complications on health systems. Regulatory clearances from the FDA, NICE, and European agencies are further reinforcing trust and accelerating procurement decisions. With global AFib prevalence projected to rise sharply over the next decade, AI-based clinical platforms are becoming indispensable in preventive cardiology and represent a core driver of market expansion worldwide.

High System Deployment Costs, Data Integration Challenges, and Infrastructure Limitations Hindering Large-Scale Market Penetration

Despite rapid progress, the high cost and infrastructure demands of AI-based AFib detection systems remain significant barriers to large-scale adoption, particularly in emerging and cost-sensitive regions. Advanced clinical AI systems require substantial upfront investments in compatible ECG/PPG hardware, cloud-based platforms, and ongoing subscription models for algorithm updates and clinical analytics. Furthermore, integration with hospital electronic health records (EHRs) and compliance with data privacy regulations such as HIPAA and GDPR add financial and technical complexity.

Smaller healthcare providers and regional hospitals often face difficulties in retrofitting existing workflows to accommodate AI-based systems, leading to adoption delays. Broadband connectivity gaps and limited availability of trained personnel in rural or developing areas further constrain deployment. For many institutions, staff training and workflow adaptation represent hidden costs that compound the initial expense of technology acquisition. These challenges make affordability, scalability, and regulatory harmonization critical to unlocking the full potential of AI-enabled AFib detection solutions across global healthcare systems.

Convergence of AI-Based Atrial Fibrillation Detection with Comprehensive Digital Health and Preventive Cardiology Ecosystems

A transformative trend reshaping this market is the convergence of AI-based AFib detection solutions with broader digital health ecosystems that integrate remote monitoring, telecardiology, predictive analytics, and cloud-based patient management systems. Rather than adopting detection algorithms as isolated tools, hospitals, health networks, and insurers are embedding AI-based arrhythmia monitoring into comprehensive cardiovascular care pathways. Companies like AliveCor, iRhythm, Philips, Tempus, and Medtronic are actively developing platforms that combine wearable devices, continuous ECG analysis, AI-driven risk stratification, and telehealth consultations into unified service models.

This convergence is shifting procurement decisions away from standalone cost considerations toward long-term value creation based on interoperability, scalability, and clinical outcome improvements. For health systems transitioning toward value-based care models, these integrated platforms provide a compelling solution by enabling continuous patient engagement, proactive disease management, and reduced hospital readmissions. As healthcare infrastructures worldwide modernize, the integration of AI-enabled AFib detection into digital ecosystems is emerging as a defining trend, positioning it as a cornerstone of next-generation cardiovascular healthcare delivery.

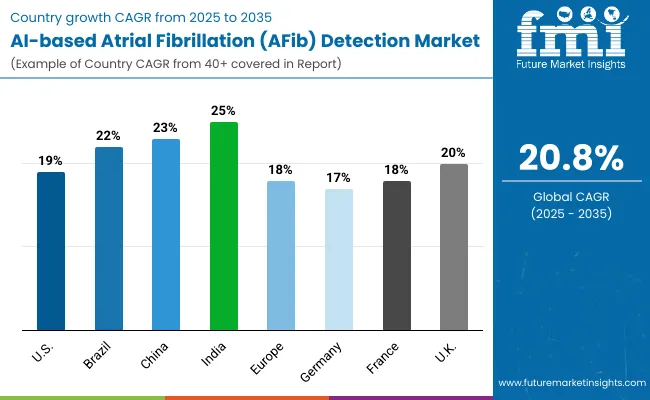

| Countries | CAGR |

|---|---|

| USA | 19.0% |

| Brazil | 22.0% |

| China | 23.0% |

| India | 25.0% |

| Europe | 18.0% |

| Germany | 17.0% |

| France | 18.0% |

| UK | 20.0% |

Asia Pacific is emerging as the fastest-growing region in the AI-based AFib Detection Market, projected to expand at a strong pace between 2025 and 2035. Among its key markets, India is forecast to grow at a 25.0% CAGR, driven by the rapid expansion of advanced cardiac care facilities, increasing deployment of AI-enabled monitoring systems, and growing awareness of arrhythmia detection among clinicians.

China is projected to expand at a 23.0% CAGR, supported by large-scale investments in digital health infrastructure, rising AFib case volumes, and public-private partnerships for AI integration in hospitals and community clinics. The region’s growth is also powered by government-backed digital health initiatives, expanding patient access to wearable monitoring devices, and early adoption of clinical AI platforms in technologically advanced economies such as Japan and South Korea.

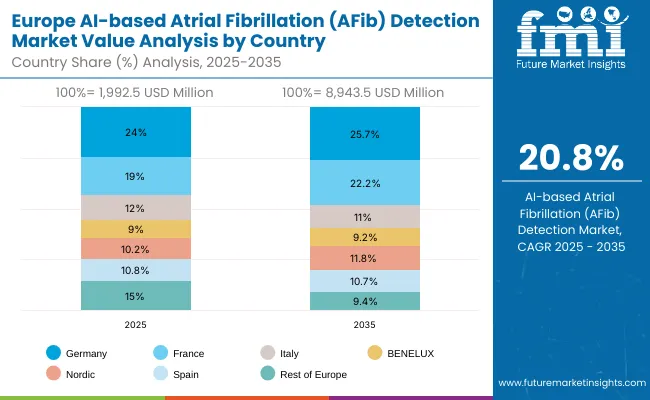

Europe is expected to grow steadily at a 16.2% CAGR through 2035. Germany, contributing 24.0% of regional revenues in 2025, is projected to increase slightly to 25.7% by 2035. France is forecast to grow at an 19.0% CAGR, expanding its share to 22.2% by 2035 through stronger uptake in both public and private hospitals. The UK will expand at a 20.0% CAGR, supported by NHS-backed initiatives to modernize cardiovascular care and incorporate AI-based arrhythmia detection. Italy and the Nordics are also expected to gain traction, collectively driving regional growth alongside broader regulatory support for digital health technologies.

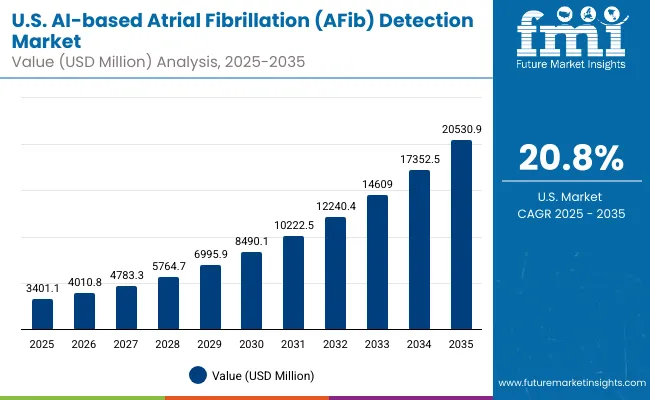

North America remains a mature but innovation-led market, with the USA projected to grow at a 19.7% CAGR between 2025 and 2035. Growth in the USA is driven by the replacement of conventional ECG diagnostics with AI-enabled clinical systems and remote monitoring solutions across hospitals and outpatient cardiology practices. Increasing case volumes of AFib diagnosis and post-treatment monitoring, combined with patient demand for preventive screening, are accelerating adoption. Large health networks are investing in standardized AI protocols to ensure clinical consistency, while FDA approvals for wearable ECGs and smartphone-based detection apps are making adoption more attractive for providers.

The AI-based AFib Detection Market in the USA is forecasted to grow at a 19.7% CAGR, primarily driven by the rapid shift from conventional ECG diagnostics to AI-enabled detection platforms. Hospitals, cardiology centers, and large health networks are replacing traditional monitoring protocols with Clinical AI Systems and Remote Monitoring platforms that ensure early detection, predictive accuracy, and workflow efficiency. Adoption is further accelerated by FDA approvals for AI-based wearables, smartphone apps, and predictive risk stratification platforms.

The AI-based AFib Detection Market in the United Kingdom is projected to grow at a 20.0% CAGR through 2035, supported by NHS-backed modernization projects aimed at integrating AI in cardiovascular care. Private hospital groups are also investing in digital health ecosystems that combine AI detection platforms, cloud analytics, and connected wearable monitoring devices. This trend is reinforced by government funding for digital health innovation and rising patient demand for preventive cardiology solutions.

The AI-based AFib Detection Market in Germany is forecast to grow at a 17.0% CAGR, driven by the country’s strong cardiology infrastructure and focus on precision medicine. Germany’s high prevalence of cardiovascular diseases and commitment to healthcare digitalization are accelerating the adoption of AI-enabled arrhythmia detection. Professional associations and healthcare providers are actively promoting workshops and research collaborations to strengthen deployment.

The AI-based AFib Detection Market in India is expected to grow at a 25.0% CAGR, positioning it among the fastest-growing global markets. Growth is supported by rapid expansion of advanced cardiac care facilities, rising clinician awareness of asymptomatic AFib, and accelerating deployment of AI-enabled Clinical AI Systems and Remote Monitoring platforms. Tier-1 hospitals are integrating continuous rhythm monitoring and screening & risk prediction into care pathways, while multi-hospital networks scale standardized AI workflows to improve time-to-diagnosis and reduce stroke risk. Increasing patient engagement via wearables and smartphone apps is widening access beyond metro hubs.

The AI-based AFib Detection Market in China is projected to grow at a 23.0% CAGR through 2035, driven by large-scale digital-health investments and rising AFib screening volumes in urban centers. Top hospitals and regional networks are shifting to integrated Clinical AI Systems with continuous monitoring and risk-prediction modules, supported by rapid consumer uptake of wearables. Domestic device makers are scaling AI platforms and expanding interoperability with hospital systems, accelerating penetration across provinces.

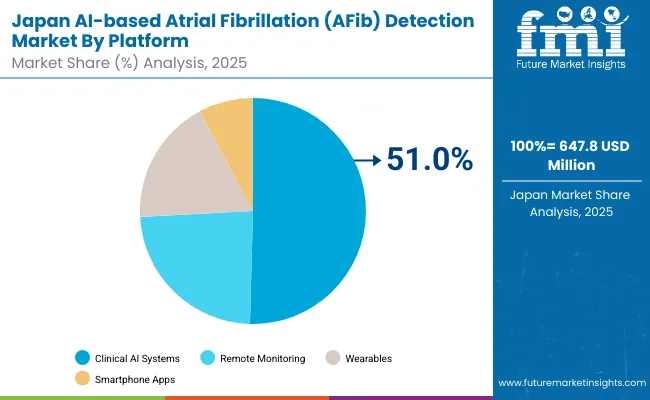

The AI-based AFib Detection Market in Japan is projected to reach USD 647.8 million in 2025,with Clinical AI Systems accounting for around 49.2%. Adoption reflects Japan’s preference for precision cardiology and robust hospital integration, with mature provider networks embedding continuous rhythm monitoring, screening & risk prediction, and post-treatment follow-up into standardized pathways for aging populations. Local solution providers and hospital groups prioritize interoperable AI platforms tightly integrated with device ecosystems and EHRs to ensure consistent clinical outcomes.

The AI-based AFib Detection Market in South Korea is estimated at USD 404.9 million in 2025, with Deep Learning contributes around 37.0% in technology segment. Early digital-health adoption and strong consumer tech penetration underpin rapid scale, as hospitals and health systems integrate continuous rhythm monitoring with telecardiology to enable same-day triage and follow-up. Multi-hospital networks are rolling out standardized AI pathways for preventive screening and post-treatment management.

The Global AI-based Atrial Fibrillation (AFib) Detection Market is moderately competitive, with a mix of global leaders, enterprise health-tech vendors, and focused innovators competing across clinical AI systems, remote monitoring, and consumer-connected devices. AliveCor, Inc. leveraging a strong footprint in AI-enabled personal ECG devices and physician dashboards. Multinational incumbents such as Koninklijke Philips N.V. and Medtronic anchor hospital-centric ecosystems, integrating AFib detection into monitoring fleets and cardiology informatics.

TEMPUS and Powerful Medical, Inc. are scaling AI models for risk prediction and ECG interpretation, while OMRON Healthcare Co., Ltd. extends detection to home settings through connected BP devices and app workflows. Competitors are expanding reach via partnerships with health systems, payers, and telecardiology providers, offering bundled solutions that combine clinical AI platforms with wearables, remote monitoring services, and smartphone applications to optimize detection accuracy, throughput, and care coordination.

Established, mid-sized players including iRhythm Inc. and Bardy Diagnostics, Inc. focus on high-yield ambulatory monitoring through multi-day ECG patches, complemented by cloud analytics and clinician review services. Powerful Medical strengthens hospital adoption with scalable AI triage and decision support, while OMRON targets population-level screening programs through retail and provider channels.

Across this tier, vendors emphasize interoperability (EHR integrations and API-first design), configurable clinician dashboards, and outcome-linked service contracts. Commercial models increasingly blend device subscriptions, algorithm licensing, and managed monitoring services to fit the budgets and staffing patterns of integrated delivery networks and regional hospitals.

As the market evolves, competitive differentiation is shifting from device-led detection toward fully integrated cardiovascular AI ecosystems combining deep-learning algorithms, longitudinal data, and workflow automation for screening, continuous rhythm monitoring, and post-treatment follow-up.

Vendors are prioritizing cross-platform compatibility (clinical AI systems + remote monitoring + apps), privacy-by-design data pipelines, and measurable value metrics (stroke-risk reduction, time-to-diagnosis, and readmission avoidance). Portfolio strategies now emphasize modular AI upgrades, multi-condition roadmaps (AFib with hypertension or sleep-related arrhythmias), and scalable deployments across large provider networks positioning integrated, interoperable platforms as the core competitive edge.

Key Developments:

| Item | Value |

|---|---|

| Market Value (2025) | USD 8,097.9 million |

| Platform type | Clinical AI Systems, Remote Monitoring, Wearables, and Smartphone Apps |

| Technology | Deep Learning (DL), Machine Learning (ML), Hybrid AI, and Other Models |

| Application | Continuous Rhythm Monitoring, Screening & Risk Prediction, Post-treatment Monitoring, and Hospital Workflow Optimization |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Europe, Germany, France, UK |

| Key Companies Profiled | AliveCor, Inc., Powerful Medical, Inc., Koninklijke Philips N.V., TEMPUS, Medtronic, OMRON Healthcare Co., Ltd., iRhythm Inc., Bardy Diagnostics, Inc. |

| Additional Attributes | Dollar sales by application and regions, adoption trends of digitally integrated AI-based AFib detection across Clinical AI Systems, Remote Monitoring, Wearables, and Smartphone Apps, rising demand in Continuous Rhythm Monitoring and Screening & Risk Prediction, growing uptake across hospitals, cardiology networks, and telecardiology providers, increasing integration with EHRs, device connectivity, and cloud analytics for precision cardiology workflows. CAD/CAM, CBCT imaging, and 3D printing for precision implant workflows. |

The Global AI-based AFib Detection Market is estimated to be valued at USD 8,097.9 million in 2025.

The market size is projected to reach USD 53,477.5 million by 2035.

The market is expected to grow at a CAGR of 20.8% during this period.

Key platforms include Clinical AI Systems, Remote Monitoring, Wearables, and Smartphone Apps.

Continuous Rhythm Monitoring is projected to command 30% of the market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Atrial Fibrillation Device Market Size and Share Forecast Outlook 2025 to 2035

Atrial Fibrillation Market Size and Share Forecast Outlook 2025 to 2035

Atrial Appendage Occluder Market Is Segmented by Product Type, Indication, Material Type and End User from 2025 to 2035

Ice Detection System Market Trends, Growth & Forecast 2025 to 2035

Gas Detection Equipment Market Growth – Trends & Forecast 2024-2034

Leak Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Odor Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bird Detection System Market Size and Share Forecast Outlook 2025 to 2035

Leak Detection Market Size and Share Forecast Outlook 2025 to 2035

Leak Detection Dye Market Trends & Demand 2025 to 2035

Fall Detection System Market Insights – Size & Forecast 2025 to 2035

Interatrial Shunt Market

Spark Detection System Market Forecast and Outlook 2025 to 2035

Fault Detection and Classification Market Size and Share Forecast Outlook 2025 to 2035

Spoil Detection Based Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Fraud Detection and Prevention Market Size and Share Forecast Outlook 2025 to 2035

Color Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Botnet Detection Market Size and Share Forecast Outlook 2025 to 2035

Threat Detection Systems Market

Emotion Detection and Recognition Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA