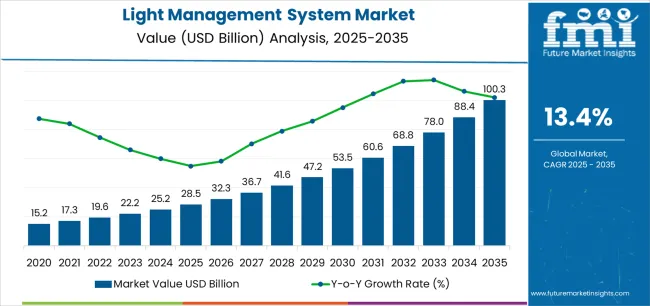

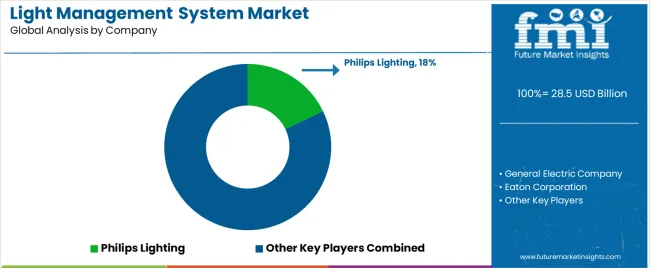

The Light Management System Market is estimated to be valued at USD 28.5 billion in 2025 and is projected to reach USD 100.3 billion by 2035, registering a compound annual growth rate (CAGR) of 13.4% over the forecast period.

The light management system market is expanding steadily, driven by increasing demand for energy-efficient lighting solutions, rapid urban development, and the growing integration of smart technologies in building infrastructure. Current market dynamics reflect strong adoption across commercial, industrial, and residential spaces due to the emphasis on sustainability and regulatory mandates promoting energy conservation.

Advancements in sensor technology, wireless connectivity, and automation have enhanced system performance and enabled seamless integration with broader building management systems. The future outlook remains optimistic as investments in smart cities and green building projects continue to rise globally.

Growth rationale is supported by the rising need to reduce operational costs, improve energy utilization, and enhance occupant comfort through intelligent lighting controls The combination of technological innovation, policy-driven efficiency targets, and widespread awareness of environmental benefits is expected to sustain market growth and broaden adoption across both developed and emerging economies.

| Metric | Value |

|---|---|

| Light Management System Market Estimated Value in (2025 E) | USD 28.5 billion |

| Light Management System Market Forecast Value in (2035 F) | USD 100.3 billion |

| Forecast CAGR (2025 to 2035) | 13.4% |

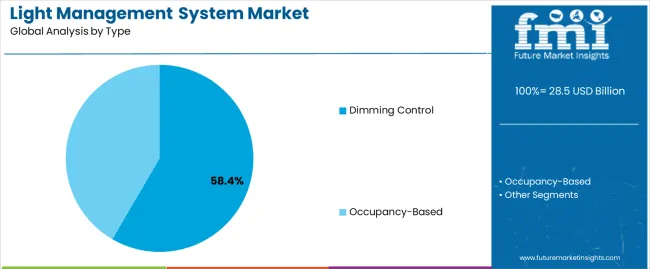

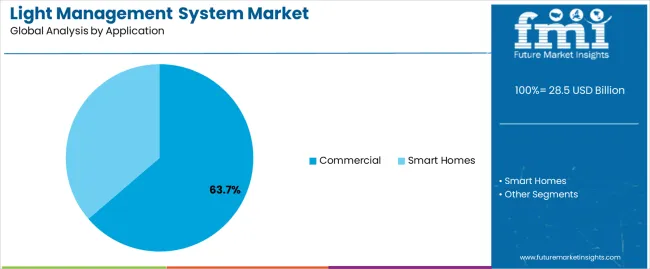

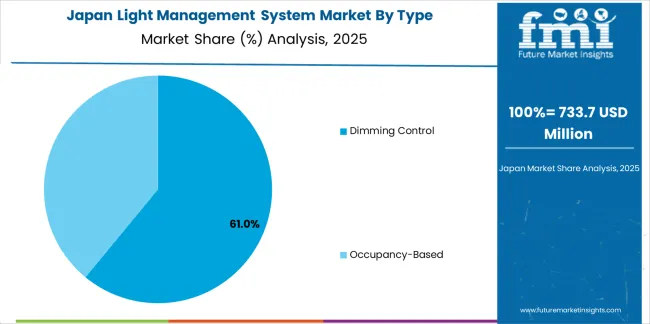

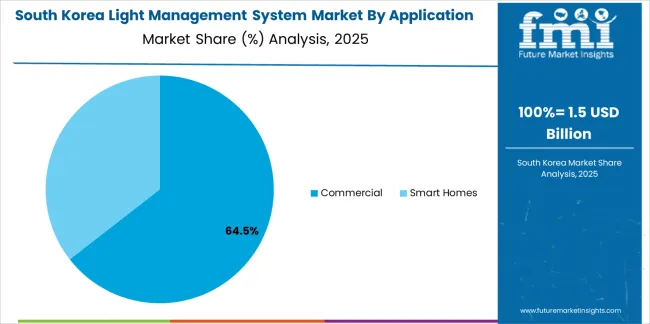

The market is segmented by Type and Application and region. By Type, the market is divided into Dimming Control and Occupancy-Based. In terms of Application, the market is classified into Commercial and Smart Homes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dimming control segment, holding 58.40% of the type category, has established itself as the leading technology due to its effectiveness in optimizing energy consumption and enhancing lighting flexibility. Its widespread deployment in both new installations and retrofit projects has been supported by ease of integration with existing lighting systems.

Demand growth has been driven by the increasing use of LED lighting, which complements dimming control functionality for precise brightness adjustment and energy savings. Regulatory support for sustainable lighting solutions has encouraged adoption across commercial and residential infrastructures.

Advancements in digital control protocols and wireless dimming technologies have further enhanced performance and user convenience As smart lighting ecosystems continue to expand, the dimming control segment is expected to maintain dominance by delivering operational efficiency, occupant comfort, and compliance with global energy standards.

The commercial segment, representing 63.70% of the application category, has remained dominant due to the extensive adoption of light management systems in offices, retail spaces, and institutional buildings. Growth has been supported by the increasing need for efficient energy utilization and the integration of intelligent lighting controls to improve workspace productivity and ambience.

Businesses are prioritizing sustainability and operational cost reduction, which has driven large-scale deployment of automated lighting solutions. The segment benefits from regulatory initiatives promoting energy efficiency certifications and incentives for smart infrastructure upgrades.

Advancements in IoT-based lighting control, occupancy sensing, and daylight harvesting technologies have further optimized energy use and reduced carbon footprints With the ongoing expansion of commercial real estate and modernization of existing facilities, the commercial segment is expected to sustain its leadership and generate significant revenue contribution to the overall light management system market.

| Attributes | Details |

|---|---|

| Top Type | Dimming Control |

| CAGR (2025 to 2035) | 13.9% |

| Attributes | Details |

|---|---|

| Top Application | Smart Homes |

| CAGR (2025 to 2035) | 13.6% |

| Countries | CAGR through 2035 |

|---|---|

| United States | 14.4% |

| United Kingdom | 15.6% |

| China | 15.0% |

| Japan | 15.7% |

| South Korea | 16.3% |

The market is quite diverse and rapidly evolving. Companies are constantly working to innovate and improve their products to stay ahead of the competition. Additionally, many smaller players in the market are also competing for market share. Overall, the light management system market is highly competitive, with companies offering a wide range of products and services to meet the needs of their customers.

Recent Development in the Light Management System Market

The global light management system market is estimated to be valued at USD 28.5 billion in 2025.

The market size for the light management system market is projected to reach USD 100.3 billion by 2035.

The light management system market is expected to grow at a 13.4% CAGR between 2025 and 2035.

The key product types in light management system market are dimming control and occupancy-based.

In terms of application, commercial segment to command 63.7% share in the light management system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flight Tracking System Market Insights - Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Light Gauge Framing System Market

Lightning Protection Systems Market

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Alarm Management System Market Analysis by Component, Industry and Region - Trends, Growth & Forecast 2025 to 2035

Runway Lighting System Market

Crowd Management System Market

Asset Management System Market

Dealer Management System Market Size and Share Forecast Outlook 2025 to 2035

Outage Management System Market Insights – Forecast 2025-2035

Energy Management System Market Analysis – Growth & Forecast 2017-2025

Catalog Management System Market Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Lightweight Acoustic Floor Systems Market Size and Share Forecast Outlook 2025 to 2035

Visitor Management System Market Analysis – Size, Share & Forecast 2025 to 2035

Traffic Management System Market Analysis – Demand, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA