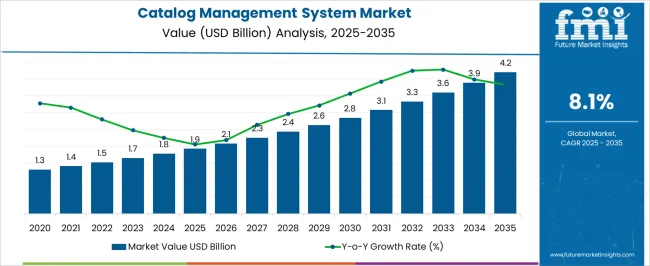

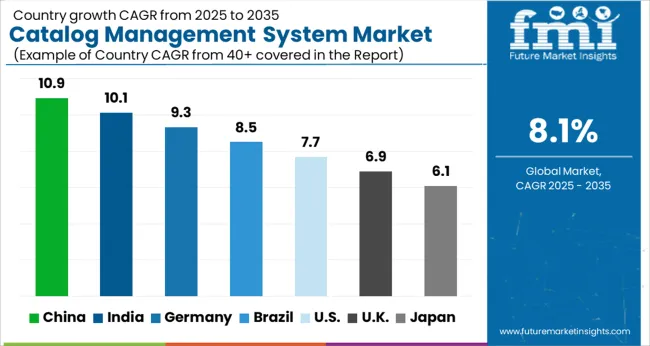

The Catalog Management System Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 4.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

| Metric | Value |

|---|---|

| Catalog Management System Market Estimated Value in (2025 E) | USD 1.9 billion |

| Catalog Management System Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The catalog management system market is expanding steadily due to the growing need for centralized product information, enhanced customer experience, and streamlined digital commerce operations. Businesses are focusing on improving product data consistency and accessibility across multiple channels to support omnichannel retail strategies.

Rising e commerce penetration, demand for personalized shopping experiences, and pressure to accelerate time to market are further driving adoption. Advances in AI powered cataloging, automation in product data enrichment, and integration with enterprise resource planning systems are strengthening operational efficiency.

Regulatory requirements for accurate product information and the increasing emphasis on customer trust are also contributing to adoption trends. The outlook remains strong as enterprises invest in scalable catalog management solutions to enhance competitiveness in the digital economy.

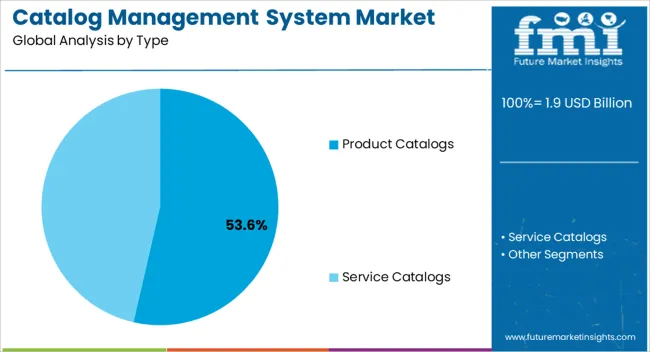

The product catalogs type segment is expected to represent 53.60% of total market revenue by 2025, making it the largest contributor in this category. Its dominance is driven by the need for centralized, structured, and searchable repositories of product information that improve visibility across sales and distribution channels.

The ability to standardize product attributes, reduce manual errors, and improve data accuracy has increased reliance on product catalogs.

Furthermore, their role in ensuring consistency in omnichannel strategies and supporting personalized shopping experiences has reinforced their widespread adoption.

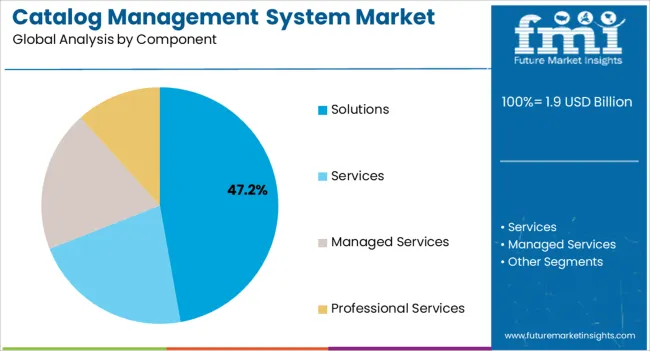

The solutions component segment is projected to account for 47.20% of the overall market revenue by 2025, positioning it as the leading segment under component type. This growth is attributed to the increasing demand for automation, AI powered cataloging, and advanced data integration capabilities.

Solutions allow enterprises to streamline product lifecycle management, enhance customer engagement, and scale efficiently.

As digital commerce ecosystems expand globally, the solutions segment continues to dominate owing to its ability to deliver measurable operational improvements and data driven insights.

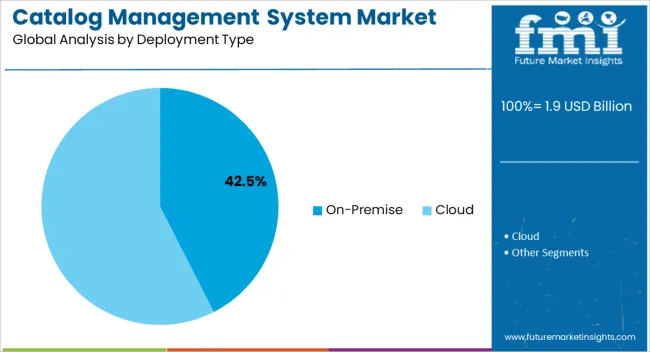

The on premise deployment type segment is anticipated to capture 42.50% of market revenue by 2025, establishing it as the leading deployment model. Its leadership is supported by enterprises seeking greater control over data security, compliance, and system customization.

Industries handling sensitive product and customer information, such as healthcare, finance, and manufacturing, have prioritized on premise solutions to maintain regulatory alignment and ensure data confidentiality.

While cloud based models are gaining traction, the stability, reliability, and customization potential offered by on premise systems continue to make this deployment type a dominant choice among enterprises.

Customer experience, staff efficiency, and overall company performance are improved by catalog management solutions. Because of expanding consumer demand for catalog management systems, internet access, and increased smartphone penetration, the eCommerce business has been developing at a breakneck speed. Moreover, the amount of money spent on the Internet has surged over the world. The eCommerce business is quickly expanding in nations such as the Philippines, Mexico, India, and China.

Catalog management systems aid in the reduction of service delivery costs, the enhancement of customer experience, staff efficiency, and the general operation of enterprises. Customers have a better shopping experience which enhances the sales of catalog management systems solutions since they provide extensive information on every product. These advantages assist firms in saving time and automating the updating of product information on eCommerce platforms.

Data collection and transfer from one channel to another demand catalog management systems are the key hindrances. Catalog management systems are also engaged in data synchronization and publication across channels. Furthermore, sales of catalog management systems might lead to highly abstracted data sets due to a lack of sufficient information about security standards and their implementation.

The main reason for the slow adoption and demand for catalog management systems solutions is concerns regarding data security. Users are hesitant to use these solutions because they are afraid of losing their critical master and reference data owing to data mistakes that occur during compilation or upgrade.

Users believe that their data privacy is in danger, that there might be no responsibility for data losses or thefts, and no mitigation might be offered. Furthermore, people are concerned about the security of their data. As a result, businesses choose providers that can adjust their existing systems to manage product information and compete.

Companies in areas like healthcare, retail, and BFSI have been investing in and implementing emerging technologies like AI and ML to expand and remain ahead of their competition. Automatic product categorization, anomaly detection, enrichment procedures through the selection of data from reputable sources, product rating, and contextual suggestions are all available with sales of catalog management systems.

Demand for catalog management systems solutions driven by AI may produce automatic insights regarding data problems and build an integrated picture of data from numerous systems. In turn, they allow customers to better understand their items. Furthermore, AI-enabled chatbots can improve consumer pleasure and experience, leading to increased revenues and profitability.

By sensing upcoming data quality issues and suggesting appropriate solutions to improve data matching and avoid data inconsistencies, ML enabled the demand for catalog management systems solutions. Consequently, this is going to assist organizations in managing compliance, driving data-based digital transformation, and achieving better operational efficiency.

IBM, for example, has begun to provide ML-enabled catalog management systems. It is anticipated that demand for such solutions might grow, spurring new improvements in demand for catalog management systems software.

The catalog needs for any business vary depending on the items or services supplied. There is no set structure that businesses adopt. Despite the benefits of catalog management systems in terms of cleansing, consolidation, and enrichment, businesses must adopt a governance strategy that maintains consistency across product catalogs to achieve consistent data.

Similarly, while creating strategies for improved interfaces with current systems, data from systems with insufficient information or data inconsistencies must also be taken into account.

The product catalog segment is holding a significant share of 62.3% in the global market. The distribution of the product catalog share among different providers indicates the market presence and competitiveness of each company. Moreover, the product catalog share in the catalog management systems market is influenced by market trends, technological advancements, and customer demands.

Companies that continuously update and expand their product catalogs are likely to attract many customers and gain a significant share of the market. The solution segment by component for the catalog management systems market is predicted to rise at a prominent CAGR of 7.5% by 2035 due to the factors such as:

Sales of catalog management systems solutions are significantly boosting to reduce downtime during the pre-and post-installation. It can also be improved in businesses at diverse locations by providing active help from trained personnel. These services give the required assistance to maintain business process efficiency, boost enterprise growth, and eliminate unnecessary operational costs.

The on-premise segment holds a commanding share of 57.3% of the market. This segment caters to organizations that prioritize maintaining their catalog management software within their premises.

Certain industries, such as government, healthcare, and finance, often have strict regulations and compliance requirements that necessitate on-premise deployment. These organizations prefer to have complete control over their data and maintain it within their secure environment.

The cloud sector is likely to have a large proportion of the catalog management systems market, which is expanding significantly at a CAGR of 7.2% owing to enterprises in many areas quickly embracing the cloud for digital transformation. When opposed to SMEs, leading firms choose the on-premises option since the budget allocation for clearing the demand for catalog management systems software products and services in company equipment is often high.

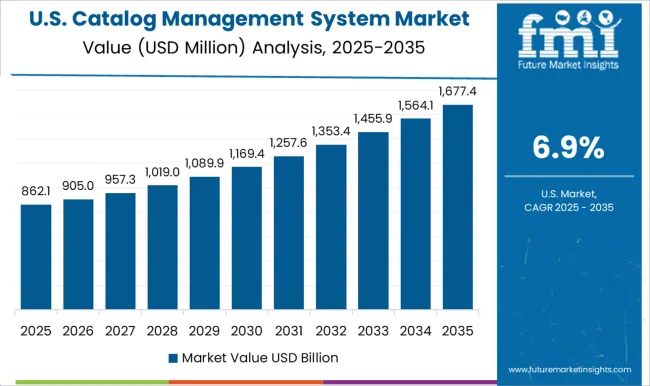

North America is a prominent hub in the global market capturing a significant share of 27.4% of the global market. The region is known for its advanced technological infrastructure, strong presence of key industry players, and large customer base. Businesses in North America across various sectors such as retail, e-commerce, and healthcare extensively utilize catalog management systems to efficiently organize and showcase their products and services.

The region's focus on data-driven decision-making and the adoption of advanced technologies, such as artificial intelligence and machine learning, further fuel the demand for catalog management systems.

The United Kingdom is expanding at a transforming rate of 7.4% during the analysis period. The catalog management systems market in the United Kingdom benefits from various factors that promote its growth and development. The country has a well-established and highly competitive retail industry, both online and offline.

With the increasing popularity of e-commerce, businesses in the United Kingdom are focusing on effective management and organization of their product catalogs to provide an enhanced shopping experience to their customers. Furthermore, the United Kingdom boasts a thriving digital economy and has witnessed significant growth in the adoption of digital technologies.

China is set to become one of the most notable markets in the world, recording a CAGR of 9.2% between 2025 and 2035. China's e-commerce landscape is one of the large and most dynamic in the world. The country has experienced tremendous growth in online retail, with consumers increasingly turning to online platforms for their shopping needs.

Catalog management systems have become integral to digital strategies adopted by businesses in China as they seek to centralize and optimize their product data, ensuring consistency and accuracy across various sales channels. By leveraging catalog management systems, businesses in China can streamline their catalog management processes, and improve data quality, ultimately boosting customer engagement and loyalty.

Suppliers have used several organic and inorganic development techniques to meet the need for catalog management systems, including:

The study provides a thorough competitive analysis of the catalog management systems industry, including company profiles, recent advancements, and key market strategies.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 8.1% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | Component, Deployment, Type, Organization Size, End User, Vertical, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa; Oceania |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Microsoft(USA); IBM (USA); Oracle (USA); Broadcom(USA); Salesforce(USA); Ping; Identity(USA); Okta(USA); HID; Global(USA); ForgeRock(USA); CyberArk(USA) |

| Customization & Pricing | Available upon Request |

The global catalog management system market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the catalog management system market is projected to reach USD 4.2 billion by 2035.

The catalog management system market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in catalog management system market are product catalogs and service catalogs.

In terms of component, solutions segment to command 47.2% share in the catalog management system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Alarm Management System Market Analysis by Component, Industry and Region - Trends, Growth & Forecast 2025 to 2035

Crowd Management System Market

Asset Management System Market

Dealer Management System Market Size and Share Forecast Outlook 2025 to 2035

Outage Management System Market Insights – Forecast 2025-2035

Energy Management System Market Analysis – Growth & Forecast 2017-2025

Battery Management System Market Report – Growth & Forecast 2025-2035

Visitor Management System Market Analysis – Size, Share & Forecast 2025 to 2035

Traffic Management System Market Analysis – Demand, Growth & Forecast 2025–2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Insulin Management System Market Growth - Trends & Forecast 2025 to 2035

Competitive Breakdown of Battery Management System Providers

Network Management System Market Insights - Growth & Forecast through 2034

Learning Management System (LMS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA