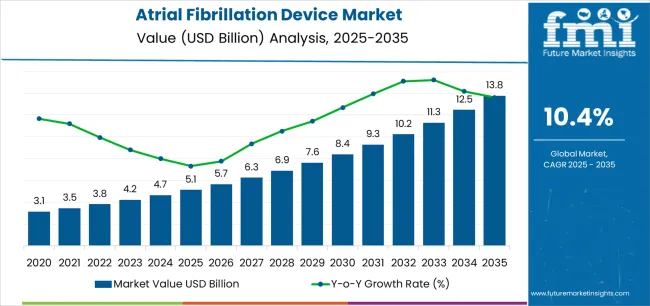

The Atrial Fibrillation Device Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 13.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period.

The Atrial Fibrillation Device market is experiencing strong growth driven by the rising prevalence of cardiac arrhythmias and the growing adoption of minimally invasive treatment procedures. Continuous advancements in electrophysiology and imaging technologies are enhancing the precision and safety of atrial fibrillation interventions, leading to greater procedural success rates. Increasing awareness among patients and healthcare professionals regarding early diagnosis and intervention has further accelerated market expansion.

Additionally, the global rise in the elderly population, coupled with a higher incidence of lifestyle-related cardiovascular conditions, is contributing to demand for advanced treatment devices. Healthcare infrastructure improvements in developing regions and growing investment in cardiac care facilities are expected to create favorable opportunities for market players.

Furthermore, the integration of artificial intelligence and real-time data monitoring into treatment devices is expected to support more personalized and effective therapy management As technology continues to evolve and healthcare systems prioritize cardiac care, the atrial fibrillation device market is set for sustained growth in the coming years.

| Metric | Value |

|---|---|

| Atrial Fibrillation Device Market Estimated Value in (2025 E) | USD 5.1 billion |

| Atrial Fibrillation Device Market Forecast Value in (2035 F) | USD 13.8 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

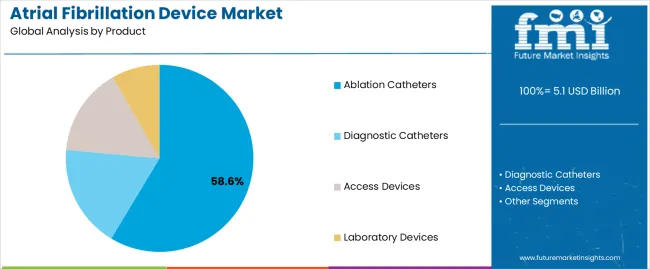

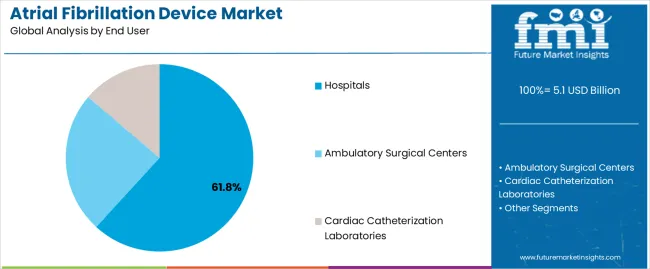

The market is segmented by Product and End User and region. By Product, the market is divided into Ablation Catheters, Diagnostic Catheters, Access Devices, and Laboratory Devices. In terms of End User, the market is classified into Hospitals, Ambulatory Surgical Centers, and Cardiac Catheterization Laboratories. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ablation catheters segment is projected to account for 58.60% of the atrial fibrillation device market revenue share in 2025, making it the leading product category. The segment’s dominance is driven by the effectiveness of catheter ablation in providing long-term rhythm control for patients with atrial fibrillation.

The increasing preference for minimally invasive procedures has supported the widespread adoption of ablation catheters, as they offer faster recovery times and reduced procedural risks compared to surgical alternatives. Advancements in mapping and navigation systems have further enhanced the precision of ablation techniques, improving treatment outcomes and reducing recurrence rates.

The introduction of next-generation catheters with improved flexibility, safety features, and energy delivery mechanisms has also strengthened their clinical reliability Growing clinical validation of ablation procedures as a preferred treatment option has encouraged their use in hospitals and specialized cardiac centers, solidifying the segment’s leadership position within the market.

The hospitals segment is expected to capture 61.80% of the atrial fibrillation device market revenue share in 2025, positioning it as the dominant end-user segment. The segment’s growth is supported by the concentration of advanced cardiac care infrastructure and the availability of skilled electrophysiologists within hospital settings. Hospitals are the primary centers for diagnosis, treatment, and post-procedural monitoring of atrial fibrillation, which has LED to consistent adoption of technologically advanced devices.

Increasing hospital investments in electrophysiology laboratories and catheterization facilities have enhanced treatment capacity and accessibility for patients. Additionally, favorable reimbursement policies and rising patient preference for hospital-based procedures due to comprehensive care and emergency support have further reinforced this trend.

The integration of advanced imaging, AI-assisted monitoring, and robotic navigation systems within hospital environments has improved procedural precision and patient safety As hospitals continue to expand their cardiac care capabilities, their role in the adoption and advancement of atrial fibrillation devices remains pivotal to market growth.

The table below compares the Compound Annual Growth Rate (CAGR) for the global atrial fibrillation device market from 2025 to 2025 during the first half of the year. This overview highlights key changes and trends in revenue growth, offering valuable insights into market dynamics. H1 covers January to June, while H2 spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 11.8% (2025 to 2035) |

| H2 | 11.4% (2025 to 2035) |

| H1 | 10.9% (2025 to 2035) |

| H2 | 10.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 10.9% in the first half and remain relatively moderate at 10.4% in the second half. In the first half (H1) the market witnessed a decrease of 90 BPS and in the second half (H2) also, the market witnessed a decrease of 100 BPS.

Increasing Prevalence of Atrial Fibrillation is Fueling the Market Growth

Atrial fibrillation is the most common cardiac arrhythmia and has increased significantly over the past few years to about 1 in 3 to 5 individuals facing a lifetime risk after the age of 45. This demographic shift, coupled with other factors such as aging populations and alterations in the lifestyle, has increased the worldwide number of those living with AF from 33.5 million in 2010 to 3.1 million in 2020.

The health burden of AF extends into increased stroke rates, heart failure, and other cardiovascular complications that imply long-term management and treatment. Fueling the growth in AF incidence and thus, demand for diagnostic tools, therapeutic interventions, and management strategies in the AF market.

Ongoing medical developments toward refined catheter ablation methods, novel mapping technologies, and further enhancements in implantable devices such as pacemakers and defibrillators continue to transform the face of AF treatment for the optimization of therapies for better patient outcomes.

While the growing burden of AF presents an opportunity for the market to drive more adequate clinical management of the disease, it is also addressing cost-effective solutions that improve the quality of life and reduce healthcare costs incurred by AF-related complications.

With increased priority on cardiovascular health and patient-centered care across healthcare systems globally, the atrial fibrillation device market grows correspondingly to meet these increasing needs.

Increasing Geriatric Population Contributed To the Growing Demand for Atrial Fibrillation Devices

Atrial fibrillation is one of the most common cardiac arrhythmias, and its prevalence definitely increases with age. For instance, whereas its prevalence stands at a reasonably low 0.3 percent of individuals in the age group of 40 years, it rises significantly to 5-9 percent at 60 to 80 years and further to about 10 percent among those older than 80 years.

Among the major contributing factors for the high prevalence rate of atrial fibrillation in the aged are related natural degenerative changes that occur with the aging heart.

With advanced age, structural changes in the form of fibrosis and stiffening of cardiac tissues are frequent, predisposing individuals to arrhythmias like atrial fibrillation. These affect the electrical conduction pathways of the heart, thus contributing to the creation and perpetuation of atrial fibrillation.

Furthermore, the development of many cardiovascular and systemic diseases is accompanied by progressive aging. These diseases act in synergy to increase the possibilities of developing atrial fibrillation.

CAD can present with myocardial ischemia and scarring, thus promoting electrical instability within this organ, while a history of hypertension can lead to left ventricular hypertrophy and atrial enlargement, which are risk factors of atrial fibrillation.

Thus, with the growing prevalence of atrial fibrillation in the elderly, proper management and treatment methods will be highly needed, hence creating a resultant demand for atrial fibrillation devices in the market.

Technological Advancement in Electrophysiology Offers New Growth Prospect for Market Growth

Novel technologies such as high-power, short-duration RF ablation, optimized cooling at the electrode-tissue interface, and next-generation balloon catheter platforms hosting Cryo Energy, Laser, and RF are making a difference in AF management.

These new developments help improve the efficiency of pulmonary vein isolation (PVI) one of the cornerstones of AF treatment by making lesions that are long-lasting and reflective of good procedural outcomes.

It will allow high-power RF ablation for faster lesion formation with reduced risk of complications and cryoablation to ultra-low temperatures necessary for precise treatment to ensure effective tissue ablation inflicting minimal damage on the surrounding tissues.

These new pulsed electrical field ablation technologies are showing promise because they provide irreversible electroporation of myocardial tissue, hence reducing possible adverse effects and improving the outcome in patients. These technologies are constantly changing due to the incessant search for improved long-term clinical outcomes and quality of life in patients.

Therefore, more and more healthcare providers and cardiac centers worldwide have adopted these advanced EP tools to be better positioned for minimally invasive treatment options in AF management.

High-Cost Restrict Atrial Fibrillation Device Market Growth

AF devices, including those devices that involve ablation systems with catheters, implantable cardiac monitoring systems, and other special devices, are usually associated with huge costs for institutions and healthcare providers.

Acquiring AF devices requires a huge initial investment, testing the healthcare budget in resource-poor settings and care services where cost is a major consideration. These include the costs of buying the devices, regularly maintaining them, upgrading the devices, and training health care personnel.

Moreover, AF devices expenses may not be covered in the policies of reimbursement and healthcare funding models. This may further complicate the adoption of the device. This financial uncertainty may prevent healthcare providers from investing in new technologies despite their clinical benefits. This can challenge the market growth of atrial Fibrillation devices.

The global atrial fibrillation device industry recorded a CAGR of 8.6% during the historical period between 2020 and 2025. The growth of atrial fibrillation device industry was positive as it reached a value of USD 4,173.90 million in 2025 from USD 2,662.4 million in 2020.

The requirement of atrial fibrillation devices have been increasing due to the increase in life expectancy. As the healthcare infrastructure have improved and life expectancy has increased in many developed as well as developing countries the population of elderly people have gone up.

Since old population is more susceptible to the cardiac health problem the demand for atrial fibrillation device have also been high among the same age group. Further the adoption of these devices have also been contributed by the growing awareness about their benefit and increased focus on early detection.

While these factor continue the drive the market for atrial fibrillation devices, technological advancement, expansion of potential application and favorable reimbursement policies will be instrumental in shaping the market’s growth trajectory.

Advancement such as high resolution imaging systems and flexible catheters enhances the diagnostic capabilities. The potential of AFib devices for surgical and non-surgical treatment is being realized. Also the supportive government initiative by providing favorable reimbursement policies for AFib procedures will drive the market expansion.

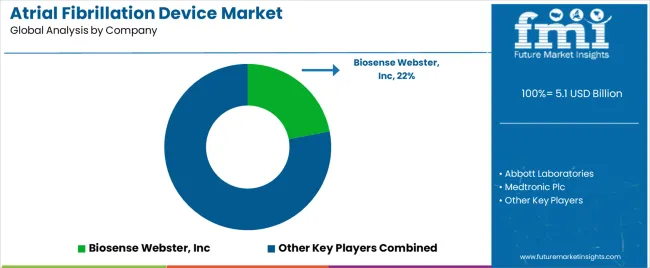

Tier 1 companies comprise market leaders with a market revenue of above USD 100 million capturing significant market share of 59.50% in global market. These market leaders are characterized by high production capacity and a wide product portfolio.

These market leaders are distinguished by their developmental efforts to introduce innovative product in the market. They provide a wide range of atrial fibrillation device. Prominent companies within tier 1 include Abbott Laboratories, Medtronic Plc, Boston Scientific Corporation, GE Healthcare, and Siemens Healthineers AG etc.

Tier 2 companies include mid-size players with revenue of USD 50 to 100 million having presence in specific regions and highly influencing the local market.

These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include EP Solutions, Teleflex, Merit Medical Systems Inc., and Biomerics etc.

Compared to Tiers 1 and 2, Tier 3 companies have smaller revenue spouts and less influence. Those in Tier 3 has smaller work force and limited presence across the globe. Prominent players in the tier 3 category are AtriCure, Inc., Biotronik SE & Co. KG, Acutus Medical Inc., and Others

The section below covers the industry analysis for the atrial fibrillation device market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia, Western Europe, Eastern Europe, and Middle East and Africa (MEA), is provided.

The United States is anticipated to remain at the forefront in North America. In Asia Pacific, China is projected to witness a CAGR 10.9% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Canada | 5.9% |

| Germany | 3.4% |

| France | 5.5% |

| Italy | 5.0% |

| China | 10.9% |

| South Korea | 8.6% |

| Japan | 4.5% |

Germany’s atrial fibrillation device market is poised to exhibit a CAGR of 3.4% between 2025 and 2035. Currently, it holds the highest share in the European market, and the trend is expected to continue during the forecast period.

Atrial fibrillation is the most common cardiac arrhythmia in the country, which affects about 1% (or approximately 800,000 individuals) of the general population and thus an existent and reasonable patient base with a requirement for management and treatment options.

The prevalence of AF detected is known to notably increase with age, mostly in patients aged between 35 to 74 years. It was reported to be 2.5% in a German population. This demographic trend underlines the growing pressures for AF management solutions with the aging of Germany's population and its increased life expectancy.

Moreover, the equal distribution of AF risk factors between both sexes further implies that effective treatment strategies would be required uniformly in both genders. In view of the associated risk of stroke, which is as high as 2.8% to 3.2% per annum in subjects with AF, there is a greater thrust on preventive measures and sophisticated therapeutic interventions.

Technological advancements in atrial fibrillation treatment has increased demand for ablation procedures and new pharmaceutical therapies. Not only do they contribute to better patient outcomes, but they also foster the growth of AF devices in Germany by providing more effective and highly personalized ways of managing the common cardiac condition.

North America, spearheaded by the USA currently holds around 25.0% share of the global atrial fibrillation device industry. North America’s market is anticipated to grow at a CAGR of 3.4% throughout the forecast period.

AI-powered smart watches and smart phones using photoplethysmography, among other wearable devices, have really changed the concept of AF monitoring in mostly asymptomatic populations. The convenience of these advanced technologies, including the photoplethysmography normally found in modern smartwatches and smartphones, is simply unparalleled with real-time monitoring facilitated via the capture of health data.

Different from complex, uncomfortable, ambulatory Holter monitors, which are very difficult to analyze based on the data output, wearable devices offer a friendly approach that motivates carrying on periodic health checks.

Indeed, the shift to wearable AF detection devices further increases access and coverage across the USA population and empowers consumers toward more proactive healthcare management.

Continued adoption by individuals is driving strong growth in wearable health devices. With their ease of use and commonness, such gadgetry is an excellent modality for the detection of AF outside traditional clinical settings, which then begets earlier diagnosis and timely intervention.

Moreover, such devices with AI integrated are capable of interpreting heart rhythms and identifying any abnormality with high accuracy.

Technological advances of such strides support the early identification of AF and help foster an environment among its users where self-monitoring is promoted, thus giving rise to better health outcomes. Such innovative devices are bound to take a lead in future cardiovascular health management because adoption rates continue to soar.

The cardiovascular disease have increased owing to the various factors. At the foremost is the changing lifestyle, which accounts for surge in risk factor such as Tobacco Use, changing dietary habits, sedentary lifestyle, rise in obesity, and stress.

Over the course of past decades there have been increase in the negative implication of the changing lifestyle of cardiac health. These include rising prevalence of hypertension, Dyslipidemia, Diabetes, Chronic Kidney Disease, Metabolic Syndrome etc. As a result of which the cardio vascular diseases have increased including atrial fibrillation.

In the last couple of decades, China has dramatically improved its health infrastructure and increased access to health services. Development of clinical capabilities and greater availability of AF devices in hospitals have greatly facilitated the diffusion process of the devices among health professionals.

The Chinese government has rolled out the "Healthy China 2035" program, which concerns health policies geared toward ensuring cardiovascular health. The policies provide great emphasis on the prevention of diseases and their active promotion in ensuring improved health outcomes through advanced medical technologies, including AF devices.

Hence, the aggregate effect of growing patient awareness and government support will provide an enabling environment for the huge increase in AF device adoption. Hence the join effect of increased patient and government initiatives has provided boom to China Atrial Fibrillation device market.

The section contains information about the leading segments in the industry. By product, ablation catheters segment is estimated to contribute 58.6% market share in 2025. Additionally, the hospitals end user is projected to record 61.8% market share.

| Product | Ablation Catheters |

|---|---|

| Value Share (2025) | 58.6% |

The Ablation Catheters segment dominates the market in terms of revenue, accounting for almost 58.6% of the market share in 2025.

Ablation catheters are central components in the treatment of AFib because they locate and destroy abnormal tissue in the projecting areas of the heart, which project abnormal electric signals. These procedures are very effective, because they offer high success rate at restoring normal heart rhythm.

Therefore, more and more healthcare professionals turn to them in search of treatment with sure results for AFib patients. Generally, ablation procedures are minimally invasive, hence improving recovery time for patients while minimizing their complication risks, which in turn improves general outcome and satisfaction.

Advancement in ablation catheter technology by integration with 3D mapping systems and advanced energy sources, including radiofrequency and cryoablation, further enhances the precision and safety of treatment.

Therefore, these developments do not only mean gains in procedural effectiveness but also a broadening in the application of ablation techniques to a large spectrum of patients and AFib severities.

| Material | Hospitals |

|---|---|

| Value Share (2025) | 61.80% |

Hospitals, offer specialized capabilities, comprehensive treatment infrastructure, and established connections with healthcare. The medical professionals such as cardiologists, electrophysiologists, and cardiac surgeons are highly trained in treating complex cardiac arrhythmias like AFib. Highly experienced medical professionals are needed to diagnose such problems with accuracy and treat them with the best devices.

Besides, hospitals are now deploying modern technologies such as highly advanced mapping systems, ablation catheters, pacemakers, and implantable cardioverter-defibrillators that are mandated to assist patients in intervening at all points in AFib care. These hospitals can provide integrated care from diagnosis to complex interventions and long-term management with continuity and effectiveness.

It is through the established ties with healthcare reimbursement programs that hospitals are advanced financially, as well as getting easier access to funding for services and devices related to AFib.

With this financial support, it becomes possible for the institutions to invest in innovative technologies, increasing the availability of advanced treatments to AFib patients. Since hospital provide comprehensive care they are dominating the atrial fibrillation device market.

Key players operating in the atrial fibrillation device market are focusing on research and development to build innovative solution and get regulatory approval for it. Large established market player are incorporating strategies such as collaboration to increase their market reach. The main cornerstone for the market player is make product that emphasis evidence based clinical practice.

Recent Industry Developments in Atrial Fibrillation Device Market

In terms of product, the industry is divided into laboratory devices (3D mapping systems, EP recording systems, RF ablation systems, ICE systems, cardiac stimulators, and others), ablation catheters (cryoablation, RF ablation, irrigated tip RF, laser), diagnostic catheters (conventional, advanced, and ultrasound), and access devices.

By end user, the industry is bifurcated into hospitals, ambulatory surgical centers, and cardiac catheterization laboratories.

Key countries of North America, Latin America, East Asia, South Asia, Western Europe, Eastern Europe, and Middle East and Africa (MEA), have been covered in the report.

The global atrial fibrillation device market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the atrial fibrillation device market is projected to reach USD 13.8 billion by 2035.

The atrial fibrillation device market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in atrial fibrillation device market are ablation catheters, diagnostic catheters, access devices and laboratory devices.

In terms of end user, hospitals segment to command 61.8% share in the atrial fibrillation device market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Atrial Appendage Occluder Market Is Segmented by Product Type, Indication, Material Type and End User from 2025 to 2035

Atrial Fibrillation Market Size and Share Forecast Outlook 2025 to 2035

Interatrial Shunt Market

AI-based Atrial Fibrillation AFib Detection Market Size and Share Forecast Outlook 2025 to 2035

Ventricular Fibrillation Treatment Market Size and Share Forecast Outlook 2025 to 2035

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

X-Ray Device Market Size and Share Forecast Outlook 2025 to 2035

Power Device Analyzer Market Growth – Trends & Forecast 2025 to 2035

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Mobile Device Management Market Analysis by Deployment Type, Solution, Business Size, Vertical, and Region Through 2035

Venous Device Market

Serial Device Servers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA