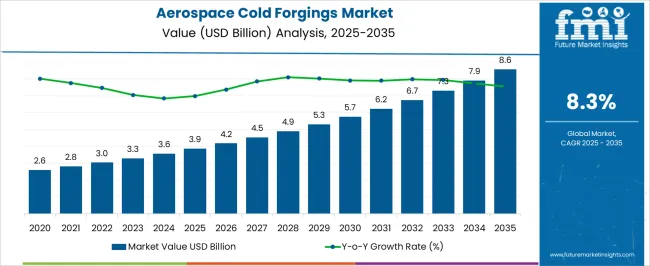

The aerospace cold forgings market is projected to expand from USD 3.9 billion in 2025 to USD 8.6 billion by 2035, reflecting a CAGR of 8.3%, indicating steady year-on-year growth. In 2025, the market stands at USD 3.9 billion, with annual values rising gradually from USD 2.6 billion in 2021 to USD 4.2 billion in 2026. This predictable YoY growth allows manufacturers and suppliers to plan production, optimize inventory, and secure long-term contracts efficiently.

By 2035, the market is expected to reach USD 8.6 billion, representing an absolute increase of USD 4.7 billion from 2025, supported by the 8.3% CAGR. Year-on-year, the market grows steadily with values rising from USD 4.5 billion in 2027 to USD 8.6 billion in 2035. This consistent growth pattern enables stakeholders to anticipate demand, adjust production schedules, and expand operational capacity incrementally. The steady YoY increases provide a reliable outlook for revenue planning and long-term engagement across aerospace cold forging applications.

| Metric | Value |

|---|---|

| Aerospace Cold Forgings Market Estimated Value in (2025 E) | USD 3.9 billion |

| Aerospace Cold Forgings Market Forecast Value in (2035 F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

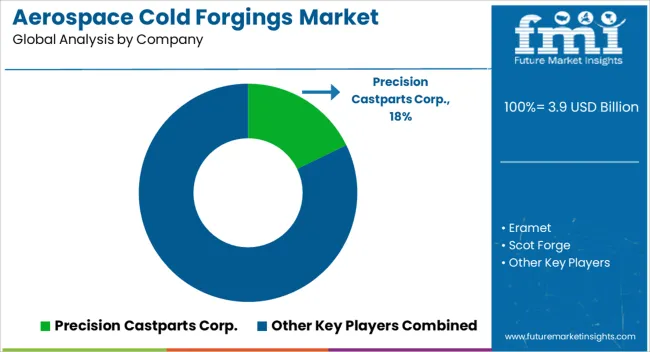

The aerospace cold forgings segment is a critical part of the broader aerospace components market, which includes machined parts, castings, and assemblies. In 2025, cold forgings account for USD 3.9 billion, representing approximately 18% of the total aerospace components market. By 2035, the segment is projected to reach USD 8.6 billion, maintaining a similar share of around 17–18%. This consistent percentage demonstrates that cold forgings will continue to be a significant contributor to overall market revenue, driven by demand for high-strength, lightweight structural components, engine parts, and landing gear.

The stable share underscores the segment’s strategic importance within the aerospace supply chain. Over the decade, the cold forgings market grows at a CAGR of 8.3%, from USD 3.9 billion in 2025 to USD 8.6 billion in 2035, closely mirroring the overall parent market growth. Maintaining roughly an 18% share provides manufacturers and suppliers with predictable revenue streams while highlighting incremental growth opportunities. The segment’s consistent contribution emphasizes its role in supporting overall aerospace production, retrofits, and maintenance programs, offering clear insights for investment, capacity planning, and strategic positioning within the broader aerospace components ecosystem.

The aerospace cold forgings market is witnessing robust expansion, fueled by rising aircraft production rates, material performance requirements, and the need for cost-effective high-strength components. Cold forging, known for its ability to deliver superior mechanical properties, is increasingly preferred over traditional machining in airframe and structural applications.

With a growing focus on fuel efficiency and load-bearing optimization, manufacturers are integrating precision-forged parts that reduce weight while enhancing durability. Advances in alloy technology, process automation, and forging simulation tools are enabling faster production cycles and tighter tolerances.

The market is further supported by long-term fleet modernization programs, increasing global defense spending, and the adoption of lightweight metals in next-gen aircraft platforms.

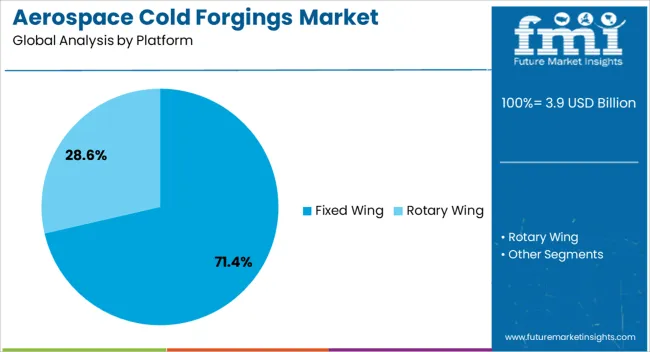

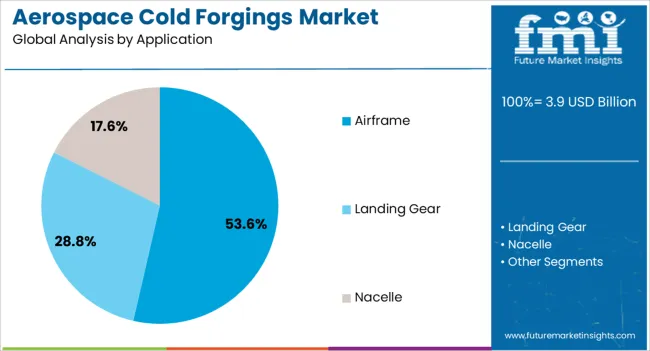

The aerospace cold forgings market is segmented by platform, application, and geographic regions. By platform, aerospace cold forgings market is divided into Fixed Wing and Rotary Wing. In terms of application, aerospace cold forgings market is classified into Airframe, Landing Gear, and Nacelle. Regionally, the aerospace cold forgings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Fixed wing aircraft are projected to dominate the platform segment with a 71.40% share in 2025. This dominance is underpinned by the widespread use of cold forged components in commercial jets, military aircraft, and business aviation fleets.

Structural integrity, fatigue resistance, and precision in fixed wing aircraft demand forging methods that offer dense, uniform material characteristics, attributes inherently supported by cold forging processes. Ongoing orders for narrow-body and wide-body aircraft, along with regional jet growth across emerging markets, are boosting demand for forged engine mounts, landing gear components, and structural fasteners.

The long lifecycle and intensive performance requirements of fixed wing platforms are ensuring continued investment in cold forging infrastructure and capacity expansion.

Airframe applications are expected to capture a 53.60% market share in 2025, positioning this as the leading application area within aerospace cold forgings. The structural backbone of an aircraft fuselage, wings, and landing assemblies relies heavily on forged parts for strength-to-weight efficiency and corrosion resistance.

Cold forging delivers near-net-shape components that minimize machining waste, align with sustainability goals, and reduce total production costs. As OEMs emphasize composite-metal hybrid structures and seek high-volume, defect-free parts, cold forging is being adopted for airframe brackets, bulkheads, and reinforcements.

The shift toward lighter, stronger aircraft is reinforcing the strategic role of forgings in critical airframe zones across both civil and defense aviation sectors.

The aerospace cold forgings market is growing as demand rises for high-strength, lightweight, and precision-engineered components used in aircraft structures, engines, landing gears, and hydraulic systems. Cold forging provides superior mechanical properties, dimensional accuracy, and material efficiency compared to conventional machining or casting.

Increasing commercial and defense aircraft production, modernization programs, and the need for cost-effective, durable components drive growth. Adoption is further supported by advancements in forging technologies, high-performance alloys, and quality assurance systems. Companies offering certified, high-precision, and lightweight cold-forged parts are well-positioned to capture opportunities in aerospace manufacturing, MRO, and component replacement markets globally.

The market faces challenges in material selection, process complexity, and stringent quality control requirements. Cold forging aerospace components demands high-strength alloys such as titanium, aluminum, and nickel-based superalloys that require precise handling and specialized tooling. Maintaining dimensional accuracy, surface finish, and mechanical properties during high-pressure forming is critical. Quality control is essential to ensure compliance with aerospace standards, traceability, and certification requirements. Equipment costs, skilled labor, and process optimization add operational complexity. Manufacturers must invest in advanced tooling, continuous process monitoring, and robust quality assurance systems to produce reliable, defect-free components capable of withstanding extreme operational environments in both commercial and defense aerospace applications.

The aerospace cold forgings market is trending toward high-strength alloys, automation, and lightweight component designs. Use of titanium, aluminum, and nickel alloys improves strength-to-weight ratios, reducing overall aircraft weight and improving fuel efficiency. Automation in material handling, forging presses, and post-forging machining ensures consistent quality and reduces production cycle times. Advanced simulation and digital twins are increasingly used to optimize die design, minimize material waste, and predict component performance under operational conditions. Lightweight, high-strength components for structural, engine, and landing gear applications are gaining preference in both commercial and military aircraft. These trends enable aerospace manufacturers to achieve enhanced performance, compliance with fuel efficiency targets, and reduced lifecycle costs.

The market offers opportunities in aircraft production, maintenance, repair, and overhaul (MRO), and defense programs. Rising demand for commercial aircraft fleets, business jets, and unmanned aerial vehicles drives the need for reliable cold-forged components. Defense modernization initiatives and new military aircraft procurement programs further increase demand. MRO operations require replacement and retrofitting of critical cold-forged parts to maintain airworthiness and operational readiness. Emerging markets with growing aerospace manufacturing capabilities provide additional growth potential. Companies that offer high-quality, lightweight, and certified forgings, combined with technical support and supply chain reliability, can capitalize on long-term opportunities across commercial, defense, and specialty aerospace applications.

Market growth is restrained by high manufacturing costs, technical expertise requirements, and certification challenges. Cold forging of aerospace-grade alloys requires expensive presses, tooling, and precision control systems, which increases production costs. Skilled personnel and specialized engineering knowledge are necessary to handle complex geometries, high-strength materials, and die design. Obtaining aerospace certifications, traceability, and compliance with regional and international standards adds operational complexity and time. Supply chain constraints for high-performance alloys and tooling materials can limit production scalability. Until cost-effective processes, skilled workforce availability, and streamlined certification pathways improve, adoption of cold-forged components may remain concentrated among high-value commercial and defense aerospace programs.

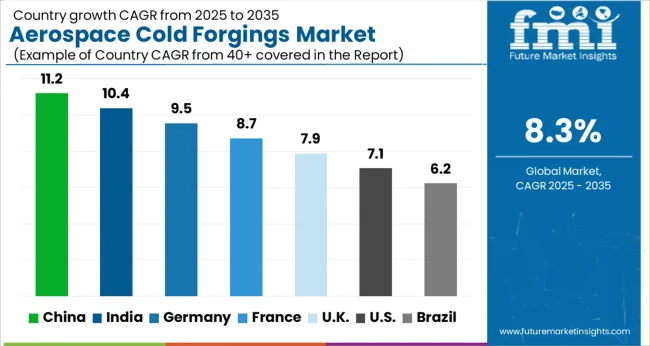

| Country | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

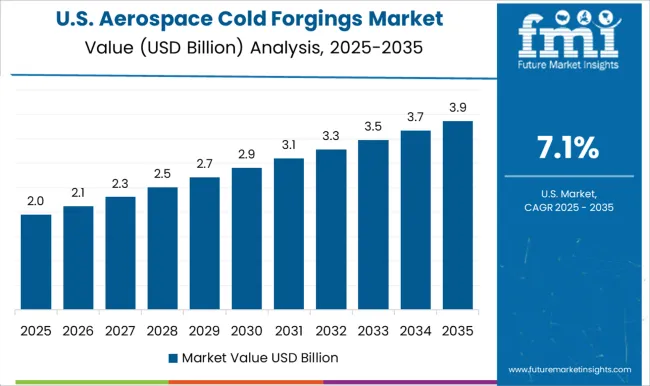

| USA | 7.1% |

| Brazil | 6.2% |

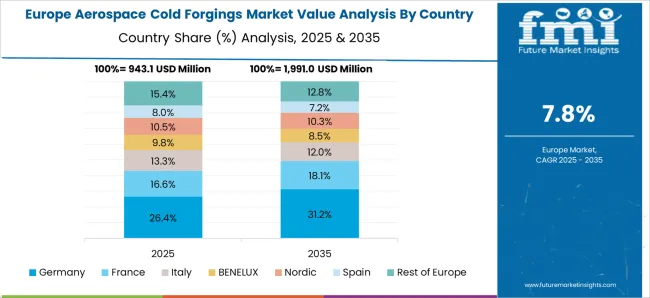

The global aerospace cold forgings market is projected to grow at a CAGR of 8.3% through 2035, supported by increasing demand across aircraft structural components, landing gear, and engine parts. Among BRICS nations, China has been recorded with 11.2% growth, driven by large-scale production and deployment in commercial and military aircraft manufacturing, while India has been observed at 10.4%, supported by rising utilization in engine components and structural assemblies. In the OECD region, Germany has been measured at 9.5%, where production and adoption for aerospace structural, engine, and landing gear components have been steadily maintained. The United Kingdom has been noted at 7.9%, reflecting consistent use in aircraft assembly and maintenance, while the USA has been recorded at 7.1%, with production and utilization across military and commercial aerospace sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is experiencing rapid growth in its aerospace cold forgings market, driven by expanding domestic aircraft production, UAV programs, and defense modernization, with a CAGR of 11.2%. Manufacturers are focusing on high-strength, lightweight forged components such as shafts, brackets, and structural parts for engines, airframes, and landing gear. Government initiatives promoting indigenous aerospace production, advanced manufacturing technologies, and military modernization are accelerating adoption. Pilot projects in commercial aircraft, military jets, and UAV platforms demonstrate operational benefits including enhanced component strength, precision, and reduced lead times. Collaborations between domestic suppliers, aerospace research institutes, and international technology partners are advancing material performance, production efficiency, and quality assurance. Rising investment in aerospace manufacturing and advanced material technologies continues to drive China’s cold forgings market.

Aerospace cold forgings market in India is growing at a CAGR of 10.4%, fueled by domestic aircraft production, UAV deployment, and defense modernization. Manufacturers are developing high-strength, lightweight forged components for engines, landing gear, and structural airframe parts. Government programs promoting Make in India, aerospace R&D, and defense procurement are supporting market adoption. Pilot projects in fighter jets, transport aircraft, and UAVs demonstrate operational benefits such as enhanced durability, precision, and reduced maintenance costs. Collaborations between domestic suppliers, aerospace research institutions, and defense contractors are advancing production technology, material quality, and design efficiency. Increasing focus on domestic aerospace capabilities and defense modernization programs continues to drive growth in India’s cold forgings market.

Aerospace cold forgings market in Germany is witnessing steady growth at a CAGR of 9.5%, supported by high-quality aircraft manufacturing, defense modernization, and precision engineering standards. Manufacturers are focusing on lightweight, high-strength forged components for engines, airframes, and landing gear. Government initiatives promoting aerospace innovation, industrial excellence, and defense preparedness are encouraging adoption. Pilot projects in commercial aircraft, military jets, and UAV platforms demonstrate operational benefits such as increased component reliability, precision, and lifecycle durability. Collaborations between aerospace manufacturers, research institutes, and technology providers are advancing material performance, process optimization, and production efficiency. Germany’s emphasis on engineering excellence and advanced aerospace technologies continues to strengthen its cold forgings market.

The United Kingdom is experiencing a CAGR of 7.9% in its aerospace cold forgings market, driven by domestic aircraft production, UAV programs, and defense upgrades. Manufacturers are developing high-strength, lightweight forged components for airframes, engines, and structural assemblies. Government programs promoting defense R&D, aerospace innovation, and industrial modernization are supporting market adoption. Pilot projects in fighter jets, transport aircraft, and UAV platforms demonstrate operational benefits such as enhanced component durability, precision, and reduced maintenance. Collaborations between domestic manufacturers, research institutions, and aerospace contractors are advancing production technology, material quality, and cost efficiency. Continued investment in aerospace and defense programs is expected to sustain growth in the UK cold forgings market.

The United States aerospace cold forgings market is growing at a CAGR of 7.1%, fueled by domestic aircraft production, UAV deployment, and defense modernization programs. Manufacturers are focusing on high-strength, precision-forged components for engines, airframes, and landing gear. Government programs promoting aerospace R&D, advanced manufacturing technologies, and defense procurement support market adoption. Pilot projects in commercial aircraft, military jets, and UAVs demonstrate operational benefits including improved reliability, reduced maintenance costs, and enhanced precision. Collaborations between aerospace manufacturers, research institutes, and technology providers are advancing material performance, production efficiency, and process optimization. Growing investment in aerospace infrastructure, defense programs, and advanced materials continues to drive steady growth in the USA cold forgings market.

Precision and material performance define the aerospace cold forgings market, where component quality and compliance drive supplier selection. Precision Castparts Corp. is positioned as a leading provider, with brochures emphasizing high-strength titanium and nickel alloys, dimensional accuracy, and tolerance specifications for critical aerospace components.

Eramet competes with specialty metal forgings, with technical literature highlighting fatigue resistance, grain structure control, and certification to aviation standards. Scot Forge provides custom cold-forged components, with brochures detailing mechanical properties, process controls, and suitability for engine and structural applications. ATI Metal focuses on high-performance alloys for rotating and static parts, with literature presenting tensile strength, heat-treatment parameters, and machining guidance. Bharat Forge delivers both commercial and defense aerospace forgings, with brochures emphasizing repeatability, surface finish, and compliance with international standards. VSMPO-AVISMA Corporation supplies titanium forgings for large and complex parts, with literature highlighting dimensional stability, alloy traceability, and processing notes. Arconic offers aluminum and titanium forgings, with brochures detailing microstructure uniformity, mechanical testing results, and design compatibility.

Shaanxi Hongyuan Aviation Forging Co., Ltd. provides high-strength forgings for regional aerospace and defense applications, with technical documentation presenting material grades, tolerance limits, and application guidance. Other regional players compete by offering rapid prototyping, lower-volume production, and tailored alloy solutions to meet specific aerospace OEM requirements. Operational strategies focus on process precision, material control, and certified quality systems. Investments are directed toward advanced cold forging presses, tooling accuracy, and inspection capabilities to ensure minimal deviations and consistent properties. Partnerships with airframe and engine manufacturers are leveraged to integrate forgings into critical assemblies. Observed industry patterns indicate emphasis on repeatable mechanical performance, tight tolerances, and traceable manufacturing processes to meet rigorous certification requirements. Product roadmaps often include expansion of alloy offerings, reduction of microstructural defects, and enhanced machinability to improve end-use compatibility. Differentiation is achieved through adherence to aerospace standards, documented process controls, and the ability to deliver high-volume, high-complexity forgings reliably. Brochures and datasheets are key to communicating material performance, mechanical properties, and processing guidance.

Precision Castparts literature emphasizes tensile and yield strengths, alloy types, and dimensional specifications. Eramet and ATI brochures highlight fatigue limits, heat-treatment ranges, and component testing results. Scot Forge and Bharat Forge materials detail surface finish, machining allowances, and tolerance verification. VSMPO-AVISMA and Arconic literature provide guidance on alloy traceability, structural suitability, and integration into engines or airframes. Shaanxi Hongyuan brochures present material certifications, dimensional control, and installation notes. Tables, diagrams, and charts are consistently used to allow engineers, procurement teams, and quality specialists to assess suitability efficiently. Market success is determined not only by forging performance but also by the clarity and technical depth of brochures, making literature critical for competitive positioning and adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 Billion |

| Platform | Fixed Wing and Rotary Wing |

| Application | Airframe, Landing Gear, and Nacelle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Precision Castparts Corp., Eramet, Scot Forge, ATI Metal, Bharat Forge, VSMPO-AVISMA Corporation, Arconic, and Shaanxi Hongyuan Aviation Forging Co., Ltd. |

| Additional Attributes | Dollar sales vary by product type, including shafts, gears, fittings, and fasteners; by material, spanning aluminum alloys, titanium alloys, and stainless steel; by application, such as airframes, engines, landing gear, and structural components; by end-use, covering military aircraft, commercial aviation, and unmanned aerial systems; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising aerospace manufacturing, demand for lightweight high-strength components, and adoption of precision forging technologies. |

The global aerospace cold forgings market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the aerospace cold forgings market is projected to reach USD 8.6 billion by 2035.

The aerospace cold forgings market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in aerospace cold forgings market are fixed wing, _narrow-body, _regional jets, _widebody, _fighter jets, rotary wing and _helicopters.

In terms of application, airframe segment to command 53.6% share in the aerospace cold forgings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Avionics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA