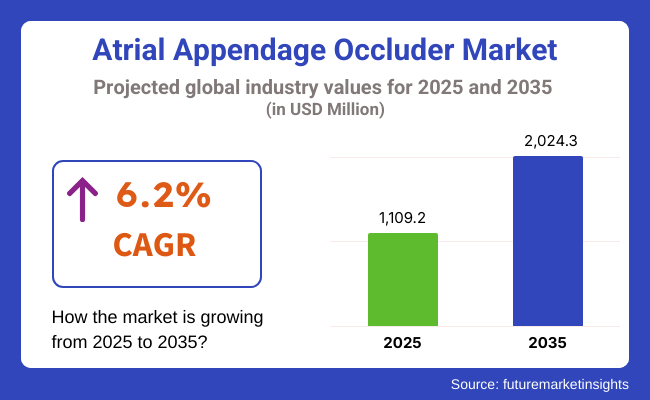

The global Atrial Appendage Occluder Market is witnessing significant growth, primarily due to the increasing prevalence of atrial fibrillation and the rising adoption of minimally invasive cardiac procedures. In 2024, the market was valued at approximately USD 1,044.5 million and is projected to reach around USD 2,024.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.2% during this period.

The market of atrial appendage occluders is expected to grow a lot between 2025 and 2035 due to the rising global prevalence of AF and the demand for non-pharmacologic strategies for stroke prevention among patients. Atrial appendage occluder devices are specifically effective in non-valvular AF patients with a high stroke risk but are contraindicated or intolerant for long-term anticoagulant therapy.

As aging brings more and more older people to AF diagnoses worldwide, the increasing burden of associated is chememic strokes is contributing to the growth of these innovative structural heart interventions. Both clinical studies and real-life registries have demonstrated the effectiveness of left atrial appendage closure for reducing strokes, leading to even more incorporation into cardiology treatment standards. In addition, there are advances in device technology such as improved conformability, retrievability, and sealing, leading to higher procedural success rates with fewer complications.

While being trained over the past decade, it experienced a growth phase triggered by increasing incidences of atrial fibrillation (AF) and the need for stroke prevention in high-risk patients. Traditionally, the market evolved from surgical procedures to minimally invasive methods, namely catheter-based techniques, which presented with safer and more effective alternatives to long-term anticoagulation.

There was size limitation and a certain amount of complexity and safety concerns for early devices, which led to improvement in materials, design, and implantation methods and, thus, device effectiveness and patient benefits. Now, improved physician awareness along with more positive outcomes in clinical trials and regulatory approvals in key areas have helped propel the market even further. Hence, atrial appendage occlusion has come to be the preferred method for stroke prevention in AF patients in whom anticoagulation therapy may not be an option.

North America is projected to hold the largest share of the atrial appendage occluder market until the end of forecast period due to the sizable patient pool for atrial fibrillation and advanced healthcare infrastructure in the region. Atrial fibrillation, a common condition among older persons, affects millions of people in the United States and stroke prevention remains a high-priority clinical endpoint.

Devices such as the Watchman and Amplatzer Amulet have been used in an expedited fashion in clinical practice, establishing a foundation for stroke prevention with devices. Cardiovascular societies well support LAAC, and AF management guidelines are now including these procedures, which helps drive physician awareness and generate referrals.

CMS and some private insurers are beginning to expand coverage based on strong clinical trial evidence; the reimbursement landscape is complex yet gradually improving. In addition, ongoing innovation in cath lab delivery systems and post-procedure care protocols is further decreasing perplexity and broadening the number of patients who qualify.

The atrial appendage occluder market is expected to remain stable in Europe, with a strong research ecosystem and a favorable regulatory framework, as well as a large number of the population over the age of 65 who develop cardiovascular disease.

Germany, the United Kingdom, France, and Italy are leading in regional adoption of LAAC devices because of high healthcare expenditure, well-entrenched electrophysiology networks, and accessibility to minimally invasive procedures in both public and private hospitals. There are multiple devices approved for use (the European Medicines Agency (EMA)) and countries such as Germany and UK are supporting reimbursement thus ensuring wider usage by eligible patients.

Several European physicians consider LAAC as an essential part of complete management of AF, particularly for patients with a high risk of bleeding due to the use of anticoagulants.

The Asia-Pacific market, which is still developing, is expected to grow rapidly during the forecast period, given the aging population, the growing number of atrial fibrillation patients, and a growing awareness of stroke prevention in the region. Countries like China, Japan, India, South Korea, Australia, etc. are increasingly investing towards building cardiovascular care infrastructure and procedural capabilities.

Japan and South Korea have some of the earliest adoption of minimally invasive cardiac procedures and also have strong electrophysiology communities. Due to its large patient population and increasing burden of non-communicable diseases, China is a particularly lucrative market, bolstered by government-led health care reforms and increasing procedural volumes in tertiary hospitals.

Increased Awareness of Bleeding Risks Associated with Long-Term Anticoagulant Use Is Driving Demand for Device-Based Stroke Prevention Solutions.

Besides that, high device and high implantation costs represent significant adoption barriers in new markets where health costs are limited, and people use out-of-pocket payments for specific medical treatments. Learning and experience requirements are essential to the LAAC procedure, and the steep learning curve is for optimal implantation.

Apart from this, there is no unified post-implementation anticoagulation protocol because there is no consensus in the world about which of the best strategies for patients will balance thromboembolic and hemorrhagic risks. Regulatory approvals and allowances differ widely across countries, leading to uneven access downgrading in some areas. In addition, strong long-term outcome data are required to ensure that new devices are effective in broader indications.

Growing Prevalence of Atrial Fibrillation and Improving Cardiac Care Infrastructure Present Strong Expansion Opportunities.

The atrial appendage occluders have different growth and innovation potentials within the limitation of this period. One of the possible growth opportunities would be expanding the indications of LAAC to groups other than those with high-risk atrial fibrillation patients who rejected anticoagulation. Clinical trials evaluating the advantages of occluders in patients with intermediate risks for strokes or undergoing concurrent procedures such as catheter ablation have started.

Improvements in occluder design in introducing completely retrievable systems, profile-reduced devices, and better sealing technologies are making therapy much safer and have more appealing long-term outcomes for patients and providers alike. There is also increasing enthusiasm for hybrid approaches involving LAAC combined with electrophysiological interventions that may provide a more complete way to manage rhythms and strokes in a single procedure.

Second-Generation Atrial Appendage Occluder Devices Are Significantly Improving The Landscape Of Stroke Prevention In Patients With Atrial Fibrillation.

Contemporary devices are outfitted with design improvements for better procedural success, lower rates of peri-device leak, and improved retrievability during implantation. Adaptive sealing mechanisms, nitinol frames with self-expanding properties, and flexible anchoring systems enhance conformability within the LAA, accommodating various anatomical differences.

The enhanced safety and procedural efficiency engender reduced complication rates, like device embolization and residual leak problems, which previously occurred more with first-generation systems. Several second-generation systems are able to integrate advanced imaging methods with delivery devices aiding in precise deployment. These changes helped in reducing procedure times and gave increased confidence to operators, allowing for more patients to be included.

Reduced Need for Post-Procedural Anticoagulation as an Emerging Market Trend.

And an emerging trend in the atrial appendage occluder market is that less reliance on post procedural anti-coagulation therapy for patients when undergoing LAAO procedures, which required long-term anticoagulation therapy for preventing thrombus formation. New generation occluders are designed for rapid endothelialization and secure sealing of the left appendage, and therefore, less maintenance of long-term medication.

This offers a great advantage for patients at very high bleeding risk, where anticoagulants represent serious complications. As clinical trials provide evidence of both safety and effectiveness in short- or no-anticoagulation treatment regimens, clinicians have turned increasingly to device-based stroke prevention. This is in favor of the increased uptake across developed and emerging markets.

Growth of the Global Atrial Appendage Occluder Market from 2020 to 2024 As a direct consequence of increased AF incidence and advances in occlusion technology with an emphasis on stroke prevention and treatment, the global atrial appendage occluder market has experienced robust growth from 2020 to 2024.

Strong growth was observed owing to the steps taken for better device designs with acceptance of minimally invasive implantation techniques which has improved procedural success and clinical outcomes. However, as the market matured, it had to grapple with increased procedural costs and limited availability in low-income areas, thus limiting wider acceptance and stalling market penetration into developing healthcare systems.

Atrial Appendage Occluders Market From 2025 to 2035; The atrial appendage occluders market is expected to witness sustainable growth from 2025 to 2035, owing to gradual innovations in occluding devices, increasing healthcare investments and growing preference towards minimally invasive procedures.

Ongoing efforts to improve patient care on the basis of features of new-generation occluders, including their larger safety profile and ease of use, are also expected to further optimize patient care and expand the indication for use in a variety of clinical settings. Additionally, burgeoning healthcare infrastructure development in developing economies, along with the growing cognizance about stroke preventive strategies are anticipated to provide profitable opportunities for market growth and wide-ranging adoption of atrial appendage occlusion solutions in the years to come.

| Market Aspect | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Implementation of guidelines that aim to ensure the safe and effective application of atrial appendage occluders are forms of standardization - in protocols and rules governing use of the occluder devices. |

| Technological Advancements | Introduction of newly designed occluders by minimally intrusive implantation techniques, improving rates of success of procedures and comfort of patients . |

| Consumer Demand | Greater uptake of occlusion devices is observed for patients with atrial fibrillation owing to an increasing need for alternatives to anticoagulant therapy for stroke prevention. |

| Market Growth Drivers | Increase in prevalence of atrial fibrillation, improved devices, and trends in stroke prevention with less invasive surgical approaches. |

| Sustainability | Initial steps in manufacturing processes that are environmentally friendly and in the invention of devices of lesser impact on the environment. |

| Supply Chain Dynamics | High-quality materials from specialized suppliers to obtain and an effort in localization of production to minimize disruptions in global supply chains during world events. |

| Market Aspect | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Continuous monitoring and possibly harmonizing regulation at the state level so as to achieve a balance between safety for patients and innovation in technology, with fast track approval for new occlusion technologies addressing unmet medical needs. |

| Technological Advancements | The next generation of occluders , fitted with avant-garde materials and delivery systems, further improve device integration, lower procedural risks, and improve long-term efficacy. |

| Consumer Demand | Trend towards minimally invasive and personalized treatment strategies driven by enhancing technologies and a shift towards patient-centered approaches leading to the uptake among a wide variety of patients. |

| Market Growth Drivers | Increase in healthcare services to emerging markets, heightened investments in cardiovascular health research, continuous and progressive innovations in technology that constantly increase patient-device safety and efficacy, increased global focus on quality of life improvements for persons with atrial fibrillation. |

| Sustainability | Practice of sustainable device manufacture and distribution with the use of recyclable materials and energy-efficient processes in tandem with global environmental norms that will lessen the carbon footprint on the use of medical devices. |

| Supply Chain Dynamics | Development of local manufacturing capabilities through advancement in technology and partnership with other strategic partners to lessen reliance on imports, improve the resilience of the supply chain, and deliver patient needs fast. |

Market Outlook

The USA atrial appendage occluder market is quite mature and sophisticated, mainly due to the prevalence of atrial fibrillation (AF) and its focus on stroke prevention. With easy access to minimally invasive LAAO procedures and positive reimbursement policies, FDA approvals of leading devices have encouraged market uptake. The volume of procedures performed is further supported by technological innovations and a robust healthcare infrastructure.

Increased clinical awareness on the part of cardiologists and electrophysiologists adds further impetus to the demand. Also, collaborative efforts between hospitals and device manufacturers will flourish in the number of products at their disposal. Nevertheless, regulatory scrutiny and high costs of procedures might inhibit rapid growth among the underserved populations even though the innovation pipeline within the market presently is very strong and an untold number of clinical trials are ongoing.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

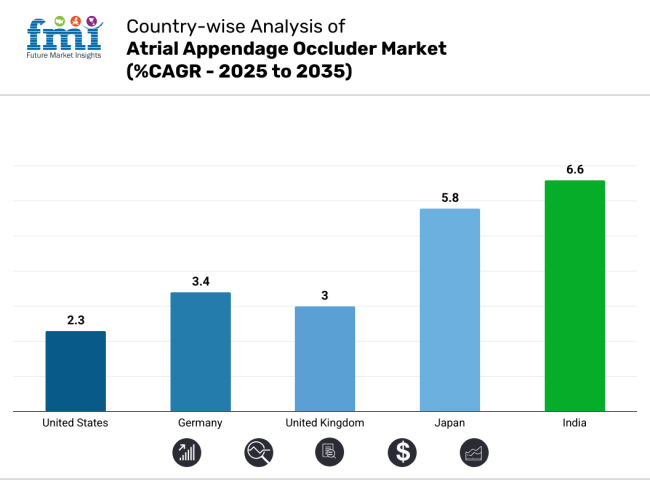

| United States | 2.3% |

Market Outlook

Germany maintains a leading position in the European atrial appendage occluder market owing to cutting-edge healthcare infrastructure and the sheer prevalence of atrial fibrillation. By and large, the country has early LAAO penetration, facilitated by laudable reimbursement schemes and strong clinical research networks. Particular hospitals and cardiac centers are high-volume sites associated with growing inclination toward tauromists.

German firms are likewise engaged in product development and enhancing technology. Nevertheless, German regulations, along with pricing strains from healthcare payers, lead to market-restricting growth; contrariwise, such regular and continual physician training and evidence-based guidelines are becoming instrumental in standardizing procedures and optimizing patient outcomes.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.4% |

Market Outlook

The market of atrial appendage occluders in the UK is steadily growing, mainly fueled by increased AF detection and awareness about stroke prevention alternatives for patients contraindicated to anticoagulants. National Health Service (NHS) is gradually incorporating LAAO procedures into the routine standard of care, although budgetary constraints and inequitable access still remain.

The ongoing clinical trials and NICE evaluations are pivotal for shaping future acceptance. Specialist clinical centers in London and other major cities take up innovative procedures and at the same time grow. This momentum is further supported by collaboration with multinational device manufacturers and initiatives aimed at reducing stroke-related healthcare costs by targeted interventions.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.0% |

Market Outlook

The atrial appendage occluder businesses in Japan are growing at a rapid pace due to the demographic factor that is the older population including the people who easily get AF and also non-treatment stroke prevention demand. The last years have seen an influx of regulatory approvals for all LAAO devices, while medical institutions are also beginning to adopt minimally invasive procedures.

Public awareness is still in development compared to Western countries, but academic societies and ongoing clinical studies educate healthcare providers. Listed above are the somewhat high coverage, access to advanced therapies, and treatment accessibility granted by the Japan government health care system. Still, there are hurdles such as a cultural preference for medicine rather than device treatment and time delays in device launch regulations.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

Market Outlook

With a rising burden of AF and increasing stroke awareness, the atrial appendage occluder market in India finds itself on the nascent end but with high growth potential. Urban tertiary care centers have early adopted LAAO technologies, particularly in high-risk subjects intolerant to anticoagulation.

Meanwhile, cardiac care infrastructure is improving, the number of trained interventional cardiologists is increasing, and international trials are beginning to attract greater participation, all combining to support the market expansion. Limited affordability, low insurance coverage, and poor awareness amongst rural people have slowed widespread adoption. Given increased investments in private healthcare and government plans for improving cardiovascular health, the Indian market is set for gradual acceleration.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.6% |

Epicardial Occlusion Devices Dominated the Market Due to Their Minimally Invasive Nature and Reduced Thromboembolic Risks.

Epicardial occlusion devices are put up surgically unto the external aspect of the left atrial appendage (LAA) to occlude possible places of thrombus formation. These devices include clips or ligation systems. Most of them are applied during concomitant cardiac surgeries such as valve replacements or CABG in a patient with non-valvular AF (Atrial Fibrillation) with increased risk of stroke and unfit for long-term anticoagulation.

The growing numbers of patients undergoing cardiac surgery, the increasing uptake of hybrid AF ablation techniques, and a growing preference for mechanical closure rather than pharmacologic anticoagulation in the elderly are some of the major factors driving this market demand. Europe and North America are leading adopters with strong cardiac surgical infrastructure. Innovations to be expected in future include minimally invasive thoracoscopic clip systems, robotic-assisted epicardial access, and bioresorbable epicardial occluder.

Endocardial Occlusion Devices Dominated the Market Due to Their Widespread Clinical Adoption.

Endocardial occlusion devices like the WATCHMAN™ and Amplatzer™ Amulet™ are catheter-delivered implants deployed to the LAA in order to restrict the risk of embolism in patients who exhibit AF. Increasingly these devices are seen as minimally invasive, non-drug preventive alternatives when oral anticoagulants are contraindicated.

Several factors, including the rise of atrial fibrillation in the general population, the increased awareness of stroke prevention strategies, supportive clinical evidence, such as PROTECT-AF and the PREVAIL trials, and expanded reimbursement coverage, stimulate enhanced usage. North America is at the top of the pyramid regarding the USA, where FDA approvals and CMS reimbursements boost penetration rates.

Europe is gradually growing with the introduction of CE-marked alternatives and renewed exposure to the physician population. Other expected developments include low-profile next-generation devices, AI-assisted transseptal navigation, and completely retrievable or repositionable implants for optimal LAA sealing.

Hospitals with Electrophysiology (EP) Labs Dominated the Market Due to Their Higher Procedural Volumes.

Endocardial left atrial appendage occlusion practices take place largely in hospitals with specialized electrophysiology laboratories, which provide interventional cardiologists and electrophysiologists with an infrastructure for catheter-based therapies. These centers benefit from advanced imaging modalities (e.g., TEE, CT), expertise in transseptal access, and multidisciplinary protocol approaches in the management of atrial fibrillation.

Key market drivers increase in hospitalization for atrial fibrillation, procedural volume for left atrial appendage closure or occlusion, and funding toward the expansion of electrophysiology programs. The lead countries in this market are the United States, Germany, and the United Kingdom. Future developments include integrated 3D mapping systems for left atrial appendage anatomy, artificial intelligence for case selection, and automated implant tracking for follow-up and registry data.

Cardiac Surgery Centers Dominated the Market Due to Their Focus On Structural Heart Interventions.

Cardiac surgery centers conduct epicardial LAA closures either as stand-alone interventions or combined with maze procedures, mitral valve repairs, or coronary bypass surgeries. Steady demand is sustained by the LAA occlusion's incorporation into the surgical AF management protocol, above all for high-risk patients. These centers also act as referral centers for complex cardiovascular cases in which stroke risk reduction is paramount.

The countries of France, Italy, and Scandinavia are having a much greater impact on this fast-developing field by clinical guidelines and national registry programs that encourage surgical LAA exclusion. Future innovations will likely encompass robotic and thoracoscopic epicardial occlusion kits, intraoperative AI for real-time LAA sealing assessment, and dual-device strategies for recurrent AF patients.

Competitive environment prevailing in the atrial appendage occluder market shows an emerging trend towards innovation, collaborative ventures, and geographical expansion. The key players are busy in developing next-generation devices with improved safety, reduced complexity in a procedure, and better delivery mechanisms. Partnership with hospitals and research institutions conducts the clinical trials data and regulatory approvals.

Even the market players would hold their shares in training physicians in the procedures to encourage adoption. In emerging markets, companies offer cost-effective product offerings and enter into alliances with local distributors. Mergers and acquisitions and diversification in portfolios remain regular marketing strategies to dominate the market.

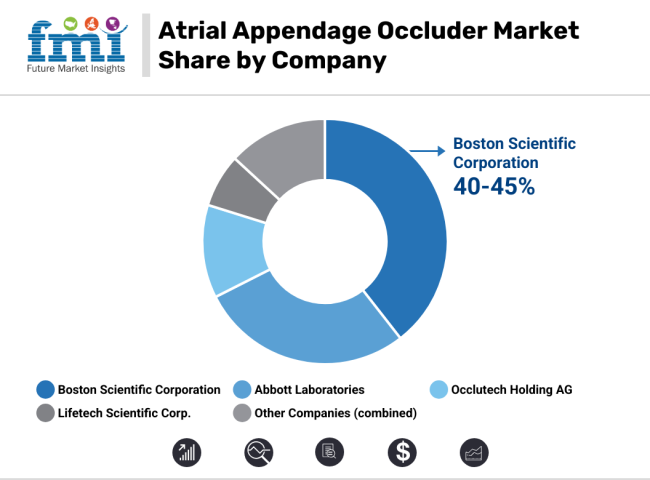

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| Boston Scientific Corporation | Market leader with the Watchman and Watchman FLX devices for LAA closure, widely used for stroke prevention in AF patients. |

| Abbott Laboratories | Offers the Amplatzer Amulet LAA occluder, providing a minimally invasive option for sealing the appendage in a wide range of anatomies. |

| Occlutech Holding AG | Develops the Occlutech LAA occluder, designed for safe and effective closure with enhanced conformability and anchoring features. |

| Lifetech Scientific Corp. | Provides cost-effective occlusion systems with global distribution, primarily serving emerging markets. |

Key Company Insights

Boston Scientific Corporation (40-45%)

Boston Scientific dominates the AAO market with its Watchman series, offering provens clinical outcomes, extensive physician training, and wide adoption across major cardiac care centers globally.

Abbott Laboratories (28-32%)

Abbott’s Amplatzer Amulet gains momentum through its dual-seal design, adaptable sizing, and increasing physician preference, supported by a strong structural heart portfolio and expanding procedural base.

Occlutech Holding AG (10-14%)

Occlutech focuses on niche device innovation and European expansion, leveraging novel design features and strategic clinical trials to secure regulatory pathways in new and emerging regions.

Lifetech Scientific Corp. (5-8%)

Lifetech targets affordability and accessibility, catering to cost-sensitive healthcare systems by offering efficient occluder solutions with growing presence in Asia, the Middle East, and Latin America.

Other Key Players (10-15% Combined)

Additional contributors to the atrial appendage occluder market include:

These companies are advancing alternative implant designs, biodegradable occlusion systems, and next-gen delivery platforms to further improve patient safety and procedural success.

Endocardial Devices and Epicardial Devices

Atrial Fibrillation (AF)-Associated Stroke Prevention, Anticoagulation Therapy Contraindication and Other Cardiovascular Indications.

Metal-Based Occluders, Polymer-Based Occluders and Hybrid Occluders.

Hospitals, Ambulatory Surgical Centers (ASCs) and Specialty Cardiac Centers.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global arterial appendage occluder industry is projected to witness CAGR of 6.2% between 2025 and 2035.

The global arterial appendage occluder industry stood at USD 1,044.5 million in 2024.

The global arterial appendage occluder industry is anticipated to reach USD 2,024.3 million by 2035 end.

India is expected to show a CAGR of 6.6% in the assessment period.

The key players operating in the global arterial appendage occluder industry are Boston Scientific Corporation, Abbott Laboratories, Occlutech Holding AG, Lifetech Scientific Corp., Cardia Inc., Conformal Medical Inc., Append Medical Ltd., Artiria Medical SA and Others.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Value (US$ Million) Forecast by Type of indication, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Procedure of positioning of the device, 2018 to 2033

Table 4: Global Value (US$ Million) Forecast by End user , 2018 to 2033

Table 5: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Value (US$ Million) Forecast by Type of indication, 2018 to 2033

Table 7: North America Value (US$ Million) Forecast by Procedure of positioning of the device, 2018 to 2033

Table 8: North America Value (US$ Million) Forecast by End user , 2018 to 2033

Table 9: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Value (US$ Million) Forecast by Type of indication, 2018 to 2033

Table 11: Latin America Value (US$ Million) Forecast by Procedure of positioning of the device, 2018 to 2033

Table 12: Latin America Value (US$ Million) Forecast by End user , 2018 to 2033

Table 13: Western Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Value (US$ Million) Forecast by Type of indication, 2018 to 2033

Table 15: Western Europe Value (US$ Million) Forecast by Procedure of positioning of the device, 2018 to 2033

Table 16: Western Europe Value (US$ Million) Forecast by End user , 2018 to 2033

Table 17: Eastern Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Value (US$ Million) Forecast by Type of indication, 2018 to 2033

Table 19: Eastern Europe Value (US$ Million) Forecast by Procedure of positioning of the device, 2018 to 2033

Table 20: Eastern Europe Value (US$ Million) Forecast by End user , 2018 to 2033

Table 21: South Asia and Pacific Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Value (US$ Million) Forecast by Type of indication, 2018 to 2033

Table 23: South Asia and Pacific Value (US$ Million) Forecast by Procedure of positioning of the device, 2018 to 2033

Table 24: South Asia and Pacific Value (US$ Million) Forecast by End user , 2018 to 2033

Table 25: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Value (US$ Million) Forecast by Type of indication, 2018 to 2033

Table 27: East Asia Value (US$ Million) Forecast by Procedure of positioning of the device, 2018 to 2033

Table 28: East Asia Value (US$ Million) Forecast by End user , 2018 to 2033

Table 29: Middle East and Africa Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Value (US$ Million) Forecast by Type of indication, 2018 to 2033

Table 31: Middle East and Africa Value (US$ Million) Forecast by Procedure of positioning of the device, 2018 to 2033

Table 32: Middle East and Africa Value (US$ Million) Forecast by End user , 2018 to 2033

Figure 1: Global Value (US$ Million) by Type of indication, 2023 to 2033

Figure 2: Global Value (US$ Million) by Procedure of positioning of the device, 2023 to 2033

Figure 3: Global Value (US$ Million) by End user , 2023 to 2033

Figure 4: Global Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Value (US$ Million) Analysis by Type of indication, 2018 to 2033

Figure 9: Global Value Share (%) and BPS Analysis by Type of indication, 2023 to 2033

Figure 10: Global Y-o-Y Growth (%) Projections by Type of indication, 2023 to 2033

Figure 11: Global Value (US$ Million) Analysis by Procedure of positioning of the device, 2018 to 2033

Figure 12: Global Value Share (%) and BPS Analysis by Procedure of positioning of the device, 2023 to 2033

Figure 13: Global Y-o-Y Growth (%) Projections by Procedure of positioning of the device, 2023 to 2033

Figure 14: Global Value (US$ Million) Analysis by End user , 2018 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by End user , 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by End user , 2023 to 2033

Figure 17: Global Attractiveness by Type of indication, 2023 to 2033

Figure 18: Global Attractiveness by Procedure of positioning of the device, 2023 to 2033

Figure 19: Global Attractiveness by End user , 2023 to 2033

Figure 20: Global Attractiveness by Region, 2023 to 2033

Figure 21: North America Value (US$ Million) by Type of indication, 2023 to 2033

Figure 22: North America Value (US$ Million) by Procedure of positioning of the device, 2023 to 2033

Figure 23: North America Value (US$ Million) by End user , 2023 to 2033

Figure 24: North America Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Value (US$ Million) Analysis by Type of indication, 2018 to 2033

Figure 29: North America Value Share (%) and BPS Analysis by Type of indication, 2023 to 2033

Figure 30: North America Y-o-Y Growth (%) Projections by Type of indication, 2023 to 2033

Figure 31: North America Value (US$ Million) Analysis by Procedure of positioning of the device, 2018 to 2033

Figure 32: North America Value Share (%) and BPS Analysis by Procedure of positioning of the device, 2023 to 2033

Figure 33: North America Y-o-Y Growth (%) Projections by Procedure of positioning of the device, 2023 to 2033

Figure 34: North America Value (US$ Million) Analysis by End user , 2018 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by End user , 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by End user , 2023 to 2033

Figure 37: North America Attractiveness by Type of indication, 2023 to 2033

Figure 38: North America Attractiveness by Procedure of positioning of the device, 2023 to 2033

Figure 39: North America Attractiveness by End user , 2023 to 2033

Figure 40: North America Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Value (US$ Million) by Type of indication, 2023 to 2033

Figure 42: Latin America Value (US$ Million) by Procedure of positioning of the device, 2023 to 2033

Figure 43: Latin America Value (US$ Million) by End user , 2023 to 2033

Figure 44: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Value (US$ Million) Analysis by Type of indication, 2018 to 2033

Figure 49: Latin America Value Share (%) and BPS Analysis by Type of indication, 2023 to 2033

Figure 50: Latin America Y-o-Y Growth (%) Projections by Type of indication, 2023 to 2033

Figure 51: Latin America Value (US$ Million) Analysis by Procedure of positioning of the device, 2018 to 2033

Figure 52: Latin America Value Share (%) and BPS Analysis by Procedure of positioning of the device, 2023 to 2033

Figure 53: Latin America Y-o-Y Growth (%) Projections by Procedure of positioning of the device, 2023 to 2033

Figure 54: Latin America Value (US$ Million) Analysis by End user , 2018 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by End user , 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by End user , 2023 to 2033

Figure 57: Latin America Attractiveness by Type of indication, 2023 to 2033

Figure 58: Latin America Attractiveness by Procedure of positioning of the device, 2023 to 2033

Figure 59: Latin America Attractiveness by End user , 2023 to 2033

Figure 60: Latin America Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Value (US$ Million) by Type of indication, 2023 to 2033

Figure 62: Western Europe Value (US$ Million) by Procedure of positioning of the device, 2023 to 2033

Figure 63: Western Europe Value (US$ Million) by End user , 2023 to 2033

Figure 64: Western Europe Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Value (US$ Million) Analysis by Type of indication, 2018 to 2033

Figure 69: Western Europe Value Share (%) and BPS Analysis by Type of indication, 2023 to 2033

Figure 70: Western Europe Y-o-Y Growth (%) Projections by Type of indication, 2023 to 2033

Figure 71: Western Europe Value (US$ Million) Analysis by Procedure of positioning of the device, 2018 to 2033

Figure 72: Western Europe Value Share (%) and BPS Analysis by Procedure of positioning of the device, 2023 to 2033

Figure 73: Western Europe Y-o-Y Growth (%) Projections by Procedure of positioning of the device, 2023 to 2033

Figure 74: Western Europe Value (US$ Million) Analysis by End user , 2018 to 2033

Figure 75: Western Europe Value Share (%) and BPS Analysis by End user , 2023 to 2033

Figure 76: Western Europe Y-o-Y Growth (%) Projections by End user , 2023 to 2033

Figure 77: Western Europe Attractiveness by Type of indication, 2023 to 2033

Figure 78: Western Europe Attractiveness by Procedure of positioning of the device, 2023 to 2033

Figure 79: Western Europe Attractiveness by End user , 2023 to 2033

Figure 80: Western Europe Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Value (US$ Million) by Type of indication, 2023 to 2033

Figure 82: Eastern Europe Value (US$ Million) by Procedure of positioning of the device, 2023 to 2033

Figure 83: Eastern Europe Value (US$ Million) by End user , 2023 to 2033

Figure 84: Eastern Europe Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Value (US$ Million) Analysis by Type of indication, 2018 to 2033

Figure 89: Eastern Europe Value Share (%) and BPS Analysis by Type of indication, 2023 to 2033

Figure 90: Eastern Europe Y-o-Y Growth (%) Projections by Type of indication, 2023 to 2033

Figure 91: Eastern Europe Value (US$ Million) Analysis by Procedure of positioning of the device, 2018 to 2033

Figure 92: Eastern Europe Value Share (%) and BPS Analysis by Procedure of positioning of the device, 2023 to 2033

Figure 93: Eastern Europe Y-o-Y Growth (%) Projections by Procedure of positioning of the device, 2023 to 2033

Figure 94: Eastern Europe Value (US$ Million) Analysis by End user , 2018 to 2033

Figure 95: Eastern Europe Value Share (%) and BPS Analysis by End user , 2023 to 2033

Figure 96: Eastern Europe Y-o-Y Growth (%) Projections by End user , 2023 to 2033

Figure 97: Eastern Europe Attractiveness by Type of indication, 2023 to 2033

Figure 98: Eastern Europe Attractiveness by Procedure of positioning of the device, 2023 to 2033

Figure 99: Eastern Europe Attractiveness by End user , 2023 to 2033

Figure 100: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Value (US$ Million) by Type of indication, 2023 to 2033

Figure 102: South Asia and Pacific Value (US$ Million) by Procedure of positioning of the device, 2023 to 2033

Figure 103: South Asia and Pacific Value (US$ Million) by End user , 2023 to 2033

Figure 104: South Asia and Pacific Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Value (US$ Million) Analysis by Type of indication, 2018 to 2033

Figure 109: South Asia and Pacific Value Share (%) and BPS Analysis by Type of indication, 2023 to 2033

Figure 110: South Asia and Pacific Y-o-Y Growth (%) Projections by Type of indication, 2023 to 2033

Figure 111: South Asia and Pacific Value (US$ Million) Analysis by Procedure of positioning of the device, 2018 to 2033

Figure 112: South Asia and Pacific Value Share (%) and BPS Analysis by Procedure of positioning of the device, 2023 to 2033

Figure 113: South Asia and Pacific Y-o-Y Growth (%) Projections by Procedure of positioning of the device, 2023 to 2033

Figure 114: South Asia and Pacific Value (US$ Million) Analysis by End user , 2018 to 2033

Figure 115: South Asia and Pacific Value Share (%) and BPS Analysis by End user , 2023 to 2033

Figure 116: South Asia and Pacific Y-o-Y Growth (%) Projections by End user , 2023 to 2033

Figure 117: South Asia and Pacific Attractiveness by Type of indication, 2023 to 2033

Figure 118: South Asia and Pacific Attractiveness by Procedure of positioning of the device, 2023 to 2033

Figure 119: South Asia and Pacific Attractiveness by End user , 2023 to 2033

Figure 120: South Asia and Pacific Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Value (US$ Million) by Type of indication, 2023 to 2033

Figure 122: East Asia Value (US$ Million) by Procedure of positioning of the device, 2023 to 2033

Figure 123: East Asia Value (US$ Million) by End user , 2023 to 2033

Figure 124: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Value (US$ Million) Analysis by Type of indication, 2018 to 2033

Figure 129: East Asia Value Share (%) and BPS Analysis by Type of indication, 2023 to 2033

Figure 130: East Asia Y-o-Y Growth (%) Projections by Type of indication, 2023 to 2033

Figure 131: East Asia Value (US$ Million) Analysis by Procedure of positioning of the device, 2018 to 2033

Figure 132: East Asia Value Share (%) and BPS Analysis by Procedure of positioning of the device, 2023 to 2033

Figure 133: East Asia Y-o-Y Growth (%) Projections by Procedure of positioning of the device, 2023 to 2033

Figure 134: East Asia Value (US$ Million) Analysis by End user , 2018 to 2033

Figure 135: East Asia Value Share (%) and BPS Analysis by End user , 2023 to 2033

Figure 136: East Asia Y-o-Y Growth (%) Projections by End user , 2023 to 2033

Figure 137: East Asia Attractiveness by Type of indication, 2023 to 2033

Figure 138: East Asia Attractiveness by Procedure of positioning of the device, 2023 to 2033

Figure 139: East Asia Attractiveness by End user , 2023 to 2033

Figure 140: East Asia Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Value (US$ Million) by Type of indication, 2023 to 2033

Figure 142: Middle East and Africa Value (US$ Million) by Procedure of positioning of the device, 2023 to 2033

Figure 143: Middle East and Africa Value (US$ Million) by End user , 2023 to 2033

Figure 144: Middle East and Africa Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Value (US$ Million) Analysis by Type of indication, 2018 to 2033

Figure 149: Middle East and Africa Value Share (%) and BPS Analysis by Type of indication, 2023 to 2033

Figure 150: Middle East and Africa Y-o-Y Growth (%) Projections by Type of indication, 2023 to 2033

Figure 151: Middle East and Africa Value (US$ Million) Analysis by Procedure of positioning of the device, 2018 to 2033

Figure 152: Middle East and Africa Value Share (%) and BPS Analysis by Procedure of positioning of the device, 2023 to 2033

Figure 153: Middle East and Africa Y-o-Y Growth (%) Projections by Procedure of positioning of the device, 2023 to 2033

Figure 154: Middle East and Africa Value (US$ Million) Analysis by End user , 2018 to 2033

Figure 155: Middle East and Africa Value Share (%) and BPS Analysis by End user , 2023 to 2033

Figure 156: Middle East and Africa Y-o-Y Growth (%) Projections by End user , 2023 to 2033

Figure 157: Middle East and Africa Attractiveness by Type of indication, 2023 to 2033

Figure 158: Middle East and Africa Attractiveness by Procedure of positioning of the device, 2023 to 2033

Figure 159: Middle East and Africa Attractiveness by End user , 2023 to 2033

Figure 160: Middle East and Africa Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Atrial Fibrillation Device Market Size and Share Forecast Outlook 2025 to 2035

Atrial Fibrillation Market Size and Share Forecast Outlook 2025 to 2035

Appendage Management Market Size and Share Forecast Outlook 2025 to 2035

Interatrial Shunt Market

AI-based Atrial Fibrillation AFib Detection Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA