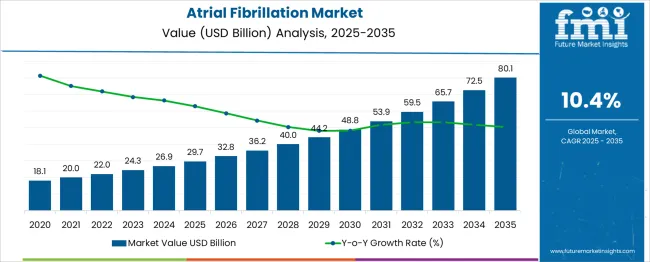

The global atrial fibrillation market is anticipated to grow from USD 29.7 billion in 2025 to approximately USD 80.1 billion by 2035, recording an absolute increase of USD 50.4 billion over the forecast period. This translates into a total growth of 170.0%, with the market forecast to expand at a CAGR of 10.4% between 2025 and 2035. The market size is expected to grow by nearly 2.7X during the same period, supported by increasing prevalence of atrial fibrillation, aging global population, rising awareness about cardiac health, and advancing treatment technologies.

Between 2025 and 2030, the atrial fibrillation market is projected to expand from USD 29.7 billion to USD 53.9 billion, resulting in a value increase of USD 24.2 billion, which represents 48.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising aging population, increasing prevalence of cardiovascular diseases, growing awareness about atrial fibrillation symptoms, and expanding adoption of advanced treatment technologies. Healthcare providers are enhancing their cardiac care capabilities to address the growing demand for comprehensive atrial fibrillation management solutions.

| Metric | Value |

| Estimated Value in (2025E) | USD 29.7 billion |

| Forecast Value in (2035F) | USD 80.1 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

From 2030 to 2035, the market is forecast to grow from USD 53.9 billion to USD 80.1 billion, adding another USD 26.2 billion, which constitutes 52 % of the ten-year expansion. This period is expected to be characterized by expansion of minimally invasive treatment options, integration of artificial intelligence in diagnosis and monitoring, and development of personalized therapeutic approaches. The growing adoption of digital health technologies and remote patient monitoring systems will drive demand for advanced atrial fibrillation management solutions with enhanced efficacy and patient outcomes.

Between 2020 and 2025, the atrial fibrillation market experienced robust expansion, driven by increasing awareness of cardiac arrhythmias and growing adoption of advanced diagnostic technologies. The market developed as healthcare providers recognized the need for effective treatment solutions to address the rising prevalence of atrial fibrillation in aging populations. Medical device innovations and pharmaceutical advancements began emphasizing the importance of comprehensive atrial fibrillation management for maintaining cardiovascular health and preventing stroke complications.

Market expansion is being supported by the increasing global prevalence of atrial fibrillation and the corresponding demand for effective treatment and management solutions. Modern healthcare systems are increasingly focused on preventive cardiology measures that can reduce the risk of stroke, heart failure, and other cardiovascular complications associated with atrial fibrillation. The proven efficacy of various treatment modalities including pharmacological interventions, catheter ablation, and surgical procedures makes them preferred options in comprehensive cardiac care programs.

The growing focus on personalized medicine and precision cardiology is driving demand for targeted therapies tailored to individual patient profiles and genetic factors. Healthcare provider preference for multifunctional treatment approaches that combine rhythm control with anticoagulation therapy is creating opportunities for innovative therapeutic combinations. The rising influence of digital health technologies and remote monitoring systems is also contributing to increased treatment adoption across different patient demographics and healthcare settings.

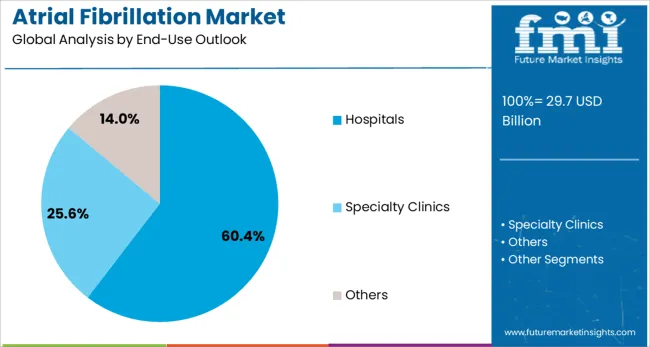

The market is segmented by treatment type, end-use, and region. By treatment type, the market is divided into pharmacological treatment (including anti-arrhythmic drugs and anticoagulant drugs) and non-pharmacological treatment (including catheter ablation, maze surgery, and electric cardioversion). Based on end-use, the market is categorized into hospitals, specialty clinics, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The pharmacological treatment segment is projected to account for 66.5% of the atrial fibrillation market in 2025, reaffirming its position as the primary therapeutic approach for managing atrial fibrillation. Healthcare providers and patients increasingly recognize the effectiveness of pharmacological interventions in controlling heart rhythm and preventing stroke complications associated with atrial fibrillation. Anti-arrhythmic drugs and anticoagulant medications form the cornerstone of atrial fibrillation management protocols.

This treatment approach provides the foundation for most clinical guidelines, as it represents the most accessible and widely applicable intervention for atrial fibrillation patients. Cardiologist recommendations and extensive clinical evidence continue to strengthen confidence in pharmacological treatment protocols. With expanding therapeutic options and improved drug safety profiles, pharmacological treatment aligns with both acute management and long-term maintenance goals. Its broad applicability across patient populations ensures steady dominance, making it the central growth driver of atrial fibrillation treatment demand.

Hospitals are projected to represent 60.4% of atrial fibrillation treatment demand in 2025, underscoring their role as the primary care setting for comprehensive cardiac arrhythmia management. Healthcare providers in hospital settings offer specialized cardiac care units, advanced diagnostic capabilities, and immediate access to emergency interventions when needed. Hospitals provide both acute treatment services for atrial fibrillation episodes and ongoing management programs for chronic conditions.

The segment is supported by the complexity of atrial fibrillation management, which often requires multidisciplinary care teams including cardiologists, electrophysiologists, and specialized nursing staff. Hospitals are increasingly investing in advanced cardiac catheterization laboratories and electrophysiology suites to provide comprehensive treatment options. As patients require coordinated care and access to multiple treatment modalities, hospital-based services will continue to dominate demand, reinforcing their central position within the atrial fibrillation treatment ecosystem.

The atrial fibrillation market is advancing rapidly due to increasing prevalence of cardiovascular diseases and growing demand for advanced cardiac treatment technologies. The market faces challenges including high treatment costs, limited access to specialized cardiac care in developing regions, and potential complications associated with certain treatment procedures. Innovation in minimally invasive techniques and digital health monitoring solutions continue to influence treatment development and market expansion patterns.

The growing adoption of digital health platforms is enabling healthcare providers to monitor patients remotely and provide personalized treatment recommendations. Remote monitoring devices offer continuous cardiac rhythm tracking, medication adherence support, and early detection of atrial fibrillation episodes that influence treatment decisions. Telemedicine services and mobile health applications are driving patient engagement and treatment compliance, particularly among elderly populations who benefit from convenient healthcare access.

Modern atrial fibrillation management is incorporating artificial intelligence and machine learning algorithms to enhance diagnostic accuracy and treatment optimization. These technologies improve the identification of atrial fibrillation patterns, predict treatment responses, and provide decision support for healthcare providers. Advanced AI systems also enable personalized treatment protocols that deliver optimal therapeutic outcomes while minimizing potential side effects and complications.

| Country | CAGR (2025-2035) |

| China | 14.1% |

| India | 13.1% |

| Germany | 12% |

| France | 11% |

| UK | 9.9% |

| US | 8.9% |

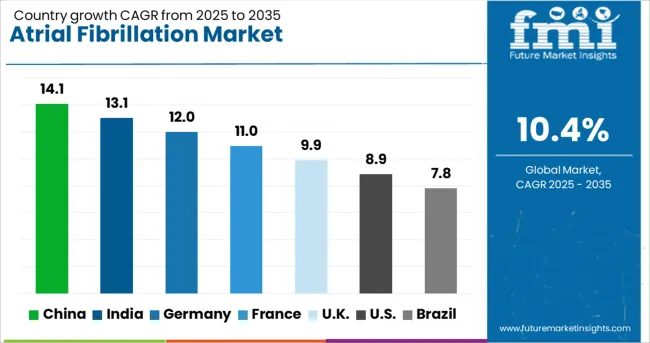

The atrial fibrillation market is experiencing robust growth globally, with China leading at a 14.1% CAGR through 2035, driven by rapidly aging population, increasing healthcare infrastructure investment, and growing awareness of cardiovascular diseases. India follows closely at 13.1%, supported by expanding healthcare access, rising disposable income, and increasing prevalence of lifestyle-related cardiac conditions. Germany shows steady growth at 12%, emphasizing advanced cardiac care technologies and comprehensive healthcare coverage. France records 11%, focusing on innovative treatment approaches and specialized cardiac centers. The UK shows 9.9% growth, prioritizing evidence-based treatment protocols and integrated cardiac care services. The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from atrial fibrillation treatment in China is projected to exhibit strong growth with a CAGR of 14.1% through 2035, driven by rapid aging of the population and increasing prevalence of cardiovascular diseases among urban populations. The country's expanding healthcare infrastructure and growing number of specialized cardiac centers are creating significant demand for comprehensive atrial fibrillation management solutions. Major international and domestic medical device manufacturers are establishing comprehensive distribution networks to serve the growing population of cardiac patients across tier-1 and tier-2 cities.

Revenue from atrial fibrillation treatment in India is expanding at a CAGR of 13.1%, supported by increasing healthcare infrastructure development, growing awareness of cardiovascular diseases, and rising adoption of advanced cardiac treatment technologies. The country's expanding middle class and increasing life expectancy are driving demand for comprehensive cardiac care services. International medical device companies and domestic healthcare providers are establishing treatment centers to serve the growing demand for specialized cardiac interventions.

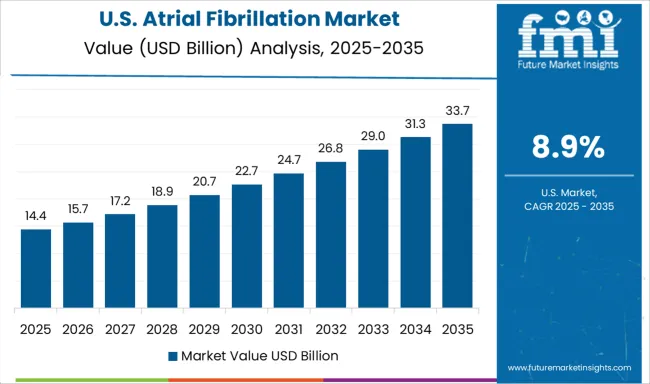

Demand for atrial fibrillation treatment in the USA is projected to grow at a CAGR of 8.9%, supported by advanced healthcare infrastructure and widespread adoption of innovative treatment technologies. American healthcare providers are increasingly focused on minimally invasive procedures, personalized treatment approaches, and comprehensive patient management programs. The market is characterized by strong demand for advanced catheter ablation systems, next-generation anticoagulant medications, and integrated cardiac monitoring solutions.

Revenue from atrial fibrillation treatment in Germany is projected to grow at a CAGR of 12.0% through 2035, driven by the country's world-renowned cardiac care system, advanced medical technology adoption, and comprehensive healthcare coverage. German healthcare providers consistently deliver high-quality, evidence-based treatment protocols that achieve superior patient outcomes while maintaining cost-effectiveness.

Revenue from atrial fibrillation treatment in the UK is projected to grow at a CAGR of 9.9% through 2035, supported by the National Health Service's focus on comprehensive cardiac care and evidence-based treatment protocols. British healthcare providers emphasize multidisciplinary care teams, patient education, and long-term management strategies for optimal treatment outcomes.

Revenue from atrial fibrillation treatment in France is projected to grow at a CAGR of 11.0% through 2035, supported by the country's strong focus on medical innovation, specialized cardiac centers, and comprehensive healthcare coverage. French healthcare providers prioritize advanced treatment technologies and research-driven therapeutic approaches, making innovative atrial fibrillation treatments widely accessible across the healthcare system.

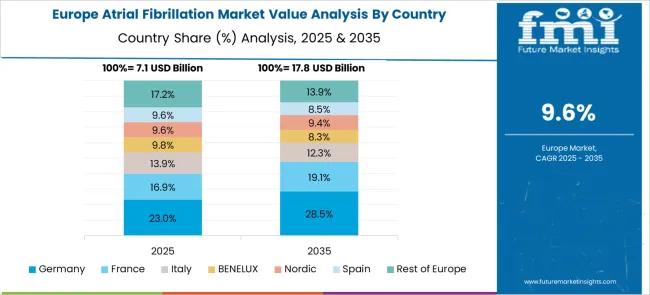

The European atrial fibrillation market demonstrates sophisticated development across major economies with Germany leading through its precision cardiac care excellence and advanced electrophysiology capabilities, supported by companies like Boehringer Ingelheim pioneering comprehensive AF treatment solutions with focus on pharmacological therapies, catheter ablation procedures, and stroke prevention applications while emphasizing clinical evidence and patient safety. The UK shows strength in integrated cardiac care services and evidence-based treatment protocols, with companies specializing in multidisciplinary AF management programs that meet strict clinical standards and provide consistent therapeutic outcomes.

France contributes through companies delivering innovative AF treatment solutions and specialized cardiac center excellence for comprehensive cardiovascular applications. Italy and Spain demonstrate growth in specialized cardiac care formulations for arrhythmia management programs. The market benefits from stringent EU healthcare regulations, established cardiac care infrastructure, and growing focus on personalized medicine approaches positioning Europe as key center for advanced atrial fibrillation technologies.

The Japanese atrial fibrillation market demonstrates steady growth driven by precision cardiac care focus, advanced medical technologies, and healthcare system preference for high-quality AF treatment systems ensuring superior clinical outcomes and safety compliance throughout cardiovascular operations. International companies establish presence through cutting-edge cardiac technologies aligning with Japan's sophisticated healthcare industry and stringent quality standards while incorporating AI integration and digital health monitoring capabilities.

The market emphasizes automated cardiac monitoring systems, precision electrophysiology excellence, and advanced therapeutic innovations reflecting Japanese healthcare precision and attention to detail in cardiovascular care processes. Growing investment in digital health technologies supports intelligent AF management systems with real-time monitoring, predictive analytics, and optimized treatment performance. Japanese healthcare providers prioritize treatment reliability, consistent clinical outcomes, and patient safety, creating opportunities for premium atrial fibrillation solutions delivering exceptional performance across hospitals, specialty clinics, and cardiac care applications requiring highest quality standards.

The South Korean atrial fibrillation market shows exceptional growth potential driven by expanding healthcare infrastructure, increasing adoption of advanced cardiac technologies, and growing awareness about cardiovascular health requiring efficient and comprehensive AF treatment solutions. The market benefits from South Korea's technological advancement capabilities and increasing focus on healthcare competitiveness driving investment in modern cardiac care technologies meeting international clinical standards and regulatory requirements.

Korean healthcare facilities increasingly adopt automated cardiac monitoring systems, advanced electrophysiology equipment, and integrated treatment technologies improving patient outcomes and clinical effectiveness while ensuring safety compliance. Growing influence of Korean healthcare innovations in global markets supports demand for sophisticated AF treatment solutions ensuring clinical excellence while maintaining cost-effectiveness. Integration of digital health principles and smart cardiac technologies creates opportunities for intelligent treatment systems with connectivity features, predictive capabilities, and real-time clinical optimization across diverse cardiovascular care applications.

The atrial fibrillation market is characterized by competition among established medical device manufacturers, pharmaceutical companies, and emerging technology innovators. Companies are investing in advanced treatment technologies, clinical research programs, regulatory approvals, and strategic partnerships to deliver effective, safe, and accessible atrial fibrillation management solutions. Product innovation, clinical evidence generation, and market expansion are central to strengthening treatment portfolios and market presence.

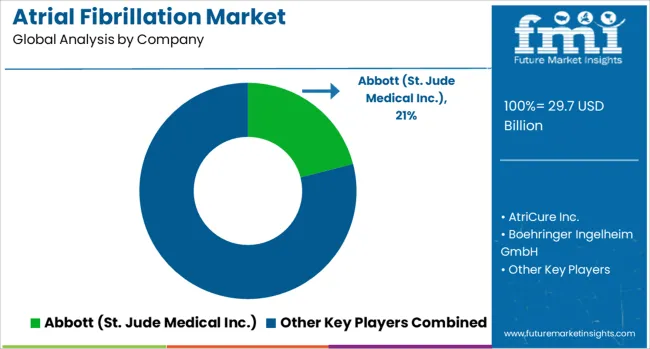

Abbott (St. Jude Medical Inc.) leads the market with advanced cardiac ablation systems and electrophysiology technologies, focusing on minimally invasive treatment approaches and comprehensive patient management solutions. AtriCure Inc. provides specialized surgical ablation systems with focus on maze procedure technologies and cardiac surgical applications. Boehringer Ingelheim GmbH delivers innovative anticoagulant medications with focus on stroke prevention and bleeding risk management. Boston Scientific Corporation offers comprehensive electrophysiology portfolios with advanced catheter ablation systems and cardiac monitoring solutions.

Bristol Myers Squibb Corporation focuses on novel anticoagulant therapies with focus on efficacy and safety optimization. CardioFocus provides specialized ablation technologies with focus on pulmonary vein isolation procedures. Sanofi-Aventis delivers established anticoagulant medications with comprehensive clinical evidence and global market presence. Biosense Webster, Inc. offers advanced electrophysiology mapping and ablation systems with three-dimensional cardiac visualization capabilities.

Endoscopic Technologies, Inc. provides minimally invasive surgical solutions for cardiac arrhythmia treatment. Johnson & Johnson operates through its medical device subsidiaries to deliver comprehensive cardiac care technologies and pharmaceutical solutions for atrial fibrillation management.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 29.7 billion |

| Treatment Type | Pharmacological Treatment, Non-Pharmacological Treatment |

| Sub-segments | Anti-arrhythmic Drugs, Anticoagulant Drugs, Catheter Ablation, Maze Surgery, Electric Cardioversion |

| End-Use | Hospitals, Specialty Clinics, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Abbott (St. Jude Medical Inc.), AtriCure Inc., Boehringer Ingelheim GmbH, Boston Scientific Corporation, Bristol-Myers Squibb Company, CardioFocus, Sanofi-Aventis, Biosense Webster, Inc., Endoscopic Technologies, Inc., and Johnson & Johnson |

| Additional Attributes | Dollar sales by treatment modality and patient segment, regional treatment adoption trends, competitive landscape, healthcare provider preferences for pharmacological versus procedural interventions, integration with digital health monitoring systems, innovations in minimally invasive ablation techniques, personalized anticoagulation protocols, and remote patient monitoring technologies |

The global atrial fibrillation market is estimated to be valued at USD 29.7 billion in 2025.

The market size for the atrial fibrillation market is projected to reach USD 80.1 billion by 2035.

The atrial fibrillation market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in atrial fibrillation market are pharmacological treatment, anti-arrhythmic drugs, anticoagulant drugs, non-pharmacological treatment, catheter ablation, maze surgery and electric cardioversion.

In terms of end-use outlook, hospitals segment to command 60.4% share in the atrial fibrillation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Atrial Fibrillation Device Market Size and Share Forecast Outlook 2025 to 2035

AI-based Atrial Fibrillation AFib Detection Market Size and Share Forecast Outlook 2025 to 2035

Atrial Appendage Occluder Market Is Segmented by Product Type, Indication, Material Type and End User from 2025 to 2035

Interatrial Shunt Market

Ventricular Fibrillation Treatment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA