The Space Management Solutions Market is estimated to be valued at USD 1,114.9 million in 2025 and is projected to reach USD 2,362.8 million by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

The space management solutions market is undergoing a strong growth trajectory as organizations across sectors aim to optimize physical workspace usage, enhance real estate efficiency, and support hybrid work models. Businesses are increasingly investing in digital platforms that enable real-time data collection, space allocation analytics, and predictive occupancy insights to support data-driven decision-making.

Integration with IoT sensors and AI-driven dashboards is improving the flexibility and responsiveness of space management platforms, allowing companies to manage assets, employee flow, and energy consumption in real time. Regulatory and ESG compliance, particularly around carbon reduction and smart building standards, is further motivating adoption.

Facility managers and enterprise leaders are prioritizing space planning tools that streamline workplace utilization while aligning with sustainability goals. With the ongoing transformation of office environments, retail spaces, and institutional layouts, space management solutions are expected to remain a strategic investment area, delivering operational cost savings and improving employee or customer experiences across industries.

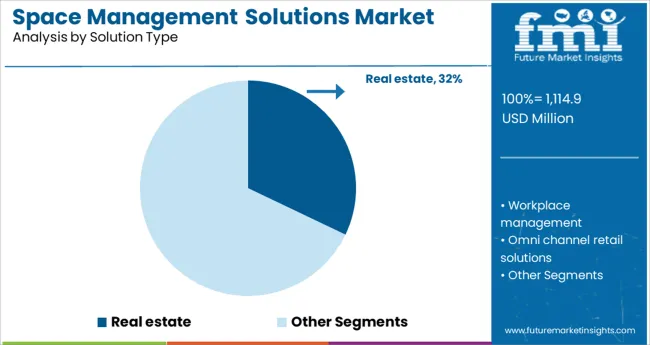

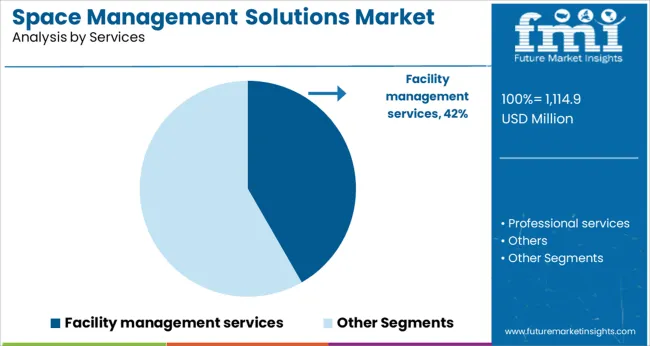

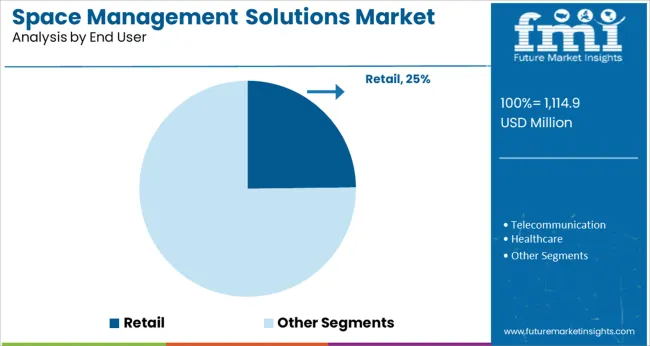

The market is segmented by Solution Type, Services, and End User and region. By Solution Type, the market is divided into Real estate, Workplace management, Omni channel retail solutions, and Others. In terms of Services, the market is classified into Facility management services, Professional services, and Others. Based on End User, the market is segmented into Retail, Telecommunication, Healthcare, Manufacturing, Utilities, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The real estate subsegment is expected to account for 32.1% of revenue within the solution type category in 2025, making it the largest contributor. This leadership is being supported by the increasing complexity of corporate real estate portfolios and the growing need for centralized platforms to manage leases, space usage, and asset allocation.

Organizations are seeking to maximize occupancy efficiency, reduce underutilized space, and track long-term cost performance across geographically dispersed properties. Real estate-focused space management tools are enabling stakeholders to consolidate portfolio data, run scenario planning, and support return-to-office strategies through space forecasting features.

As remote work and hybrid occupancy models reshape long-term leasing strategies, demand for agile, analytics-driven platforms is solidifying real estate’s leading position in this segment.

Facility management services are projected to contribute 41.7% of total market revenue in the services category in 2025, establishing this as the dominant service offering. The prominence of this segment is attributed to the growing complexity of managing dynamic workspaces, increased compliance needs, and the integration of smart building technologies.

Facility management providers are offering bundled services that include space monitoring, energy management, cleaning, and workplace safety, enabled by AI and IoT-driven tools. Organizations are increasingly outsourcing facility operations to optimize performance and focus on core business functions.

The need to ensure efficient usage of floor space, meeting rooms, and shared environments has resulted in higher reliance on external service experts. With cost reduction and occupant well-being being prioritized post-pandemic, facility management services are expected to remain a central component of space management strategies.

Retail is projected to hold 24.8% of the total market share within the end user category in 2025, emerging as the leading vertical. This segment’s leadership is being driven by the retail industry's focus on optimizing store layouts, enhancing footfall management, and improving customer engagement through space intelligence.

Retailers are leveraging space management tools to analyze in-store traffic patterns, reduce dead zones, and align product placement strategies with consumer behavior insights. The integration of space utilization platforms with POS systems and inventory tracking is enabling real-time visibility into performance across outlets.

As omnichannel retail grows, space is also being reconfigured to accommodate backroom fulfillment and in-store pick-up zones, increasing demand for adaptive planning tools. Furthermore, the push for energy-efficient retail operations and the incorporation of ESG targets have reinforced space management as a key enabler of profitability and sustainability in the retail environment.

Most of the sales of space planning and space management software are achieved for workplace management necessities arising out of resources and infrastructure constraints. Some of the prominent factors favouring the space planning and space management software market growth:

Scarcity of Skilled Labours - An Obstacle to Knowledge Transfer

Some challenges holding back the space planning and space management software market from realizing its full potential:

Lack of visibility across the entire inventory of space which leads to delays in decision making is the major challenge faced by most of the vendors in the space management solutions market.

Among all the major end-use verticals of the market, the Hospital sector is anticipated to rule the space planning and space management market over the forecast period. The deployment of patient beds on the hospital floor is what fuels the segments rise.

Particularly the peak period of the Covid-19 pandemic compelled healthcare institutions to adopt such software to accommodate a maximum number of patients. Such advantages have resulted in higher demand for space planning and space management software even after the subsidence of the pandemic period.

The North American region holds the largest space planning and space management software market by contributing almost 28.5% share in the overall sales and export.

Among the assessed regions, the space management solutions market in North America is expected to dominate during the forecast period owing to its rising adoption for optimizing enterprise resource planning. North America region is expected to be followed by Western Europe and APAC.

Over the last couple of years, Asia Pacific countries have witnessed some remarkable growth opportunities and have acquired the 2nd position with a contribution of around 22.6%.

This space planning and space management software market analysis report represents the figures in favour of the Asia Pacific region for rapid growth during the forecast years.

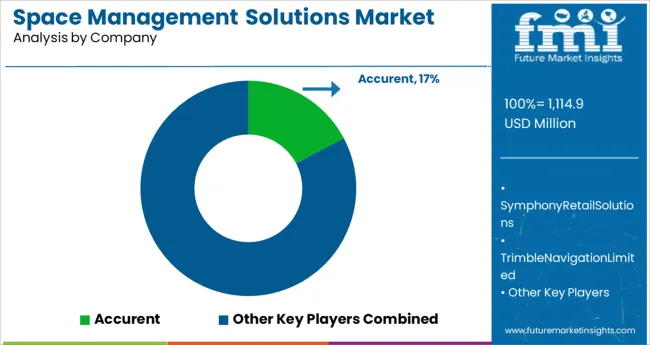

A number of businesses involved in the space planning and space management software market are now engaged in launching strategies like target marketing and improving user experience as a way of boosting their brand recognition. The recent developments in the direction of integrating features related to other business activities have also created immense opportunities for the key players in the present market.

Sensing the huge gap in the existing market for providing suitable solutions according to rapidly diversifying workplace environments, many new entrants have come up in the space planning and space management software market in recent years. Many start-up companies have also started providing support services as a major strategy to penetrate the market.

The overall space planning and space management software market is turning fragmented with the emergence of many new players that were once consolidated due to the dominance of some prominent solution developers.

Serraview is a renowned workplace management software provider that entered into a long-term partnership with PointGrab in March 2020. PointGrab is known for developing Cognipoint edge-analytics smart sensing solutions that will be integrated with software for further strengthening the sales of space planning and space management software by the company.

| Attributes | Details |

|---|---|

| Growth Rate | CAGR of 7.8% from 2025 to 2035. |

| Base year for Estimation | 2025 |

| Historical Data Available for | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025-2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis. |

| Segments Covered | Solution Type, Services, End User Industry, Regions |

| Regions Covered | North America; Latin America; Asia Pacific; Japan; Western Europe; Eastern Europe; Middle East & Africa |

| Key Countries Profiled | The USA, Canada, Brazil, Argentina, Germany, The UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, GCC, South Africa |

| Key Companies Profiled | Accurent; Symphony Retail Solutions; Trimble Navigation Limited; JDA Software Group, Inc.; Asset Works.; Others |

| Customization | Available upon Request |

The global space management solutions market is estimated to be valued at USD 1,114.9 million in 2025.

It is projected to reach USD 2,362.8 million by 2035.

The market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types are real estate, workplace management, omni channel retail solutions and others.

facility management services segment is expected to dominate with a 41.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Space-based C4ISR Market Size and Share Forecast Outlook 2025 to 2035

Space Lander and Rover Market Size and Share Forecast Outlook 2025 to 2035

Space-Based Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Space Frame Market Size and Share Forecast Outlook 2025 to 2035

Space Situational Awareness Market Size and Share Forecast Outlook 2025 to 2035

Space Robotics Market Size and Share Forecast Outlook 2025 to 2035

Space On Board Computing Platform Market Size and Share Forecast Outlook 2025 to 2035

Space Militarization Market Size and Share Forecast Outlook 2025 to 2035

Space Economy Market Size and Share Forecast Outlook 2025 to 2035

Space Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Space Tourism Providers

Space Tourism Industry Analysis by Supplier, by Age Group, by Tourism Type, by Demographics, by Nationality, by Booking Channel, by Tour Type, and by Region - Forecast for 2025 to 2035

Spacer Tapes Market Insights & Growth Outlook through 2034

Space DC-DC Converter Market Insights – Growth & Forecast 2024-2034

In Space Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA