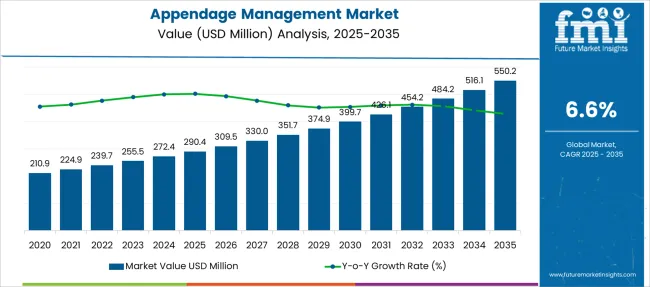

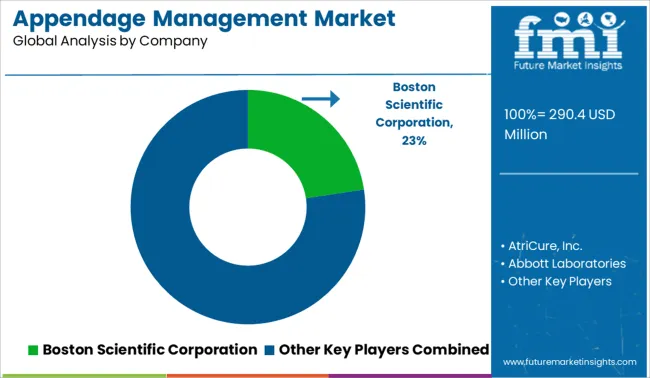

The Appendage Management Market is estimated to be valued at USD 290.4 million in 2025 and is projected to reach USD 550.2 million by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Appendage Management Market Estimated Value in (2025 E) | USD 290.4 million |

| Appendage Management Market Forecast Value in (2035 F) | USD 550.2 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

The appendage management market is expanding steadily due to rising global incidences of atrial fibrillation, increasing procedural volumes for left atrial appendage (LAA) closure, and technological advancements in cardiac rhythm management. Growth is further supported by the shift toward minimally invasive interventions, which is reshaping clinical decision-making in stroke prevention.

Increased awareness among clinicians about embolic stroke risks, along with positive clinical outcomes published in peer-reviewed journals, is influencing adoption. Additionally, aging populations and higher comorbidity rates are prompting hospitals and cardiac centers to invest in specialized appendage management solutions.

Favorable reimbursement frameworks and ongoing innovations in device delivery mechanisms are also reinforcing confidence among interventional cardiologists and electrophysiologists. Looking forward, broader indications, next-generation device miniaturization, and clinical guideline integration are expected to strengthen the market’s clinical and commercial footprint.

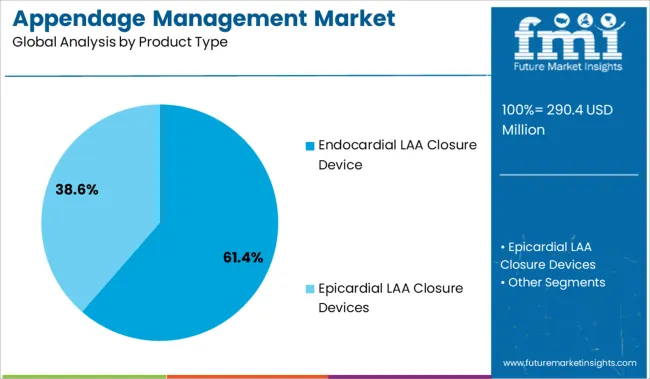

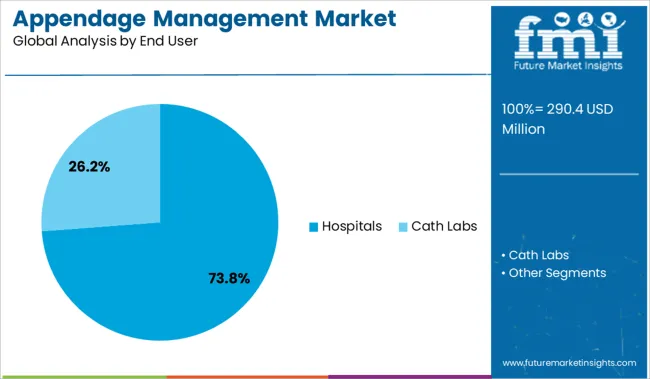

The market is segmented by Product Type and End User and region. By Product Type, the market is divided into Endocardial LAA Closure Device and Epicardial LAA Closure Devices. In terms of End User, the market is classified into Hospitals and Cath Labs. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Endocardial LAA closure devices are expected to account for 61.40% of the total market revenue by 2025, making them the leading product type. Their dominance is being driven by favorable safety and efficacy data in high-risk atrial fibrillation patients, as well as ease of percutaneous implantation.

The minimally invasive nature of these devices has reduced the need for open-heart procedures, significantly lowering patient recovery time and procedural risk. Enhanced imaging compatibility with transesophageal echocardiography and fluoroscopy has further improved precision during deployment.

Continuous clinical trial support, regulatory approvals, and device innovations including enhanced seal mechanisms and retrievability have positioned endocardial devices as the preferred choice among interventional cardiologists seeking to reduce long-term stroke risk without permanent anticoagulation.

Hospitals are projected to hold 73.80% of the appendage management market share by 2025, solidifying their role as the primary point of care for these procedures. This leadership is being reinforced by the availability of specialized cardiac catheterization labs, experienced electrophysiology teams, and integrated patient care systems that support perioperative and post-procedural management.

Hospitals also serve as the principal centers for early technology adoption, clinical research, and training, making them the preferred location for LAA closure procedures. The presence of reimbursement infrastructure, access to emergency response systems, and high patient throughput enables cost-effective deployment of these interventions.

As procedural volumes increase and device approvals expand, hospitals remain at the forefront of appendage management implementation, particularly for high-risk and comorbid patient groups.

| Particulars | Details |

|---|---|

| H1, 2024 | 6.68% |

| H1, 2025 Projected | 6.64% |

| H1, 2025 Outlook | 6.54% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 10 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 14 ↓ |

Future Market Insights presents a comparative analysis about the market growth rates and development prospects in the global appendage management market. According to FMI analysis, the appendage management market is expected to drop by 14 Basis Point Share (BPS) in H1-2025 (O) compared to H1-2024.

Further comparison between the values for H1-2025 outlook and H1-2025 projected showed a dip of 10 BPS. Key reasons for this dip in BPS is attributed to the risks associated with improper implantation of the medical device.

In Asia-Pacific region, the developing countries have moderately updated healthcare infrastructure when compared to those highly developed regions which will indirectly hamper the growth of appendage management market. Also frequent product recalls will tend to restrict the market growth.

Major risks associated with improper implantation include blood clot formation, bleeding, infection and even allergic reaction to the device and irregular heartbeat as well. These factors will impact the overall market growth.

Despite these negative prospects, there are some plus points that stay ahead for the industry including increased adoption rate of closure devices, increasing reimbursement policies and higher adoption of minimally invasive surgeries in non-traditional markets. The market, thus, is expected to show a reduced compounded growth rate in H1-2025 as compared with H1-2024.

Sales of appendage management market grew at a CAGR of 5.7% between 2013 and 2024.

In 2024, the global market of appendage management accounts for approx. 10.9% of the overall cardiac surgery devices market that accounts around USD 2060.1 Million.

Traditional methods of open heart surgery has various complications associated with the procedure. Implantation of left atrial appendage closure device is done by a non-surgical approach or by causing minimum invasion.

Non-surgical approach, usually helps in faster recovery due to minimally invasive nature. The patient is discharged in a day, thus, reducing the hospital days and aiding better patient outcome.

Decreasing surgical and implantation complications subsequently increases the adoption rate of LAA closure devices, which further contributes in driving the expansion of the appendage management market.

Appendage management procedures are a one-time procedures and has a notable success rate. The complications associated with the surgical procedure of appendage management has been significantly reduced post product approvals. The only unsuccessful surgeries are incomplete or not attempted procedures. This goes to show that there are very few, if any complications associated with the surgical procedure. As a result, the growing adoption of closure devices owing to their success rates drives the growth appendage management market.

The global appendage management market is expected to grow at a CAGR of 6.6% through the forecast period 2025 to 2035.

Frequent Product recalls is expected to hamper the growth of market over the forecast period. Product recalls hampers the company image as well as doubts the reliability of the product. This factor is considered as a restraint for the appendage management market.

In February 2020, AtriCure, Inc.’s Epicardial left atrial appendage closure device, AtriClip was recalled.

Such recalls affect the consumer perception of the product, brand image of the company and doubts the quality of the product casing a restraint in appendage management market.

Moreover, some of the threats encountered during the implantation include damage to structures in the heart, dislodging of the device, incomplete closure of the left atrial appendage, bruising, bleeding, infection, and blood clot formation on device, allergic reaction to the device, irregular heartbeat, stroke or even rarely death. Risks associated with improper implantation of the device is other restring factor for market.

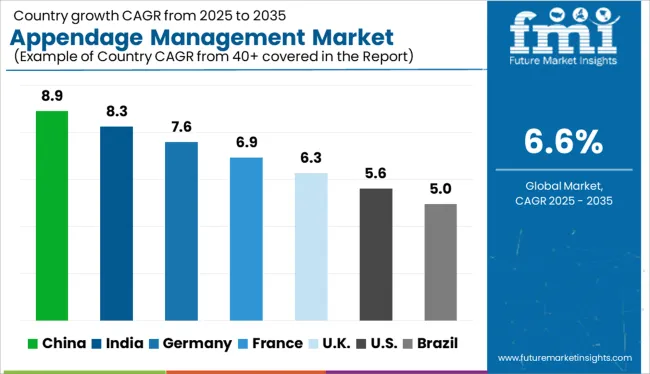

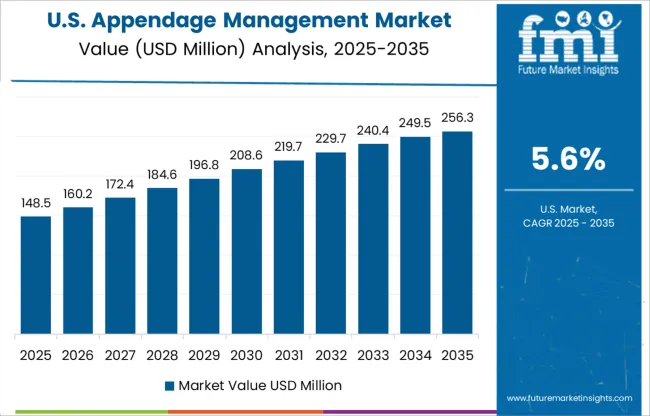

The USA is estimated to account for around 86.3% of the North America appendage management market in 2025 owing to the increasing adoption of left atrial appendage closure devices in attempt to eliminate the risks of side effects of drugs and favorable reimbursement policies which are luring the manufactures in appendage management market. Health insurance in the USA is a reimbursement program by Medicare and Medicaid insurance or a social welfare program funded by the government.

Moreover, focus on new technology development with advancements in medical device industry exhibiting innovative product design with enhanced patient safety is expected to create a huge platform for innovative technologies in USA

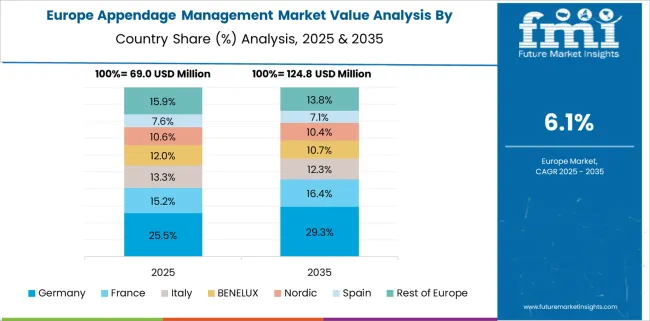

Germany is estimated to account for 20.7% of market revenue share in Europe in 2025. Rising geriatric population who are on risk due to high cholesterol, high blood pressure, obesity, physical inactivity are some of the major factors boosting the demand for appendage management market in Germany.

The risk associated with stroke by atrial fibrillation increases by age. The growing geriatric population is considered an important factor driving the appendage management market.

For instance, According to the World Health Aging 2024 highlights by the United Nations Department of Economic and Social Affairs, in 2024, population aged 65 years and above for Germany was 21.7%. Population ages 65 and above as a percentage of the total population.

As per reported data in 2020 by European Society of Cardiology in Germany, Age group of 75-84 years show a non-valvular atrial fibrillation (NVAF) incidence of 18.6 per 1,000 person-years. The prevalence of NVAF was found to be between 10% and 17% of those aged 80 years or older.

UK having huge growth due to technological advances and high healthcare expenditure is expected a growth rate of CAGR 5.3% by 2035.

Additionally, rapid technological advancement, following rise in diseases and the increase in disposable income can boost the demand for appendage management.

Presence of various manufacturers and awareness about cardiovascular disease is predicted to drive the expansion of Europe appendage management market and drive the focus of the manufacturers in these markets.

Demand for appendage management market in Japan has been rising recently, thereby, estimated to contribute nearly 27.2% of market revenue share in the APAC region in 2025.

Developing healthcare infrastructure with improved services and affordability is expected to drive the growth of the market for appendage management in Japan.

Japan appendage management market is lucrative due to rising adoption of LAA closure devices. Key players are determined to establish their company footprints in these emerging markets by increasing distribution channels and partnering with the regional players and distributors. This is expected to drive the demand for appendage management in the Japan.

Endocardial LAA closure device is expected to account for the highest share of nearly 66.2% in 2025 due to advanced technology with ease of implantation and high specificity, thus, driving the market.

Endocardial LAA closure devices has been widely used and has a good success rate. However, patient are adopting this devices due to it effective product feature. In spite of new innovative products for LAA closure, endocardial LAA closure devices are expected to continue to gain maximum market revenue share over the forecasted years.

By end user, Cath Labs lead the market with market value share of 74.7% in 2025 owing to high walk-in patient in Cath lab for catheterization procedures. More skilled healthcare professionals and technologically advanced services are easily available in Cath lab.

Additionally, appendage management and implantation can be easily performed in Cath lab. Thus this segment is expected to witness significant growth in recent years.

The appendage management market is an extremely consolidated market, with major competitors such as Boston Scientific Corporation, AtriCure, Inc., Abbott Laboratories, Cardia, Inc., Medtronic plc, DePuy Synthes (Johnson & Johnson Services, Inc.), SentreHEART, Inc., Lifetech Scientific Co., Ltd, Occlutech International AB, Johnson & Johnson.

Company operating in every region of the globe. To attract more customers, major players are focusing on mergers and acquisition and launching novel products in order to boost their market position and expand their product portfolios.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2013 to 2024 |

| Market Analysis | USD Million for Value and Volume in Unit |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Germany, UK, France, Spain, Russia, China, Japan, South Korea, India, Australia, New Zealand, GCC Countries, South Africa |

| Key Segments Covered | Product Type, End User and Region |

| Key Companies Profiled | Boston Scientific Corporation; AtriCure, Inc.; Abbott Laboratories; Cardia, Inc.; Medtronic plc; DePuy Synthes (Johnson & Johnson Services, Inc.); SentreHEART, Inc.; Lifetech Scientific Co., Ltd; Occlutech International AB; Johnson & Johnson company |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global appendage management market is estimated to be valued at USD 290.4 million in 2025.

The market size for the appendage management market is projected to reach USD 550.2 million by 2035.

The appendage management market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in appendage management market are endocardial laa closure device and epicardial laa closure devices.

In terms of end user, hospitals segment to command 73.8% share in the appendage management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Asset Management Services Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA