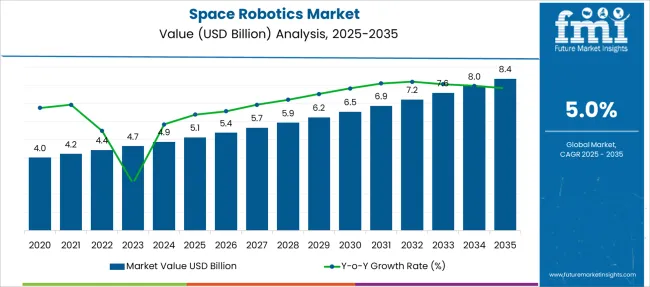

The Space Robotics Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 8.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The space robotics market is experiencing robust expansion, supported by rising investment in satellite servicing, orbital debris removal, and planetary exploration missions. The integration of robotics with AI, vision processing, and haptic feedback systems is transforming how operations are conducted in space. These systems are being designed to perform high-precision tasks in zero-gravity environments, significantly reducing reliance on human presence.

Governments and space agencies are increasing focus on modular robotic systems capable of performing autonomous docking, payload handling, and infrastructure maintenance. At the same time, private aerospace firms are accelerating deployments with robotic solutions embedded into commercial missions for satellite launch support, in-orbit servicing, and lunar resource exploration.

As long-duration missions become the norm, robotics is expected to play a central role in reducing operational risks and enabling long-term human survival in deep space. Continued advancement in machine learning algorithms, materials engineered for space durability, and power-efficient robotic actuators will drive future opportunities in the market.

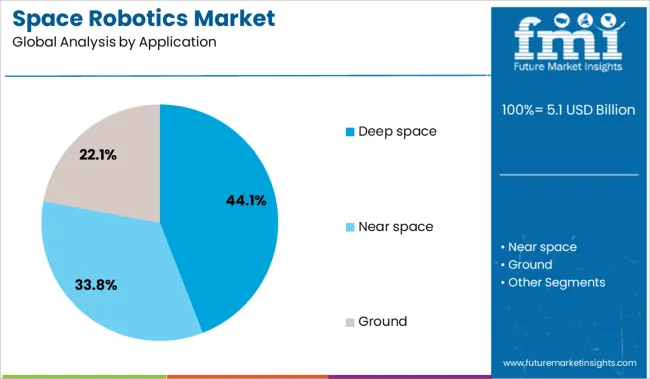

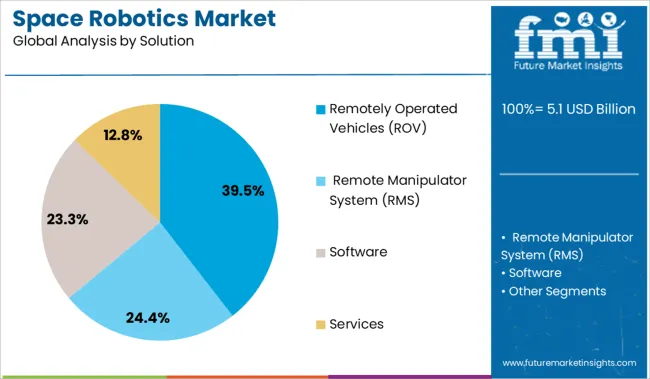

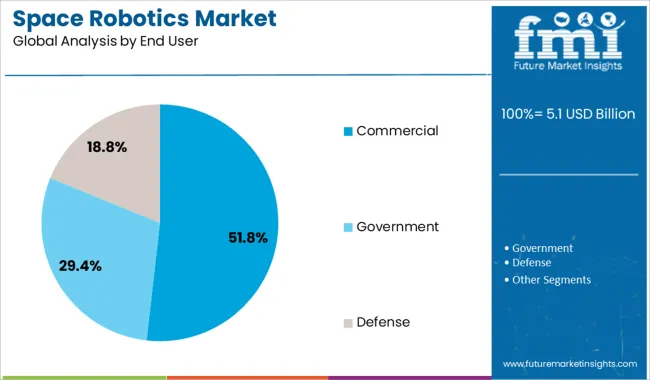

The market is segmented by Application, Solution, End User, and Technology and region. By Application, the market is divided into Deep space, Near space, and Ground. In terms of Solution, the market is classified into Remotely Operated Vehicles (ROV), Remote Manipulator System (RMS), Software, and Services. Based on End User, the market is segmented into Commercial, Government, and Defense. By Technology, the market is divided into Remote sensing, Autonomous systems, Teleoperation, Robotic software, Artificial Intelligence (AI) and Machine Learning (ML), and Human-Robot interaction. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The deep space segment is anticipated to account for 44.1% of the space robotics market revenue in 2025, positioning it as the leading application category. This dominance is driven by growing mission volume targeting the Moon, Mars, and other planetary bodies, requiring autonomous systems to navigate unstructured and hazardous terrain.

Space agencies and commercial entities have prioritized deep space exploration for its potential to unlock scientific data and extraterrestrial resources. Robotics has become indispensable in environments where real-time human control is not feasible due to communication delays.

Advancements in radiation-hardened materials, AI-guided mobility, and autonomous decision-making have further enabled robust deployment in deep space missions. The emphasis on robotic precursor missions to scout terrain and establish initial infrastructure ahead of human arrival has strengthened the role of robotics in this segment.

Remotely operated vehicles are projected to hold 39.5% of the total market share under the solution segment in 2025. This leadership is underpinned by their proven capability in supporting high-precision manipulation, inspection, and repair tasks in orbital and planetary environments.

The ability to control ROVs from ground stations or nearby spacecraft allows for flexibility across a range of mission profiles. They offer a balance between autonomy and manual oversight, reducing risks while maintaining operational control.

These vehicles are often equipped with modular tools, vision systems, and adaptive grippers, making them versatile across satellite servicing, assembly, and scientific sampling missions. The continued development of semi-autonomous control frameworks and low-latency communication systems has reinforced the demand for ROVs in both government and commercial operations.

The commercial segment is forecast to dominate the end user category with a 51.8% revenue share in 2025. This expansion is being fueled by a surge in private sector participation in satellite deployment, in-orbit servicing, and lunar logistics. Companies are increasingly investing in robotic systems to reduce operational costs, extend satellite lifespans, and conduct space-based manufacturing.

The rise of mega-constellations and small satellite platforms has created a market for robotic deployment and maintenance services, further intensifying commercial demand. Moreover, commercial firms are leveraging robotic solutions to support space tourism infrastructure, asteroid mining preparation, and lunar outpost construction.

The competitive landscape has encouraged rapid prototyping and commercialization of space-qualified robotic systems, driving cost innovation and performance enhancement. As public-private partnerships grow and launch costs decline, the commercial sector’s influence over the space robotics market is expected to deepen further.

The space robotics market is experiencing growth driven by increasing demand for autonomous satellite servicing and on-orbit manufacturing. Challenges such as high development costs, harsh space environments, and regulatory constraints are hindering broader adoption.

The space robotics market is benefiting from the rising demand for autonomous satellite servicing. Robotic systems are increasingly utilized for tasks such as satellite maintenance, repair, and refueling, reducing the need for human intervention in space. This trend is driven by the desire to extend the operational life of satellites and reduce costs associated with launching new ones. As the number of satellites in orbit increases, the need for efficient servicing solutions becomes more critical.

Despite advancements, space robotics faces significant challenges due to the harsh space environment. Robots must operate in conditions characterized by extreme temperatures, radiation, and microgravity, which can affect their performance and longevity. These environmental factors necessitate the development of robust and resilient robotic systems capable of withstanding such conditions. The complexity of designing and testing such systems contributes to high development costs and extended timelines.

Global space robotics market demand is projected to rise at a 5% value-based CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 5.8%, followed by India at 5.6%, and the United States at 5.3%, while Japan posts 4.9% and Germany records 4.7%. These rates translate to a growth premium of +16% for China, +12% for India, and +6% for the United States versus the baseline, while Germany shows slower growth. Divergence reflects local catalysts: increasing investments in space exploration and robotics in China and India, steady growth driven by ongoing space missions in the United States, and more moderate growth in Japan and Germany due to market maturity and competition from other space technologies.

| Country | CAGR (2025-2035) |

|---|---|

| United States | 5.3% |

| Germany | 4.7% |

| Japan | 4.9% |

| India | 5.6% |

| China | 5.8% |

The United States is advancing space robotics through mission-specific integration across government and private sector launches. Robotic mechanisms are prioritized in deep-space research, payload docking, and ISS maintenance. Advanced command-and-control layers are being paired with robotic arms and autonomous positioning systems. Demand is further supported by national defense requirements and growing collaboration between aerospace primes and AI firms. Research clusters in California and Texas are influencing rapid prototyping cycles and launch-readiness precision, reinforcing the country’s leadership.

The space robotics market Germany is supported by a strong industrial engineering base, with public-private programs emphasizing long-duration space missions. Development of robotic arms for the European Space Agency (ESA) and joint space efforts has become a focal point. German manufacturers are emphasizing modular design, part interchangeability, and mission-specific retrofits. Industry leaders based in Bavaria and Baden-Württemberg are partnering with academic research labs to test robotic components for vacuum environments, ensuring hardware reliability during long orbital cycles.

The robotic systems in Japan are shaped by their precision engineering legacy, used extensively in payload manipulation and narrow-orbit path tasks. Robotic units are being embedded into ISS operations and future lunar logistics. Japan's government emphasizes redundancy, real-time calibration, and multi-purpose functionality in robotic design. Robotics manufacturers are working with microelectronics and sensor firms to enhance in-orbit vision and feedback capabilities. Public funding has favored upgrades to robotic docking interfaces and tethered equipment to boost mission safety and hardware reuse.

India is positioning itself as a cost-efficient contributor to the space robotics segment, integrating robotic tools in mission planning and payload recovery. ISRO is actively using robotic elements for lunar and interplanetary missions. Domestic developers are producing lightweight, custom-fit manipulators for satellite deployment and surface exploration. Focus remains on maximizing mission efficiency through modular hardware and open-source control software. National interest lies in establishing end-to-end autonomy in robotic navigation, facilitating spacecraft repair and in-situ resource handling.

The space robotics growth strategy in China is centered on capability independence and volume scalability. Robotic systems are integrated into Tiangong Space Station, with tools assisting in module relocation and experiment handling. Robotic assets are part of a long-term vision to automate satellite servicing and in-orbit assembly. Strategic procurement policies support internal component supply, ensuring minimal foreign dependence. The government directs funds toward developing robotic grapplers, autonomous toolkits, and advanced end-effectors tailored to future lunar operations and Mars orbiters.

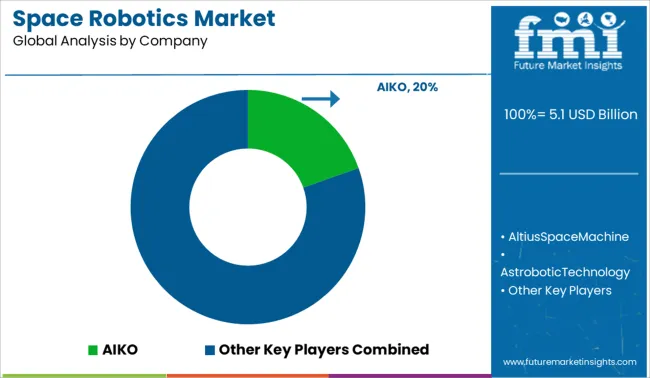

In the space robotics market, valued at approximately USD 5-6 billion in 2024, AIKO has claimed a commanding position by delivering AI-powered autonomous systems and robotic manipulators for satellite servicing and on-orbit applications across Europe and North America. This dominance is supported by strong venture capital backing and collaborative contracts with aerospace integrators.

Other key players such as Astrobotic, GITAI, Honeybee Robotics, Blue Origin, and MastenSpaceSystems have secured strategic portfolios, ranging from lunar rovers and robotic arms to debris-removal drones, via government partnerships, e-commerce procurement by space agencies, and export licenses in USA, Europe, India, and ASEAN. Technology claims are shaped by regulatory protocols in export controls, mission assurance, and component certification.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 5.1 billion |

| Projected Market Size (2035) | USD 8.4 billion |

| CAGR (2025 to 2035) | 5.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Application | Deep space, Near space, Ground |

| Solution | Remotely Operated Vehicles (ROV), Remote Manipulator System (RMS), Software, Services |

| End User | Commercial, Government, Defense |

| Technology | Remote sensing, Autonomous systems, Teleoperation, Robotic software, Artificial Intelligence (AI) and Machine Learning (ML), Human-Robot interaction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AIKO, AltiusSpaceMachine, AstroboticTechnology, BlueOrigin, BluHapticsInc., GITAI, HoneybeeRobotics, IntuitiveMachinesLLC., Ispace, ITTCorporation, LunarOutpost, MastenSpaceSystems |

| Additional Attributes | Dollar sales across space-robotic architectures and subsystems indicate manipulator arms and autonomous servicing tugs dominate the revenue pool. Rising demand from satellite-servicing, in-orbit manufacturing and defense missions is displacing crewed extravehicular methods, underpinning sustained growth. Premium science platforms and commercial habitats increasingly specify plug-and-play modules that enable refill-style upgrades and recurring service contracts. Mission-specific coatings, radiation-stable lubricants and debris-mitigation fixtures deliver compliance with sustainability protocols set by NASA, ESA, and emerging Asian agencies. Production remains concentrated in Europe and North America, supplying a widening launch and constellation ecosystem in Asia-Pacific and Latin America through resilient cross-border supply arrangements today globally. |

The global space robotics market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the space robotics market is projected to reach USD 8.4 billion by 2035.

The space robotics market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in space robotics market are deep space, _planetary exploration, _asteroid mining, _space research, near space, _satellite operations, _space station maintenance, _orbital transportation, _others, ground, _launch operations, _ground control operations and _space research labs.

In terms of solution, remotely operated vehicles (rov) segment to command 39.5% share in the space robotics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Space-based C4ISR Market Size and Share Forecast Outlook 2025 to 2035

Space Lander and Rover Market Size and Share Forecast Outlook 2025 to 2035

Space-Based Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Space Frame Market Size and Share Forecast Outlook 2025 to 2035

Space Situational Awareness Market Size and Share Forecast Outlook 2025 to 2035

Space On Board Computing Platform Market Size and Share Forecast Outlook 2025 to 2035

Space Militarization Market Size and Share Forecast Outlook 2025 to 2035

Space Economy Market Size and Share Forecast Outlook 2025 to 2035

Space Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Space Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Space Tourism Providers

Space Tourism Industry Analysis by Supplier, by Age Group, by Tourism Type, by Demographics, by Nationality, by Booking Channel, by Tour Type, and by Region - Forecast for 2025 to 2035

Spacer Tapes Market Insights & Growth Outlook through 2034

Space DC-DC Converter Market Insights – Growth & Forecast 2024-2034

In Space Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA