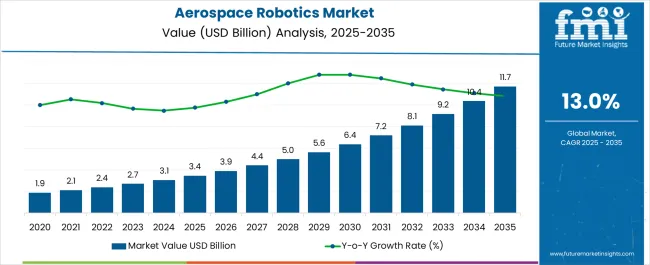

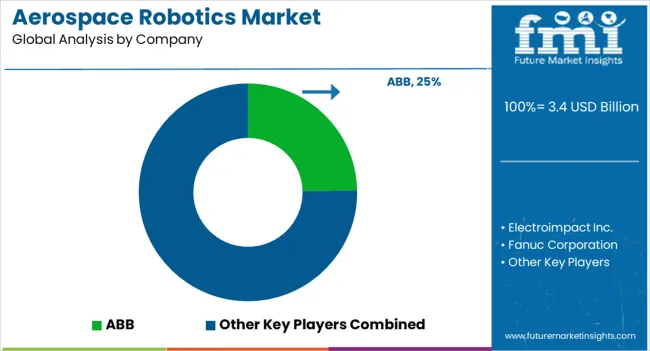

The Aerospace Robotics Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 11.7 billion by 2035, registering a compound annual growth rate (CAGR) of 13.0% over the forecast period.

This growth is driven by the increasing demand for automation in aerospace manufacturing, maintenance, and repair, as robotics technology enhances precision, reduces labor costs, and improves safety. In the first five-year phase (2025-2030), the market is expected to grow from USD 3.4 billion to USD 6.5 billion, representing an addition of USD 3.1 billion, which accounts for 37.4% of the total incremental growth.

Advancements in robotic systems, AI, and digitalization in aerospace operations drive this growth. The second phase (2030–2035) will contribute USD 5.2 billion, representing 62.6% of the total growth, reflecting stronger momentum as the aerospace sector adopts more advanced robotics for both production and servicing.

Annual increments will rise from USD 0.8 billion in the early years to USD 1.3 billion by 2035, fueled by innovations in robotic automation, 3D printing, and AI-based control systems. Manufacturers focusing on developing highly sophisticated robotic systems capable of handling complex tasks will capture the largest share of this USD 8.3 billion opportunity.

| Metric | Value |

|---|---|

| Aerospace Robotics Market Estimated Value in (2025 E) | USD 3.4 billion |

| Aerospace Robotics Market Forecast Value in (2035 F) | USD 11.7 billion |

| Forecast CAGR (2025 to 2035) | 13.0% |

The aerospace robotics market is gaining traction owing to the increasing automation demands in aircraft manufacturing, assembly, and maintenance processes. Rising complexity in aerospace component design, coupled with the need for precision and repeatability, is accelerating the integration of robotics across key production lines.

Labor shortages, safety concerns, and cost optimization efforts are prompting aerospace OEMs and suppliers to transition from manual to automated systems. Robotics adoption is further encouraged by advancements in vision systems, multi axis control, and AI based motion programming.

Aerospace manufacturers are focusing on reducing production cycles and improving quality assurance, both of which are effectively supported by robotics implementation. The market outlook remains robust as the industry continues to pursue digital transformation strategies, with robotics playing a pivotal role in boosting productivity, minimizing errors, and ensuring compliance with stringent aerospace standards.

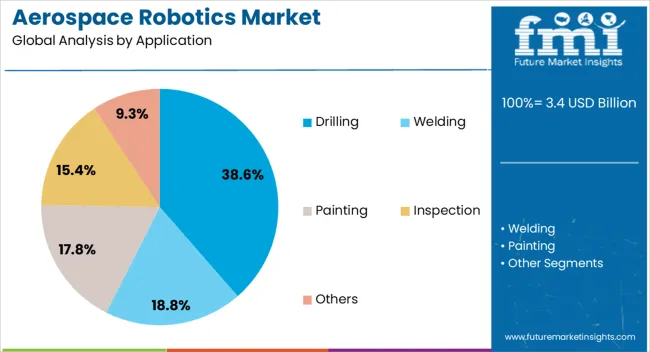

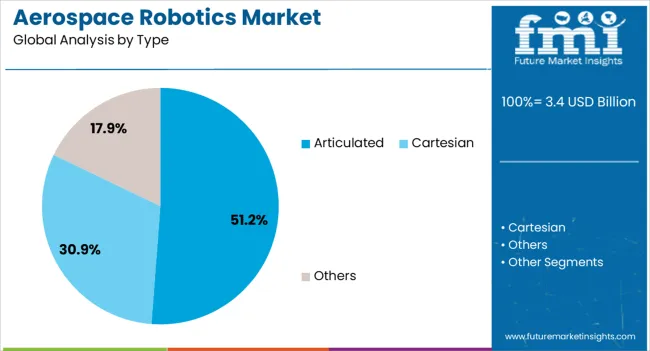

The aerospace robotics market is segmented by application, type, technology, solution, and geographic regions. By application of the aerospace robotics market is divided into Drilling, Welding, Painting, Inspection, and Others. In terms of type, the aerospace robotics market is classified into Articulated, Cartesian, and Others.

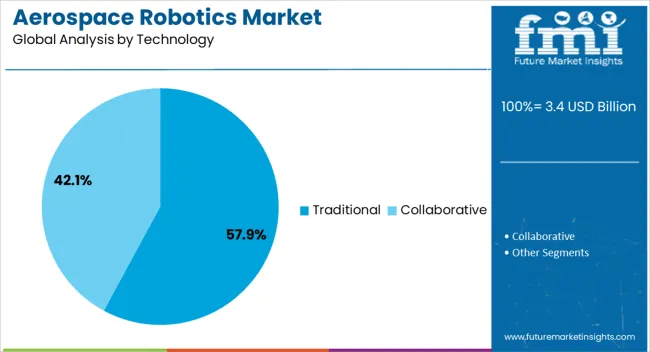

Based on technology, the aerospace robotics market is segmented into Traditional and Collaborative. By solution, the aerospace robotics market is segmented into Hardware, Software, and Services. Regionally, the aerospace robotics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The drilling segment is projected to account for 38.60% of the total revenue by 2025 within the application category, positioning it as the most prominent use case. The precision and consistency robotics bring to repetitive drilling tasks in aircraft fuselage and structural assembly.

Manual drilling in aerospace manufacturing often results in quality inconsistencies and operational inefficiencies, which are effectively mitigated through the integration of robotics. Automated drilling systems reduce material waste, improve cycle times, and ensure alignment with the strict tolerance levels required in airframe manufacturing.

Additionally, the use of robots in drilling has led to significant improvements in worker safety and reduced ergonomic risks. These factors together have contributed to drilling maintaining a leading share within aerospace robotics applications.

The articulated segment is expected to capture 51.20% of total market revenue by 2025 within the type category, emerging as the leading configuration. This is attributed to its enhanced flexibility, multi joint movement capabilities, and compatibility with complex aerospace manufacturing tasks.

Articulated robots are being widely used in material handling, welding, sealing, and composite layup operations where high precision and spatial adaptability are critical. Their ability to operate in tight and variable spaces makes them ideal for aircraft component fabrication and subassembly processes.

As aerospace manufacturers seek to streamline workflows and achieve greater consistency, articulated robots are becoming integral to production lines, sustaining their dominance in the type segment.

The traditional technology segment is anticipated to represent 57.90% of total revenue by 2025 within the technology category, highlighting its prevailing influence. This segment’s leadership is supported by its proven reliability, cost effectiveness, and ease of integration into existing aerospace infrastructure.

Traditional robotics systems have consistently demonstrated performance in tasks such as riveting, drilling, painting, and fastening, all of which are essential to aircraft production. While collaborative and AI-enabled robots are gaining attention, traditional robotics continues to be the foundation of automation across high-volume manufacturing due to its scalability and maturity.

Its well-established role in aerospace operations ensures that it remains the most utilized technology, particularly among Tier 1 suppliers and major OEMs.

The aerospace robotics market is driven by the increasing demand for automation in manufacturing and significant opportunities arising from the growth of space exploration and commercial aviation. Emerging trends like collaborative robotics are reshaping the industry, but challenges such as high investment costs and integration complexities remain. By 2025, addressing these challenges through cost-effective solutions and simpler integration methods will be crucial for sustained market growth and the broader adoption of robotics in aerospace manufacturing.

The aerospace robotics market is experiencing significant growth due to the increasing demand for automation in aerospace manufacturing. Robotics plays a crucial role in reducing human error, enhancing production speed, and improving precision in aircraft assembly. As aerospace companies focus on improving efficiency and meeting growing production demands, robotic systems are being increasingly integrated into manufacturing processes. By 2025, the need for automated solutions in aerospace manufacturing will continue to rise, driving growth in the robotics market for this sector.

Opportunities in the aerospace robotics market are growing with the expansion of space exploration programs and the increase in commercial aviation. As private companies and government organizations invest in space missions, the need for robotic systems that assist with satellite deployment, space station construction, and other space activities is growing. Additionally, with the expansion of commercial aviation, robotics is being used to enhance the maintenance and assembly of aircraft. By 2025, the market will continue to expand, driven by increased space exploration activities and a booming aviation sector.

Emerging trends in the aerospace robotics market include the growing use of collaborative robotics (cobots) in aircraft manufacturing. Unlike traditional industrial robots, cobots work alongside humans, providing greater flexibility and safety in manufacturing environments. The trend toward collaborative robots is reshaping how aerospace companies approach assembly and maintenance tasks, allowing for improved human-robot interaction and efficiency. By 2025, collaborative robotics will continue to gain traction, especially in areas that require precision, such as aircraft assembly and inspection processes.

Despite growth, challenges such as high initial investment and integration complexity persist in the aerospace robotics market. The cost of implementing robotic systems, particularly advanced technologies, can be prohibitive for smaller companies or those with limited budgets. Furthermore, integrating robotics into existing manufacturing setups can be complex and time-consuming, requiring specialized knowledge and training. By 2025, overcoming these challenges will require manufacturers to develop cost-effective, easily integrated robotic systems that meet the specific needs of aerospace companies without disrupting existing workflows.

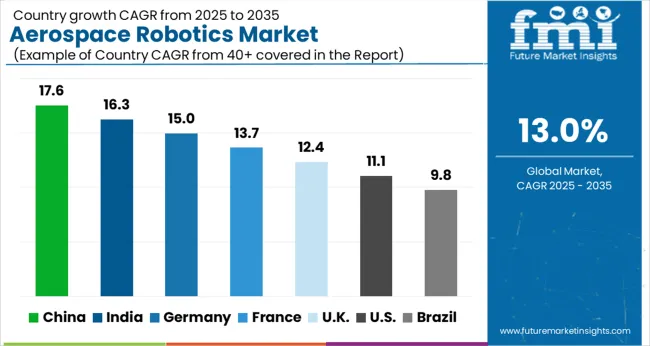

| Country | CAGR |

|---|---|

| China | 17.6% |

| India | 16.3% |

| Germany | 15.0% |

| France | 13.7% |

| UK | 12.4% |

| USA | 11.1% |

| Brazil | 9.8% |

The global aerospace robotics market is projected to grow at a 13% CAGR from 2025 to 2035. China leads with a growth rate of 17.6%, followed by India at 16.3%, and France at 13.7%. The United Kingdom records a growth rate of 12.4%, while the United States shows the slowest growth at 11.1%. These varying growth rates are driven by the increasing demand for automation in the aerospace industry, advancements in robotic technologies for assembly and manufacturing, and rising investments in space exploration and defense applications. Emerging markets like China and India are experiencing higher growth due to expanding aerospace industries, government support for automation in manufacturing, and increasing demand for more efficient production systems, while more mature markets like the USA and the UK see steady growth driven by technological innovations, regulatory policies, and continued investments in advanced aerospace systems. This report includes insights on 40+ countries; the top markets are shown here for reference.

The aerospace robotics market in China is growing rapidly, with a projected CAGR of 17.6%. China’s rapidly expanding aerospace and defense industries, coupled with the country’s focus on increasing automation in manufacturing, are key drivers of market growth. The country’s growing investments in space exploration, aircraft manufacturing, and defense technologies are pushing for advanced robotics solutions to enhance efficiency and precision in assembly and production processes. Additionally, China’s government policies supporting high-tech innovations, along with the country’s large-scale infrastructure projects in the aerospace sector, continue to drive demand for robotics solutions. The rise of smart manufacturing technologies and digitalization is further fueling the adoption of aerospace robotics.

The aerospace robotics market in India is projected to grow at a CAGR of 16.3%. India’s growing aerospace and defense sectors, combined with increasing investments in automation for manufacturing and assembly, are driving the demand for aerospace robotics. The country’s rising focus on developing indigenous aerospace technologies and expanding its space exploration capabilities further accelerates market growth. Additionally, India’s rapid industrialization and the growing need for efficient, precise, and scalable production systems in the aerospace industry are contributing to the adoption of robotics solutions. The Indian government’s push for modernization in defense and space technologies continues to provide a favorable environment for the expansion of aerospace robotics.

The aerospace robotics market in France is projected to grow at a CAGR of 13.7%. France’s established aerospace industry, particularly in aircraft manufacturing and space exploration, is a major contributor to the growth of the robotics market. The increasing demand for automation in the aerospace sector, driven by the need for precision, efficiency, and cost-effectiveness in production processes, continues to fuel the adoption of robotics. Additionally, France’s strong regulatory support for aerospace innovations and its focus on sustainability in manufacturing further drive the demand for robotics solutions. The country’s growing interest in space technologies and defense applications is expected to continue supporting the expansion of aerospace robotics.

The aerospace robotics market in the United Kingdom is projected to grow at a CAGR of 12.4%. The UK aerospace sector, which includes major aircraft manufacturers and a strong defense industry, is driving steady demand for aerospace robotics solutions. The growing focus on enhancing manufacturing processes, reducing costs, and increasing precision in aerospace production is contributing to the adoption of robotics technologies. Additionally, the UK government’s investments in space exploration and defense technologies, along with a focus on advancing automation in aerospace manufacturing, further boost market growth. The UK market is also supported by advancements in artificial intelligence, machine learning, and automation technologies, driving innovation in the aerospace robotics sector.

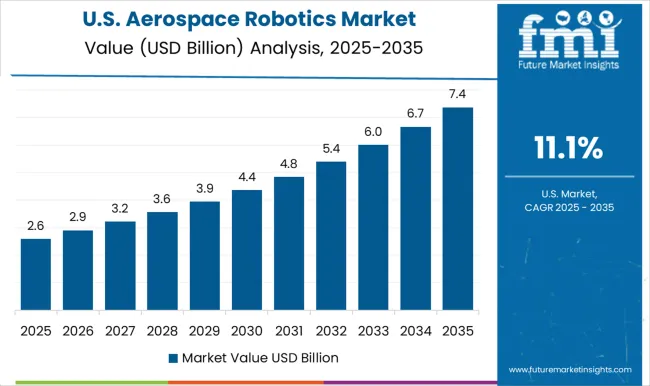

The aerospace robotics market in the United States is expected to grow at a CAGR of 11.1%. The USA aerospace industry, with its well-established infrastructure and focus on cutting-edge technologies, continues to drive demand for robotics solutions in aircraft manufacturing, space exploration, and defense applications.

The country’s ongoing investments in automation technologies, particularly in the areas of precision manufacturing, robotic assembly lines, and defense systems, are key factors supporting the market growth. The growing emphasis on increasing production efficiency and reducing operational costs in the aerospace sector is also contributing to the adoption of robotics. Additionally, USA government programs promoting space exploration and advancements in defense technologies further accelerate the need for aerospace robotics.

The aerospace robotics market is dominated by ABB, which leads with its innovative robotic solutions used in various aerospace applications, including assembly, manufacturing, and inspection processes. ABB’s dominance is supported by its advanced automation technologies, strong market presence, and ability to deliver precise, reliable robotic systems designed to meet the rigorous demands of the aerospace industry.

Key players such as Fanuc Corporation, Mitsubishi Electric Corp., and Yaskawa Electric Corp. maintain significant market shares by offering high-performance industrial robots that improve efficiency, reduce operational costs, and ensure safety in aerospace manufacturing operations. These companies focus on expanding their robotic portfolios and enhancing the integration of advanced sensors, AI, and machine learning into their systems.

Emerging players like Electroimpact Inc., JH Robotics, Inc., and Universal Robots A/S are expanding their market presence by providing specialized robotic solutions for niche aerospace applications such as fuselage assembly, composite material handling, and aircraft inspection. Their strategies include improving robotic flexibility, offering easy-to-use collaborative robots (cobots), and reducing setup time for manufacturing processes.

Market growth is driven by the increasing demand for automation in aerospace manufacturing, the rise in aircraft production rates, and the growing adoption of Industry 4.0 technologies. Innovations in autonomous robotics, smart manufacturing integration, and robotic maintenance are expected to continue shaping competitive dynamics and fuel further growth in the global aerospace robotics market.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Application | Drilling, Welding, Painting, Inspection, and Others |

| Type | Articulated, Cartesian, and Others |

| Technology | Traditional and Collaborative |

| Solution | Hardware, Software, and Services |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Electroimpact Inc., Fanuc Corporation, JH Robotics, Inc., Mitsubishi Electric Corp., Universal Robots A/S, and Yaskawa Electric Corp. |

| Additional Attributes | Dollar sales by robot type and application, demand dynamics across aerospace manufacturing, maintenance, and defense sectors, regional trends in aerospace robotics adoption, innovation in autonomous robotic systems and AI integration, impact of regulatory standards on safety and precision, and emerging use cases in satellite assembly and aircraft inspection. |

The global aerospace robotics market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the aerospace robotics market is projected to reach USD 11.7 billion by 2035.

The aerospace robotics market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in aerospace robotics market are drilling, welding, painting, inspection and others.

In terms of type, articulated segment to command 51.2% share in the aerospace robotics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA